TheCaribbeanstandsatadefiningmomentinitseconomicand

leadershipnarrative.Asglobalmarketsevolveandnew industriesemerge,theregioncontinuestodemonstrate remarkableresilience,strategicforesight,andarelentlesscommitment toprogress.The “10 Most Influential Caribbean Business Leaders of the Year 2025” celebratesthevisionarieswhoseimpactextendsbeyond organizationalsuccess—shapingnationaldevelopment,regional competitiveness,andtheglobalperceptionofCaribbeanenterprise.

Thisspecialeditionbringstotheforefrontleaderswhoarerewritingthe rulesofinnovation,sustainability,andinclusivegrowth.Theyrepresent adiversetapestryofsectors—finance,tourism,technology,energy, logistics,manufacturing,andsocialenterprise—yetshareonedefining trait:anunwaveringbeliefintheCaribbean’spotentialtolead,not follow Theirdecisionsinfluencenotjustboardrooms,butcommunities; notjusttoday’soutcomes,butthelong-termtrajectoryofentire markets.

Incuratingthislist,wesoughtleaderswhoexemplifystrategicclarity duringuncertainty,ethicalstewardshipinchallengingtimes,and transformativethinkingatamomentwhenagilityisparamount.Each honoreeembodiestheregion’suniqueblendofcreativity,cultural richness,andentrepreneurialdrive.Theyarenotmerelyrespondingto globalshifts—theyareproactivelybuildingtheframeworksthatwill definetheCaribbeaneconomyoftomorrow.

Theirjourneysremindusthatleadership,atitscore,isabout responsibility:topeople,topurpose,andtoprogress.Whether spearheadingdigitaltransformation,advancingsustainablebusiness models,expandingregionaltrade,orempoweringthenextgeneration oftalent,theseindividualsdemonstratewhatispossiblewhenambition alignswithaction.

Thisissuealsoreflectsabroadermessage—thattheCaribbeanisnota peripheralplayerbutadynamicforceintheglobalbusinesslandscape. Behindeveryinnovation,everyexpansionstrategy,andevery communityinitiativefeaturedhereisaleadercommittedtoelevating theregion’svoiceandshapingitsfuturewithintention.

Asyouexploretheirstories,mayyoufindinspirationintheirresilience, wisdomintheirexperiences,andconfidenceintheCaribbean’s continuedrise.Theleadersfeaturedinthiseditionexemplifywhatit meanstomovefrompotentialtoimpact—andtodosowithintegrity, vision,andpurpose.

Wearehonoredtopresentthe 10 Most Influential Caribbean Business Leaders of the Year 2025 Theirlegacyisalreadyunfolding,andtheir influencewillundoubtedlycontinuetoshapetheregionforyearsto come.

22

36

Defines Modern Leaders 16 30 26 38

THE STORIES WITHIN

Keith Davies

Modernizing the Bahamian Finance Industry

THE STORIES WITHIN

Shanika Roberts-Odle: Governing a Growth Through Failure

THE PRO PERSPECTIVE

Unlocking The Future A Comprehensive Overview of Generative AI Capabilities in Financial Services

THE PRO PERSPECTIVE

Cyber Insurance and Cyber Defence: Why One Does Not Work Without the Other

INDUSTRY INSIGHTS

Rethinking Leadership What the Next Decade Demands

INDUSTRY INSIGHTS

The Human Advantage Why Emotional Intelligence

Managing

Art

Business

Business

Digital

Co-designer

Marketing

Aparna Bhat COO

N/A

Denise Turnquest President Commonwealth Bank Ltd commbank.com.au

Keith Davies CEO

Kanoo Pays kanoopays.com

With exper�se in opera�onal excellence and team leadership, Aparna enables businesses to scale efficiently and deliver consistent, high-impact outcomes.

Denise is a dis�nguished financial leader known for driving opera�onal excellence, customer-centric innova�on, and sustainable growth.

With exper�se in financial technology, strategy, and customer experience, Keith leads Kanoo Pays’ mission to deliver secure, seamless, and accessible payment solu�ons for consumers and businesses.

Nicola Goldie Head of Na�onal Accounts

Virgin Money uk.virginmoney.com

Sam Stu�ard Sophos & Sales Account Execu�ve

Duxbury Networking duxbury.co.za

Sarah Zweifach Clinical Product Management Story Health storyhealth.com

Shanika Roberts-Odle CEO

Barbados Medicinal Cannabis Licensing Authority bmcla.bb

Suvi Ahlajärvi Development Director Orbis Oy orbis.fi/en

Sylvia Romm Founder Sonder Health sonderhealthplans.com

Tatum Ge�y General Partner

THENA Capital thenacapital.com

Nicola is a mul�ple award winning Leader and Mentor who is passionate about driving the best customer, colleague and shareholder outcomes.

Sam is a dedicated technology specialist focused on delivering advanced cybersecurity and networking solu�ons.

Sarah is focused on building virtual speciality care programs and services. She has also built both physician and pa�entfacing tools and experiences at healthcare companies.

Shanika Roberts-Odle is a transforma�onal leader shaping the future of the medicinal cannabis industry.

Suvi Ahlajärvi is the Development Director at Orbis Oy, where she drives strategic ini�a�ves and oversees the company’s development projects.

Sylvia Romm is the Founder and Chairperson of Sonder Health. With over 13 years of experience in the healthcare sector, she is passionate about providing quality solu�ons in the niche.

Tatum is an investor and MedTech enthusiast with a proven track record of transforming seed and growth-stage companies into global household brands.

Intheforward-lookingCaribbeanfinanceenvironment,

whereoldCaribbeanconcernsintersectwithnew Caribbeaninnovations,anewsetoftransformational leadersisemerging.Attheforefrontofthisemerging generationis ,Presidentof DeniseTurnquest CommonwealthBankLimited Withextensiveexperience inallaspectsoffinancialservices,includinglending, collectionsandoperations,sheisatourdeforce.

Acertifiedpublicaccountantandadistinguishedgraduate ofHarvardBusinessSchool’sProgramforLeadership Development,Denisehasacareerpredicatedupon a commitment to continuous development and implementation through concrete expertise.Hercommitmenttoeducation anddevelopment,reflectingherpledgetocontinued professionalandpersonaldevelopment,extendsfromher earlystudiesafterIveyBusinessSchoolatWestern Universitytoher2021designationasCharteredBanker, beingrecognizedbytheCharteredBankersProfessional Forum.

HerexperiencesduringtheHarvardBusinessSchool Programweretransformative,focusingonrecentbest practices,improvinganddevelopingthroughpersonalized coachingbyexceptionalprofessors,andengagingand sharingexperiencesandlearningwithpeerleadersfrom aroundtheworld.whichhasshapedherasaprofessional andtheremarkableleadershehasbecome.

Denise’scareerisamasterclassinleadershipandlearning, rootedinasolidfocusonfinanceandfinancialservices. Indeedherbackgroundmakesheroneofthemost experiencedandinfluentialleadersacrossthebusiness environmentintheCaribbean.

Denise’sjourneyisatestamenttothepowerofcontinuous learningandadaptability.Hercareer,whichshedescribesas having“donemyABCsinbanking”byworkingat American,British,Canadian,andCaribbeanbanks,ina seriesofprogressiverolesthatconsistentlyfacilitated growthanddevelopment.“I’vebeenreallyblessedtohave hadaprogressivecareer,alwaystakingontherolesthat addedresponsibilityandgavemeopportunitiesforgrowth,” shefeels.

ExperiencesoutsidetheBahamasincludingstudyingatthe IveySchoolofBusinessinCanadaandworkinginPuerto RicoandVenezuela,taughthershecould“keeppace, thrive,andinfactexcel”invariedcircumstancesandwith peoplefromallovertheworld.

Denise’sextensiveexperienceinvariedcircumstancesand withpeopleallovertheworldwasadefiningaspectofher career.Earlyon,inPuertoRico,sheunderwentcommercial credittrainingalongsidecolleaguesfromacrosstheregion. Asoneofthetopperformers,shewasselectedtoworkin Venezuela.ThoughshespokeverylittleSpanishatthetime, shequicklylearnedandmadestrongcontributions.

Shespentmostofherformativeyearshoningherskillsin commerciallending.UponjoiningCommonwealthBank, knownasaleaderinpersonallending,sheexpandedher expertisetobecomeequallyskilledinconsumerlending. HerprogressionatCommonwealthBankenabledherto assumerolesoutsideoflending,includingoperations, humanresourcesandinformationtechnology.Shealso gainedcriticalexperienceindelinquencymanagement,a keysuccessfactorforanypersonallendinginstitution. TakingonthesediverserolesexposedDenisetovirtuallyall functionsanduniquelypreparedherfortheBank’s presidency

Deniseattributesmuchofhersuccesstotwoimpactful mentors.One,whomshedescribesassomewhatofa perfectionistwithveryhighstandards,taughtheravaluable lesson:“Ifyoucometomewithaproblem,you’dbetterbe recommendingasolution.”Thismantraforcedhertothink criticallyandpushedherbeyondbeingdependentonothers foranswers,tocomeupwithrecommendations,andto addressproblemswithwellthought-outsolutions.

Today,shepushesherteamtothinkbeyondtheirroles, preparingthemforhigher-levelresponsibilities.

ExecutiveleadershipprogramsatbothIveyandHarvard BusinessSchoolalsoshapedher.Bothinstitutionsusethe casestudymethod,whichallowedhertocollaboratewitha diversegroupofpeers-sharingandgainingnewinsights. Thisapproach,shesays,taughtherto“considerand understanddifferentperspectivesonaparticularissueand then...makethebestdecisionforallconcerned.”

Also,forDenise,resilienceandadaptabilityarenotjust buzzwords;theyaretheveryprinciplesthathaveguided herremarkablecareer.Shebelievesthatself-inspirationis key,asexternalvalidationorpromotionsmaynotalways come.

“You shouldn’t feel entitled because you ’ re a woman, but you should be entitled because you are the best person for the job.”

“I have set very high standards for myself, and I work to those standards.”

“Ihavesetveryhighstandardsformyself,andIworkto thosestandards,”shesays.Sheadvisesothers,particularly women,tonever“worktorule”outofdisappointment.This mindset,shesays,onlyconfirmsanydoubtsothersmight have.Instead,sheseesfailuresasopportunitiestolearnand grow,notasanendtotheroad.Shelooksbackat challengingsituationsandasksherself,“WhatcouldIhave donedifferently?”Thisself-critical,learning-oriented approachhasallowedhertokeepmovingforward.

Whenitcomestoencouragingyoungerwomen,Denise believesinleadingbyexample.“ItrytomodelwhatI’m teaching,”shestates.Apowerfultoolinherleadership arsenalishumility.Sheshareswithherteamthatshehas takenonrolesinthepastwhereshe“reallydidn’tknow anythingabouttheareabutcommittedtolearningquickly” Bybeingvulnerableandopentolearningfromthosewith moreexperience,sheearnsrespectandtherightto recommendandmakechanges.

Shealsoembodiesastrongworkethic.Knownforbeing thelastonetoleavethebankintheevening,shelaughsas sheshareshersecret:sheisnotamorningpersonanduses thatquiettimetofocus.Peopleappreciateheraccessibility andherwillingnesstoputinthetimeandeffort.Sheknows thebank“insideandout”becauseshehasworkedside-bysidewithherteam.Sheencourageseverymemberofher teamtoalwaysgivetheirbest,becauseeverythingtheydo addsabuildingblocktotheirreputation.“Ifsomeoneasks youtodosomethingandyou’renotableorpreparedtogive ityourbest,tellthemsorry,Ican’tdoit,”sheadvises,a powerfulmessageforaspiringleaders.

Denisehasakeenunderstandingofhowherpast experienceshavepreparedherforthelarge-scaleprojects sheisleadingtodayatCommonwealthBank.Shepointsto twoongoinginitiativesasthemosttransformative:

Thetechnologytransformation,now2.5yearsin,began withstrengtheningthe“foundationofthehouse.”By migratingallsystemstocloudtechnology,upgradingthe bank’snetworkandWi-Ficapabilities,andreplacingand upgradingoutdatedequipmentandsoftware,theBankis moreresilient,moreefficientandabletoservecustomers betterandmorecreatively.Deniseisparticularlyproudthat CommonwealthBank,alocalbank,leapfroggedglobal giantslikeScotiabankandRoyalBanktobecomethefirst bankintheBahamasandtheregiontoofferApplePay

Herearlierexperiencetaughtherthatwhilebeingasmall, localinstitutionmeanstheydon’thavethedeeppocketsof globalbanks,theycouldprogressusingadifferentstrategy Historically,thebank’sapproachwastolagbehindand adopttechnologyonlywhen“allthekinkshavebeen workedout”–purchasingthebestinclassatthattime. However,now,shesays,cloudtechnologyandSoftwareas aService(SaaS)havemadeadvancedtechnologymore affordable.Thisnewapproachallowsherteamtobemore aggressiveandforward-thinking,reshapingthecustomer experienceandthefutureofbankingintheregion.

Thesecondmajortransformationisashiftinthebank’s culture.For65years,CommonwealthBankoperatedasa family-styleinstitutionwhereleadershipatthetopdrove decisionmaking.Nowanalmost$2billionbank,this modelisnolongersustainable.

Deniseisleadingaculturalshifttowardownershipand accountability,movingawayfroma“leadertellsyouwhat todo”mentalitytoonewhereemployeesareempoweredto takeownershipoftheirwork.

Sheexplainsthatinthepast,anerrormightbehandledwith agentle,family-stylecorrection.Butsheispushingfora moreefficientandaccountablemodel.“Ineedyouto understandwhatyourjobrequires,andIneedyoutodo yourjobproperly,”shesays,emphasizingthattheBank willprovidethetrainingandsupportneededfor professionaldevelopmentandsuccess.

Thischangeisfocusedonfiveculturalpillars:customer centricity,commitmenttoemployees,transparency, innovation,andownershipandaccountability.Byfocusing onthesepillars,Deniseisnotonlymodernizingthebank’s operationsbutalsobuildingamoretechnologically empoweredandcollaborativeworkforcereadytofaceand overcomefuturechallengesandtodeliversustainedgrowth andinnovation.

UnderDenise’sleadership,postCovid,Commonwealth Bankhasdeliveredverystrongfinancialandresilient resultsrepresentingthethreebestannualresultsinthe Bank’shistory TheseresultsshowhowtheBank’sfocuson technology,cultureandcustomerservicehastranslatedinto measurablevalueforbothshareholdersandcustomers.

Denise’scareerhasbeenaboutmorethanjustbreaking barriers;it’saboutensuringthatthepathremainsopenfor thosewhofollow.Shesharedthatshedidn’tfullygraspthe significanceofbeingthefirstfemalepresidentof CommonwealthBankuntilshewasappointed.Shesawitas thenextlogicalstepinherprogression,aresultofherhard work.Butwhatshedidn’trealizewastheprofoundimpact itwouldhaveonotherwomen.Peopleshedidn’tknow reachedouttoher,expressingtheirprideandcallingit anotherglassceilingbroken.

Thisrealizationbroughtwithitatremendoussenseof responsibility.Asshereflectedonherdiscussionswithher country’sfemaleGovernorGeneralandthefirstfemale PoliceCommissioner,sheunderstoodherdutytoperformat thehighestlevel.“It’saresponsibilitytodowell,sothat youcontinuetopavetheway,”sheexplains.Sheneverset outtobeatrailblazer,butherrelentlesspursuitof excellencehasmadeherone.

“If you come to me with a problem, you'd better be recommending a solution.”

Shewantstobearolemodelforherdaughterandher daughter’sfriends;someonetheycanlookuptoandwho inspiresthemtobelievethattheycanachievewhateverthey aspiretobe.Thekey,shesays,isto“putintheworkand continuemovingforwardandnotbesidetrackedbyeither mistakesorfailures.Butjustkeeppressingforward,keep pickingyourselfbackup,andkeepmovingforward–learningthelessonsasyougotoavoidmakingthesame mistaketwice.”

Whenaskedaboutherlegacy,Denise’sanswergoesbeyond personalachievement.“It’snotsomuchwhatIhave achieved,butwhatIamdoingtodaytoposition CommonwealthBanktocontinuetobetheleaderin personalbankingintheBahamas.”Sheisstrivingtoleavea legacyofexcellenceandinnovationwhichpositionsthe bankforcontinuedgrowthanddevelopment.

Asatrailblazerforwomeninfinance,Deniseadvocatesfor work-lifebalanceandmutualsupport.Sherecallstimesin hercareerwhenshehadtopullbacktobethereforher youngdaughter,achoiceforwhichshefeltwassometimes judged–eventhoughshewasonlypullingbackto“regular workinghours”.Shewantstonormalizethisforother women.Herlegacyisalsobuiltontheimpactshehason individuals.Sherecentlyreceivedarequestforareference fromsomeonesheworkedwith20yearsago,amoment thatmadeherstopandreflect.“IguessIdidmakea difference20yearsago,”shemuses,atestamenttoher quiet,yetprofound,influence.

Deniseisaleaderknownforinspiringotherstobetheir best.Shepushesforaculturewhereindividuals“earnthe righttomovetothenextlevel.”Herpowerfulfinalmessage toaspiringleadersisthis:“Youshouldn’tfeelentitled becauseyou’reawoman,butyoushouldbeentitled becauseyouarethebestpersonforthejob.”Inthenext phaseofhercareer,Denisewillundoubtedlycontinueto inspireotherstogivetheirbestandtobepatient,knowing thatifyoukeepgivingyourall,successwillcomewhenit’s supposedto.

“DuringthisperiodofsuccessattheBank,Iamfortunateto bepartofahigh-performingteam,supportedby professionalbankingstaff–allBahamian.Ourfortunesare shared–werisetogether.”

On a Mission to Position The Bahamas as a Global Leader in Digital Currency!

TheBahamas,likemanysmallislandnations,facesa

uniquechallengeintherapidlygrowingworldof finance:howtomodernizeitsfinancial infrastructurewhilemaintainingeconomicsovereigntyand improvingthelivesofitscitizens.MeetKeithDavies, CEOofKanooPays,avisionaryleaderwhohasmadeit hislife'smissiontosolvethiscomplexpuzzle.

Keith,aveteranintheBahamianfinancialindustry,has devotedhisexpertisetotransformingthenation'sfinancial framework.Hiseffortsaredrivenbyacommitmentto preservingeconomicindependenceandimprovingthewellbeingoftheBahamianpeople.

AsCEOofKanoo,hehasledtheintegrationofthenation's firstCentralBankDigitalCurrency(CBDC)-enabled paymentservicesintothecompany'splatform.Byworking closelywiththeCentralBankofTheBahamasandother financialinstitutionsfromthestart,thisinitiativeis revolutionizinghowBahamiansmanagetheirfinances, contributingtoamoreinclusiveandprogressiveeconomic landscape.

Thisgroundbreakinginitiativeisjustthelatestinhislong careeroffinancialinnovation.Fordecades,hehasbeenthe drivingforcebehindTheBahamas'financialevolution.His fingerprintscanbefoundonvirtuallyeverymajor developmentinthecountry'sfinancialsector,fromcrafting theregulationsthatgovernthesecuritiesindustryto buildingthenation'sstockexchange.

Keith'sjourneyisanexampleofhiscommitmentto progress.Hehasbeeninstrumentalindevelopingthe

As a leader, you must sometimes make unpopular decisions to protect the future of the business, staying true to the principles that guide you. This commitment helps you navigate tough choices, knowing it's for the greater good.

clearingandsettlementsystemsforcapitalmarketsand creatingthegovernment'stradingplatform.Eachstepofhis careerhasbeenmarkedbyadedicationtopushing boundariesandembracingnewtechnologies.

Butit'shisworkwithKanoothattrulyshowcaseshisvision forthefuture.ByembracingCBDCtechnology,he'snot justkeepingTheBahamasrelevantintheglobalfinancial conversation;he'spositioningthecountryasapotential leaderinthedigitalcurrencyspace.Thismovecouldhave far-reachingimplications,notonlyforTheBahamasbutfor smallnationsworldwidegrapplingwithsimilarchallenges.

Forhim,thisisn'tjustabouttechnologicaladvancementor keepingupwithglobaltrends.Attheheartofhisworkisa deep-seateddesiretoimprovethelivesofhisfellow Bahamians.Heseesfinancialinnovationasameanstoan end—awaytocreatemoreopportunities,increasefinancial inclusion,andboosteconomicgrowthinhishomeland.

AsKanoocontinuestorolloutitsinnovativepayment solutions,theeyesofthefinancialworldareonThe Bahamas.WithKeithatthehelm,thissmallislandnationis poisedtomakeabigsplashinthefutureoffinance.His blendofregulatoryexpertise,innovativespirit,and commitmenttosocialgoodmakeshimauniquefigurein theworldoffinance.

Davies'storyisapowerfulreminderthat,withtheright leadershipandvision,eventhemostdauntingchallenges canbecomeopportunitiesforgroundbreakinginnovation.

AsTheBahamasstepsintothespotlightoftheglobal financialstage,itdoessowithaleaderwhounderstands thattrueprogressismeasurednotjustintechnological advancementsbutinthepositiveimpactonpeople'slives.

Below are the interview highlights:

Pleasetellusaboutyourselfandwhatinspiredyouto jointhissector.

Mycareerisatestamenttomypassionforinnovationand growth.I'veplayedapivotalroleinshapingtheregulations thathavepropelledthesecuritiesindustryandThe Bahamas'StockExchangetotheircurrentreputablestatus. I'vealsomadesignificantcontributionsbybuildingour capitalmarketsclearingandsettlementsystems,and creatingthegovernment'stradingplatform.Ialsolaunched thefirstCentralBankDigitalCurrency(CBDC)-enabled paymentserviceproviderinthecountry

Theinspirationcamefromtheopportunitytoworkon transformativeprojectsthatimprovethelivesof

Bahamians.Itwasanaturalprogressionformetotakeon thesechallengesandgivemybesttoachieveourgoals.

Canyougiveourreadersaninsightintoyourcompany anditsinceptionstory?

Kanooisadigitalpaymentserviceproviderlicensedbythe CentralBankofTheBahamas.Ourdigitalwalletallows merchantsandconsumerstotransactdigitallybasedonthe corevaluesofsecurity,prosperity,empowerment,and convenience.

Ourinceptionbeganwhenourchairman,NicholasRees, introducedmetoatechnologycontactin2016or2017.We quicklystarteddiscussingwhatwecouldachieveandbegan developingaprojectplan.NicholasandIworkedclosely, puttingtogetherthepiecestobringKanootolife.Since then,we'vebeenworkinghandinglove,andtherestis history.

Whatmotivatesyoutoleadandinspireyourteam towardsachievingbusinessgoals?

Asaservantleader,Imeasuremysuccessbythesuccessof thoseinmycharge.Itakeresponsibilitywhenthingsgo wrongandupliftmyteamwhenthingsgoright.Myfocusis onlearningandimprovement,encouragingmyteamtosee mistakesasopportunitiesforgrowth.It'saboutcontinuous progressandhelpingothersrecognizeandachievetheir potential.Ifindjoyinseeingotherssucceedandexceed theirownexpectations.

Howdoyoubalanceshort-termsuccesswithlong-term success?

Inthisbusinessandmanyothers,it'samarathon,nota sprint.Whilequickeruptionsofenergyaresometimes needed,it'sessentialtofocusonyourultimategoaland workbackwardfromthere.Balancingshort-termsuccess withlong-termsustainabilityrequiresconsistent,positive steps.Short-termwinsandlossesarelessimportantthan maintainingsteadyprogress.Failuresarepartofthe learningprocess,andrecognizingfleetingopportunitiesis crucial.Stayinggroundedandunderstandingbothshorttermandlong-termgoalsiskeytoasuccessfulbusiness strategy

Canyoushareasignificantchallengeyouhavefacedas abusinessleaderandhowyouovercameit?

Ihadtopivotastrugglingbusinessmodelearlyinmy careerafterraisingsubstantialcapital.Duetovarious misstepsanduncontrollablefactors,wefacedfinancial trouble.Ihadtoquicklychangeourcorebusiness

At Kanoo, we aim to move at the speed of life, whether walking, jogging, or running, providing tools that make life easier. ,,

elements—staff,practices,products,services,and technology—tomakeitwork.

Myprioritywasensuringmyteam'ssuccess,helpingthem findnewpositions,andtakingcareofthem.Thisapproach paidoff,asformeremployeescontinuedtosupportthe business.

Overcomingthischallengerequiredhardwork,dedication, focus,andtheabilitytopivot.Iimplementedalong-term, goal-orientedplan,stayingfocuseddespitethenormal businesscycle’supsanddowns.

Howdoyoufosterapositiveandinclusivework environmentinyourorganization?

Leadershipsetsthetoneforanorganization.Ifleadersaren't positiveandinclusive,itaffectseveryone.Ibelievein practicingwhatIpreach,alwayslookingforthebestinmy team,andneverblamingthemforhonestmistakes.Aslong assomethingisn'tintentionallyillegalorharmful,Iseeitas ajobwelldone.Idemonstratethisthroughmyworkethic andexpectthesamefrommyexecutives,ensuringthatit permeatestheorganization.

Whatroledoesinnovationplayinyourbusiness's growthandsuccess?

Innovationdrivesourbusinessgrowthandsuccess.In fintech,wesolveproblemsbyprovidingwhatpeoplewant, notwhatwethinktheyneed,andbyapproachingtheminan invitingway Wemeetpeoplewheretheyareandguide themtowheretheywanttobe.

AtKanoo,weaimtomoveatthespeedoflife,whether walking,jogging,orrunning,providingtoolsthatmakelife easier.Innovationiscrucial,soweconstantlythinkabout what’snextandhowtoimprove.Ourgoalistooffer solutionsthatpeoplefindessentialandcan'tdowithout.

Howdoyouadaptyourleadershipstyletodifferent personalitiesandworkstyleswithinyourteam?

Iinsistonhiringpeoplesmarterthanmewithdifferent personalitiesandleadershipstyles.Bringingindiverse perspectivespreventsfailureandpromotesgrowth.InThe Bahamas,wecomparethistoamixedconchsalad,whichis deliciousbecauseofitsvariety.

Wewantteammemberstoembracechange,bescrappy, shakethingsup,andthinkoutsidethebox.Myleadership styleiswelcomingandencouragesindividuality,allowing

ideasfromtheleftfieldtothrive.Thisapproachmakesusa strongerorganization.

Canyoudiscussatimewhenyouhadtomakeadifficult decisionasabusinessleaderandwhatfactorsinfluenced yourdecision-makingprocess?

Ioncehadtomakethedifficultdecisiontoscaledown operationsatacompanyIwasleading.Althoughitwas hardtosendpeoplehome,Iunderstoodthatthebusiness neededtosurvivetoeventuallygrowandhelpmorepeople. Ibalancedbusinessneedswithpersonalcare,ensuringthat employeesweresupportedastheytransitionedaway Asaleader,youmustsometimesmakeunpopulardecisions toprotectthefutureofthebusiness,stayingtruetothe principlesthatguideyou.Thiscommitmenthelpsyou navigatetoughchoices,knowingit'sforthegreatergood.

Whatdoyoumeasuretomeasurethesuccessofyour business,andwhatmetricsdoyoufocuson?

Inbusiness,theprimarygoalisprofit.AsCEO,myroleis tosafeguardapositivereturnoninvestmentforour investorsandshareholders.Achievingthisrequiresgood businesspractices,corporategovernance,anddeliveringa high-qualityproductatacompetitivecost.Ourproduct mustbesleek,scalable,andmeetmarketneeds.Wealso needaskilled,motivatedteam.Byfocusingonthese elements,weaimtogenerateprofitanddrivebusiness growth.

Whatadvicewouldyougivetoaspiringbusinessesthat wanttomakeapositiveimpactintheirindustry?

Goodworkcanbehard,butworkingsmartiskey Working foryourselfmeanslonger,harderhours,butit'srewarding whenyoureffortsbenefityoudirectly.Focusanddiscipline areessential.Yourvisionisunique,andnoteveryonewill seeitrightaway Youmustclearlycommunicateyour visiontootherssotheycanadoptandsupportit.

AtKanoo,we'recommittedtogivingpeoplethe'Powerto Prosper'.WhenItalktobusinessesaboutbecoming merchants,theyquicklygraspandfeelourvision. Manyhavetoldme,"I'msold.Iwanttobepartofthis," withinminutes.Thisemotionalconnectionmakesiteasy forthemtojoinus.Whenpeoplearesoldonyourvision, deliveringservicesbecomeseffortless,astheyareeagerto bepartofwhatyou'redoing.

GenerativeAI,whichisabranchofartificial

intelligence,pertainstoalgorithmsthatareableto createnewcontent,data,orinsightsderivedfrom existinginformation.Thistechnologyleveragesdeep learningmodelstounderstandpatterns,predictoutcomes, andcreatesolutionsthatcansignificantlyenhancevarious industries,includingfinancialservices.Inrecentyears,the surgeofgenerativeAIapplicationshastransformedthe landscapeoffinance,offeringinnovativetoolstoaddress complexchallengesandimproveoperationalefficiencies.

ThesignificanceofAIinthefinancialindustrycannotbe emphasizedenough.Asfinancialinstitutionscontinueto navigateanincreasinglycompetitiveandregulated environment,theyareturningtoAI-drivensolutionsto enhancedecision-making,mitigaterisks,anddeliver superiorcustomerexperiences.Fromriskmanagementto personalizedservices,thecapabilitiesofgenerativeAIare reshapinghowfinancialservicesoperate,makingthem moreagileandresponsivetomarketdemands.

Thisarticleprovidesacomprehensiveoverviewofthe capabilitiesofgenerativeAIinfinancialservices.Wewill explorekeyareassuchasriskmanagementandfraud detection,enhancedcustomerexperience,andoperational efficiencyandcostreduction.Eachsectionwillhighlight thetransformativepotentialofgenerativeAI,showcasing itsabilitytorevolutionizetraditionalprocessesandprepare financialinstitutionsforthefuture.Byunderstandingthese applications,stakeholderscanbetterappreciatethevalue generativeAIbringstothefinancialsectorandthe implicationsforitsongoingevolution.

Inthefinancialservicessector,managingriskanddetecting fraudarecriticaltomaintainingstabilityandtrust. GenerativeAIoffersinnovativesolutionstoenhancethese

areas,providingfinancialinstitutionswithpowerfultoolsto analyzedata,predictpotentialrisks,andidentifyfraudulent activities.

Predictiveanalytics,poweredbygenerativeAI,allows financialinstitutionstoassessriskbyanalyzingvast amountsofhistoricaldataandidentifyingpatternsthatmay indicatefutureoutcomes.Byleveragingmachinelearning algorithms,organizationscanbuildmodelsthatpredict creditrisk,marketfluctuations,andotherfinancial vulnerabilitieswithgreateraccuracy.Thisproactive approachenablesinstitutionstomitigaterisksbeforethey materialize,ensuringamoreresilientfinancialenvironment.

Forinstance,bankscanutilizegenerativeAItoassessloan applicationsinreal-time,analyzingapplicantdataand behaviorpatternstopredictdefaultrisk.Thisnotonly streamlinesthelendingprocessbutalsoenhancesthebank's abilitytomakeinformeddecisions,ultimatelyleadingto reducedlossesandimprovedprofitability.

Fraudulentactionsfrequentlyappearasirregularitiesin transactionpatterns.GenerativeAIcansignificantly improvethedetectionoftheseirregularitiesthrough advancedanomalydetectiontechniques.Bycontinuously monitoringtransactionsandapplyingmachinelearning algorithms,AIsystemscanidentifyunusualbehaviorsthat mayindicatefraudulentactions,suchasunauthorized accountaccessorsuspicioustransactionamounts.

Thesesystemsarecapableofadaptingandlearningfrom freshdata,whichenhancestheireffectivenessprogressively overtime.Forexample,ifausertypicallymakessmall purchasesbutsuddenlyattemptstowithdrawalargesumof money,generativeAIcanflagthistransactionforfurther

investigation.Thiscapabilitynotonlyenhancessecurityfor consumersbutalsoprotectsfinancialinstitutionsfrom potentiallossesassociatedwithfraud.

Compliancewithregulatoryrequirementsisasignificant challengeforfinancialinstitutions,oftenrequiring extensiveresourcesandmanualoversight.GenerativeAI canstreamlinecompliancemonitoringbyautomatingthe analysisofregulatoryframeworksandensuringadherence tolegalstandards.AIsystemscancontinuouslyscan transactions,communications,andbusinesspractices, identifyingareasthatmayposecompliancerisks.

Moreover,generativeAIcanfacilitatethecreationof detailedcompliancereports,allowinginstitutionsto demonstrateaccountabilitytoregulatorsefficiently.By automatingtheseprocesses,financialorganizationscan reducetheburdenofcompliancewhileminimizingtherisk ofregulatorypenaltiesandenhancingoveralloperational efficiency

Insummary,theintegrationofgenerativeAIinrisk managementandfrauddetectionrepresentsa transformativestepforfinancialservices.Byharnessing predictiveanalytics,anomalydetection,andautomated compliancemonitoring,institutionscansignificantly enhancetheirabilitytomanagerisksandsafeguardagainst fraudulentactivities.Asthetechnologycontinuestoevolve, itspotentialtorevolutionizeriskmanagementpracticesin thefinancialsectorwillonlygrow.

Inanerawherecustomerexpectationsarecontinually evolving,financialinstitutionsareincreasinglyturningto generativeAItoenhancetheoverallcustomerexperience. Byleveragingadvancedalgorithmsandmachinelearning techniques,theseinstitutionscanofferpersonalized services,timelysupport,andimprovedinteraction,thereby fosteringstrongerrelationshipswiththeirclients.

GenerativeAIplaysapivotalroleindelivering personalizedfinancialadvicetailoredtoindividualclient needs.Byanalyzingvastamountsofdata,including transactionalhistory,spendingpatterns,andrisktolerance, AIsystemscangeneratecustomizedrecommendationsfor investmentstrategies,savingsplans,andbudgetingtips.

Thislevelofpersonalizationnotonlyempowersclientsto makeinformedfinancialdecisionsbutalsohelpsfinancial institutionsbuildtrustandloyalty Asclientsreceiveadvice thatcloselyalignswiththeiruniquefinancialsituations, theyaremorelikelytoengagewiththeirfinancialservice providersandremainsatisfiedinthelongterm.

Theimplementationofchatbotsandvirtualassistants poweredbygenerativeAIrepresentsasignificantleapin customerserviceforfinancialinstitutions.TheseAI-driven toolsareavailable24/7,providingclientswithimmediate assistanceforawiderangeofinquiries,fromaccount balancestoloanapplications.Byemployingnatural languageprocessing(NLP),thesechatbotsareableto comprehendandreplytocustomerinquiriesina conversationalway,ensuringthatinteractionsappearmore human-like.Furthermore,theycanlearnfrompast interactions,continuouslyimprovingtheirresponsesand enhancingtheuserexperience.Asaresult,clientsbenefit fromquickerresolutiontimesandreducedwaitperiods, leadingtohighersatisfactionrates.

GenerativeAInotonlyimprovescustomerinteractions throughchatbotsbutalsoenhancesreal-timesupport capabilities.FinancialinstitutionscanutilizeAItoanalyze customerinteractionsacrossvariouschannels—suchas phonecalls,emails,andchatapplications—toprovide timelyandeffectiveresolutions.Forexample,AIsystems canidentifycommonqueriesandautomaticallygenerate responsesorsolutions,streamliningthesupportprocess. Additionally,bypredictingclientneedsbasedonprevious interactions,AIcanproactivelyreachouttocustomerswith relevantinformationorassistance,ensuringthattheyfeel valuedandcaredfor Thisproactiveapproachtocustomer supportnotonlyenhancestheexperiencebutalsofosters strongerrelationshipsbetweenclientsandfinancial institutions.

Inconclusion,theintegrationofgenerativeAIinenhancing customerexperienceistransforminghowfinancialservices operate.Byofferingpersonalizedfinancialadvice,utilizing chatbotsandvirtualassistants,andprovidingreal-time support,financialinstitutionscansignificantlyimprove customersatisfactionandloyalty.Astechnologycontinues toevolve,thepotentialforevenmoreinnovativesolutions toenhancecustomerexperienceisboundless.

Inthefast-pacedworldoffinancialservices,operational efficiencyandcostreductionhavebecomeparamount. GenerativeAIpresentsatransformativeopportunityfor financialinstitutionstostreamlinetheirprocesses,minimize expenses,andenhanceoverallproductivity.Thissection delvesintothreekeyareaswheregenerativeAIismakinga significantimpact:streamliningback-officeprocesses, automatingroutinetasks,andoptimizingresourcesthrough AIinsights.

Back-officeoperationsarecriticaltothesmoothfunctioning offinancialinstitutionsbutofteninvolverepetitiveand time-consumingtasks.GenerativeAIcansignificantly streamlinetheseprocessesbyautomatingdataentry, reconciliation,andreportingtasks.Forinstance,AI algorithmscananalyzelargevolumesofdata,identify discrepancies,andgeneratereportsinreal-time,reducing theneedformanualintervention.Thisnotonlyaccelerates theworkflowbutalsominimizeshumanerror,leadingto moreaccuratefinancialrecordsandcompliancewith regulatoryrequirements.

Moreover,AI-driventoolscanfacilitateseamless integrationacrossvarioussystemswithinanorganization, enablingbetterdataflowandcommunication.Bybreaking downsilos,financialinstitutionscanachievegreater operationalcohesion,ultimatelyenhancingservicedelivery andresponsivenesstomarketchanges.

Routinetasksinfinancialservices,suchastransaction processing,accountmanagement,andcustomerinquiries, canconsumesubstantialtimeandresources.GenerativeAI enablestheautomationofthesetasksthroughadvanced machinelearningalgorithmsandnaturallanguage processing.Forexample,AIcanmanagetransaction approvalsbyanalyzingpatternsandmakingdecisions basedonpredefinedcriteria,significantlyspeedingup processingtimes.

Furthermore,AI-poweredsolutionscanhandlecustomer inquiriesthroughchatbotsandvirtualassistants,providing instantresponsesandfreeinguphumanemployeestofocus onmorecomplexissues.Thisautomationnotonlyreduces laborcostsbutalsoenhancesemployeesatisfactionby allowingstafftoengageinmoremeaningful,high-value work.

OneofthemostcompellingadvantagesofgenerativeAIin financialservicesisitsabilitytoprovideactionableinsights thatdriveresourceoptimization.Byanalyzinghistorical dataandreal-timemarkettrends,AIcanidentify inefficienciesandsuggestimprovementsinresource allocation.Forexample,AIcanhelpfinancialinstitutions determinetheoptimalstaffinglevelsneededtomeet demandduringpeaktimes,thusavoidingoverstaffing duringquieterperiods.

Additionally,AIcanenhancedecision-makingprocessesby providingpredictiveanalyticsthatforecastsfuturetrends andcustomerbehaviors.Thisforesightallowsfinancial institutionstoallocateresourcesmoreeffectively,ensuring theyarewell-preparedforupcomingchallengesand opportunities.

Insummary,generativeAIisrevolutionizingoperational efficiencywithinfinancialservicesbystreamliningbackofficeprocesses,automatingroutinetasks,andoptimizing resourceallocation.Theseadvancementsnotonlydrivecost reductionsbutalsoempowerfinancialinstitutionstoadapt

swiftlytoadynamicmarketplace,ultimatelypositioning themforsustainedsuccess.

Aswehaveexploredthroughoutthisarticle,generativeAI ispoisedtorevolutionizethefinancialservicessectorby providingenhancedcapabilitiesacrossvariousdomains, includingriskmanagement,customerexperience,and operationalefficiency.TheintegrationofAItechnologies allowsfinancialinstitutionstoleveragevastamountsof datatomakeinformeddecisions,optimizeprocesses,and improveclientinteractions.

ThebenefitsofgenerativeAIinfinancialservicesare multifaceted.Firstly,itenhancesriskmanagementthrough predictiveanalyticsandanomalydetection,enabling organizationstoidentifypotentialthreatsandmitigaterisks effectively.Secondly,AI-drivensolutionsimprovecustomer experiencebyofferingpersonalizedfinancialadviceand facilitatingreal-timesupportthroughchatbotsandvirtual assistants.Finally,theautomationofback-officeprocesses androutinetasksleadstosignificantcostreductionsand improvedresourcemanagement,thusallowingfinancial institutionstofocusonstrategicinitiatives.

Despitethepromisingadvantages,theadoptionof generativeAIinfinancecomeswithchallengesthatmustbe addressed.Dataprivacyandsecurityareparamount,asthe handlingofsensitivefinancialinformationrequires stringentsafeguardstopreventbreaches.Additionally,bias inAIalgorithmscanleadtounfairtreatmentofcertain customersegments,necessitatingtheimplementationof ethicalguidelinesandoversight.Financialinstitutionsmust alsonavigateregulatorycomplexities,ensuringcompliance whileinnovatingthroughAItechnologies.

Lookingahead,thefutureofgenerativeAIinfinancial servicesismarkedbyseveraltrendspoisedtoshapethe industry.AsAItechnologiescontinuetoevolve,wecan expectenhancedpredictivecapabilitiesthatwillallowfor moreaccuratefinancialforecastingandriskassessment. Furthermore,theintegrationofAIwithotheremerging technologies,suchasblockchainandquantumcomputing, promisestocreatemoresecureandefficientfinancial

ecosystems.ThedemandfortransparencyandethicalAI usewilllikelydrivethedevelopmentofframeworksand standardstogovernAIdeploymentinfinance.

Inconclusion,generativeAIholdsthepotentialto transformthefinancialserviceslandscapebydriving innovation,improvingefficiencies,andenhancingcustomer satisfaction.Asfinancialinstitutionsembracethese advancedtechnologies,theymustalsoremaincognizantof thechallengesahead,ensuringthattheirAIstrategiesalign withethicalstandardsandregulatoryrequirements.The journeytowardamoreAI-drivenfinancialfutureisjust beginning,andthosewhoadaptproactivelywill undoubtedlyleadthewayinthisneweraoffinancial services.

1. Brynjolfsson,E.,&McAfee,A.(2014).*TheSecond MachineAge:Work,Progress,andProsperityina TimeofBrilliantTechnologies*.W W.Norton& Company

2. Chui,M.,Manyika,J.,&Miremadi,M.(2016). "Wheremachinescouldreplacehumans—andwhere theycan’t(yet)."McKinseyQuarterly.Retrievedfrom [McKinsey.com](https://www.mckinsey.com)

3. Deloitte.(2021)."GenerativeAIintheFinancial ServicesIndustry."Retrievedfrom[Deloitte.com] (https://www.deloitte.com)

4. KPMG.(2020)."ArtificialIntelligenceinFinancial Services:TheNewFrontier."Retrievedfrom [KPMG.com](https://home.kpmg)

5. PwC.(2022)."AIinFinancialServices:TheFutureof Banking."Retrievedfrom[PwC.com] (https://www.pwc.com)

6. Narayanan,A.,&Chen,Y.(2023)."AIandtheFuture ofRiskManagementinFinancialServices."*Journal ofFinancialTechnology*,5(2),45-59.

7. Accenture.(2021)."HowAIisTransformingthe FinancialServicesIndustry."Retrievedfrom [Accenture.com](https://www.accenture.com)

8. McKinsey&Company.(2022)."TheStateofAIin FinancialServices."Retrievedfrom[McKinsey.com] (https://www.mckinsey.com)

9. WorldEconomicForum.(2020)."TheFutureof FinancialServices:HowAIischangingtheindustry." Retrievedfrom[WEForum.org] (https://www.weforum.org)

10. Gartner.(2023)."TopStrategicTechnologyTrendsin FinancialServices."Retrievedfrom[Gartner.com] (https://www.gartner.com)

Leadership,asitwasgloballyunderstood,is changingradically The20th-centurystyle-which washeavilydependentonhierarchy,control,and logicalthinking-isbeingreplacedbyamoreflexible, democratic,andresponsivemanner.Wearenotevena decadeintothenewerathatischaracterizedbydisrupting technologies,climatechangecrisis,changingofpower amongthenations,andtheredefinitionofwork,andyetit isalreadyveryclearthatleadershipconceptsofthepast cannotbeusedtosolvetheproblemsofthefuture.The leadersoftomorrowmustbedifferentleaderssuchasthose thatleadtheirfollowersnotwithpower,butwithpurpose; notthroughauthority,butthroughauthenticity;andnotby commandingothers,butbyconnectingwiththem.

Leadershipwasformostpartofthelastcenturyconsidered afunctionofpower—establishingdirection,preservinglaw, andincreasingproductivity.Leaderswhocould successfullybringaboutthestructuresandforeseethe outcomeswereviewedasthemosteffective.However,the worldisnolongerthesame.Amongothers,thepaceof innovation,theriseofremotecollaboration,andthe increasingexpectationsofpurpose-drivenemployeeshave changedthecontextinwhichleadershipworks.

Controlwillnotbeasignofaleader'sstrengthinthe comingyears;instead,adaptabilitywillbe.Leaderswhoare abletohandletheunclearsituationwiththeircomposure, stilltalkduringthemadness,andrallypeopleeventhough thingsareuncertainwillbeconsideredtop-notch.Theywill gaintheiridentitynotfromthedegreetowhichtheycontrol butfromtheextentthattheyenable.

Leaderswhorepresentvaluesbiggerthanmoneywillbethe maincharactersofthefollowingtenyears.Astheconsumer marketbecomesmoresociallyconsciousandtheloyaltyof employeesisaffectedbyit,companiescannotanymore allowthemselvestoseparatebusinesssuccessfromthe positiveimpactonsociety Thoseleaderswhowillremain afloataretheonesfindingthematchbetweentheirvision andtheirvalues—thatis,leaderswhonotonlytalkbutalso intheirverycoreintegratesustainability,ethics,and inclusionintheirdecision-making.

Purpose-drivenleadershipwillnotjustbeaphraseflaunted onbanners,butratheranactualplanofaction.Itwillbean absolutenecessityforexecutivestospelloutdirections beyondnumberswhytheirbusinessesexistandwhatthey dotohelptheworld.Thus,theywillnotonlymaketheir employeesenthusiasticbutalsoprovidetheirorganizations withstabilityandendurance.

Inthefollowingyears,artificialintelligence,automation, anddigitalecosystemswillbethemajorrevolutionsofthe industriesandthewayjobsarearranged.Nevertheless,the biggestleadershipissueinparallelwiththetechnological progresswillbetokeepthehumansideofit.Theleadersof thenextdecademustbalancetechnologicalintelligence withemotionalintelligence.Moreover,theyoughttoview technotasasevererbetweenhumanbondsbutratherasa promoterofthemandthusactaccordingly

Suchameasurebetweenthetwospherescallsfornotonly insightbutalsomoralprinciples.Executivesaretheonesto

taketheresponsibilitytomakeinnovationstheservantof mankind,notviceversa.Theyshouldproceedwitha“yes” tothequestion“Canwedoit?”onlyifprecededbya “shouldwe?”.Thefuturemanagers’legacywillbethose whowillbeabletohumanizetechnologicalmeans—who can,throughtechnology,hastencreativity,inclusiveness, andempathyinsteadoflettingthemwearaway.

Theleaderoftomorrowisaconnectorratherthana commander;abuilderoftrustratherthanasystems manager Theyleadthroughempathy,theyactwith integrity,andwhentheythink,theythink"withoutany limits".Theyperceiveriskasawindowforsuccessand inclusionastheirpower.

Rethinkingleadershipinvolveschangingthementalpicture oftheworldthatrequiresleaderstohavecourage, compassion,andconsciousness.Thenexttenyearswillbe

theonesoftheleaderswhoknowthatleadershipisnot aboutbeingontopbutratheramong.Moreover,itisnot aboutleadingthechange—itmeansbeingthechange.

Eventually,thosewhoarefutureleaderswillnotbethe oneswhocraveformorepowerbutratherthosewhoseek forpurpose.

Theupcomingdecadewillforciblyrequireleaderswith suchcharacteristicsasfar-sightedness,deepempathy,and bravedecision-makingskills.Theseleadersareableto simplifycomplexityandconversely,seeitasan opportunity Theywillnotonlyseethevalueoftheirvision butalsocreateit.Thequoteaboutleadershipnowneedinga rethinkistheveryonethattellsusthatwearenotonly gettingreadyforthefuturebutwearealsoshapingit.

We'veallheardthesaying"failfast"intheworld

ofstartupsandinnovation.Theideaistomove quickly,takecalculatedandinnovation.The ideaistomovequickly,takecalculatedrisks,andif somethingdoesn'twork,failquicklysoyoucanpivotand tryanewapproach.Whilefailingisneverfun,thereis wisdominthismindsetoffailingfasttolearnand forward. move

Thought Leadership Piece by Sam Stuttard, Account Manager at Duxbury Networking

CybercrimeinSouthAfricaisescalatingatan

alarmingrate.AccordingtothelatestSophosreport oncyberinsuranceandcyberdefences,90%of organisationsthatexperiencedransomwareattacksin2024 hadcyberinsurance.Thatmightsoundreassuring—until youconsiderthatnearlyhalf(47%)oforganisationswith cyberinsurancehadpartoftheirclaimdenied,highlighting howincompletecyberdefencescanimpactpayouts.

Thisstatisticpointstoacriticalreality:cyberinsurance aloneisnotasafetynet.Toqualifyforapolicy—andmore importantly,tobenefitfromitwhenanincidentoccurs— organisationsmusthavetherightsecurityfoundationsin place.AsDuxburyNetworking,theSouthAfrican distributorofSophossolutions,wehaveseenhowessential itistotreatcyberinsuranceandcyberdefenceastwosides ofthesamecoin.

Cyberinsurancehasbecomeahottopicinboardrooms, especiallyfollowinghigh-profilebreachesandransomware attacksinrecentyears.Thepremiseissimple:acyber insurancepolicyhelpscoverthecostsassociatedwith recoveringfromabreach,includinglegalfees,forensic investigation,customernotification,andevenransom paymentsincertaincases.

Butrealityisfarmorecomplex.InSophos’s2024global research,97%oforganisationswhopurchasedacyber

insurancepolicysaidthattheyinvestedinimprovingtheir defencestooptimisetheirinsuranceposition.Almosttwothirds(64%)investedintheircyberdefences.Theseinclude multi-factorauthentication(MFA),regularpatch management,endpointprotection,andactive monitoring—allofwhichmustbeprovableandoperational atthetimeofclaim.

Thatmeansapolicyisnotjustacheckbox;itisthe outcomeofacomprehensivecyberdefencestrategy.

Today’sinsurersarehighlyselectivewhenitcomesto underwritingcyberrisk.Theyassessthestrengthofan organisation’sdefencesbeforesettingpremiumsor providingcoverage.Sophosdatashowsthatorganisations withstrongcybersecurityposturesarefarmorelikelyto receivefullcoverageandfasterpayouts.Incontrast, businesseswithoutdatedsystems,poorvisibility,or fragmentedsecuritytoolsfaceexclusions,higher deductibles,oroutrightdenial.

ThisisespeciallyrelevantforSouthAfricanSMEsthatmay assumecyberinsurancewill“coverthegaps”intheir defences.Inpractice,insurersarenowdemandingevidence ofcontinuousmonitoring,threatdetectionandresponse capabilities,andclearlydefinedincidentresponseplans.

OneofthereasonswehavepartneredwithSophosisthat theirsolutionsaredesignedwithcyberinsurance

requirementsinmind.ThroughtheSophosCentral platform,organisationsgainunifiedvisibilityintotheir network,endpoints,cloudworkloads,andmore—all backedbyAI-poweredthreatdetectionandresponse.

SophosManagedDetectionandResponse(MDR)has becomeacrucialenablerformanySouthAfrican businesses.Notonlydoesitprovide24/7monitoringand rapidresponsetoactivethreats,butitalsocreatesauditreadylogsandproofofcompliance—somethinginsurers increasinglyrequireduringinvestigations.

Sophosalsooffersguidedincidentresponseservicestohelp organisationsnavigatethepost-attackchaos.Thisincludes real-timesupport,forensicanalysis,rootcause identification,andrecommendationstoclosegaps—exactly whatunderwritersarelookingforwhenassessingriskand validatingclaims.

Whileinsuranceisasmartinvestment,itshouldnever becomeareasontodeprioritiseproactivedefence.Apolicy doesnotstopanattack—itsimplyhelpscoverthecosts afterthefact.Sophosfoundthatorganisationswithboth cyberinsuranceandMDRexperiencedalowerimpactfrom ransomwareattacks,includingshorterrecoverytimesand lowertotalcostofdamage.

Inotherwords,thecombinationofstrongdefencesand financialprotectionleadstothebestoutcomes.

TheSouthAfricanthreatlandscapeisbecomingmore complex,especiallywithincreasingregulatorypressure aroundPOPIAcompliance,risingransomwareincidents, andthecyberskillshortageimpactinglocalbusinesses.For thisreason,webelieveorganisationsmusttakeastrategic viewofcyberrisk.

Askyourself:isyourcurrentsecurityposturestrongenough topassaninsurer’sscrutiny?Doyouhavevisibilityacross yourendpoints,networks,andusers?Areyourstafftrained todetectphishingorsocialengineeringattacks?

Iftheanswerisno—oreven“I’mnotsure”—thennowis thetimetoreassessyourapproach.Cyberinsurancemay playaroleinyourrecoveryplan,butitmustsitatopa foundationoflayered,intelligent,andactivelymanaged defences.

AtDuxburyNetworking,weworkcloselywithourpartners tohelpthemachievethatbalance.WithSophosasour technologypartner,weareproudtooffernotjustworldclasstools,buttheguidanceandsupportbusinessesneedto strengthentheirresilience. Becauseincybersecurity,coveragestartslongbeforethe policy.

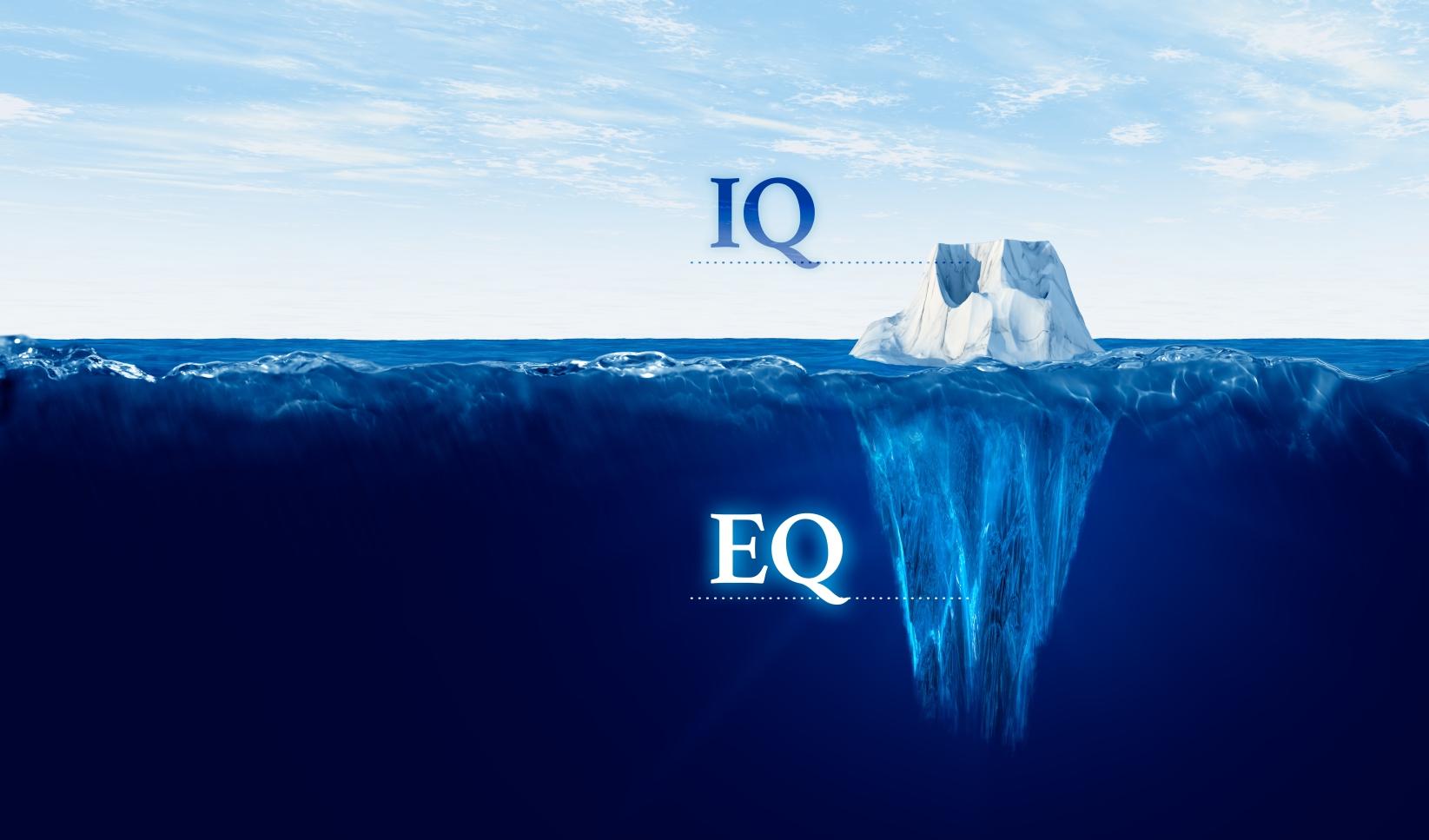

IWhynatimewheretheworldseemstoberuledby algorithms,automation,andartificialintelligence,the notionthatleadershipisaboutdominatingsystems, data,andtechnologyisquiteappealing.Nevertheless,the onefactthatremainsafterthedigitalrevolutionisthat emotionalintelligenceiswhatseparatesgreatleadersfrom goodones,nottechnicalexpertise.Nextleadership generationwillnotrequireknowingmorebutfeelingmore. Thehumanadvantage,toitsultimate,isintheabilityto relateto,understand,andmotivateothers.

Foralongtime,successfulleadershipwasjudgedbythe mentalcapacity,thestrategicthinking,andtheskilllevelof theleader.Insucharole,leadershadtorapidlythink throughasituation,makeadecisionquickly,andcarryout thetaskwithouterror.However,aslargerorganizations tendtobecomemorecomplicatedandtheworkplacesmore multicultural,anentirelydifferenttypeofintelligencehas comeoutontopasthemostimportantone—emotional intelligence(EQ).

EQincludestheskillsofidentifying,understanding,and dealingwiththepersonalemotions,aswellasdetectingand influencingtheemotionsofotherpeople.Withit,leadership canturnfromatransactionaltoarelationalone.SmartIQ maycreatethestrategy,butstrongEQunitespeoplesothat theycanbringitintoactionwithenthusiasmandasenseof purpose.

Intheworldweliveinwheremosttasksareautomated,the leader’sadvantageisnotbeingmoreefficient—itisbeing moreempathetic.Machinesarecapableofperforming calculations,analysis,andevenmakingpredictions,but theyarenotcapableofestablishingconnections,giving comfort,orinspiring.These,still,remainashuman qualities.

Atitsheart,leadershipisamatterofemotion.Peopledonot followleadersbecauseoftheirtitles—rather,theyfollow leaderstheytrust.Theyarenotstraitjacketedbythe strategiesoftheleaders—theycommittothosemaking themfeelvalued,understood,andrespected.Emotional intelligenceequipsleaderstoconvertthisgapfromcontrol totrustintoexperiencefrombeinganauthoritytosharing authenticity.

Understandingoneselfiswhatconstitutesthebasisofthis skill.Leaderswhoareawareoftheirownemotionshave thecapacitytocontrolthemratherthanbeundertheir power.Theyactfromtheircontrolinsteadoftheir reactivity.Theveryactofthisself-controladdstoone's credibility,especiallyindifficultsituationswherecalmand confidencearemostrequired.

Theinnersideofemotionalintelligence,ontheotherhand, empathy,isalsoverypowerfulinitseffect.Itprovidesthe abilitytounderstandothers’viewpoint,todetectthe unspoken,andtousenotonlylogicbutalsocompassionin leading.Bydoingso,theyprovideaplatformwhere everyonecanopenlyparticipate,voicetheiropinion,and developthemselves.

Modern-daycompaniesnotonlyrequireawell-thought-out strategy,butalsodependheavilyontheirculture.Culture eventuallyisaveryemotionalthing.Cultureisinfluenced bythepeople'swayoffeeling,notonlybytheirwayof functioning.Leadershavinghighemotionalintelligence realizethatwhatkeepsthecompanygoingisthegoodspirit

ofthepeopleandwhatmakesthepeoplemoreeffectiveis thefeelingofbeingpartofagroup.

Ontheotherhand,emotionalintelligenceisalifelinethatis thrownespeciallytodiverseandglobalizedwork environments.Ithelpsleaderstounderstandsubtle differencesinculture,tohaveconversationsdespite differencesamongthemandtoencouragethefeelingof beingincluded.Emotionalfluencyisasimportantas languagefluencyinsuchaworld.

Therapiddevelopmentoftechnologymadethehuman touch,themostimportantthingincommunication,themost endangeredone.Theintroductionofremotework,AIdrivenmanagementsystems,anddigitalcommunication hascomplicatedtheproblemofmakingconnectionsbut,at thesametime,hasmadethesolutionoftheproblemmore criticalthaneverbefore.Insuchaworld,associalmedia usedtobeacknowledged,emotionalintelligenceturnsinto anewformofdigitalfluency

Leadingthenextdecadewillcallforthisequilibrium—the capabilityofmixingtheaccuracyoftechnologywiththe powerofhumaninstinct.Emotionalintelligenceisgoingto bethetoolthatinourhastetoautomateprocesses,helpsus keepthehumansideofleadership.

Leadersoftomorrowwillberecognizedforthedepthof theirunderstandingratherthanthebreadthoftheir knowledge.Theirstrengthwillbederivednotfromrank, butfromtheirbeinghuman.Theywillinstitutethe atmosphereofcare,employemotionalliteracyintheir leadership,andturnworkplacesintocommunitiesof belonging.

Forleadership,atitscore,isnotamechanicalbutamoral act.It'snotaboutenforcingperformance,butnurturing potential.Emotionalintelligenceisnotonlythe characteristicofpresent-dayleaders—itisthehallmarkof leaderswhotranscendtime.

For Subscrip�on: www.insightssuccessmagazine.com

www.x.com/insightssuccess