So, again we’ve found a situation where the big brands plead ignorance to something awful happening in the world. Last issue, it was a hate-mongering UFC fighter working for Monster. This issue, it’s something much worse: big soda companies’ use of sugar sourced from a region of India that is rife with worker abuses.

According to a recent story in the New York Times, big soda companies Coca-Cola Co. and PepsiCo, among others, source sugar from the Maharashtra state in India –one whose mills rely on child labor, worker indebtedness and a set of labor requirements so harsh that many women working to cut sugarcane are undergoing unnecessary mastectomies to avoid missing work.

In many cases cited by the Times, working in concert with journalism organization the Fuller Project, women were forced into marriage as soon as they began menstruating, both in order to reduce the number of children their parents needed to feed, and to create a paired labor arrangement. Husbands and wives working the fields together are more efficient and more likely to be hired, according to the Times, with the husbands hacking down sugarcane and their wives ripping razor-sharp leaves off the canes, then stacking, bundling, and carrying them to waiting trucks. The workers can’t leave – they’ve already been advanced on their pay ahead of their arrival, so any missed days keep them mired in debt. Hence menstruation or pregnancy can lead to them owing even more to their employers, furthering the cycle of debt.

Both Coke and Pepsi - which have pledged to remove forced labor from their supply chains – acknowledge that some of their sugar comes from the region, but they blame the contractors who purchase it for them. Similarly, the mill owners say they don’t employ child labor or forced labor – they blame the contractors they use to pull together and who manage their workforce. The local government has investigated but little change has taken place.

By Jeffrey Klineman

careful look at the labor practices there – right now it’s hard to give these companies the benefit of the doubt.

I’m obviously no expert on international labor conditions and I understand that the region is likely leaning into its biggest potential financial resource when it looks the other way on the plight of its workers. But it’s clearthat the brands that benefit from these arrangements have a duty to look at more than maintaining their margins in their dealings with their suppliers in Maharashtra State.

As we know with innovation, it’s hard for big brands to move quickly; global supply chains are hard to reset. But it’s still hard to excuse Coke, which, according to the Times, knew about labor abuses in Maharashtra as long ago as 2019, when auditors hired by the company offered documentation about child labor and forced labor. The Pepsi team said it wasn’t aware of what was happening. Mondelez, which also buys from that region, said it would investigate. Maybe Coke could share its audit.

Meanwhile, both Coke and PepsiCo are continuing to grow their Maharashtra operations. We hope that their financial commitment to the region is buttressed by a hard,

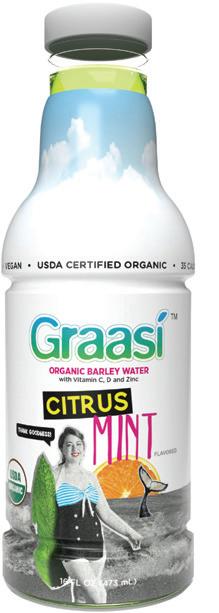

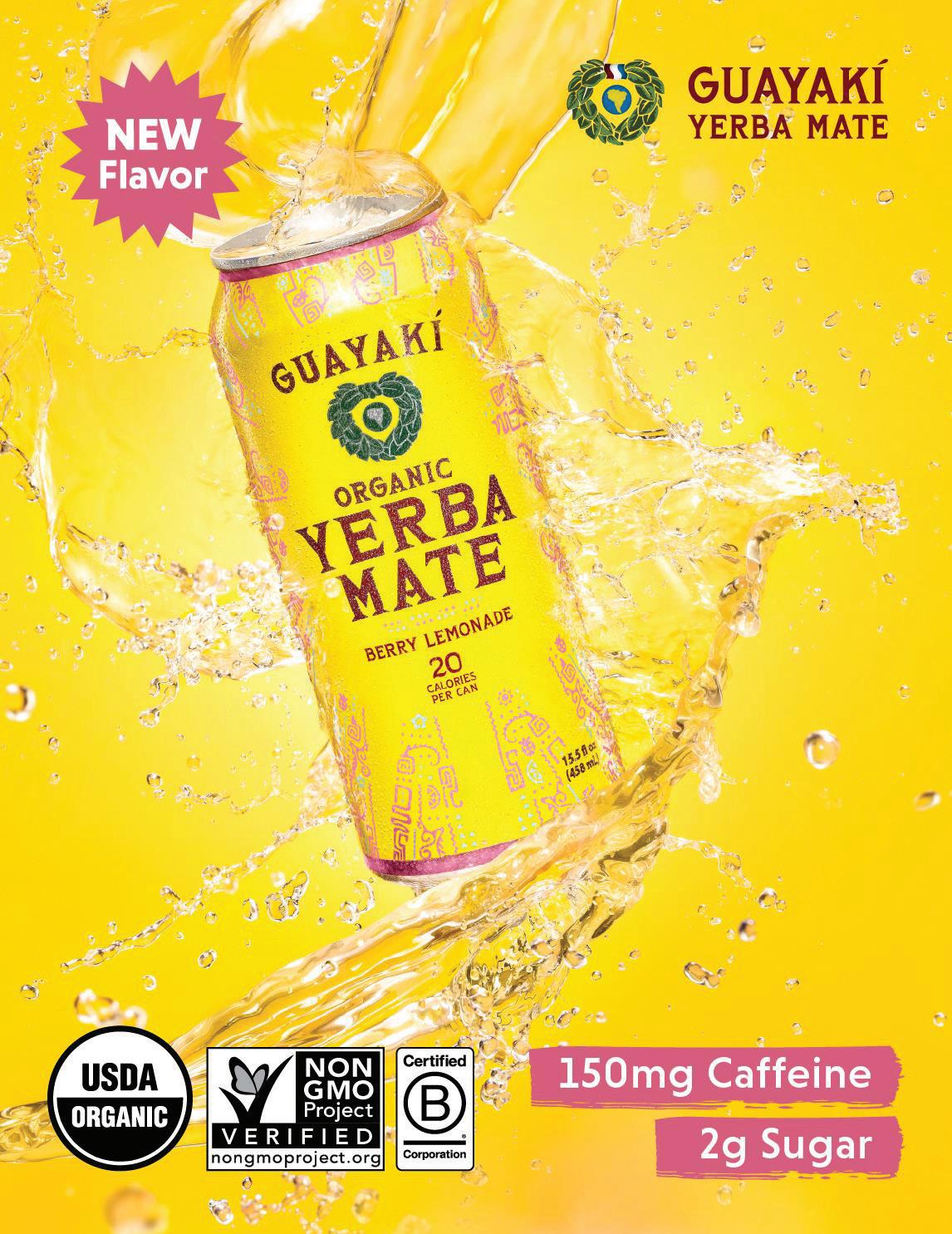

In the meantime, there are a great many entrepreneurial brands that are actually growing because of the attention they’re paying to supply chain issues, both via Fair Trade certification and a core commitment to clean, abuse-free sourcing. Brands like Sambazon, Guayaki, Just Ice Tea, and many more aren’t just making money while sourcing abroad, they’re activists – and they continue to grow.

The Times report is double jeopardy for Big Soda because it puts both the abuse of workers, and the use of the sugar that is the core ingredient of their products front and center. We’re in a generational economic shift, to the conscious consumers of Generation Z, while health concerns around excessive sugar consumption continue to accelerate.

It’s an example not of the moral quality of the issue, but of the speed at which opinions harden against the bottom line, that I’m going to bring up the internet backlash against Bud Light last year and its financial impact on that brand. Think about it this way: fortunes can be lost in weeks. Even if you can’t understand it as a moral imperative, you can certainly think of it as a financial one.

Coke and Pepsi might not be good at innovating quickly, but they’d better learn to clean up their mess in Maharashtra with all due speed.

By Barry Nathanson

By Barry Nathanson

In our lives there are a few truly special days. On March 5th, my second granddaughter came into our lives. My son David and his wife Michelle gave us the best gift one can ever ask for: Andie Nathanson. For those who are at that stage of life, having grandchildren tops anything. Being now twice blessed in this way is amazing.

Andie came along at just the right time. My fear was that she would arrive at the start of Expo West. If that had been the case, I would have had to drop the event, and New Hope would have been out of luck: no Barry, no Expo.

Luckily, the timing worked out: I arrived in Anaheim energized and ready to take on the world. Andie quickly paid dividends, her arrival my opening conversational salvo throughout my three days on the floor. It’s always great to share such good news.

Then I jumped into the world of beverages. Expo West is always the highlight of the year for trade shows. This year did not disappoint. On the first day in North Hall, it was nearly overwhelming, crowded, trash bins were overflowing, and you needed a

machete to traverse the aisles, but the latest and greatest were on full display.

Luckily thingss went smoothly and we all got to see why this show is so dynamic. It’s great theatre, and it makes a terrific stage to introduce the brands that will grace our shelves in 2024 and beyond.

Beverages are back! Over the past few years, Covid diminished the volume of new launches, SKUs and packaging innovations. There was hesitancy to fully commit. That is now the past. Even with our strong team of BevNET attendees, we had a hard time covering all there was to offer. I was in awe of how many marketers grabbed me to show their wares. It’s always great to see old friends, to catch up, but they all had a story to tell of their launches and initiatives. We actually conducted business.

Expo West is a bellwether of the beverage marketplace. I was delighted to see such activity. Yet, it still pales in comparison to the launch of Andie. She’s got great branding for sure! Life is good.

By Gerry Khermouch

By Gerry Khermouch

“If you’ve got it, flaunt it,” goes the old expression. Hey, that worked for Madonna! But maybe not so much in beverages, where the path to success often seems to point to downplaying your most distinctive attributes rather than playing them up. Sounds crazy, I realize. That’s likely why it took me so many years to realize it myself. But please bear with me here.

In a category overflowing with me-too items, this seems completely counterintuitive. Surely, if you’ve got a meaningful differentiator, then shouldn’t you be banging the drum about it as loudly as you can? Well, yes, up to a point. But that point may come a lot earlier than you expect.

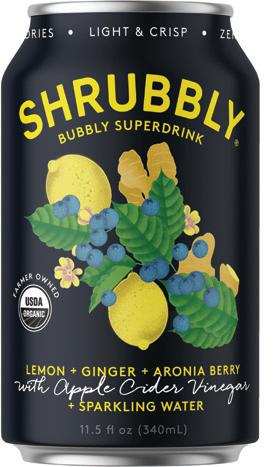

In the face of skeptical retailers and distributors, it certainly helps to be able to make a case that your brand represents a breakthrough, one that can cut through the clutter and perhaps disrupt a major category or brand, with all the sales upside that implies. Among the early adopters your premium brand is likely to cultivate at first, heralding your unique ingredient (acai! Aronia berry! ube!), nutrient category (probiotics! prebiotics! antibiotics!) or process (coldbrewed! dog-chewed!) can generate that crucial first try.

After all, these are the label readers who desperately want to be first in their social circle to bring news of life-changing developments like – I don’t know, yaupon tea in a bottle?

That’s in the earlier stages, for sure. What seems to happen, though, is that as a brand broadens enough to start to cultivate more of a mass audience – that large “total addressable market” that investors crave these days – those kinds of messages start to fall on deaf ears. As the brand migrates from the natural and specialty channel to conventional grocers and mass merchandisers and maybe even c-stores and dollar stores, it starts to reach shoppers who aren’t into label-reading so much. Maybe not into reading much of anything, for that matter. Suddenly, your brand’s unique properties can start to become confusing, irrelevant or even intimidating.

That might be the point at which you need to dial back the messaging a bit. It certainly doesn’t mean you abandon your recipe, but the messaging might need to move more into the background in favor of benefits that resonate with Walmart, Kroger and Terrible Herbst shoppers. It’s a tough call, because you’re talking less about the very concepts that changed your own life and got you excited about launching the brand in the first place.

Hey, they’re still there on the back of the label, on the website, and in the discussions your sampling team can have with passersby in Aisle 8. Just not on the front panel and bus-shelter ads. Sometimes, that’s the key to getting to the next growth plateau.

What evidence do I have of this? It’s anecdotal, for sure. Come on, I’m just a journalist! (Our low bar is reflected in jokes like this one: What’s the definition of a trend? Two facts and a deadline.) Still, anecdotally speaking, a brand like Bai never seemed to truly ignite until it stopped talking so much about the coffee fruit at its heart, and the benefit to growers of offering an ancillary income stream to the

actual coffee beans, and just started describing itself as an antioxidant infusion. (A secondary motive was to dispel any impression it was a highly caffeinated drink, though it did contain some caffeine.) Consumers might not have known too much about antioxidants either, but they knew enough to know they were good, and that messaging gave them psychological cover to drink a delicious beverage that was very low on calories and somehow good for them.

In doing so, Bai was merely reprising the marketing of Vitaminwater, whose very name conferred its benefit, granting users license to drink a highly sweetened beverage that, by the letter of the law, really shouldn’t have been allowed to go out labeled as a water. This hunch seemed to be confirmed by one incident long after Vitaminwater’s acquisition by Coca-Cola, when Coke’s marketers undertook a flavor tweak that didn’t go over well with loyal users. On social media, aggrieved drinkers posted complaints along the lines of, “Look, I know that Vitaminwater doesn’t really have vitamins. I just drink it because it tastes good. And now it doesn’t taste good anymore.”

At the recent Natural Products Expo West, there were abundant signs of beverage marketers taking a step back from what had been core parts of their identity for the greater benefit of bringing more shoppers into the franchise.

Take the Good Sport sports drink brand, whose unique selling proposition was that it harnessed the nutritional content of milk in the service of offering an ideal hydrator. These days, you’re hard pressed to spot any reference to the ultrafiltered, deproteinized milk anywhere but in the fine print of the nutrition panel, even though that’s very much the secret to its efficacy. Too complicated and confusing. Naturally sourced with three times the electrolytes, is what you’re told. Since the brand is partly funded by a dairy company, this must have been a hard decision to make. But if it unlocks a new bout of growth for an excellent, natural product, it will be worth it.

Or take Guru, in the market two decades now as a rare energy brand boasting organic credentials. A recent rebrand downplays the better-for-you and organic qualities of the brand in favor of putting a more overt emphasis on its robust energy delivery and flavor. Flow Beverage similarly has concluded recently that, while the sustainability cred derived from its Tetra Pak cartons still is core to its identity, it’s better off flagging that it’s mineral-infused water that tastes good. Let me stress that none of these brands has abandoned its core concepts. It’s just that the messaging hierarchy has changed.

Of course, there are other, sometimes less savory, reasons for downplaying a key part of your identity. One is the area of claims, explicit or implied. As your brand gets more established, the target on your back with regulators and, more importantly, class action lawyers gets larger and brighter. Once your brand’s superiority has been seeded with those all-important retailers, distributors and early adopters, it may be time to start dialing them down in fa-

vor of a more generalized positioning that marketers love to describe as “lifestyle.”

I saw that pattern at Essentia, which evolved to a generalized, and in some ways meaningless, “overachieving H2O.” Did that hurt the brand? Not judging by a test I conducted that I’ve written about here before.

When I came into a wad of free-bottle coupons, I dispensed them to anyone I saw cradling a bottle of Essentia, whether in a Whole Foods café or the New York subway. You seem to really like this brand, I would say as I pressed a coupon into their hand. How come? Several dozen coupons in, I’d yet to encounter a consumer who said anything about rapid hydration or even alkalinity. Tastes good, some said. I know it’s good for me, others said. It soon exited to Nestlé for a nice premium.

Sometimes that evolution is forced. Years ago Penta Water got its hand slapped by the government for the smoke it was blowing about its special molecules, or whatever. (Pre-Internet, Penta actually hung CDs from the necks of bottles so shoppers could learn about its unique structure when they got home.) So Penta dropped that messaging, to no discernible effect. Its better-for-you identity had already been seeded.

And what if your proprietary functional ingredient has been demonstrated in court not to exist? That’s what hap -

pened with Bang Energy under legal assault by Monster Beverage over its core “super creatine” ingredient that long was emblazoned on every can on the way to becoming a billion-dollar brand. No such thing, Monster’s lawyers proved. Totally fictitious.

So, the brand duly scrubbed the phrase off its cans (and after some further judicial prodding, off its website and other marketing vehicles). But by then the message about Bang’s special efficacy had long since sunk in, and in any case most buyers no longer were gym rats obsessed with muscle-building. So – whatever. The change didn’t seem to meaningfully weaken the brand.

True, it was spiraling downward in the face of its various legal, distribution and other problems, but its new owner, Monster, shows no signs of doubting that Bang’s prominence can be restored.

In some ways, this is all a disappointing aspect of beverage brand-building. One would prefer not to have to make these compromises. Why hide your light under a bushel? But there comes a growth stage where they may be necessary to get more consumers to pick up your life-altering product.

Longtime beverage-watcher Gerry Khermouch is executive editor of Beverage Business Insights, a twice-weekly e-newsletter covering the nonalcoholic beverage sector.

Premium water maker Hawaii Volcanic has inked a distribution deal with top U.S. bottled water manufacturer BlueTriton to service the Hawaii-based brand in retail, home and office accounts through its ReadyRefresh Direct Delivery platform. The deal was brokered via L.A. Libations, which holds an equity stake in the brand.

According to Hawaii Volcanic CEO Jason Donovan, the brand provides BlueTriton with its first offering in Hawaii, while adding an additional premium water brand to its portfolio in the Western U.S. market, complementing its Arrowhead brand. Donovan noted that Hawaii Volcanic’s focus on sustainability was also key to securing the partnership, as the brand sources from a renewable water source and is packaged in recyclable glass.

“They love that we’re very aligned on mission first and we will be filling in some whitespace for them,” Donovan said. “I think we’re adding to their portfolio being in the super premium category and being in glass.”

“BlueTriton’s ReadyRefresh Direct Delivery business is excited about our new

DSD partnership in California with Hawaii Volcanic Water,” said Joe Wiggetman, Chief Customer Officer of BlueTriton Brands, in a statement. “We look forward to satisfying our consumers with another outstanding healthy hydration option.”

In addition to DSD services, BlueTriton’s ReadyRefresh network has access to over 200,000 home and office accounts in California alone, L.A. Libations CEO Danny Stepper told BevNET. The partnership is underway in California with the possibility of expanding to Arizona, Texas and Florida in the near future.

BlueTriton was founded in 2021 following the acquisition of ReadyRefresh and the Nestle Waters North America brand portfolio by an investment group.

“What I’ve learned from doing deals with strategics is that when it’s natural, and if it just feels like it fits on both sides, that’s when things usually go good,” Stepper said. “It’s when you’re trying to do something unnatural and forcing it that they tend not to go well. So, I’m very bullish that this is going to be really great for both organizations.”

Founded in 2012, Hawaii Volcanic had

primarily been distributed in the Aloha state until last year, when it closed a $10 million funding round that included investments from L.A. Libations and surfing icon Bethany Hamilton, among others. The brand has since been focused on building distribution along the West Coast, hitting its goal of 8,000 doors by the end of 2023 and adding retailers such as Walmart, Erewhon, Albertsons, Safeway, Vons, Pavilions and around 120 CVS stores in California.

While L.A. Libations has been able to build Hawaii Volcanic’s presence in a number of mainstream retail chains, Stepper said the key unlock BlueTriton will bring to the brand is actually in its ability to add more small chains and independent accounts to its footprint.

Stepper also noted that the deal offers future opportunities for L.A. Libations to work with BlueTriton for distribution agreements on additional brands, noting that ReadyRefresh also services non-water products like ROAR Organic.

“This is super exciting for Hawaii Volcanic, but it also opens the door for L.A. Libations to do more with them,” he said.

Westrock Coffee is expanding its already ambitious strategic vision for ready-to-drink, announcing in February an agreement with Texas-based Select Milk Producers to create a joint venture for dairy or plant-based milk and coffee beverages.

The collaboration was affirmed in a letter of intent between the two companies, which detailed plans for the construction and operation of extended shelf-life and aseptic multi-serve bottle lines inside a new manufacturing facility Select Milk intends to build in Littlefield, Texas, set to go online in Q1 2026.

Dallas-based Select Milk is a major milk processor in the Southwest and Midwest, and is the owner or joint venture partner in eight plants. The company was an original partner with The Coca-Cola Company in fluid dairy brand Fairlife before being bought out in 2020.

The new plant will produce drinks made with coffee extracts and concentrates supplied from Westrock’s 524,000 square foot, $300 million facility in Conway, Arkansas, the centerpiece of the family-run company’s plan to dominate the liquid format. The Conway site is set to go online this spring, but is already getting an upgrade.

“As we near completion of the Extract and RTD facility in Conway, Arkansas, we made the decision to expand our ex-

tract and concentration capabilities so that as we add additional lines in the future, we can do so without having to impact the existing operations of the facility,” said Westrock Coffee’s CEO and Co-Founder, Scott Ford, in a statement.

“In addition, we have expanded our multi-serve bottle capacities by adding cold-chain capability to our facility. Together, these additions better position us to respond to existing customer demand for extended shelf life (“ESL”) and multi-serve bottles and ensure we can grow our capabilities in the future without disrupting operations.”

As detailed in the most recent edition of BevNET Magazine, Westrock has made deep investments in its RTD strategy that have dampened recent quarterly earnings, with management promising short-term pain will translate to long-term gains before the facility has even officially opened.

Westrock is funding both the Select Milk joint venture and the Conway expansion by issuing $72 million in convertible senior unsecured notes (bearing 5% annual interest) due 2029 in a private offering. The notes are convertible into shares of common stock in certain circumstances and during certain periods at a conversion price of $12.84 per share, subject to adjustment.

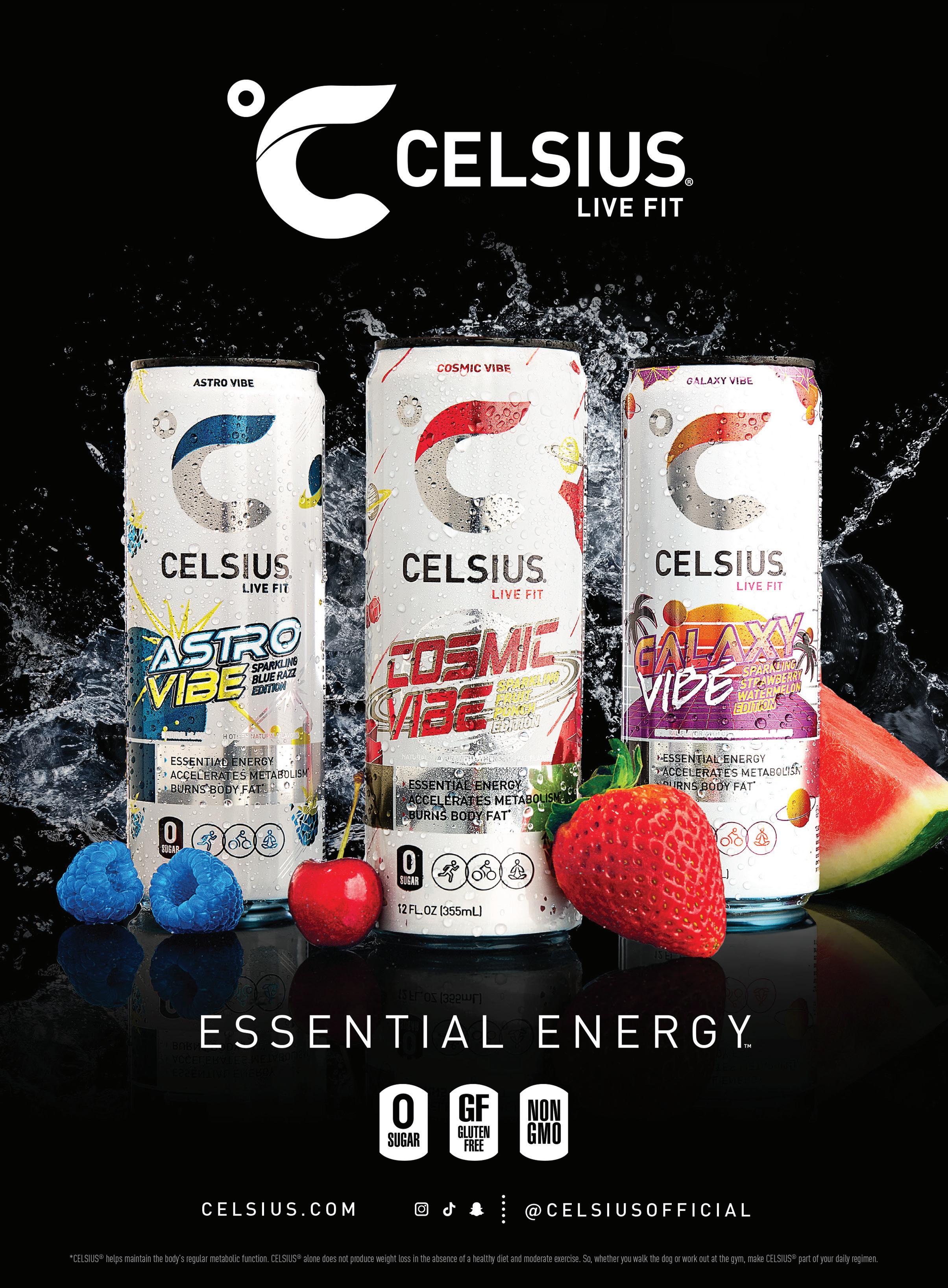

Celsius is showing no signs of stopping its upward trajectory as it reported nearly triple-digit gains in its Q4 2023 earnings in February.

The Boca Raton, Florida-based energy drink company posted revenue of $347.4 million, a 95% increase compared to Q4 2022. For the first time, Celsius topped the billion dollar mark with FY2023 revenue of $1.32 billion, up 102% versus the previous year.

The “stellar” performance to close out the year, CEO John Fieldly said, was backed by its strategic distribution partnership with PepsiCo, a focus on refrigerated placements and a “methodical approach” to international expansion.

“The energy drink category is now a three-team race,” Fieldly said in prepared remarks referring to Red Bull and Monster as the top two category leaders.

Celsius held about 9.3% of dollar share revenue with unit sales up 119%, according to Circana data for the last 52-week period ending December 31.

Company leadership was bullish on the opportunity in its Celsius Essentials line which launched late last year. The new amino acid laden, performance energy drink reported a record 49% ACV (All Commodities Volume) year-to-date on February 18.

Gross margin was about 48% in both the Q4 and full-year results and its nonGAAP adjusted EBITDA was up 316% to about $296 million for FY2023, compared to $71 million in the prior year.

Net income attributable to common stockholders was $39 million for Q4, compared to a -$28 million loss in the same quarter the previous year.

The energy brand touted its growing footprint in foodservice where 12.5% of its Pepsi distribution sales come from the channel. The company also has also been prioritizing its branded cooler program where it currently has over 10,000 refrigerated cases across the U.S. representing over 300% gain year-over-year.

With an eye towards increasing its placements and velocities in the convenience channel, cold placement has been a “big initiative” in order to drive impulse purchases, Fieldly said in the question-and-answer section. “We do

see uplift if you’re by the register and you’re cold. If it’s cold it’s sold.”

In ecommerce, Celsius announced it was the highest selling energy drink with 19.7% share of the category, edging out Monster Energy which clocked in at 19.6%.

It has also made gains in its Club channel sales. Club sales were $77.1 million in Q4, up 64% year-over-year.

One of the pillars of its continued growth revolves around its international distribution where last year it moved into two key markets. Utilizing its partnership with PepsiCo, the brand began distributing in Canada in mid-January and is “pleased” with sales in the country in the limited timeframe.

Celsius also announced Suntory Beverage & Food as its sales and distribution partner in the United Kingdom and Ireland.

In looking for the best partners to align with internationally, Fieldly noted that Suntory’s access to the gym community was “very attractive” but

Celsius needs to “build a loyal foundation” before it scales too quickly.

CFO Jarrod Langhans did caution that there will be some “costs and investments” in building awareness and production in both of these international markets.

Celsius already had a co-packer in Canada that it used as a backup for its U.S. business but in the UK, the company is “launching from zero,” Langhans said. “We won’t have the same scale and leverage advantages within manufacturing as we do in the US. But it’s not going to be a significant component of either our growth or our cost infrastructure this year.”

Despite launching the Essentials line and new flavors throughout the portfolio in 2023, Celsius continues to “monitor its SKUs” looking for areas where it can “cut its tail” on slower moving varieties, Fieldly said.

Celsius stock was up about 17%, trading at $79.40 per share at the time of publication.

As it looks to scale up to meet fast-rising demand for new innovations, Liquid Death has closed a $67 million funding round at a valuation of $1.4 billion.

The financing adds to the more than $200.6 million the betterfor-you beverage maker has raised since 2019, while the new valuation is double the $700 million valuation it touted following its Series D round closed in 2022.

This latest round features investments from several distributors, including the “No. 1 distributors in North Carolina, Oregon, Utah, and Washington,” among others.

According to Liquid Death founder and CEO Mike Cessario, having the distributors invested in the brand was an important step towards strengthening the brands relationship with its top DSD partners. While he declined to name any specific companies involved in the financing, he said that eight of the brand’s top 10 distributors are among the investors.

Cessario noted that having a “shared alignment” with its distributors was important for the business, particularly in an industry where DSD houses frequently invest heavily into building beverages from the ground up only to be left with a large vacancy when a brand exits to a strategic.

“We’re really making them feel like they truly are an extension of our company,” he said. “We want to bring them in and have them more involved in every way because it’s so critical to have a shared alignment with them.”

As well, he suggested that having distributors at the cap table also sends a confident message to other investors about the strength of Liquid Death, as distributors “really know what’s working” on shelf.

Beyond DSD partners, a new institutional investor – SuRo Capital – has joined the brand’s cap table alongside follow-on investments from existing partners Live Nation, Science, Inc., and Gray’s Creek Capital Partners. SuRo is a publicly traded investment firm.

Several celebrity investors also joined in the raise: actor Josh Brolin, NFL star DeAndre Hopkins, Chapelle’s Show co-creator Neal Brennan, comedian Jim Jeffries, and Derrick Green, vocalist of the metal band Sepultura, all participated.

The company reported that it brought in $263 million in retail sales last year, while it expanded its footprint to over 113,000 retail stores across the U.S. and the U.K. That growth has been bolstered by the expansion of its product portfolio beyond the water and sparkling water categories, launching last year a canned iced tea line and most recently adding a powdered hydration line called Death Dust.

Much of the new funding will now go towards supporting continued innovation and scaling. Last year marked a complete transition to total U.S. manufacturing for Liquid Death across all product lines, and Cessario said the company is now seeking to add new co-packing partners this year to both meet demand and increase efficiency in order to improve margins.

While the brand’s flagship still water in a can remains its top selling individual SKU, Cessario said that Liquid Death’s sparkling water and tea lines combined are now more than half of the business, and this year will see additional flavor extensions on both lines (several of which were showcased at Natural Products Expo West in Anaheim, California).

With Death Dust, Liquid Death is now extending its portfolio beyond RTD. Cessario noted that powdered hydration products are the smallest category the brand has tackled to date, but he believes the brand is primed to stand out in a set that has already seen significant growth and disruption in recent years through the expansion of brands like Liquid I.V. and PRIME. However, he cautioned that the company views powders as an experimental space and isn’t anticipating the line to be as large out the gate as its past line extensions.

The launch is already providing some lessons for the company. Liquid Death has now heavily discounted its first batch of Death Dust products by 40%, admitting it did not make the flavors strong enough. However, the flexibility of powders has allowed the company to quickly recover, Cessario suggested, and an improved version will be on shelves within 60 days.

“We’re never afraid to admit to people that we can continue to get this better,” he said. “I think people really appreciate that, because so many companies don’t ever admit it, like ‘Oh, we can do no wrong, everything we do is perfect.’ No, we’re human, like anyone else we’re learning, and we care.”

The new financing follows rumors last summer that Liquid Death was exploring a potential IPO and had secured Goldman Sachs to help lead the process. Although Cessario had previously said the brand has considered going public as one option, there’s been little update on whether an IPO has made progress since July.

Cessario told BevNET that the company wants to keep its options open while it focuses on getting the business to a position where it could confidently issue an IPO should they ultimately choose to.

“We’re not hyper-focused that this is one thing we’re going to do, we’re just focused on continuing to grow,” he said. “We just want to make sure that we’re in a position where we have options, so if we do decide that an IPO is right, that we have all the things in order that we would need to have that be an option and be successful. And likewise, with any other sort of partnership or option.”

Seattle-based craft soda producer Jones Soda Co. is crossing over into BevAlc with the launch of Spiked Jones Hard Craft Soda, announced in March.

The company, which also expanded into foodservice and deeper into cannabis this year, is now leveraging its unconventional soda brand to move into the ready-to-drink category with the help of another Washington-based beverage company. Rainmaker, producer of Locust Cider, will partner with Jones on national distribution, a collaboration focused on “operational efficiencies, incremental sales and profits for key retailers,” read a statement.

Spiked Jones will launch with 19.2 oz single cans (6.9% ABV) and a mixed 12-pack of 12 oz cans (8.4% ABV). Known for its indulgent flavors, the initial SKUs include M.F. Grape, Orange & Cream, Strawberry Lime, Berry Lemonade, Cola & Lime, and Green Apple. Cans will feature user submitted photos, as popular with other Jones Soda products.

The product is not Jones Soda’s first foray into BevAlc, in 2018 it launched Spiked Jones, a hard cider-soda produced in partnership with Jeff Bland, the cider maker for Spire Mountain Ciders at Fish Brewing in Olympia, Washington. But that was before other soda and non-alc beverage producers began a rapid push into ready-to-drink products, also aiming to open up new revenue streams using familiar brand names.

Hard soda sales were up 50.6% in the two weeks ending February 2, with brands like Hard MNT Dew dominating in share, according to NielsenIQ data for US x AOC (extended All Outlet Combined) channels.

The brand has secured a major retail grocery partner for initial distribution in Q2 2024, to be announced at a future date, according to a statement. Jones Soda was founded in 1986 and has since become a retail mainstay available in chains such as Walmart, Kroger, Albertsons, Circle K and Kum & Go, among others. In February, the company created a new internal foodservice division to focus on growing the brand in on-premise accounts including bars, restaurants and quick-service locations across the country.

The partnership with Rainmaker compliments and broadens Jones’ flavors and formulation, retail grocery and convenience relationships, as well as its new footprint in food service, according to a release. The launch is being supported by in-store sampling and activation at music festivals.

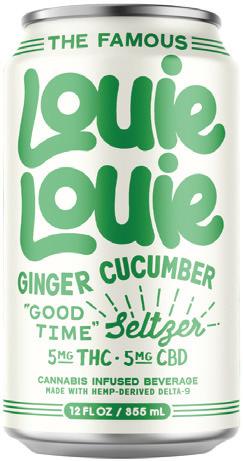

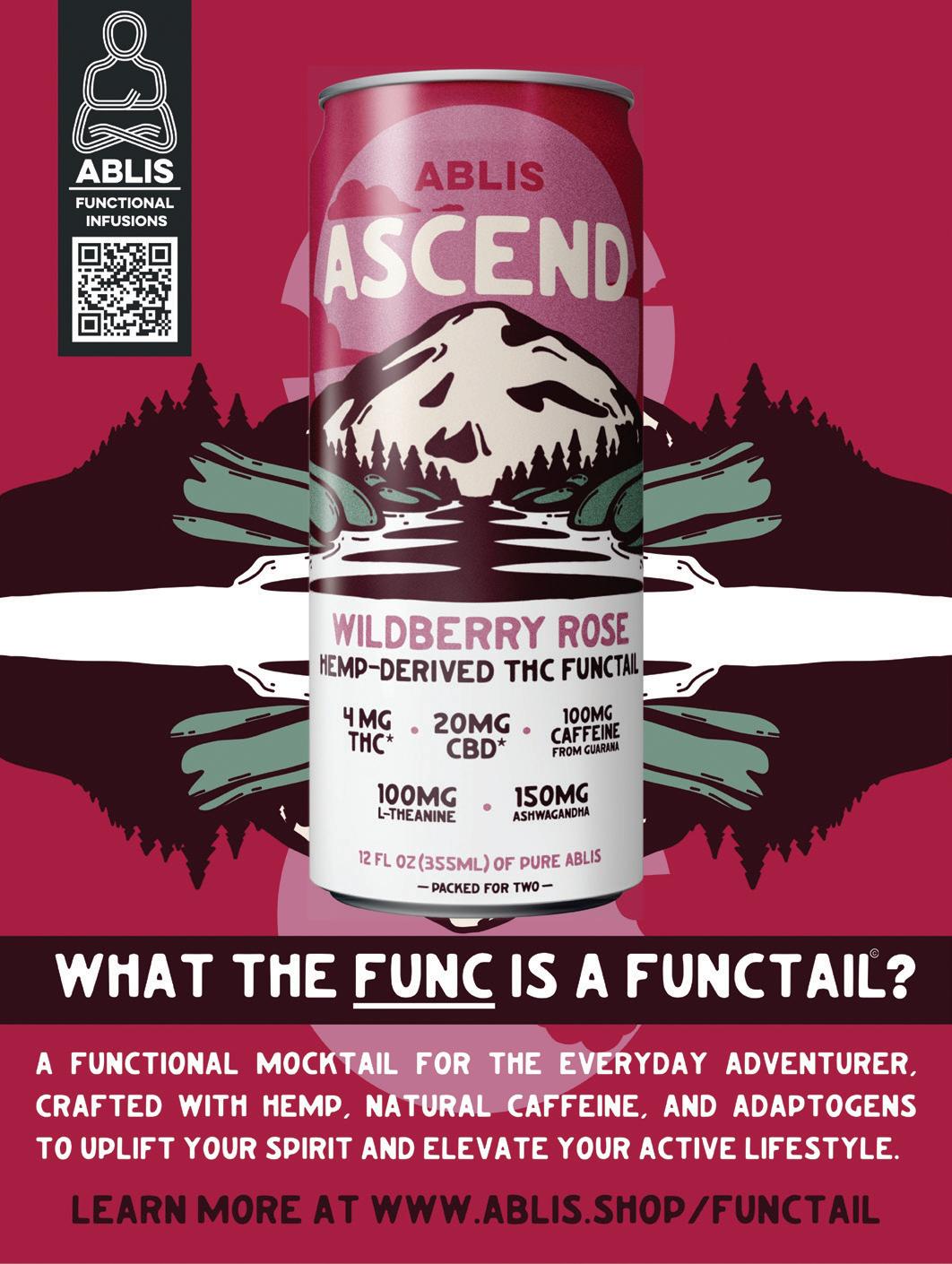

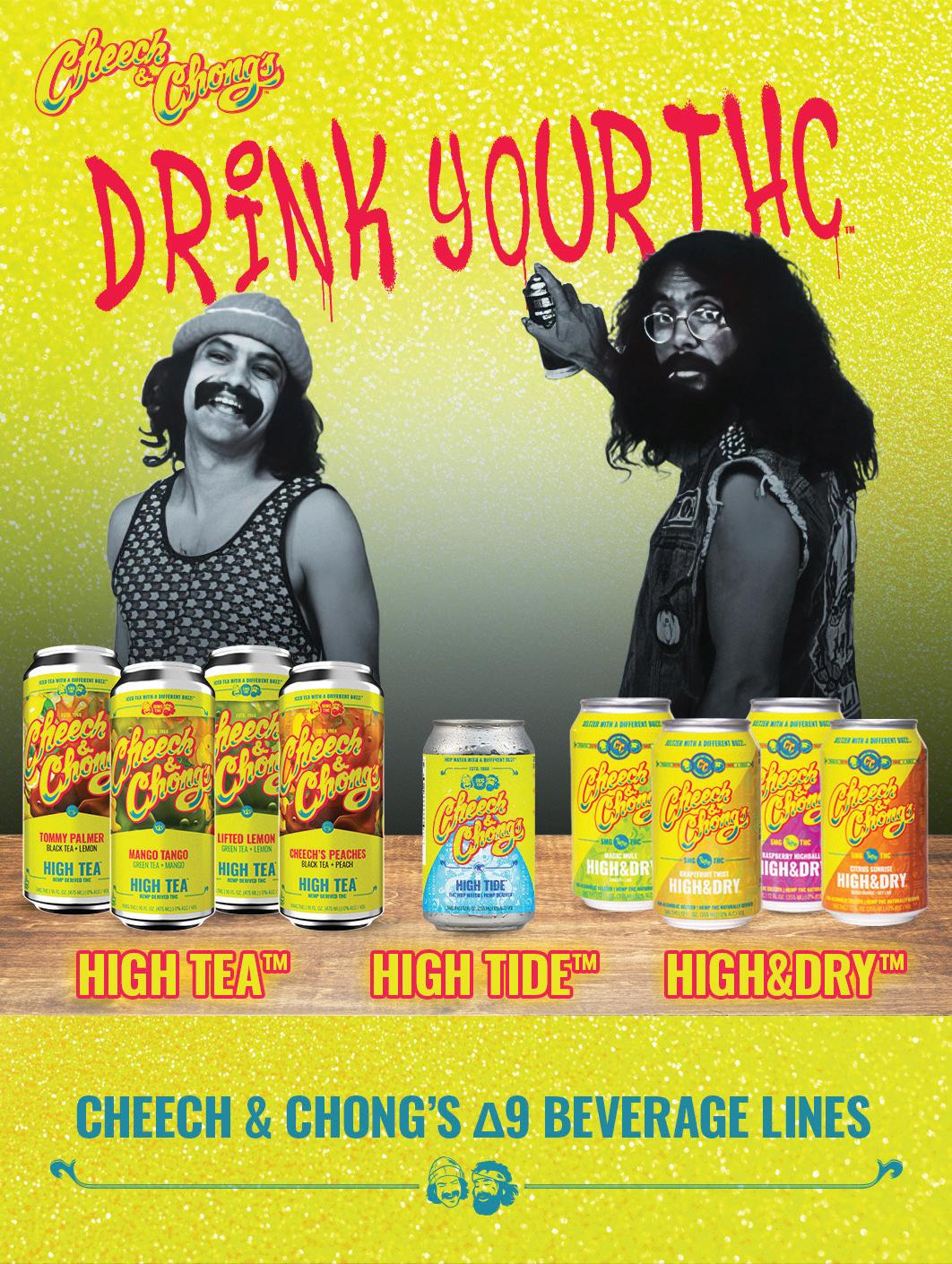

The expansion arrives on the heels of its move into the Delta-9 hemp category via its cannabis Mary Jones beverage line, allowing it to grow its THC-infused products in mainstream retail accounts.

Last year, David Knight became president and CEO of the company, taking over the role from outgoing executive Mark Murray, who had been credited with helping to turn around the brand following years of declining sales.

In its most recent Q3 2023 earnings report in November, Jones reported revenue for the quarter fell to $4.5 million from $4.8 million the prior year. However, gross profit as a percentage of revenue increased 600 basis points to 32.9% in the quarter.

The next challenge for the proposed $24.6 billion merger between Kroger and Albertsons is coming from the federal government.

The Federal Trade Commission (FTC) announced on Feb. 26 it has filed a lawsuit to block the merger in the U.S. District Court for the District of Oregon, alongside a bipartisan group of nine attorneys general from Arizona, California, the District of Columbia, Illinois, Maryland, Nevada, New Mexico, Oregon and Wyoming.

According to the FTC, the commission investigating the merger’s anti-competitiveness unanimously voted (3-0) in favor of filing a temporary restraining order and preliminary injunction against the deal, which the agency argues eliminates competition in the grocery industry, and will lead to higher prices for consumers and harm the tens of thousands of workers employed by both corporations.

Even the supermarket’s executives have admitted to the anti-competitiveness of the deal, the FTC claims, highlighting in a release that one executive reacted to the deal by claiming: “you are basically creating a monopoly in grocery with the merger.”

The FTC emphasized that if the deal were completed, the combined companies would operate over 5,000 stores, 4,000 retail pharmacies and employ 700,000 workers across 48 states.

“This supermarket mega merger comes as American consumers have seen the cost of groceries rise steadily over the past few years,” said Henry Liu, Director of the FTC’s Bureau of Competition, in a press release. “Kroger’s acquisition of Albertsons would lead to additional grocery price hikes for everyday goods, further exacerbating the financial strain consumers across the country face today.”

But Albertsons reinforced its stance in a statement that the merger will “expand competition, lower prices, increase associate wages, protect union jobs, and enhance customers’ shopping experience;” Kroger echoed similar claims.

The FTC’s complaint holds that the two companies are direct competitors, but whether that matters in a grocery landscape that now sees non-direct competitors hold a significant share of the market remains a question likely to be debated by the court.

Both Kroger and Albertsons reemphasized their belief that rejecting the deal would harm their ability to compete against multi-channel retailers like Amazon, Walmart and Costco. The companies claim that by merging, the combined entity could offset these aforementioned group’s “growing dominance of the grocery industry” by ensuring local supermarkets can better compete.

February’s filing reveals that in addition to believing the merger reduces competition, FTC is challenging whether the previously announced divestiture plan with C&S Wholesale Grocers has the potential to be successful and allow the newly divested businesses to hold their own against their former parent organization.

The companies have said they plan to divest 400 stores, and can sell up to 650, to the wholesale and distribution compa-

ny. The FTC claims the plan itself is “inadequate” and features a “hodgepodge of unconnected stores, banners, brands, and other assets that Kroger’s antitrust lawyers have cobbled together.”

C&S’s current share of the grocery market also remains up for debate. The FTC claims the Piggly Wiggly and Grand Union banner operator runs only 23 supermarkets, and a single retail pharmacy. Media reports have placed C&S’s total retail footprint at 160 locations. Either way, federal regulators believe the proposed divestiture does not create a “standalone business.”

If nothing else, the FTC’s suit ensures that any potential timeline for completing the merger will be stretched.

“This is a first step in order to slow things down,” explained Brian Albrecht, chief economist at the International Center for Law & Economics. “[This deal has] already been slowed down a bunch, but [now it is] the court saying they have to slow down.”

Albrecht believes the dispute between the regulator and the retailers must be over a significant number of markets. While there is always a chance that once divested, stores could fail under new ownership – as was the case when Albertsons divested stores to Haggen to appease regulators in its 2014 merger with Safeway – Albrecht, doesn’t believe that is a likely outcome.

He highlighted that it has become commonplace in recent years for grocers to create efficiencies by leaning heavily into vertical integration. Considering C&S specializes in wholesale distribution, he believes those existing operations could give newly divested stores a solid foundation for success.

Walmart has notably grown to become a leader in grocery since opening its first supercenter store in 1988, which saw it sell groceries for the first time. That same year was also the first, and last time, a supermarket merger has been challenged in court with American Stores and Albertsons’s acquisition of Lucky Stores. That means the last precedent set on competition in the grocery space is nearly 40 years old and came before many of today’s top players had entered the game.

There has been a lot more change to the landscape since then as well. Big box stores, discount chains and even dollar stores have also become grocery shopping venues, shifting how and where consumers buy food. Online grocery shopping has also evolved, albeit in more recent years, to become an important part of the food-buying landscape.

The changes to the market, including the landscape for grocery and the higher prices consumers have faced in recent years, will remain a central feature to both sides’ defense.

Both Kroger and Albertsons emphasized that they are willing to go to court for the deal. Given the current FTC’s track record, the federal regulator is also expected to put up a fight. That means the merger’s close date could be pushed out well beyond the anticipated August 17 date executives set earlier this year.

Just two weeks into his tenure as CFO at Meati, Phil Graves received a promotion.

The mycelium root-based protein company in mid-February elevated Graves, a former Patagonia exec, to CEO, following the departure of president/COO Scott Tassani.

“This was a joint decision with Phil, the Board and [founder] Tyler [Huggins] to leverage Phil’s success in scaling mission-driven organizations,” said a spokesperson for Meati. “Phil brings deep expertise in financial management, strategic planning, and operational optimization, and his passion and skill for driving profitable growth is exactly what Meati needs now.”

Graves previously helped scale businesses including Patagonia, Wild Idea Buffalo, and Bass Pro Shops/Cabela’s. He most recently served as CEO of Wild Idea Buffalo and has expertise in driving profitable growth, financial management, strategic planning, and operational optimization.

While Graves is getting promoted, Meati is making cuts elsewhere. The company announced it is trimming 13% of its employees as Graves prioritizes “right sizing” the company’s workforce as part of its push toward profitability. The February layoffs are the only expected personnel changes currently, the spokesperson noted.

The news comes less than six months after the Boulder, Colo.-based company raised $50 million to give itself an “economic cushion” before proceeding to terminate 10% of its employees; the layoffs impacted 20% of the company, or 60 roles, but 30 were offered new positions within the business.

At the time, the company also decided to close its pilot scale production plant. All of these efforts have been made to put the protein player on a path toward profitability, which it now believes is in view.

“Meati has a clear path to profitability that includes aiming to be EBITDA positive within the next 12 months,” said a spokesperson. “Phil is focused on helping drive Meati to nearterm profitability and responsible, sustainable growth as the company continues to disrupt the food industry by bringing MushroomRoot, a revolutionary, new protein to market.”

Keeping with its “every five years” timeline, better-for-you CPG investment firm Boulder Food Group (BFG) Partners, which counts brands like Olipop and Mid-Day Squares in its portfolio, is launching its third fund, targeting a $125 million pot.

The fund has already raised about 70% of its goal (about $87 million), and will center on seed- to series B-stage companies with typical check sizes of between $3 million and $5 million, said managing partner Dayton Miller.

BFG operates at its best when it can be one of the first institutional investors into a business in the early stage where “there’s a lot of action that happens,” Miller added. BFG’s portfolio strategy is centered around a rough schedule of five years to invest the fund’s pool of capital and another five years of possible follow-on investments.

The firm has incrementally increased its fund size: its $54 million Fund I launched in 2014, followed by $108 million in its 2019 Fund II.

Founded by former Bear Naked COO Tom Spier, the firm’s strategy has been “very patient and very methodical” in its placement of capital, Miller said. “Hopefully, we’re not too influenced by the winds of any given day.”

Pulling from their collective experience leading CPG companies, Spier and Miller – former CEO of Function beverages – “have a real appreciation for how hard it is” for founders and “empathy” for brands.

After sticking to consumables in Fund I, BFG took a step into personal care products in Fund II, where it saw a lot of deal flow happening. The firm wanted to explore the synergy between natural channel consumers of food and beverage brands and certain sectors of personal care products. With successful exits from hair care company Curlsmith to Helen of Troy and skincare maker ZitSticka to Heyday, Miller said BFG feels it has “earned the right” to continue to invest in the sector.

Yet, the investment group is still heavily focused on environmentally friendly and better-for-you food and beverage products.

In the last fund, BFG invested in rising CPG brands like Graza, Mid-Day Squares and Oats Overnight. The investment group has also made notable investments in Caulipower, MALK, Barnana, Bobo’s and Olipop. BFG has successfully exited food and beverage investments from Chameleon Cold Brew, with its sale to Nestlé in 2017 (later sold to SYSTM Foods) and, in 2020, Sovos Brands’ acquisition of Birch Benders (which changed hands again to Hometown Foodsthree years later).

BFG has taken a board seat in about half of the companies in its portfolio. Miller said BFG’s approach to consulting and advising its invested companies isn’t a “onesize-fits-all” approach, noting that “informal relationships” with founders can be “just as influential” as board seats.

Seeing as the investment climate has been particularly uncertain in the last year, BFG will be using a healthy amount of caution when preparing to deploy the new capital.

Where is the firm looking for its next big break?

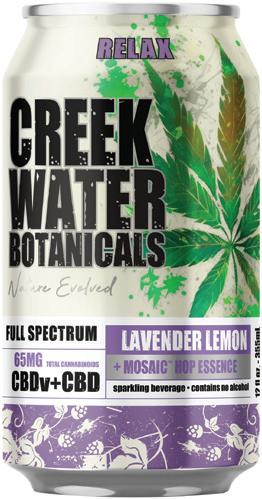

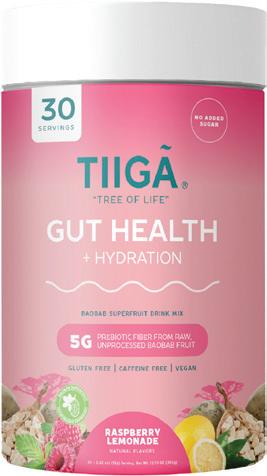

BFG invested in Olipop in Fund II and is confident there will be more opportunity for products positioned around gut health. The subcategory continues to draw attention from consumers, producers and investors alike, especially, when paired with the intersection of GLP-1 drugs and CPG, Miller said.

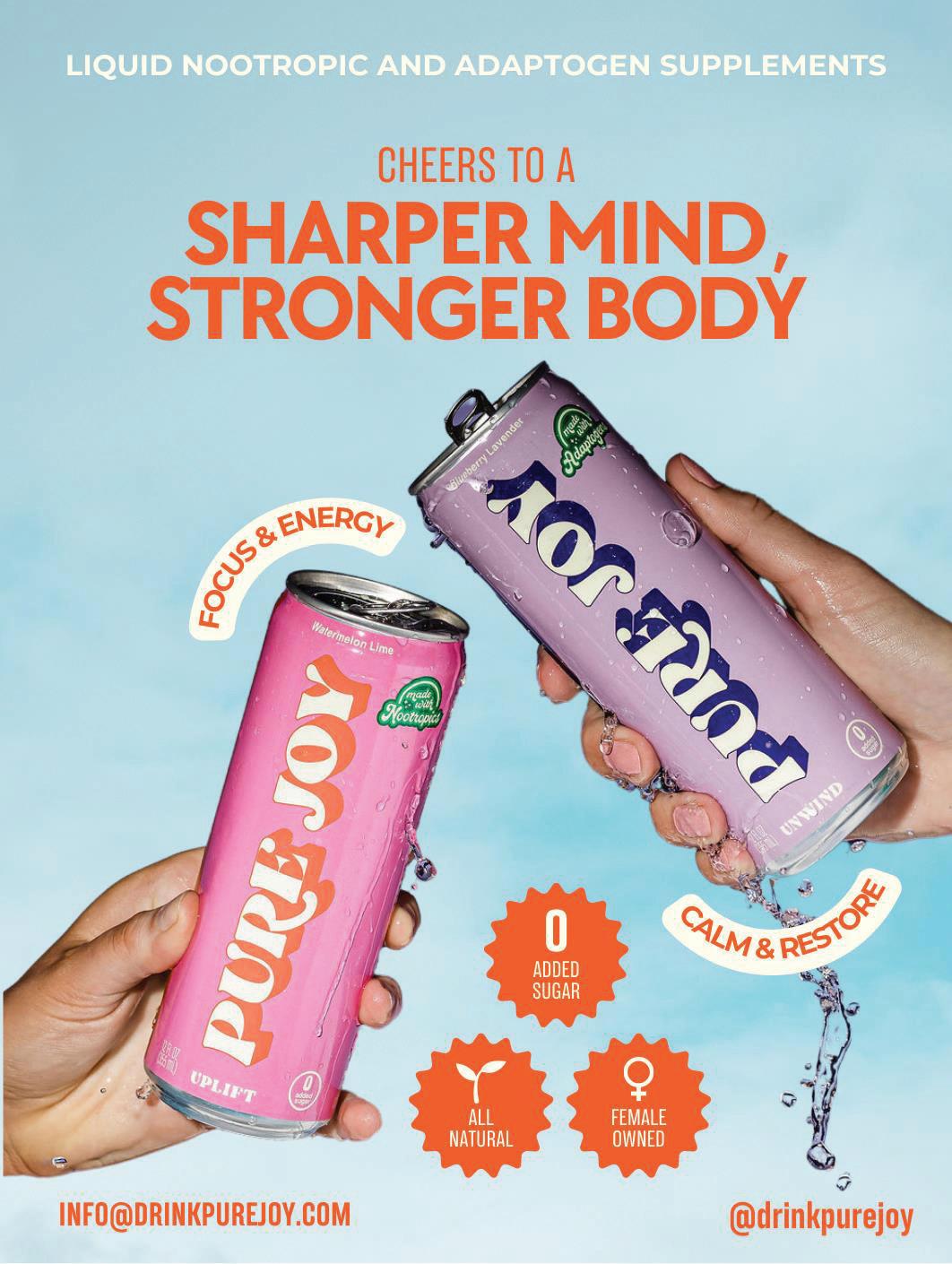

Another possible opportunity for capital deployment could be brands that claim to improve brain health and provide mental clarity. Though BFG has not disclosed any investments for Fund III yet, it has been tracking the upward trend towards more food and beverage brands positioning around supporting cognitive health with low-sugar and fitness-oriented products.

Miller is especially interested in the link between “not only physical well being but also emotional well being and food.”

The strategy continues down the path laid by its previous interest and growth capital to primarily DTC brands MUD/WTR or Athletic Greens which have leaned into methods for reducing brain fog and glucose spikes.

Alter Eco has shifted hands once again.

Texas-based investment firm Trek One Capital announced on Feb. 1 its acquisition of the Fair Trade, regenerative confections and pantry staples producer, having officially closed the deal in December 2023. Terms were not disclosed.

The transaction coincides with a leadership shift. Arnulfo Ventura, who joined the company in 2022 from chip brand Beanfields, officially departed from the CEO role in September and was succeeded by Keith Bearden, an advisor to Alter Eco’s previous owner NextWorld Evergreen (NWE), ahead of the closing. Bearden was tasked with leading Alter Eco through the acquisition and will remain on as the company’s CEO.

“I look forward to my partnership with Trek One along with their support and commitment to take the Alter Eco premium brand of products to the next level,” Bearden said in a statement.

Alter Eco was founded in 2004 as a mission-based company to support cacao farmers in South America. The company boasts regenerative agriculture, organic and Fair Trade claims across its product lines, which includes chocolate bars, truffles, granola and quinoa products.

In 2017, Alter Eco was acquired from its co-founders Edouard Rollet and Mathieu Senard by strategic equity firm NWE. Following its acquisition by NWE, Rollet and Senard told Nosh that while it wasn’t the highest bid the company received, the brand’s stakeholders felt the evergreen fund was the right fit for Alter Eco and its mission since it had less pressure to quickly produce returns.

Under its ownership, Alter Eco launched its charitable arm, The Alter Eco Foundation, in 2020 to support dynamic agroforestry in the Amazon and help farmers adopt regenerative practices. The strategic equity firms’ portfolio also included similar purpose-minded brands like Mighty Leaf Tea and acai producer Sambazon.

Trek One, a newly established investment vehicle, counts Tejas Environmental Solutions, a waste water and salt water disposal service provider, as its only

other portfolio company. According to operating partner and CFO Brian Fontana, the firm was created from a combination of family offices, existing businesses and investment vehicles.

Fontana was introduced to Alter Eco through an individual who was looking for a capital partner to help buy the business after NWE decided to divest its ownership stake. Trek One saw this acquisition as an opportunity to diversify its approach beyond the energy sector, but Fontana said it has no immediate plans to expand further into food and beverage.

Alter Eco has moved its headquarters from San Francisco to Houston, Texas. The company’s entire labor force worked remotely prior to the deal, and Fontana said all fulltime employees will remain with the company, but certain finance and accounting contractors have been eliminated due to redundancies with Trek One’s in-house capabilities. As it looks ahead, Fontana said the primary focus will be expanding Alter Eco’s distribution beyond its traditional roots in natural and specialty stores.

“The previous owners either didn’t want to focus on growth [or] they were happy with the consistency of the annual revenue and turnover that the company had,” said Fontana. “There’s a capital requirement to expand the business, and … our focus is to provide the capital and the leadership to expand the business to other markets in addition to expanding the product offering itself.”

Making the leap from building a brand to growing a business sometimes means controlling one’s destiny.

RIND Snacks is attempting to do just that by creating a vertically integrated production model with the acquisition of Vermont-based granola company Small Batch Organics. Along with leveraging the producer’s manufacturing muscle, RIND has also leased a 15,000 sq. ft. warehouse in neighboring Bennington, Vermont, where it will handle its own logistics and fulfillment. The terms of the both deals were not disclosed.

Officially RIND closed on the Small Batch sale in October, but merging the two companies’ supply chains and operations is not something that happens overnight, RIND co-founder and CEO Matt Weiss told Nosh.

“Like most brands, we’ve relied on third parties; whether it’s product developers, co-manufacturers, 3PLs, et cetera,” he said. “It’s an exciting new step in RIND’s evolution from a dried fruit snack brand to a dynamic, diversified and vertically integrated snack platform.”

Though it did not need new investment to acquire Small Batch, RIND saw the opportunity to raise new capital as a way to “allow additional runway to really hit the ground running” and “play offense” as it moves into selfmanufacturing, Weiss said.

Although the specifics of the Series A extension have not been made public at this point, RIND confirmed that The Angel Group, RCV Frontline — the venture arm of JPG Resources — and FABID founder Ryan Williams (a previous investor) have all added investment in recent months.

The former two investment groups bring a wealth of knowledge and expertise from the founder-operator perspective and, in the case of RCV, a breadth of experience in manufacturing and product innovation.

This will be integral as RIND moves into a self-manufacturing model; yet, the dried fruit snack maker will not be alone. It has retained all of Small Batch’s labor force — founder Lindsey

Martin and one full-time employee — as well as a part-time staff of about 15 to 20 employees. Weiss also added that RIND’s staff of now nine full-time employees might expand as it grows the business this year.

Founded in 2015, Small Batch has operated predominately as a private label producer and co-manufacturer of granola products but had recently branched out into branded offerings with distribution in select Costco and Whole Foods locations.

“This [acquisition] is one plus one equals four,” Weiss said, and will allow RIND to not only dictate its production and innovation streams but also “extend into adjacent categories.”

Since its launch in 2018, RIND has operated as an asset-light, speed-tomarket snack brand reliant on comans and a variety of service providers to help the business grow. It will maintain some production redundancies with co-packers for now but is expecting to integrate about 90% of all production to its Vermont facility throughout 2024.

The addition of the Small Batch capabilities is already showing an increase in profitability for RIND, Weiss said. As the company “recaptures its value chain,” it is expected to improve its gross margin by 15 percentage points while also expanding into new day parts with product innovation.

Though there is a variety of new offerings that RIND is planning to launch throughout the year, including a whole new line that will be unveiled at Expo West, the first new product is an extension of its Remix line. The Cherry Cashew Crunch features upcycled dried cherries, spiced cashews and, in a first for the company, vanilla granola.

The new Remix variety will be available in all Sam’s Clubs locations to start and will be followed shortly thereafter in Wegmans, Hudson News and select Walmarts, among others.

While maintaining some of Small Batch’s co-manufacturing business, RIND will be “opportunistic” in private label opportunities that are “non-competitive and non-dilutive,” Weiss said.

In saying that, Weiss added that moving production in-house will allow the company more flexibility to co-develop products with its strategic retailer partners like Walmart, Target and Costco.

“You have a manufacturing portfolio of what you can do and templates you can build,” he said. “That is a huge growth opportunity for us in revenue and expands our TAM [total addressable market] dramatically.”

RIND was founded to address food waste, using overripe or not able to sell produce and diverting the whole fruits into a healthy snack. The company claims to eliminate over one million pounds of otherwise discarded fruit every year. RIND’s whole portfolio is Upcycled Certified and the addition of Small Batch’s production capabilities fits into this sustainability mission. Both the recently acquired facility and the new fulfillment warehouse run on 100% solar energy and use renewable packaging solutions.

Or as Weiss put it: “RIND acquired a ‘green’ company in the Green Mountain State.”

This year has begun with a trove of news from Boston Beer Company, including the announcement that CEO Dave Burwick will step down and retire from the company’s board of directors, effective April 1.

Michael Spillane, a Nike executive and lead director on Boston Beer’s board of directors, will replace Burwick.

Burwick took the reins in 2018 following the departure of longtime CEO Martin Roper. He joined Boston Beer’s board in 2005. Prior to taking the top role at Boston Beer, Burwick was the CEO of Peet’s Coffee and served as president of WW International Inc. (formerly Weight Watchers) and CMO of PepsiCo.

“Dave has positioned the company very well for ongoing success in 2024 and beyond,” founder and chairman Jim Koch said in a press release. “I can’t thank Dave enough for his partnership with me and for his contributions to Boston Beer over the past two decades.

“His steady leadership, talent, work ethic, values, guidance, and motivation have been unwavering, and I appreciate all he did to make Boston Beer a more successful company and a better place to work,” he continued.

Burwick’s tenure includes the transformation of Twisted Tea and Truly Hard seltzer into billion-dollar brands, the acquisition of Dogfish Head, and the formation of partnerships with PepsiCo and Beam Suntory.

When Burwick stepped into the role, the company’s revenue was $850 million and has grown to $2 billion, according to Koch’s remarks in the release.

Spillane’s most recent role at Nike is president of consumer creation, before which he served as president of product and merchandising, according to the release. Other roles at Nike included president and CEO of subsidiary brands Umbro and Converse.

“After nearly eight years on the Boston Beer board – and as a native of the Boston area – I’m thrilled for the opportunity to help advance Boston Beer’s long-term goals as we enter a new growth phase,” Spillane said in the release. “I am grateful for Dave’s leadership and partnership and I’m look-

ing forward to working with Jim and so many other great people at Boston Beer to build on the strong foundation and culture that Jim, Dave and all of our coworkers have built over the course of four decades.”

Spillane joined Boston Beer’s board in 2016 and became lead director last year.

A few weeks before Burwick’s announcement, BostonBeer filed a Form 8-K with the U.S. Securities and Exchange Commission (SEC) detailing salaries, raises and bonuses for named executive officers (NEOs). All of Boston Beer’s NEOs except for Burwick received raises for 2024.

Burwick “opted not to be considered for a base salary increase” in 2024, maintaining a salary of $860,503. He received a +3% increase in 2023, below the 5% increase first promised to him when hired in 2019. He forwent his raise in 2022.

Burwick is the latest Boston Beer leader to leave the company in the past year. Former CFO Frank Smalla stepped down from the role in March 2023, staying on with the company in an advisory role through April 14. In the 8-K filing announcing Smalla’s departure, Boston Beer said his exit “is not related to any disagreement with the company or any matter relating to its operations, policies or practices.”

CFO Diego Reynoso received the largest percentage increase in the latest filing: +4%, to $624,000. Reynoso was named CFO and treasurer in July, effective September 5.

Boston Beer chief sales officer John Geist also announced he would be leaving his executive role in 2023, retiring after 26 years with the company. His last day in the role was December 31. However, he is staying with the company in a senior advisory role, and will maintain his executive salary of $608,650. Geist was “not eligible for a salary increase” in 2024, according to the filing.

All other NEOs received +3% salary increases for 2024, effective March 4:

• Chief accounting officer and VP of finance Matthew Murphy (new base salary of $393,756);

• Chief supply chain officer Philip Hodges ($633,450);

• Chief marketing officer Lesya Lysyj ($545,432).

News of Burwick’s retirement came moments before the company’s Q4/full-year 2023 earnings call with investors. In it, Boston Beer revealed -6% declines in shipments (sales to wholesalers) and depletions (sales to retailers) for the full year. Shipments (-3.5%) and depletions (-1%) improved in Q4.

Boston Beer experienced a “slowdown” in the first eight weeks, contrasted with “a reasonably strong finish to 2023,” founder Koch told investors. He attributed the sluggishness to Dry January, continued beer category “leakage” driven by Bud Light’s continued catastrophic declines, and the calendar cycling a price increase Boston Beer took in 2023 that drove increased load-in at the retail tier.

Despite the declines, all NEOs received 2023 bonuses, except for Smalla, who was not eligible, according to the 8-K filing. Cash bonuses are determined by whether the company meets projected goals, including depletions growth (50% of the goals), EBITA targets (30% of the goals) and “resource efficiency” (20% of the goals) – the latter of which will be referred to as “cost savings” in future filings “for the sake of clarity.”

Company performance against these goals determines the “bonus scale” and how much of the bonus pool NEOs actually receive.

“The committee has retained the discretion to increase or decrease an officer’s bonus payout by up to 10% from the baseline target bonus, if the officer was deemed to have performed ‘successfully’ in 2023, and by up to 30% if the officer was deemed to have performed ‘exceptionally,’” Boston Beer wrote in the filing. “The committee had also retained the discretion to decrease an officer’s 2023 bonus payout to as low as $0 if the officer was deemed to have performed ‘unsatisfactorily.’”

Boston Beer’s compensation committee determined that the company achieved 95% on the bonus scale in 2023 – significantly above the 38% Boston Beer achieved in 2022. As a result, NEOs were scheduled to receive the following cash bonuses on March 6:

• Burwick: $1,032,605 (was eligible for 120% of his base salary);

• Murphy: $189,850 (was eligible for 50% of his base salary as of May 3, 2023, after taking on the interim CFO tag from March 7 through September 4);

• Geist: $432,000 (was eligible for 75% of his base salary);

• Lysyj: $332,500 (was eligible for 60% of her base salary);

• Hodges: $214,500 (was eligible for 60% of his base salary);

• Reynoso: $111,000 (was eligible for 60% of his base salary).

For 2024, the bonus target eligibility will remain the same percentage for Murphy (50%) and Hodges (60%). Reynoso and Lysyj each received a +5% increase to their bonus target eligibility percentages, now both at 65% of their base salaries. Geist received a -15% reduction, to 50% of his base salary.

All other executives have a 2024 bonus target eligibility of 50% to 100% of their base salaries.

To end 2023, the “traditional” part of the beer category, which Koch estimated accounts for 80% of volume, declined -4%, while the 20% that includes beyond beer grew volume +7%.

For Boston Beer, those ratios are inverse, as beyond beer has long dominated its portfolio. Twisted Tea accounted for 49% of the company’s dollar sales at multioutlet retailers and convenience stores in 2023, according to market research firm Circana. Truly

Hard Seltzer accounted for 31%. The remaining 20% was primarily split among Samuel Adams, Angry Orchard and Dogfish Head.

During the call, Burwick highlighted the performance and opportunities for Twisted Tea and Truly Hard Seltzer.

In Q4, Twisted Tea dollar sales increased +29% and the brand gained +2.4 sharepoints, accounting for 28% of the total flavored malt beverage (FMB) segment in the off-premise channel, Burwick said. He attributed this growth to the brand’s Q3 college football tailgate campaign, increased media spending and optimized packaging.

A standout for Twisted Tea has been its variety pack, which was the third-largest and fastest-growing SKU in the FMB segment, Burwick said.

Opportunities for the brand include increasing shelf space, as the company estimates it accounts for 18% of FMB space at retail despite having a 28% share of total FMB dollars and 85% of hard tea dollars.

Twisted Tea remains “underpenetrated” in the on-premise channel, where it has a 60-point share of FMB volume. The brand is “underdeveloped” with Black and Hispanic drinkers, although household penetration among these communities increased +55% in 2023, Burwick said.

Geographically, Twisted Tea is deepening its roots in large markets such as California and Texas, where it is still underdeveloped. This progress has helped introduce the brand to Hispanic drinkers, Burwick said.

Twisted Tea Light, a 4% ABV offering, accelerated its sales per point of distribution last year; so far, its sales have been 85% incremental to the brand’s portfolio, and its ACV is 14%, with lots of runway ahead.

“We believe Light is an X-factor for brand growth in 2024,” Burwick said.

This year, Twisted Tea faces a tidal wave of competitors from all corners of the beverage-alcohol industry, including AriZona Hard Iced Tea, Monster’s Nasty Beast, FIFCO’s Lipton Hard Iced Tea, New Belgium’s Voodoo Ranger Hardcharged Tea and many more.

“Today, everybody is piling into it – there’s literally hundreds of new competitors,” Koch said. “I don’t see much traction from the vast majority of them. What I don’t know is, will something begin to get traction with a brand name from somewhere else, like AriZona or a Monster? They have a big, high hill to climb because Twisted Tea is the original. We defined the flavor profile, so to a hard tea drinker, it should taste like Twisted Tea.”

Koch doesn’t envision “a strong No. 2 emerging,” but he admitted the segment is beginning to include “great competitors,” which makes sense given the hard tea segment’s trends.

“It’s the biggest growth pocket outside of Mexican imports, so we expect to see everybody come in,” Koch continued. “But we’re 25 years into this, so we’ve got a 25-year head start. But we’re expanding our brand support. I think we’ve quadrupled it over the last few years, so we’re overinvesting to maintain that leadership.”

Twisted Tea’s continued growth will depend on the company’s ability to recruit new drinkers to its wide base which ranges “from upscale college kids to blue collar NASCAR fans,” Koch said.

“We know we’re not going to stay in the high 20s all year so we feel OK with it,” Burwick added.

Burwick also announced during February’s call that Hard MTN Dew is transitioning to Boston Beer Company’s beer distributor network and will expand to all 50 states.

The move marks the end of distribution by PepsiCo’s Blue Cloud Distribution, which had been a fissure between Boston Beer and its distributor partners since the brand’s launch.

PepsiCo confirmed the shift in its ready-to-drink alcohol business model, moving to brand licensing and flavoring sales model and away from distribution. The company said this move would help accelerate growth and speed up national distribution of brands such as Hard MTN Dew with Boston Beer and Lipton Hard Iced Tea with FIFCO USA.

PepsiCo also confirmed that Blue Cloud Distribution would transfer the distribution rights of both brands to its partners’ distribution networks “over the coming months as agreements are reached with suppliers and distributors, ensuring continued service to customers.”

“PepsiCo has always been a company that prides itself on innovation – charting new pathways for growth,” Sylvia Dong, PepsiCo SVP of strategy and transformation, said in a statement shared with Brewbound. “In only two years, the Blue Cloud Distribution team stood up a malt alcohol distribution network across 18 states. This network was leveraged to grow two successful brands in Hard MTN Dew and Lipton Hard Iced Tea. We are proud of the Blue Cloud associates who pioneered a new business model in a new space.

“Our commitment has always been to delight consumers at every beverage occasion with an ambition of reaching a national footprint,” she continued. “This means evolving our business model to extend the footprint of these brands, making them available to consumers nationwide.”

The new model for Blue Cloud is similar to that of competitor Coca-Cola’s Red Tree Beverages. Red Tree leadership has

continually emphasized that the wholly owned subsidiary has no interest in being a bev-alc distributor.

“One thing I want to be very clear about is that Red Tree will not distribute alcohol in the United States, nor will Coca-Cola,” Red Tree president Jenny Dowdy said last fall. “The creation of Red Tree was really just a way to formalize the way that we operate. It just underscores that we operate as a distinct entity from our non-alc business.”

Coca-Cola’s bev-alc ventures include Topo Chico Hard Seltzer, Simply Spiked, and Peace Hard Tea with Molson Coors; Fresca Mixed with Constellation Brands; Absolut & Sprite with Pernod Ricard; and Jack & Coke with Brown-Forman.

The contentious issue of Hard MTN Dew distribution manifested in Virginia where the company’s existing distributors challenged the appointment of Blue Cloud for Hard MTN Dew.

The Virginia Alcoholic Beverage Control Authority sided with Blue Ridge Beverage and Reyes Beverage Group subsidiary Premium Distributors of Virginia, ruling in late 2023 that Boston Beer was prohibited from appointing any distributor other than Premium and Blue Ridge to distribute Hard MTN Dew in those distributors’ respective sales territories.

The distribution model was also heavily criticized by the National Beer Wholesaler Association (NBWA), which claimed the organization skirted the three-tier system, and opened up the possibility of large soda giants using their existing retailer relationships – and inherent slotting fees – to get better shelf space for bev-alc products.

Oat milk still dominates when it comes to plant-based milk pairings with coffee, but pistachio milk experts Táche are ready to offer something new: Táche Pistachio Milk Latte (6-packs are $38), now available to order through the brand’s website and rolling out to retailers later this year. For more information, pistachiomilk.com.

Plant-based milk brand Mooala has introduced a new on-the-go format for its Bananamilks in Sprouts stores nationwide. Available in three flavors – Vanilla, Chocolate and Strawberry – each 8 oz. shelfstable carton of milk is available for a SRP of $1.69. Sprouts is also the inaugural national retailer for Mooala’s new Simple Organic line of Oatmilk and Almondmilk. For more information, visit mooala.com.

Building on the success of its barista line, Oatly is pushing further into the coffee add-ins category with a new line of nondairy creamers that’s hitting store shelves this month. Available in four varieties – Vanilla, Mocha, Sweet & Creamy and Caramel – the oat-based creamers were “developed to swirl beautifully into coffee while delivering the perfect amount of flavor,” according to the brand. For more information, visit oatly.com.

In honor of Lilly Pulitzer’s 65th anniversary, the resort wear brand has collaborated with Natalie’s Orchid Island Juice Company to lend custom artwork to the latter’s 8 oz., 16 oz., and 32 oz. orange juice bottles. An exclusive run of the limited edition bottes featuring Lilly Pulitzer’s signature, handpainted prints will launch in resorts, grocery stores, restaurants and concessions nationwide this month and will be available on shelves through mid-October. For more information, visit orchidislandjuice.com.

G Fuel seeks to take consumers on an excellent adventure with its latest flavor release, Wyld Stallyns Bahama Mama. Made in partnership with Creative Licensing Corporation, the limited edition variety takes inspiration from the classic

comedy film Bill & Ted’s Excellent Adventure. Each full-art collector’s box ($39.99) includes a 40-serving tub of Wyld Stallyns Bahama Mama, a pair of futuristic shades and a 24 oz. shaker cup featuring Bill, Ted, Rufus and their phone booth time machine. For more information, visit gfuel.com.

Better-for-you energy drink maker Celsius has introduced its newest flavor, Sparkling Raspberry Peach. Like the rest of the brand’s Original offerings, the new flavor boasts 200mg of caffeine derived from guarana extract and contains zero sugar. Celsius’ Sparkling Raspberry Peach is available for purchase on Amazon for $23.70 per 12-pack of 12 oz. cans. For more information, visit celsius.com.

First teased at NACS last year, Pepsi-owned energy drink Rockstar has officially unveiled its latest creation, Rockstar Focus. Available in three flavors at launch – White Peach, Lemon Lime and Orange Pineapple – each 12 oz. can boats 200mg of caffeine and features Lion’s Mane for a mental boost. The zero-sugar, calorie-free beverages are now available via the brand’s website for $22.49 per 12-pack and at retailers nationwide for $2.99 per can. For more information, visit rockstarenergy.com.

The Coca-Cola Company is looking to its sparkling mineral water brand Topo Chico to extend into the non-alcoholic cocktail mixer set with a new line featuring Ginger Beer, Tonic Water and Club Soda flavors. Available in 7.1 oz. glass bottles, the mixers can be used with alcohol, in a mocktail, or consumed on their own. The line is set to hit shelves on March 17 and will retail for $6.79 per 4-pack. For more information visit coca-cola.com/us/en/ brands/topo-chico/.

Co-branded, candy flavored drinks have risen in popularity in recent years and now Wild Bill’s Craft Beverage Co. is joining the fun via a partnership with Bazooka Candy Brands to create a Ring Pop flavored craft soda. Available in Blue

Raspberry and Berry Blast, the drinks are launching today at select retailers around the country and online D2C. For more information visit drinkwildbills.com/.

Have you ever found yourself wanting to bottle the starstruck feeling of seeing your favorite artist perform live? Well, Coca-Cola has you covered with its new limited edition K-Wave Zero Sugar flavor. The new CSD features a “fruity fantasy” flavor profile and can be purchased on the company’s website for $8.95 per 4-pack. For more information, visit cocacolastore.com.

Texas-based organic coffee maker Chameleon has had single-serve bottles and cans on the market previously, but its new three-SKU line of 8 oz dairy-free cold brews feature revamped packaging design and are available in three flavors: Nitro (5 calories), Sweetened (40 calories) and Double Espresso (10 calories). Expect to find them in stores this July, priced at around $3.49 each. For more information, visit chameleoncoffee.com.

Now you can have your cereal and drink it too! Ready-to-drink coffee brand Victor Allen’s has teamed up with General Mills to create its newest product, Cinnamon Toast Crunch Iced Coffee. Each 8 oz. can features a blend of milk, sugar and Arabica beans and has 100 calories. Victor Allen’s Cinnamon Toast Crunch Iced Coffee is available at Sam’s Club and on samsclub.com for $15.98 per 12-pack. For more information, visit victorallen.com.

PepsiCo’s bottled tea brand Pure Leaf has added its first Zero Sugar Sweet Tea variety. Retailing for $2.49 per 18.5 oz. bottle and also available in a 64 oz. multiserve container, the tea is sweetened with sucralose and contains no artificial flavors or coloring. For more information, visit pureleaf.com.

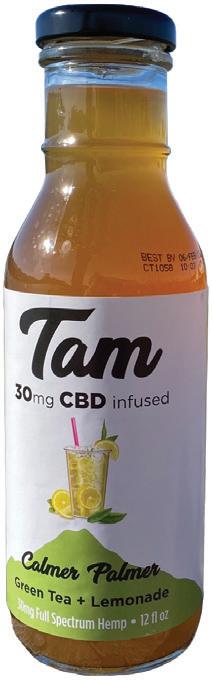

Uncle Matt’s has been making an Arnold Palmer for some years, so jumping into teas isn’t such a big leap. The new multi serve line features organic black teas in

unsweet and sweet (10 grams of sugar and 40 calories per serving) varieties, both in 52 oz. bottles priced at $4.99 each. For more information, visit unclematts.com.

Twrl Milk Tea has teamed up with the Taiwanese American Federation of Northern California (TAFNC) and illustrator Eugenia Yoh to create a special edition can design for its Taiwan-Style Black Milk Tea. The Formosan black bear illustration and Taiwanese milk tea symbolize Taiwan’s commitment to environmental conservation, culinary excellence, and fostering global friendships. The special edition cans will be available at retailers such as Whole Foods Market, Sprouts, Wegmans and Central Market. For more information, visit twrlmilktea.com.

The House of Rémy Marti n is celebrating its tricentennial with the launch of the 300th Anniversary Coupe. The new LTO was crafted by cellar master Baptiste Loiseau from the Rémy Martin “Réserve Perpétuelle,” a collection of eaux-de-vie, exclusively from the Grande Champagne terroir in the center of the Cognac region. Rémy Martin’s 300th Anniversary Coupe is currently available for purchase on the brand’s website for $2,750 per bottle. For more information, visit remymartin. com.

Penelope Bourbon’s Tojaki Cask Finish straight rye whiskey has returned. The third installment in the company’s Cooper Series, Tojoaki Cask Finish is distilled in Lawrenceburg, Indiana, aged eight years and bottled at 106 proof. A limited allocation of 1,900 (6-pack) cases will be available at a SRP of $89.99 per 750ml bottle. For more information, visit penelopebourbon.com.

Hard Truth Distilling has dropped its first line of bourbons produced grain-to-glass. Available in three varieties – Sweet Mash Wheated Bourbon (100 proof, 50% ABV), Sweet Mash Bourbon (93 proof, 46.5% ABV) and Sweet Mash Four Grain Bourbon (100 proof, 50% ABV) – they will be available in select markets starting March 1. For more information, visit hardtruth.com.

Premixed Cocktails

Several years of growth have paid off for Buzzballz, as it was bought out by Sazerac earlier this month. That leaves Beatbox as the largest independent brand, with huge ongoing growth. Meanwhile, Coke/BF teamup Jack and Coke is starting to gain momentum, as is The Long Drink. And look out for carb-free brand Carbliss, which showed huge gains in the trailing 52 weeks.

New Hope Network’s Natural Products Expo West returned to the Anaheim Convention Center in March with a plethora of new product innovations in the beverage set, including freshly brewed products from La Colombe and Super Coffee, new line extensions from Uncle Matt’s and Minor Figures and much, much more.

Before the doors even opened to the 65,000 registered attendees, a handful of beverage brands announced sizable funding rounds despite the VC market recently dropping to its lowest level in four years. Alternative milk brand MALK closed a $7 million internal investment round led by existing investors Benvolio Group and Rotor Capital while canned water producer Liquid Death closed a $67 million funding round at a valuation of $1.4 billion.

Additionally, Asian-inspired sparkling water brand Sanzo added some star power to its cap table with producer/DJ Steve Aioki and actor Simu Liu joining the brand as investors.

When the doors finally opened on day one of Expo West, brands like Uncle Matt’s and Minor Figures unveiled their first forays into new categories.

Minor Figures’ relationship with coffee is still tight as ever, even if there’s been some changes. At the show, the UK-based oat milk specialists were serving up hot lattes at their booth, a reflection of the brand’s current strategy to drive awareness and adoption mainly from behind the barista bar. Minor Figures’ new slimmed-down lineup consists of three barista-version oat milks – original, organic and light, all of which are manufactured in the U.S.

– that are mainly marketed towards foodservice and high end coffee purveyors. The brand is also looking beyond coffee as well: next up is its 32 oz. Chai Concentrate, set to enter foodservice outlets this June

Elsewhere, having extended its reach across the juice set with a deep portfolio of multi- and single-serve offerings, Uncle Matt’s Organic is also tackling a new category: tea. At its North Hall booth, the brand showcased its multiserve tea line, which features organic black teas in unsweet and sweet (10 grams of sugar and 40 calories per serving) varieties, both arriving in 52 oz. bottles. The drinks will retail for $4.99 each.

The brand’s namesake founder and CEO Matt McLean noted that Uncle Matt’s was already sourcing tea for its Half & Half tea and lemonade flavor for its line of lemonades, so using the same supplier it was a relatively simple addition to add proper ready-to-pour teas to its portfolio.

“I think the Half and Half makes it believable for us [to the consumer],” he said. “Our brand is about premium, and I think an organic refrigerated premium black tea is a pretty easy thing for us.”

Also at the show, there was no shortage of caffeine to keep attendees and brands alike awake and functioning for the three-day extravaganza, especially with La Colombe’s revamp under Chobani’s ownership and Super Coffee fine-tuning its identity (and portfolio).