22 Custom Cargo Solutions

Aleksejs Busils, NK TEHNOLOĢA, discusses the importance of custom engineering solutions for bulk cargo handlers.

27 Waste Fuels The Future

Ben Beattie, Forbeats, provides an overview of the European dry bulk sector, examines the causes of disruption, and explores how toll processors can help operators overcome challenges.

Building Better Bulk Terminals

Superior Industries outlines how integrated construction management is streamlining terminal development for marine bulk handlers.

Red Tape Or Red Warning

Bob Nelson, Conveyor Belt Specialist, examines the impact of European chemical regulations on the conveyor belt industry and questions whether they represent unnecessary red tape or essential environmental safeguards.

Nicholas Ball, XFuel, explores how recycled carbon fuels can support the dry bulk sector’s decarbonisation journey while maintaining competitiveness.

30 Bridging Regulation And Readiness

Lee Hyungchul, Korean Register, explores how classification societies are expanding their roles to help dry bulk operators navigate the complex demands of emissions control and decarbonisation.

36 Navigating New Regulations

Morten Løvstad, DNV, explains how bulk carriers can navigate regulatory complexity and decarbonisation goals in a rapidly evolving maritime industry.

Dusty Jacobson, Metso, outlines eight critical considerations for optimising cone crusher performance and modernisation in mining and aggregates operations.

David Fotheringham, Kymeta, explores how resilient satellite connectivity is transforming safety, security, and digital operations in the dry bulk shipping industry.

Robert Vennemann, Konecranes, highlights how four-rope mobile harbour cranes are transforming dry bulk handling.

Superior Industries is a leader in the global market for material handling solutions that support dry bulk. A pioneer in the engineering and manufacturing of high capacity mobile conveyors, Superior’s products have earned a strong reputation for mobility and quality. See videos, pictures, and hear from customers at superior-ind.com

Tired of spillage and inefficient unloading?

Siwertell unloaders solve it with market-leading capacity, low energy consumption and minimal product loss, tailored for your needs. Fast, clean, and cost effective from day one

MANAGING EDITOR

James Little james.little@drybulkmagazine.com

SENIOR EDITOR

David Bizley david.bizley@drybulkmagazine.com

ASSISTANT EDITOR

Alfie Lloyd-Perks alfie.lloyd-perks@drybulkmagazine.com

SALES DIRECTOR

Rod Hardy rod.hardy@drybulkmagazine.com

SALES EXECUTIVE

Sophie Birss sophie.birss@drybulkmagazine.com

PRODUCTION MANAGER

Iona Macleod iona.macleod@drybulkmagazine.com

ADMINISTRATION MANAGER

Laura White laura.white@drybulkmagazine.com

HEAD OF EVENTS

Louise Cameron louise.cameron@drybulkmagazine.com

EVENT COORDINATOR

Chloe Lelliott chloe.lelliott@drybulkmagazine.com

DIGITAL EVENTS COORDINATOR

Merili Jurivete merili.jurivete@drybulkmagazine.com

DIGITAL CONTENT COORDINATOR

Kristian Ilasko kristian.ilasko@drybulkmagazine.com

JUNIOR VIDEO ASSISTANT

Amélie Meury-Cashman amelie.meury-cashman@drybulkmagazine.com

Dry bulk operators know a thing or two about complexity. Port bottlenecks, unpredictable weather systems, out-of-the-blue directives from charterers – it’s all part of the job. But as climate regulations tighten, these kinds of everyday operational headaches now carry a very real carbon cost.

With FuelEU Maritime, CII, and the EU ETS now in full swing, emissions efficiency is no longer something you deal with at a once-a-year strategy pow-wow. It’s daily – voyage by voyage, tonne mile by tonne mile. And while there’s rightly a lot of attention right now on future fuels and technical upgrades, there’s one lever that, in my view, remains very much underutilised: how ships are navigated in real time. Not voyages planned in theory but navigated in the moment. Our industry doesn’t lack data. Quite the opposite, we’re drowning in it. Fuel logs, weather reports, AIS tracks, engine metrics, noon reports and so on. But the reality on many bridges is this: data is still reviewed after the fact. A ship may arrive in port but it’s only then you find out it burned more fuel than necessary or spent hours waiting at anchorage. Too late to fix it, too late to reduce the emissions.

That’s where real-time navigation support comes in. The new generation of AI-powered platforms are designed to help crews make smarter decisions during the voyage, ably assisted by colleagues and third-party experts ashore – not just figure out what went wrong after. This matters in dry bulk because so many of emissions inefficiencies are operational: A vessel speeding to port only to idle 36 hours at anchor; A suboptimal route that burns more fuel than necessary; Sudden last-minute weather changes that cause delays, stress on crew and higher engine loads. All these things stack up in emissions, OPEX, and compliance risk. With real-time decision platforms, crews can adapt on the fly. Speed and routing can be optimised in the moment, not guessed days in advance. Arrival times can be adjusted to reduce idle time. And risks – navigational or environmental – can be flagged before they turn into problems This isn’t science fiction. It’s already happening in other segments like cruise, RoRo, and containers but dry bulk is catching up. Three benefits speak for themselves:

n Dynamic routing, not static planning: you don’t just stick to a plan. You respond to what’s unfolding – traffic, congestion, security status, weather – and make smarter port calls.

n Fewer stop-starts = fewer emissions: smooth sailing (literally) is more fuel-efficient. Avoiding unnecessary slowdowns, sharp turns, or last-minute course corrections reduces consumption and strain on the engines.

n Better safety and fewer surprises: enhanced situational awareness helps crews stay ahead of traffic and environmental risks. That means fewer close calls and fewer fuel-wasting manoeuvres.

And perhaps the biggest point: you don’t need a retrofit or a newbuild to start doing this. Most of this is software – layered on top of existing systems, integrated with bridge routines, and built to support rather than replace human judgment. Crews stay in the driving seat, just with hugely better tools – the digital equivalent of a second pair of eyes that never gets tired. Dry bulk is facing enough uncertainty as it is. Decarbonisation doesn’t have to mean reinventing everything. Sometimes, it’s about sailing smarter with the assets you already have, and making sure that every voyage is as efficient, safe, and predictable as possible. Because in a world where every tonne of CO₂ is tracked and taxed, operational discipline isn’t just good practice, it puts you in the front of the race.

Inmarsat Maritime together with distribution partner Station Satcom have secured an order to install NexusWave on a bulk carrier managed by Singapore-based Norse Ship Management as the ship manager looks to meet the growing demands for crew and business connectivity across its fleet.

In line with Norse Ship Management’s digitalisation objectives, NexusWave provides uninterrupted remote access to business-critical applications and real-time engine-monitoring, ensuring seamless data exchange between ship and shore. The fully managed bonded connectivity service offers unlimited data and global coverage, enabling the crew to experience a home-like internet on board, where web-based applications perform as smoothly as they do on land.

Capt. Akshay Yadava, Managing Director, Norse Ship Management, said: “Crew welfare is our top priority, and providing a home-like internet experience onboard is increasingly vital to keeping our crews happy and motivated. With growing traffic demands on the commercial side and the need to ensure consistent, high-speed connectivity, we have selected NexusWave to upgrade our current system. We look forward to a continued successful collaboration with Station Satcom.”

NexusWave’s unique network bonding technology is designed to allow applications to leverage the combined speed and capacity of all available network underlays simultaneously, rather than relying on a single network at a time. This means ship owners and managers benefit from reliable, secure, and high-performance connectivity.

Anshul Khanna, Director Station Satcom Private Limited, said: “We are proud to be entrusted by Norse Ship Management to deliver NexusWave across its fleet. This partnership reflects Station Satcom’s commitment to enabling smarter, safer, and more connected maritime operations. Our integrated deployment approach ensures Norse benefits from a single, robust platform tailored to its evolving digital needs.”

Justin Yi, Regional Director, Inmarsat Maritime, said “Norse Ship Management’s decision to adopt NexusWave

highlights its forward-thinking approach to digitalisation, with a clear commitment to enhancing crew welfare and operational efficiency. We extend our thanks to Station Satcom for its expert support in successfully delivering this deployment.”

Designed to meet the evolving needs of Inmarsat Maritime’s customers, NexusWave will be enhanced with the forthcoming integration of the next-generation ultra-high capacity ViaSat-3 Ka-band network – a move that will further boost speed and capacity. Industry is increasingly turning to autonomous technologies to navigate toward safer, more sustainable operations.

Amid increasing pressure on shipping to achieve the IMO 2050 decarbonisation targets, the Responsible Shipping Initiative (RSI) and DNV have completed a new study: “Decarbonization of the short sea dry bulk fleet”, co-funded by the Swedish Transport Administration. The study finds that while Swedish cargo owners and charterers are committed to greener practices, a lack of regulatory and economic incentives for smaller tonnage is hindering their progress.

Europe’s short sea general cargo fleet is ageing rapidly, with many vessels nearing the end of their operational life and few replacements on order. Most of these ships fall below the 5000 GT compliance threshold for international and EU emissions regulations, which means that shipowners often have little incentive to invest in lower-emission vessels in line with decarbonisation trajectories. As a result, cargo owners who rely on these vessels, including RSI members EFO AB, Lantmännen, SSAB, Stockholm Exergi, and Södra, face a strategic challenge: how to secure future transport capacity that helps them meet their climate goals.

Sebastian Tamm, Chairman of RSI and Manager Logistics Development at EFO, said: “Through RSI, we’ve long promoted responsible shipping, focusing on working conditions, health, and safety. During the COVID lockdown, we shifted our focus to decarbonisation. However, our typical short-term Contracts of

POWTECH TECHNOPHARM

23 - 25 September 2025 Nuremberg, Germany www.powtech-technopharm.com

Antwerp XL 14 - 16 October 2025 Antwerp, Belgium www.antwerpxl.com

TOC Americas

21 - 23 October 2025

Panama City, Panama www.tocevents-americas.com

Global Grain Geneva

11 - 13 November 2025

Geneva, Switzerland www.fastmarkets.com/events/ global-grain-geneva-2025/

GEAPS Exchange 2026 21 - 24 February 2026

Kansas City, USA www.geaps.com/exchange

SOLIDS Dortmund 18 - 19 March, 2026 Dortmund, Germany www.solids-recycling-technik.de

To stay informed about industry events, visit Dry Bulk Magazine’s events page: www.drybulkmagazine.com/events

Affreightment limit shipowners’ ability to invest in radically different vessels. This study highlights the need to turn long-term decarbonisation goals into actionable short-term targets for contracting. This will help with planning, investment, and compliance with new regulations. We appreciate DNV’s insights and support in developing this study with us.”

The project was divided into three work packages (WP). WP1 established emissions baselines for each RSI member using automatic identification system (AIS)-based modelling, due to the lack of primary emissions data. This helped identify key trades for green fleet renewal based on transported volumes and emissions. WP2 examined the costs of introducing green ships and calculated the ‘green premium’ for vessels powered by e-methanol compared to marine gas oil (MGO). Measures such as government support and improved transport efficiency were evaluated to reduce costs and workshops were held with shipowners and fuel providers. WP3 used a fleet renewal model to assess the pace of renewal required to meet climate targets, comparing this with alternative strategies such as biofuel blending and operational efficiency improvements.

Hannes von Knorring, Principal Consultant and Global Cargo Owner Segment Lead at DNV Maritime, said: “A major challenge in adopting low-emission fuels is the uncertainty shipowners face around long term costs and market demands. Cargo owners may also lack insights into fuel options and their impact on supply chain emissions. While the smaller vessels used by RSI members are not yet regulated they must report from this year on emissions to the EU, making it easier for cargo owners to collect data and set actionable targets. Through this project, RSI’s mission is to share knowledge, set standards, and find common ground for future shipping needs, and we are pleased to support their efforts.”

Amrize celebrated the launch of the MV Tamarack, a next-generation carrier with a capacity of over 10 000 m3 of cement.

Equipped with state-of-the-art technology, the vessel will efficiently deliver Amrize building materials to customers, further enhancing the agility and reliability of its leading distribution and logistics network.

“The arrival of the Tamarack is a major milestone for Amrize as we support significant construction growth, including Ontario’s plans to invest more than US$200 billion over the next 10 years to deliver new infrastructure, transit, roads, hospitals, schools, homes, and high-rises,” said Jaime Hill, President, Amrize Building Materials. “This next-generation carrier allows us to cost-effectively deliver critical building materials at speed and scale to help our customers build their ambition.”

Leading the way in maritime innovation and supply chain efficiency, Amrize’s new vessel will play a critical role in supporting economic development and ensuring reliable cement supply supporting infrastructure, commercial, and residential construction. In recent years, Amrize has been a trusted supplier of high-performance building solutions for major Toronto projects, through Innocon, including the Ontario Line – Pape Tunnel and

ust and spillage from conveying coal, grain, iron ore, fertilizers, and other bulk commodities at high-volume ports and terminals create significant operational challenges: environmental compliance, worker health and safety risks, and production slowdowns. Our modular Transfer Point Kits, ApronSeal™ dual-seal skirting, impact cradles, and dust curtains are field-proven to effectively control turbulent material and contain residual airborne particles. This improves workplace conditions and protects conveyor components from fouling and breakdown. By reducing maintenance costs, extending equipment life, and supporting compliance, Martin maximizes your operation's throughput and profitability.

Underground Station in partnership with Infrastructure Ontario and Metrolinx, and the Daniels on Parliament affordable housing project development with The Daniels Corporation.

The partnership with Eureka Shipping strengthens this capacity, as the new 12 500 DWT mechanical and pneumatic MV Tamarack replaces two older ships with a single, streamlined, high-performance vessel. Equipped with diesel-electric propulsion, advanced manoeuvrability systems, shore-power compatibility, noise insulation and energy-saving cargo handling, the Tamarack is designed to maximise operational efficiency while minimising emissions.

Beginning its planned 15-year service, Tamarack – owned by Eureka Shipping, a joint venture between the CSL Group and SMT Shipping – is the first new cement carrier on the Great Lakes in two decades.

“Bringing MV Tamarack to the Great Lakes has been a true team effort,” said Kai Grotterud, Managing Director of Eureka Shipping. “This highly efficient vessel is the result of close collaboration with Amrize, smart design, and a shared vision for advanced shipping. We’re proud to set a new standard for operational performance in the region.”

INDIA GCMD and INTERCARGO partner to advance decarbonisation

Atwo-year coalition partnership to accelerate decarbonisation efforts in the dry bulk segment has been signed by the Global Centre for Maritime Decarbonisation (GCMD) and the International Association of Dry Cargo Shipowners (INTERCARGO). This partnership combines GCMD’s technical insights and experience in executing pilots with INTERCARGO’s member reach and IMO engagement to help close critical adoption and operational gaps.

GCMD and INTERCARGO will collaborate to promote the adoption of energy efficiency technologies (EETs) amongst dry bulk shipowners and facilitate mutual knowledge exchange on advancements in low- and zero-carbon-fuelled dry bulk vessels.

Dry bulk vessels often operate on a ‘tramp’ trade basis with irregular and unpredictable routes, which makes it

challenging for these vessels to plan bunkering at ports that offer zero- or near-zero-emission (ZNZ) fuels. Global bunkering infrastructure also remains in development, with ZNZ fuels unlikely to be available at all ports in the foreseeable future.

Whilst the industry works to scale ZNZ fuel availability and ready ports for their handling and bunkering, there is an urgent need to adopt pragmatic nearer-term solutions, such as drop-in biofuels, onboard carbon capture systems and EETs, to meet the International Maritime Organisation’s (IMO) decarbonisation targets. To address this, GCMD is actively conducting pilots and trials to lower barriers for the broad market adoption of these solutions. With INTERCARGO’s operational expertise and member network, the partnership will help advance the deployment of these solutions across the dry bulk segment.

Shipowners often face challenges in deploying EETs due to fuel savings uncertainty and some face limited access to financing. GCMD is installing sensors onboard vessels to validate fuel savings that will underpin Pay-As-You-Save (PAYS), a financing model that GCMD is developing in parallel to link repayments to verified fuel savings. The collaboration aims to accelerate the uptake of EETs in this segment.

Professor Lynn Loo, CEO of GCMD, said, “This partnership offers a valuable opportunity to deepen our understanding of the dry bulk segment’s operational realities and work collaboratively to address gaps in meeting the industry’s decarbonisation targets. Through INTERCARGO’s consultative status at IMO, we hope to contribute to the development of global regulatory frameworks for maritime decarbonisation.”

Mr Dimitris Monioudis, Technical Committee Chairman of INTERCARGO, said: “As the voice of the world’s largest shipping segment, INTERCARGO is committed to making decarbonisation work for all our members. This partnership helps ensure practical, scalable technologies reach the companies moving most of the world’s essential cargoes. By combining GCMD’s strength in executing first-of-a-kind pilots with our members’ operational expertise and consultative status at the IMO, we can accelerate progress towards the industry’s decarbonisation targets.”

Ship unloaders

Road mobile ship unloaders

Storage & reclaim

Convey units

Truck loading

Ship loaders

Ben Beattie, Forbeats, provides an overview of the European dry bulk sector, examines the causes of disruption, and explores how toll processors can help operators overcome challenges.

he dry bulk sector underpins Europe’s industrial base, powering its energy mix, agricultural supply, and chemical industries. Commodities such as coal, iron ore, grains, fertilizers, and specialty chemicals flow in vast volumes through ports like Rotterdam, Antwerp, and Hamburg, as well as through key Mediterranean hubs. Europe is not only a vital consumption market but also a major global transit corridor for dry bulk shipping.

In recent years, the sector has faced unprecedented turbulence. The Russia-Ukraine war has disrupted Black Sea grain exports and constrained supplies of essential raw materials. Attacks on vessels in the Red Sea have forced cargo to avoid the Suez Canal and reroute around Africa, lengthening transit times and inflating freight costs.

Meanwhile, Brexit has added bureaucracy and customs delays for UK-EU trade, while shifting tariff landscapes continue to complicate flows between major economies. Layered on top of this are tightening environmental regulations that require costly investments in vessels and port infrastructure. As a result of these challenges, bottlenecks have become an inevitable part of doing business.

The dry bulk market is vast, representing roughly half of global seaborne trade by volume. In Europe, demand is driven by a diverse mix of commodities: grain imports to feed populations, iron ore and coal for steelmaking, fertilizers for agriculture, and an increasingly important flow of specialty and commodity chemicals. Despite long-term demand, the market is cyclical and subject to significant volatility.

In fact, the sector faces several structural challenges. Market volatility and fluctuating freight rates often dictate investment decisions, leaving operators vulnerable to sudden downturns. Overcapacity in the global dry bulk fleet has at times depressed freight rates, eroding profitability and leading to underutilised vessels.

Environmental regulations are another major challenge: the International Maritime Organisation (IMO) has introduced carbon intensity targets, while the EU’s Emissions Trading Scheme (ETS) has been covering CO 2 emissions from all large ships (of 5000 t and above) entering EU ports, regardless of the flag they fly, since January 2024. Compliance requires investments in vessel retrofits, alternative fuels, or carbon allowances – an additional cost burden in an already tight-margin industry.

Geopolitical events have had a major impact on European dry bulk trade. The war in Ukraine has reduced exports of grain and fertilizers from the Black Sea, pushing importers to diversify sourcing from other regions, while sanctions on Russia have reshaped flows of coal and oil products into Europe. At the same time, Red Sea disruptions are forcing vessels to take the Cape of Good Hope route, adding weeks to voyages and substantially increasing shipping costs.

Trade policy uncertainty is also weighing on flows. According to BIMCO data, 1.5% of global dry bulk cargoes – equivalent to 2.6% of demand – were already impacted by tariffs imposed by the US and retaliatory tariffs by China in Q1 of 2025. Europe, as a key node in global supply chains, is exposed to these shifting patterns.

In response to these pressures, operators require greater resilience. To achieve this, companies are diversifying sourcing and routes, holding larger inventories, and in some cases nearshoring production. Supply chain visibility, flexibility, and predictability have become paramount.

Yet these strategies often introduce new complexities, requiring greater coordination and adaptability across the sector. For many, bottlenecks – whether at ports, in transport, or within manufacturing – are unavoidable without external support.

Toll processors provide dry bulk manufacturers and operators with an essential buffer against disruption – with facilities already equipped to handle hazardous and non-hazardous materials, toll processors offer a ready-made solution to address bottlenecks.

By outsourcing processing tasks, whether one-off or ongoing, companies can expand capacity without major capital investment. This flexibility enables operators to scale production when demand surges or when alternative supply chains require rapid adaptation.

However, experienced toll processors are not just service providers, they are network builders. Many have developed partner ecosystems that allow them to source elusive or delayed raw materials from surplus stock. By maintaining accurate databases of surplus goods and implementing contingency plans, they help manufacturers keep production lines running. This is especially valuable in Europe, where geopolitical disruptions

have made some chemicals and raw materials scarce or slow to arrive.

Another key advantage of toll processors is their ability to provide full-service outsourcing solutions. Beyond processing, they handle repacking, labelling, warehousing, logistics, and customs clearance. They can also ensure batch traceability and manage import and export paperwork. For manufacturers navigating Brexit-related customs complexities, or shippers contending with Red Sea diversions, this end-to-end approach reduces delays and lowers costs. Essentially, by streamlining multiple processes into a single outsourced solution, toll processors help minimise the inefficiencies that often create bottlenecks.

Safety and regulatory compliance are vital in bulk processing, particularly when handling hazardous materials. Toll processors bring the necessary certifications, such as ISO9001, and maintain COMAH facilities. They follow strict protocols, including detailed risk assessments and the use of material safety data sheets (MSDS), to ensure that processing is conducted safely. For operators, this means outsourcing to a compliant toll processor not only ensures safety but also speeds up approval and oversight processes which, in practice, translates into fewer operational delays, reduced waste, and greater confidence in meeting delivery deadlines. By combining flexibility, networks, end-to-end services, and rigorous safety practices, toll processors alleviate pressure points in the European dry bulk sector. They enable manufacturers and operators to overcome shortages, maintain schedules, and optimise costs in an environment where disruption has become the norm.

One of the most telling examples of toll processing’s value comes from a partnership that Forbeats has had with one of the largest chemical companies in the world since 2009.

The scope of work for the clients is extensive. As the toll processing partner, Forbeats supplies approximately 30 different raw materials, ranging from powders to liquids, some with different hazardous properties, and all with specifications to match. These are sourced from across the globe, with every material specification requiring client approval. Once delivered, the raw materials are securely stored, with annual stock checks ensuring full accountability until instructions are received for manufacturing. This provides a critical buffer in supply chains prone to disruption.

Manufacturing is carried out to the client’s exact formulations, with production orders varying significantly – from small 500 kg batches to industrial-scale runs of more than 200 000 kg.

This variability demands both capacity and agility, qualities that experienced toll processors are uniquely positioned to deliver. Finished products are then packed into specialist printed packaging provided by Forbeats, ensuring consistency and quality branding for end markets.

Distribution is equally complex. While most finished goods are shipped to European markets, consignments also go to the Middle East and Africa. As a toll processor partner, Forbeats provides support for both global transport – covering air and sea freight – and local logistics, demonstrating the value of end-to-end service integration. This global reach allows the client to maintain reliable supply to distant and diverse markets.

The finished products serve the soil and groundwater remediation sector, which is vital to environmental protection and sustainability. This application highlights how toll processing does not just solve logistical bottlenecks but also contributes to the delivery of solutions with tangible societal and environmental benefits. Additionally, Forbeats remains committed to identifying raw material alternatives, introducing production tweaks, and implementing efficiency gains, all while upholding the highest quality standards.

This case study illustrates how a well-established toll processing partnership can provide stability, scalability, and innovation, even in times of global volatility. By handling sourcing, storage, manufacturing, packaging, and logistics, toll processors effectively act as an extension of the client’s own operations. The result is a streamlined, resilient, and responsive supply chain that delivers critical products to Europe, the Middle East, and Africa, while supporting industries essential for sustainability.

The European dry bulk sector sits at the intersection of global trade flows, geopolitical risk, and environmental regulation. Operators face a challenging environment marked by volatility, rising costs, and increasingly complex regulatory requirements. Bottlenecks in ports, logistics, and production are likely to remain a recurring feature of the industry.

With flexible capacity, extensive networks, and comprehensive service offerings, toll processors provide the resilience and agility needed to keep supply chains moving. Their commitment to safety and compliance ensures operations run smoothly, while their ability to scale rapidly gives manufacturers and shippers the confidence to respond to sudden disruptions.

As Europe and the Mediterranean continue to adapt to shifting trade dynamics, toll processors will play a crucial role in supporting operators and maintaining competitiveness. In times of uncertainty, strategic partnerships of this kind are not just helpful, they are essential.

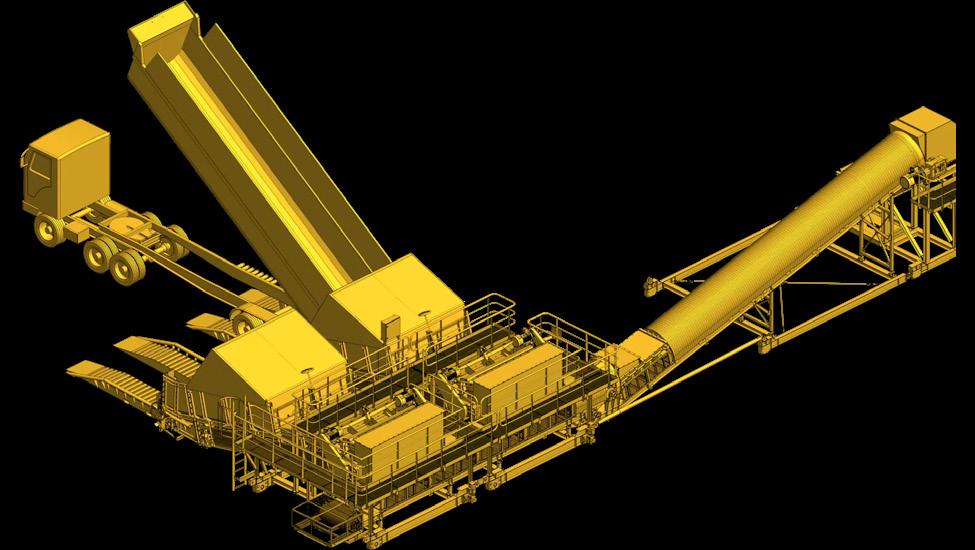

Superior Industries outlines how integrated construction management is streamlining terminal development for marine bulk handlers.

ulk terminals face growing pressure to do more with less: handle more volume, operate with tighter timelines, reduce overhead, minimise downtime, and meet increasingly stringent environmental regulations. For dry bulk handlers pursuing growth, modernisation, or infrastructure upgrades, meeting those demands often means coordinating multiple vendors across design, equipment procurement, and on-site construction, while also ensuring sustainable operations and compliance with environmental standards.

While Superior Industries has long been recognised for its bulk material handling conveyors, the company

also provides integrated construction management services tailored for turnkey material handling infrastructure at deepwater ports. This unified approach helps marine terminals streamline expansion projects, reduce coordination headaches, and accelerate timelines without compromising quality.

“We’re much more than conveyors and ship loaders,” says Scott Gulan, who helps lead Superior’s marine terminal business. “We support everything from engineered systems and structural steel to bulk storage buildings and foundation work.”

Historically, Superior’s work in the marine environment centred around mobile telescopic radial conveyors, key solutions for barge and ship loading. But as the needs of bulk handlers evolved, so did Superior’s capabilities.

Today, Superior’s marine terminal solutions cover much more than telescoping conveyors for ship loading. The portfolio now includes narrow dock solutions, linear travel stacker/loaders, tripper conveyors, hoppers,

transfer conveyors, overland systems, and even custom-engineered equipment built to the exact wishes of each terminal. These systems are designed to maximise material flow in tight spaces and optimise loading efficiency across long travel paths. Every piece of equipment is designed and manufactured in-house, promoting integration and long-term reliability.

“You can’t walk onto a port and assume standard conveyors will do the job,” says Gulan. “We tailor everything – length, width, height, capacities, components, and structures – because each terminal has unique constraints.”

Superior’s Construction Management group offers something few equipment suppliers can match: turnkey execution. That means a single point of contact, one contract, and a fully coordinated team that handles engineering, fabrication, subcontractor management, and on-site installation.

“It’s the same reason owners choose us in other bulk markets,” says Austin Schmidgall, who leads Superior’s Construction Management efforts. “Instead of dealing with a dozen vendors, they work with one. We’re fully licensed, bonded, and insured, and we manage the entire process.”

That process covers every critical phase of terminal development – from early analysis to final commissioning. Superior’s integrated team handles ROI evaluation, engineering and layout design, steel fabrication, machinery selection, freight, installation, and startup. In the field, crews perform excavation, concrete work, mechanical and structural erection, plumbing, electrical controls, and commissioning. Behind the scenes, in-house project managers oversee planning, scheduling, and coordination to keep everything aligned and moving forward.

“And when we can’t self-perform something, like sheet piling or dock inspections, we bring in trusted partners who meet our standards,” says Schmidgall.

One of the most overlooked pain points in terminal development is the disconnect between design and execution. Traditional workflows rely on external engineering firms to design a system, then hand it off to contractors to build. That handoff can be riddled with miscommunications, clashes, or incompatibilities.

In order to eliminate that problem, Superior’s engineers, designers, and construction teams all sit under one roof. Layouts are modelled in-house. Designs are reviewed for feasibility by the same crews who will install them. Changes happen fast and without finger-pointing.

In mining and materials handling, the Hägglunds Quantum Power motor reshapes reality with shared DNA. Adding a slim new connection block to the proven Hägglunds Quantum, it opens up an unthinkable space – stretching to 170 rpm while retaining full torque capacity at high efficiency. Take your operations to a new dimension of productivity with Hägglunds. We drive what drives you.

Hägglunds is a brand of Rexroth. www.hagglunds.com

“You don’t get to the jobsite and realise the equipment doesn’t fit,” says Tom Koehl, a veteran design engineer at Superior. “That risk is gone because our whole team has eyes on the project from day one.”

“This isn’t new territory for us”, says Gulan. “We’ve been managing large-scale construction projects for four decades. Now, we’re just applying that same proven approach to meet the needs of marine terminals.”

As terminal operators learn about Superior’s capabilities in turnkey project management and in-house equipment supply, new partnerships are forming with ports up and down both coasts of North America. This momentum reflects growing confidence in the company's ability to handle complex terminal expansions from concept to commissioning.

Many ports require contractors to be licensed within the state province or region, which can disqualify even capable partners. Superior’s Construction Management group maintains the necessary licenses to operate in key coastal regions and is prepared to secure additional credentials as project needs arise. It is one more way the Superior removes barriers and makes complex terminal projects easier to execute.

Not every terminal project is a multi-acre development. Some involve upgrades or retrofits to ageing equipment. Others require short-term throughput increases using temporary infrastructure. Superior’s model scales up or down depending on the need.

Whether it is a simple ship loader replacement or a full greenfield terminal project, the team approaches it with the same rigour and process.

“We don’t treat smaller projects like after-thoughts,” says Koehl. “If you need a stacker, we’ll design the best stacker for your dock, not just drop-ship whatever’s in the catalogue.”

As global trade volumes grow, marine terminals are under pressure to modernise – quickly, efficiently, and without costly missteps. That is why more operators are rethinking not just how they handle material, but who they trust to build and manage those systems.

Choosing a single-source partner is not just about convenience. It is about speed, accountability, and better results. With engineering, equipment manufacturing, and construction all under one roof, delays are reduced, coordination is seamless, and responsibility is clear.

“We own the outcomes,” says Schmidgall. “If something needs to be adjusted, you’re not waiting on three companies to talk to each other. You’re calling us, and we’re already working on it.”

“We’re not just a vendor,” adds Scott Gulan. “We’re a partner committed to helping terminals run better, grow faster, and build smarter.”

Bob Nelson, Conveyor Belt Specialist, examines the impact of European chemical regulations on the conveyor belt industry and questions whether they represent unnecessary red tape or essential environmental safeguards.

Especially within the past two decades, the EU/EEA has led the world in regulatory controls designed to protect human health and the environment. Primarily aimed at the use of potentially harmful substances within the manufacturing process, there are long-standing regulations such as the registration, evaluation, and authorisation of chemical substances (REACH regulation EC 1907/2006) and EU Regulation No.2019/1021 Persistent Organic Pollutants (POPs).

Such regulations affect conveyor belt manufacturers, importers, traders, and end-users alike. But are they simply another example of ‘red tape interference’ from Brussels,

or do they serve as a warning that needs to be taken much more seriously? To be able to answer that question it is first necessary to understand what the regulations are and what they are designed to achieve.

Reach stands for Registration, Evaluation, and Authorisation of Chemical substances, and was established by the EU with the specific aim to improve the protection of human health and the environment through better and earlier identification of the properties of chemical substances. REACH places direct responsibility on industry to manage the risks from chemicals and to provide safety information. Manufacturers and importers are required by law to gather information on the properties of the chemical substances they use and register the information in a central database in the European Chemicals Agency (ECHA) based in Helsinki.

Nearly all the rubber used for conveyor belts is synthetic, and literally dozens of chemical components – such as anti-degradants, anti-ozonants, and accelerators – are used to make it. These include substances such as OTOS (N-oxydiethylene-2-benzothiazolesulfenamide, CAS 102-77-2). It is an inescapable fact that it is necessary to use some chemicals that are potentially extremely dangerous to humans and the environment.

REACH calls for the progressive substitution of harmful chemicals, which are referred to as ‘substances of very high concern’ (SVHC’s) when suitable alternatives have been identified. Anything to do with science is a process of continual evolution, so since its original introduction, regulation regarding SVHC has become increasingly stringent and demanding. For example, previous compliance was largely based on declaring (registering) the use of listed chemical substances and staying within specific limits applicable to each substance. Now, however, regulations such as Article 31 demand that if a product contains an SVHC in a concentration greater than 0.1% of the total weight of the finished product, the manufacturer is compelled to register its use with the European Chemicals Agency (ECHA) and also provide the customer with a safety datasheet. There is also Article 33 (obligation for supply of information to downstream users when SVHC >0.1%), which is important for importers and essential for compliance.

One of the biggest concerns involves short-chain chlorinated paraffins (SCCPs). These are most commonly used to artificially accelerate the vulcanising process, as well as for plasticising and fire retardancy. REACH regulations clearly stipulate that SCCP’s should either not be used at all or at least only used on a very limited basis (0.15%), because they are listed on the International Agency for Research on Cancer’s (IARC) Carcinogen List as ‘possible carcinogens’. A clue to their presence can be

a strong, pungent aroma, whereas good quality rubber that does not contain SCCPs usually has very little smell at all.

Shortly after the introduction of the REACH regulation, the European Parliament issued another directive in the form of EU Regulation No. 2019/1021 on Persistent Organic Pollutants (POPs). These substances pose a serious risk to human health and the environment because they are bioaccumulative in humans and wildlife, and toxic to aquatic organisms even at low concentrations. For example, in Europe, SCCPs have been forbidden under the POPs regulation since 2019 at levels above a very low threshold of 0.15%.

Regulated worldwide by the Stockholm Convention and the Aarhus Protocol, these international treaties are implemented in the EU by the POPs Regulation through the ECHA. They are designed to prohibit or severely restrict the production, placing on the market, and use of persistent organic pollutants in manufactured products.

In Europe, nearly 95% of used car tyres are recycled, whereas the amount of used conveyor belting being recycled is almost non-existent by comparison. Although there are initiatives to improve the situation, a great deal of used rubber belting still goes to landfill or is being burned, for example, by cement plants. There are many reasons for this disparity. Recycling conveyor belts is an appreciably slower, more complicated, expensive, and logistically difficult process compared to recycling vehicle tyres. There is also much less demand for the polyester and nylon fabric inner plies and certainly no practical use for the metal cables found in steel cord reinforced belts.

The harsh reality is that under foreseeable market circumstances, recycling conveyor belts is not only ecologically problematic, but also not viable. This is why using belts with strictly controlled chemical content and the longest possible working life is more important than ever before.

National authorities are responsible for regulation enforcement through inspections as well as handing out penalties in cases of non-compliance. They exchange information and coordinate activities related to enforcement through the Forum for Exchange of Information on Enforcement. The level of penalty depends upon where the case is heard. In the UK, for example, higher courts such as Crown Courts can impose unlimited fines and/or up to two years’ imprisonment. This is certainly not common knowledge within the conveyor belt industry.

In truth, those with duties under such regulations are usually legal entities rather than individuals. When prosecutions are brought, they are typically against

these legal entities rather than individuals. A fine, albeit a substantial one, may therefore be the only option. Even so, where offences committed by a corporate body are shown to have been committed with the consent of, or are due to the neglect of, a senior person in that organisation, they too may be regarded as being guilty of the offence and may be prosecuted separately.

Aside from the leading brand European conveyor belt manufacturers, most manufacturers have chosen to ignore REACH and POPs requirements. Importers and traders seem even less interested. The primary reason is cost, due to the significant impact on production expenses. Raw materials can account for up to 70% of the cost of producing an industrial conveyor belt. Competition is fierce and largely driven by selling price. As in all markets, unregulated (non-compliant) raw materials cost considerably less than regulated ones, creating a substantial price advantage for those willing to ignore safety regulations.

Manufacturers located outside of EU/EEA are not subject to the regulations. They are therefore free of the responsibility and the consequences of using unregulated raw materials that are prohibited or have strict usage limitations within the European community. Given such an advantage, it is hardly surprising that low-grade, unregulated belting, primarily imported from China, is growing at an unprecedented rate. Meanwhile, importers and end-users of their products are unlikely to be aware of the risks that they are being exposed to because it is virtually impossible to know how much SVHC and POPs these belts contain.

The majority of European conveyor belt manufacturers are also exposing themselves to risk because they are importing at least part of their product range from outside of Europe to allow them to compete at the ‘bargain basement’ end of the market. The only known exception to this practice is Netherlands-based Fenner Dunlop Conveyor Belting, which has a ‘set in stone’ policy of ensuring compliance and high quality standards by making all its own belts, including the rubber.

The use of SVHCs and POPs in the manufacture of rubber conveyor belts is a very real issue that needs to be addressed today. The regulations designed to control their use can no longer be ignored or simply regarded as being ‘red tape’. Both corporately and individually, there is a responsibility and duty of care to colleagues and the environment to take appropriate action. The first step is to stop using cost as an excuse, because good-quality belts made from regulated raw materials have been proven to last considerably longer and are consequently far more cost-effective. It is time to decide.

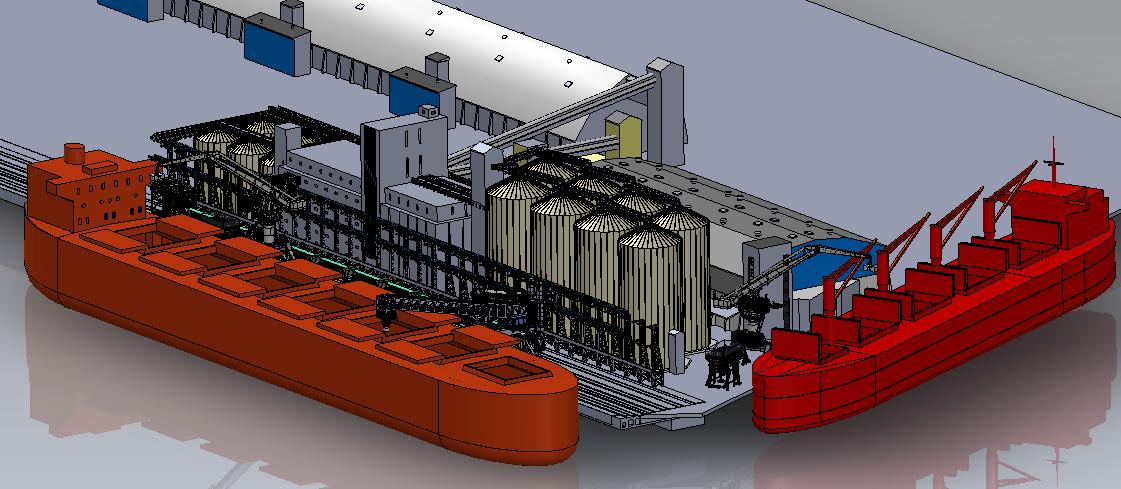

Aleksejs Busils, NK TEHNOLOĢIA, discusses the importance of custom engineering solutions for bulk cargo handlers.

ulk cargo handlers play a critical role in global commerce and transportation, which is why it is of utmost importance to empower port authorities, terminal operators, and maritime stakeholders with cutting-edge solutions that optimise efficiency, enhance safety, and foster sustainable growth and development, through engineering excellence and equipment manufacturing tailored for the dynamic needs of clients in the bulk material transshipment industry.

When it comes to the transshipment business, there is no one right way of doing things, as every client and site is unique. That being said, operators are often attracted to the idea of using standardised procedures, equipment and technologies to streamline their operations and costs, and maintain a predictable and reliable transshipment rate. This option seems like the obvious choice, but cannot always adapt to the needs of individual operators, given limited space, strict zoning laws, legislation and other factors impacting the available infrastructure and future development options. This is a problem – or rather, a challenge – for the engineers.

NK TEHNOLOĢIJA has deep roots in the Baltics and a port heritage. Its attitude with respect to the development of existing infrastructure and cities is that one has to do the best one can with the space and tools at hand to remain efficient and competitive. For over 15 years, the company has put an emphasis on a structured approach to solving these tasks, and analysing every challenge to provide the most appropriate solution.

A few key areas are worth highlighting and exploring – in particular, longevity and sustainability. It is important to have a deep understanding of the ongoing processes at a port and the key indicators for driving down the costs of the transshipped materials and increasing the profit per unit handled, all with long-term growth in mind. For the purposes of the article, these will be separated into two distinct areas – storage, including weighing and dosing (handling), and loading.

One topic that is always relevant is, of course, design engineering. This could be considered the backbone of a strong site infrastructure. NK TEHNOLOĢIJA supplies solutions for integrated and unified bulk handling systems by allocating technological equipment and developing the

capacity of already existing systems. The company provides port terminal analysis, development and modernisation of port terminals, as well as port equipment refurbishment, broadening the scope of operations, integrating new equipment into existing systems, and integrating used equipment into newly developed technological chains – an all-in-one solution to maximise the investment efficiency, by working through the available options at the drawing board, and preparing a solid work plan.

Storage is a topic which always needs to be considered in context. Conventional warehousing solutions can be very efficient, providing the most care and security for the materials handled, whilst also focusing on a lasting solution that is considered as a noteworthy asset. Over the years, NK TEHNOLOĢIJA has provided a range of equipment and design solutions for various storage and transshipment warehouses – broadening the capabilities of some port terminals, and expanding the technological range of possibilities for others. This can be seen through more standardised (but still custom) material feeders, allowing for more direct truck-to-warehouse, or truck-to-ship loading. Dry bulk material feeders are designed to handle material intake from trucks or other forms of material containers, to then feed the materials onto the shiploader and into the ship directly. This eliminates the need for a temporary storage unit, to store the material in between delivery and ship loading, whilst also maintaining a controlled supply of the material.

Many material handlers consider integrating a weighing and dosing stage into their technological chain to operate on clear, exact data from their operation, whilst also retaining options for repackaging and additional handling options on site. Key pieces of equipment for port operators who need that extra functionality at their site to assist with bagging and weighing operations are stationary and mobile weighing and receiving hoppers of various sizes, which are designed and manufactured according to the customer’s required specification. The hopper can be equipped with weighting, measuring and filtering equipment, which provides further capabilities for locations with strict environmental (or internal) policies, bridging that sustainability gap.

On the other hand, considering a more versatile project, integrating NK TEHNOLOĢIJA’s material handling solution, utilising a container system, allows the client to skip the transshipment stage at a port terminal, by handling all material loading into containers at a more favourable site location near the production, and simply transporting the end product in 20 containers (specialised or standardised), allowing for more flexibility in tight locations, and allowing for a continuous circulation and use of these containers at multiple locations (whilst also building up a backlog of material ready to go at the loading site, providing security for when that material is needed quickly). This solution is

Since 1981, our team has assisted industries worldwide to achieve cleaner, greener, and more efficient loading operations. Our advanced dust control and bulk loading systems—spanning loading spouts, valves, conveyors, dust collectors, and full automation—are engineered to increase throughput while supporting your sustainability goals. Call 231.547.5600 to partner with us and optimize your loadout solutions.

made possible by a special tilting spreader designed and manufactured by NK TEHNOLOĢIJA, which smoothly leads us to the loading section.

A specific approach has been designed for handling cargo at multiple sites with mobile equipment, namely, the tilting spreaders are designed for handling 20 ft containers by inverting containers over the stacker feed conveyor or any other stationary or mobile equipment. The spreader can also load cargo directly into the ship hold with a capacity of up

to 36 t. Tilting angle allows for complete cargo unloading from the shipping container, with no leftovers. The tilting spreader allows us to store bulk cargo in containers, and eliminates the cargo trans-loading procedure and intermediate storage facility, allowing for customers to prepare cargo for shipment at a remote location and distribute containers across multiple transshipment sites, whilst also retaining the containers within relative reach for continuous reuse. A clear advantage – the tilting spreader can be designed to work with custom design containers with OEM guarantee.

For terminal operators that already have a serious infrastructure or are willing to invest additional resources, there is always the industry standard ship loader – a popular solution for an uninterrupted flow of bulk cargo materials. NK TEHNOLOĢIJA designs various ship loaders for fertilizers, grain, coal and other bulk goods, including travelling (mobile) ship loaders with slewing and luffing booms. The ship loaders delivered have been time tested and proved to have high fault tolerance, and are fit for the harshest operating conditions. It puts a strong emphasis on cooperating with the best and most trustworthy international sub-suppliers of key standardised equipment to bring the best of the both worlds – bringing the client a unique approach with available components for further maintenance.

Wrapping up the list in this article, it is worth highlighting a new versatile piece of equipment designed for port terminals, specifically the new Pelikan Crane. NK TEHNOLOĢIJA is an official partner of the German company ARDELT (Kranbau Eberswalde), producer of gantry cranes, and has received permission to manufacture and service the updated PELIKAN 500, 600, and 800 hydraulic cranes.

The crane offers a wide range of possible applications with German engineering at its core. Features include:

n Movable counterweight design, which enables the balance of the jib system to be improved across the whole working range – reducing energy consumption.

n Optimised computer-designed steel structure, which ensures a long service life.

n High operating availability using components from market leading manufacturers.

n Lifting capacities increased by up to 40%, with a lower deadweight.

n Greater working area due to improved integration of the operating cylinders.

n High working speeds, ensuring greater handling capacity.

n Improved operator control.

n Short delivery times, simple maintenance and improved spare parts availability due to a higher degree of standardisation.

To summarise, custom engineering solutions are an inseparable part of a sophisticated material handling operation, which help maximise the efficiency and reliability of these key infrastructure sites. Investing time and resources in developing a strong infrastructure can set the cornerstone for sustainable growth, and a brighter future for the next generations.

Nicholas Ball, XFuel, explores how recycled carbon fuels can support the dry bulk sector’s decarbonisation journey while maintaining competitiveness.

ry bulk carriers are a cornerstone of the global supply chain, transporting the raw materials that form the foundation of modern industrial society. In 2024, major bulk accounted for almost a quarter of total seaborne cargo, and was comparable in tonnage to crude oil shipments.

Unlike other shipping segments, the dry bulk sector operates without straightforward or predictable patterns. Each commodity has its distinctive industrial characteristics and growth trends, which have varying impacts on the dry bulk shipping sector. Iron ore and coal sit in a carefully structured industrial supply chain operation, while grain is traded seasonally, typically resulting in irregular cargo volumes and ship-ping routes.

The dry bulk sector has faced a challenging year to date in 2025. Persistently low freight rates, combined with a confluence of shifting trade routes, evolving policy dynamics, and changes in industrial demand, mean owners are under pressure to maintain profitability in a tightening market.

These developments can be seen as a new normal, meaning dry bulk owners and operators must adapt and unlock profits wherever possible. Today, dry bulk owners and operators must adjust decades-long routes and agreements to leverage the variable demand for commodities and increased fleet capacity.

Alongside these pressures, a long-term challenge looms over the dry bulk sector, one that is easily over-looked amid short-term disruptions. Here and now, shipowners need to respond to the energy transition. Policymakers are delivering regulations that will have a material effect on profitability. IMO's MEPC 83, which took place in April, led to agreement on a pricing mechanism to achieve global net-zero emissions for global shipping.

Although not yet formally approved in the IMO, this regulation would establish a carbon price for shipping, with impacts that will ripple through global supply chains. All the while, the complexity of challenges facing dry bulk owners continues to stack up, and the sector must act quickly. Dry bulk owners that have yet to prioritise their decarbonisation strategy risk falling behind.

A significant portion of the global dry bulk fleet runs on fossil fuels, and an increasing number of vessels are approaching retirement age. What innovative solutions can help the dry bulk sector navigate this challenge? Relying on charterers' goodwill to further relax restrictions on chartering older vessels is not a viable long-term solution. Owners, therefore, will need to make significant upgrades to their vessels, which will impact day-to-day operations while ships are out of service.

As with the whole maritime industry, low-carbon and zero-carbon fuels offer an important solution for supporting the dry bulk sector's long-term decarbonisation goals. Today, there is a significant gap between the supply and demand for alternative fuels (AFs). Low-carbon fuel production and distribution have not achieved the scale required for dry bulk fleet operators and owners to effectively decarbonise.

Closing this gap will require a significant outlay, which will be a challenging commitment for a sector where more than 95% of the fleet continues to run on conventional fuels. Instead, dry bulk shipowners need de-carbonisation solutions that are economically sustainable, allow them to remain competitive, and can be dropped into existing engines, machinery, and storage systems without major modification or disruption.

Dry bulk shipowners face difficult choices: fleet overhaul means paying a premium for new builds, while failing to act will expose companies to financial penalties. Vessel pooling to secure compliance under the FuelEU Maritime regulations means ceding some independence and aligning with another operator's operational plans.

Dry bulk shipowners, therefore, require reliable long-term solutions without delay, especially with the clock ticking on fleet compliance and rising fuel costs. As the energy transition gathers pace, dry bulk owners will need to abandon their historic reliance on an energy strategy that uses low-quality, low-cost fuels.

Regulations across all transport sectors mandate higher-quality, lower-carbon-burning fuels. Demand for these fuels is outstripping supply, pushing costs up and pushing fuel procurement teams to rethink their strategies.

Given the nature of dry bulk trade routes and the specific demands of its cargoes, AF pathways in this segment will follow a different trajectory. Operators' fuel choices will be limited by the supply and techno-logical maturity of AFs in the ports and markets where the vessel operates.

Furthermore, the range and complexity of AF choices may make decision-making challenging for many owners, who may need to wait and see how AF supplies develop in ports along their typical routes. Indeed, many owners are waiting for suppliers to move first, aware that the cost of AFs 10 – 20 years in the future will play a significant role in the return on their investment today.

An additional complication for the dry bulk sector is the divergence between fuel suppliers' and fuel buyers' interests. Given the sector’s operating profile, flexibility is essential, making the spot bunker fuel market well suited to its routes and charter agreements, while enabling owners to hedge against fuel price volatility. By contrast, suppliers of AFs who need to invest in production and distribution infrastructure want to ensure there will be demand for their fuels after making these investments. To protect themselves and their investment, these suppliers are eager to secure long-term offtake agreements from shipowners to protect their production and distribution infrastructure investments.

The sector would greatly benefit from an affordable, scalable, and proven fuel that reduces emissions. One that can work as a drop-in fuel for more than 12 000 dry bulk vessels on the water today and help them comply with tightening emissions regulations. Perhaps surprisingly, fuel made from recycled marine sludge offers a realistic, low-cost, and low-carbon solution to dry bulk shippers' energy transition dilemma.

Sludge is a regulated waste stream that every ship has to manage. The shipping industry produces millions of tonnes of residual waste oil annually, equal to 1 – 3% of all fuel oil vessels use. This significant problem for the sector is regulated by MARPOL Annex 1. Vessel operators view MARPOL Annex 1 sludge as waste to dispose of as easily and cheaply as possible, while its disposal is expensive and time-consuming.

Processes for handling the waste material vary worldwide. In the United States, operators pay for the disposal of sludge, while in less regulated states, the waste may be stored in open 'lakes', leading to contamination, with devastating impacts on local wildlife.

Furthermore, the illegal discharge of sludge continues, with an estimated 3000 or more illicit dumping incidents per year in European waters alone. Adequately disposing of sludge with contained environmental impact often requires incinerating it on board – a process that offers no direct benefit to the vessel and releases CO2 emissions.

But sludge and other waste feedstocks can be transformed into recycled carbon fuels (RCFs). These are

both proven to extend decarbonisation compliance for their vessels and to be cost-effective. By ex-tending the lifecycle of carbon in waste fossil sources, substituting for traditional fossil fuels, and avoiding emissions from low-value incineration or other forms of disposal, recycled carbon fuels can claim to re-duce lifecycle emissions for the vessels that use them. The carbon savings from recycled carbon fuels help users achieve regulatory compliance at a sustainable cost, especially as RCFs avoid EU ETS charges, carbon levies, or port emission rules.

To be considered low-carbon, RCFs must meet very specific sustainability and environmental standards. The EU mandates a GHG reduction over its lifetime of at least 70% compared to a fossil fuel.

XFuel has developed a technology to transform waste feedstocks into a direct-replacement (drop-in) low-carbon marine gas oil (MGO) at a price that is competitive with fossil fuels. XFuel’s chemical liquid refining technology (CLR – ‘CLEAR’) can refine marine sludge and other waste hydrocarbons into sustainable MGO, which is ISO 8217 DMA compliant and compatible with existing engines and infrastructure.

The technology is both modular and decentralised. Each modular fuel production facility is cost-effective at the CAPEX stage, potentially unlocking savings across its OPEX. A single module can produce 14 000 t of refined MGO annually from 16 000 t of dewatered sludge.

Importantly, CLR technology is feedstock-flexible: in addition to marine sludge, it can process various waste

hydrocarbon liquid streams, which our R&D team is expanding. Its modular design allows for rapid scaling, enabling production to grow with demand. Furthermore, modules can be strategically located near ports, ensuring proximity to waste feed-stock providers and fuel offtakers, which minimises the environmental impact of the supply chain and re-duces operational costs.

For dry bulk vessel owners facing an ageing fleet and challenging operating conditions, recycled carbon fuels offer cost-effective compliance with mounting regulations on carbon emissions.

The production process means fuels can be produced cost-competitively with fossil alternatives and reduce operators' carbon liabilities. By partnering with XFuel's technical expertise, dry bulk vessel owners can develop a sustainable strategy to decarbonise their fuel supply ahead of emissions regulations that is quick to implement and requires no retrofits to their vessels or significant infrastructure changes.

Dry bulk vessel owners and operators can convert the waste they produce into low-carbon fuel, offering both environmental and economic benefits that reflect the industry's unique nature. While the dry bulk sector is facing some headwinds, options exist that can help owners and operators meet compliance, manage the complexities of the energy transition, and maintain operational profitability.

Lee Hyungchul, Korean Register, explores how classification societies are expanding their roles to help dry bulk operators navigate the complex demands of emissions control and decarbonisation.

aritime decarbonisation has moved from the margins to the mainstream. Following the International Maritime Organization’s (IMO) commitment to reaching net-zero greenhouse gas emissions by 2050, a growing suite of policy instruments are reshaping the economics and operations of global shipping. Nowhere is this felt more acutely than in the dry bulk sector, where older

fleets, longer voyage profiles, and thin margins create a challenging emissions baseline.

For bulk operators, the pace of change is unprecedented. New fuels, shifting charter conditions, complex regulatory metrics, and tightening port requirements are converging into a multi-dimensional compliance landscape. The shift demands a new kind of support. Classification societies, once limited to

structural certification, are now emerging as full-spectrum technical partners. Korean Register (KR), in particular, is developing tools, partnerships, and frameworks to help owners navigate emissions control and decarbonisation with greater clarity and control.

KR’s recent work on ammonia illustrates how classification’s role is expanding to fill gaps in regulation, safety, and fuel readiness. Ammonia is emerging as a viable zero-carbon option for deep-sea shipping, especially in segments where fuel availability and cargo energy density are critical. However, ammonia presents handling and environmental risks, particularly around unburnt discharge and operational safety.

Recognising the need for internationally harmonised standards, KR has helped bring the issue of ammonia effluent discharge to the 10 th session of the ‘IMO Sub-Committee on Carriage of Cargoes and Containers (CCC)’ in 2024, contributing to its formal inclusion on the MEPC 83 agenda. Building on this, KR launched a working group in June 2025 alongside KTR (Korea Testing & Research Institute), HD Hyundai,

Samsung Heavy Industries, and Hanwha Ocean to draft a safety and discharge protocol for ammonia effluent. The group aims to submit draft regulatory guidelines to the IMO in 2026.

By identifying regulatory blind spots and initiating cross-industry collaboration, classification societies are contributing to the safe adoption of next-generation fuels. This work is not limited to technical research. It also shapes the pace and direction of fuel transition across fleet segments. Without such early-stage standardisation, the risks of fragmented regulation and stranded investment remain high.

Beyond fuel guidance, KR is equipping shipowners with tools to understand and manage compliance across the operational lifecycle. The IMO’s mid-term measures, approved at the 83 rd MEPC meeting in April, require shipowners to accelerate their decarbonisation efforts and transition to alternative fuels, while introducing economic instruments targeting GHG emissions from fuel use. In response, KR is developing two complementary digital platforms – KR-PILOT and KR-POWER – which are scheduled for official launch this year.

KR-PILOT supports strategic planning by enabling users to develop customised decarbonisation strategies. It allows simulation of various scenarios through combinations of energy-saving technologies, fuel cost projections, and GHG regulatory costs associated with the IMO’s mid-term measures and EU regulations. Through these simulations, shipowners can determine the most cost-effective and compliant decarbonisation pathways, either for individual vessels or across their entire fleet. For KR-classed ships, relevant operational and technical data are automatically integrated, while non-KR vessels can also access the platform through manual data entry.

KR-POWER complements this with real-world analytics, evaluating vessel performance by combining AIS-based positional information with a wide range of marine environmental data. Key features include operational profiling based on statistical data such as vessel routes, sailing status,

speed, and draft. By integrating AIS data with environmental factors such as wind, wave conditions, water depth, and temperature, the platform also enables regional and voyage-specific analysis, as well as fuel consumption analysis.

This operational modelling is particularly relevant under the IMO’s new GHG Fuel Intensity (GFI) mechanism, approved at MEPC 83. From 2027, the GFI will apply to all ships above 5000 GT and establish performance targets based on two levels: a base target and a direct compliance target.

Ships that outperform the target may generate surplus units (SU), while underperformers will face charges of up to US$380/t of CO₂-equivalent.

The mechanism is designed to create economic incentives for emissions reduction without mandating a particular technology or fuel. For dry bulk operators, who typically run older fleets with long haul profiles, the implication is clear. Achieving compliance will require optimised performance across multiple dimensions, including voyage planning, power demand, hull maintenance, and auxiliary load. KR’s ability to simulate regulatory exposure and evaluate mitigation strategies provides owners with the foresight they need to prepare for a more financially exposed emissions regime.

Alongside IMO measures, KR is supporting clients in meeting the European Union’s FuelEU Maritime Regulation, which will impose GHG intensity targets on energy used onboard from 2025, with penalties applied

from 2026. FuelEU requires shipowners to demonstrate that their chosen fuels meet the annual GHG intensity limit, starting with a 2% reduction in 2025 and tightening to 6% by 2030.

For dry bulk operators calling at EU ports, this introduces a new layer of complexity, especially when blending fuels, testing biofuel batches, or using shore power. KR is developing verification frameworks and simulation tools to help owners calculate their deficit or surplus positions, manage fuel data, and ensure overall compliance. This support is critical, as under FuelEU Maritime, shipowners may face penalties of up to €2400 per t of VLSFO-equivalent for any GHG intensity shortfall and energy used.

KR’s decarbonisation strategy also addresses emissions generated outside the voyage profile. One area of growing importance is construction-phase emissions, particularly for ships using LNG as fuel. The natural evaporation of LNG inside fuel tanks produces boil-off gas (BOG), which increases tank pressure.

While vessels can utilise BOG as fuel during operation, it cannot be flared while berthed or under construction, often resulting in forced combustion or atmospheric venting – both of which contribute to unnecessary emissions.

To address this issue, HD Hyundai and Donghwa Pneutec jointly developed a BOG treatment system, and KR has verified the entire process – from design and manufacturing to operation. The result is an emissions avoidance of more than 50 metric t of CO 2 -equivalent per vessel. This method aligns with broader environmental goals, including port regulations – such as the mandatory application of alternative maritime power (AMP) – as well as lifecycle emissions reporting requirements.

Classification’s involvement in emissions mitigation at the yard stage shows how far the scope of work has evolved. KR is increasingly focused on lifecycle emissions, including those associated with design, build, operation, and decommissioning. As regulators and financiers begin to request emissions audits across the vessel lifespan, the ability to demonstrate verified reductions outside the voyage envelope may become a differentiator for dry bulk carriers looking to secure long-term charters or green finance.

Another area in which classification societies are becoming essential is in the independent validation of new technologies. Energy-saving devices, such as air lubrication systems, advanced propeller designs, or wake-equalising ducts, can offer significant efficiency gains. However, the effectiveness of these devices can vary greatly depending on various factors, including the vessel's operating route, sailing trim, and the maintenance condition of its hull plating.

For ageing dry bulk vessels that lack advanced design technologies, the application of energy-saving solutions can deliver significant performance improvements. To predict and verify the expected benefits, KR offers a professional third-party verification service in accordance with its internal guidelines. This service includes a review of computational fluid dynamics (CFD) analysis reports submitted by shipping companies and helps reduce the risk of underperforming retrofits or poor return on investment. KR’s technical assurance enables shipowners to make more confident decisions and develop better strategies for complying with GHG emission regulations.

In addition to tools and validation, KR is playing a key role in aligning international and regional regulatory frameworks. The European Union’s Emissions Trading System (EU ETS) now applies to voyages entering or leaving EU ports, adding a carbon cost to many bulk trades. Owners must manage not only IMO compliance but also the purchase and surrender of emissions allowances, verified by recognised authorities.

KR helps bulk operators bridge these overlapping systems by providing integrated data platforms, monitoring verification reports, and scenario models that quantify financial exposure under different regulatory regimes. This dual capability is crucial in

regions where national and international schemes coexist. As more countries and blocs introduce carbon pricing, classification societies will be needed not just as recordkeepers, but as compliance strategists.

KR also supports shipowners through technical consulting and bespoke advisory services, recognising that decarbonisation readiness often requires organisational as well as operational change. This includes company-specific guidance on fuel handling, emissions monitoring, regulatory developments, and the application of KR’s digital compliance tools. These services are designed to assist both onboard and shoreside personnel, particularly where in-house technical teams are small or stretched by evolving reporting requirements.

For the dry bulk segment, which includes a high proportion of single-ship owners and smaller operators, these services offer practical ways to keep pace with evolving expectations. Whether through simulation tools, compliance roadmaps, or verification training, KR supports the transfer of knowledge from the policy table to the operations deck.

Looking ahead, the industry’s progress on emissions will be shaped by its ability to integrate ambition with feasibility. Shipowners will need to align capital planning with policy trajectories, charter conditions with compliance exposure, and technology adoption with operational constraints. Classification societies are in a unique position to facilitate that integration. They operate across technical, commercial, and regulatory boundaries, and they have both the expertise and neutrality to offer trusted support.

KR’s model reflects this evolving role. The organisation is not only providing the structural backbone for compliance, but also offering the predictive models, verification methods, emissions tracking systems, and training needed to ensure that decarbonisation strategies succeed in practice. From ammonia discharge standards to simulation platforms and lifecycle emissions validation, KR is contributing to a more stable and transparent path toward net-zero shipping.

For dry bulk operators facing increasing scrutiny, higher costs, and accelerating regulatory expectations, classification is no longer a passive service. It is becoming an essential part of commercial readiness and environmental accountability. In the new maritime economy, where emissions are monitored, priced, and compared across markets, the role of classification is evolving into that of strategic enabler.

Hyungchul Lee, Chairman and CEO of KR since 2019, brings over 30 years of experience in statutory services and global business development. He leads KR through key industry challenges, including decarbonisation and digital transformation, while strengthening its global role and Korea’s maritime competitiveness.

Morten Løvstad, DNV, explains how bulk carriers can navigate regulatory complexity and decarbonisation goals in a rapidly evolving maritime industry.

he maritime industry is undergoing a profound transformation. Driven by cross-industry consensus to achieve full decarbonisation by the middle of the 21st Century, some key regulations have been introduced over the past few years, affecting the choices made by shipowners across the global fleet.