As we approach the end of 2025, we are proud to present the fourth edition of Women’s Tabloid Magazine, celebrating significant strides in gender equality, women’s leadership, and record-breaking business funding. The month of October is dedicated to Breast Cancer Awareness, and we commit to raising awareness and inspiring action.

Ms. Ugnė Buraciene, Group CEO of payabl., appears on the cover page of this issue. The cover story highlights her extensive experience, strategic vision and personal dedication, which drive payabl.’s mission to simplify financial operations through sustainable growth, clarity and a strong commitment to diversity.

Continuing our focus on impactful leadership, this issue features a Q&A with Ms. Sheree Holland, Director and CFO at Axiory Global Limited, who discusses the evolving brokerage landscape, the role of AI in operations, and the significance of diversity and inclusion in the industry.

Additionally, we are excited to launch a new segment, ‘7 Entrepreneurs to watch out for’, highlighting seven inspiring female founders who are breaking barriers across diverse sectors such as financial services, cosmetics, femtech, augmented reality, travel, and investment. Through short Q&A sessions, they uncover their unique entrepreneurial paths and share valuable insights.

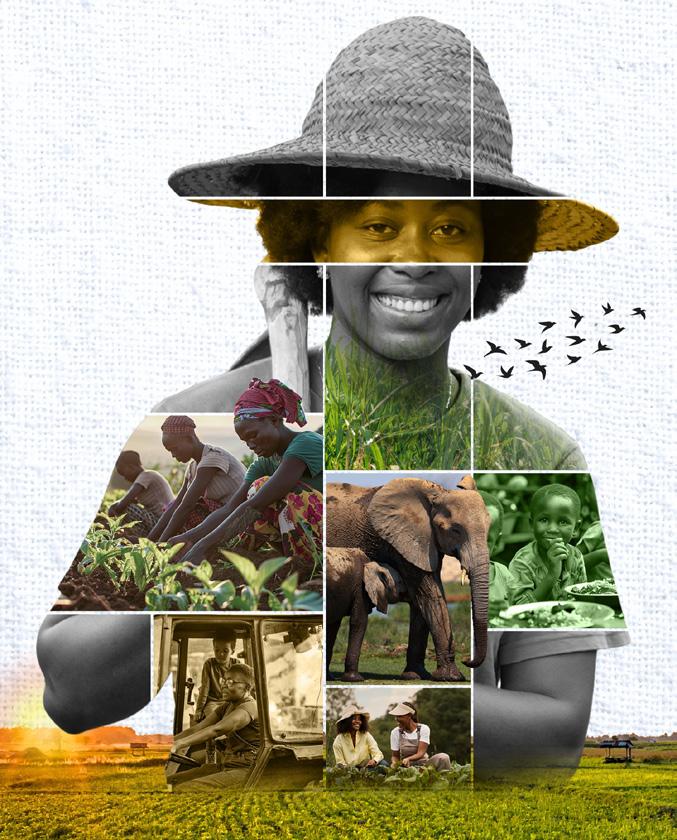

Finally, this issue features exclusive articles from our editorial team exploring women’s influence on Wall Street, African agriculture, Rwanda’s parliament and other sectors, offering fresh insights and highlighting expanding opportunities for female leadership.

This edition presents a diverse range of perspectives that reflect resilience, innovation and leadership. Women’s Tabloid remains committed to its mission: to empower, inform, and inspire women across industries and around the world.

With gratitude, The Women’s Tabloid Editorial Team

Director Anisha Divakaran

Editorial

Naina Patel, Riyah Fatima, Jyotsna Iyer

Design & Layout

Alex Jerry, Anjali Rathod

Business Analysts

Jacob George, Renny Fernandez, John Mendes

Research Analysts

Dia Fernandes, Kavitha, Pratik Mahant

Business Development Manager Daniel D’costa, Lorenshiya Franklin

Ashvin Fernandes

HOW PAYABL. IS REIMAGINING MONEY FLOW “ONE DELIBERATE, DISCIPLINED STEP AT A TIME” WITH MS. UGNĖ BURACIENE THE RISE AND RECKONING OF

7 ENTREPRENEURS TO WATCH OUT FOR

Andrew Tulloch, co-founder of AI startup Thinking Machines Lab, has left the company to join Meta Platforms. An experienced AI specialist, Tulloch previously spent over a decade at Meta and later worked at OpenAI before co-founding Thinking Machines with Mira Murati, where his contributions were key to establishing the company in its early phase. Meta reportedly offered him a package potentially worth up to $1.5 billion over at least six years, depending on bonuses and stock performance. His move forms part of Meta’s broader strategy to attract leading AI talent, having hired more than 50 researchers, engineers and specialists from firms including OpenAI, Google DeepMind, Apple, Anthropic and xAI. Meta has also restructured its AI teams under the new Superintelligence Labs division, acquiring a 49% stake in data-labeling startup Scale AI and appointing its CEO, Alexandr Wang, to lead the division.

KLARNA’S $1.37 BILLION IPO: A STRONG

Klarna, the Swedish fintech firm, successfully completed its IPO pricing on 9th September. It raised approximately $1.37 billion, with its public offering being the largest IPO of 2025 on the NYSE. The shares were priced at $40, above the expected range of $35 to $37. The company made its debut on the NYSE the next day, 10th September, and was valued at over $19 billion in its Wall Street debut. Based on Klarna’s IPO earnings, the company delivered a $2.7 billion gain to its VC investor Sequoia Capital. The BNPL lender has established itself as a competitor for credit cards and traditional banks in the region. Its growth is persistent, with an increasing number of businesses adopting Klarna as a major mode of transaction.

Francesca Bellettini was appointed as the CEO of the Italian luxury fashion brand Gucci. This appointment was announced by Kering- the parent company of Gucci, on 17 September 2025. Bellettini, in her new role, reports to Luca de Meo, CEO of Kering. Bellettini brings decades of experience in the luxury fashion industry to this role at the helm of Gucci. She joined Kering in 2003, and in 2013, she was appointed the President and CEO of Saint Laurent. In ten more years, she rose to the position of Kering Deputy CEO in charge of Brand Development, overseeing Saint Laurent, Balenciaga, and Bottega Veneta. Bellettini’s appointment comes amidst a larger organisational restructuring in Kering.

MARÍA CORINA MACHADO WINS 2025 NOBEL PEACE PRIZE

Venezuelan opposition leader and former Deputy of the National Assembly, María Corina Machado, has been awarded the 2025 Nobel Peace Prize for her efforts to promote democracy and human rights in Venezuela. The Nobel Committee recognised her role in uniting the country’s fragmented opposition and advocating for free and fair elections amid ongoing political and economic turmoil. They emphasised that the ability to vote, express opinions freely, and to have political representation is fundamental to maintaining peace both within nations and internationally. Machado’s work further reinforces the enduring importance of civic courage and democratic principles worldwide.

This October, global fashion brands are marking Breast Cancer Awareness Month 2025 with pinkthemed collections and charity collaborations to fund cancer research and education. Brands such as Ralph Lauren, APL, and Guess Watches are participating through special initiatives. Ralph Lauren celebrates 25 years of its Pink Pony campaign, donating proceeds from select apparel to the Pink Pony Fund and global charities. APL launched a limited-edition TechLoom Traveler in Fusion Pink, contributing 20% of sales to the Women’s Cancer Research Fund. Guess Watches unveiled two special-edition pink timepieces supporting The Get In Touch Foundation, reinforcing the fashion industry’s ongoing commitment to breast health awareness and cancer prevention.

Margherita Della Valle is the Group CEO of Vodafone, a position she assumed permanently in April 2023 after serving as interim CEO since January 2023. In her early days as CEO, Valle brought in radical but necessary changes within the company, such as downsizing the workforce, selling its operations in Spain and Italy, and a merger with Three UK for its mobile operations in the country. This clarified from the very beginning that her insider status would not keep her from implementing difficult changes in her role as CEO.

SANDY RAN XU CEO, JD.COM

Sandy Ran Xu is a Chinese business leader who has served as CEO of JD.com since May 2023. She joined JD.com in 2018 as Vice President of Finance and became the company’s CFO in 2020. With a background in global finance and strategic growth, Xu’s appointment signaled JD.com’s focus on operational excellence and long-term profitability. Since stepping into the CEO role, she has steered the company through a rapidly evolving e-commerce landscape, prioritising innovation, customer experience, and sustainable growth.

WADHA AHMAD AL-KHATEEB CEO, KUWAIT NATIONAL PETROLEUM COMPANY (KNPC) Image source: kpc.com.kw

Wadha Ahmad Al-Khateeb is a Kuwaiti oil and gas executive who has been the CEO of Kuwait National Petroleum Company (KNPC) since 2022. She has been a key force driving strategic transformation across the company. Under her leadership, KNPC has advanced major refining and sustainability initiatives, reinforcing its position as a strong player in the global energy industry. Al-Khateeb’s appointment marked a significant milestone for female leadership in the region’s energy sector, reflecting her deep expertise and forward-looking approach.

India’s EdTech sector has grown at an unprecedented pace over the past decade, driven by low-cost data, broader internet access and evolving learning models. In 2024, the market was valued at $7.5 billion, with projections of $29 billion by 2030.

The COVID-19 pandemic dramatically accelerated EdTech adoption. With 321 million students and teachers confined to their homes during lockdowns, online learning became a necessity rather than an option. Global investment in EdTech increased to $16.1 billion in 2020, up from just $500 million in 2010, highlighting the sector’s rapid growth over the decade.

Established players such as BYJU’S, Unacademy, Vedantu and upGrad scaled operations rapidly, while new entrants captured emerging niches. Even global platforms benefitted.

By 2021, India had established itself as the second-largest EdTech market in the world after the United States, attracting approximately $4.73 billion in funding that year. Indian companies also began expanding internationally, acquiring firms across the US, the Middle East, Africa and Southeast Asia to establish a global presence.

The unicorn leaders

BYJU’S: Launched in 2011 in Bangalore, BYJU’S rapidly set the benchmark for online learning in India and developed into one of the world’s most valuable EdTech companies at the time. By 2018, the platform had over 15 million registered users, of whom 900,000 paid an annual subscription fee, with an impressive 85% choosing to renew. In 2022, BYJU’S was valued at $22 billion and had become the world’s most valuable EdTech company.

Unacademy: What began in 2010 as a modest YouTube channel, soon developed into a full fledged online learning platform. As of 2021, the company was valued at $3.44 billion and had raised $860 million in funding from investors. Unacademy now is one of India’s largest online learning platforms with over 50 million active learners and more than 1500 daily live classes. The platform has built its reputation on affordability and accessibility, aiming to democratise the process of preparing for India’s toughest competitive examinations.

Vedantu: In the online education space, Vedantu has established itself as a prominent and trusted platform, delivering personalised and affordable learning solutions

for students from grades 1 to 12. Powered by its proprietary WAVE (Whiteboard Audio Video Environment) technology and supported by expert educators, it offers scalable online and offline tutoring aligned with school curricula and competitive exams. In Q4 FY25, Vedantu achieved profitability, with collections rising 67% yearon-year to ₹90 crore (approximately $11 million). The company closed FY25 with total collections of ₹284 crore (around $35 million), a 55% increase from the previous fiscal year, while reducing cash burn by 30% to ₹70 crore ($8.5 million). With a focus on accessibility, innovation and student engagement, Vedantu continues to expand its reach across India and explores opportunities in global markets.

upGrad: Founded in 2015, upGrad has emerged as a leading higher education technology platform in South Asia, empowering over 10 million learners across more than 160 countries. The platform offers over 200 industry-relevant courses in partnership with top global universities, combining data-driven learning, expert faculty and personalised career services. With a network of over 1,400 hiring partners and more than 500 career advisors, upGrad has facilitated over 450 successful career transitions. Achieving unicorn status in 2021 with a valuation of $1.2 billion, upGrad continues to shape professional learning and global workforce development. In response to declining interest in U.S. and U.K. campuses due to stricter visa regulations and rising costs, upGrad is strategically expanding its university partnerships across the Middle East and Asia-Pacific regions, including Singapore, Malaysia, Japan, Vietnam, Bangladesh, Nepal, and Sri Lanka.

Physics Wallah: Originally launched as a YouTube initiative, Physics Wallah achieved the unicorn status in 2022. It is transforming education in India through digital-first learning models that expand access for students in underserved regions. Reaching 98% of India’s pin codes currently, PW serves over 10 million learners via its app and provides educational content to more than 36 million students through 80 YouTube channels in eight vernacular languages. Renowned for its affordability and accessibility, PW exemplifies how these models are breaking barriers for students nationwide. Guided by a student-first ethos and a sharp understanding of market needs, Physics Wallah offers cost-effective learning solutions, offering learning outcomes equivalent to top traditional coaching institutes.

If we teach today as we taught yesterday, we rob our children of tomorrow. “

- John Dewey

When vision and capital transformed EdTech

When Covid-19 struck in 2020, the world was forced into an abrupt digital pivot. Education, one of the most disrupted sectors, saw schools and universities shut overnight, only to be reimagined almost instantly through the EdTech ecosystem. What had once been a niche option for the techsavvy or institutions in partnership with digital providers, now became the default mode of learning.

India, in particular, witnessed a meteoric transformation. Venture capital responded in kind; funding surged to $1.95 billion in 2020 alone, surpassing the combined total of the preceding five years. For students, affordability and accessibility made digital classrooms attractive. Quality education, interactive content and top-tier tutors were suddenly within reach across income groups

The surge reflected in numbers. By 2021, India had more than 4,000 EdTech start-ups, offering everything from adaptive learning platforms to AI-driven management systems. Unicorns became the face of this boom.

• During COVID-19 pandemic, Physics Wallah experienced significant growth, later securing $210 million in 2024 and reaching a valuation of $2.8 billion.

• upGrad’s valuation grew in 2022 to $2.25 billion reinforcing its strength in professional learning.

• BYJU’S and Unacademy dominated fundraising in 2021, raising $1.44 billion together, accounting for more than 76% of the total EdTech funding in 2021.

EdTech firms moved swiftly to expand and strengthen their market positions, reflecting a broader industry focus on growth, consolidation, and diversification of learning models. BYJU’S, for instance, made significant investments in offline education through its acquisition of Aakash Institute, while PhysicsWallah scaled its tech-enabled Vidyapeeths and Pathshalas – both proving to be strong revenue drivers. Similarly, Vedantu acquired the doubt-solving platform Instasolv, upGrad added The Gate Academy and Rekrut India to its portfolio, LEAD School

took over the gamified assessment start-up Quiznext, and Eduvanz acquired Klarity.

The surge in the investment grew stronger as a wave of new players entered the market. Reports showed that Indian start-ups raised $2.22 billion in 2020, four times more than the year before, with K–12 learning taking the largest share at almost $1.98 billion. In just one year, from 2019 to 2020, 435 new EdTech firms appeared, including:

• LearnVern (offering job courses in local languages),

• Filo (on-demand help for exam preparation) and

• BeyondSkool (live skills classes for children).

Women in India’s EdTech EdTech, is reshaping the way knowledge is delivered, making learning more inclusive, tailored, and engaging than ever before. At the forefront of this transformation are women who are not only driving innovation but also ensuring that technology adapts to the diverse needs of learners worldwide.

Divya Gokulnath, co-founder of BYJU’S, whose determination and clear sense of purpose had helped propel the company onto the global stage, turned it into a leading force in EdTech. Her dedication to delivering affordable, effective learning tools has won her recognition internationally and contributed significantly to the platform’s vast user base.

Similarly, Tanushree Nagori, co-founder of Doubtnut, has harnessed image recognition technology to provide quick and reliable solutions for students grappling with mathematics and science problems.

Akanksha Chaturvedi, through her venture Eduauraa, is reimagining the education landscape with fresh, innovative methods designed to make quality learning accessible to all.

Meanwhile, Anuradha Agarwal, founder of MultiBhashi, has focused her efforts on early-stage language acquisition. Drawing on her background in computer engineering and management, she has created a platform that helps young learners build strong foundations in communication.

Together, these women exemplify how female entrepreneurs are redefining education through technology, not just by founding companies but by shaping the very future of how students learn.

The Indian Edtech sector has faced significant turbulence in recent years, driven by high operational costs, low user retention, and increasing regulatory pressures. Many startups faltered due to poor market research, lack of patience, and a failure to differentiate between users and paying customers. In addition, the premature adoption of advanced technologies such as AI, AR, and blockchain without clear value for learners, drove up costs and created user confusion. Limited collaboration with teachers and educational institutions, alongside insufficient user training, further hindered adoption and engagement. These challenges contributed to the sector’s slowdown.

Even as companies expanded rapidly during the pandemic, the post-pandemic landscape has been particularly challenging. With the reopening of physical classrooms, the market has seen oversaturation, intense competition, and shrinking margins, leading to a dramatic reduction in funding, from a peak of $3.6 billion in 2021 to just $0.64 billion in 2024. The resulting cost-cutting measures and layoffs have affected thousands of employees, including major players such as BYJU’S, Vedantu, and Unacademy. Many smaller startups, including Stoa School and Bluelearn, have shut operations, while others struggle to maintain relevance in a more selective and competitive environment.

In response, some EdTech companies are shifting towards hybrid models that combine online and offline learning. Experts predict a consolidation phase, with success likely to favour innovation-driven and specialised firms that

complement traditional education systems rather than attempt to replace them. As investors and founders recalibrate their expectations, adaptability and tangible value are emerging as the key determinants of sustainable growth in India’s EdTech landscape.

What comes next for EdTech in India India’s EdTech sector is experiencing significant growth and transformation. The market, valued at approximately US$7.5 billion in 2024, is projected to reach US$29 billion by 2030, according to a report by the Internet and Mobile Association of India (IAMAI) and Grant Thornton Bharat. Key developments shaping the landscape include the integration of artificial intelligence (AI), immersive technologies like virtual reality (VR), augmented reality (AR) and data-driven insights. These innovations are redefining learning experiences, enabling personalized tutoring and virtual classrooms that cater to diverse learning needs. Hybrid models are bridging the gap between online and offline education, ensuring equitable access for students across urban and rural areas.

AI-powered platforms are enhancing personalisation, predictive analytics and adaptive curricula, while immersive technologies are making abstract concepts more tangible and interactive. EdTech is also addressing social-emotional learning, mental health and workforce upskilling, positioning itself as a tool not only for academic achievement but for holistic personal and professional development.

Despite these advancements, the sector faces challenges. The downfall of BYJU’S, which dominated headlines in 2024, has raised concerns about the long-term sustainability of large-scale EdTech ventures. Unacademy is navigating its own trials, expanding offline operations while improving unit economics and managing leadership turnover, with hybrid models central to its strategy. PhysicsWallah, by contrast, is emerging as a trailblazer, leveraging recent funding to expand offline centres and preparing for a $437 million IPO, signalling renewed investor confidence in niche, innovation-driven players. Generative AI adoption is accelerating, with platforms introducing AI tutors and intelligent content generation to enhance personalisation and reduce operational costs, foreshadowing a restructuring of business models across the sector.

Looking ahead, 2025 is expected to be a year of consolidation and strategic growth. Investors are prioritising

companies with proven unit economics, sustainable expansion, and demonstrable learning outcomes rather than vanity metrics such as user downloads. EdTech verticals such as study abroad, upskilling, and reskilling are gaining traction, particularly as AI and automation reshape workforce requirements. With hybrid learning, ethical AI, immersive technologies, and micro-credentialing becoming central to the sector, India’s EdTech landscape is evolving into a more mature, outcome-driven ecosystem. ■

editorial@womenstabloid.com

In 2024, the US led EdTech with a USD 74.34 billion market, followed by China (USD 15 billion), Germany (USD 11.2 billion), the UK (USD 8.1 billion), and India (USD 7.5 billion). While the US drove adoption and growth, China excelled in innovation, India in scale, and Europe in fostering dynamic startup ecosystems and digital education initiatives.

Gen Z has significantly influenced various industries, with fashion being among the most visibly transformed. Their preferences are reshaping global fashion dynamics, both commercially and culturally. Following are some of the women’s fashion trends, some new, some revived, which have been popularised by Gen Z.

Oversized apparel has become a staple of Gen Z wardrobes. From oversized T-shirts to baggy jeans, Gen Z has largely moved away from form-fitting silhouettes, favouring looser, more relaxed styles. This is seen as an expression of comfort, individuality, and straying away from strict body and shape standards from the past.

While patchwork in clothing has been a part of many fashion trends in the past, it is one of the important trends gaining traction from Gen Z. From multi-textured jackets to patched denim, Gen Z fashion has used patchwork in clothing as a form of self expression and creativity. It is not just about fixing what’s broken, but about adding a piece of oneself to one’s clothing.

From platform heels to boots and chunky train ers, many young people are gravitating towards footwear with wide soles. It fits well with the wave of casual and comfortable fashion that has swept over the generation.

One of the most noticeable features of Gen Z fashion is the trend of statement prints, from favourite television quotes to social impact slogans. Young people are embracing the culture of being bold and unapologetic about who they are and what they believe. This culture of being loud and original makes its way into Gen Z’s fashion trends with people wearing T-shirts, jackets and other apparel with statement prints.

One of the emerging trends among Gen Z is the resurgence of crochet, transforming a traditional craft into a modern fashion statement. Young consumers are adopting crochet not just for its aesthetic appeal but as a way to showcase creativity and individuality. Crocheted pieces ranging from tops and cardigans to accessories

have become a symbol of craftsmanship and personal style, reflecting a wider interest in handmade and sustainable fashion.

With Gen Z largely being digital natives, they have been exposed to a tide of information about products they consume since the early years, something which was not readily available to previous generations. This awareness has translated into more conscious consumption, particularly regarding the impact that fast fashion has on the planet. They are also a part of the generation that has inherited the world facing unprecedented environmental challenges, with heightened pollution levels, global warming and collect ing waste, and as a result, they are moving towards more sustainable fashion, ranging from slow fashion, smaller brands to thrifted clothes gaining more traction.

Gen Z has distinctly prioritized comfort in their apparel choices, reflecting a shift away from conventional fashion norms. This shift reflects a growing empha sis on individuality in fashion and a rejection of traditional body and beauty conventions. The preference for comfortable clothing is evident across various trends, from the adoption of more relaxed corporate attire to the continued popularity of oversized garments and footwear.

Gen Z has also challenged traditional norms by embracing gender-neutral and androgynous apparel, reflecting a progressive move beyond the conventional gender binary. Young consumers are redefining gendered fashion norms and broadening the scope of inclu sivity. This trend includes men adopting styles traditionally associated with femininity and female celebrities opting for tuxedos instead of dresses on the red carpet.

or making an entire outfit. This DIY approach signals a wider shift in the fashion industry towards personalization and authenticity.

Millennial fashion was strongly defined by minimalist aesthetics and the ‘less is more’ philosophy. This is now shifting, with Gen Z driving a resurgence of maxi malism. Rather than opting for subtle, understated styles, Gen Z gravitates towards bold, colourful, and expressive fashion – unafraid to experi ment with unconventional combinations. As a result, Gen Z wardrobes are increasingly characterised by vibrant colour pairings, statement accessories, and contrasting layers.

The revival culture is strong in Gen Z fashion. Whether through retro pop culture references or the return of vintage styles from the 1980s and 1990s, nostalgic fashion is no longer just about revisiting the past. It reflects a deeper effort to reconnect with earlier fashion eras and reinterpret their aesthetics through a contemporary lens. This generational shift has seen the resurgence of Y2K-inspired looks, 70s-style statement overcoats, bold silhouettes from the 80s, and the minimal yet distinctive appeal of 90s fashion.

There has been a noticeable surge in demand for modest fashion among Gen Z, driven by several cultural and social factors. First, a growing emphasis on comfort and a rejection of traditional body ideals has led many to favour more modest styles. Second, fashion is increasingly viewed as a means of expressing both cultural heritage and individual identity, prompting many young consumers to incorporate traditional garments into everyday wear. Third, the rise of digital platforms such as Pinterest and Instagram has expanded access to stylish, modest fashion options. As a result, modesty is no longer seen as a compromise but as a viable and fashionable choice, with a grow ing number of designers and global brands catering to this evolving consumer base.

Many Gen Z individuals are becoming increasingly self-reliant in their fashion choices, as demonstrated by trends such as crocheting and patchwork. In line with this, many are involved in designing and creating their own outfits, whether by combining separate pieces editorial@womenstabloid.com

HOW PAYABL. IS REIMAGINING MONEY FLOW “ONE DELIBERATE, DISCIPLINED STEP AT A TIME” WITH MS. UGNĖ BURACIENE

~ Ms. Ugnė Buraciene, Group CEO of payabl.

As fintech continues to redefine how money moves, payabl. positions itself as the intuitive control layer for financial operations — empowering businesses to observe, follow, and direct every part of their financial ecosystem.

Founded in 2011, the European fintech innovator payabl. began with a clear mission: to help merchants take control of their money flow. Today, that mission defines a new era of financial infrastructure — one built on expertise, transparency, reliability, and control.

With Ugnė Buracienė leading as the Group CEO, payabl. is seeking to reimagine how businesses manage, move, and master their money flow.

In a world where many businesses prioritise growth at any cost, payabl. focuses on building robust systems that deliver stability, compliance, and long-term value. What sets payabl. apart is its commitment to clarity before speed. Its licensed infrastructure, combined with in-house product development, gives merchants the confidence that every transaction — whether in euros, dollars, or pounds — moves securely and efficiently.

This approach aligns closely with the perspective of Ugnė, who has publicly spoken about the importance of building operational efficiency and embedding finance infrastructure — not merely chasing the flashiest trends, but to make fintech sustainable and serviceable in the

long term. Ugnė also uses public platforms to engage with industry challenges. In her recent interviews, she has emphasised the balance between regulatory, security, and ecosystem collaboration as one of the central tasks for payment providers.

Payabl.one: A unified platform with global reach

From online payments and in-store transactions to multi-currency business accounts and card issuing, payabl. provides a unified ecosystem that supports businesses at every stage of growth. Through its flagship platform, payabl.one, companies can accept payments, manage funds, issue cards, and track settlements in real time — all within a single connected view.

In addition to the payabl.one platform, payabl. operates from several key cities including London, Amsterdam, Frankfurt, Limassol, and Vilnius, bridging the gap between local expertise and international reach. The company’s clients span sectors including retail, tech, travel, financial services and digital commerce — industries that demand precision, scalability, and resilience.

Under Ugnė’s leadership, payabl. has accelerated its growth trajectory, expanding its footprint across Europe, securing multiple EMI and regulatory licenses (including the UK), and investing heavily in technological and operational infrastructure.

In everything she leads, Ugnė Buracienė brings the same conviction: that clarity, purpose, and perseverance are the real foundations of progress — in fintech, in leadership, and in life. Her leadership reflects a rare balance of discipline and empathy — qualities that also define her personal pursuits. Earlier this year, she and 15 colleagues at payabl. signed up for Ironman 70.3 Hawaii, a challenge that embodies her belief in endurance, resilience, and teamwork.

Ugnė’s vision is rooted in consistency: to build fintech infrastructure that not only scales, but endures. She sees payabl. not just as a payments company, but as a technology control layer — one that simplifies complexity for businesses by unifying acquiring, accounts, and card issuing. Her guiding principle: technology must serve clarity, not obfuscation.

She believes that a balance of innovation and integrity

will define the next decade of fintech. And it’s a balance that continues to guide both her leadership and payabl.’s evolution — one deliberate, disciplined step at a time.

Over nearly two decades, Ugnė has charted a career across banking, payments, and financial technology — from software and gateway platforms through to full-stack fintech. Her path illustrates not only technical mastery, but also the ability to navigate regulatory, operational, and cross-border complexity with subtlety.

Ugnė plays an active role in advancing the fintech and technology sectors across Europe. She currently serves on the Board of Directors of the CYENS Centre of Excellence — Cyprus’ leading research and innovation hub for interactive media, smart systems, and emerging technologies — where she helps strengthen collaboration between research, industry, and society. She also sits on the Board of TechIsland, a non-profit organisation promoting Cyprus as a thriving technology and innovation hub.

A passionate advocate for diversity and inclusion, Ugnė is the Cyprus Country Ambassador for the European Women Payments Network (EWPN) and a Money20/20 Europe RiseUp mentor, supporting the next generation of female leaders in fintech.

In short, Ugnė Buracienė is a leader who blends technical depth, strategic restraint, and mission-driven growth. Her journey speaks not of short-term flair, but of deliberate building — the kind that generates strength, stability, and sustained impact.

Women’s Tabloid had the opportunity to dive deeper into Ugnė’s professional journey, leadership, payabl.’s mission, and her insights about the fintech sector in the UK and beyond in an exclusive interview

Technology is reshaping every industry, including payments. You have worked in this sector for more than 15 years, which technological shifts do you believe will define the next phase of growth in payments?

Technology has always been at the heart of transformation in payments, but what’s changing now is the pace and depth of that evolution. Over the next phase, I believe growth will be defined by three interconnected shifts: embedded finance, data intelligence, and infrastructure resilience.

We’re seeing financial services move closer to where value

is created — embedded directly into digital ecosystems, from e-commerce platforms to logistics networks. This is blurring the boundaries between payments, banking, and software, and driving demand for unified platforms like payabl.one, where everything connects seamlessly.

At the same time, data is becoming a true strategic asset. The ability to interpret payment flows in real time — to detect risks, optimise conversion, or automate reconciliation — will separate leaders from laggards. Finally, as volumes and regulation increase, infrastructure resilience will matter more than speed. Fintechs that can deliver stability and compliance without sacrificing agility will lead the next chapter.

In short, the future of payments isn’t about replacing banks or card networks. It’s about creating intelligent, reliable systems that let businesses move money with clarity,

control, and confidence — anywhere in the world.

As a recognised leader in the payments industry, advising and championing new ideas, what is one fundamental insight about achieving success in fintech that you believe is often overlooked?

One thing I’ve learned over the years — and it’s something many people in fintech overlook — is that success isn’t just about innovation or speed; it’s about endurance. Building a sustainable company is not a sprint. It’s a long, demanding race that requires discipline, focus, and the ability to stay composed under pressure.

At payabl., this mindset has become part of our culture. Earlier this year, 15 of us — myself included — committed to competing in Ironman 70.3 Hawaii. It’s more than a sporting challenge; it’s a reflection of how we lead, grow, and persevere as a company. The Ironman teaches you that success comes from thousands of small, deliberate steps — not quick wins. You train consistently, push through fatigue, and trust the process. That same mindset applies to building a business.

Fintech is one of the most complex and highly regulated industries in the world. The companies that thrive are not the ones chasing every new trend, but those that combine ambition with structure, innovation with accountability, and vision with resilience.

That’s how we operate at payabl.: with focus, patience, and shared purpose. Because, in both Ironman and business, lasting success is built on endurance — not speed.

In today’s financial sector, market dynamics and technology are evolving at remarkable speed. How do you ensure payabl.’s vision remains clear and focused amid such shifts?

In a fast-moving industry like ours, clarity of vision is everything. Over the past year, we’ve gone through a complete brand and strategic revamp — not as a cosmetic

Technology should make life easier, not more complicated. Our role at payabl. is to simplify the complex — to give businesses the tools and visibility they need to move confidently through a fast-changing financial world.

exercise, but as a way to sharpen who we are, what we stand for, and where we’re going. Our purpose is simple yet powerful: to help businesses take control of their money flow. That’s the anchor we return to, no matter how much the market changes.

We operate in an environment where technology, regulation, and customer expectations evolve daily. The only way to stay focused is to build from first principles — expertise, transparency, reliability, and control. These are not just words on a wall; they guide every product we design and every decision we make.

Our new unified platform, payabl.one, embodies that vision. It brings together acquiring, business accounts, and card issuing into one connected view — giving businesses real-time visibility and control over their operations.

So even as we evolve, the direction remains constant: we don’t chase complexity; we simplify it. We don’t react to noise; we focus on what creates lasting value. That’s how we ensure payabl.’s vision remains both steady and relevant in a changing world.

“

Ugne is a powerhouse. A brilliant executive with a no non-sense, down to earth approach that always gets results.

- Martynas Bieliauskas, Founder and CEO of Bivial AG

Your leadership team reflects gender balance. From your experience, what is one strategic action business leaders can take to cultivate inclusive teams that deliver stronger outcomes?

For me, inclusion starts with intentionality — it doesn’t happen by chance. Building gender-balanced teams requires leaders to make diversity a strategic priority, not a side initiative. It’s about designing systems that enable equal opportunity at every level, from hiring to leadership development.

At payabl., we’ve been very deliberate about this. Today, women make up half of our leadership team, and that balance didn’t happen overnight. It came from actively challenging biases in recruitment, ensuring fair evaluation processes, and creating an environment where different voices are not only heard but influential.

But inclusion goes beyond numbers. It’s also about culture — how you lead, communicate, and make decisions. Diverse teams perform better not because they look different, but because they think differently. They question assumptions, approach problems from multiple perspectives, and build more resilient solutions.

As leaders, we must set that tone. Inclusion starts at the top, with how we show up, who we empower, and how we measure success. When you build a culture that values diversity of thought, you unlock creativity, accountability, and stronger outcomes. That’s what drives both performance and progress — in business and beyond.

Scaling the payabl. team from 30 to over 300, what approaches did you take to maintain a high-performing and motivated workforce?

Scaling from 30 to over 300 people in just a few years is one of the most rewarding and challenging parts of leadership. For me, the key has been to grow with purpose — ensuring that every stage of expansion strengthens, rather than dilutes, our culture and performance.

At payabl., we focused first on clarity. Everyone, no matter their role or location, needs to understand why we exist and what we’re building. Our vision — helping businesses take control of their money flow — anchors everything we do. That shared sense of purpose unites teams across borders and functions.

The second priority was empowerment. I believe high performance comes from trust and accountability. We hire exceptional people, set clear goals, and give them ownership to deliver. Micromanagement has no place in a scaling company.

Finally, culture cannot be left to chance. We’ve invested heavily in communication, leadership training, and recog nition. We celebrate wins, learn from challenges, and make sure people see their impact on our collective success.

When you grow fast, structure and spirit must evolve together. Our progress so far proves that with the right values, communication, and trust, scale doesn’t weaken culture — it amplifies it.

In a fast-growing fintech like payabl., how ensure that growth is both sustainable and with your strategic vision?

Sustainable growth doesn’t happen by accident — it’s the result of discipline, clear priorities, and a strong sense of purpose. At payabl., we’ve always believed that growth should strengthen the organisation, not stretch it. That means expanding in a way that’s controlled, compliant, and aligned with our long-term strategy.

From the start, we built our foundation on three pillars: robust governance, scalable infrastructure, and a culture of accountability. Every new product, market, or partnership must reinforce these pillars. We don’t grow for the sake of size — we grow to create value for our merchants,

employees, and partners.

Our strategy is guided by a simple principle: clarity before speed. We take the time to understand market dynamics, anticipate regulatory shifts, and ensure that our systems, people, and processes are ready to support the next level of scale.

At the same time, we stay adaptable. The payments landscape evolves rapidly, and agility is essential. The goal is to move fast — but always on solid ground.

In short, sustainable growth means expanding with intention, not impulse. It’s about building an organisation that can endure and perform — not just this quarter, but for decades to come.

In a fast-changing payments industry, how do you ensure that the updates to payabl.one keep the platform and its merchants ahead of the curve?

money flow, compliance, or reconciliation. That feedback loop ensures we’re not just adding features, but solving problems that matter.

We also invest heavily in in-house development. Having full control over our technology allows us to innovate faster while maintaining stability and compliance. Whether it’s integrating new payment methods, enhancing data visibility, or refining fraud controls, every update to payabl. one is built to give businesses more clarity, control, and confidence.

Finally, innovation at payabl. isn’t about chasing trends — it’s about anticipating what’s next. We stay close to regulators, networks, and industry partners to ensure our merchants are always prepared for what’s coming, not just what’s current.

That’s how we keep payabl.one evolving — not through noise, but through meaningful, lasting progress.

What guidance would you share with aspiring CEOs on navigating challenges and building a successful career in business?

The best advice I can offer is to embrace challenges as part of growth. Leadership is not about avoiding difficulty — it’s about learning to stay composed, make decisions

with clarity, and keep moving forward even when the path isn’t easy.

Every stage of my career has taught me something about balance: between confidence and humility, ambition and patience, structure and flexibility. You can’t control every circumstance, but you can control your response — and that’s where real leadership begins.

For aspiring CEOs, I’d also say: build your foundation early. Understand your business deeply — not just the vision, but the numbers, the people, and the operations. Success in leadership is 90% preparation and 10% reaction.

And finally, take care of your energy. I’ve learned through my own experiences — including training for Ironman 70.3 — that endurance, discipline, and mental strength are essential both in sport and in leadership. It’s not about being the fastest; it’s about staying focused and resilient for the long run.

A great leader doesn’t just deliver results — they build something that lasts. That’s the mindset that turns challenges into opportunities, and ambition into lasting impact. ■

Asia–Pacific contributed around 70% of global economic growth in 2023, with Micro, Small and Medium Enterprises (MSMEs) forming a core pillar of the region’s growth agenda. As economies across Asia prioritise innovation, localisation, and regional integration, MSMEs have assumed a central role in longterm development strategies. Consequently, investment from both public and private sectors in MSMEs is expanding, reflecting their essential contribution to sustainable economic growth.

Investing in MSMEs could add significantly to the continent’s overall economy MSMEs are a significant driver of economic activity across Asia. MSMEs contribute an average of 38% to national

economic output, though the figure varies depending on each country’s level of development and business formalisation. In Malaysia, MSMEs employ around 48% of the workforce, compared to 70% in Singapore. Across ASEAN as a whole, they account for 97% of private-sector enterprises, provide jobs for 85% of the labour force, generate around 45% of regional GDP and contribute between 15 and 20% of total exports. Despite their scale and impact, access to finance remains one of the sector’s biggest constraints. A study by the McKinsey Global Institute, covering 16 advanced and emerging economies, estimates that improving MSME productivity and closing financing gaps could add the equivalent of 5% to GDP in advanced economies and 10% in emerging markets.

inclusion

The World Bank estimates that around 600 million new jobs will be needed by 2030 to absorb the expanding global workforce, with small and medium-sized enterprises expected to create seven in every ten of these roles. Across Asia, this places MSME development at the centre of economic and employment planning. Beyond macroeconomic growth, the growth of MSMEs supports poverty reduction, improves access to livelihoods and drives economic empowerment at the local level. Their role is also integral to advancing the UN Sustainable Development Goals, particularly in areas of equality, inclusion, and sustainability. As key employers of women and marginalised communities, MSMEs help build resilience and drive more inclusive social progress.

MSMEs as high-growth investments

Many of today’s most valuable corporations began as small enterprises, a reminder of the long-term potential that early-stage businesses can hold. Across Asia, MSMEs are attracting increasing attention from both local and international investors because of their scalability, adaptability and capacity for innovation. Based on reports for 2024, the Asia-Pacific private equity market experienced a cautious recovery. The Bain & Company Asia-Pacific Private Equity Report 2025 noted that deal value in the region rose by 11%, while EY’s India-focused reports noted that investments of around $56 billion were recorded in India alone, with analysts highlighting growing interest in tech-enabled and sustainability-focused MSMEs across the region.

The International Finance Corporation (IFC) estimates the global finance gap for formal small and medium-sized enterprises at around $5.7 trillion, rising above $8 trillion when informal businesses are included. According to ADB, MSMEs received only 17.7% of total bank lending across Asia in 2023, equivalent to an average of 10% of regional GDP. Lending frameworks also tend to favour larger firms, leaving smaller enterprises underserved. Several structural issues contribute to this shortfall. These include:

• Limited collateral,

• Restrictive lending conditions, and

• Low financial literacy among smaller business owners

In addition to financing challenges, MSMEs face a pronounced productivity gap: in emerging Asian economies,

productivity typically stands at about 25–30% of that of large firms, constraining competitiveness and growth potential.

Key strategies to strengthen MSMEs

Access to finance

Access to funding remains the biggest challenge for small businesses in Asia. ADB and Mastercard (2024) estimate that the Asia-Pacific region accounts for nearly $2.5 trillion of the global MSME financing gap, with 43% of formal SMEs still unserved or underserved. Expanding credit availability through government-backed lending, digital credit channels, and tailored financial instruments remains essential to bridge this gap.

Private capital continues to play a crucial role in scaling MSMEs, particularly in Asia’s emerging markets where access to traditional bank lending remains limited. IFC (2025) highlights the importance of greater participation from private investors and impact funds to help close the global SME finance gap. In Asia, blended-finance models are gaining traction, combining concessional funding with private equity to expand credit for women-led and green enterprises. Regional investment platforms such as ADB Ventures and the Mastercard–ADB partnership are mobilising capital for early-stage and growth-stage businesses in sectors including clean energy, agritech and digital services.

Bringing informal enterprises into the formal economy remains a key development priority. The International Labour Organization’s Asia-Pacific Labour Market Report 2025 shows that the informal sector still represents around 68% of total employment in South and Southeast Asia. Greater formalisation would enhance access to finance, improve regulatory visibility, and strengthen protections for workers and entrepreneurs alike.

Digital adoption is increasingly linked to MSME growth across Asia. A 2024 survey in India found that 73% of small businesses in semi-urban and rural areas reported higher revenues after adopting tools such as mobile payments and online marketplaces. In Southeast Asia, nearly 90% of digital SMEs said they had expanded their sales and market reach through digitisation, reflecting the strong link between technology use and business performance.

The ADB and OECD highlight high-potential sectors for MSME-led growth including agritech, green manufacturing, logistics, and digital services. Targeting these areas through supportive policy, innovation hubs and blended finance could generate significant employment while advancing regional sustainability goals.

Investment in Asia’s MSME ecosystem continues to expand, supported by the region’s growing role in global supply chains and rapid digital transformation. Private equity buyout investments across Asia reached around $138 billion in 2024, rising by just over 8% from the previous year. Venture capital activity also remained strong driven by investor interest in technology, agritech and clean-energy enterprises.

Cross-border partnerships are also playing a larger role in MSME financing, as investors increasingly collaborate to facilitate technology transfer, innovation, and business expansion. Meanwhile, multinational corporations are increasing investment in local MSME supply chains to strengthen regional resilience and sustainability performance.

Across Asia, MSMEs have continued to expand and formalise, supported by targeted policy measures and regional partnerships. In Indonesia, the sector now contributes around 61% of GDP and employs 97% of the workforce. In Vietnam, SMEs make up over 95% of all registered enterprises, contributing more than 40% of GDP and employing around half of the national workforce. India’s MSME ecosystem has also advanced through large-scale digitisation, with over 60 million businesses now registered on the Udyam portal and the Udyam Assist Platform. Together, these enterprises contribute around 30% of India’s GDP and play a vital role in employment generation and exports.

In 2024, ADB and the Mastercard Impact Fund signed an MoU to support MSMEs across APAC, initially targeting Malaysia, Indonesia, Thailand, India, the Philippines, Vietnam, and Georgia. The initiative includes a $5 million grant to catalyse lending, particularly for women-led enterprises and climate-focused businesses, and will support up to $1 billion in ADB financing over four years through risk-reduction capital, incentives, and capacity building.

Small

businesses are the backbone of our economy, and their success is our success.

- Richard Branson

Across Asia, governments and development institutions are rolling out targeted initiatives to strengthen MSME growth and resilience. Some of the key national and regional programmes supporting MSMEs through credit, incubation, and digital transformation are listed below:

The national initiative in Singapore led by the Infocomm Media Development Authority (IMDA) to help SMEs adopt digital tools and build their capabilities. The program has assisted over 95,000 SMEs by providing grants, advisory services and access to pre-approved digital solutions to boost efficiency and market reach.

Thailand – SME Soft Loan Schemes

The Thai government continues to expand financial support for small businesses, including a THB 50 billion national SME loan initiative and a dedicated THB 15 billion scheme for southern-border provinces to help sustain operations and employment.

Philippines – Kapatid Mentor ME (KMME) Programme

This long-running initiative in the Philippines provides business coaching, mentorship and learning modules for MSMEs. It is a public-private partnership between the Department of Trade and Industry (DTI) and the Philippine Center for Entrepreneurship (PCE) or Go Negosyo. Since its launch in 2016, the program has mentored thousands of entrepreneurs nationwide.

Indonesia – PROMISE II Impact Programme

Focused on circular economy, climate innovation, and inclusive growth, this programme supports impact-driven MSMEs and encourages private-sector collaboration for sustainable scaling.

Sri Lanka – Small and Medium-sized Enterprises Line of Credit (SMELoC) Project

ADB continues to support Sri Lanka’s SME sector through

the Small and Medium-sized Enterprises Line of Credit (SMELoC) programme. The programme aims to enhance access to affordable finance for small businesses via local partner banks. The initiative prioritises underserved segments such as women-led and climate-focused enterprises. Backed by the Women Entrepreneurs Finance Initiative (We-Fi), the programme has expanded over multiple phases, including additional funding during the COVID19 period to provide working capital support and stabilise affected MSMEs.

The AIM ASEAN programme is a two-year initiative led by the ASEAN Foundation in partnership with AVPN through the AI Opportunity Fund: Asia-Pacific (Phase 2), supported by ADB and Google.org. The programme aims to train 100,000 MSMEs across all ten ASEAN Member States by providing hands-on, practical guidance

on how to use AI tools to improve business operations, increase online sales, and manage finances more effectively. Training materials are being developed and adapted with local partners to reflect the real-world challenges and goals of business owners, helping MSMEs harness AI for tangible day-to-day benefits. ■

editorial@womenstabloid.com

In recent years, circular business models have gained steady momentum among MSMEs as companies shift from the traditional “take–make–dispose” approach to practices centred on re-use, refurbishment, recycling, and sharing. By doing so, MSMEs can not only reduce their environmental footprint but also open new opportunities for cost savings, innovation, and long-term competitiveness.

For small enterprises, this shift is not simply about environmental responsibility but also about long-term economic resilience. By adopting circular practices, MSMEs can lower their dependence on volatile raw material markets, reduce costs and tap into new streams of revenue through repair, refurbishment and resale.

Globally, progress towards circularity has slowed. The Circularity Gap Report 2025 shows that only 6.9% of the world economy operates on circular principles, down from 7.2% two years earlier. Despite growing awareness, most industries still follow a linear model of production and consumption, resulting in material overuse and waste. Yet, the potential benefits remain vast. A recent PwC study estimates that full adoption of circular practices across Asia–Pacific could add $339.6 billion to regional GDP

and create up to 15 million new jobs.

At the same time, international development institutions are recognising the value of circularity in small business ecosystems. Programmes led by ADB and regional partners increasingly prioritise projects that embed environmental sustainability, climate resilience, and resource efficiency within MSME financing frameworks. Impact investors are also stepping in, offering blended-finance models that combine public funding with private capital to make circular transformation more accessible to small firms.

The path towards circularity remains complex. For many MSMEs, the main challenges lie not in intent but in capacity, from the cost of adopting new technologies to the absence of clear policy support. In many developing Asian economies, limited recycling and waste-management infrastructure continues to hinder progress.

Looking ahead, the circular economy is forecast to generate up to $4.5 trillion in global economic benefits by 2030, while cutting carbon emissions and easing pressure on natural resources. For Asia’s MSMEs, the transition presents both challenge and opportunity.

In 1792, twenty-four stockbrokers and merchants gathered beneath a buttonwood tree in lower Manhattan to sign an agreement that shaped modern finance, laying the foundation for what we now know as the New York Stock Exchange (NYSE).

More than a century later, during the Second World War, labour shortages opened the doors of the Exchange to women for the first time, as they began working as pages and reporters on the trading floor. What began as a wartime necessity became the first step towards women’s long-term inclusion in Wall Street’s financial ecosystem. In the decades that followed, their presence, once rare, grew steadily and marked a significant cultural shift in global finance.

• Muriel “Mackie” Siebert, the first woman to purchase a seat on the New York Stock Exchange. Her firm became the nation’s first discount brokerage and by 1977 she became the first female superintendent of banks for the state of New York.

• Alice Jarcho made history in 1976 by becoming the first full-time female floor broker at the New York Stock Exchange (NYSE).

• Gail Pankey became the first Black woman to become a member of the New York Stock Exchange in 1985.

A few other notable women:

Victoria Woodhull

Victoria Woodhull became the first woman to operate a brokerage firm on Wall Street, establishing Woodhull, Claflin & Co. in 1870 alongside her sister, Tennessee Claflin. In addition to her financial ventures, she co-founded Woodhull & Claflin’s Weekly, a radical publication advocating social reform. In 1872, she made political history as the first woman to stand as a candidate for presidency of the United States, decades before women had the right to vote.

Often called the “Witch of Wall Street,” built one of the largest personal fortunes of her era through shrewd, conservative investment in railways, real estate, and government bonds. Eschewing speculation, she prioritised long-term value and liquidity, a strategy that saw her estate reach an estimated equivalent of $2–4 billion today. Her disciplined approach made her one of the earliest examples of sustainable wealth-building on Wall Street.

Isabel Benham

In 1934, Isabel Benham became the first woman to work as a railroad analyst on Wall Street. She later became the first female partner at a Wall Street bond house, marking a key advancement for women in investment research.

Mary Roebling

In 1937, Mary Roebling was appointed president of Trenton Trust Company, becoming the first woman to lead a major American commercial bank. She later founded Women’s Bank N.A. in Denver, the first bank in the United States to be chartered by women. Between 1958 and 1962, Roebling also served as the first female governor of the American Stock Exchange, further consolidating her role as a pioneer in finance and governance.

Women of Wall Street today Women are taking on increasingly prominent leadership roles across Wall Street, with 2025 marking a record number of female executives in top positions at major financial institutions. The number of women CEOs in the Fortune 500 has reached an all-time high of 55, representing 11% of all companies, up from 10.4 % in 2024. This steady rise signals a broader shift in senior representation within global finance, as inclusion, transparency, and leadership diversity continue to reshape corporate culture.

By 2030, women are projected to control approximately 38% of total U.S. financial assets, estimated at around $34 trillion. On Wall Street, female leaders now oversee global banks, manage multi-trillion-dollar portfolios, lead high-profile mergers and acquisitions, and shape the strategic direction of capital markets.

This growing influence signals a long-term transformation in financial leadership, with women playing a central role in the future of Wall Street. Here are seven women who exemplify this shift, each leading major institutions and

shaping the future of finance on Wall Street.

• Jane Fraser made history in 2021 when she became the first woman to lead a major U.S. bank, taking over as CEO of Citigroup. Under her leadership, Citi reported revenues of $81.1 billion in 2024, its strongest performance since 2010, and net income of $12.7 billion, a 37% year-on-year increase. Her strategic restructuring, which included streamlining operations and exiting several international consumer markets, has positioned Citi for long-term growth. In recognition of her leadership and performance, Fraser’s total compensation for 2024 rose to $34.5 million.

• Sallie Krawcheck is the co-founder of Ellevest, a digital investment platform founded in 2014 and launched publicly in 2016 to close the gender-investing gap and improve women’s financial inclusion. Under her leadership, Ellevest grew to manage more than $2 billion in assets by early 2024, offering tailored investment and financial-planning services designed around women’s career and income patterns. In December 2024, Krawcheck announced she would step down as CEO,

moving to a board role. Although she no longer serves as CEO, she remains one of the most influential voices in women’s financial empowerment and inclusive wealth management.

• Mary Callahan Erdoes, often referred to as Wall Street’s “$1 Trillion Woman,” has served as CEO of JPMorgan Chase’s Asset & Wealth Management division since 2009. During her tenure, client assets under management have expanded from approximately $1.6 trillion to $6.4 trillion. She joined the firm in 1996 and has played a central role in scaling the division into one of the largest and most respected investment and private banking businesses globally.

• Thasunda Brown Duckett is the President and CEO of TIAA as of October 2025. She was the fourth Black woman in history to lead a Fortune 500 company when appointed in 2021. At the time of her appointment, TIAA managed $1.3 trillion in assets, which has since grown to approximately $1.4 trillion as of December 2024. The company employs around 16,500 people. Duckett remains focused on improving retirement outcomes, with particular emphasis on closing the racial and gender wealth gaps.

• Adena Friedman is the President and CEO of Nasdaq, and the first woman ever to lead a major global stock exchange. Appointed CEO in 2017, she has played a central role in transforming Nasdaq from a traditional equities exchange into a technology-driven global financial platform, focusing on data, analytics, and market infrastructure. Under her leadership, Nasdaq has expanded its footprint in digital assets and ESG data services, reinforcing its position as one of the world’s most innovative financial institutions. Friedman is widely recognised for advocating diversity in leadership and for advancing financial technology to make capital markets more transparent and accessible.

• Anu Aiyengar serves as the Global Head of Mergers & Acquisitions at JPMorgan Chase & Co., where she has advised on more than $1 trillion worth of deals across industries including technology, retail, and financial services. Having joined the firm in 1999, she became the first woman to lead JPMorgan’s global M&A division — one of Wall Street’s most competitive and highstakes environments. Known for her strategic insight and composure in complex negotiations, Aiyengar has helped

shape some of the decade’s most significant transactions. Beyond her professional achievements, she is recognised for her advocacy of diversity and mentorship in finance, supporting initiatives to improve women’s representation in senior dealmaking roles.

• Abigail P. Johnson is the Chair and CEO of Fidelity Investments, one of the world’s largest asset management and financial services firms. She assumed the role of CEO in 2014 and became Chair in 2016, marking the third generation of the Johnson family to lead the company. Under her leadership, Fidelity has strengthened its position as a global investment powerhouse, managing more than $4.5 trillion in assets. Johnson has overseen major initiatives in digital innovation, including the firm’s move into blockchain technology and digital asset management. She is recognised for modernising Fidelity’s culture and expanding its reach among a younger, more diverse generation of investors.

Women’s impact on Wall Street today

Women’s participation in financial leadership has evolved dramatically over the past century, reshaping the face of Wall Street and global finance. What began as a slow integration during the mid-20th century has now become a powerful movement toward balanced representation and inclusive decision-making.

Diverse perspectives drive performance: Research consistently shows that companies with gender-diverse leadership teams perform better financially. Recent global studies indicate that organisations in the top quartile for gender balance at the executive level are around 39% more likely to outperform their peers on profitability. The evidence strengthens the case for balanced representation, proving that diversity in leadership is not only fair but commercially beneficial.

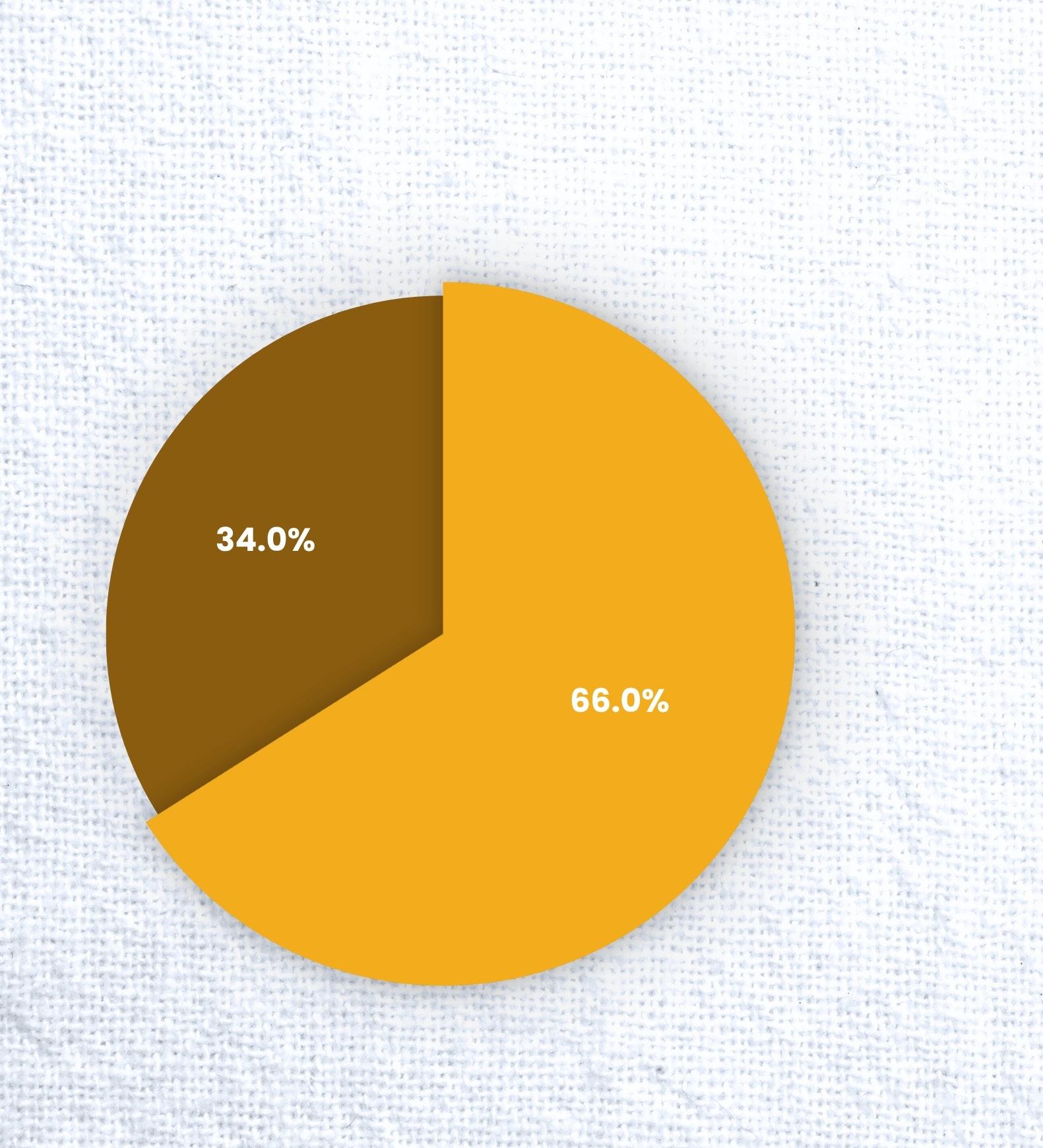

Collaborative leadership: Leadership studies increasingly show that women tend to adopt a more collaborative and inclusive management style, encouraging open communication and stronger team cohesion. Recent data indicates that women now hold around 34% of senior management roles globally, up from just 19% two decades ago. In finance and professional services, their presence in top management has nearly doubled over the past ten years. Organisations that promote gender balance in leadership also report higher levels of employee engagement and innovation, as teams led by women are more likely

to foster trust, transparency, and shared accountability.

Rising ethical standards: Gender diversity at senior level has been closely linked to stronger governance and ethical oversight. Companies with higher female representation on their boards are around 25% more likely to adopt robust environmental, social and governance (ESG) frameworks. Research published in 2024 also found that organisations with at least 30% of women on their boards are significantly more transparent in their sustainability reporting and risk management practices. Across global stock exchanges, women now hold an average of 28% of board seats, compared with just 12% a decade ago, reflecting a growing recognition that ethical and sustainable growth depends on diverse leadership perspectives.

Improved workplace culture: As more women move into senior roles, the culture within financial institutions and corporations is shifting towards greater empathy, collaboration and balance. Organisations with higher female representation in leadership consistently report stronger employee engagement and higher staff retention. Workplaces led by women also tend to adopt more progressive policies, including flexible working arrangements, enhanced parental leave and structured mentorship programmes. These approaches not only improve employee satisfaction but also strengthen long-term loyalty and performance. Across Wall Street and beyond, this growing emphasis on inclusion and wellbeing is redefining what effective leadership looks like in modern finance.

Building future talent: Mentorship continues to play a defining role in shaping the next generation of women leaders on Wall Street. Surveys show that around 70% of women in finance credit mentoring relationships as vital to their career advancement, helping them navigate complex corporate structures and gain visibility in leadership pipelines. Several initiatives across the financial sector are addressing this need more systematically.

The Financial Women’s Association (FWA) runs structured mentoring cohorts pairing senior finance professionals with young entrants through its Wall Street Exchange Programme. Meanwhile, 100 Women in Finance’s LaunchMe initiative connects early-career professionals and students with seasoned mentors, strengthening cross-border learning and access to leadership networks. The Women in Financial Markets (WIFM) Mentorship Programme also provides targeted guidance for women

aspiring to senior roles in investment, trading, and financial management.

Women have made remarkable progress in reshaping Wall Street, transforming an institution once defined by exclusivity into a more inclusive and forward-looking financial landscape. Today, women hold close to half of entry-level positions in finance and roughly 30% of senior leadership roles across major firms. Yet representation continues to taper at the top, with only around 12% of managing directors in private equity and less than 2% of mutual fund assets managed by women.

While these figures reveal that the journey towards parity is still underway, they also highlight steady and measurable progress. Studies consistently show that greater gender balance in leadership is not only a moral imperative but also a commercial advantage, linked to stronger financial performance, greater innovation and higher employee engagement. ■

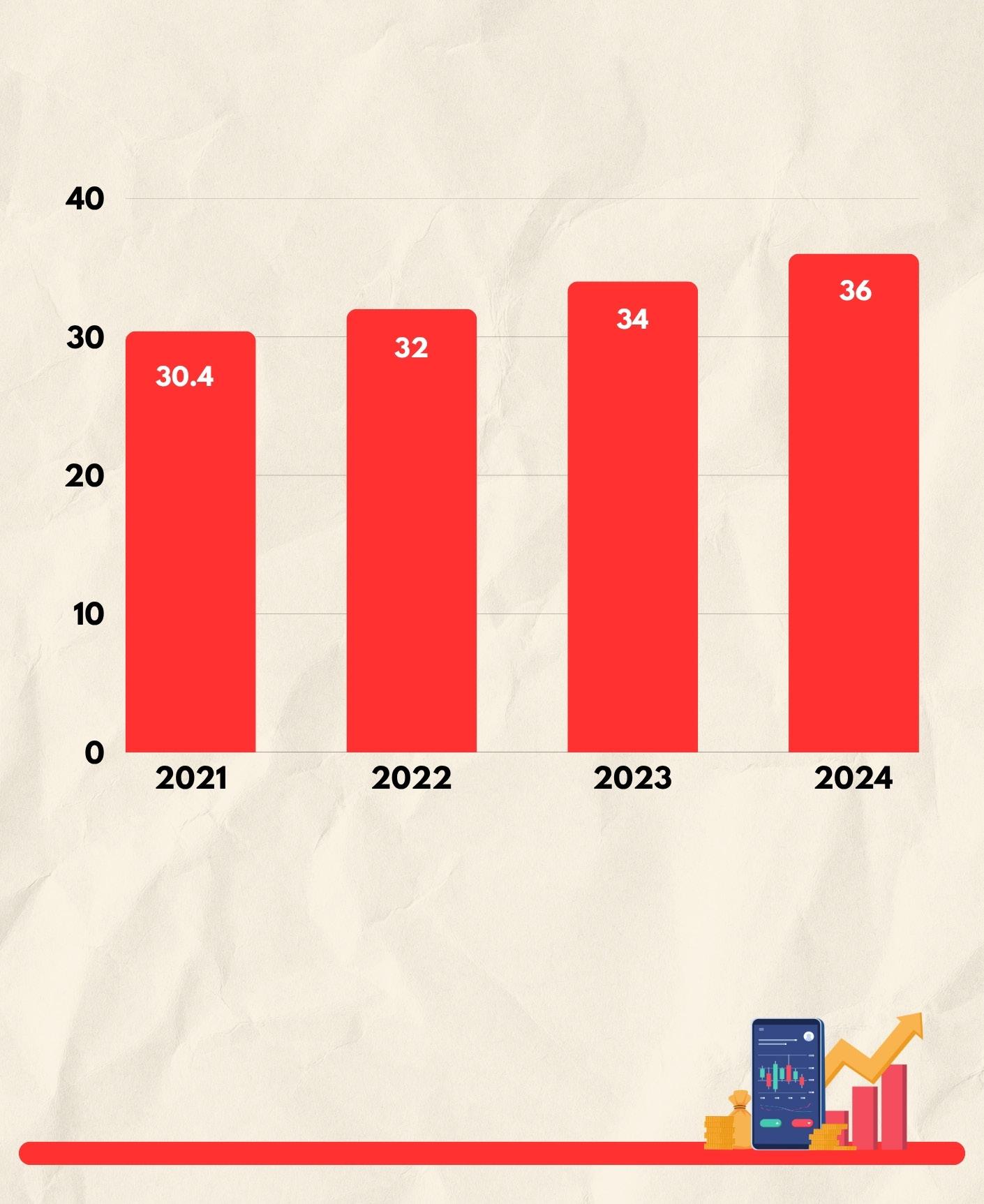

Percentage of board seats held by women in NYSE issuer boards editorial@womenstabloid.com

*Based on analysis of corporate leadership in the top 100 issuers by market capitalisation.

Source: Market Monitor: Gender equality in corporate leadership - G20 & Regional Analysis

Having been in the travel and tourism industry since 1997, Ms. Johanna Makgalemele leads Travel with Flair with experience, commitment and a strong vision. As co-founder, she has transformed the company into a multi-award-winning leader in personalised corporate and leisure travel, recognised for innovation and service excellence, including the prestigious - Most Empowered Business of the Year award. A trailblazer, she became the first African to serve on the Global Tourism Board of the Association of Corporate Travel Executives,

representing the Middle East and Africa. Beyond her business achievements, Makgalemele has contributed to the media as the executive producer of Women on the Move, a television series on SABC 2 showcasing accomplished South African businesswomen and promoting economic empowerment. Deeply committed to philanthropy, she focuses on initiatives that uplift women and advance community development. Through her leadership, public speaking, media projects, and charitable work, she continues to inspire and mentor a new generation of female leaders.

With over three decades in the industry, Travel with Flair has grown to six branches and more than 700 professionals. What strategic decisions or turning points would you credit as most pivotal to the company’s sustained growth and industry leadership?

At the heart of our journey has been a bold vision: to build a travel company that reflects the excellence, innovation, and spirit of Africa. One of our earliest and most impactful decisions was to invest in our people— through our own accredited training academy—because we believed that empowered professionals are the foundation of exceptional service. Embracing technology was another game-changer; we saw it not as a threat, but as an opportunity to enhance human connection and streamline complexity. But most importantly, we led with courage— especially when others hesitated. We built partnerships, expanded across borders, and never lost sight of our purpose: to create meaningful travel experiences that move businesses forward and uplift lives.

In a sector that has faced immense pressure and transformation over recent years, what have been the core principles guiding your leadership and business resilience at Travel with Flair?

Leadership during turbulent times demands heart, humility, and hope. I’ve always led from a place of service—putting people first, listening deeply, and remaining anchored in our values. Even in the face of industry-wide uncertainty, we focused on what we could control: how we treated our teams, how we supported our clients, and how we used change as a catalyst for growth. Our resilience came from our willingness to evolve without losing our soul. We stayed agile, optimistic, and future-focused. And above all, we chose compassion over fear—because I believe that business with heart will always outlast business with ego.

The travel industry is often defined by its responsiveness to change, be it geopolitical shifts, economic pressures, or technological evolution. How does your team stay ahead of trends while maintaining operational excellence?

We have created a culture of “curiosity and courage”— where innovation is not only encouraged but expected. My team understands that excellence is not a destination, it’s a discipline. We consistently scan the horizon, anticipate trends, and stay plugged into global best practices. But what sets us apart is how we translate those insights into human impact. Whether it is through personalised

dashboards, or wellness-led itineraries, every change we implement is designed to make travel more intuitive, empowering, and meaningful. We lead not by following trends, but by shaping them.

How is Travel with Flair redefining value for clients beyond cost-saving, particularly in areas like traveller well-being, risk management, and customised service?

True value is measured not just in rands and cents, but in how a journey makes you feel. We have redefined our offering to reflect the holistic needs of modern travellers—from real-time safety alerts and 24/7 emergency support to curated wellness recommendations and traveller profiling. We understand that behind every booking is a human being—someone’s parent, colleague, or leader— and we never take that responsibility lightly. Our clients trust us not just because we’re efficient, but because we care. And in a world that is constantly shifting, that kind of care is priceless.

What key trends do you believe will shape the future of Africa’s business travel sector, and how is Travel with Flair aligning itself with these changes?

Africa is rising—and so is its travel landscape. We are seeing an exciting shift toward “pan-African mobility”, “digital-first solutions”, and “purpose-driven travel policies”. As intra-Africa trade grows and women entrepreneurs take centre stage, the business travel sector must adapt with inclusivity, sustainability, and innovation at its core. At Travel with Flair, we are aligning with this future by embracing smart tech, mentoring the next generation of industry leaders, and building partnerships that transcend borders. My hope is that African companies won’t just be users of global systems—we’ll be creators of them. And we are committed to making that vision a reality. ■

We lead not by following trends, but by shaping them.

MD, GENERAL COUNSEL & CO-FOUNDER, BILLIE

Aiga Senftleben co-founded Billie in 2016. Billie has since become a leading provider of BNPL (Buy Now, Pay Later) solutions for B2B transactions, offering innovative digital payment services. A qualified lawyer, Senftleben previously led the legal teams at Funding Circle Europe and Zencap, and held senior legal roles at PayPal and eBay. She oversees the legal, compliance, and people departments at Billie, and is known for

championing diversity, equality, and inclusive workplace culture. Her leadership has helped achieve a 46% female representation in management and close the gender pay gap within the company’s 110-strong, multicultural team. She is also a member of the Digital Finance Forum at Germany’s Federal Ministry of Finance, showing commitment to the industry beyond her entrepreneurial venture as well.

Having transitioned from a legal background with experience at companies like PayPal, eBay, Funding Circle, and Zencap, what motivated you to co-found Billie and make such a significant impact in the fintech sector, particularly in the B2B BNPL space?

My experience at PayPal revealed a clear market failure: consumer payments were seamless, while B2B transactions remained archaic. Working in SME lending at Funding Circle further highlighted the critical need for working capital among small businesses, yet the tools were slow and manual. The motivation to co-found Billie was to apply modern fintech principles—automation, realtime data, and a superior user experience—to solve this fundamental B2B challenge. We aimed to build the infrastructure for a digital “Pay by Invoice,” giving businesses the same convenience consumers enjoy. My legal and regulatory background was foundational to building a compliant, robust solution from day one, which is a critical differentiator.

BNPL is transforming how businesses manage cash flow. How is Billie using this model to empower B2B buyers and sellers, and what improvements have you observed in the overall customer experience so far?