“c04EconomicActivity_PrintPDF” — 2022/5/28 — 13:00 — page 23 — #23

4.7 The relationship between the business cycle and economic indicators KEY KNOWLEDGE • the relationship between the business cycle and economic indicators

FS

Source: VCE Economics Study Design (2023–2027) extracts © VCAA; reproduced by permission.

O

Mention has already been made that as the economy travels along the business cycle from boom, to slowdown, recession and recovery, the level of economic activity changes. This alters economic conditions and will be reflected in various indicators, some of which are summarised in table 4.5.

PR

O

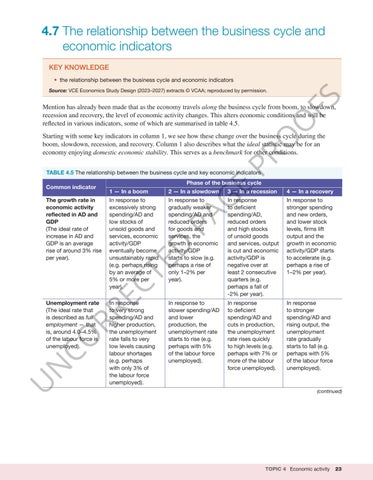

Starting with some key indicators in column 1, we see how these change over the business cycle during the boom, slowdown, recession, and recovery. Column 1 also describes what the ideal statistic may be for an economy enjoying domestic economic stability. This serves as a benchmark for other conditions. TABLE 4.5 The relationship between the business cycle and key economic indicators

U

N

Unemployment rate (The ideal rate that is described as full employment — that is, around 4.0–4.5% of the labour force is unemployed).

E

3 — In a recession

In response to excessively strong spending/AD and low stocks of unsold goods and services, economic activity/GDP eventually become unsustainably rapid (e.g. perhaps rising by an average of 5% or more per year).

In response to gradually weaker spending/AD and reduced orders for goods and services, the growth in economic activity/GDP starts to slow (e.g. perhaps a rise of only 1–2% per year).

In response to deficient spending/AD, reduced orders and high stocks of unsold goods and services, output is cut and economic activity/GDP is negative over at least 2 consecutive quarters (e.g. perhaps a fall of -2% per year).

In response to stronger spending and new orders, and lower stock levels, firms lift output and the growth in economic activity/GDP starts to accelerate (e.g. perhaps a rise of 1–2% per year).

In response to very strong spending/AD and higher production, the unemployment rate falls to very low levels causing labour shortages (e.g. perhaps with only 3% of the labour force unemployed).

In response to slower spending/AD and lower production, the unemployment rate starts to rise (e.g. perhaps with 5% of the labour force unemployed).

In response to deficient spending/AD and cuts in production, the unemployment rate rises quickly to high levels (e.g. perhaps with 7% or more of the labour force unemployed).

In response to stronger spending/AD and rising output, the unemployment rate gradually starts to fall (e.g. perhaps with 5% of the labour force unemployed).

D

PA

G

2 — In a slowdown

CO RR EC

The growth rate in economic activity reflected in AD and GDP (The ideal rate of increase in AD and GDP is an average rise of around 3% rise per year).

Phase of the business cycle 1 — In a boom

TE

Common indicator

4 — In a recovery

(continued)

TOPIC 4 Economic activity

23