1 minute read

Edward Jones

from February 2023

by Star News

chairman were present as was one hired facilitator ($100/hour), two county attorneys, county clerk, finance director, communications director, and administrative specialist: 14 attendees.

Advertisement

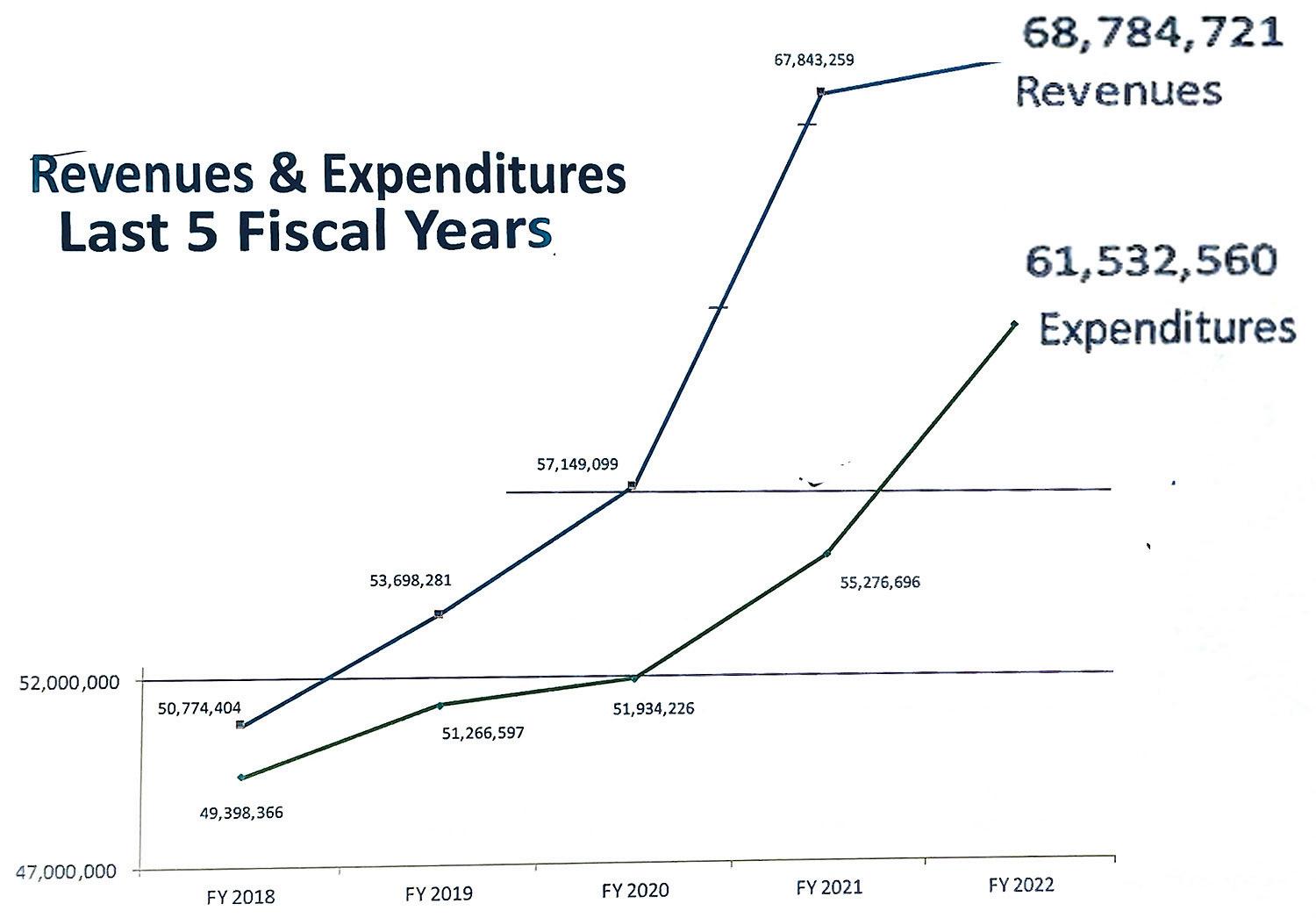

One of the retreat’s numerous meetings was the presentation of the county’s annual audit results Fiscal Year July 1, 2021 - June 30, 2022. Audit was performed by Rushton Certified Public Accountants Clay L. Pilgrim, CPA, CFE, CFF and Julie M. George, CPA. They presented their findings in a series of charts and explanations in two booklets.

The overall financial picture of the county was commented on by CPA Julie George, “Revenues are not only keeping up, they are exceeding expenses. . . this is a positive trend. . . 6.4 months of operating budget on hand.”

District 2 Commissioner Clint Chance asked the accountants what their opinion was on the county having 6.4 months of cash in reserve, was that enough or was it too much? Pilgrim stated that it was a “healthy, but not too healthy” amount. George stated, “I don’t think that’s too much. I’ve seen it as high as, probably, 17 months before. . . six months reserve. . . it’s great to see.”

Rushton’s fees, which was voted on by the board, totaled $102,800 for the Financial Audit and the Single Audit required because of the level of federal funding the county receives.

Bullet points from the 155 page detailed report and accompanying 13 page booklet:

1. Revenues over expenses have been accumulating since 2018; at FY2022 net position was $18,125,143. (See chart this page)

2. Revenue over expenditures for FY2022: $7,252,161 ($7.25M) (See chart this page)

3. Fund Balance (cash reserve/cash on hand) total: $39,508,245 ($39.5M) of which the vast majority (83%) $32,883,295 ($32.8M) is “Unassigned” (not tagged for any particular expense/ not restricted/ not committed) Specifially, the auditors pointed out: “The County’s unassigned fund balance increased $6,521,229 over the prior year.”

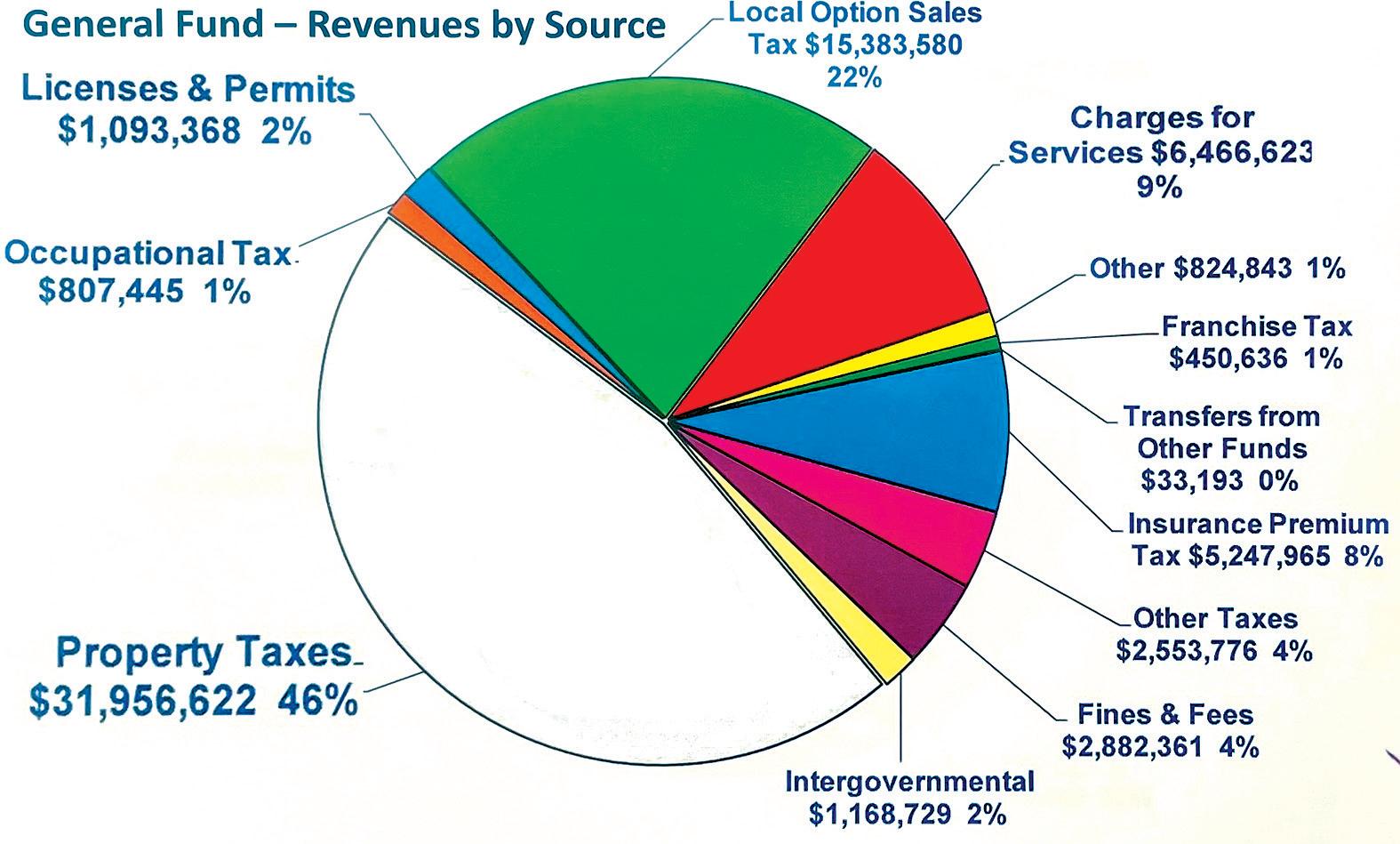

The majority of the General Fund Revenues are from property taxes: 46% for $31,956,622. The Local Option Sales Taxes accounts for 22% of the budget followed by Charges for Services 9%, Insurance Premium Taxes 8%, and other taxes, licenses, permits, fines, etc. (See chart this page.)

The majority of the General Fund Expenditures by Function is Public Safety at 53% for $32,413,440, followed by Public Works 13%, General Government 13%, and Judicial 13%. The remainder expenditures by function were in recreation 5%, housing 2%, debt service 1%, and health and welfare at less than 1%.