JUNE 2024 www.ethanolproducer.com PAGE 18 Maximizing Seasonal Maintenance Shutdowns RTE Enters Voluntary Carbon Market PAGE 36 Plant Personnel Salary Survey PAGE 56 STRATEGY ON A SCHEDULE PLUS

Predicting

The case for a data-driven approach to reliability By Natae Shreeves

Creative Utilization Merchant CO2 markets continue to grow, diversify By Sam A. Rushing

gather in Sioux City, Iowa By Katie Schroeder

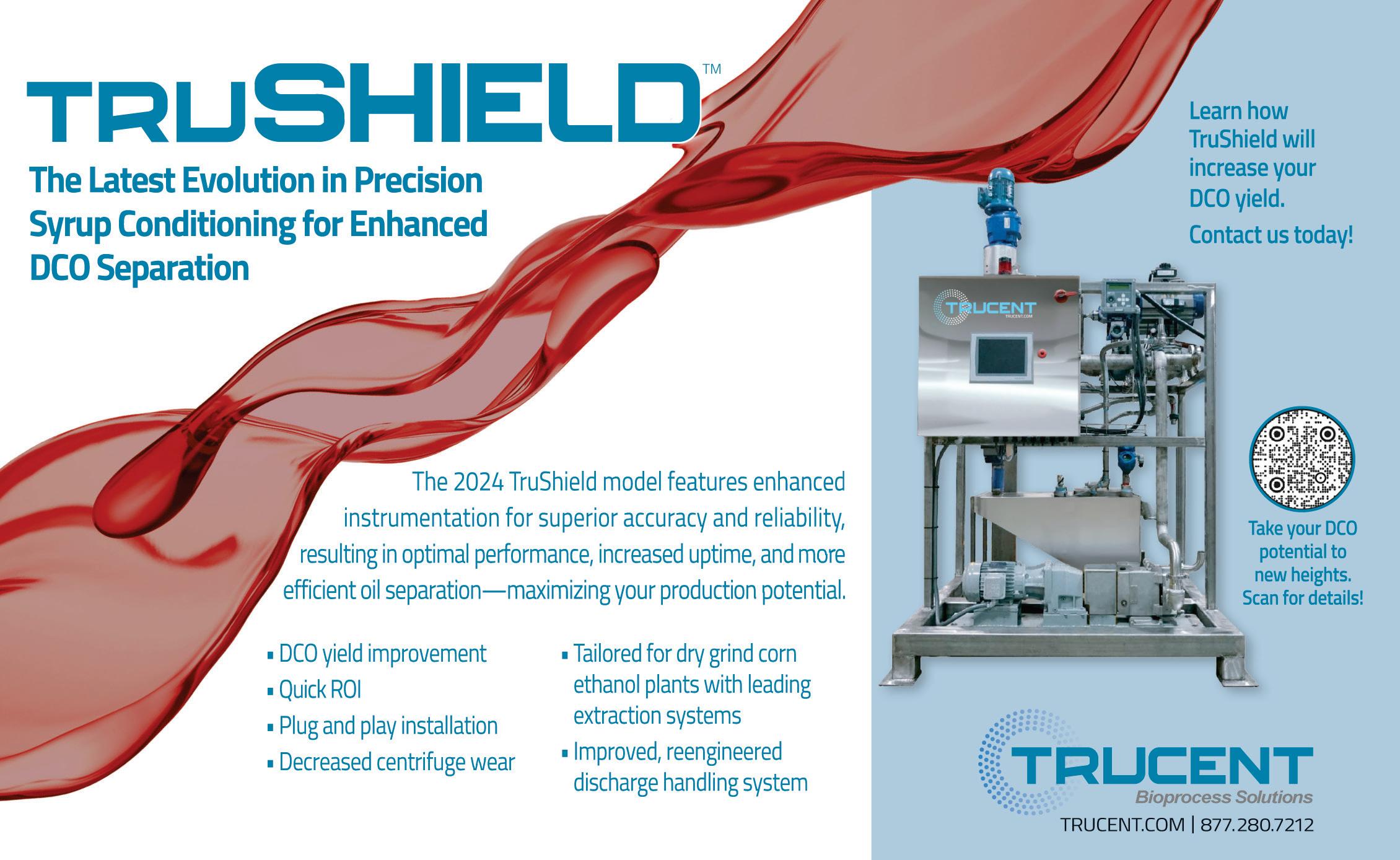

How Ace Ethanol boosts corn oil output By Kathy Weitze

4 | ETHANOL PRODUCER MAGAZINE | JUNE 2024 DEPARTMENTS 5 AD INDEX/EVENTS CALENDAR 6 EDITOR'S NOTE Maintenance, Carbon Markets and Money By Tom Bryan 8 DRIVE Support for Biofuels Will Continue to Be Bipartisan By Emily Skor 10 GLOBAL SCENE Markets, Milestones, and the Economic Upside of Low-Carbon Fuel Policy By Andrea Kent 12 BUSINESS BRIEFS 87 MARKETPLACE FEATURES 18 MAINTENANCE Shutting Down To Maintain Strategies for optimizing scheduled downtime By Katie Schroeder 26 TECH The New Tools of Preventative Maintenance How plants use drones, robots, AI and more By Luke Geiver Ethanol Producer Magazine: (USPS No. 023-974) June 2024, Vol. 30, Issue 6. Ethanol Producer Magazine is published monthly by BBI International. Principal Office: 308 Second Ave. N., Suite 304, Grand Forks, ND 58203. Periodicals Postage Paid at Grand Forks, North Dakota and additional mailing offices. POSTMASTER: Send address changes to Ethanol Producer Magazine/Subscriptions, 308 Second Ave. N., Suite 304, Grand Forks, North Dakota 58203. 36 CARBON Venturing Into the Voluntary Market North Dakota producer jumps into the VCM By Luke Geiver 46 MARKET Efficiency Trade-offs The financial upshot of producing less DDGS By Susanne Retka Schill 56 STAFF Six-Figure Standard 2024 plant personnel salary survey results By Tom Bryan SPOTLIGHTS 66 VEOLIA Driving Decarbonization By Katie Schroeder 67 PREMIUM PLANT SERVICES The Cutting Edge of Cleaning By Katie Schroeder 68 VISIONARY FIBER Transforming the Renewable Fuels Industry By Scott Kohl Contents JUNE 2024 VOLUME 30 ISSUE 6 18 26 36 46 56 70 TEMP LINK Always Alert By Katie Schroeder CONTRIBUTIONS 72 RELIABILITY

to Prevent

76 COPRODUCT

80 EVENT

In

Middle Maintenance

to

82 YIELD

Meeting

the

personnel

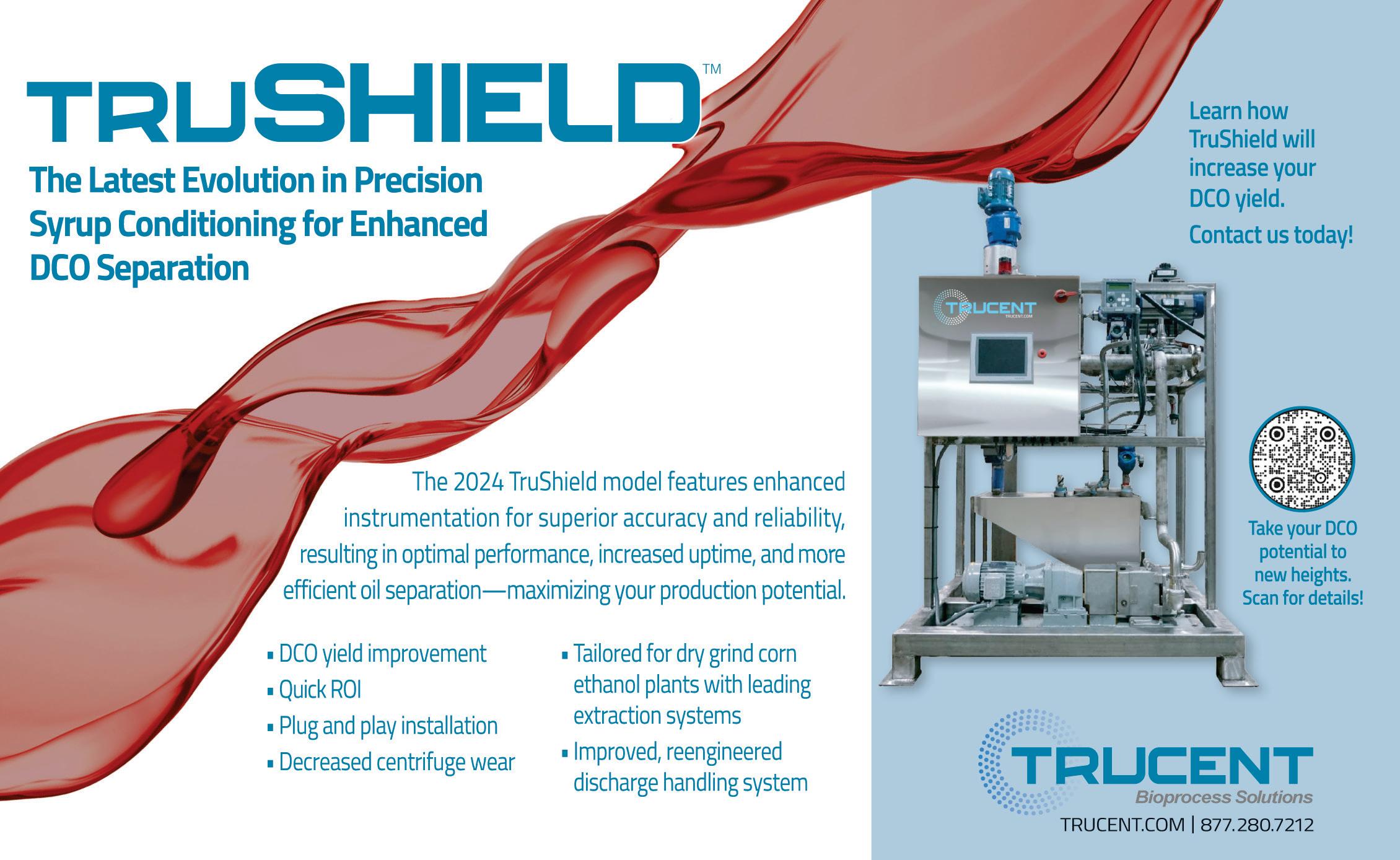

Taking DCO Extraction to the Max

EDITORIAL

President & Editor Tom Bryan tbryan@bbiinternational.com

Online News Editor Erin Voegele evoegele@bbiinternational.com

Associate Editor Katie Schroeder katie.schroeder@bbiinternational.com

DESIGN

Vice President of Production & Design Jaci Satterlund jsatterlund@bbiinternational.com

Graphic Designer Raquel Boushee rboushee@bbiinternational.com

PUBLISHING & SALES

CEO Joe Bryan jbryan@bbiinternational.com

Vice President of Operations/Marketing & Sales John Nelson jnelson@bbiinternational.com

Senior Account Manager/Bioenergy Team Leader Chip Shereck cshereck@bbiinternational.com

Account Manager Bob Brown bbrown@bbiinternational.com

Circulation Manager Jessica Tiller jtiller@bbiinternational.com

Marketing & Advertising Manager Marla DeFoe mdefoe@bbiinternational.com

EDITORIAL BOARD

Ringneck Energy Walter Wendland Little Sioux Corn Processors Steve Roe Commonwealth Agri-Energy Mick Henderson Aemetis Advanced Fuels Eric McAfee Western Plains Energy Derek Peine Front Range Energy Dan Sanders Jr.

Please recycle this magazine and remove inserts or samples before recycling

TM

COPYRIGHT © 2024 by BBI International

Advertiser Index

Upcoming Events

2024 International Fuel Ethanol Workshop & Expo

June 10-12, 2024

Minneapolis Convention Center | Minneapolis, MN (866) 746-8385 | www.fuelethanolworkshop.com

Celebrating its 40th year, the FEW provides the ethanol industry with cutting-edge content and unparalleled networking opportunities in a dynamic business-to-business environment. As the largest, longest running ethanol conference in the world, the FEW is renowned for its superb programming—powered by Ethanol Producer Magazine—that maintains a strong focus on commercialscale ethanol production, new technology, and near-term research and development. The event draws more than 2,000 people from over 31 countries and from nearly every ethanol plant in the United States and Canada.

2024 Carbon Capture & Storage Summit June 10-12, 2024

Minneapolis Convention Center | Minneapolis, MN (866) 746-8385 | www.fuelethanolworkshop.com

Capturing and storing carbon dioxide in underground wells has the potential to become the most consequential technological deployment in the history of the broader biofuels industry. Deploying effective carbon capture and storage at biofuels plants will cement ethanol and biodiesel as the lowest carbon liquid fuels commercially available in the marketplace. The Carbon Capture & Storage Summit will offer attendees a comprehensive look at the economics of carbon capture and storage, the infrastructure required to make it possible and the financial and marketplace impacts to participating producers.

2025 International Biomass Conference & Expo

March 18-20,

2025

Cobb Galleria | Atlanta, GA (866)746-8385 | www.biomassconference.com

Now in its 18th year, the International Biomass Conference & Expo is expected to bring together more than 900 attendees, 160 exhibitors and 65 speakers from more than 25 countries. It is the largest gathering of biomass professionals and academics in the world. The conference provides relevant content and unparalleled networking opportunities in a dynamic business-to-business environment. In addition to abundant networking opportunities, the largest biomass conference in the world is renowned for its outstanding programming—powered by Biomass Magazine–that maintains a strong focus on commercial-scale biomass production, new technology, and near-term research and development. Join us at the International Biomass Conference & Expo as we enter this new and exciting era in biomass energy.

Customer Service Please call 1-866-746-8385 or email us at service@bbiinternational.com. Subscriptions Subscriptions to Ethanol Producer Magazine are free of charge to everyone with the exception of a shipping and handling charge for anyone outside the United States. To subscribe, visit www.EthanolProducer.com or you can send your mailing address and payment (checks made out to BBI International) to: Ethanol Producer Magazine Subscriptions, 308 Second Ave. N., Suite 304, Grand Forks, ND 58203. You can also fax a subscription form to 701-746-5367. Back Issues, Reprints and Permissions Select back issues are available for $3.95 each, plus shipping. Article reprints are also available for a fee. For more information, contact us at 866-746-8385 or service@bbiinternational.com. Advertising Ethanol Producer Magazine provides a specific topic delivered to a highly targeted audience. We are committed to editorial excellence and high-quality print production. To find out more about Ethanol Producer Magazine advertising opportunities, please contact us at 866-746-8385 or service@ bbiinternational.com. Letters to the Editor We welcome letters to the editor. Send to Ethanol Producer Magazine Letters to the Editor, 308 2nd Ave. N., Suite 304, Grand Forks, ND 58203 or email to editor@bbiinternational.com. Please include your name, address and phone number. Letters may be edited for clarity and/or space.

ETHANOLPRODUCER.COM | 5 2024 Int'l Fuel Ethanol Workshop & Expo 16-17 2025 Int'l Fuel Ethanol Workshop & Expo 54 ACE American Coalition For Ethanol 53 AgCountry Farm Credit Services 43 AGI 21 Apache Stainless Equipment 38 ArrowUp 29 Beyond (a Christianson Company) 75 BOSS Railcar Movers 12 Bulk Conveyors, Inc. 39 Carbis Solutions Group, LLC 48 Check-All Valve Mfg. Co. 63 D3MAX LLC 34-35 Ecolab 49 Fagen Inc. 28 Fluid Quip Mechanical 15 Fluid Quip Technologies 13 Growth Energy 32 Howden 20 Hydro-Thermal Corporation 50 ICM, Inc. 55 IFF, Inc. 9 Indeck Power Equipment Co. 40 Interra Global Corporation 42 Interstates, Inc. 51 J.C. Ramsdell Enviro Services, Inc. 78 Jacobs Corporation 60 KATZEN International, Inc. 24 Keit Industrial Analytics 64 Kelvion 41 Kemin Bio Solutions 62 Krieg & Fischer 61 Lallemand Biofuels & Distilled Spirits 11 Leaf by Lesaffre 79 Mason Manfacturing, LLC 22 Mole Master Services Corporation 25 Natwick Associates Appraisal Services 14 NLB Corp. 7 Phibro Ethanol 71 POET LLC 86 Premium Plant Services, Inc. 67 RCM Engineering-Thermal Kinetics 59 RPMG, Inc. 52 SAFFiRE Renewables 85 Salco Products, Inc. 45 Spraying Systems Co. 3 Sukup Manufacturing Co. 2 Temp Link Innovations 70 The CMM Group 23 Trucent 30 Veolia 66 Victory Energy Operations, LLC. 31 Visionary Fiber Technologies 69 WINBCO 74 Zee Loffler 58 Zenviro Tech US Inc. 88

Maintenance, Carbon Markets and Money

The stories in this issue were produced in April when many U.S. ethanol plants were approaching, actively conducting or just past their scheduled spring shutdown—one of usually two times a year when facilities go offline for deep cleaning, maintenance and repair. So, while the timing of this mid-summer maintenance coverage might seem out of season, it allowed our writers to catch producers while heavy maintenance was top-of-mind.

Maintenance is hard to report on without subdividing it into specific categories: preventative and predictive maintenance, for example, each have different meanings and functions. Likewise, the maintenance done at an ethanol plant daily or weekly differs a great deal from what’s done once or twice a year. And, in fact, certain work can only be done when a plant isn’t running.

Our page-18 cover story, “Shutting Down To Maintain,” reminds us that seasonal shutdown work starts well before it begins in earnest, and—like the tip of an iceberg—the work that takes place when a plant is offline reflects a fraction of the planning, scheduling, vendor coordination and prep work required to get the whole job done inside of a few days. Game planning a shutdown requires a deep understanding of a facility’s history built from the cumulative observations of plant personnel over time. The staff needs to know their plant. They also need good partners, not only for shutdown services, but for inspections, cleaning, equipment repair and replacement.

Today’s maintenance vendors, it turns out, are not only bringing experience to the job but all kinds of new tech. As we report in “The New Tools of Preventative Maintenance,” there seems to be a new gadget, software or service for every maintenance— or compliance—task ethanol producers now face. We couldn’t report on them all, of course, but our page-26 story covers a lot: LDAR, drones, robots, ground-penetrating radar, AI and more.

On page 36, we switch gears with “Venturing Into the Voluntary Market,” a story about a western North Dakota ethanol producer becoming the first ethanol plant (in the world, presumably) to be issued CO2 removal credits, or CORCs, within a global marketplace. It’s not only a story about Red Trail Energy’s multi-year effort to complete an onsite CCS project, but how its management team worked with EcoEngineers, Puro.earth and RPMG to navigate the process of generating CORCs, get into the play and begin monetizing their accomplishment.

We circle back to cover an early-year story in “Efficiency Trade-offs,” on page 46. This is a deep dive into ag economist Scott Irwin’s recent unpacking of modern ethanol plant revenue in the context of plants producing more ethanol and corn oil, but less DDGS. We detail how Irwin pinned down a net gain of about 28 cents per bushel, revealing a few industry trends along the way.

Finally, be sure to check out “Six-Figure Standard, on page 56, which lays out the results of our latest Ethanol Plant Personnel Salary and Job Satisfaction survey. The results show an industry inclined to pay virtually all department heads over $100,000 a year.

6 | ETHANOL PRODUCER MAGAZINE | JUNE 2024 FOR INDUSTRY NEWS: WWW.ETHANOLPRODUCER.COM OR FOLLOW US: TWITTER.COM/ETHANOLMAGAZINE Editor's Note

NEW! ATL-5022 AUTOMATED TUBE LANCER

NLB’s ATL-5022 tube lancer cuts downtime and expense, delivering high -pressure water to five rotating lances from a single hose . Fewer hoses m eans fewer tangles , and rotating the lances ins tead of the nozzles m eans fewer nozzle replacements.

All movements are directed from the cab, with remote troubleshooting . And the system operates with smaller, more economical pumps than other models.

With the ATL-5022, NLB s ets a new standard for pro ductivit y and cost- e ec tiveness

Call us! (8 00) 441-5059 See it in action at NLBCOR P.COM

Support for Biofuels Will Continue to Be Bipartisan

This year’s upcoming elections could swing in any number of different ways. There's a world where the White House, the House and the Senate all change hands. There's a world where none of them flip. And at the moment, each of these political outcomes looks as likely as any other.

Still, there's one thing I feel confident enough to say with certainty: no matter who wins or loses in November, the American bioethanol industry will continue to rely on, and receive, support from lawmakers on both sides of the aisle, as we have for almost two decades now. That's because the contributions our industry makes work for both. E15 is a perfect example. This is a fuel option that lowers greenhouse gas emissions while saving consumers money and supporting good jobs in America's rural communities. There aren't many American-made products that are both good for the environment and easy on your pocketbook, but E15 does both—that's why it continues to be supported by both parties.

Just look at all of the statements that were issued in the wake of EPA's emergency waiver announcement in April that allowed E15 to be sold throughout this summer—an army of both republicans and democrats loudly applauded the move and most of them dedicated themselves anew to finding a permanent legislative solution. In the Venn diagram of today's political world, biofuels might be one of the only places where the two circles overlap.

Our industry faces challenges today, and it'll face challenges regardless of who the American people choose to lead us in November. Maintaining bipartisan support is the best way for our industry to ensure that our policy needs are being met, and that we can continue to deliver more affordable, lower-carbon solutions that benefit all Americans, not just the ones from any one political party.

Of course, nothing is guaranteed. American bioethanol needs friends in every camp, every trench, and every foxhole, but building and maintaining those relationships isn't something an organization like Growth Energy can do on its own—we need your help.

We hosted our spring fly-in in April—a great opportunity for our members to help us tell this industry’s story. In the dozens of meetings we had that week, many lawmakers and their staff were asking pointed, detailed questions about attendees’ innovations and investments. They are hungry for concrete examples of ingenuity and of how the private sector is moving beyond proof of concept. They want to know how they can accelerate your progress. But they need examples to validate their decisions on important policy matters to their peers and their constituents.

So I would encourage you to continue educating your elected leaders. The more specifics they have on the innovative things happening in your plants and on your farms, the better off we’ll all be before and after November comes and goes.

As we have since 2007, when the Renewable Fuel Standard was first enacted with bipartisan support, we'll continue to work on both sides of the aisle to make sure this industry and its farm partners get the policies they need to continue to grow. Bipartisan support has gotten us this far, and regardless of who’s in the White House, it'll carry us into the future as well.

8 | ETHANOL PRODUCER MAGAZINE | JUNE 2024

Drive

Emily Skor CEO, Growth Energy

S YNERXIA ® GEMS T ONE C OLLE CTION

THE RIGHT YEAS T S, A T THE RIGHT TIME, F OR THE RIGHT PURPOSE

Yeast blends are often greater than the sum of their parts. Achieve the perfect synergy of fermentation yield, speed and robustness with the SYNERXIA® Gemstone Collection.

Our broad portfolio of yeasts and yeast blends offers greater flexibility to tailor solutions based on shifting process requirements or market conditions.

Powered by XCELIS® AI, our proprietary data analytics and predictive modelling tool, the SYNERXIA® Gemstone Collection helps de-risk decision making with custom yeast blends that take your ethanol production process to the next level.

Learn more at bioscience.iff.com/synerxia-gemstone

©2023 International Flavors & Fragrances Inc. (IFF). IFF, the IFF Logo, and all trademarks denoted with ™, or ® are owned by IFF or its affiliates unless otherwise noted

X CELIS® Yeasts

Andrea Kent Past-President & Board Member, Renewable Industries Canada Vice President of Industry and Government Affairs, Greenfield Global Inc.

Andrea Kent Past-President & Board Member, Renewable Industries Canada Vice President of Industry and Government Affairs, Greenfield Global Inc.

Markets, Milestones, and the Economic Upside of Low-Carbon Fuel Policy

It has been a hectic few years for the renewable fuels industry, and it’s not about to slow down. This summer marks the anniversary of both the Canadian Clean Fuel Regulations and the U.S. Inflation Reduction Act. Additionally, several state-level low carbon markets are emerging, and attention is turning to upcoming federal elections in the U.S., Mexico and, eventually, Canada. It’s bustling.

It is against this backdrop that investors, producers and lawmakers face a central question: how to best realize the environmental objectives of low carbon market policies while simultaneously seizing the exciting economic benefits these policies provide.

Here, the benefits of market-driven policies excel. Low-carbon fuel standards, like those in California, British Columbia and the Canadian CFR, utilize the carbon intensity of fuels to create a market signal. This establishes financial incentives that promote decarbonization and provide real financial incentives for producers and innovators of low-carbon fuels. In all low-carbon fuel policies to date, including the most recent Canadian CFR, we have already seen how ethanol can create an affordable and accessible path to policy compliance for fuel blenders—along with additional benefits

For instance, before the introduction of Canada’s first federal renewable fuels regulation, large government subsidies to farmers were common during downturns. Today, these agricultural subsidies have been reduced, signaling not just immediate benefits, but also a shift toward setting a sustainable rural economic course for the future.

The importance of ethanol is further highlighted by the recent U.S. EPA decision to issue an emergency waiver for E15 this summer. Ethanol is consistently cheaper than standard gasoline, often by as much as $0.30 per gallon, enabling drivers using E15 to accumulate considerable savings over time. As the automotive industry gradually moves toward electrification, ethanol can act as a steady bridge, increasing its blend in the remaining vehicle fleet to maintain demand for farmers while supporting feedstock prices.

Lastly, ethanol’s benefits go beyond current uses, with innovations like converting it to sustainable aviation fuel (SAF) on the horizon. These advancements position today’s ethanol producers as future biofuel leaders, opening new technology, market and product opportunities. To fully leverage this potential, stable ethanol policies are needed to anchor research and development, helping ensure producers can commercialize emerging technologies.

The next two years could be some of our busiest yet. Voters on both sides of the border can reap the benefits of low-carbon fuel policies, which impact both domestic and international fuel markets. After all, policies—like ballots—are about more than just ticking boxes. They are potent tools that can drive market activity and determine economic growth for years to come.

10 | ETHANOL PRODUCER MAGAZINE | JUNE 2024

Global Scene

THE FUTURE OF FERMENTATION IS HERE

Enter a new era of ethanol production with FermaCore™ Propel, the LATEST INNOVATION IN LIQUID YEAST OFFERINGS. Featuring extreme robustness and the fastest fermentation kinetics we’ve ever o ered, FermaCore™ Propel is a true breakthrough designed to MAXIMIZE ETHANOL YIELDS AND INCREASE ENZYME REPLACEMENT — leading to LOWER CARBON INTENSITY. Whatever form you need it to take, you can expect more from FermaCore™ Propel. Because at LBDS, fermentation is at our core.

START SHAPING THE FUTURE OF ETHANOL PRODUCTION

©20 24 Lallemand Biofuels & Distilled Spirits

NOW AVAILABLE

PROPEL

BUSINESS BRIEFS

Green Plains commissions demonstration facility combining MSC and SFCT

Green Plains Inc. recently announced that it has begun commissioning a demonstration facility in York, Nebraska, that combines Fluid Quip Technologies’ precision separation and processing technology (MSC) with Shell’s fiber conversion technology (SFCT). The new facility combines fermentation, mechanical separation and fiber conversion technology into one platform. The facility will demonstrate the potential to liberate all available renewable corn oil currently bound in the fiber fraction of the corn kernel, generate cellulosic sugars for production of low-carbon fuels, and further enhance and expand production of ultra-high pro-

tein feed ingredients for global animal feed diets.

Following a successful demonstration of the combined technology, and subject to positive final investment decisions, Green Plains and Shell will look for potential opportunities to take this technology platform forward through full commercial deployment, beginning with one of Green Plains’ existing MSC facilities. Green Plains will market and distribute protein products through the company’s animal nutrition platform, and Shell will manage the energy-based low-carbon feedstocks and products for various uses within its global platform.

Aemetis lands $10.5 million in IRA tax credits for efficiency projects

Aemetis Inc., a renewable natural gas and renewable fuels company focused on low and negative carbon intensity products, recently announced that it received an allocation of $10.5 million of Inflation Reduction Act tax credits by the DOE and the IRS under the first phase of IRA Section 48C awards.

The $10.5 million allocation will support a mechanical vapor recompression energy (MVR) efficiency project and other energy efficiency projects at the Aemetis Keyes ethanol production facility in California; the projects will reduce fossil natural gas use at the plant by 80% and lower the

carbon intensity of the biofuels produced there by more than 20%.

“The Inflation Reduction Act funds new job creation and supports new investment in projects in almost every state,” stated Eric McAfee, chairman and CEO of Aemetis. “Late last year we demonstrated the conversion of IRA tax credits into funding for our projects, so monetization of the tax credits supports long-term debt financing and, in the case of the MVR project, is expected to significantly increase operating cash flow from our existing biofuels plant in California.”

12 | ETHANOL PRODUCER MAGAZINE | JUNE 2024 You Spoke. We Listened. Setting the New Standard in the Railcar Moving Industry Call: 816.378.0001 Email: sales@bossrcm.com www.bossrcm.com ASK OUR CUSTOMERS WHY THEY MADE THE SWITCH TO BOSS

PEOPLE, PARTNERSHIPS

PROJECTS

&

Technip Energies, LanzaTech selected by DOE for $200 million

Technip Energies and LanzaTech Global Inc. have been selected by the U.S. Department of Energy Office of Clean Energy Demonstrations to begin award negotiations for up to $200 million in Bipartisan Infrastructure Law and Inflation Reduction Act funding as part of the Industrial Demonstrations Program.

The project, dubbed SECURE—Sustainable Ethylene from CO2 Utilization with Renewable Energy—aims to develop a transformational technology to produce sustainable ethylene from captured carbon dioxide. Technip Energies and LanzaTech announced their joint collaboration agree-

ment to create this new pathway to sustainable ethylene at commercial scale last July. If awarded, up to $200 million is expected to fund the design, engineering, construction and equipment procurement for a commercial-scale integrated technology unit in the U.S. Leveraging Technip Energies’ substantial industry expertise, this integrated solution has significant replication potential for ethylene crackers worldwide. Globally, there are an estimated 370 ethylene steam crackers, over 40% of which use Technip Energies’ technology, including eight in the U.S.

CE+P partners with Booker Tate on sugarcane, ethanol production

California Ethanol + Power has announced that Booker Tate Ltd. will help guide sugarcane cultivation plans for Sugar Valley Energy, a proposed bioenergy project in California that is expected to produce ethanol, biogas, power and sustainable aviation fuel.

Plans for the biorefinery project have been ongoing for more than a decade. Once operational, the proposed Sugar Valley Energy facility is expected to produce up to 76 MMgy of low-carbon ethanol from sugarcane, 42 megawatts of biobased electricity,

and 1.43 million Btu of pipeline-quality renewable natural gas. Additional coproducts include soil amendments, biogenic carbon dioxide, field residue and green fly ash. Earlier this year, CE+P announced that its plans for the biorefinery are being expanded to produce up to 61 MMgy of SAF via the addition of alcohol-to-jet technology.

The partnership with U.K.-based Booker Tate, an international sugar and agribusiness consultant, will help guide sugarcane cultivation plans and ethanol production for Sugar Valley Energy.

What can 5% more oil mean to your operation?

Contact us today to learn more about how Overdrive™ can help you turn oil production all the way up

©2023. All rights reserved Fluid Quip Technologies , LLC. All trademarks are properties of their respective companies. FluidQuipTechnologies .com | 319-320-7709

READY TO GET MORE OIL? TURN IT UP 5% OR MORE. OVERDRIVE™ OIL PRETREAT SYSTEM

The Specialist in Biofuels Plant Appraisals

• Valuation for nancing

• Establishing an asking price

• Partial interest valuation

Few certi ed appraisers in the United States specialize in ethanol plant and related biofuels properties. Natwick Appraisals o ers more than 50 years of worldwide experience. Your appraisal will be completed by a certi ed general appraiser and conform to all state and federal appraisal standards. Our primary specialty in industrial appraisal work is with ethanol, biodiesel, and other types of biofuel facility appraisals, including cellulosic ethanol plants.

BUSINESS BRIEFS

PEOPLE, PARTNERSHIPS & PROJECTS

Avina

unveils plans for 120 MMgy EtJ facility in the Midwest

Avina, a developer of clean hydrogen and derivative fuel solutions, has announced plans for a cutting-edge sustainable aviation fuel plant in the Midwest set to commence operations in 2027. The facility will use the alcohol-tojet production pathway to produce 120 MMgy of SAF, resulting in significantly reduced lifecycle carbon emissions compared to conventional jet fuel. The SAF will be certified to meet ASTM D7566 standards. Preliminary front-end engineering and design (Pre-FEED) for the project is complete, and FEED is reportedly underway.

Avina has announced that it has entered into long-term supply agreements with leading ethanol suppliers for a significant portion of the low carbon intensity (CI) ethanol feedstock volume requirement. Substantial volumes of ethanol will be supplied by facilities with operational carbon capture and sequestration. By using this low-CI ethanol feedstock, the project is estimated to avoid around 840,000 metric tons of aviation-related carbon emissions annually.

Blue Biofuels takes steps toward commercialization of cellulosic ethanol technology

Blue Biofuels Inc. has announced that the company has achieved a significant milestone by successfully producing its first batch of cellulosic ethanol, utilizing its cellulose-to-sugar (CTS) system.

Bolstering its technological leadership, Blue Biofuels has been granted two U.S. patents, with an additional six patents currently pending. According to the company, these patents underscore Blue Biofuel’s commitment to proprietary advancements, strongly positioning it in the biofuels landscape.

Entering into the next phase, Blue Biofuels has embarked on the funding

process to establish production capacity for sustainable aviation fuel in collaboration with Vertimass. Blue Biofuels is evaluating prospective locations in Florida capable of accommodating both SAF and cellulosic ethanol production facilities. The company has also commenced with a front-end loading (phase one and two) engineering study for a 2.4 MMgy cellulosic ethanol facility grounded in the company’s CTS system. The engineering study will meticulously outline each process step, technical layout and required equipment for the facility.

natwick@midconetwork.com

14 | ETHANOL PRODUCER MAGAZINE | JUNE 2024

701-235-5541 701-793-2360 Callusforafree,no-obligation consultationtoday. Natwick Appraisals 1205 4th Ave. S.,

ND 58103 www.natwickappraisal.com

Fargo,

Continuum Ag, Siouxland Energy Cooperative collaborate to explore 45Z tax credits

Siouxland Energy Cooperative of Sioux Center, Iowa, and Continuum Ag of Washington, Iowa, recently announced an agreement to provide farmers a path to receive potential premiums associated with carbon intensity (CI) certified grain. Continuum Ag will provide farmers with the certification necessary to participate in producing and delivering low-CI grain, while Siouxland would purchase the certified bushels. The goal is to offer premiums for certified grain and capitalize on the pending 45Z Clean Fuel Production Tax Credits.

“We could not be more excited to work with Siouxland and their farmers to quan-

tify on-farm CI Scores and build potential tax credit markets. Farmers and biofuel manufacturers are each other’s key partner, and teaming together to produce lowcarbon fuels is an opportunity I’m glad we get to help with,” said CEO and founder of Continuum Ag, Mitchell Hora.

This exploratory partnership is aimed at encouraging farmers to educate themselves, quantify their baseline CI scores at TopSoil.Ag and spread awareness of the potential opportunities ahead.

Our team of experts have over 20 years of ethanol plant maintenance expertise. We o er full service and parts for all Fluid Quip equipment to ensure peak performance.

• OEM Parts Warehouse

•$2 million+ inventory on-hand

IGPC Ethanol to install Whitefox’s energy-efficient dehydration system

Whitefox Technologies has announced that IGPC Ethanol Inc. has agreed to install the Whitefox ICE membrane dehydration system at IGPC’s ethanol plant in Aylmer, Ontario. This is a landmark agreement as it represents Whitefox’s first ICE project in Canada. The installation is anticipated to be completed in late 2024.

Paul Morin, IGPC director of operations, said, “We are very excited to have a Whitefox ICE system integrated into our distillation area. This system yields many benefits that align with our strategic goals.

It will help us lower our CI while reducing the strain on our sieves and making a more user-friendly distillation system. I am very impressed with how [this] custom-made [platform] integrates with our system to maximize energy savings.”

The Whitefox ICE system treats existing recycle streams to free up and debottleneck distillation-dehydration capacity, which will enable IGPC to lower natural gas use, cut carbon emissions, improve plant cooling and potentially increase production capacity, depending on the system design.

•Factory Trained & Certified Techs

•MZSA™ Screens

•Paddle Screens

•Grind Mills

•Centrifuges

•Gap Adjusters

©2023. All rights reserved Fluid Quip Technologies LLC. All trademarks are properties of their respective companies. FluidQuipMechanical.com | 920-350-5823

SHUTTING DOWN TO MAINTAIN

Ethanol Producer Magazine talks with ethanol producers and industry experts on best practices for plant shutdowns and managing capital expenditures in aging facilities.

By Katie Schroeder

Planned shutdowns, vital for high-level ethanol production, require months of planning, scheduling, communication and coordination. Ethanol producers pay attention to their plant’s history, existing problems and future needs, all while balancing vital maintenance with equipment upkeep, repair and installation. Preparation is extensive, and a plant’s operations team starts planning for the next shutdown almost before the current one is completed.

Located in Mason City, Iowa, Golden Grain Energy has been operating for 19 years, and the plant’s team is well-acquainted with handling the complexities of an annual shutdown. Matt Dutka, the plant’s manager, explains the ins and outs of preparing for and carrying out successful planned maintenance during scheduled downtime.

Plan and Prepare

Creating a list of each task that needs to be done during a shutdown involves accounting for the history of the facility and the cumulative observations of plant person-

nel over the course of months, years or even decades, explains Dutka. This reconnaissance occurs both when the plant is running and when it’s offline, scheduled or otherwise. GGE’s maintenance team will often seize downtime opportunities to assess process components and game plan while repairing equipment. “There’s a lot you need to document and observe—from five years ago to five weeks ago—making decisions on what you’re going to work on during the coming shutdown,” Dutka says.

Inspections help producers assess their plant’s needs prior to shutdown. ICM’s Af-

18 | ETHANOL PRODUCER MAGAZINE | JUNE 2024

Maintenance

termarket Services division assists ethanol plants across the Midwest, working in areas of the plant ranging from the process building to the energy center, fabricating and supplying new process components, and running shutdowns for producers. Kristen Gordon, director of Aftermarket Services, and James Weber, reliability services manager, explain that their team also offers plant inspections prior to a shutdown to help producers assess their plant’s equipment, identify what needs repair, and how soon. “It’s really important to get all the pre-work done [so] they’re prepared for what they might

find. Having that information available helps determine the manpower needed to perform the work,” Weber says. “Based on the preliminary inspection, ICM will quote the work to be completed and determine if there are additional inspections or needed repairs ... because while the plant is down, you want to look at everything. You open everything up to look inside, make sure everything is where it’s supposed to be and not wearing out.”

Having that third-party inspection ahead of time helps producers know what their capital expenditure will look like going into a shutdown; and it also helps them figure out what

resources are needed to complete the work in their desired time frame.

Roughly 50 ethanol plants rely on ICM and its partners to provide shutdown services. The company’s breadth of experience is valuable, Gordon explains. “[We have] field leads that have years of experience and [strong] relationships with the customers, so when they’re going from plant to plant they can leverage what they’re seeing at one plant to help another customer,” she says. Aftermarket Services also offers 24/7 support to producers in the event of a breakdown.

ETHANOLPRODUCER.COM | 19

STRATEGIC DOWNTIME: While planned shutdowns are typically associated with cleaning and basic maintenance, plant repairs, equipment replacement and even technology installations are not uncommon during scheduled downtime.

PHOTO: WESTERN PLAINS ENERGY

Contractor availability plays an important role in mapping out a shutdown, explains Rick Holaday, plant manager at Western Plains Energy, a 50 MMgy ethanol producer in Oakley, Kansas. “There are a lot of plants in this area of the Midwest, and a lot of us use the same contractors,” Holaday says. “So, we do have to schedule around some of the other areas.” WPE does a threeday shutdown twice a year for maintenance, once in the spring and once in the fall; the duration of the shutdown will sometimes be extended if a critical repair needs more time for completion. Along with contractor availability, Holaday also takes into account what parts are needed for repairs and the amount of time needed to clean, fix or upgrade equipment.

In order to keep track of what needs to be done during each shutdown, Holaday and his team share a spreadsheet with lists of different equipment and maintenance needs. As soon as one shutdown is finished, he is already planning for the next one through

after-action review. Weekly department head meetings and a spreadsheet used to track the status of equipment help Holaday and his team stay on the same page with everything that needs to happen during a shutdown. “I would say about 75% of the repairs are actually the same [each time]—pumps and valves and whatever we rebuild twice a year, spring and fall,” Holaday says. “A few of them are unique. In the spring, for example, we usually do a boiler inspection, so [that’s done] annually. And then, usually in the fall we do power building cleanouts. But for the most part [the seasonal shutdowns] are all the same.”

GGE has an annual shutdown of five to eight days to address the plant’s preventative maintenance needs, handle repairs and carry out the installation of new technology. The length of the shutdown depends on what process components need to be replaced. For example, Dutka explains that GGE’s big job this year is a replacement of the plant’s burner management system, a key plant component. For these more significant

| |

Maintenance

process components, contractors will often visit a plant in advance to assess projects and do prep work prior to shutdown. “[Beyond that], they’re going to basically wait for us to have the plant down; we’ve got to get it locked out [before] they’ll roll in,” Dutka says. “Operationally, we have about a day just to get the plant down and get it to a safe and locked-out condition before we can even get the contractors really working on anything.” Holaday also emphasizes that though managing new equipment installation and maintenance is a balancing act, deliberate preparatory work helps make tie-ins more efficient. The benefits of shutdowns are numerous, including improvement of equipment reliability and production efficiency, as well as helping producers avoid unscheduled downtime. “If we have a potential issue or defect, a controlled shutdown is going to catch it, as opposed to unscheduled downtime,” Holaday says. Unscheduled downtime is chaotic because producers don’t have control of when or how it will happen. All equipment will eventually break or not run optimally, lowering efficiency and increasing the cost of production. However, scheduling downtime allows producers to be proactive in addressing

RUNNING TESTS: Scheduled shutdowns are most effective when coupled with advanced planning, inspection and analysis, sometimes including testing equipment with technology such as vibration sensors.

ETHANOLPRODUCER.COM

PHOTOS: WESTERN PLAINS ENERGY

Maintenance

potential problems, and it enables them to select a date when shutting down has less of a financial impact.

Profitability and margins play a key role in determining the scope of work that a plant does in a year, Dutka explains. A helpful question he considers when determining whether to install new equipment and technology is, “Are we profitable enough to take on those new projects?” If margins are good, then his team is more likely to take on projects that require a higher investment. These decisions can sometimes be intricately connected to seasonal shutdowns.

Shutting Down

It takes the GGE team around 12 hours to shut down the plant, Dutka explains, adding that process components like corn oil centrifuges and GGE’s Whitefox system are taken offline first. “We’ll stop feeding centrifuges, put additional equipment in recycle mode and shut the gas off to the dryers before backing energy down to the thermal

oxidizer and the HRSG, which is our heat recovery system,” he says. “From that point ... basically, you’re technically down—so it’s just a matter of commencing with recycling, pulling energy and different feed streams off and slowly backing out of everything.”

Before any repairs can be done, the plant’s equipment must be locked out and tagged out in order for the plant’s maintenance team and contractors to make repairs. Lockout/tagout is the process of securing equipment, machinery and industrial plant processes so energy isn’t reintroduced dur-

22 | ETHANOL PRODUCER MAGAZINE | JUNE 2024 Always Here When You Need Us! Shell & Tube Heat Exchangers ASME Pressure Vessels Custom Fabrication

ing service or repair. This includes closing electrical circuits and valves, neutralizing ex treme temperatures, securing moving parts and more.

During a shutdown, GGE’s maintenance team fixes, replaces and executes preventative maintenance on equipment that they cannot

SMART OUTSOURCING: Far left, remote viewing technology is used to assess a cleaning job. Adjacent, a trained hydroblasting technician uses automated lancing equipment to clean evaporator tubes in an ethanol plant.

clean-in-place (CIP) tasks, while contractors clean ductwork, burners, energy centers, vessels, tubes and pipes that are too dirty to be cleaned with CIP. Built-up debris reduces pipe diameter from three inches to one inch, and without cleaning, the pipes can plug up. “If you allow that buildup to be

PHOTOS: PREMIUM PLANT SERVICES

plant include any area with only one means of access, including an ethanol tank, basement, dryer or burner. To issue a confined space permit, EH&S and operations must make sure that there is enough oxygen in the space, the required equipment is locked out and tagged out, and there is not an excess of CO2 in the air.

A “hot work” permit is required for any work in the plant that has a source of energy and makes a spark, including a grinder, torch or welder. When issuing a permit, the GGE team assesses nearby potential risks and checks to make sure that everything is locked out that needs to be.

Managing Aging

As ethanol plants age, shutdowns are beginning to include significant repairs—or replacements— of vital components. Gordon and Weber explain that ethanol plants are

experiencing more failures as various process components hit the 15-year mark. “A lot of these plants are the exact same age, from within a year or two of each other—we started a lot of plants around 2006—and they are all in the same boat,” Weber says.

The fact that so many ethanol plants started up around the same time will test both producers and equipment suppliers, as the same components at different plants are likely to fail at the same time. “Right now, we’re talking about sieve bottles,” Weber says. “We constantly have sieve bottles in our shop being built, and ... we’re trying to build inventory, [but] we can’t because they’re going out as fast as they are getting built,” he says. “Things like that are going to be an issue as plants start having failures; it’s going to be harder and harder to get things.” Weber recommends that producers look at their

24 | ETHANOL PRODUCER MAGAZINE | JUNE 2024

World class design begins with a vision Collaboration is the process Bringing it to life is our passion katzen.com

Maintenance

RA ISIN G TH E BAR IN GR AIN SILO CLEA NOUT

Experience

five-year plan and consider ordering process components more than six months before they will likely need to be installed. “It’s never too early to start planning,” he says. Some parts that formerly took eight weeks to receive now take 30 weeks, making planning ahead more necessary than ever.

More items get added to WPE’s list as time goes on, Holaday explains. “As the plant ages, we find ourselves having to add more items to the list that we’ve never seen before, so it does get a little bit challenging.” The costs associated with repairing vital infrastructure or equipment can never be totally eliminated, but they can be managed through consistent inspections. “This includes your fit testing, your testing of external tank thickness and floors, and the inspections [overall], staying ahead of it to make sure you can plan out those capital expenditures, instead of having them creep up on you quickly,” Holaday says.

Although a shutdown is a lot to manage, constant communication, consideration for safety and early planning can help smooth out the process.

Author: Katie Schroeder Contact: katie.schroeder@bbiinternational.com

More than 35 years of tackling the most dif cult silo cleanout projects in 30+ countries worldwide.

Safety

Professional service technicians are MSHA and OSHA-certi ed and adhere to a rigorous continuing education program.

Capability

We conquer the most dif cult cleanout projects in the world with our proprietary silo cleaning technology.

ETHANOLPRODUCER.COM | 25

BIG PICTURE PLANNING: Planned shutdown maintenance includes cleaning, inspection and repair work both inside and outside the plant. The scope of work can include multiple acres of infrastructure.

PHOTO: WESTERN PLAINS ENERGY

10 /2 2 02 25 4

The New Tools

of Preventative Maintenance

Ethanol producers are increasingly relying on high-tech equipment and AI to stay ahead of the biorefinery maintenance curve.

By Luke Geiver

26 | ETHANOL PRODUCER MAGAZINE | JUNE 2024 Tech

26 | ETHANOL PRODUCER MAGAZINE | JUNE 2023

VENDORS STEP IN: Service providers like Montrose Environmental are helping ethanol plants with both maintenance and compliance by deploying an array of technologies on site, from optical gas imaging for leak detection and repair to drones and robotic dogs, like this one from Boston Dynamics, equipped with lasers and sensors.

ETHANOLPRODUCER.COM | 27 ETHANOLPRODUCER.COM | 27

PHOTO: STOCK

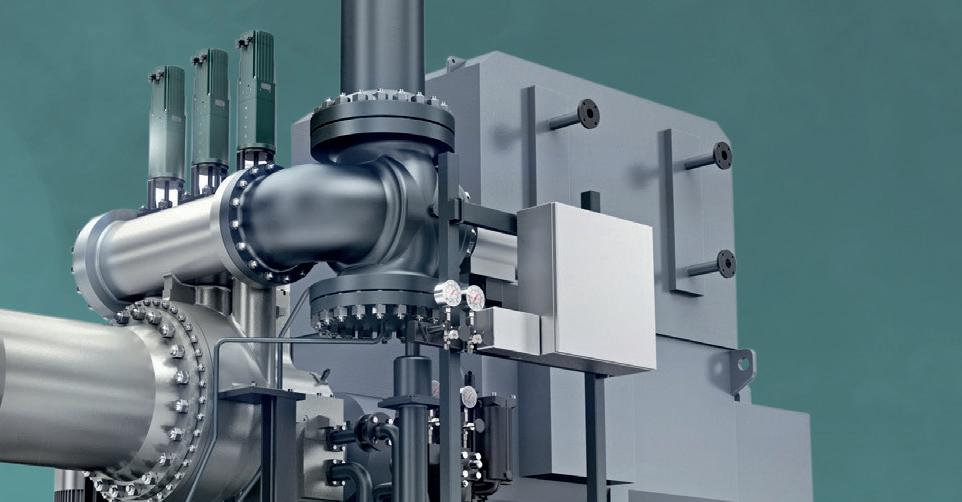

Today, for almost every ethanol plant preventative maintenance task, there’s a high-tech tool, device or service designed for the job. Vibration issues? There are ways to find, monitor and diagnose it with the help of artificial intelligence. Questions about the structural integrity of concrete? Ground penetrating radar lets you to see below the surface. Need a fuller view of your facility— or an up-close look at something up high? Cutting-edge drones are available for vibrant imagery and data. Trying to stay on top of environmental compliance? Service providers have it covered with robust leak detection and repair capabilities.

Seeing through Concrete

To understand the importance of ground-penetrating radar, consider the role of rebar in a concrete structure, says Cheyenne Wohlford, president of Custom Concrete Specialists of Seward, Nebraska.

Without the correct placement of steel rebar in a concrete structure—like a storage silo or a grain bin foundation—spalling issues can occur on the face of the concrete. After spalling, cracks might show up. Wohlford and his team perform crack and spall repair along with full shotcrete (i.e., sprayed concrete), steel reinforced liners, roof cap repair or, in worstcase scenarios, total replacement. “We try to

catch it before it gets to [the point of needing extensive] repair,” Wohlford says.

To do that, his team uses a groundpenetrating radar (GPR) setup that has been custom-designed specifically for the work his crew does. And GPR, it turns out, is not only used on the ground.

Even properly reinforced concrete structures require inspection, and sometimes repair,

28 | ETHANOL PRODUCER MAGAZINE | JUNE 2024

Tech

READING THE BOUNCE: Ground-penetrating radar units are non-destructive detection and imaging solutions for identifying subsurface structural issues. A radio signal is sent into the structure, in this case vertically, bouncing back in a way that provides information on what lies below the surface. PHOTO:

CCS

after enduring continuous operation over 15 to 20 years. “These areas are under constant use.” Wohlford says.

Unlike a grain elevator that stores grain for weeks or months, a silo at an ethanol plant cycles product through daily or hourly at times.

Most GPR units operate as non-destructive detection and imaging solutions for

identifying structural subsurface issues underground or within concrete. A radio signal is sent into the concrete; the way it “bounces” off the underlying structure upon return creates a reading. Interpreting the bounce reading gives a GPR technician an idea of what lies below the surface.

ETHANOLPRODUCER.COM | 29

DROPPING IN: The maintenance and compliance needs of an ethanol plant overlap with those of many other industries. The use of new, industry-agnostic technologies like drones, shown here, is becoming increasingly common.

PHOTO: CCS

“We like the GPR scanning tools because when we use [one] at a plant, it is like the plant is going to the doctor and getting a once-over,” Wohlford says. “We can figure out where everything is.”

CCS uses a two- or three-person crew on a boom lift to systematically scan an area. The process allows them to generate data that can produce recommendations for repairs. From there, they can help a plant determine a longterm maintenance schedule to avoid future high-cost repairs.

“You can determine what your structure is really lacking. When you make a repair plan you are relying on data and not the recommendation of a general contractor,” he says, adding that the data generated allows everyone involved in a repair project to “compare apples to apples.”

CCS has used the GPR tech on steel bin foundations, flour mills, retrofitted new equipment, floors and several other areas in and out of the ethanol sector. The generated imagery allows an engineer to know exactly what is in place instead of assuming what is there.

PHOTO: TRACTIAN

PHOTO: TRACTIAN

“The number one takeaway of GPR is that the blueprints don’t always dictate what the rebar structures are in the wall,” he says. The human factor in the construction of these structures is very real. One can tell where a day shift of workers transitioned to the night

crew, or when a storm rolled through and shut down the project for a few hours.

“There will be areas that are fantastic and others that are very sporadic,” Wohlford says. “When they have to wait on construction after first starting, cold joints form.”

30 | ETHANOL PRODUCER MAGAZINE | JUNE 2024

NEW LAYERS OF TECH: Tractian’s vibration sensors are available for a variety of equipment, including centrifugal motor pumps, peripheral motor pumps, gear motors, electrical motors, turbines, fans and compressors.

Tech

MAINTENANCE:

While those areas don’t create issues in the first few years, they can show up later, making it clear where two concrete structures don’t want to be joined or married together anymore. That is how major issues start and grow, Wohflord says. That’s why he and his team rely on the data generated by GPR. “It tells the real story of what has happened and what is likely to happen in the future,” he adds.

AI-Infused Smart Sensors

According to Tractian, a quickly growing developer of hardware, software and artificial intelligence-based solutions for industrial-level preventative maintenance and monitoring, cavitation issues (at 35.5%) account for the highest percentage of equipment failures or maintenance issues. Lubrication (23%), unbalancing (18%), mechanical looseness (13.5%)

and blade issues (10%) make up the other major failure points in most facilities.

To help plant managers predictively maintain their facilities, the company has created a patented vibration sensor. The sensor has 4G/LTE connectivity and automatically sends out real-time alerts about any change in vibration that could indicate a potential problem, the company says. The list of faults or issues that can be anticipated or diagnosed by the unique sensor package is greater than 70, ranging from bearing wear to cavitations to structural mechanical clearance.

The sensors detect failures based on vibration, temperature and hour-meter data collected in real time. Then, the AI built into the system generates a “fault” alert and sends it to the user. After that, an analysis of the failure, and the precise prescription of what needs to be done to get the asset back to full operation, is automatically generated. At that point, plant personnel would go to the asset in question, perform the maintenance and verify the alert, informing the system about the identified failure and whether the diagno-

CONNECTED

Tractian's patented vibration sensor has 4G/LTE connectivity and automatically sends out real-time alerts about any change in vibration that could indicate a potential problem.

CONNECTED

Tractian's patented vibration sensor has 4G/LTE connectivity and automatically sends out real-time alerts about any change in vibration that could indicate a potential problem.

PHOTO: TRACTIAN

ETHANOL PRODUCER_HALF PG

AD_VISION BURNERS_12-09-2022_PRINT.pdf 1 12/9/2022 4:41:49 PM

THAN K YOU

President Biden, Secretar y Vilsack, & Administrator Regan

For Protecting Access to E15

This Summer.

sis was “assertive,” according to the company. Following that, the AI algorithm is able to perform continued learning.

“With each fault identified and insight checked, our technology absorbs the data and enhances its knowledge about the machine for the next detections,” the company says.

Tractian’s vibration sensors are currently available for a variety of equipment pieces, including centrifugal motor pumps, peripheral motor pumps, gear motors, electrical motors, turbines, fans and multiple compressor styles.

The company’s technology is used across a wide range of industries, from biotech to food and beverage to mills and agriculture.

According to Tractian, “The world’s largest sugar and ethanol producers are already transforming their maintenance [regimens] with our patented technology.”

Leaning On LDAR

Montrose Environmental is a pure-play environmental compliance service provider. “Solving environmental challenges isn’t something we do,” says Tanya Esquivel, vice president of LDAR at Montrose, “it is all we do.”

On the leak detection and repair (LDAR) front, Montrose provides turnkey solutions, services and technologies that help clients achieve compliance at both the state and federal levels. Some services even go beyond that. Although Method 21, the longestablished protocol for measuring fugitive emissions, was the standard across industries for more than 25 years, the Montrose team identified an alternative approach that would

help clients move past the limitations of the dated protocol, Esquivel says. “We were a trailblazer in offering optical gas imaging, drones and robotic dogs equipped with lasers and sensors,” she says.

According to Esquivel, Montrose has also developed specialized teams in each area of service. The use of sensors, drones, robots, “fenceline” monitoring and mobile detection technologies all help to identify emissions in real-time. Using Sensible EDP, an environmental software program that combines all that real-time emissions data, LDAR info and lab results, the company provides clients with a wide array of insight, including the information needed to make decisions before emissions ever occur. For detection and measurement, the company’s list of services totals 17. For LDAR consulting and support alone, it’s nine.

“Regulations are ever-evolving, and it can be daunting to navigate them alone,” Esquivel says. “There is value in partnering with an LDAR expert that can evaluate current and future needs.”

Esquivel and her team work with more than 1,100 facilities in over 20 different industries, from small mom-and-pop facilities to large refineries. The needs of an ethanol plant overlap with several industries, she says. Leveraging technology like drones and robotic dogs, along with the use of other technologies that are industry-agnostic, can benefit ethanol producers, she adds.

Drone Flights Do More

Pinnacle Engineering has grown into a

Learn More at GrowthEnergy.org

SUITE OF SOLUTIONS: The use of sensors, drones, robots, “fenceline” monitoring and mobile detection technologies all help to identify possible emissions leaks in real time.

PHOTO: STOCK

VENTURING INTO THE

As the first-ever ethanol producer to deliver carbon removal credits to the voluntary market, Red Trail Energy and its partners are creating a blueprint for others to follow.

By Luke Geiver

The U.S. ethanol industry has officially entered the voluntary carbon market (VCM). In March, Red Trail Energy, a western North Dakota producer, became the first ethanol plant to be issued CO2 removal credits (CORCS) within a global marketplace that connects CO2 suppliers and buyers looking to neutralize their carbon footprint. Apart from RTE’s much-celebrated, multi-year effort to complete an onsite carbon capture and sequestration project at its North Dakota biorefinery, the plant’s management team worked with EcoEngineers to successfully navigate the process of generating CORCs. Puro.earth, a finnish-based carbon crediting platform—backed by Nasdaq and other investors—issued the CORCs, mak-

ing them available for companies like Microsoft, Shopify and other massive brands to purchase as part of their CO2 reduction initiatives. Renewable Products Marketing Group, the Minnesota-based ethanol marketing company, will market the credits.

Jodi Johnson, RTE CEO, called the accomplishment a groundbreaking milestone, noting that the company’s position in the ethanol industry is now stronger. Antti Vihavainen, CEO of Puro.earth called the milestone monumental, highlighting the scale of the project as an example of how large projects can and will supply the VCM with significant volume. Jim Ramm, vice president of biofuels at EcoEngineers, said the achievement by RTE and all those involved has created an opportunity for eth-

anol producers that can be leveraged now and well into the future.

Get to Know the VCM

The voluntary carbon market was created to promote the removal of industrial carbon dioxide at a global scale. The market provides corporations and other entities that do not directly produce carbon dioxide in large volumes the ability to participate indirectly in the physical reduction of CO2. Through one of several marketplaces operating today, a buyer can purchase carbon removal credits, in various forms, for a fluctuating fee. By purchasing credits, the buyer is able to meet its own carbon reduction initiatives while incentivizing the removal of CO2. In return, the supplier is monetarily

36 | ETHANOL PRODUCER MAGAZINE | JUNE 2024

Carbon

VOLUNTARY MARKET

rewarded for partaking in CO2 removal practices. The way RTE and its partners are venturing into the VCM appears to be refreshingly clear cut, but both Vihavainen and David LaCreca, senior carbon consultant for EcoEngineers, say that’s not always the case for the carbon capture and storage (CCS) sector.

The wind and solar industries have been participating in, and benefiting from, the VCM for years, LaCreca says. The VCM is roughly 30 years old and picks up where global governmental policies leave off. The purpose of the market is to reward carbon removal and make CCS projects more feasible.

“Renewable fuels haven’t really played in this sandbox before, as others have,” LaCreca says.

Playing in the VCM requires the establishment of capture metrics, proof points, traceability and several other terms that all relate to verification. According to LaCreca, a project aiming to participate in the VCM as a supplier must submit project documentation in a particular format with exacting methodology. For RTE, LaCreca and his team were brought in to explore the feasibility of the ethanol plant participating in the VCM in the first place, and then to produce the documentation required from RTE to receive CORCs.

According to Puro.earth, the verification process is one major reason why Nasdaq has taken a leading investor position in its company. Puro.earth has developed a rigorous, effective and proven process for analyzing and verifying the carbon capture and/

or sequestration abilities of suppliers to the VCM. While most carbon offset schemes focus broadly on emissions reduction, Puro. earth’s approach is all about carbon removal. The company requires scientifically verified removal methods that capture and store CO2 durably for a minimum of 100 years—with industrial scaling potential. The scaling criterion is one of several reasons Vihavainen and his team are excited to work with RTE.

“Puro has developed multiple methodologies for this,” Vihavainen says. His company has worked with scientific advisory boards and other third-party advisors to create its verification system. The company has no investments or stake in any CO2 supplier or marketplace, he emphasizes. It exists to generate CORCs that the marketplace can

ETHANOLPRODUCER.COM | 37

RISING OPPORTUNITY: This spring, Richardton, North Dakota-based Red Trail Energy became the first ethanol plant to enter the voluntary carbon market.

PHOTO: RED TRAIL ENERGY

trust. Vihavainen says Puro’s approach is aligned with global benchmarks, namely the International Carbon Reduction and Offset Alliance, a trade group of providers of voluntary carbon offsets.

Also, Puro only certifies durably stored carbon with net-negative emissions. Avoided or reduced emissions aren’t included in any carbon accounting. The company recognizes five different carbon removal methods: biochar, terrestrial storage of biomass, carbonated materials, enhanced rock weathering and geologically stored carbon.

To date, Puro has certified CORCs for 175 different projects across 33 separate countries for a total of 818,527 tons of CO2.

RTE is by far Puro’s largest CO2 CORC supplier. It’s also the only U.S. project in its portfolio. The majority of all CORC suppliers through Puro are in the biochar sector.

The verification process required of suppliers includes four steps. First, the supplier makes a claim on the net negativity of their products or process with accompany-

38 | ETHANOL PRODUCER MAGAZINE | JUNE 2024

PIECES OF THE PROCESS: Participating in the voluntary carbon market requires the establishment of capture metrics, proof points, traceability and other steps related to verification. Puro.earth and EcoEngineers have helped Red Trail Energy through the whole process.

Carbon

PHOTO: RED TRAIL ENERGY

ing evidence via a lifecycle assessment or environmental product declaration (which basically says the product has removed more CO2 than it has emitted). Second, independent assessors in the Puro system visit the production facility, validate data accuracy and issue an audit statement. Puro covers the cost of verification. Third, the verified volume of extra carbon absorbed in the products or process is then issued CORCs for every metric ton of CO2 removed and stored. Then, suppliers are free to sell their CORCs to any venue, marketplace or broker; they can also sell them directly to companies that want carbon credits to neutralize their emissions by indirect removal.

“We publish a price index with Nasdaq,” Vihavainen says. “We promote the existence of high-quality carbon removal.”

The CORC Carbon Removal Price Index tracks the price of all CORC transactions (with a separate index for biochar). As of February, the CORC index price hovered around $170 per ton. Over the past

18 months, the index price has fluctuated from roughly $130 per ton to almost $200 per ton.

When a CORC is retired (i.e., bought) the owner of the CORC can claim the benefit. CORCS will last up to three years, Vihavainen says. There are several marketplaces for buyers and suppliers to connect, including Supercritical, Patch, Carbonfuture, Cloverly, Watershed, Klimate, Lune and even Salesforce. CORCs are digital, certified and tradable.

Ethanol’s Future In the VCM

Puro.earth gets compensated for its CORC certification work in two ways: An account holder can pay an annual membership fee, or a service fee is applied to the supplier when a CORC is traded for the first time. The fee is based on the volume of the annual output of CORCs and the price level of the CORCs.

Apart from its revenue generation goals, Puro’s mission and overarching goal

is to expand the number of carbon removal projects across several industries. The company also aims to expand the access of CO2 buyers to suppliers with large CO2 removal volumes, like RTE.

When Puro.earth launched in 2017, Vihavainen says, there were a half-dozen biochar companies in the world, and now there are more than 500. That growth is, in part, due to Puro.earth and its ability to create an additional buyer for one of the industry’s main processes: carbon removal. Prior to RTE, the suppliers that Puro.earth has typically certified have had annual output totals far less than 100,000 CORCs. In fact, RTE is the first supplier to be certified by Puro that is at or above that level.

“Adding RTE is very significant,” he says.

None of it would have happened without Ramm of EcoEngineers. Ramm introduced RTE to LaCreca and his team. At first, LaCreca wasn’t sure if the RTE project would work in the VCM. Now, he says,

BCI equipment is built to last, one piece at a time, by a team that still believes quality matters.

From custom design, to fabrication, to service & support...

BCI is Elevating Conveying Standards

• Chain Conveyors

• Bucket Elevators

• Parts & Accessories for all makes/models of conveying equipment

Over 200 Years of Combined Experience. Made in the USA.

ETHANOLPRODUCER.COM | 39

it’s starting to look like a blueprint for other ethanol producers to follow. RTE underwent an independent verification and successfully met all requirements of feedstock sustainability, carbon sequestration permanence and financial additionality. Through only the first 14 months of its CCS project, RTE was issued more than 150,000 CORCs.

EcoEngineers has published a case study on its work with RTE that demonstrates the opportunity to both RTE and the ethanol sector as a whole. Participating

in VCMs, the study says, “creates alternate revenue streams that reduce project risks and create optionality for bioenergy with carbon capture and storage projects.” The study added that “current incentive programs in the U.S. such as the 45Q federal tax credit for carbon capture and storage and state low-carbon fuel standards ... are attractive to ethanol producers, but long permitting times and regulatory risks that impact credit pricing pose barriers.”

By participating in the VCM, produc-

ers have more choices, LaCreca says. “They now have the choice to go from one to the other depending on price.”

Shashi Menon, CEO of EcoEngineers, says that the company’s goal was to set RTE up for success in regulated markets (i.e., LCFS programs) while also helping the ethanol producer jump into the voluntary market. “This gives RTE a significant competitive advantage within the ethanol sector and serves as a new industry standard for others to follow,” Menon says.

THE POWER BEHIND PROGRESS

40 | ETHANOL PRODUCER MAGAZINE | JUNE 2024

RENT • SALE • LEASE Stock Boilers HRSG Waste Heat Recover y Boilers High Temp Hot Water Custom Control Panels

Ramm echoes that belief.

GROUNDED IN SCIENCE: Entering the voluntary carbon market involves a thorough verification process that includes scientific proof of the permanence, suitability and safety of a CCS site's sequestration reservoir. Technologies such as seismic vibroseis (left) were used at Red Trail to assess the site's geology early on.

“The VCM recognizes that these CO2 removal projects, like that at RTE, are very important to meeting their clients’ goals,” he says. “Ethanol [producers are] in a really good position to participate in the VCM because they provide the best form of CO2 for sequestration.”

Should an ethanol plant control the environmental attributes of its captured carbon, it will have optionality. Some producers looking to capture CO2 via pipeline may not retain their environmental attributes based on their respective contracts with a pipeline provider. According to EcoEngineers, by registering CCS pathways in several jurisdictions and alternative VCMs, ethanol producers will be able to choose to attach the CCS credits to the fuel product and sell ethanol for a premium, or separate the CCS credits from the fuel and sell CO2-removal credits into the “demand-heavy VCM.”

Despite the testing and documentation requirements necessary to register CORCs through Puro.earth, Ramm and LaCreca estimate they could onboard a capturing producer through feasibil-

ETHANOLPRODUCER.COM | 41

Carbon

PHOTO: RED TRAIL ENERGY

HEAT EXCHANGER SERVICE & NEW EQUIPMENT CTI TUBE SHIELDS & LINERS PLATE HEAT EXCHANGERS René Langley 717 268 6223 Rene.Langley@Kelvion.com CONTACT COMPANY Extend the life of your heat exhangers Avoid bundle replacements Eliminate leaks caused by localized erosion /corrosion at the tube ends or throughout the entire tube length Avoid costly down-time In-house service for heat exchanger refurbishment New heat exchangers Spare Parts for Kelvion and all other OEM brand heat exchangers Field Service to service your unit in situ

IN-STATE PARTNER: The Environmental Energy and Research Center, based in eastern North Dakota, played a pivotal role in the development of Red Trail Energy's carbon capture and sequestration project. PHOTO: EERC

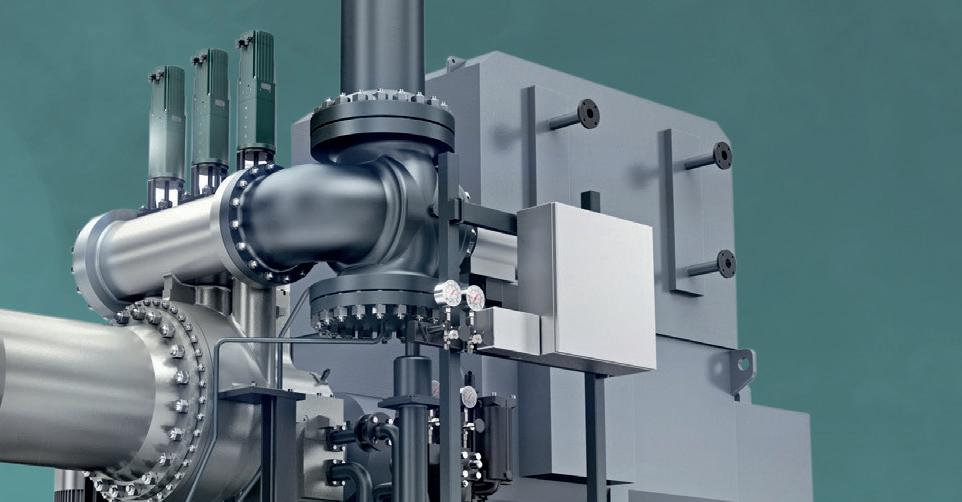

Two Years of CCS at Red Trail

Commencing with sequestration on June 16, 2022, Red Trail Energy was the first carbon capture and storage project permitted in the U.S. under what is called “state primacy.” Today, after nearly 24 months of active CCS, the ethanol produced at RTE has a lower carbon footprint than conventional ethanol sources. In addition to enabling RTE to enter the voluntary carbon market, CCS gives its biofuel more value in the clean fuel marketplace.

RTE emits an average of 180,000 metric tons of CO2 annually from its fermentation process. The facility is capturing 100 percent of those emissions—approximately 500 metric tons of CO2 per day—and permanently storing it more than a mile below ground in the Broom Creek formation.

In October 2021, less than five months after receiving the RTE application, the North Dakota Industrial Commission approved the Class VI injection well and the reservoir pore space RTE needed to operate the facility. The Energy & Environmental Research Center, based at the University of North Dakota in Grand Forks, played an instrumental role in the project’s validation and development.

42 | ETHANOL PRODUCER MAGAZINE | JUNE 2024 ETHANOL DRYING SPECIALISTS - Technical Support - Startup Assistance - Proven Performance - In Stock PARK RIDGE, IL | 847-292-8600 mSORB EDG Molecular Sieve Beads ®

SHARING THE SCIENCE: Amanda Livers-Douglas, assistant director for integrated subsurface projects at the EERC, speaks with members of the community at an informational meeting about Red Trail Energy's CCS project.

PHOTO: EERC

ity studies, education about the VCM and other essential steps in roughly 90 days. Other producers currently capturing CO2, or planning to, may be wondering whether entering the VCM is right for them. For Ramm, the answer is a resounding yes, he says.

LaCreca believes the VCM will be a strong growth driver in the short term for carbon capture projects.

“I think that a lot of the ethanol producers or capture equipment companies can leverage this and help make a more rapid decarbonization of the industry happen,” he says.

Those that move into the VCM early may also be rewarded. While the incentive portion of the VCM is a major driver now, it isn’t meant to last forever. The goal, according to LaCreca and Vihavainen, is that someday every industrial carbon producer will incorporate capture methods into its systems, regardless of incentives.

For CO2 capture projects that aren’t funded or economically feasible at the moment, Puro has an accelerator program to match up projects with investors. It also has a large list of sales channel partners, suppliers and buyers already connected and ready to do business with a large list of credit takers. Interested auditors and verification companies can also link up to Puro. As Vihavainen says, every part of the VCM is growing, including the number of participants.

EcoEngineers has already proven its trailblazing capabilities within the ethanol sector, its management team says. Now, they’re ready for their next project, equipped with the knowledge gained from their role in helping the first-ever ethanol plant enter the voluntary carbon market. Their work has been verified and is repeatable.

Author: Luke Geiver Contact: writer@bbiinternational.com

ETHANOLPRODUCER.COM | 43

Carbon CUSTOMIZED SERVICE Relationships matter in agriculture. Work with a lender who values you and understands your business. Our Agribusiness and Capital Markets team will customize a plan to fıt your needs. Contact Jess Bernstien or Nicole Hatlen today to get started. 877-811-4073 AgCountry.com F OCUSED ON A G. FOCUSED ON YO U.

SAVE THE DATE June 9-11, 2025 OM AHA, NEBR AS KA #FEW25 @ethanolmagazine Produced By 866-746-8385 | service@bbiinternational.com Where Producers Meet FuelEthanolWorkshop.com

Efficiency Trade-offs

More ethanol and oil wrung from each bushel of corn means less DDGS. How well does it pay?

By Susanne Retka Schill

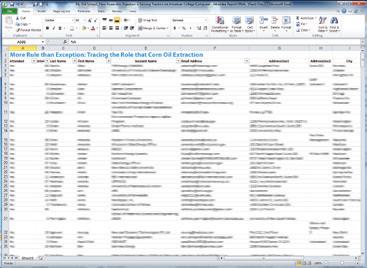

As ethanol yields have increased and more corn oil gets spun out, the inevitable result is that DDGS production goes down. Ag economist Scott Irwin, chair of agricultural marketing at the University of Illinois Urbana-Champaign, pins down the impact as a net gain worth about 28 cents per bushel of corn produced.

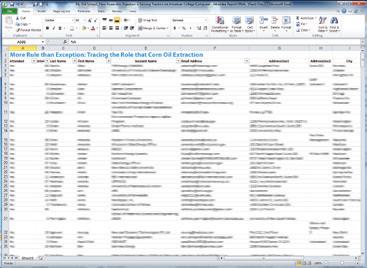

Getting to that conclusion requires data analysis that reveals multiple industry trends. Irwin has been following the ethanol industry closely since the mid-2000s, “when it was clear we were having a major build-out in ethanol capacity in the U.S., and it was having a major impact on corn prices,” he says. In recent years, Irwin has looked at the profitability of the industry annually, utilizing a representative ethanol plant model developed by a fellow ag economist at Iowa’s AgMarketing Research Center. The spreadsheet uses Iowa-based corn, ethanol and coproduct prices and allows users to either run the model’s assumptions for other fixed and variable costs or replace them with their own numbers.

A critical variable to getting a good analysis is inputting the best numbers for ethanol and coproduct yields. “I can’t do a reasonable

Scott Irwin Chair of Agricultural Marketing

Scott Irwin Chair of Agricultural Marketing

job of assessing the profitability of ethanol production in the U.S. without having a good handle on critical measures of productivity,” Irwin says. The challenge, of course, is that this data is not publicly reported like commodity prices. Four years ago, Irwin began analyzing the industry’s conversion rates using data from the USDA and the DOE’s Energy Information Administration. His most recent report, “Trends in the Operational Efficiency of the U.S. Ethanol Industry: 2023 Update,” was published online in February at farmdocdaily.illlinois.edu. Note: All figures and data illustrations in this article, with the exception of one, come from this report.

The analysis gives a snapshot of how the industry is doing, using the best available data, Irwin says. “I will take the EIA/USDA data any day over private data that is a subset of the industry,” he says. “I know and trust their survey methods—I’m the opposite of most farmers. I know the statisticians, and I under-

46 | ETHANOL PRODUCER MAGAZINE | JUNE 2024

Market

COPRODUCT CALCULATIONS: DDGS is widely considered to be corn ethanol's principal coproduct, but it is not the most profitable ancillary output pound for pound. PHOTOS: STOCK

stand their survey methods and their rigor and consistency.”

Ethanol production data comes from the EIA, published in its Monthly Energy Review. Feedstock and coproduct volumes come from the USDA’s monthly Grain Crushings and CoProducts report.

The USDA’s report distinguishes wet mills from dry, giving a window into how wet milling—dominated by ADM and Cargill— compares to dry-grind milling in ethanol production. While the corn crushed by dry mills ranged between 85% and 93% between Oct. 2014 (when the crush report began) and Oct. 2023, the average was 91%, leaving wet mills with an average 9% share of the crush.

Ethanol Yield

Getting data from two different agencies, using two different surveys and reporting methods, complicates the analysis of corn ethanol yield. EIA reports total ethanol production, regardless of feedstock. USDA tracks

The ethanol yield in late 2014, when the crush report first came out, amounted to 2.88 gallons per bushel, improving over the decade by about 1.8% per year, on average, to 2.95 in 2023.

48 | ETHANOL PRODUCER MAGAZINE | JUNE 2024

Market

We designed the REDI-RACK® to accommodate pre-selected components reducing the engineering time and getting you moving product sooner rather than later. 1.800.845.2387 I www.CarbisSolutions.com Pre-Engineered Loading Racks ®