Iroquois believes that at the heart of the best independent insurance agents is an entrepreneurial spirit. That’s why for 45 years, we have been helping agencies grow revenue, profits and agency value, without sacrificing their independence. The only partnership Iroquois believes in is the one where member agencies, carrier partners, and Iroquois can all benefit—what we call “Win/Win/Win.”

• customizes its membership to fit your needs

• supports your agency with a 60-person expert field team

• gives you the freedom to choose your own markets

• delivers superior compensation for superior performance

• has no initiation fees or monthly dues

• operates in all 48 contiguous United States

Wondering what you could have earned with an Iroquois membership last year? There is only one way to find out.

Gene Knippers, JD Regional Director

Arizona

(602) 653-5104

gknippers@iroquoisgroup.com

iroquoisgroup.com

The construction industry is critical to our nation’s economy. It is also one of the country’s largest industries, employing nearly 11.8 million people in 2022. But for more than a decade, construction has struggled to recruit and retain enough workers to meet the sector’s growing demand.

The Associated Builders and Contractors reports that by 2024 the construction industry will need to bring in more than 342,000 new workers to meet current industry demand, and that’s presuming construction spending growth slows significantly next year.

But according to a new report by the U.S. Equal Employment Opportunity Commission (EEOC) titled, “Building For The Future: Advancing Equal Employment Opportunity in the Construction Industry,” federal infrastructure investments into the construction space may provide a new opportunity to hire and diversify the construction sector’s workforce. The Infrastructure Investment and Jobs Act of 2021 and the CHIPS and Science Act of 2022 provide an opportunity to build a more inclusive construction industry and ensure that it is equally open to all qualified workers, the EEOC says.

“Many construction companies and industry groups are making good faith efforts to comply with civil rights laws and are undertaking proactive steps to reduce the barriers that have historically limited access to good construction jobs,” the report says. “Nevertheless, discrimination remains a substantial barrier to entry, retention, and advancement of women and people of color in construction.”

The report provides findings and next steps based on the agency’s enforcement experience, witness testimony presented at the EEOC’s May 2022 hearing on discrimination and harassment in construction and other Commission hearings and academic research.

The report’s key findings say:

• Women and people of color are underrepresented in the construction industry and especially in the higher-paid, higher-skilled trades.

• Discrimination based on sex, race and national origin persists and contributes to the underrepresentation of women and workers of color in construction.

• Harassment is pervasive on many worksites and poses a significant barrier to the recruitment and retention of women and workers of color in the industry.

• Racial harassment in construction often takes virulent forms and nooses appear with chilling frequency on jobsites across the country.

• Harassment in construction is a workplace safety issue as well as a civil rights issue.

• Construction workers who experience discrimination often do not know to whom or how to report violations.

• Retaliation is a serious problem in the construction industry and hinders efforts to prevent and remedy unlawful discrimination and harassment.

The EEOC’s report on advancing equal employment opportunity in construction is available at: https://www.eeoc.gov/.

Andrea Wells Vice President, ContentChairman of the Board Mark Wells | mwells@wellsmedia.com

Chief Executive Officer Joshua Carlson | jcarlson@insurancejournal.com

ADMINISTRATION / CIRCULATION

Chief Financial Officer Mark Wooster | mwooster@wellsmedia.com

Circulation Manager Elizabeth Duffy | eduffy@wellsmedia.com

Staff Accountant Sarah Kersbergen | skersbergen@wellsmedia.com

EDITORIAL

V.P. of Content Andrea Wells | awells@insurancejournal.com

Executive Editor Emeritus Andrew Simpson | asimpson@wellsmedia.com

National Editor Chad Hemenway | chemenway@insurancejournal.com

Southeast Editor William Rabb | wrabb@insurancejournal.com

South Central Editor/Midwest Editor Ezra Amacher | eamacher@insurancejournal.com

West Editor Don Jergler | djergler@insurancejournal.com

International Editor L.S. Howard | lhoward@insurancejournal.com

Content Editor Allen Laman | alaman@wellsmedia.com

Assistant Editor Jahna Jacobson | jjacobson@insurancejournal.com

Copy Editor Stephanie Jones | sjones@insurancejournal.com

Columnists & Contributors

Contributors: Frederick Fisher, Tim Hardcastle, Dr. Robert Hartwig, Rachele Holden, Matthew Mitchell, Matt O’Brien, Jim Sams

Columnists: Chris Burand, Tony Caldwell, Bill Wilson

SALES / MARKETING

Chief Marketing Officer Julie Tinney | jtinney@insurancejournal.com

West Sales Dena Kaplan | dkaplan@insurancejournal.com

Romeo Valdez | rvaldez@insurancejournal.com

Kelly DeLaMora | kdelamora@wellsmedia.com

South Central Sales Mindy Trammell | mtrammell@insurancejournal.com

Southeast and East Sales (except for NY, PA, CT)

Howard Simkin | hsimkin@insurancejournal.com

Midwest Sales

Lisa Whalen | (800) 897-9965 x180

East Sales (NY, PA and CT only)

Dave Molchan | (800) 897-9965 x145

Advertising Coordinator

Erin Burns | eburns@insurancejournal.com

Insurance Markets Manager

Kristine Honey | khoney@insurancejournal.com

Sr. Sales & Marketing Coordinator

Laura Roy | lroy@insurancejournal.com

Marketing Administrator

Alberto Vazquez | avazquez@insurancejournal.com

Marketing Director Derence Walk | dwalk@insurancejournal.com

DESIGN / WEB / VIDEO

V.P. of Design

Guy Boccia | gboccia@insurancejournal.com

Web Team Lead

Josh Whitlow | jwhitlow@insurancejournal.com

Ad Ops Specialist

Jeff Cardrant | jcardrant@insurancejournal.com

Web Developer Terrance Woest | twoest@wellsmedia.com

Web Developer Jason Chipp | jchipp@wellsmedia.com

V.P. of New Media

Bobbie Dodge | bdodge@insurancejournal.com

Videographer/Editor Ashley Waldrop | awaldrop@insurancejournal.com

ACADEMY OF INSURANCE

Director Patrick Wraight | pwraight@ijacademy.com

Online Training Coordinator

George Jack | gjack@ijacademy.com

‘[D]iscrimination remains a substantial barrier to entry, retention, and advancement of women and people of color in construction.’

Simple solutions for complex times® is more than just our tagline at UFG Insurance.

We’ve made it our mission to create simple solutions for doing business with us, which begins with providing trusted insurance protection and service that exceeds expectations.

For a carrier committed to making insurance simple, think UFG. After all, insurance can be complicated and we all deserve simple solutions in these complex times. ufginsurance.com/services

Simple solutions for complex times INSURANCE

About 33 million U.S. homes with a combined reconstruction cost value of $11.6 trillion are at risk of hurricane-force winds. But two new computer models promise to help property owners and insurers better predict where those winds will hit in the coming hurricane season and beyond.

CoreLogic in late May released its 2023 Hurricane Risk Report to mark the start of the Atlantic hurricane season and found that more than 32 million single-family residences and 1 million multifamily residences are at moderate or more significant risk of sustaining damage from hurricane-force winds. Nearly 8 million homes, with an RCV of $2.6 trillion, have direct or indirect coastal exposure, making them susceptible to storm surge.

More than 4 million homes are in the New York City metropolitan area with combined RCV of $2.4 trillion are at risk. Other major metro areas with substantial hurricane wind risk are the HoustonWoodlands-Sugar Land and Miami-Ft. Lauderdale-Pompano Beach areas, with combined RCV of $649.8 billion and $585.0 billion, respectively, said CoreLogic.

The same week, the National Hurricane Center announced it had improved its Probabilistic Storm Surge model to version 3.0, which will provide coastal surge predictions up to three days in advance. That’s an improvement over the two-day warning that officials had previously used.

“It’s a big upgrade,” NHC storm surge specialist, Cody Fritz, told National Public Radio.

The system, which combines wind and storm tracks with new data on vegetation in the storm’s path, also allows surge modeling for the first time for Puerto Rico and the U.S. Virgin Islands, which have been hard-hit by storms in recent years. The changes don’t come a day too soon, officials said.

“We are seeing a sharp increase in catastrophic storm surge impacts in our coastal communities,” Ken Graham, director of

NOAA’s National Weather Service, said in a statement. “Our new capabilities to effectively and accurately model and forecast storm surge (are) critical to upholding the NWS mission of protection of life and property.”

Also, Aon, the global data analytics firm, unveiled a new computer model and forecasting system that allows insurers to better assess portfolio losses as soon as a hurricane’s landfall point becomes clear.

The Auto Event Response program combines NHC data with up to 10 academically reviewed models to produce real-time impacts on exposed properties, Aon Managing Director Daniel Hartung explained in a webinar.

The system, which examines properties in a storm’s actual path, rather than basing losses on simulations or probabilistic forecasts, can produce a “quantifiable loss estimate at various granularities,” he said.

It also provides a better idea of the

actual wind speeds as hurricanes move inland and decay, he said. A report will be delivered automatically via email to subscribers, within an hour of a forecast update.

A new version of Aon’s Impact Forecasting, an enhanced hurricane model, is now being reviewed by the Florida Hurricane Commission, Aon’s Will Skinner said.

Forecasters recently have called for an “average” hurricane season in the Atlantic. But “average” does not necessarily mean less risk or lower costs.

The 2022 Atlantic hurricane season was close to average, with 14 named storms, eight hurricanes and two major hurricanes, but one of those was Hurricane Ian — among the strongest hurricanes to ever make U.S. landfall. Ian was also one of the costliest hurricanes in history in terms of insured losses, causing an estimated $60 billion.

Safety National® offers multi-line insurance solutions to address large construction and contracting risks for workers’ compensation, general liability and auto liability coverage.

As placement specialists for businesses like commercial general contractors, trade contractors and heavy civil infrastructure providers, we offer a flexible approach to insurance program development. We look at each submission individually and are deeply committed to designing a plan that addresses each organization’s specific needs.

By Jim Sams

By Jim Sams

Asingle voicemail message left on a cellphone without permission is enough to allow an individual to proceed with a class-action lawsuit alleging violations of the Telephone Consumer Protection Act of 1991, a panel with the 6th Circuit Court of Appeals ruled on June 1.

The appellate panel reversed a District Court ruling that found Matthew Dickson lacked standing to pursue a lawsuit against Direct Energy LP because he suffered no concrete harm.

“The 6th Circuit’s ruling in Dickson v. Direct Energy resolves a critical legal issue for TCPA plaintiffs on Article III standing and will allow our case to move forward and hopefully secure a judgment for the in excess of 2.5 million class members who were subjected to Direct Energy’s illegal prerecorded telemarketing calls,” Dickson’s attorney, Brian K. Murphy, said in an email.

The TCPA allows civil penalties of $500 per call, or $1,500 for “willful violations.” Murphy, a partner with the Murphy Murray Moul + Basil law firm in Columbus, Ohio, said Dickson is seeking damages in the range of $1.4 billion to $4.2 billion for Direct Energy’s robocalling campaign.

Dickson alleged in a lawsuit that he

received “multiple” ringless voicemails, known as RVMs, on his cell phone in November 2017. RVM technology allows telemarketers to automatically dial telephone numbers and deliver prerecorded voice messages without triggering the device’s ringer.

Congress passed the TCPA in 1991 to bar automatic telephone calls to people who have not given permission. Dickson alleged that the pre-recorded messages placed on his cell phone by “Nancy Brown with Direct Energy” were a nuisance and a violation of the law. He filed a lawsuit and sought class-action status to seek damages for an estimated 2.5 million consumers who received voicemails during Direct Energy’s telemarketing campaign.

During discovery, Dickson said he received 11 ringless voicemails from Direct Energy. An expert for Direct Energy, however, concluded that only one of those RVMs came from the company, which sells electricity distribution plans to residents and businesses.

U.S. District Judge John R. Adams, with the Northern District of Ohio in Akron, ruled that a single RVM was not enough concrete harm to give Dickson standing because Dickson was not charged for the call and the call did not tie up his phone.

Dickson appealed, arguing that even one call was an “intrusion upon seclusion.”

The 6th Circuit panel said it has never before been asked to decide whether a single call is enough to give a consumer standing under the TCPA. The panel reviewed several decisions by the Supreme Court and other Circuit Courts to decide that it is. Citizens have a common-law right to privacy, which includes the right to be left alone, the panel said.

“From a lay perspective, we can see why members of the public and Congress, through the TCPA, deemed such calls intrusive,” the opinion says. “For example, some consider their phone number a matter of private information in and of itself. People commonly exercise discretion in publicizing their phone numbers, entrusting them only to their circle of friends, family, and select others.”

The panel said the District Court relied on two 11th Circuit rulings that found an invasion of privacy must be “substantial” to create a concrete harm that would give Dickson standing to pursue his lawsuit. Those rulings are “not persuasive,” the panel said, because they did not look to “both history and the judgment of Congress to determine whether an intangible harm is sufficiently concrete to constitute an injury in fact.”

“Dickson’s receipt of an unsolicited RVM bears a close relationship to the kind of injury protected by the common law tort of intrusion upon seclusion; and his claimed harm directly correlates with the protections enshrined by Congress in the TCPA,” the panel said. “Therefore, Dickson suffered a concrete injury in fact sufficient for Article III standing purposes.”

Sams is the editor of Claims Journal.

‘[W]e can see why members of the public and Congress, through the TCPA, deemed such calls intrusive.’

Think again. We’ve spent the past century building a specialty insurance platform with a vast array of products and superior claims handling. From simple to complex risks, or quite frankly, anything in between, our specialists can construct a tailor-made program to fit your needs. If you need something unique, just ask us.

The sky’s the limit. THINK HUDSON.

Rated A by A.M. Best, FSC XV

HudsonInsGroup.com

MANAGEMENT LIABILITY

PROFESSIONAL LIABILITY

FINANCIAL INSTITUTIONS LIABILITY

MEDICAL PROFESSIONAL LIABILITY

TRUCKING

PRIMARY GENERAL LIABILITY

& EXCESS LIABILITY

GENERAL LIABILITY & PACKAGE

PERSONAL UMBRELLA

SPECIALTY LIABILITY

CROP

SURETY

$14,000

The monthly salary California goat grazing services and herding companies could be required to pay herders — up from about $3,730 — if no changes are made to state labor regulations set to take effect Jan. 1. Goats are in high demand to clear vegetation that could fuel wildfires. One herder typically handles about 400 goats. Many herders are from Peru and live in employer-provided trailers near grazing sites. Herding companies say the new rules affecting overtime pay will make it unaffordable to provide goat grazing services.

$24,000

$267,622

The amount in penalties the U.S. Department of Labor’s Occupational Safety and Health Administration proposed against Dollar General Corp., citing the company for two repeat and three serious safety violations at two stores in Southeast Oklahoma. OSHA says the Oklahoma violations are part of a trend. In 12 inspections in six states from October through December 2022, OSHA cited Dollar General stores for dozens of violations, including many repeat violations and proposed nearly $4.5 million in penalties. Since 2017, OSHA has found violations in more than 240 inspections at U.S. stores operated by Dollar General Corp. and Dolgencorp LLC, and proposed more than $21 million in penalties.

The amount in settlements Florida investigators allege a former Progressive Insurance claims adjuster pocketed via a scheme in which she used claimants’ identities to submit fraudulent auto claims. Kiyuana R. Pasley, 41, of Homestead, was an adjuster at Progressive from 2019 to 2022. The Florida Department of Financial Services said in a news release that an investigation “revealed that Pasley hijacked up to 11 active claims without the knowledge of the insured.” She has been charged with fraud.

$10 Million

The amount E. Jean Carroll, the advice columnist who won a $5 million sexual abuse and defamation award against former President Donald Trump, is seeking in a court filing aiming to hold him liable for remarks he made after the verdict. The amended lawsuit was filed in New York City by Carroll’s lawyers, who said Trump “doubled down” on derogatory remarks about the former Elle magazine columnist during a cable television appearance a day after the $5 million verdict was handed down.

“Our first priority is helping consumers to understand their options for finding insurance with another company or the California FAIR Plan.”

— A California Department of Insurance (CDI) spokesperson said following State Farm’s late-May announcement that it was no longer writing new personal or business property/ casualty policies in California. The insurer cited increased risks from wildfires and inflation among its reasons for ceasing to write those types of policies in the state.

“The U.S. intelligence community assesses that China almost certainly is capable of launching cyberattacks that could disrupt critical infrastructure services within the United States, including against oil and gas pipelines and rail systems. … It’s vital for government and network defenders in the public to stay vigilant.”

— U.S. State Department spokesperson Matthew Miller said in a press briefing after the department warned that a Chinese cyber-espionage campaign had been aimed at military and government targets in the United States.

“There’s a lot of weight there, a lot of people there. … The average elevation in the southern part of the island is only 1 or 2 meters (3.2 or 6.5 feet) above sea level — it is very close to the waterline, and so it is a deep concern.”

— U.S. Geological Survey Lead Researcher Tom Parsons said new research shows New York City is slowly sinking under the weight of its skyscrapers, homes, asphalt and humanity itself. USGS research shows the city’s landmass is sinking at an average rate of 1 to 2 millimeters per year.

“The consequences are potentially disastrous. … You can’t balance a perceived labor shortage on the backs of teen workers.”

— Said Reid Maki, director of the Child Labor Coalition, which advocates against exploitative labor policies, about legislation in several states that would allow children as young as 14 to work in more hazardous occupations, longer hours on school nights and in expanded roles including serving alcohol in bars and restaurants. Wisconsin, Ohio and Iowa are actively considering relaxing child labor laws to address worker shortages, which are driving up wages and contributing to inflation.

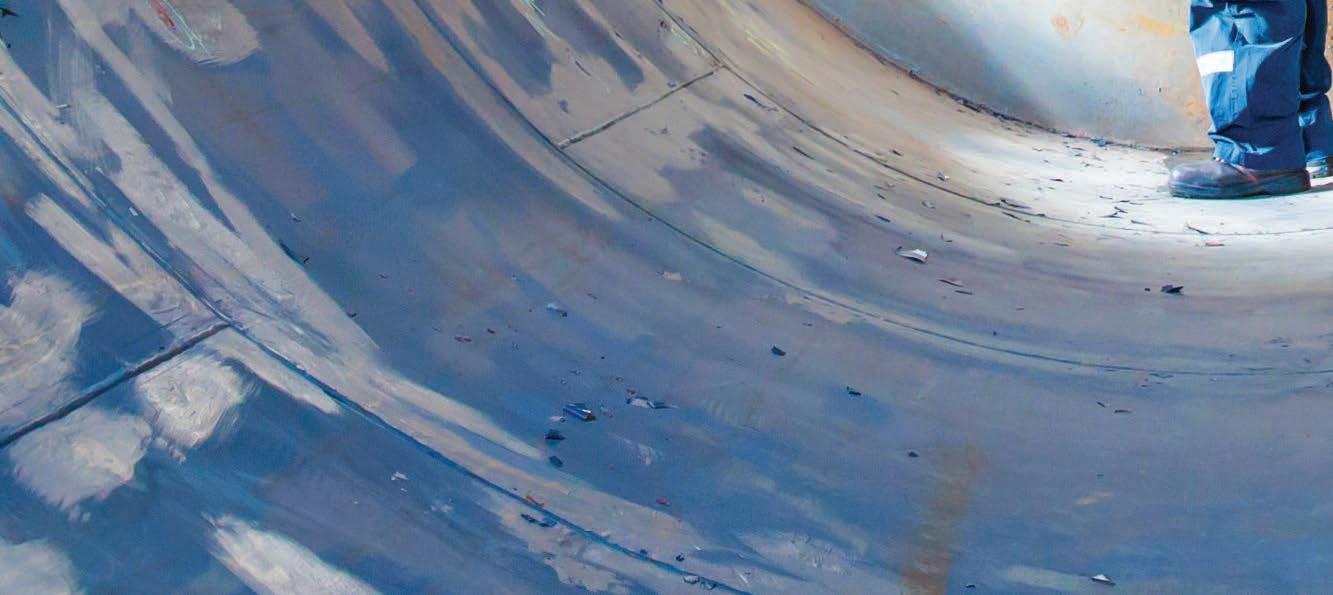

“We will be suing Marathon and the other entities for gross negligence over Higgins’ death. … Marathon put its profits over worker safety.”

— Houston attorney Tony Buzbee said regarding suits filed against Marathon Petroleum MPC.N. in relation to worker deaths and injuries at the company’s refineries in Texas. Scott Higgins, a 55-year-old machinist, was killed and two contract employees, including Eduardo Olivo, were injured in a fire at Marathon’s giant Galveston Bay Refinery in May. Higgins was the second worker to die at the Marathon refinery this year. A contractor was electrocuted on Feb. 28.

“There’s a lot of us like me that are displaced. Nowhere to go. … There’s a lot of homeless out here, a lot of people living in tents, a lot of people struggling.”

— Chef Michael Cellura, 58, of Fort Myers Beach, Florida, said of the many now homeless survivors of Hurricane Ian, the Category 5 hurricane that blasted the barrier island last September. At that time, Cellura had a restaurant job and a fancy new camper home on Fort Myers Beach. He now lives in his older Infiniti sedan with a 15-year-old long-haired chihuahua named Ginger. Like many others, he’s struggled to navigate insurance payouts, understand federal and state assistance bureaucracy and simply find a place to shower.

action. In March, the operator of tech job- search website Dice.com settled with the agency to end an investigation over allegations it was allowing job posters to exclude workers of U.S. national origin in favor of immigrants seeking work visas. To settle the case, the parent company, DHI Group, agreed to rewrite its programming to “scrape” for discriminatory language such as “H-1Bs Only,” a reference to a type of work visa.

By Matt O’BrienThe head of the U.S. agency charged with enforcing civil rights in the workplace says artificial intelligence-driven “bossware” tools that closely track the whereabouts, keystrokes and productivity of workers can also run afoul of discrimination laws.

Charlotte Burrows, chair of the Equal Employment Opportunity Commission, told The Associated Press that the agency is trying to educate employers and technology providers about their use of these surveillance tools as well as AI tools that streamline the work of evaluating job prospects.

And if they aren’t careful with say, draconian schedule-monitoring algorithms that penalize breaks for pregnant women or Muslims taking time to pray, or allowing faulty software to screen out graduates of women’s or historically Black colleges — they can’t blame AI when the EEOC comes calling.

“I’m not shy about using our enforcement authority when it’s necessary,” Burrows said. “We want to work with employers, but there’s certainly no exemption to the civil rights laws because you engage in discrimination some high-tech way.”

The federal agency recently released its latest set of guidance on the use of automated systems in employment decisions such as who to hire or promote. It explains how to interpret a key provision of the Civil Rights Act of 1964 known as Title VII that bars job discrimination based on race, color, national origin, religion or sex, which includes bias against gay, lesbian and transgender workers.

Burrows said one important example involves widely-used resumé screeners and whether or not they can produce a biased result if they are based on biased data. “What will happen is that there’s an algorithm that is looking for patterns that reflect patterns that it’s already familiar with,” she said. “It will be trained on data that comes from its existing employees. And if you have a non-diverse set of employees currently, you’re likely to end up with kicking out people inadvertently who don’t look like your current employees.”

Amazon, for instance, abandoned its own resume-scanning tool to recruit top talent after finding it favored men for technical roles — in part because it was comparing job candidates against the company’s own male-dominated tech workforce.

In some cases, the EEOC has taken

Much of the EEOC’s work involves investigating the complaints filed by employees who believe they were discriminated against. And while it’s hard for job applicants to know if a biased hiring tool resulted in them being denied a job, Burrows said there is “generally more awareness” among workers about the tools that are increasingly being used to monitor their productivity.

Those tools have ranged from radio frequency devices to track nurses, to monitoring the minute-by-minute tightly controlled schedule of warehouse workers and delivery drivers, to tracking keystrokes or computer mouse clicks as many office employees started working from home during the pandemic. Some might violate civil rights laws, depending on how they’re being used.

Burrows noted that the National Labor Relations Board is also looking at such AI tools. The NLRB sent a memo last year warning that overly intrusive surveillance and management tools can impair the rights of workers to communicate with each other about union activity or unsafe conditions.

“I think that the best approach there — I’m not saying not to use it, it’s not per se illegal — but is to really think what it is that employers are looking to measure and maybe measure that directly,” Burrows said. “If you’re trying to see if the work is getting done, maybe check that the work is getting done.”

Copyright 2023 Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.

Ryan Specialty has signed a definitive agreement to buy national wholesale broker Socius Insurance Services from Abry Partners, employees, and other shareholders.

Socius will become a part of RT Specialty, Ryan Specialty’s wholesale distribution specialty.

Terms of the transaction were not disclosed. It is expected to close in July.

Socius generated approximately $40 million in revenue for the 12 months ended April 30, 2023. The Northern Californiabased wholesaler has deep expertise in complex lines of business such as management, professional and cyber liability, as well as property/casualty insurance. Socius also has significant concentrations of top tier local talent in key hubs such as San Francisco, Miami, and Tampa, which will provide complementary scale and distribution capabilities to RT Specialty, according to Chicago-based Ryan Specialty.

W. R. Berkley Corporation has formed Berkley Specialty Excess to offer excess liability coverages in specialized markets, with an initial focus on the environmental and energy industries.

John Termini was named president of the new business.

Termini has nearly 30 years of experience in the property/casualty insurance market, with a focus in the environmental and energy sectors. He has held various executive and leadership positions, and most recently served as the head of the environmental and energy division of a global specialty (re)insurer.

Ohio Mutual Insurance Group, United Mutual Insurance

Ohio Mutual Insurance Group plans to merge Medford, Wisconsin-based United Mutual Insurance Co. as a subsidiary under Ohio Mutual’s mutual holding company structure.

The boards of directors for both organizations voted on May 17 to approve the transaction, subject to regulatory approval and a vote of United Mutual policyholders.

The transaction is expected to be completed in the third quarter of 2023.

Founded in 1878, United Mutual currently serves nearly 6,000 policyholders in North Central and Western Wisconsin through a network of nearly 40 independent agencies.

Ohio Mutual Insurance Group, founded in 1901 and based in Bucyrus, Ohio, partners with nearly 400 independent agencies to distribute property/casualty insurance products throughout Connecticut, Indiana, Maine, New Hampshire, Ohio, Rhode Island and Vermont.

Risk Strategies, a specialty insurance brokerage with national reach, has acquired Combined Underwriters of Miami, an independent agency that offers commercial and personal insurance and benefits products in south Florida.

Combined Underwriters of Miami has been around for 30 years, specializing in a range of commercial insurance for apartments, hotels, restaurants, shopping centers, warehouses, freight forwarding operations and more. Susana SanchezArmengol is president.

Risk Strategies has more than 100 offices across North America.

Terms of the acquisition deal were not disclosed.

Maury, Donnelly & Parr, a Marylandbased broker and risk consultant that’s almost 150 years old, has acquired CANUSA Insurance Services in Sarasota, Florida.

The merger marks a continued expansion by MDP, which acquired Connecticut-based Northeastern Underwriters in 2021.

CANUSA is headed by Charles Hosie, who has 35 years’ experience in personal

lines insurance. The office’s name and branding will remain the same.

MDP was founded in 1875 as a marine insurer for businesses using the Port of Baltimore.

Arthur J. Gallagher & Co., the global insurance brokerage and consulting firm, acquired Florida-based Insurance by Ken Brown Inc., a retail broker specializing in coverage for construction and swimming pool companies in the Southeastern United States.

Ken Brown, Derek Brown and the team will remain in their Altamonte Springs headquarters, under the direction of Peter Doyle, head of Gallagher’s Southeast retail property/casualty brokerage operations.

Gallagher, headquartered in Rolling Meadows, Illinois, operates in 130 countries.

Terms of the acquisition deal were not disclosed.

Arthur J. Gallagher & Co. also acquired Nashville-based Bernard Benefits, an employee benefits brokerage serving clients in Tennessee, Indiana and Texas.

Bernard, which focuses on small businesses, is a subsidiary of Bernard Health.

Bernard’s Brian Tolbert, Matt Kleymeyer and the team will remain in Nashville and will report to Robby White, head of Gallagher’s South Central region employee benefits consulting and brokerage operations.

Inszone Insurance Services acquired Specialty Contractors Insurance Services. Specialty Contractors Insurance Services has predominantly served business owners and contractors. It is headquartered in Sacramento, California.

Inszone is a national provider of benefits, and personal and commercial lines insurance.

Data from the first quarter of 2023 shows that the number of product recalls in the U.S. increased 14.2% from the previous quarter. According to Sedgwick brand protection’s latest U.S. product recall index report — which analyzes recall data from five key industries — this marks the highest single-quarter total in four years.

After a second consecutive record-breaking year for the number of units recalled in 2022, stakeholders have been watching closely to see whether that trend would continue into 2023. However, data from the first quarter of 2023 reveals that the number of recalled units fell 21.6% from the previous quarter and lags far behind the number that

had been recalled by this time in 2022. With three quarters in the year yet to be reported and regulatory and consumer scrutiny continuing to increase, there is still the possibility of a third consecutive year with over 1 billion recalled units. Released quarterly, Sedgwick’s industry-leading recall index report offers in-depth analysis of the latest product recall data, safety regulations, and key challenges for the automotive, consumer product, food and beverage, medical device, and pharmaceutical industries.

Automotive recalls increased 3.4% to 245 events. Electrical systems were the leading cause

with 48 events, followed by equipment with 46, and airbags with 17.

The consumer product industry recorded the most recalls in a single quarter since Q3 2015, with 94 events. The number of units recalled also increased significantly from the previous quarter, up 442.1% to 23.1 million units. Only one quarter in the last five years saw more units recalled.

While U.S. Food and Drug Administration (FDA) recalls increased 23.2% from the previous quarter to 117 events, the number of units impacted decreased 78.7% to 39.3 million. In contrast, the number of U.S. Department of Agriculture (USDA) recalls held steady at 11 events for the second consecutive quarter, even as

the number of pounds recalled increased 1,129% to 2.9 million. The number of medical device recalls increased 4.6% to 252 events. While manufacturing defects accounted for the greatest proportion of these (with 59), quality concerns were the leading cause in terms of units impacted, with 68.5 million or 82.3% of all recalled devices.

Q1 2023 marked the most pharmaceutical recalls in a single quarter in the past 18 years, with 144 events. The number of units impacted increased 1,071.8% to 49.5 million after an unusually low number of units were recalled in Q4 2022.

Projections

Technology advancements and increased adoption of

As demand for cyber insurance continues to grow, insurers must remain vigilant in managing the changing risk associated with the line of coverage.

According to DBRS Morningstar, while cyber insurance is a market opportunity for insurers, it also presents a different type of risk to manage, one that can be more difficult to value and price than most other insurance risks.

With artificial intelligence, cyberattacks will continue to evolve, meaning insurers will need to monitor and manage the risks accordingly. “The challenge arises in part due to the relative lack of com-

prehensive and credible data given the evolving nature of cyber crime, its potentially catastrophic nature as well as the high level of technical expertise necessary to correctly value this risk,” DBRS Morningstar said in a recent commentary. These challenges can be handled with “Appropriate policy terms and conditions and risk management measures that are effective in managing the volatility of the loss ratio and the containment of cyber-related losses are critical determinants in an insurers’ ability to manage underwriting cyber risk exposures.”

Reinsurance can assist in mitigating unexpected large losses, the commentary noted,

though the limited availability and cost could limit an insurer’s ability to increase its cyber market share.

As the line matures, it is expected that insurers offering the coverage will benefit from a revenue source with continual high demand and more stable profits. The latter will arise as a result of better claims experience data accrual, leading to more accurate pricing and stable loss ratios.

While loss ratios rose considerably between 2018 and 2020, improvements were seen in 2021 and are expected to continue in 2022.

The authors of the commentary, Komal Rizvi, vice president, Insurance, Global

Financial Institutions Group, and Marcos Alvarez SVP and global head, Insurance, Global Financial Institutions Group, expect more refined cyber coverage offerings, the result of a maturing market as well as a better understanding of claims drivers. Cyber policy evolution will occur more quickly than in other lines, mainly due to the evolving nature of cyber attacks.

Even so, there is the risk of constrained growth, given the high demand for cyber insurance coupled with a large cyber protection gap, the commentary noted.

“Cyber risk can be vulnerable to mispricing given that losses can fluctuate widely, and, in

electric vehicles (EVs) will push regulators to move quickly to ensure that vehicles equipped with the latest features are safe for the road. Manufacturers should be prepared for a slate of new regulations and guidance as regulators work to ensure vehicle safety.

The U.S. consumer product industry will see strict regulatory enforcement continue from both the Consumer Product Safety Commission (CPSC) and the Federal Trade Commission (FTC). The CPSC will likely continue its more public efforts to pursue remedies from manufacturers and its practice of issuing civil penalties.

Manufacturers will want to update their recall and communications plans to align with CPSC’s new, more aggressive enforcement strategy.

The FDA has outlined an

ambitious list of topics it will tackle in 2023 with draft or final guidance, including allergens, dietary supplements, food additives, topics related to the Food Safety Modernization Act (FSMA), and labeling. The infant formula industry is also on notice from the FDA, which issued a constituent update and sent a letter to stakeholders encouraging them to quickly improve their processes and implement the programs it outlined.

For the medical device industry, the FDA is focused on improving the supply chain and preventing shortages with a higher allocation for related programs in its draft budget

for FY2024. The FDA is also testing two pilot programs that implement digital solutions for new product submissions and enhancing stakeholder communications. Cybersecurity and protecting patients from cyber threats and their consequences will be top

of mind for the FDA and device manufacturers.

some cases, can be extremely high. The losses can be difficult to model and quantify given the wide scope of loss events involved, including the costs of reputational damage, compensation to any victims of the cyberattack, business interruption costs, and ransomware demands, to name a few,” the

report outlined.

Because cyber coverage offers insurers a source of income that isn’t correlated to catastrophic weather events, this could be beneficial to insurers that might have a substantial proportion of their business in the property insurance market.

Another benefit to insurers is the ability to offer ancillary services to cyber insurance customers, “such as access to professional advice, assessment of cyber security processes and procedures cur-

rently in place, and assistance in containing damage and preventing further fallout once a breach occurs.”

These services could be crucial to small to mid-size businesses that do not have the ability to source these services on their own.

One caveat remains, the potential for systematic, widespread losses in digital supply chains. This can be remedied, according to the report, by adequate diversification in the risk pool.

Mitigating risk through reinsurance, along with policy language clarity, and a disciplined underwriting process will be key to managing tail risk.

With the COVID-19 public health emergency now officially ended, pharmaceutical companies will need to be mindful of changes in drug distribution, clinical trials, and oversight that were granted during the pandemic. Cannabis and tobacco products will be another focus for the FDA, which has begun research on the medical uses of cannabidiol and proposed tighter regulations around the manufacture of tobacco products.

“As the number of recall events increase across industries, the risks to manufacturers grow more serious, with increased regulatory enforcement and a more publicized recall process,” said Chris Harvey, Sedgwick senior vice president of brand protection. “Regulators are working to prioritize product safety while balancing innovation with oversight — meaning manufacturers can expect to contend with new rules and regulations. Businesses will need to remain agile to keep pace with these changes and prepare for future ones.”

Kuhn is now senior vice president, management liability and head of large public at Ascot

John KuhnBased in the New York office, Kuhn will lead the development and execution of Ascot’s large public directors and officers (D&O) strategy, with a focus on underwriting and portfolio management through dual distribution channels.

He will also be responsible for recruiting and onboarding talent, implementing new processes and systems to enhance underwriting excellence and collaborating with business units across Ascot to facilitate effective partnerships and manage exposures.

Prior to joining Ascot, Kuhn was head of public D&O at AIG, where he spent nearly a decade in various financial-lines roles.

Sompo International named Risa Ryan as chief underwriting officer (CUO) and member of the executive team. Ryan is based in Florham Park, New Jersey.

In this newly created position, Ryan will create a collaborative global framework exhibiting best-in-class underwriting and pricing tools to ensure a consistent underwriting approach, delivering products and services that address the multinational needs of our clients.

Before Sompo, Ryan was global head of standard insurance products at Swiss Re. Prior to that, she was senior vice president, head of analytics North America at QBE.

Cowbell, a provider of cyber insurance to small- and medium-sized businesses, hired Matt Byrne as vice president of tech E&O underwriting.

Byrne has over eight years of underwriting experience in cyber and professional lines at traditional carriers and MGAs, supporting SMEs with up to multi-billion revenue risks. In addition to working on professional lines, Byrne has experience working on traditional property/casualty lines supporting larger programs.

He is based in the San Francisco Bay Area and is focused on retail and wholesale relationships across the U.S.

Conning named Matt Daly, head of the corporate and municipal bond teams, as the new head of Conning North America, effective September 30. The current head, Mike Haylon, will retire at the end of 2023.

Daly has over 25 years of industry experience, with more than 20 of those years at Conning.

Conning also named Cindy Beaulieu, chair of Conning’s investment policy committee, as chief investment officer of Conning North America, as of September 30. Beaulieu has over 29 years of industry experience and joined Conning in 2011.

Steve Searl, with 35 years of corporate bond research experience, and Mike Griffin, with 18 years of industry experience in portfolio management and trading, will serve as the new co-heads of the corporate and municipal teams.

East Lockton appointed Joe Caruso as its financial institu-

tions practice leader in the Northeast.

Caruso is based in New York, New York.

Caruso brings 30 years of experience to his new role, joining Lockton from Allianz Global Corporate & Specialty, where he served as regional head financial lines/ financial institutions. He also worked as financial institution industry practice leader at AIG and served at Marsh.

Lockton is headquartered in Kansas City, Missouri.

Frank Verdi joined Alliant Insurance Services as vice president within its employee benefits group. Based in Boston, Verdi will focus on strategic employee benefits for clients throughout the Northeast.

Verdi has 35 years of experience on both the carrier and brokerage sides of the business. Before joining Alliant, Verdi was area vice president for Gallagher.

Alliant is headquartered in Newport Beach, California.

Marsh McLennan Agency named Kate Moher president of national employee health and benefits.

Moher joined the White Plains, New York-based agency in 2018 as national employee health and benefits practice leader. She has 28 years of industry experience and previously served as chief executive officer at C2 Solutions and as national vice president broker strategy and development at UnitedHealth Group.

Harford Mutual Insurance

Group, headquartered in Bel Air, Maryland, named Jeffery Bischoff as assistant vice president of information technology.

Bischoff has 25 years of IT experience. Most recently, he held the position of technology solution manager in the policy platform department at American Family Insurance Group.

Previously, Bischoff held technical positions at Selective Insurance Group, Housing Authority Insurance Group, and Travelers Insurance before joining New London County Mutual Insurance in 2015 as assistant vice president of IT.

Insurance broker NFP has Josh Jeter as a senior vice president and aviation specialty practice leader in the company’s aviation industry group.

Jeter comes to NFP from Gallagher, where he served as area vice president in its aerospace practice. Before Gallagher, he served as an aviation underwriter specialist at Allianz Global Corporate & Specialty and as assistant manager of aviation and reinsurance at Ironshore Insurance Services.

NFP is headquartered in New York, New York.

The Hartford promoted Hayes Henderson to head of sales and relationship management for group benefits; appointed Karen Raftery head of a newly created business vertical in group benefits focused on small and mid-

sized employers; named Lynn Kennedy head of sales and distribution for small commercial; and appointed Paul Hiscox chief sales and underwriting officer for personal lines.

Henderson will be responsible for developing strategies to enhance The Hartford’s market position and drive profitable growth for group benefits. His appointment is effective July 1.

Most recently he served as regional vice president in the east region for group benefits sales and has more than two decades of group sales experience, including 15 years at The Hartford.

Raftery will lead the new group benefits vertical focused on providing employers with 2-499 employees competitive employee benefit and leave management solutions. Her appointment is effective July 1.

Raftery, who has 17 years of group sales experience at The Hartford, most recently served as regional vice president for the central region.

Kennedy is taking on an expanded role, which consolidates all small commercial sales under one leader. She will be responsible for leading all small commercial distribution channels, which include agency, alternative and direct, as well as the field and sales performance teams. Her appointment is effective June 1.

Kennedy joined The Hartford in 2006 and was most recently head of alternative distribution for small commercial.

Hiscox is also taking on an expanded role leading all personal lines distribution channels, including direct, agency, partnerships and The Hartford’s write-your-own flood program. In addition, he continues to lead personal lines

underwriting. His appointment is effective June 1.

Hiscox joined The Hartford in 2001 and was most recently head of underwriting and direct sales for personal lines.

Midwest

Lockton, in Kansas City, Missouri, hired Jason Sandler and Craig Taylor in its intangible asset and contingent liability practice, a division within its broader transaction liability practice.

Sandler and Taylor bring significant expertise in IP matters and associated credit and monetization strategies, including collateral protection insurance. They will advise clients on the placement of coverages that support the residual value of IP, in addition to working with Michael Perich, head of litigation insurance, on policies that provide support for IP-related disputes and litigations.

Sandler most recently served as a senior vice president at Marsh. Before that, he was an IP attorney at Cravath, Swaine & Moore.

Taylor most recently served as a senior vice president at Marsh. He has spent over a decade in the insurance industry.

Valley Insurance Agency Alliance promoted Amy Russell to lead Pod marketer and hired Michael Welch as commercial marketer.

Russell, who previously served as

marketing specialist and account manager, has more than 30 years of experience in the insurance and marketing industries. She pioneered VIAA’s Pod marketing program, a carrier rating platform that assists agents with obtaining the best quotes for commercial clients.

Welch has more than 35 years of insurance experience. Before joining VIAA, he worked in commercial marketing at various insurance agencies in the Northeast.

VIAA is headquartered in St. Louis, Missouri.

South Central

Stephens Insurance LLC, an affiliate of Stephens Inc., hired Chris Bettina as a senior vice president within the property and casualty practice.

Bettina brings nearly 15 years of experience in the insurance industry that spans global insurance and captive markets. He most recently served as a senior vice president at Arthur J. Gallagher & Co. Bettina is based in the Houston, Texas, office of Stephens Insurance.

Stephens Inc. is headquartered in Little Rock, Arkansas.

Southeast

Nashville-based Davies Group, a rapidly growing professional services and technology firm serving the insurance industry, named Jen Morrissey group chief operations officer. She will head up Davies’ global technology, mergers, procurement and real estate functions.

Morrissey was previously chief information officer with Unison Risk Advisors and was with Willis Towers Watson before that.

Mansukhani hired Rachel T. Velilla as a partner in the firm’s Los Angeles, Orange County and San Diego, California, offices.

She joins the firm’s insurance, trucking and transportation and commercial litigation practice groups.

Velilla represents individuals, corporations and self-insured entities in general liability matters, including premises, vehicle accident, trucking, transportation and common carrier liability.

The company is based in San Diego.

Venbrook Group LLC named Juan Aguilar chief financial officer.

Aguilar has 20 years of industry experience, most recently serving 15 years at Aon PLC, where he held leadership roles across finance, operations and business strategy and development.

Before Aon, he held senior finance roles at Abbott Laboratories.

Venbrook is headquartered in Woodland Hills, California.

Aihara & Associates Insurance Services named Mike Kinoshita executive vice president.

Kinoshita is a third-generation insurance agent and current senior client advisor at The J. Morey Company, an Ori-gen Family Company.

Aihara & Associates is based in Los Angeles

Increases in auto accident severity, attorney involvement and litigation, as well as recreational activities are driving claims in the personal umbrella space — and one expert believes their impacts will only accelerate into the future.

In a recent interview with Insurance Journal, Shannon Cragg, vice president of personal lines claims at Nationwide, encouraged agents to have holistic conversations with their clients to ensure all their assets are protected.

The market for personal umbrella is active and

competitive. The AM Best rate filings website shows most filings made have been to increase rates, according to Nationwide. The amount of the increase depends on the carrier and their current pricing levels; several carriers have been particularly active and aggressive in filing for rate.

Data shows automobile claim severity has been increasing for several years.

According to a LexisNexis Risk Solutions report, automotive claim severity for bodily injury and property damage increased by 35% since 2019, while collision claim severity

has jumped 40%. LexisNexis said bodily injury claims were 8% to 10% higher than the prior year, on top of a more volatile surge in 2021 that led to the total bodily injury claim cost increase of 35% since 2019.

In the years immediately after COVID-19 surfaced, “we didn’t see the lower-severity accidents, the commuting back and forth to work, what I would call the ‘bumper hits,’” Cragg explained. At the same time, though, Cragg said there has been an increase in driving speeds and riskiness.

Recent Nationwide research supports this. It shows dangerous driving behavior has not improved since last

year. Nationwide reports that 59% of Gen Z drivers admit to being more impatient on the road than they were a year ago — while 47% report driving faster and taking phone calls on a handheld device.

And that’s not all.

Thirty-eight percent of Gen Z consumers admitted to looking at their phone more frequently while behind the wheel; 34% of Gen Z drivers video chatted while driving and 24% of Gen Z and 23% of Millennials used or checked social media while driving.

Fifty-four percent of Americans admit they’ve driven more than 10 mph above the speed limit over the past

12 months. More than a third (35%) of vehicle passengers witnessed their driver texting while behind the wheel.

“The trends we’re seeing are not heading in the right direction,” said Beth Riczko, president, P&C Personal Lines at Nationwide. “This unnecessary multitasking behind the wheel is not worth the risk and drivers create danger for themselves, the passengers, others on the road, and even pedestrians.”

Cragg said nuclear verdicts and attorney representation are also on the rise.

According to the Institute for Legal Reform, “nuclear verdicts

are increasing in both amount and frequency.” The median nuclear verdict increased 27.5% between 2010 and 2019 — far outpacing inflation — and there was a clear upward trend in the frequency of nuclear verdicts over time.

“We’re seeing more attorney involvement,” Cragg said. “You’re seeing more increase of disputes, and then when you get a jury award, you’re getting these, kind of explosive awards, at times.”

Cragg believes this this appetite extends into libel, slander and defamation.

Numbers published by Risk Placement Services show that in 2022, awards from nuclear verdicts were more than $18 billion — compared to $9.1 billion in 2021 and $4.9 billion

in 2020. RPS reported that the most common losses were from auto claims, product liability, patent infringement, and, increasingly, in the construction space.

Cragg also sees more liability stemming from recreational activities, such as owning a boat or swimming pool or operating all-terrain vehicles.

“I think as those things are becoming more and more prevalent, it just becomes really important to make sure you’re protecting your entire portfolio,” she said when speaking about ATVs and sideby-side vehicles.

Understanding portfolios

and risks is key. Ensuring that clients understand bodily injury or property damage limits do not cap exposure is crucial. Cragg believes the challenges described here will continue to accelerate into the future.

She emphasized having proactive, holistic conversations with insureds.

“I think the challenges I just described are going to continue to accelerate at a faster pace,” Cragg said of the risks outlined in this story. “All of those things that I named — whether it’s medical costs, the tort responses — are outpacing inflation. And so from an industry perspective, how do you price appropriately for that? How do you help mitigate? How do you help inform?”

It seems almost weekly there is a story or two in the national headlines addressing gun violence in the U.S., and a recent Insurance Journal article indicated respondents of a survey thought insurance could have a role in firearm safety. It’s an interesting question, should insurance drive increased firearm safety?

Anyone with a degree of familiarity with the insurance industry might conclude that it’s possible. Insurance companies are famous (infamous?) for requiring that people and businesses take certain steps to mitigate the risks to their property and the risks of being sued by their friends and customers. You remember that time a friend of yours was

complaining because their insurance company told them to cut a tree away from their house so that limbs didn’t fall on it during a storm or when you had to call a client to tell them to implement a driver safety program for their business or risk losing coverage for their fleet of delivery trucks?

Let’s look at firearms from a risk management perspective and see if we can determine whether or not insurance can drive increased firearm safety. For our purposes, we are excluding firearms that people possess as a part of their career, including police, armed security officers, certain emergency medical personnel, and members of the military. Of course, all of these people could own firearms for personal use, so that would be included.

For many people, having a firearm is simply a fact of life. For others, it’s a foreign object, something they have never seen in person, let alone used and kept around. So, why do people have them?

Some people use their firearms for hunting. For some people, hunting is a family pastime. They went hunting with a father, grandfather, or someone else, and they do it because it helps them to connect with their past. For others, it’s a way of providing for their family. They hunt to eat or to provide other resources for their family.

Some people use firearms for sport. Some people call themselves sport hunters, but that’s not what we’re dealing with here. There are competitive shooting competitions where

shooters are judged based on different criteria, including how well they shoot in different conditions. You might know someone who competes in three-gun competitions, which is an event where competitors are required to shoot targets of different shapes and sizes using three different types of firearms — a shotgun, a rifle and a pistol.

Some people have firearms for personal protection. Some keep firearms in their home, others keep them at their workplace, and others carry firearms. For these people, a firearm is meant to protect people and property from harm. They may have firearms because of the type of business that they have, or because of where they live. That leads us to one more reason people have firearms.

Some people use firearms to commit crimes. They intend to use them to frighten people to comply with their demands or they intend to harm people. Whether the harm is in the fear of what might happen, or the use of the firearm to hurt people, these people are using them in ways that are counter to society in general and to individuals specifically.

We look at these in light of the original question and that is, can insurance drive increased firearm safety? That brings us to the question of how insurance policies cover firearms.

When it comes to firearms and insurance, we can look at them in two ways. First, as items of personal property, in which case, in general, firearms are covered just like other items of personal property. If you have a Homeowners’ policy based on the ISO Homeowners’ 3 – Special Form, there is a special limit of $3,000 for theft of firearms.

It is possible that some carriers may have other limitations on coverage for firearms as property, but we haven’t seen it, even when certain insurance companies made big news saying that they would severely restrict coverage for firearms on their policies.

When it comes to the liabilities surrounding firearms, that’s another story. Keep in mind the reasons that people have firearms include hunting, sport shooting, and for personal protection. Let’s look at three likely scenarios here.

A hunting accident. A hunter is out sitting in a tree

stand, waiting on the animal she’s hunting. She sees the animal near a tree on the opposite edge of a clearing. She takes aim and fires, missing the animal. That’s when she realizes that there was another hunter behind that tree. That hunter had made the sound that caused the animal to move at the last second and happened to have his leg sticking out in the line of fire. He was hit. He went to the hospital, has medical bills, and can’t go to work for a couple of weeks. How might the ISO HO-3 (03/22 edition) respond?

Coverage E – Personal Liability

If a claim is made or a “suit” is brought against an “insured” for damages because of “bodily injury” or “property damage” caused by an “occurrence” to which this coverage applies, we will:

1. Pay up to our limit of liability for the damages for which an “insured” is legally liable. Damages include prejudgment interest awarded against an “insured”; and

2. Provide a defense at our expense by counsel of our choice, even if the suit is groundless, false or fraudulent.

We may investigate and settle any claim or suit that we decide is appropriate. Our duty to settle or defend ends when our limit of liability for the “occurrence” has been exhausted by payment of a judgment or settlement. We aren’t taking the space to dig into the defined words. You can look them up for yourself. So far, we haven’t looked at any exclusions, so what we know so far is that bodily injury happened and that damages occurred because of the bodily injury. There is an exclusion,

however, that may be problematic.

Expected or Intended Injury

“Bodily injury” or “property damage” which is expected or intended by an “insured”, even if the resulting “bodily injury” or “property damage”:

1. Is of a different kind, quality or degree than initially expected or intended; or

2. Is sustained by a different person, entity or property than initially expected or intended.

You could make the argument that the hunter expected or intended to injure an animal and therefore this exclusion applies. The way it reads gives us the idea that since the shooter intended bodily injury to the animal, but bodily injury happened to someone else, this exclusion still applies.

I would attempt to make the argument that the context of the term bodily injury in the rest of the policy indicates the idea that a person was injured in some way and therefore the general meaning of the term should be interpreted to speak to bodily injury of persons, and since an animal isn’t a person, there was no expected or intended bodily injury and therefore it isn’t excluded.

Someone accidentally shoots themselves. We have all heard stories where someone picked up a firearm that didn’t belong to them, kids are playing around and find a firearm, or someone doesn’t realize that the firearm is loaded, and the end result of all of these situations is that someone gets shot. For the sake of this discussion, let’s set aside the irresponsibility of a firearm owner who fails to secure their

firearms or teach their children not to play with them.

This is one situation where the expected or intended injury does not apply. It’s truly an accidental situation. Someone was handling the firearm and for whatever reason didn’t realize that it was loaded and they pulled the trigger, injuring someone, possibly even themselves. This takes us back to the insuring agreement that tells us that there is coverage for bodily injury because of an occurrence that happened during the policy period.

A self-defense shooting. A business owner is in the office and hears glass breaking. He comes out of his office to see someone reaching their arm in through a broken window. The business owner has his handgun. When the person breaking in gets inside, he sees the business owner and brandishes his handgun at the business owner. The business owner then pulls his handgun and shoots the intruder, who later on files a suit for damages related to his injuries.

You might say that a person breaking into someone else’s business shouldn’t be able to sue for damages when they are injured, but things happen.

Let’s look at the business owner’s CGL policy (CG 00 01 04 13) to see how it might respond.

We will pay those sums that the insured becomes legally obligated to pay as damages because of “bodily injury” or “property damage” to which this insurance applies.

This is the insuring agreement for Coverage A – Bodily continued on page 24

continued from page 23

Injury

Again, for the sake of space, we will let you look up any definitions that you don’t already know. This is, of course, not the whole insuring agreement and you could look that up, too. It is important that so far, we have found the possibility of coverage for this event.

We need to look at the exclusions and if you’re a policy-reading person, you already know which exclusion we are going to bring up.

“Bodily injury” or “property damage” expected or intended from the standpoint of the insured. This exclusion does not apply to “bodily injury” resulting from the use of reasonable force to protect persons or property.

This exclusion is a little different but tells us essentially the same thing. If the insured intends to injure someone, this exclusion applies. There is an exception, which was in the homeowners’ policy, but relevant at that moment. If the insured is using reasonable force to protect persons or property, this bodily injury is not excluded. You could make the argument about what is considered reasonable in this instance, but for the sake of our conversation, let’s just consider what happened was a reasonable response.

It seems that the biggest reason that people want firearm owners to buy insurance on their firearms is to compensate someone else for what might happen with that firearm and

that seems fair on the surface. If an accident were to happen with that firearm, the owner could be seen as negligent and, in that event, there should be a mechanism to pay the damages related to it.

But when you consider that the bulk of firearm deaths don’t come from accidents, that changes the conversation. Most firearm deaths occur in the commission of a crime or by suicide, both of which are arguably intentional acts, or an expected or intended injury, and the unfortunate truth is that many insurance policies simply do not cover those activities.

If we then consider that most deaths related to firearms are in some way intentional, not accidental, that begs one more question.

We’ve already covered how many insurance policies might respond to claims related to bodily injury related to a firearm. But that doesn’t address whether or not insurance could be used to improve firearm safety, or if it should.

According to a study by Johns Hopkins Bloomberg School of Public Health Center for Gun Violence Solutions in 2020, they ranked ways that people were injured and ultimately died in 2020. The highest cause of death in this chart was by poisoning (overdose), and the second highest cause of death was through the use of firearms.

What is more relevant to our topic today, is that the fourth-highest ranked cause of death was by motor vehicle traffic and the numbers for

each are very close to one another (45,222 by firearm and 40,689 by vehicle accident). This seems instructive because some of the requirements being asked of firearm owners are similar to the requirements of vehicle owners.

Licenses. If you want to drive a vehicle in the United States, you need a valid driver’s license. We accept this because this is the law and has been for over 100 years in some parts of the country. In every state, there is an application to process, a written test, time spent driving as a learner, and a road test to make sure that the driver at least knows the rules of the road and the basics of the laws in that state.

Some states are working on laws that require all firearm owners to have a license to purchase and possess a firearm. Since these laws do not currently exist in all states, and many states have very different philosophies and laws around firearm licensing, we cannot comment on this, other than to say that it is possible that some might suggest that a license to own a firearm could or should exist.

Registration. When you purchase a car, motorcycle, or other vehicle, it has to be registered in your state. That’s the process where you either apply for registration at the car dealer, or you go to the motor vehicle office and get a license plate for your vehicle. Every vehicle needs to be registered.

There are those who say that the same thing needs to be done for firearms. When a person purchases a firearm, they could become the registered owner of that firearm and they will need to maintain the registration as long as they own

it. You might be wondering what all of this has to do with insurance. Don’t you remember the last time you went to the motor vehicle office to update your registration? Didn’t you have to provide proof of insurance?

Insurance. When you drive or own a motor vehicle, you are supposed to have insurance in most states. There is at least one state that does not require drivers to have insurance, but they do require drivers to show proof of financial responsibility that meets a state minimum amount, so basically for most people, you need insurance there, too. If a driver is pulled over for a traffic violation or there is an accident, one of the first things that anyone asks for is proof of insurance.

When it comes to firearms, a good risk management practice would be to have some kind of insurance in place. For most firearms owners, that insurance would likely be in the form of their homeowners’ insurance, just like anyone driving a car would have automobile insurance.

This brings us to one of the misconceptions about insurance that came out in the above-mentioned survey. Many of the respondents believe that firearms owners should have a separate policy for each firearm. That would be unnecessary because there isn’t a per firearm limit of liability on the homeowners’ policy. It’s an occurrence limit.

Think about auto insurance. Each automobile that a person or family owns has the same opportunity to be in an accident as every other automobile because the same people are driving all of the cars on the policy. There is no need to

purchase an auto policy per vehicle.

Let’s go back to the original question. Would insurance requirements help drive firearm safety? Consider this question in the light of automobiles. Everyone who drives is supposed to have a driver’s license, but according to one 2020 story, over 11 million people drive every day without a license because their license was suspended. The licensing requirement did not stop them from driving.

We are required to show proof of insurance to get a registration, but many people drive without insurance. According to the Insurance Research Council, 12.6% of drivers did not have insurance in 2019. Even when people do have insurance, there are millions of drivers who purchase the minimum insurance required in their state, so they do not have enough insurance to pay for the injuries that they could cause. The insurance requirement does not stop people from driving.

Rather than driving safety, an insurance requirement may only drive firearm sales into venues where purchasers do not have to show proof of insurance. Private firearm sales between individuals would be difficult to track and validate insurance coverage, just like a private automobile sale between two individuals is. Additionally, the insurance requirement may make firearm ownership more expensive for

people, which could drive them from making their purchases at the gun shop where they check for insurance.

Automobiles and firearms are not the same thing and we aren’t saying that they are. People drive a car if they need to get to work, if they need to take someone to a hospital, or for many other reasons. They say that they have to drive a car and it doesn’t matter to them that they don’t have a license, registration, or insurance. As long as they don’t get caught, nothing happens to them. This attitude could also be held by some people who feel the need to own a firearm. They may not care if they don’t have the proper licensing, registration, or insurance. They feel that they need it. They want it and they will get it. As long as nothing happens, nothing happens to them.

As we already discussed, there are no insurance policies available to handle the result if someone owns a firearm with the intent of harming other people or damaging people’s property. Therefore, adding an insurance requirement does not increase firearm safety.

The question then remains as to whether or not the insurance industry should be the driving force behind firearm safety. Insurance companies are limited by two major factors. Can they get their rules, rates, and policy forms approved by the states that they operate in? Will customers buy those policies?

It’s hard to pin down whether or not insurance companies should work to drive increased safety because the bulk of firearm related injuries are not necessarily accidental and therefore not the purview of

the insurance company.

An insurance company should be involved in firearm safety as much as they are involved in safety in general. If they are helping their insureds to avoid fires, offering hurricane season tips, or other ways to combat common property losses, it seems reasonable that they would be involved in firearms safety. If they aren’t working to reduce other kinds of losses, any involvement in the firearms debate seems like the company is simply trying to be seen as “on the right side” of an issue, which might be part of their marketing plan, but doesn’t help in the overall reduction or management of risk.

Market Detail: MBA Insurance offers programs for various rental vehicles. On the Powersports Program (motorcycle/ATV/ golf cart rentals), the rental operator pays a monthly premium for each unit insured on the policy and there is a two-vehicle minimum requirement to qualify for the program. For the renter to obtain insurance for the rental, they are required to purchase an addendum through MBA for $15 a day. On the Powersports Liability Only Program (scooter rentals), the rental operator pays a monthly premium for each unit insured on the policy and there is a three-vehicle minimum requirement to qualify for the program.

Available Limits: Not disclosed.

Carrier: Not disclosed.

States: Available in 45 states; not available in District of Columbia, Hawaii, Maryland, Massachusetts, New York, Virginia.

Contact: Carlos Avila; carlos@mbainsurance.net; 480-946-1066.

Market Detail: National Workman’s Comp Solutions offers coverage for hard to place workers’ compensation. Provides quote options for over 1,000 insurance agencies across the country. If you are having trouble securing quotes or considering the state fund, let us provide competitive options for your client companies. Insures all risk factors including: high hazard risks; roofing; staffing agencies; landscaping; high experience mods; general contractors and construction; high risk manufacturing; home health care; mold remediation/ asbestos and more.

Available Limits: Not disclosed.

Carrier: Not disclosed.

States: Available in 50 states plus District of Columbia.

Contact: Kyle Wilson; kyle@nationalwcs. com; 800-437-1009.

Market Detail: Boz Insurance Services Inc. is a managing general underwriter specializing in professional and general liability for long term care facilities — including but not limited to assisted living facilities,

adult residential facilities, adult family homes, group homes, RCFE’s, and skilled nursing facilities. Minimum premium as low as $1,200 (varies by license type); minimum deductible — $0. Available Limits: Not disclosed. Carrier: A+ Demotech rating. States: Arizona, California, Florida, Nevada, Oregon, Texas, Utah, Washington. Contact: Quinton Goss; quinton@bozinsurance.com; 805-472-4869.

Market Detail: RPS Signature Programs provides insurance for softball teams, players, coaches, umpires, camps, clinics and. General liability insurance coverage for USA Softball events: The USA Softball Tournament/Clinic Liability Insurance Plan provides protection for lawsuits and court judgments that may result from bodily injury and property damage claims arising out of USA Softball sanctioned tournament or clinic operations. The policy includes participants liability insurance, which is one of the most important aspects of liability coverage for sports organizations. Covered under the USA Softball policy: tournament or clinic organizers; tournament or clinic officials; participating teams or players; individual team members; field owners (as additional insureds, if requested); tournament or clinic sponsors. Accident medical insurance coverage for USA Softball event participants: Under the USA Softball Tournament/Clinic Accident Insurance Plan, coverage extends to covered injuries incurred by tournament participants while practicing or playing in tournament games. For clinics, coverage applies to participants while taking part in clinic activities at the designated clinic site. There is no coverage for travel or off-premises activities under this plan. This policy is written on an excess basis; the policy

is secondary over any other valid and collectible insurance or healthcare plan the insured may have. Insureds need to submit expenses to their healthcare plan first, for this policy to consider a claim. If no other coverage is in force, this policy will pay the claim as primary, subject to the deductible and other policy terms. The policy only covers medical and dental expenses, which are incurred during the benefit period (within 52 weeks of the date of injury). Tournaments and clinics must be USA Softball approved or USA Softball sanctioned by their local USA Softball Commissioner to be eligible for this insurance program. The enrollment form must be signed by a USA Softball Commissioner in order to bind coverage. Coverage goes into effect as of the date the tournament or clinic starts, provided that the enrollment form and full premium are received by RPS Signature Programs prior to the start date. General liability and accident insurance may be purchased separately or as a package. Coverage automatically extends to make-up dates caused by weather, but no refunds are allowed for this program. Has pen.

Available Limits: Accident medical — $250,000 per claim; accidental death — $5,000; accidental dismemberment — $10,000 principal sum; chiropractic and physical therapy — $2,500 ($100 per visit); durable medical equipment — $1,000; deductible per claim — $500 for youth/$500 for adults; 90/10 % coinsurance; 52-week benefit period.

Carrier: Markel Insurance Co., rated A by A.M. Best.

States: Available in 50 states plus District of Columbia.