With us your fruit is in good hands. From arrival at the port to collection from our storage; we offer your product the best possible treatment.

In our storage locations in Vlissingen and Kruiningen, the products are subjected to a quality check, after which they are stored and kept at the desired temperature until you want to transport the products further.

“Transitions from the Spanish to the German season may not go smoothly”

Rudolf

“These days we can draw on the entire portfolio of bananas, some of which are from our own cultivation”

38 “Eastern Europe is increasingly developing into an interesting sales market for fruit vegetables”

Christian Zeiler

40 Production and trade dynamics of Sicilian table tomatoes and peppers in the European context

42 “That market has got to grow too”

Thimo van Marrewijk

44 Fully renewed Jongfresh lays foundation for the future

48 “The crisis made us; it forced us to become creative”

Jan van Heijningen

52 “For the export market to take off, Belgian greenhouse vegetable prices must fall significantly”

Vergro

55 “We’re ambitious and keep evolving”

Joris Buijs, Noordhuys Packing

56 Energy management in greenhouse horticulture

62 How did Yu&Me snack tomatoes penetrate this category?

64 “The bell pepper season’s slightly later start means sales are well-balanced”

Harm Aben, Frankort&Koning

65 “Dutch bell pepper season starting more gradually than ever”

Marco Bergman, Harvest House

“The future is for the premium apple“

“Competitiveness against Dutch and Belgian producers has become more comparable for us on the whole“

Volker Janssen

67 “Chili consumption rising thanks to fresh packs and meal boxes”

Gilad Produce

68 “Auctions still play a prominent role in day trading”

Wouter Willems, ZON fruit & vegetables

70 Moroccan tomatoes in 2022/2023: a season to forget

76 Strong hunger for knowledge might double Morocco’s tomato production

78 ToBRFV and tomato imports to Germany: quantifying the correlation

80 “We now generate 80 percent of our sales through our greenhouse production”

Hans Hofmann, Vegetables bau Hofman

82 Veredelung heute: Resistenzen, Roboter, Kälte und Schneiden an der DNA

84 Aubergine breeding: Continually trying to improve quality and production

86 Premium tomato to get even better

Dirk Landahl

Thierry Mellenotte Pink Lady

“Exporter-ripener-supermar-

Han Ploegmakers Banafood

“Winning this award proves our stable cooperative’s vision is on the right track”

Adriaan Vis FruitMasters

10 “LNG and soon Bio LNG make up nearly 40% of our fleet”

Günther Maters, Koeltrans

12 “The city did not even reach out to us traders”

Konrad Koester

19 Italian strawberries: export share drops by 2%, but production picks up in southern Italy

20 “Decline in Spanish product’s production and quality offers chances for Hoogstraten strawberries”

Belgian cooperative optimistic about nice strawberry season

24 “Any growing is a challenge and 2023 is going to be one of the toughest years we will see in my opinion”

34 “I’d go as far as to say that Leanri is even tastier than Nadorcott”

John Gijbels, Euro Gijbels

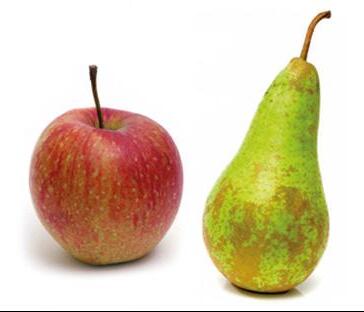

36 Italy is lacking in an ever-increasing supply of pears

96 “Retailers boycotting flown-in fruit and vegetables is a cheap ad campaign”

Peter Hobert, BUD Holland:

98 “Some supermarkets halting air freight fruit and vegetables smacks of pure greenwashing”

Alain Tulpin, Tulpin Group:

100 “The entire food industry should be concentrated in one location”

Nils Doerwald, CEO of Fruchthof Berlin

103 “We have to find solutions; the organic apple market is saturated”

112 South American companies spot and grab opportunities in Europe

116 “Belgian asparagus a little slow to get going”

Benny Cuypers, BelOrta

150

“Decide, plot a course, do your homework, get behind it, and see it through”

Shawn Harris

Stepping aside after 500 months

Mart Valstar and Bas Rensen

118 “Growing preference for European asparagus”

Will Teeuwen, Teboza

120 “Satisfied with Dutch asparagus season so far”

Rick Mengers, ZON fruit & vegetables

123 “There is an opportunity for a premium market for early asparagus to develop in Germany”

Jacques Guironnet, ASPA2

126 How Vietnam benefits from its King of Fruit popularity boom

130 “The Spanish stone fruit production is falling mostly in the hands of larger and more professional companies”

José María Naranjo, Sales & Market Development Manager at Tany Nature

132 Türkische Kirschsaison durch Wetter, Kosten und das große Erdbeben beeinträchtigt

Frühe Regionen werden dieses Jahr keine sehr hohe Kirschenproduktion haben

134 “If we had had more, we would have also exported more, because the demand has been there throughout the campaign”

Esther García, La Unión

136 BayWa Global Produce battles economic dynamic with investments

144 “Sharp decline in produce trade from North America to Europe has changed our business”

Rob Borley, AMS Export

148 “We expect a lot of this season”

Jean Contreras, Arco Fruits

156 What’s happening in the global vertical farming industry?

ket relationship determines banana chain‘s success”

High temperatures at the turn of the year, followed by a cold front in the second half of January caused extreme difficulties for Behr AG’s Spanish vegetable growing operation. Meanwhile, planting could also be carried out much later than usual at the Büttelborn site due to the unexpected cold snap, which is why supply bottlenecks could not be ruled out, said Rudolf Behr, CEO of the company of the same name. He talked to us about this year’s seasonal change in the sector of outdoor vegetables, the omnipresent inflation and cost increases as well as the development of organic cultivation.

This year’s season started with planting at the beginning of September at Agrar Systems, the Spanish subsidiary in the heart of Murcia’s growing region. Until the second week of January, high temperatures dominated the events. “Our range of varieties did not match the temperatures, so quality deficiencies were inevitable. In addition, the original harvest schedule could not be adhered to: That means we started the harvest about three weeks too early, which is why there was overproduction in addition to the quality deficiencies. From the second week of January onwards, it slowly became cooler, whereupon growth radically slowed down. As a result, a tight supply situation is now emerging that will last until the end of the season,” Behr sums up.

Overall, the winter harvest in Spain was an up and down affair. Behr: “Prices

recovered from a very low level from the third week of January. However, the price increase was far too hesitant in relation to the shortage situation. The high losses suffered since November are expected to be only slightly mitigated at the end of the season.”

Due to the shortage, the Spanish winter season is expected to end earlier, Behr continues. Immediately after planting at the Büttelborn site in Hesse, the crops were exposed to night frost for more than ten days, which is why the start of harvest is unpredictable for the early crops, he says. “Accordingly, the transition from the Spanish to the German season may not go smoothly. The connection from the Hessian harvest to northern Germany, on the other hand, will not be a problem,” he adds. Behr AG’s most important crops continue to be iceberg lettuce, mini

romaine, broccoli, cauliflower and spinach.

In general, the vegetable producer is not too worried about climate change. “Our farms are located in different climatic zones, so there are no major obstacles. We have the principle that quality must come before regionality and therefore recommend that the customer is more flexible.”

In addition to conventional outdoor products, the organic production has also been successively expanded in recent years. The main crops are lettuces, courgettes,

“Transitions from the Spanish to the German season may not go smoothly”Rudolf Behr at Fruit Logistica 2023

beans, cabbages, sweet corn, spinach, celery, leeks and pumpkins. “In the case of Hokkaido pumpkins, we want to set up a year-round programme via Germany, Spain and South Africa. We also intend to try growing organic tomatoes twelve months a year in Germany and Spain. We have already succeeded with celery and broccoli. With lettuces, we have insect problems from mid-September to early November in Germany, and in Spain we face similar challenges from mid-April.”

According to Behr, consumers are also paying attention to prices when buying organic. Accordingly, a clear shift from organic specialists to supermarkets and discount stores can currently be observed. “The purchase volume of organic vegetables was down by eight per cent in 2022, while increases continued to be recorded in food retailing - both full-range and discount. Considering that these market segments are among our main customers, we did not suffer any losses in terms of volume,” Behr sums up and points to the latest product innovations. “New in our test cultivation this year is the organic country cucumber, which we grow in

Rosenweide in Lower Saxony. Also new is the organic mini watermelon.”

Both in conventional and organic vegetable production, the increased operating costs are making themselves felt, Behr further observes. “Supply and demand still regulate the price of vegetables. In 2022, we were not able to compensate for the increased operating costs with the revenues. It is always difficult to add rising costs to prices concurrently.”

Despite all the challenges, Behr AG is looking ahead with confidence. “We are definitely optimistic due to the growth steps we have taken in the past. It is important for us to maintain relevance in the market in order to be able to work fairly with customers. Therefore, we will persistently continue to offer and push product and packaging innovations in the future. In terms of packaging, we pay strict attention to the reuse and recyclability of packaging (PP film as well as PET trays) and wherever possible we use cardboard trays or refrain from packag-

ing altogether. On the other hand, we do not see many opportunities for great new developments at the moment in view of the reluctance to buy. The standard is in the foreground - that is what we are concentrating on,” concludes Behr.

pkluender@behr-ag.com

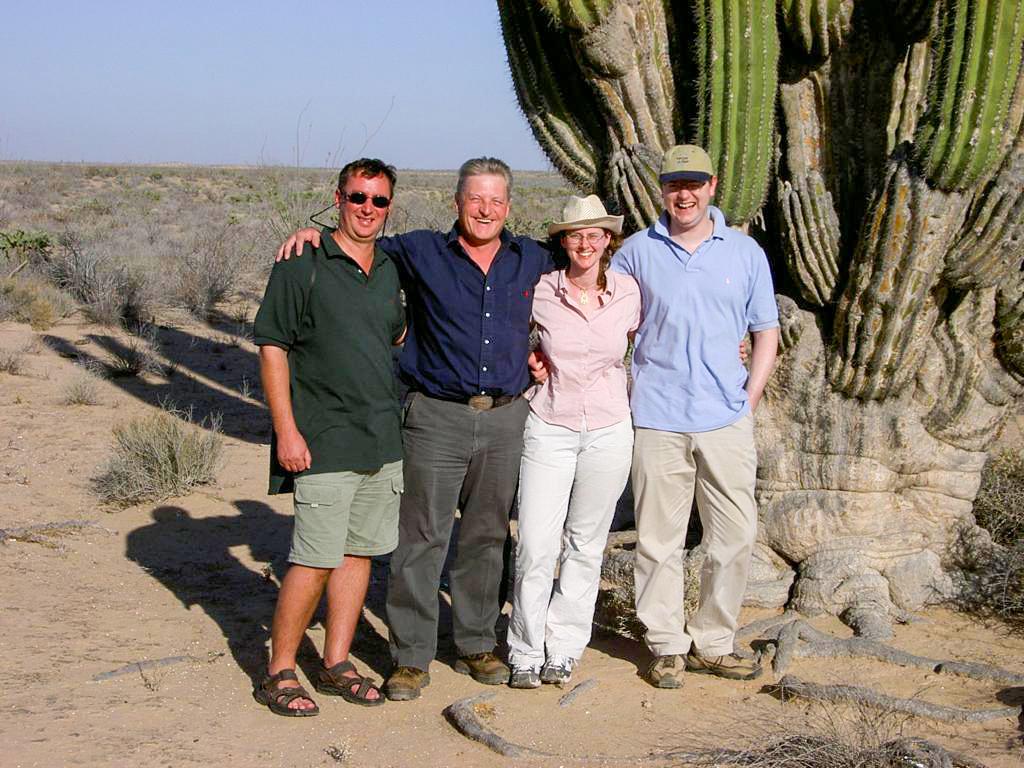

On February 13, the Hamburg-based company Direct Fresh GmbH celebrated its 10th anniversary. Started as a modest agency, the company has developed under the leadership of Dirk Landahl into a flexible and renowned partner for the European food retail sector. We spoke with Landahl and his son-in-law Felix Stamer about the rapid development of the company as well as the global banana industry.

After the initial years, the first step was the move to the current company headquarters at Kiebitzhof in Hamburg in 2015. “After several years of growth, we had to cope with a decline in turnover for the first time that year, which was followed by a comprehensive restructuring. We wanted to focus more on retail programmes and less on spot markets and the two products bananas and garlic,” says Landahl looking back. He has been the sole shareholder of the company since 2019.

The fundamental decision paid off in the following years, which was reflected in a steady development of turnover. Landahl: “Despite or thanks to Corona, we recorded our best turnover result in seven years in 2020, and this performance was improved again in the following year, 2021. The past banana year was of course affected by the considerable cost increases, but we were still able to win new customers for us and at times triple the volume with existing customers. Given that the market has recovered to a certain extent, we expect another good year.”

Direct Fresh GmbH’s sales markets nowadays fall on three pillars, Landahl continues. “We supply the service providers of the discounters and in some cases also act as a direct contact for the food retail trade. In addition, we have opened

“These days we can draw on the entire portfolio of bananas, some of which are from our own cultivation”

Dirk Landahl:Felix Stamer and Dirk Landahl with their supplier Alfredo Montalvo from Ecuador (m) at this year’s Fruit Logistica

up new markets, for example in France and Bulgaria. It is noticeable that we are increasingly being noticed, in that above all the direct routes and our broad supplier network are appreciated. Last year, we also took a stake in a 250 ha banana plantation in Ecuador, 135 ha of which are already in production. Shortly before that, in 2020, we founded Direct Fresh Sourcing GmbH and launched and protected our own brand Bellarillo. This means that nowadays we can draw on the entire portfolio of bananas, partly from our own cultivation.”

The launch of the own brand Bellarillo in 2021 was another milestone for the Hamburg-based company.Another topic that is currently gaining relevance is the market launch of sustainable, CO2-compensated bananas. “We have already been able to deliver the first quantities to food retailers. As an importer, we are constantly in a balancing act between ecology and economy, but we are striving to further expand our volume in the coming years. We see sales opportunities in Europe-wide food retailing and are convinced that this trend will continue in

the coming years,” says Felix Stamer. Over the years, Ecuador has asserted itself as the main source country for bananas in all qualities, adds Landahl. “The projects in Colombia have already started very successfully and will soon be followed by other origins such as Peru, Costa Rica as well as the Dominican Republic.”

Both the supplier and buyer network is being expanded bit by bit. Nowadays, Direct Fresh GmbH is active as an internationally established trading partner in numerous countries, from the neigh-

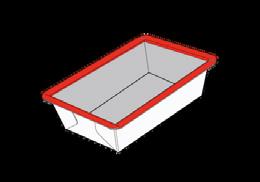

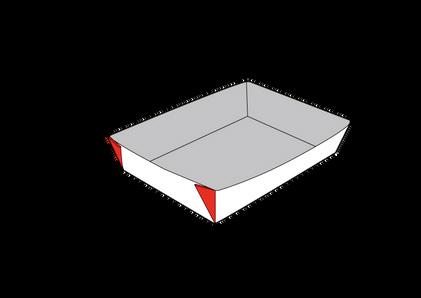

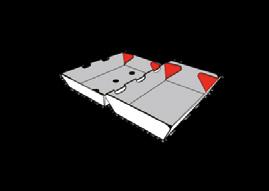

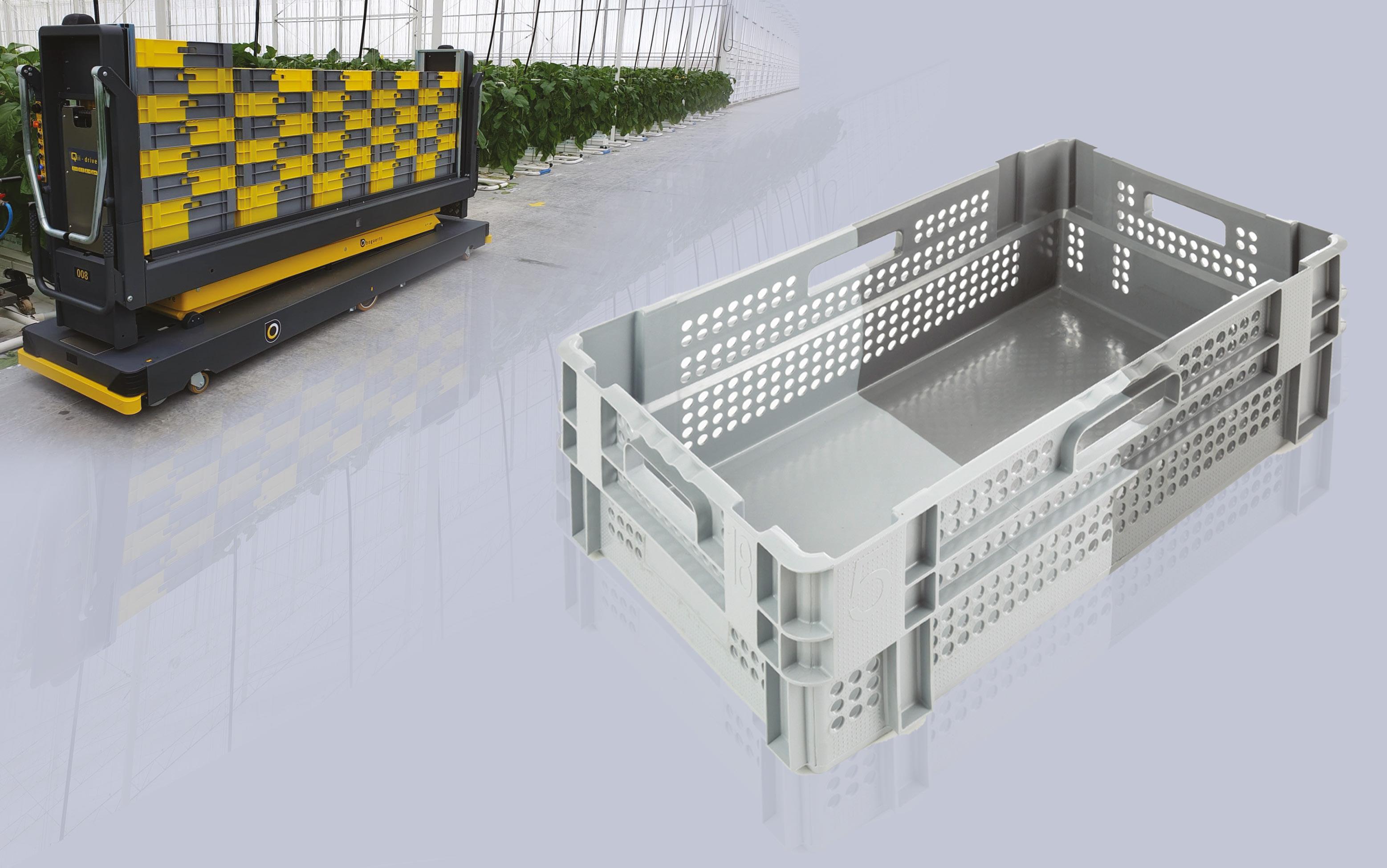

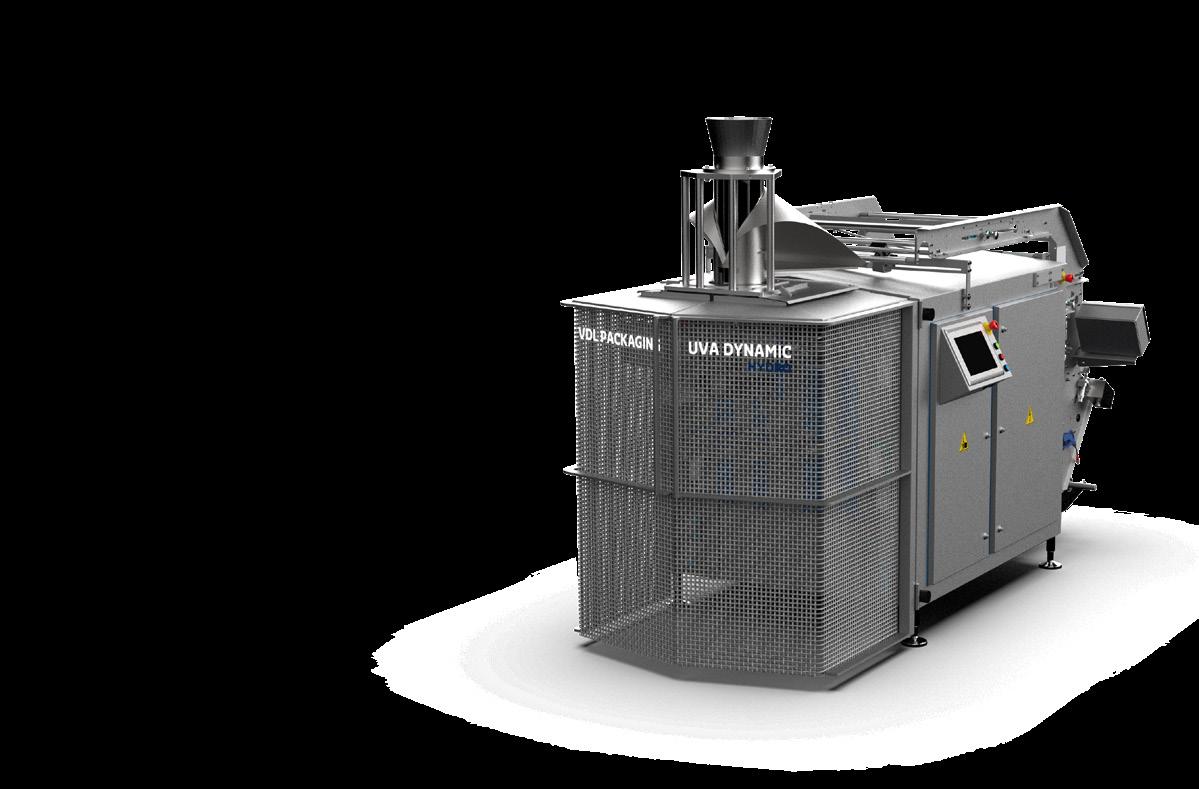

• Sustainable, strong design •

• You buy directly from the manufacturer (Helmond – NL) •

• More than 60 years of experience in Food & Agri •

• We produce also big foldable boxes •

bouring markets of Austria and the Netherlands to Central and Eastern Europe and the Arab countries. Landahl: “Across the market, we are seeing an increased demand for third-party brands or entry-level price bananas, as consumers are becoming more price-conscious due to the price trend. Currently, bananas are offered at 1.40-1.50 euros at the POS in this country, while we used to have prices around 1.00 euro. But you have to remember that bananas are still the cheapest item in the fruit and vegetable department.”

Although banana distribution is and remains the company’s core competence, Direct Fresh GmbH is also dedicated to the distribution of other overseas products, such as garlic

and ginger. “In the future, we also want to obtain the latter from our own contract farming, in which we want to use the open spaces on our farm in Ecuador for the production of organic and Demeter ginger. Preliminary talks with our cultivation partner have already been very positive. There are sufficient water resources available, the decisive factor now is whether the production of ginger is also realistic in terms of the soil. If that were the case, I think the first shipment, i.e. the market launch on the European market, would be possible in about one year,” Landahl concludes.

Refrigerated transport to Germany is one of Koeltrans’ core focal points. This Dutch company which recently turned 12.5, operates mainly in the fruit, vegetable, flower, and plant sectors. But, according to owner Günther Maters, it is looking to expand its services in other sectors.

What are the most important developments in transport to Germany? Controlling costs and optimizing servi-

ces, Günther answers: “Customers are becoming increasingly demanding regarding information. We, thus, have 24/7

occupancy, bundle freights, optimized load factors, and cross-docking facilities. All while giving clients real-time updates.”

“High demands are placed on the equipment, not only on the trucks and trailers but also on the drivers, who must provide the necessary hands-on services. That requires driver training and supervision, which we do in-house at what we call the ‘Koeltrans academy’. Driving time regula-

Günther Maters, Koeltrans:

“LNG and soon Bio LNG make up nearly 40% of our fleet”

tions to keep the trucks running as much as possible and allow drivers to rest as legally required need plenty of attention too. Plus, the Mobility Pack is quite challenging, now and in the longer term. To seamlessly implement that, in 2018, we added a branch in Germany to our existing one in the Netherlands. We can thus offer clients the flexibility they want.”

“We all currently face price increases, thanks to the war in Ukraine and inflation, which puts pressure on margins. The transportation industry had to deal with much-delayed truck and trailer delivery times as well as skyrocketing equipment prices. Drivers’ wages are also rising tre-

mendously, with ten percent and higher hikes being commonplace. So, to ensure quality and quantity, we have to be creative in anticipating truck usage rates. With more than 180 units in our fleet, we have that well in hand,” says Günther.

“We began greening our fleet years ago. LNG and soon Bio LNG make up nearly 40% of our fleet. Since this calls for knowhow and experience, we’re sure we’re a step ahead of the rest of the market with this,” Maters explains. “The recent LNG prices made that tricky sometimes, but this will benefit us, given future legislation and CO2 surcharges. Also, Bio LNG has the advantage of 90% CO2 savings compared to diesel.”

“Our fleet already includes LHVs, many of which operate in Germany. However, current laws and regulations have weight limitations. Weight is a concern for the fruit and vegetable sector; not so much for flowers and plants.” He considers improved customer data flow as the biggest future challenge. “That and our green fleet means Koeltrans is ready for the future. On to the next 12.5 years,” concludes Günther. gunther@koeltrans.nl

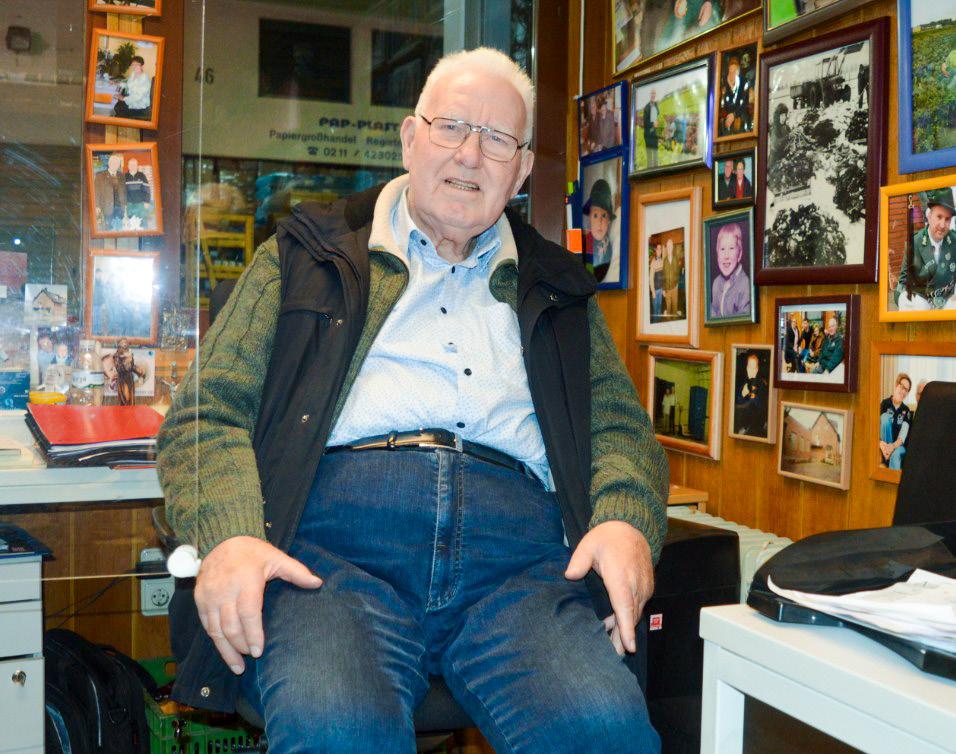

Konrad Koester has been working at the wholesale market for about three decades:

Like many long-established wholesale market colleagues at the Frischezentrum Düsseldorf, Konrad Koester has spent a significant part of his professional life at the fruit and vegetable trading centre. The fruit wholesaler was therefore very angry about the council’s decision of 1 July 2021 to dissolve and close the wholesale market as a public trading area. With a lawsuit against the city, the end of the wholesale market was narrowly averted for the time being; a total of fifteen lawsuits are now running against the city. FreshPlaza had an in-depth conversation with Konrad Koester, the dedicated managing director of the company of the same name, in Düsseldorf.

“Although the wholesale market is no longer responsible for the entire fresh produce supply of the city of Düsseldorf, it is still responsible for an essential part of the general public supply,” Koester pleads. A fundamental part of this general public supply are public and state-subsidised places, which include not only museums and zoos, but also the city’s wholesale markets, so that citizens can maintain their living at a reasonable price. “At the same time, traders also need a place where they can handle the goods cheaply and deliver them to the respective buyer.”

After the past lawsuit, another three lawsuits against the city are ongoing. For one, Koester has filed an application for a standards check against the city council’s decision to close the wholesale market. For another, further lawsuits are underway against the dismissal of the resident traders as well as the rent increase. “We

pay 16-17 euros/m2 cold rent these days, which is about double the old rent until a few years ago. The city has decided to pass on the third-party waste that is deposited on the premises to the rental costs of the market firms. The admissibility of this increase is currently being examined and I am confident that the city council will have to withdraw this decision.”

IMMEDIATE

According to Koester, the exact opposite is the case in Düsseldorf. “The city has not even reached out to us. That can be seen clearly in the open stands, which are simply not allowed to be reoccupied, even though there would have been enough new applicants. The city council doesn’t recognise the importance of the diversity of supply that the wholesale market has to offer.”

WHOLESALE

NEEDED Koester also points to the key role of the wholesale market at the time of the pandemic. “Especially in the first months of the crisis, the wholesale market was needed more than ever because the food retail chains could not keep up with the local supply. In Italy, a special crisis management system was set up with networking of the wholesale markets, in which the wholesale markets were given additional financial support. In most cases, wholesale market companies are owner-managed and known for their reliability.”

The Higher Administrative Court of North Rhine-Westphalia in Münster is currently examining whether the ruling of the Administrative Court of Düsseldorf was correct. After that, only a further trial before the Federal Constitutional Court in Leipzig would be possible. Should it come to the end of the wholesale market, it would also be the end for the Konrad Koester company, according to the owner. “We are a service provider for regional community catering and buy about 60 per cent of our raw goods directly on site from our wholesale market colleagues. That guarantees the quality of our company. If we no longer have the wholesale market to buy from, we can no longer guarantee the safety of our products. But if we were to win the lawsuit, I would call for the immediate renovation of the wholesale market area to the latest hygiene standards.”

Most wholesalers prefer the comprehensive redevelopment of the current site, according to a small survey. “The cur-

“The city did not even reach out to us traders”

Konrad Koester

rent wholesale market is a discontinued model,” said 87-year-old Wilhelm Andree, who has spent his entire career at the wholesale market. “We would prefer to stay here, but we are not afraid of a possible closure of the wholesale market,” said Yusuf Bidi from the company of the same name. His colleague Hasan Atula from Christoph Kotz e.K. sees the situation in roughly similar terms. “This is where we have our base, which would fall away if we relocated.” Gastro-wholesaler Azad Dagdelen of Adam Reuters GmbH does not believe that the wholesale market’s demise can still be averted. “The wholesale market is coming to an end: We are already considering several options and are open to everything.”

“A metropolis like Düsseldorf simply also needs a modern wholesale market,” Koester continues. According to him, this

does not only apply to Düsseldorf, but also to the other fresh food centres in Germany. “The wholesale markets that still exist today are, without exception, the largest urban vegetable warehouses and can therefore also have the quickest access to fresh vegetables if something is needed. This storage and transhipment function of a wholesale market should by no means be underestimated. The management of such a trans-shipment centre requires certain qualities that the city does not have, in my opinion. In other words, the city cannot manage the wholesale market, but only administer and safeguard it. That is a very important difference. So if I were to win the case, the structures would also have to be fundamentally changed. In that case, we wholesale market traders would take the management into our own hands, but under cover of the city.”

Koester then also points out the erroneous media reporting and the negative

tenor with regard to the German wholesale markets. “We have a fantastic product and concentrated expertise. If sales were to decline, we would also be in a position to open up new markets. We will inevitably have to switch to service and delivery. The influx of customers is visibly decreasing. Accordingly, I would also be in favour of opening 24 hours a day so that we could also attract restaurants and other tradespeople to the market. For this, a location commitment of at least 20 years would also be crucial in order to build up the wholesale market in a sustainable way and to ensure that the existing quality and expertise are not lost.”

These days the fruit consumption in Europe seems to be on a downward slope. A concern for many and also for Pink Lady, one of the most well-known apple brands. Pink Lady Europe is responding to that situation by looking to consolidate the consumer loyalty by adapting the strategy and reacting positively to what consumers expect. During an interview with PRIMEUR at Fruit Logistica Pink Lady Europe CEO Thierry Mellenotte shared his thoughts on topics like consumer needs, price positioning, sustainability ambitions, managing growth and new apple introductions. Despite the challenges, he still sees opportunities for the middle and long term. “Our message is that Pink Lady is not just an apple. There is a vision, a message, and a value.”

Thierry Mellenotte, Pink Lady: “The future is for the premium apple”

The world around us is a challenging environment at the moment. How is Pink Lady doing amidst this turmoil?

“Recently it appeared that the average apple consumption in Netherlands fell by four percent from November 2022 to January 2023. Pink Lady is on the same trend. We are not worse; we are not better; we are just following the trend for the whole category. The apple stock in the Netherlands is quite high. One of the reasons for that is again that the consumption is not what it used to be in the past. Of course, we are concerned by the economic context. What we see is that the mass of the market is driven by low price – Elstar or Jonagold for example – and because of the premium positioning of Pink Lady it is normal to be impacted. We know that the inflation context impacts the behaviour of the consumer - who is faced with some concerns - a lot. We have to deal with that.

That is the reason why we decided at the beginning of this season to increase our promotional activity on the market. We increased the marketing budget for Europe by 10 percent. We are quite confident because we have the support of the major retailers. We also have a good activity on the wholesale market. Maybe the European season will be a little bit longer compared to the past, but due to the context that is normal. For us the main challenge is to consolidate loyalty of the consumer and that is why we adapt our strategy. What is challenging is to win capacity while at the same time reacting positively to what the consumer expects. They are looking for promotion and a good offer. We know that private labels and discounters are working well. At the same time, we must not forget our medium and long term strategy: to continue to develop market share, to continue to include new consumers and continue to develop the brand value. Also we know that on the medium and long term our CSR policy is quite important for the consumer: what the brand is doing for aspects like biodiversity, limitation of the carbon footprint, improving quality, developing new techniques and technology for our growers. We focus on the present but will not forget our medium and long term strategy for the brand.”

“Our strategy is to first develop what we call double references. To cover the wider range of consumer needs with loose and prepacked apples. For Netherlands – one of our most important markets in Europewe have the objective to develop sales and

Club apple Pink Lady – the brand name for the Pink Cripps apple variety (now also including Rosy Glow and Seksie) that has a pink hue on a green background - was developed in 1973 in Australia from a crossing between the Lady Williams and Golden Delicious varieties and is therefore celebrating its 50th anniversary this year. Since the first harvest of Pink Lady apples in 1979, patenting in 1990 and registration in 1992, the Pink Lady trademark has been registered in more than 70 countries. In Europe, it represents an annual harvested volume of well over 200,000 tonnes, produced by over 3,000 growers in Europe.

promotion for visibility of PinKids – small apples specifically targeted at kids. Our third objective is to develop commitment promotion for consumers. These initiatives include the program ‘Adopt a tree’ –which gives the consumer the possibility to adopt a real tree in a real orchard. The consumer receives news about what the grower is doing in the orchard in every season.

This initiative wants to sensitize the consumer about what the grower – who is distant from the consumer – is doing to produce apples. We think that it is important for the apple category to edu cate people and to raise awareness as to what happens in an orchard during the year. BeeP ink is also a pro motion in which we explain to the consum er what is done in the orchard to protect bees and what we are doing to develop biodiversity. The third big promo tion for the brand value is PinkChef

which is a cooking competition. We also pay attention to Corporate Social Responsibility (CSR). In various European countries we have a communication plan to explain to the consumer our efforts in terms of biodiversity, to protect bees and how we defend the growers’ value. Just to explain to the consumer that Pink Lady is so much more than an apple.”

“A very important and huge question for the Western-European apple category will be: in what direction do we want to go? For me the only way is to be the best in terms of quality, to develop new brands with real added value for the consumer and to be more and more responsible in a way that is integrated in how we think about maximising the reduction of our footprint on the planet.”

Given the current downward trend in European fruit consumption, how do you see the development of the apple category in general and of the Pink Lady’s position within that category?

“The trend of downward consumption is there. The first impact of this decreasing consumption is on the basic product: Elstar, Jonagold, Gala. I strongly believe that the market will grow for the premium brand as the market will become more and more sophisticated. I also believe that in countries like Germany, the Netherlands, Belgium, France or Italy, the future is for the premium apple because those countries will never be able to compete with apples from for instance Poland or Turkey in terms of low production cost. A very important and huge question for the Western-European apple category will be: in what direction do we want to go? For me the only way is to be the best in terms of quality, to develop new brands with real added value for the consumer and to be more and more responsible in a way that is integrated in how we think about maximising the reduction of our footprint on the planet.”

“It is difficult to understand the decrease in fruit consumption. In Germany, for instance, figures show that both apple prices and consumption decreased by around nine percent. Even if the whole category is decreasing in terms of price, it is not enough to limit the decrease in terms of consumption. That is terrible. For too long already the main competition of fruit has been fruit itself. In one way it is a good thing to see the development of new apple brands with a new marketing concept. Because we use the same tools as our main competitors in food which are snacks, yoghurt, desserts, sugar, and junk food. We need to introduce the same tools; marketing is not vulgar. It is just to explain who you are, what you are doing and how, to convince consumers that what you are doing is good for them.”

Pink Lady has been on the market since 1979, and expanded to Europe in the 90s. Does a concept apple have a shelf life?

“We try to cover new consumer needs and that is why a few years ago we developed PinKids. For the grower that gives value to the smaller apples. For parents it is

a way to motivate children to eat more fruit. It is a way to avoid waste; if you give a normal sized apple to a small child, only part of it will be eaten, because it is too much. We are developing manufactured products of Pink Lady apples. We have a strategy to develop products with major companies in their own category. For instance a specific reference that we made for the German market is a Pink Lady cider. We also have Pink Lady juice, yoghurt, and compote. For us that is a way to develop the presence of Pink Lady in other categories than just fresh apple and to enlarge the consumer population.”

Specifically young people, who are tomorrow’s consumers, seem to have a strong preference for other fruits over the more traditional fruits such as apples. How does that affect your business?

“We know that a big part of the Pink Lady consumers are families. But also, young adults and young couples with young children and teenagers. From our research we see the taste profile of Pink Lady matches very well with what children are expecting. It is sweet, full of flavour with a little bit of acidity. We are not so concerned by the competition of the blueberry or other power fruit. We have the right fruit and with good communication and marketing we are able to share the brand value with the consumer: protecting biodiversity, decreasing our carbon footprint and so on. We know that is a concern of the younger generation and it is a strong focus of Pink Lady.”

“I think this affects the whole category. We have done a lot of research on who our consumer is, and we make sure to cover all the different social categories so that we are close to the whole population. That means we have high, medium, and modest level offerings. Our objective is to offer the best of our production to the majority of the people. And we are concerned for Pink Lady, being a premium apple mostly with a premium price, to keep the same price position and react positively to consumer budget constraints. That, however, is not only up to us and sometimes we are quite surprised to see the price positioning by the retail, but we cannot manage that. In many European countries the apple consumption is maintained by huge promotion of two or three kilo bags with Elstar or Jonagold apples. The retailer will probably not have a good margin on this type of product. So they need to have some other reference that can compensate that low margin. And when you have a strong brand such as for instance Pink

Lady, maybe they take too much advantage of that.”

How does Pink Lady give substance to that sustainability ambition, other than with organic production?

“About two percent of our production is organic and if the growers are not organic they follow an integrated fruit production programme. In the current context it is very difficult for the organic fruit category in terms of price because there is a lot of organic volume. The price difference between organic and traditional produce is between 25 and 35 percent and we must recognize that in this very specific period of time, when you ask the consumer to pay some 30 percent more, maybe that is too much. For the organic growers it is a very difficult time.”

“We strongly believe there is a third way between traditional and organic production where new techniques and technologies will help growers to always improve their ways to produce. That is why we dedicate part of our investments to new start-ups in the field of new growing and storing methods, decreasing the carbon footprint and alternative chemical products. Using the best that is found in the organic production method combined with new technology could bring a new way to grow.”

How is Pink Lady doing in terms of growers; are you still expanding your grower base?

“For the coming years until 2030 we have an objective to increase the production with about six to seven percent per year in order to win capacity but well control the quality that we put on the market. When you are a big brand and the demand is there, even when in the current situation it is quite challenging, we know that in the middle to long term we have a lot of market share to win with Pink Lady, but we need to manage our growth well. We consolidate our current grower base of just over 3,000 growers in Europe because they are used to growing the technical Pink Lady apple and try to introduce new growers in our group year after year. We know that for young growers it is quite difficult to develop a new orchard and we can help them with that a lot.

In a group it is also important to have new people who can bring new ideas and with experience from different economic sectors. We believe it is a good way to remain dynamic, to grow, to move and to think. As of last year we have a group that represents the new generation, only of new

growers between 25 and 35 years old. They come with their sensitivities, new ideas and their difficulties. It is important for the entire group to understand what the new generation of growers is looking for and what they are expecting from the brand.“

Many new apple varieties – both free and concept – are being introduced to the market. Is that a concern for Pink Lady?

“If you have more and more competitors that means more choice for the consumers to taste something new and that might lead to losing some of them. I think the flipside of it is that it creates confusion for the consumer. I believe that it is quite important to have new brands and new products on the market if you want to develop the whole category, because that creates interest for the consumer. If you have a category of products that never has any innovation, you will see the category decreasing. So it is nice, but we have to consider whether all those new references are bringing something really new? I am not sure about that. You will find more and more apples and new brands, but they are not really distinctive in terms of taste, economical model or values. It might create confusion for the consumer. For instance, in Italy, where there is so much new offer, some retailers adopt the strategy to change references quickly. That means a new brand is put on the shelves for maybe four weeks and then it stops and is replaced by another because of the pressure from the apple industry to introduce a new apple. When there is too much choice in non-distinctive apples, that is overkill.”

Some of those new introductions are similar to Pink Lady and based on the Cripps Pink variety. What is your policy towards those look-a-likes?

“That is why we invest a lot of time and money to involve our growers, not only for the quality of the product, but also for the CSR-strategy that we have behind the brand. We have the big advantage of a production of more than 200,000 tonnes now. We are the leading apple for the premium category and have a strong distribution and a strong brand awareness that gives us an advantage over look-a-like varieties. But we need to propose something more than just a fantastic apple in terms of product and that is why all our growers signed a commitment charter based on four pillars: responsibility for the planet, developing the economy and the social tissue of our territories – we know that the Pink Lady production is very important in some areas -, supporting new techniques to help growers to be more involved in planet protection and increasing and developing transparency and information for citizens.

Our message is that Pink Lady is not just an apple. There is a policy, a message, and a value. One of our goals is to protect a fair value for the grower. We are trying to develop more advantages so that we are able to say to the consumer: You have the choice between a Pink Lady and a pink apple. Maybe the difference in taste will not be so obvious, but what the consumer needs to know is what we can do. Behind the Pink Lady it really is different with much more responsibility than the other pink apples can deliver..“

Approximately 11,700 tons of Italian strawberries were exported during the 2022 season, about 2% less compared to the previous year, with quantities perfectly in line with the volumes of the last five years. There was also a slight decrease in value compared to last year, with the average price holding almost steady at €3.42/kg.

Production-wise, 4,100 hectares of Italy’s area for strawberries grown in single-crop farming in 2023 is a slight decrease of 1 percent compared to the previous year. Italian strawberry cultivation continues its relentless expansion in the areas of southern Italy, while areas in northern and central Italy have been slightly decreased.

In southern Italy, in fact, the increase in areas amounted to 2 percent over last year, but the overall increase compared to 2020 is 12 percent. So far, the areas in southern Italy represent about 65 percent of the nation’s strawberry cultivation with more than 2,650 hectares cultivated in 2023. Basilicata and Campania are the main production areas, together co-producing 50 percent of Italy’s total production. Basilicata with about 1,030 hectares, maintains the 2022 yearly investment, whereas in Campania the estimates seem to show +4%, which equals an increase of about 38 hectares compared to last season, exceeding 1,050 hectares.

Spain continues to be Italy’s main competitor, both in terms of export propensity and volumes produced. In fact, in 2022, Spanish exports closed with a volume of about 278,000 tons, down 12 per-

cent compared to the volumes that were shipped the previous year, the quantity being the lowest in the last five campaigns.

“The export share of Italian strawberries is almost stable,” says manager Pietro Paolo Ciardiello. “In terms of area, 50 percent of Italy’s strawberry production is grown in the Campania and Basilicata regions. However, thanks to the contribution of other areas, the supply has remained consistent for 12 months of the year. Not only are the strawberries from integrated pest management cultivation destined for export, but also those from organic production.

Specifically, we are noticing a strong foreign demand and good consumption for organic strawberries. In general, the Italian strawberry is recognized and appreciated in northern Europe, a long-standing export destination, and in eastern countries such as Slovenia, Czechia, Poland, and Romania, which in the last decade has been importing Italian product even if in limited quantities. The commercial trend of the current campaign is positive, with growing numbers being exported at the beginning of this season; in fact, we have recorded a greater demand from

northern Europe more than from Italy, perhaps because in the Nordic countries strawberry consumption is off-season.”

On the other hand, Luca Zuccarella of the OP Zuccarella cooperative from the Basilicata region - Italy’s main strawberry-growing area - explains how the weather pattern has caused significant difficulties for the current season. “We were already experiencing record temperatures at the transplanting stage, which disrupted crop operations. So far, the frequent and significant temperature swings have generated an erratic production situation, with rapidly fluctuating volumes, thus not allowing us to fully meet all orders. We have also had reduced volumes at Easter, when production usually peaks, due to the cold weather setbacks. Another major pain point are production expenses, with labour costs affecting the company’s budgets, in addition to increases on packaging, transportation and fertilizers. Despite the critical socioeconomic issues, which in recent months have generated buying habits geared toward fighting inflation, European consumers have not given up on Italian strawberries. This is evident in the increase in the tons of strawberries sold compared to the past campaign both on the domestic market, but especially on the European market.“

It is no secret that, in Northern Europe, the past winter was unusually tough for strawberries grown under lights. High energy prices affected many growers, and there was virtually no Dutch and Belgian supply until March. During the winter, the Belgian cooperative Hoogstraten operated at ten percent of its previous years’ volumes. But, at the time of this interview, in early April, they had festively kicked off the strawberry season. Production will soon be fully underway. “The dark spring delayed growth somewhat, but volumes are starting to increase week by week. Sales should begin to peak by late April,” begins Marcel Biemans.

The winter story is clear. The extremely high energy costs made many growers wait to plant. Supply was minimal throughout Belgium and thus also at Coöperatie Hoogstraten. Still, things are looking up, and a beautiful summer is on the horizon. “Strawberry demand is always high at Easter, but the dark spring meant volumes were still very low. That resulted in quite high prices for the time of year. After Easter, prices dropped to between €5 and €6/kg. We can work with these prices in the trade and hopefully hold on to them. They’re sorely needed to compensate for the high cultivation costs.”

“It’s a good thing that prices are down a bit. That means all the channels get going simultaneously, and we start getting

more volume again. The nice weather with temperatures of 20+°C is around the corner. That and demand will benefit production. Strawberries are the pre-eminent product that depends on nice weather on both sides of the trade. So for now, the time ahead certainly looks favourable,” says Marcel.

A strawberry oversupply might soon become an issue again. Greenhouse production was delayed, which could result in a convergence with cold cultivation in May, resulting in high output and a price drop. Marcel doesn’t consider that a negative for now. “It’s playing out in the market because everyone’s getting nice volumes. I just think you have to act upon

it. For example, my colleague Michiel Vermeiren has drawn up a peak rush action plan with our retail partners. From late April through June is traditionally a period of high demand.”

“Our growers also tell us that the crops are more spread, whereas last year, the plants’ production peaked more at certain times. Plus, it remains to be seen whether, due to the delay, all crops will have top production. The recent dark weather seems to have prevented the strawberry plants from reaching their full potential. However, it’s all still speculation; the plants could soon suddenly start producing. Add that the cold crops have shifted back a bit and we can bring everything to market gradually. It’s also important to engage with our growers and business partners in this regard,” Marcel explains.

The demand export market is another reason for this optimism. Spain and Morocco have recently dominated the market, but now those countries’ productions are declining. Spanish products are also losing quality due to the continuing heat, so the time is ripe for Belgian and Dutch strawberries. “The export countries are already noticeably competing

“Decline in Spanish production and quality offers chances for Hoogstraten strawberries”Belgian cooperative optimistic about nice strawberry season:

in the market, which obviously benefits us. By this time last year, we still had to compete with large volumes of reasonable quality from Spain. That seems to be somewhat different now.”

Coöperatie Hoogstraten’s main export markets change throughout the season. “France is usually one of the most important export markets, but in the spring, for instance, Scandinavia also participates very well. Germany, too, is increasingly becoming a demand market. During the summer, we export to, say, Italy and Spain; in the fall, it’s the UK. We, thus, keep up with the season and see these markets appreciate our strawberries’ extra attention to care and sorting. That takes some extra effort from our growers, but customers are willing to pay more. It’s our trump card,” admits Biemans.

Looking ahead, he hopes the past winter’s problems are never repeated. “Energy prices have fallen but are still high. Nonetheless, our growers say they might switch the lights on again this winter. Of course, we will, however, continue to discuss this because, with strawberries

being such a costly crop, growers must be sure it’s worth their while to plant. We sell plenty via auction, but we want a part of the lit cultivation covered in advance, so our growers have a good basis. Ultimately, people have to want to pay for the product. If that happens, there will be lit cultivation next winter. There was some demand last winter, so even if we don’t get the previous years’ volumes, it will hopefully be more than last winter.”

Another way to achieve more certainty is to switch from June to ever-bearers. Energy costs and commodity price increases are causing headaches. Personnel costs,

as well as finding staff, make things harder for many too. Switching to ever-bearers - which growers are increasingly attracted to - could be a solution. These strawberries could have standard production but cost less, labour and costwise. Marcel, however, warns that this should not be considered a cure-all.

Together we strive for the highest quality in products and production, In craftmanship and innovation. We invite you to cocreate a sustainable future for the fruit and vegetable sector. So join us www.hoogstraten.eu

Als toonaangevende producent van massief karton, maken we het mogelijk dat deze verse en diepgevroren producten onder de best mogelijke omstandigheden worden bewaard en vervoerd. In duurzame, betrouwbareen innovatieve verpakkingen op maat, die garant staan voor kwaliteitsbehoud en voedselveiligheid. Met respect voor mens en milieu, door zo min mogelijk te verspillen.

tion would be the same every week, but in reality, that’s often not the case.”

“Last year, 96% of the strawberries we offered were June bearers, the remaining four percent, ever-bearers. This year that share will rise to about eight percent. That’s double, yet it’s not explosive growth. Nevertheless, this is noticeably being considered. We just don’t want to rush anything. It has to fit within our brand and, of course, be an added value for our growers. We’re looking at and tinkering with the idea, but discussions continue,” Marcel concludes.

info@hoogstraten.eu

“It has indeed aroused the interest of many because it could be beneficial when it comes to workers,” Marcel admits. “But it brings its own challenges. When you plant ever-bearers, you can plant cultivation at the beginning of the year reason-

ably well. At some point, however, Mother Nature starts to dictate the course. That can lead to an ever-bearer peak production exactly when you don’t want it from a labour and market perspective. In an ideal world, these strawberries’ produc-

The Earth provides us with energy, food and water. A source of life, which we must use sparingly. At Smart Packaging Solutions we use energy and raw materials sparingly, developing THE PERFECT BODY. A protective packaging for fragile natural products such as meat, fish, fruit, vegetables and flowers.

Our packaging is developed from three high-tech, fully integrated production sites in Leer and Oudegem (our headquarters) in Belgium and in Loenen, the Netherlands. From paper that we recycled in our own factories to sturdy, moisture-resistant and one hundred percent recyclable solid cartons.

www.smart-packaging-solutions.com

The British berry sector has seen huge growth, 600 per cent in 25 years and the soft fruit production is now valued at £1.5 million.

Likemost producers the UK strawberry growers are contending with higher inputs and a shortage of labour. The minimum wage has seen another increase this year, transportation rates have gone up as well as energy prices, while the price has remained relatively static for the last 15 years. There has been a big move in the last ten years to growing in poly tunnels which not only offer more protection, but also allow growers to extend their season.

There have also been advances in robotic harvesting and many growers are trialling these in the tunnels and on open ground production.

The UK strawberry season is slowly getting underway with small volumes coming mainly from heated tunnels and glasshouse. The main crop will start in May.

One Scottish grower picked the first strawberries on 22nd of March. PJ Stirling is one of the biggest and earliest strawberry producers in Scotland, situated at Seahills Farm just north of Arbroath.

“Growers who have glasshouses heated by gas are finding it too expensive to produce this early in the year. Our tunnels are heated using biomass boilers fuelled by locally sourced woodchips. Each boiler can heat 1HA of strawberries and are fully automated, as are the irrigation systems,” explains Gary Bruce, Farm Manager at Seahills Farm.

Initial volumes were small but at the season’s peak they will pick 44 tonnes a week.

Meanwhile in England The New Forest Fruit Company’s strawberry season kicked off 30th of March, about a week later than normal, this was due to a very dull wet March, 200mm of rain and 50% less light levels in this month.

“Volumes are slow to build as April is proving to be as bad as March so far this year, over 80mm of rain fell between 7th to 14th of the month,” said CEO Sandy Booth. “Peak season will be pushed to the middle of May, it is normally the beginning of May. Demand is very good, prob-

ably due to the poor quality coming from abroad.”

New Forest Fruit have been trialling harvesting robots and this is progressing well with the accuracy at 95% which means they are not picking fruit that is not ready and speeds are coming, but this takes time to learn. These robots are now scouting to count berries coming in the following week and the week after which helps in predictions.

“Last year was very challenging with 15% increase in wages, plus the number of returnees was well down due to the war in Ukraine, which meant more retraining than normal and more costly picking speeds. Labour for 2023 is looking good so far but only time will tell. There are more returnees this year which will help in trying to keep costs down and other costs hopefully will stabilise to allow us to make some profit.”

“Any growing is a challenge and 2023 is going to be one of the toughest years we will see in my opinion.”

Scottish grower, Andrew Todd from Blacketyside Farm in Fife will harvest the

“Any growing is a challenge and 2023 is going to be one of the toughest years we will see in my opinion”

first strawberries from heated tunnels around mid-April, mostly for local sales with small volumes going into retail. The timing this season is mostly normal with some blocks around a week later.

“The tunnels are heated by water piped from our biomass boiler, it was a big investment but a good opportunity to get into renewables. Growers get RHI (Renewable Heat Incentive) payments, but no new applications are being accepted, which is a shame as there is now less incentive for growers to make such a big investment.”

Andrew has focussed on progressing the business and increasing production as demand has been increasing steadily for the last 15-20 years, but last year was the first time the market had retracted, and this puts even more pressure on price.

“This strawberry production will outstrip demand, partly due to less demand, and partly more production. This is a worrying trend as things are tight for growers. We have always been a forward-thinking

industry, we understand that retailers need full availability and have always tried to cater for that, but now the situation is tricky for us. Some growers have just decided to stop growing berries.

Another challenge is labour, although Andrew is quietly confident he will have enough for this season, it is becoming more difficult. “We are lucky to have a lot of returnees, but we do need more people from the Agricultural Visa scheme. The returnees are great as they just get right back into picking, but new people need lots of training which is time consuming and expensive.”

Getting access to the right chemicals has also become a challenge as growers have lost a lot of products which they used to control pests and diseases. Aphids and mildew are a big worry for growers.

“We are hoping that demand will pick up this year, last year was the first year that people could easily go away on holiday after the Covid travel restrictions were fully lifted and it really hit demand.

August is always a difficult month when a lot people are out of the country.”

“Volumes from Spain are dipping, but Spanish strawberries are still available and the supply is steady,” according to Ben Goodchild, Sales and Procurement Manager at Nationwide Produce. “Dutch supply is starting to climb, but it is mainly going to European retailers.”

According to Ben the UK strawberry season will be interesting, “The main production will start in May, but there is a reduction in growers as some have not planted this year, which may lead to a reduction in production. The reality is that costs are high and labour is short and expensive. Wholesalers and caterers may pay more for fruit, while the retailers are still in negotiations with growers, but with inflation so high prices will not be near where they need to be.“

Summer fruit from Sweet and Sunny is grown especially for you with love and lots of sunshine. As a result, it is deliciously sweet and extra juicy. Be tempted and enjoy this tasty treat.

sweetness. Juicy & delicious!

Strawberry producer Volker Janssen on the impact of higher electricity prices:

2022 was also a difficult year for the strawberry production in greenhouses. “Initially, we had to contend with weak prices in the spring, as programs could be served longer with Spanish strawberries, which is why trade in Dutch and Belgian produce in particular was delayed. In the autumn, it was too hot at the usual planting time for autumn strawberries in early/mid-August, which meant that many farms were only able to plant late. This late crop then did not hit the market until mid-October and in too large quantities all at once. In view of the harvest delay, the overall fall yields were also too low, which in turn was due to the heat,” says Volker Janssen, a strawberry producer from Viersen and member of the Landgard growers’ cooperative.

The situation was also aggravated for the Janssen family by the exponential rise in electricity prices, which was particularly noticeable in greenhouse cultivation. Janssen: “We were fortunate enough to have fixed contracts that ran until

the end of 2022. Accordingly, the significantly increased costs for electricity and gas will only be fully felt by us with the new contracts from January 2023, that is, during the new season.” The operation falls under the so-called electricity price

brake, which is why costs have roughly doubled with the new contracts. “In view of the fact that energy prices have risen significantly not only in Germany, but throughout Europe, competitiveness has become more comparable for us overall, especially in relation to Dutch and Belgian producers. This is because they are currently operating at the same high price level that we have had in Germany for some time.”

Given the circumstances, the grower’s goal is to grow as energy-efficiently as possible and keep costs as low as possible. “Consumers simply have less money available at the moment and are saving accordingly when buying food. So even though the demand for strawberries will be there, we won’t be able to pass on 100 percent of our price increases. Overall, we expect the prices to be adequate, but no more than that. We will not be able

“Competitiveness against Dutch and Belgian producers has become more comparable for us on the whole”

to build up reserves for further developments,” he predicts.

The facade of the greenhouse facility: Over 90 percent of the yields are marketed to German food retailers via Landgard. The remaining yield is sold in vending machines under the Edelrot private label.

In week 11, the first greenhouse strawberries of this year’s season could already be picked. “This is a new variety bred in

Germany called Rendezvous, which we grew for the first time last year as a test variety and this year we expect to be able to harvest it in the early range until midMay. The qualities of the early strawberries are good, but the volume is still low for the time being, especially since we are producing in the greenhouse virtually with the handbrake on. Due to extremely cold temperatures in Spain, there will be little produce on the market at the start of the season. That’s why we are positive that we will be able to achieve good prices.”

As an early variety, the new cultivar Sunsation has established itself, followed by Malling Centenary. Still strongly represented in greenhouse is the already established Elsanta. In addition, remontant varieties are gaining in importance, according to Janssen. “The lower costs as well as less effort and material input in production speak particularly in favour of these varieties. The taste can currently still be optimized, but there will certainly be new, improved cultivars in the future. Overall, the cultivation of remontant varieties will remain challenging. This is

Strawberries

because they are less uniform in harvest, the produce ripens in peaks and is therefore more difficult for farms to plan.”

In the 1990s, Volker Janssen ventured into protected tomato cultivation on substrate, followed by the first trials with greenhouse strawberries about 30 years ago. Since 2020, together with his son Dominik, he has devoted himself fully to the strawberry cultivation in the open field as well as in protected cultivation (tunnel, foil greenhouse and greenhouse). At that time, energy expenditure was already an important motivation behind the restructuring of the company, Janssen confirms. “In the Netherlands and Belgium, there has been a strong expansion of strawberry cultivation in the last two years. Existing facilities - such as tomato or bell pepper glasshouses - have been converted to strawberries. In addition, existing large farms have expanded their production with new large greenhouse complexes.”

In Germany, on the other hand, the area under cultivation has remained almost the same for several years. Among the reasons for this are the more complex German building regulations and a lack of lobbying, coupled with the current unresolved energy issue, Janssen describes the difficult conditions. “Due to price increases for all energy sources, the costs for the greenhouse cultivation have tripled in some cases. Producers in the Netherlands and Belgium are struggling with the same problems. Under these conditions, anything that requires a lot of energy to grow is simply not interestingon the whole, this makes greenhouse production difficult. Imported goods from

warmer regions like Morocco and Spain, on the other hand, will put more pressure on the market.”

The current energy crisis is also having a restraining effect on the use of advanced greenhouse technology, such as lighting, he said. “The use of self-generated electricity is not profitable at the moment. This can be seen, for example, in the fact that currently no goods are offered at the auction clocks. This problem not only affects strawberry cultivation, but also other crops. We therefore do not use cost-intensive photosynthetic lighting, but we do work with interfering light to extend the day and thus improve the yield.”

Given the circumstances, no investments are planned for now, he said. “You have to face the fact that the near future is not going to be years of growth. You just have to stick with it and trust that things will change again. Developments generally move much faster today, so at the moment we have to be patient,” Janssen concludes.

info@edelrot.eu

Wendy Bangels +32 470951032

Tim Pittevils +32 470957905

The independent German banana ripening company Banafood celebrated its 15th-anniversary last year. Its founders, however, have more than 75 years of collective banana trade experience. After first working as the company’s commercial director for 18 months, Han took over ‘the banana thing’ from Hans Maagendans this year. He is now in overall charge of the banana ripening plant. “Who wouldn’t want to be involved, all day, with supermarkets’ top fruit and vegetable product,” begins Han.

dealt a lot with bananas in my career, but my knowledge has really deepened in the past two years because here, we’re dedicated to bananas. The great thing about working here is that you genuinely add something to the product. We’re not just a broker or box shipper. Although we don’t produce ourselves, we deal with the whole production planning, from overseas imports and logistics to ripening and delivery to our customers’ DCs. Here, the triangular exporter-ripener-supermarket relationship is hugely important. By continuously coordinating

and informing each other, you get the bananas at the right colour and time.”

Han finds himself in a well-organized company. “Banafood was founded in 2007, but the founders have over 75 years of banana experience. Our head ripener, Sander Maagendans, learned the trade from his father, Hans. That ensures continuity in the ripening field and means the third and fourth generations of banana specialists are now part of our compa-

ny. Sander also brings a new perspective, which our clients notice, too. Our input doesn’t end once the bananas have been ripened and loaded. We like brainstorming about what happens to the product at DC and store level because there’s still plenty to be gained there. I’m not saying we know everything, but by working well together, you can improve the entire chain,” he says.

After its latest expansion in 2018, Banafood has a roughly 60,000 box/week capacity. “What’s unique about Banafood is that it’s an independent banana ripening facility. We’re not tied to any importer, retailer, or brand, which is fantastic. Although we’re very well aware of what’s happening in the market, we don’t sell bananas ourselves. We work specifically for retail and food service. We, thus, have a reasonably stable supply. We also work with fixed ripening schedules. That and our modern ripening system means we can deliver the right quality and guarantee a good shelf life. Some ripen bananas

“I’ve

Han Ploegmakers, Banafood:

“Exporter-ripener-supermarket relationship determines banana chain‘s success”

After nearly 40 years in the banana business, Hans Maagendans is going to take it a little easier from this year. He is, however, not considering retirement at all and will remain involved with Banafood as an advisor.

Forty years ago, Hans not only gained a wife but a career in the banana sector too. From 1983 to 1995, he had been head ripener at Bruigom & Visser, his father-in-law, Jan Ritmeester’s company in the Netherlands. When Bruigom & Visser was sold to Chiquita in 1995, the name changed to Chiquita Fresh Gorinchem. After over 12 years at Bruigom & Visser, Hans was the operational unit manager at Chiquita Fresh from 1995 to 2007. He spent the last 15 years of his career in Germany, where Hans and fellow shareholders started the new ripening company Banafood Services GmbH.

for shorter and more irregularly. That makes short-term financial sense but does nothing for shelf life and quality.”

“Most of our buyers are in the Netherlands and Germany. Though we’re based in Germany, the initial focus was largely on the Netherlands, but we’re now also increasingly gaining a foothold in Germany. Several retailers have started their own ripening facilities, but plenty of parties still don’t have the ripening capacity for that. I think being an independent ripener in Germany is why we can grow even more. In Germany, there’s still often a clear ripener-supplier link. but we ripen for several parties, which makes us very flexible. We’re not bound by national borders either and are always open to ripening for other customers,” Han explains.

“And we’re ripening more and more for food service clients. You don’t have to tell our ripeners that those bananas must be more yellow than for retailers. That’s the beauty of an experienced team. When the ripeners arrive at work, they can tell where the bananas originated by the belt colour and pallet type.” Banafood also ripens other products like mangoes and avocados, though in much lower volumes than bananas. “There are definitely future growth opportunities here,” Han admits.

The banana diseases, TR4 and Black Sigatoka, have been banana market threats for years. Still, Ploegmakers is not con-

cerned that bananas will eventually disappear from supermarkets. “The multinationals are working hard together on solutions to find fungi-resistant varieties. We, obviously, have limited influence there. That doesn’t mean we’re oblivious to the threat, but neither does it deter us from, for example, investing in our ripening capacity.”

Banafood mostly ripens bananas from Ecuador and Colombia. “We work with other banana-producing countries, too, but we’ve had good experiences with Ecuador and Colombia. Each country has its pros and cons. Ecuador usually delivers somewhat firmer bananas. For Colombia, the transit time is slightly shorter. Last year, at certain points, the availability of bananas was a definite issue. That was due to adverse weather and delays in the ports. But here, too,

coordination between exporters, ripeners, and buyers is paramount. If that’s flawless, these challenges are more manageable,” explains Han.

Banafood Services GmbH

Carl-Kühne Straße 7 47638 Straelen

T.0049(0)2839 5689100

E .info@banafood.eu

I. www.banafood.eu Cold

600 spots!pallet

He is optimistic about banana consumption in Europe. “Bananas are the most sold fruit in the supermarket, and that’s not going to change any time soon. Local growers can protest all they want, saying we should buy everything from nearby, but the market’s subject to more factors. For example, last year, because of current events, many Dutch supermarkets had to switch to overseas cultivation.”

“Last year was a good year for us. While other products’ prices rose, those of bananas remained quite stable. Supermarket prices have increased since the start of 2023, but bananas are still being sold too cheaply. I thought the increased price would make some shoppers choose other products, but all our customers’ fair trade banana share remains nicely level. These days, at least 75% of the bananas we ripen are labelled Fairtrade,” Han concludes.

han@banafood.eu

With more than 60 years of experience, Verhoeckx has grown into a comprehensive supplier of top quality mushrooms and hard fruit.

In recent years, to extend the citrus season, later varieties have been increasingly considered. Climate issues, especially in Spain, have led to several citrus varieties finishing earlier and earlier. People are thus turning more and more toward varieties they can harvest later in the season. The Leanri clementine is one of these relatively new varieties. It was recently introduced but seems to, slowly but surely, be gaining its place on the market. John Gijbels, too, started with this red-orange premium variety this year and is convinced. “I think it’s perhaps the tastiest clementine we can offer,” says the Belgian trader with a Catalan production site.

The Leanri is a Murcott/Clementine hybrid, with exclusive rights held by the Protected Vegetable Varieties Company (CVVP) in Spain. The variety was introduced with great fanfare in Spain in 2019 before being commercialized in large volumes for the first time in the 20202021 season. Leanri can be harvested in

January and February, ripening four to five weeks before Nadorcott and after the end of the Clemenules harvest. It has been considered promising from the getgo. The variety has a high Brix value of up to 14 degrees, a 70 mm diameter, and an average weight of 150 g. That is according to information from the CVVP. Listing the

characteristics creates expectations, but, says John, these are justified.

He has Leanri available until March, so the first season has just finished. According to John, who grows Leanri on some ten hectares, you could best describe this variety’s first full season as ‘promising’. In Spain, growers are purchasing these trees in large numbers. “However, most Northern Europeans have yet to become acquainted with this new variety. We started with it last year, and this season we had somewhat more for the first time, but volumes are still quite limited.”

“The feedback I’ve received has been extremely positive. Some customers even say they sold more Leanri this season than Nadorcotts last year. Many and I, too, think the Leanri is even tastier than the Nadorcott. Until Orri hits the market, it

“I’d go as far as to say that Leanri is even tastier than Nadorcott”

John Gijbels, Euro Gijbels:John Gijbels

may be the best clementine available. So, it also immediately strikes a chord with consumers, which keeps them coming back,” Gijbels says.

That, in itself, is already an extraordinary feature. Indeed, explains John, the premium variety is somewhat more expensive than other varieties. However, despite financially challenging times for many, consumers are picking it up. “We hear people taste a true difference compared to other clementines. That’s not so true for other premium varieties, so I foresee a bright future for this variety. This season was one of testing and discovery for us, but the variety seems to be catching on well in the Belgian market. Customer retention is high - a vital first step to build on in the coming years. Ultimately, the crucial thing for a variety to succeed is that people like eating it.”

This variety seems to be succeeding in that. “I always wondered if people would like it. We’ll have to see how it goes in other countries, but in Belgium, my expectations have been met. Quality-wise, they’re great this year, with a high Brix value. Also, despite being slightly harder to peel than a Clemenule, I still consider it an ‘’easy peeler’,” John admits. That is why he will continue down the same path next year. “We still have to buy quite a lot in. I had to buy two-thirds of my volume to meet demand. So next season, we’ll do at least the same as last year. From there, we’ll see which way to go. With the more expensive varieties, it’s always a matter of waiting to see if they’ll eventually be fully picked up, but the Leanri has all the qualities to succeed,” he concludes.

For the Italian pear sector, the situation is not one of the best. If until a few years ago the domestic market was being met by national production, today it has to rely more and more on imports from abroad. This was confirmed by operator Albano Bergami, owner of a company that produces and commercializes, and one of Italy’s top specialists in the pear sector.

“Insects, diseases and frost, have brought the pear sector to its knees in a few years, especially the Abate variety, typical of the Emilia Romagna region,” says Bergami. “Until a few years ago the import of pears in large quantities would have been unimaginable, while today we see Chilean, South African, as well as Argentinean products on our markets and in the retail sector, and increasingly early, whereas years ago it was only the case from late spring or early summer.”

For Bergami, it is not normal for Italy to import Conference pears from the Netherlands and Belgium; it is a sign that something is broken in the national system.

“As early as the beginning of April 2023,” adds wholesaler Daniele Di Mauro, who sells in the north of Italy, “I imported an excellent Abate pear from Chile because the Italian national one was almost finished or of poor quality.”

The Centre for Fruit and Vegetable Services (CSO) also confirmed that, in the past, domestic pears almost entirely met domestic demand and a 20 percent was exported. But in recent years, this was no longer the case.

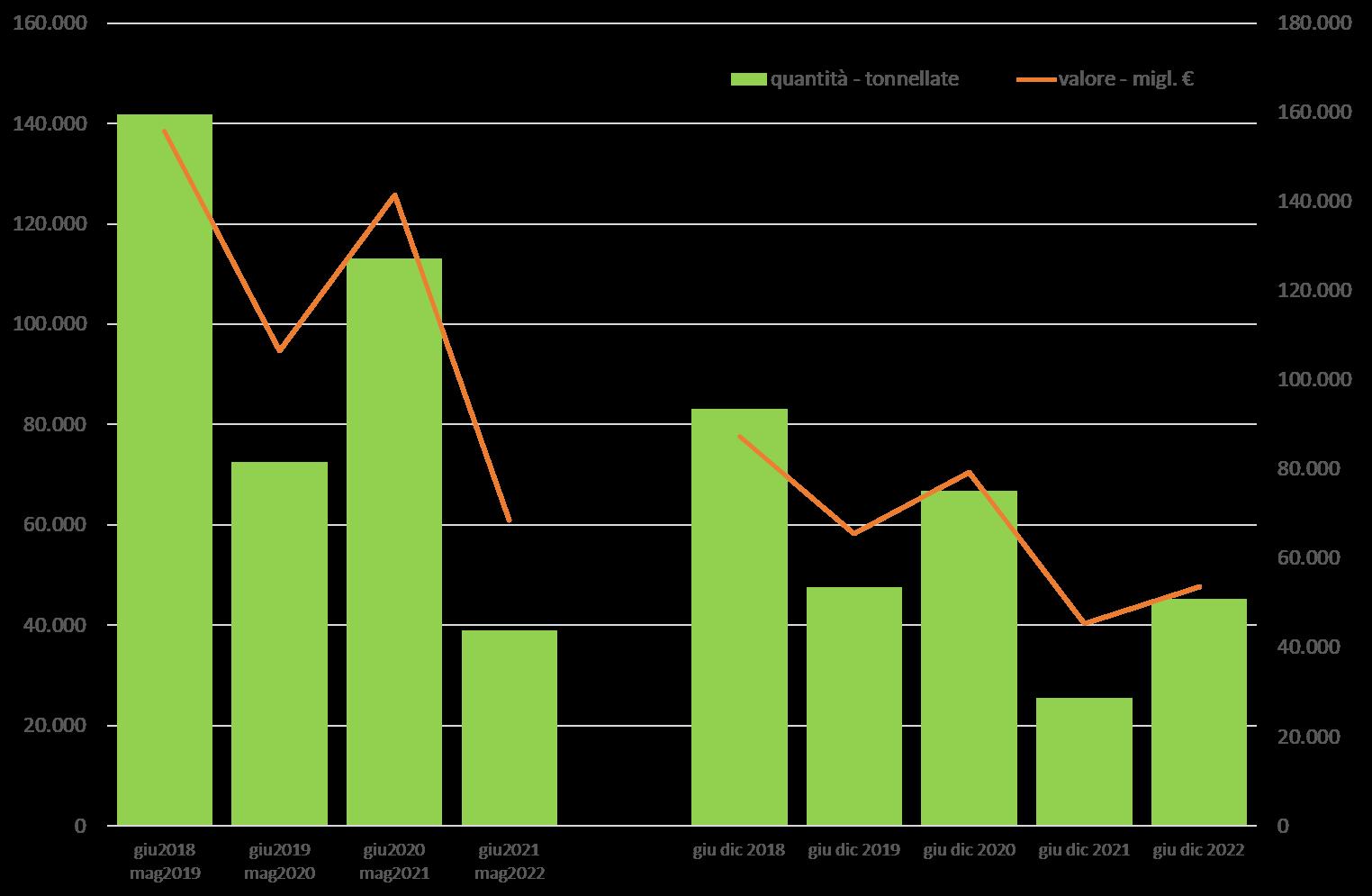

“During the previous 2021/22 commercial year,” says the CSO, “exports saw quantities characterized by an exceptionally low level, complicit with supply relegated to an all-time low. This low performance was caused by a combination of several adverse climatic factors, which represents an anomaly in terms of production. In fact, we have to keep in mind that this year’s production was just over 200,000 tons.”

Shipments to foreign markets between June 2021 and May 2022 stopped at 39,000 tons, marking a 65 percent drop compared to the previous season, perfectly in line with the production gap for Italian pears. Consequently, the share of exports in proportion to supply, amounting to just under 20 percent, remained similar to previous years.

“During the last harvest, we noticed a good recovery in exported quantities for the 2022-2023 sales year compared to last year, which, however, remain below the average potential for the period due to difficulties in the production system also encountered in the current season, mainly due to a high presence of small gauges. On the domestic market, a similar situation was found as well with consumption picking up in the second half of 2022 compared to 2021, but below average,” explained CSO specialists.

Official statistics on pear exports in June-December 2022, the latest available update, showed the handling of about 45,000 tons. Compared with the same period of the previous year, these quantities mark +77% but are down -43% on 2021 and -11% on 2020/21, which was the last season with a comparable production level.

The growth compared to 2021 affected almost all destinations (at least the main ones) with an increase also in the number of the number of markets reached by domestic shipments.

The main destinations remain within Europe, accounting for almost 90 percent of the overall volumes.

In the period June-December 2022, Germany absorbed about 38 percent of domestic exports, compared to 34 per-

cent in June-December 2021 and 44 percent in 2020; in terms of quantity, the volume was almost double the lowest in the previous season.