Social Security Myths: What to Know

There are some myths around Social Security we should clear up.

The first is that it is going bankrupt. But according to a Social Security Administration analysis from June 2025, benefits will continue – though starting in 2033, it may only pay 77 cents on the dollar. Congress has options to fix the shortfall before then. The second myth is that budget cuts will delay or reduce benefits. Budget cuts and staff reductions may affect wait times when calling or visiting a Social Security office, but only Congress can change benefit amounts, which they have not done. Currently, the Social Security Administration states that benefits and Supplemental Security Income (SSI) for current recipients will not be delayed.

Third is the myth that these benefits are no longer taxed. However, if your combined income exceeds certain thresholds, you'll owe taxes on part of your benefits. For now, save adequately and make informed decisions about when to claim your benefits. A financial advisor can help.

Matthew Besier, your Edward Jones financial advisor

At 179 East Beck Street

This article was written by Edward Joes for use by Matthew Besier your local Edward Jones Financial Advisor Member SPIC

https://www.LinkedIn/In/MatthewBesier-AAMS

https://www.Facebook.com/EJAdvisorMatthewBesier

7 - Publisher’s Letter

8 - WHO Rob & Chris Nuptials in NYC Cover Photo Norm Hall and The Littles

26 - CREATIVE

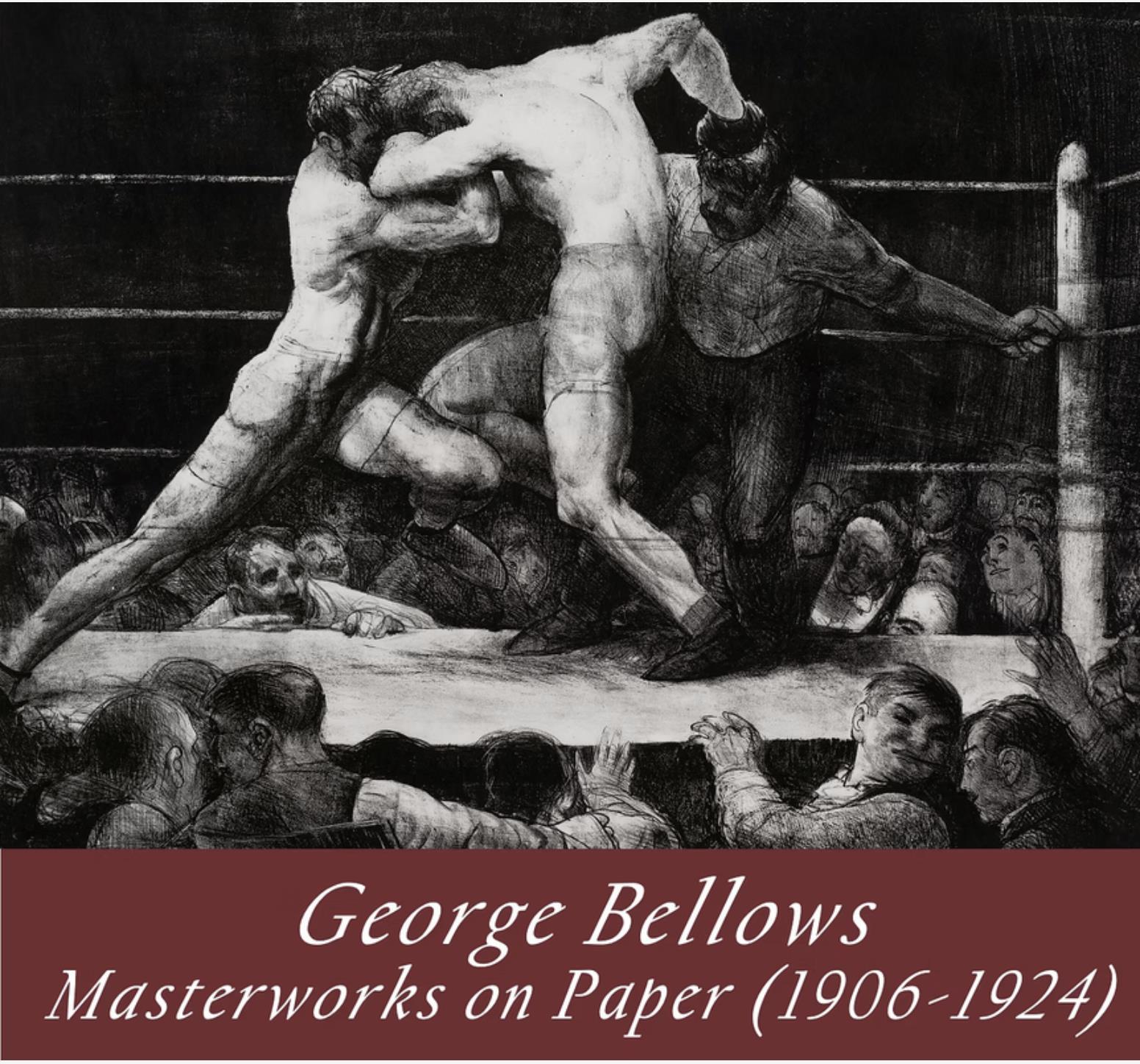

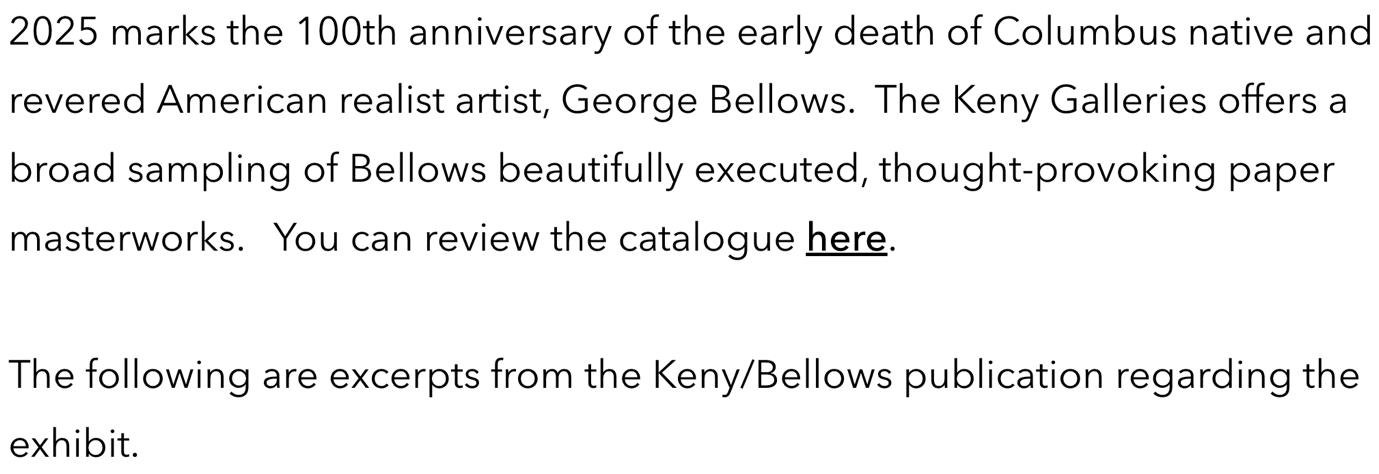

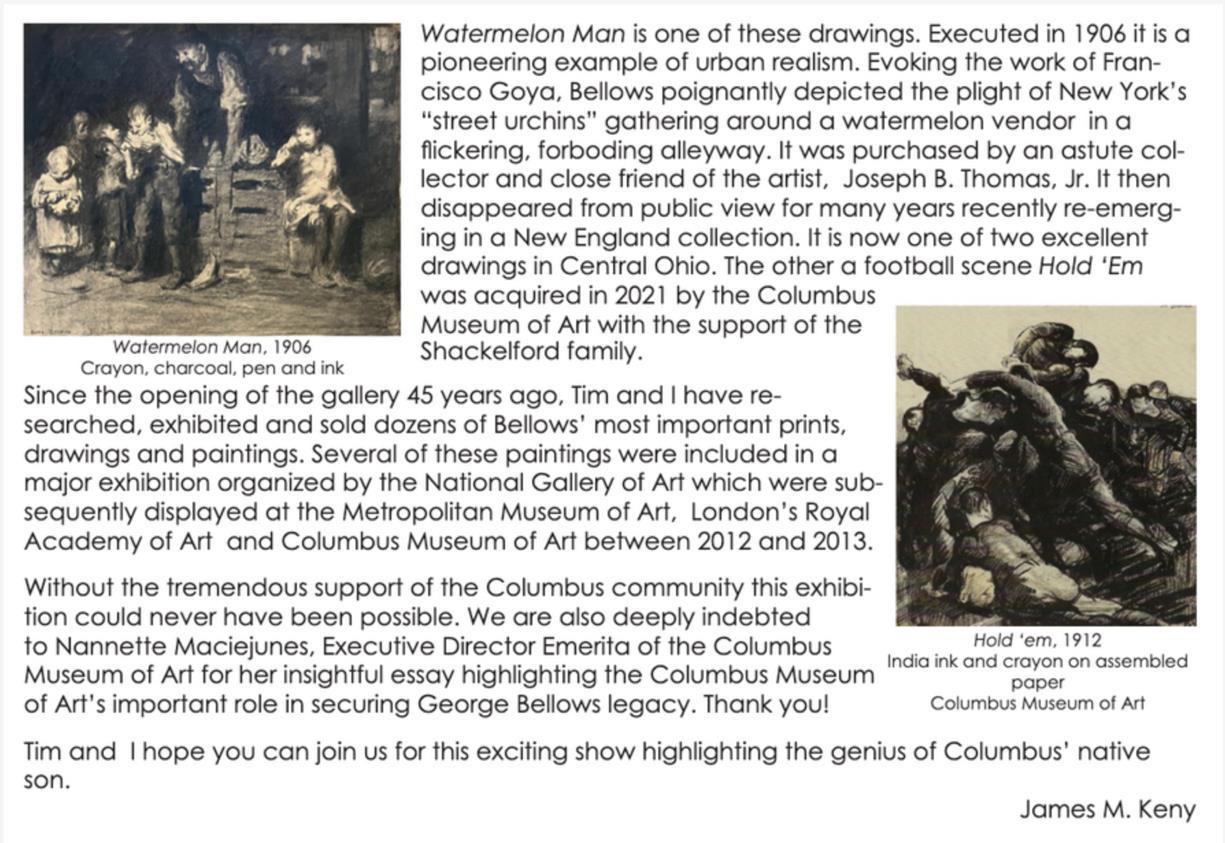

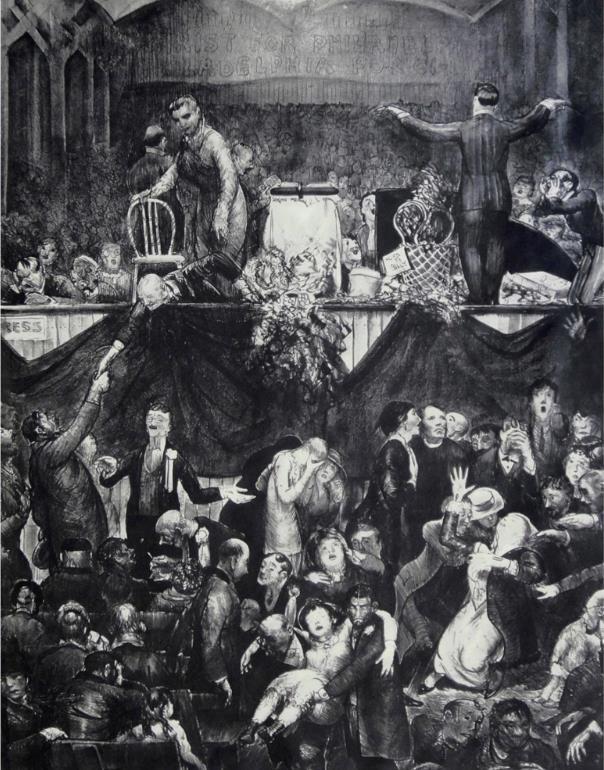

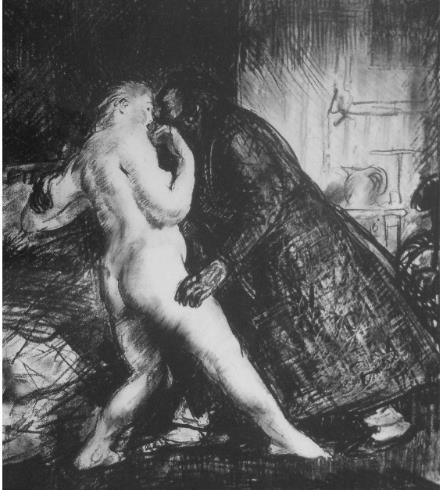

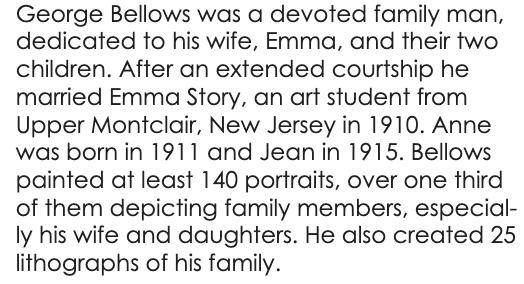

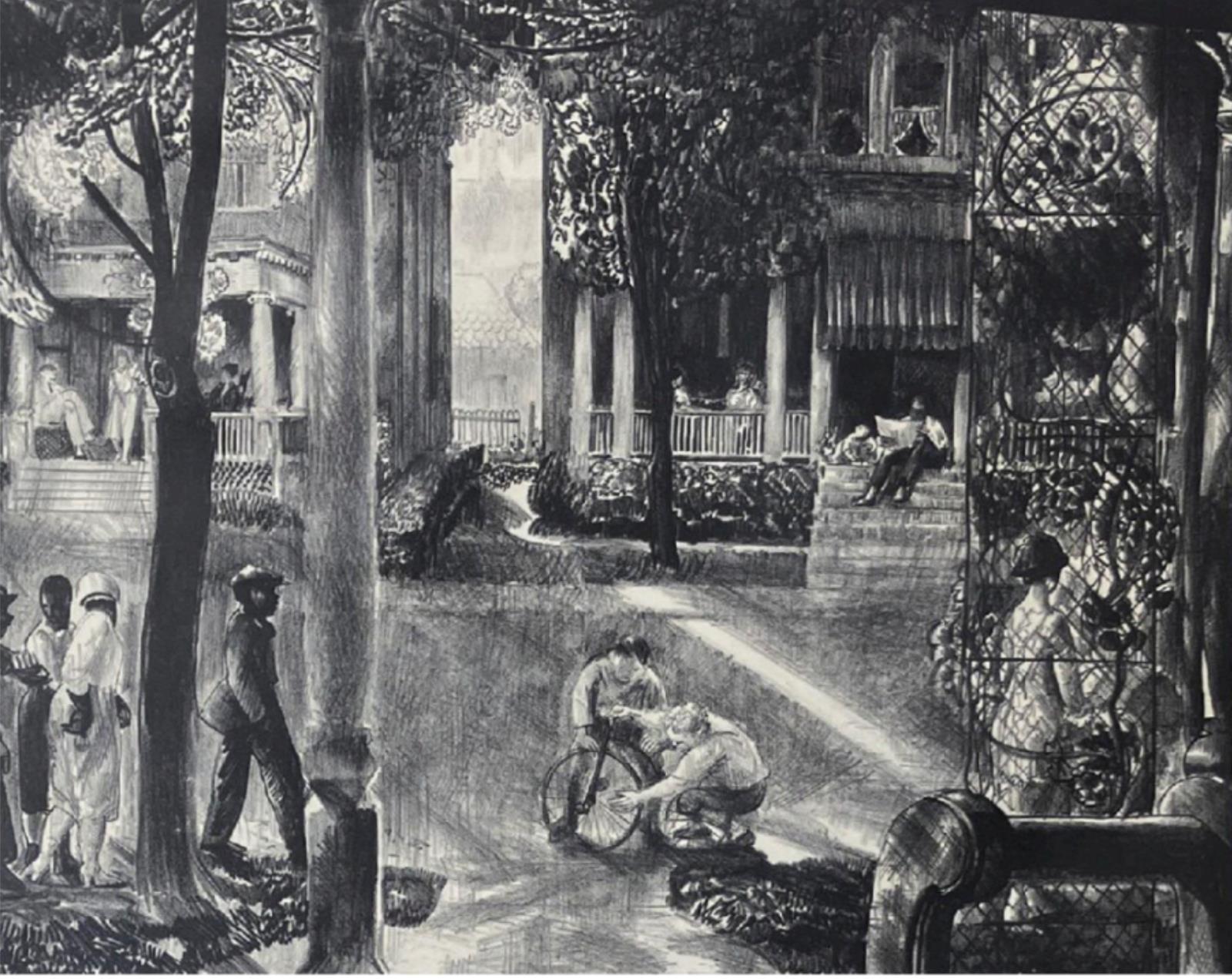

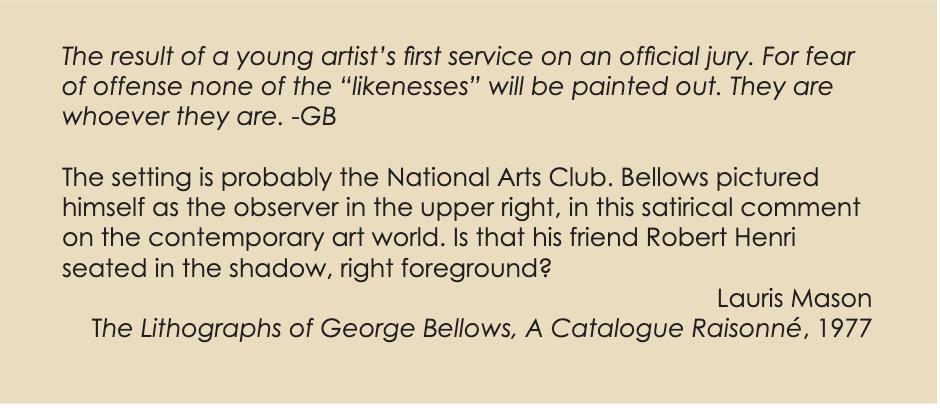

Keny Galleries – George Bellows Masterworks on Paper

40 - GIVE

German Village Garten Club

Annual Wine Dinner Honoring the Legacy of Robert Mullinax