94

Trade Finance during the Great Trade Collapse

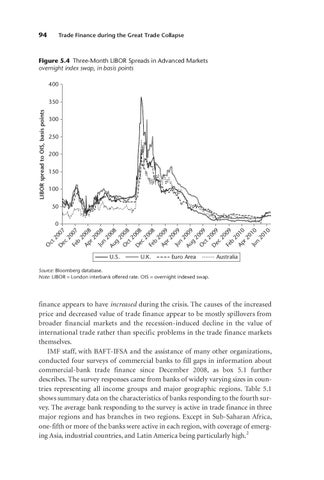

Figure 5.4 Three-Month LIBOR Spreads in Advanced Markets overnight index swap, in basis points 400

LIBOR spread to OIS, basis points

350 300 250 200 150 100 50

07 20 Ap 08 r2 0 Ju 08 n 2 Au 008 g 2 O 008 ct 2 D 008 ec 20 Fe 08 b 2 Ap 009 r2 0 Ju 09 n 2 Au 009 g 2 O 009 ct 2 D 009 ec 20 Fe 09 b 2 Ap 010 r2 0 Ju 10 n 20 10 Fe

b

20

ec D

O

ct

20

07

0

U.S.

U.K.

Euro Area

Australia

Source: Bloomberg database. Note: LIBOR = London interbank offered rate. OIS = overnight indexed swap.

finance appears to have increased during the crisis. The causes of the increased price and decreased value of trade finance appear to be mostly spillovers from broader financial markets and the recession-induced decline in the value of international trade rather than specific problems in the trade finance markets themselves. IMF staff, with BAFT-IFSA and the assistance of many other organizations, conducted four surveys of commercial banks to fill gaps in information about commercial-bank trade finance since December 2008, as box 5.1 further describes. The survey responses came from banks of widely varying sizes in countries representing all income groups and major geographic regions. Table 5.1 shows summary data on the characteristics of banks responding to the fourth survey. The average bank responding to the survey is active in trade finance in three major regions and has branches in two regions. Except in Sub-Saharan Africa, one-fifth or more of the banks were active in each region, with coverage of emerging Asia, industrial countries, and Latin America being particularly high.2