HOUSE

R E P O R T

TRENDS

An overview into which trends to watch

EXPERT GUIDANCE

Navigate this year’s market with confidence

INSIDER INSIGHT

Words of wisdom from Nicole Kobrinsky

I N S I D E R L O O K A T T H E P H O E N I X M E T R O M A R K E T Copyright June © 2024 T H E

1 A quick and insightful look at the realities of the real estate market in Phoenix Metro

2 We utilize The Cromford Index™ which is a set of market indicators to measure the balance of supply and demand

3-4 A comprehensive look at more detailed market statistics from a past and current perspective

Trends

Highlights

Overall Insights

CONTENTS

OVERALL INSIGHTS

We are now seeing a weakening trend in the market The Cromford® Market Index stands at 106 but is dropping Sellers are nervous and buyers are unenthusiastic. We are not in a buyer's market overall, but some significant markets are. If current trends continue then more areas could join them.

Supply continues to climb, which is unusual for the time of year and we notice that the rate of climb has increased since last month Buyers have 54% more homes to choose from than they had last year but still face 30year mortgage rates over 7% which is limiting demand. Sellers are starting to face serious competition from each other and their agents are having to work hard to get their homes sold

Most of the slightly positive signs we saw last month have disappeared. We have far fewer pending listings than last month and under contract listings are down 7.8% from this time last year. The closed sales count for May was higher than April but down 7.4% compared with last year.

Pricing was unexpectedly strong in April, but May has seen this trend reverse and the average price per sq ft is now up only 3 5% for the last year The median sale price was unchanged, as it is far less affected by the luxury home market. It is up just under 6% compared to a year ago.

We are entering the weakest time of the year, between June and September when luxury home buyers are thin on the ground. They tend to find cooler places to hang out than face the heat of a Phoenix summer house hunting expedition. Investors are busy during the summer as bargains are easier to find and gross margins on fix-and-flips are looking very healthy these days. Investors tend to pay less than market value, so this also drives the average $/SF lower between June and September We expect pricing to be flat to lower over the next 3 months, after a strong rise between January and May.

The new home market remains healthier than the re-sale market and this creates extra competition for sellers in areas and price ranges where home builders are active.

Nicole Kobrinsky PRESIDENT & BROKER OF RECORD

H O U S E R E P O R T | P A G E 1

DATA SOURCE: ARIZONA REGIONAL MULTIPLE LISTING SERVICE, INC (ARMLS) & CROMFORD ASSOCIATES LLC

HIGHLIGHTS

MARKET TYPE

SUPPLY TREND

The Supply Trend Index decreased 2 5 pts in the last month

MARKET INDEX

The 100 mark represents the index value for a balanced market A value above 100 represents a market that favors a seller A value below 100 represents a market that favors a buyer. The Market Index Trend is down 12 1 pts in the last month

DEMAND TREND

The Demand Index Trend is down a small 2pts in the last month

SELLER'S MARKET BALANCED BUYER'S MARKET 100 BELOW 100 ABOVE 100

C R O M F O R D M A R K E T I N D E X | A L L A R E A S & T Y P E S H O U S E R E P O R T | P A G E 2 DATA SOURCE: ARIZONA REGIONAL MULTIPLE LISTING SERVICE, INC (ARMLS) & CROMFORD ASSOCIATES LLC

TRENDS

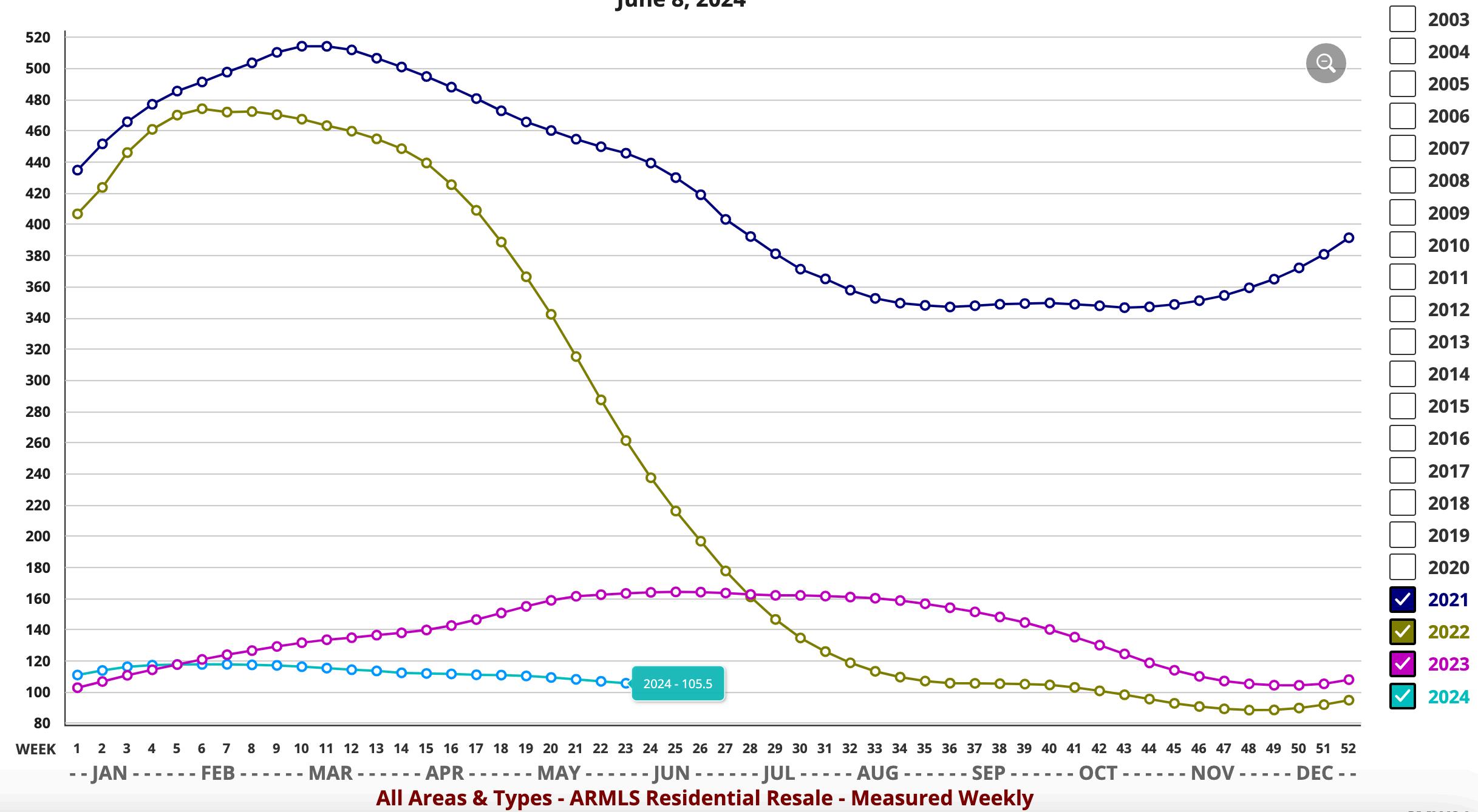

CROMFORD MARKET INDEX

MARKET HIGH

The Market Index was 514 at the height of the market in May 2021

2024 EXPECTATIONS

Entering into 2024 we would say a case for (very) mild optimism can be made. There is certainly no sign whatsoever of a housing market crash

MARKET LOW

In the late Spring of 2022, the market decelerated quickly The lowest Market Index of 88.3 was seen in December 2022.

DATA SOURCE: ARIZONA REGIONAL MULTIPLE LISTING SERVICE, INC (ARMLS) & CROMFORD ASSOCIATES LLC

T H R E E Y E A R | A L L A R E A S & T Y P E S H O U S E R E P O R T | P A G E 3

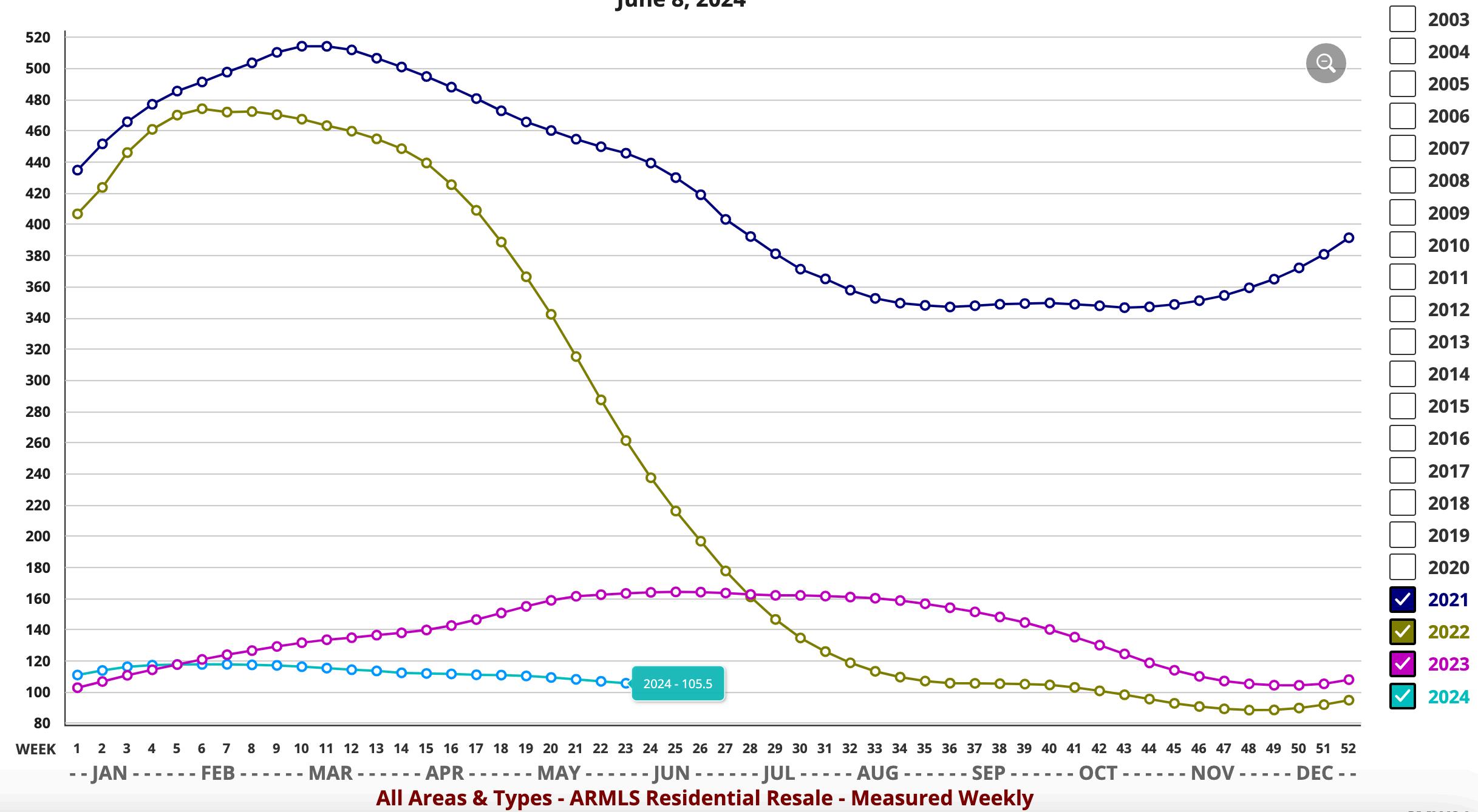

PRICING

The monthly median sales price trend down 7 4% since last year The monthly average price per square foot trends up 3 5% YOY

INVENTORY

Active listings (excluding UBC) are up 54% YOY and months of inventory is up 73 3% from 1 5 to 2 6 months YOY Prices are likely to inch upward in the coming months

VOLUME

Overall volume of residential sales for the year is down 4 95% compared to June 2023

AS OF JUNE 2023 AS OF JUNE 2024 %Δ (yr) 1 MONTH AGO %Δ (1 mo) ACTIVE LISTINGS (excluding under contract) 11,730 18,044 54% 17,129 5 3% ACTIVE LISTINGS (including under contract) 15,062 21,353 42% 20,979 1.8% PENDING LISTINGS 5,696 5,015 -12% 5,486 -8 6% LISTINGS UNDER CONTRACT 9,028 8,324 -7.8% 9,336 -11% DAYS ON MARKET 66 65 -1.5% 66 -1.5% MONTHS OF INVENTORY 1 5 mo 2 6mo 73 3% 2 4 mo 8 3% SALES PER MONTH 8,107 7,508 -7 4% 7,046 6 6% SALES PER YEAR 74,551 70,862 -4 95% 71,874 -1 41% MONTHLY AVERAGE SALES PRICE PER SQ. FT $287.67 $297.71 3.5% $306.61 -2.9% MONTHLY MEDIAN SALES PRICE $425,000 $450,000 5.9% $450,000 0% H O U S E R E P O R T | P A G E 4

TRENDS Y E A R O V E R Y E A R | A L L A R E A S & T Y P E S DATA SOURCE: ARIZONA REGIONAL MULTIPLE LISTING SERVICE, INC (ARMLS) & CROMFORD ASSOCIATES LLC

Questions or Comments? Email Report author: Nicole Kobrinsky at nicole@housegallery com

6901 East 1st St Suite 103 Scottsdale, Arizona 85251

(480)808-1223 | housegallery com

© 2024 HOUSE GALLERY COLLECTIVE ALL WORLDWIDE RIGHTS RESERVED ALL MATERIAL PRESENTED HEREIN IS INTENDED FOR INFORMATION PURPOSES ONLY WHILE, THIS INFORMATION IS BELIEVED TO BE CORRECT, IT IS REPRESENTED SUBJECT TO ERRORS, OMISSIONS, CHANGES OR WITHDRAWAL WITHOUT NOTICE THIS INFORMATION IS BASED ON DATA FROM ARIZONA REGIONAL MULTIPLE LISTING SERVICE, INC (ARMLS), CROMFORD ASSOCIATES LLC , REALTORS PROPERTY RESOURCE®, LLC AND INTERPRETED BY HOUSE GALLERY COLLECTIVE, LLC DATA HAS BEEN LIMITED TO SALES REPORTED WITHIN THE COUNTY OF MARICOPA BOUNDARIES

IF YOUR PROPERTY IS CURRENTLY LISTED WITH ANOTHER REAL ESTATE BROKER, OR YOUR ARE UNDER A BUYER REPRESENTATION CONTRACT WITH ANOTHER REAL ESTATE BROKER, PLEASE DISREGARD THIS OFFER IT IS NOT OUR INTENTION TO SOLICIT THE OFFERINGS OF OTHER REAL ESTATE BROKERS