Light-as-air dry oil spray instantly absorbs into hair for enhanced manageability and shine.

Light-as-air dry oil spray instantly absorbs into hair for enhanced manageability and shine.

Travel retail’s renewed ascent has been gaining unprecedented momentum as operators embrace transformative strategies and revolutionary technologies that are reshaping passenger experiences worldwide. The convergence of sophisticated data analytics, immersive retail concepts and strategic diversification has been driving sustainable growth amid evolving market dynamics.

At the forefront of this experiential retail evolution stands Avolta’s “Predictably Surprising” framework, where the company’s five strategic pillars have been redefining customer engagement. Cruise retail has emerged as a premium channel, while the company’s organic growth and increase in Club Avolta membership reflect successful execution of contextual retail approaches that understand traveler intent and emotional states.

Record performance has marked Qatar Duty Free’s milestone 25th anniversary year. Supporting this success is the groundbreaking 36Q data platform, which has enabled real-time passenger behavior analysis and shifts merchandising decisions from assumptions to actionable insights. Daily Chef Noof’s modern Qatari cuisine and strategic partnerships with local brands provides wished-for cultural authenticity, creating touchpoints that resonate with evolving transit tourism strategies.

Data-driven transformation is reshaping global operations at Gebr. Heinemann, where the departure from democratic assortments toward curated luxury and accessibility has been generating stronger consumer engagement and increased basket sizes. Global expansion into markets including Jeddah, Noida and cruise retail has extended the company’s reach.

Despite regional tensions across the Middle East and Eastern Europe, which continue to influence travel patterns and operational planning, operators have maintained momentum through adaptive strategies and diversified geographic exposure.

As we head to Cannes this year, I’m energized by the opportunity to connect with the visionary leaders driving our industry’s transformation. The insights and innovations we’ll encounter will undoubtedly shape the stories we tell and the trends we track in the months ahead. Looking forward to seeing you there.

Kindest regards,

HIBAH NOOR Editor-in-Chief hibah@gtrmag.com

OCTOBER 2025 · VOL 37 · NO 6

Global Travel Retail Magazine (ISSN 0962-0699) is published seven times a year by Paramount Publishing Company Inc. The views expressed in this magazine do not necessarily reflect the views and opinions of the publisher or the editor. October 2025, Vol 37. No. 6. Printed in Canada. All rights reserved. Nothing may be reprinted in whole or in part without written permission from the publisher. Paramount Publishing Company Inc.

GLOBAL TRAVEL RETAIL MAGAZINE Tel: 1 905 821 3344 www.gtrmag.com

PUBLISHER Aijaz Khan aijaz@globalmarketingcom.ca

EDITORIAL DEPARTMENT

EDITOR-IN-CHIEF Hibah Noor hibah@gtrmag.com

DEPUTY EDITOR Laura Shirk laura@gtrmag.com

SENIOR EDITOR Wendy Morley wendy@gtrmag.com

SENIOR CORRESPONDENT Atoosa Ryanne Arfa atoosa@gtrmag.com

SENIOR WRITER Alison Farrington alison@gtrmag.com

ART DIRECTOR Jessica Hearn jessica@globalmarketingcom.ca

ADVISORY BOARD

Gary Leong Thomas Henningsen

CIRCULATION & SUBSCRIPTION MANAGER accounts@globalmarketingcom.ca

We’re pioneering the travel experience revolution. Combining the best of Autogrill, Dufry, HMSHost & Hudson.

26 Beyond the milestone

As Qatar Duty Free (QDF) marks a record-breaking 25th anniversary with over 25 new openings and 18% sales growth, Chief Retail and Hospitality Officer Thabet Musleh reveals how data-driven personalization, strategic talent acquisition and cultural authenticity are positioning QDF for its next phase of global expansion

40 Predictably surprising

Avolta CEO Xavier Rossinyol speaks with GTR Magazine about the company’s multi-channel evolution, from experiential retail concepts to cruise expansion, as the travel retail giant targets sustainable growth through innovation and collaboration

102 A tale of technologies

Travel retail is moving into a new era where AI, contactless payments and Just Walk Out technology bring greater speed, personalization and operational efficiency, while opening new possibilities for travelers, retailers and airports

116 New era, new beauty

Driven by growing consumer literacy and the rise of dermacosmetics, the medicalization of beauty sees healthcare professionals playing a role in shaping current beauty norms. GTR Magazine turns to the experts to learn more about this integration and how brands are exemplifying the shift

30 The risk of structural decline

Dag Inge Rasmussen, Chairman & CEO at Lagardère Travel Retail, says with the support of more relevant product ranges, more easily navigable stores and locally inspired environments, it is time to get creative and reinvent the duty free offer to effectively respond to the needs of the modern traveler

34 Record-breaking momentum accelerates

Dubai Duty Free Managing Director Ramesh Cidambi reveals how experiential arrivals retail, strategic luxury expansion and digital innovation are driving the company toward a projected annual revenue of US$2.2 billion

46 Strategic curation

Gebr. Heinemann CCO Inken Callsen is reshaping the travel retail channel through strategic curation, data-driven decision-making and a renewed focus on luxury and accessibility that is driving commercial impact across diverse global markets

52 Connecting continents

Newly appointed MEADFA President Abdeslam Agzoul shares his vision for collaboration, sustainability and growth across the Middle East and Africa

58 Back at the helm

Returning to ARI Middle East as CEO during its 35th anniversary, Nuno Amaral outlines his plan for operational excellence and strategic expansion across the region, while continuing his global role as ARI’s Chief Operations Officer

64 Complete control

Beaute Luxe transforms from African distribution specialist to integrated travel retail operator with direct airport stores in India and a flagship perfumery in Kathmandu, Nepal, managing the entire beauty value chain from brand sourcing to customer experience

66 Powering growth

Sunil Tuli, APTRA President and Group Chief Executive at King Power Group (Hong Kong) shares his insight on the association’s current priorities across more than 45 distinctly different markets

68 The profitability puzzle

The Shilla Duty Free has been seeing encouraging signs of recovery, with revenues climbing and passenger demand strengthening across its key travel markets. The company is investing in experiences, loyalty and sustainability to secure long-term growth amid shifting dynamics

72 Wellness takes flight

From immersive lounges and gardens to fitness zones, airports are transforming flights and layovers into opportunities for relaxation, renewal and rejuvenation

78 “The Milei effect” transcends borders

Considering the popularity of President Milei and the removal of currency controls in Argentina earlier this year, the country is set to experience continued economic growth and inspire political courage beyond its borders

82 On the horizon: accelerated expansion

With retailers increasing investment in the sector, GTR Magazine examines the current state of the border retail market in Latin America. Experts discuss growth opportunities, new initiatives and digital innovation

84 Hike in tourism

According to Chief Operating Officer Lara Plaza, London Supply Group survives on tourism, which means it needs to have the right offer all of the time, and be quick on its feet

86 Luxury at sea

For cruise lines, luxury elevates margins and reinforces positioning. It is the new standard, reshaping passenger expectations and setting a new frontier for the world’s most prestigious brands

90 Journey with purpose

ARI is driving sustainability through a global network of ESG Champions. These employees were selected to lead initiatives tailored to their local business units, bringing the retailer’s 2025-2030 ESG strategy to life

92 The ultimate channel for innovation

TFWA President Philippe Margueritte says to remain relevant, the travel retail industry needs to integrate new technologies and create environments where the airport becomes the destination, plus more on TFWA’s Innovation Square in Cannes

98 State of crisis

Ongoing political and economic tensions between Canada and the United States have created unprecedented uncertainty for travelers and businesses. GTR Magazine speaks with FDFA for an update on the decline of cross-border travel and its appeal to the government for support

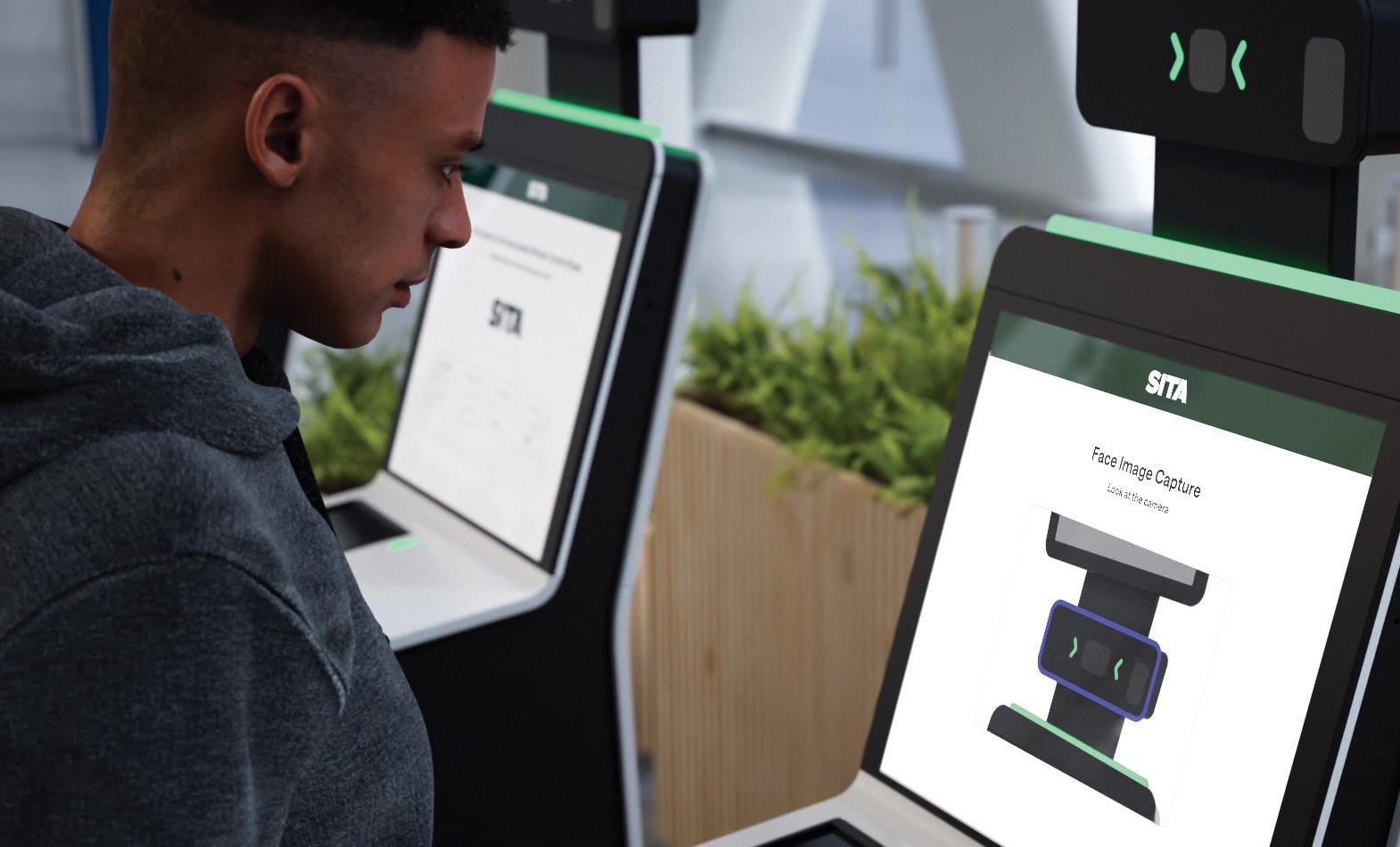

108 Biometrics: the digital backbone of travel

From the implementation of facial recognition to the curation of the retail journey, GTR Magazine examines the benefits, challenges and future of biometric technology in travel retail

120 Transcending boundaries

In this Fragrance Report, GTR Magazine looks at Gen Z’s relationship with the category and how scent has evolved into a medium of selfdiscovery, exploration and creative expression

124 Fenty Beauty’s Caribbean milestone

Rihanna’s inclusive, trend-setting beauty brand is now available in over 20 locations in the region

126 Mix & match

Coty SVP Mette Engell discusses how Gen Z’s demand for personalized scent experiences is reshaping travel retail strategy through layerable formats, sustainability innovation and immersive retailtainment activations

128 Crafting from instinct

Ajmal Perfumes is transforming traditional Middle Eastern perfumery through creative freedom and emotional storytelling, scaling globally while keeping its soul intact

130 Serpentine strikes

Roberto Cavalli’s blockbuster fragrance debut at Dubai Duty Free signals a strategic pivot toward Middle Eastern markets as the company eyes global expansion through travel retail exclusivity

132 Leading retail innovation

Tairo Group excels in the Caribbean and Mexico TR with the help of CapEx furniture, reaffirming its commitment to retail excellence

134 Spending on impulse

From crafting brand visibility and shopfloor retailtainment to catering to various snacking moments and budgets, confectionery brands are finding ways to mitigate consumer confidence in travel retail

138 Confectionery: a powerful conversion category

GTR Magazine takes a closer look at Nestlé International Travel Retail’s 2025 in this case-style article. In addition to a regional overview, the company details the range of initiatives its implementing to drive shopper conversion

142 Packing alpaca

From Q1 2026, Sol Alpaca plans to expand into strategic airports across Europe and Asia, prioritizing high-traffic locations strongly aligned with its core values: authenticity, sustainability and textile excellence

144 Transparency, craftsmanship and quality

German jewelry house Coeur de Lion targets expansion in the global market, underlining its commitment to craftsmanship and quality

146 Innovation, storytelling and aspirational design

Tateossian looks to increase its footprint in the global channel, with cruise market and key airport hubs key targets

148 Crystal clear

Swarovski’s balanced global footprint drives growth through collaborative partnerships, exclusive collections and micro-capillarity strategies as the brand capitalizes on expansion in the Middle East and across the Americas

150 Travel smart

Canadian luggage manufacturer Heys is set to showcase breakthrough collections and airport partnerships in Cannes, as travel retail becomes increasingly central to its global growth strategy

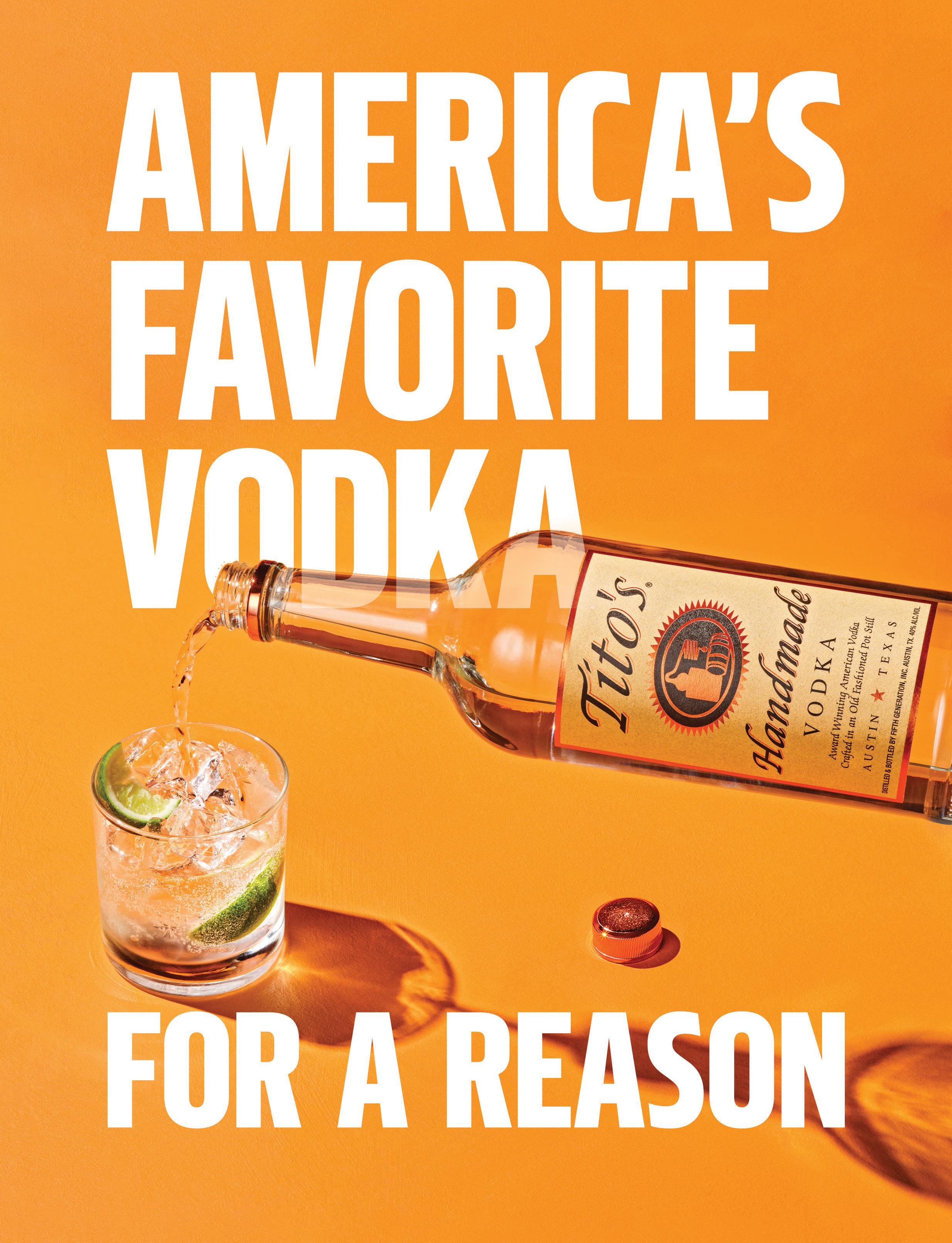

152 Sparking change

With an emphasis on animal welfare, food security, community rebuilding and more, Tito’s Handmade Vodka’s philanthropic platform “Love, Tito’s” supports non-profits that are meaningful to employees and fans alike

154 Sober-curious

Travelers are rethinking how wellness fits into their lifestyle, especially when it comes to alcohol and tobacco. The “sober-curious” mentality is gaining momentum, and travel retailers such as Gebr. Heinemann are responding

158 Decoding Gen Z

Gen Z is approaching spirits with priorities shaped by digital culture, shifting values and fluid brand loyalty. This generation’s palate calls for authenticity, social responsibility and meaningful engagement, pushing the industry to innovate

164 Leading the charge

Rawan Elayyan, Head of Travel Retail at Mazaya, discusses plans to amplify the shisha company’s differentiation through curated activations and exclusive product offerings, while detailing her vision for building lasting consumer connections and establishing Mazaya as a category leader

166 Beyond the bottle

In this Wine Report, GTR Magazine speaks with representatives from across the category for an update on market trends and challenges, as well as on the integration of experiential retail in the channel

174 Premium momentum

MONARQ Group’s diversified approach and Japanese whisky expertise are driving robust growth across cruise, duty free and domestic channels, with strategic partnerships fueling expansion into new markets

Cambodia marked a historic milestone in September with the inauguration of Techo International Airport (KTI), the nation’s largest aviation infrastructure project and one of the world’s biggest airports by land area.

Strategically located south of Phnom Penh, KTI begins operations as a state-of-the-art hub designed to expand connectivity for travel, trade and investment. The opening was marked by the arrival of the first commercial flight operated by Air Cambodia, greeted with a traditional water salute.

Developed by Cambodia Airport Investment Co., Ltd. (CAIC) — a subsidiary of Overseas Cambodian Investment Corporation (OCIC) in joint venture with the State Secretariat of Civil Aviation (SSCA) — KTI highlights Cambodia’s dedication to infrastructure development and its growing role in regional connectivity. With capacity for 13 million passengers annually in its first phase, the airport is set to transform Phnom Penh into a growing aviation hub, strengthening tourism, expanding trade flows, and enhancing Cambodia’s international connectivity.

To offer international standards at KTI, CAIC has appointed leading partners including Vinci Airports, Lagardère Travel Retail, Newrest, and Singapore Airlines Engineering Company to manage operations, retail, catering, and aircraft maintenance. These collaborations position KTI to serve regional travelers and gradually expand long-haul routes, laying the foundation for stronger global connectivity.

Techo International Airport is designed to expand connectivity for travel, trade and investment

Duty Free Americas (DFA) and The Estée Lauder Companies (ELC) have joined forces in a strategic global retail partnership to launch ELC brands across DFA stores.

This exciting collaboration marks a significant milestone in elevating prestige beauty experiences for international travelers and will be a key driver in ELC’s accelerated expansion ambitions in the Americas.

“We are very excited to launch this partnership with The Estée Lauder Companies and its exceptional portfolio of beloved brands,” says Jerome Falic, Chief Executive Officer, Duty Free Americas. “This collaboration is underpinned by our shared commitment to delivering best-in-class retail experiences for international travelers. By integrating ELC’s world-class brand portfolio and deep consumer understanding with DFA’s expansive retail net-

work and operational expertise, together we are uniquely positioned to drive further growth, enhance in-store engagement, and set a new benchmark for excellence in travel retail.”

Through this retail partnership, ELC’s diverse portfolio of iconic brands will be available to international travelers through DFA’s robust retail network, offering travelers access to exceptional beauty products and personalized in-store engagement.

“We are delighted to enter a strategic global retail partnership with DFA, a leader in travel retail operations,” adds Olivier Dubos, SVP and GM, Travel Retail Worldwide, The Estée Lauder Companies. “This partnership is anchored in consumer centricity – the driving force behind our Beauty Reimagined strategy.

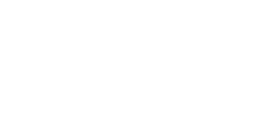

Philip Morris International (PMI) Global Travel Retail (GTR) and Lagardère Travel Retail continue to strengthen their partnership, setting new benchmarks in premium travel retail and brand engagement. Their focus remains on delivering exceptional legal-age consumer experiences across Europe’s travel hubs.

The launch of the new multi-category solution at Geneva Airport’s Aelia Duty Free showcases their ongoing commitment to innovation and excellence in the travel retail sector.

The shop installation showcases a state-of-the-art retail concept, combining advanced design with a dynamic and diverse product offering in the tobacco and nicotine category. It is said to reflect the shared strategy of both partners to elevate the role of premium, consumer-centric execution that resonates only with legal-age nicotine users seeking more than just destinations.

The Geneva retail solution presents PMI GTR’s latest innovations as part of its multi-category transformation strategy, designed to offer experiential and memorable shopping environments. It also reinforces PMI GTR’s com-

mitment to transforming the tobacco category - from traditional sales to impressive shopping experiences - tailored to legal-age nicotine users with diverse preferences who are also seeking better alternatives.

The TFWA management committee elected Alessio Crivelli, Global Travel Retail Director from EssilorLuxottica, as the association’s Vice President Marketing during its management committee meeting on September 5. His mandate will run with immediate effect until the next election which will be held in October 2026.

In a statement the TFWA Board said, “We’d like to extend a warm welcome to Alessio Crivelli as our new Vice

President Marketing. Representing EssilorLuxottica, a company that is a worldwide leader in our industry, he brings a professional background uniquely suited to this role, with an outstanding track record in marketing across renowned brands including Adidas. His Italian heritage will enrich the diversity of our board, and his presence will give greater voice to a community that champions the premiumization of our industry with distinction and style.”

This summer, Avolta has once again teamed up with London Gatwick to inspire and delight travelers with a new summer campaign, “You Deserve the World.”

Running from July through to the end of September in the UK, the campaign brings a refreshed in-store experience to Avolta’s World Duty Free stores in both the North and South Terminals.

“You Deserve the World” taps into the joy of self-treating, using bold and engaging point-of-sale messaging to create moments of uplift and connection throughout the shopper journey. Striking visuals paired with playful straplines – such as “Duty Free – More Like Guilt Free” and “Treat Before Take Off – Always!” – are designed to grab attention and encourage travelers to pause, browse, and reward themselves. Oversized props and themed displays provide photo opportunities for customers, alongside per sonalized services such as bottle engraving.

Whether it’s a luxury beauty item, a premium bottle of spirits, or the perfect pair of holiday sunglasses, Avolta’s

curated offering across all key categories invites passengers to enjoy a little something extra before their trip even begins. This year’s campaign is also supported by a strong digital presence, with vibrant, content and messaging running across World Duty Free’s and Gatwick’s social media platforms, to drive footfall and extend the campaign’s energy beyond the airport walls.

Following an impactful brand refresh, the launch of their GTRX trio and the global ‘Everything Considered’ campaign this year, Pernod Ricard Global Travel Retail and Aberlour have opened the first ever Aberlour Boutique, in the Departures YP concourse of Terminal 1, Taiwan Taoyuan International Airport.

Designed in partnership with Pernod Ricard GTR’s longstanding partner Everrich Duty Free, the 350-square-meter store sits at the heart of one of Asia’s most dynamic travel retail locations, Taiwan. It artfully combines the heritage, storytelling and full range of Aberlour’s meticulously crafted Speyside single malt with a unique consumer experience that connects to the very soul of Taiwan.

It was opened with a theatrical ribbon-cutting ceremony on August 27, with Everrich’s President, Kevin Chiang and

Pernod Ricard GTR’s CEO, Laurent Pillet in attendance. After a rousing lion dance performance, Chiang and Pillet spoke to the strength of their partnership in achieving a world first brand store for Aberlour and the exclusive product journey their teams have created for travelers, before toasting the future success of the boutique and leading a convivial tour of the space.

Echoing the June activation in Taipei Airport – which marked the start of Aberlour’s global roll-out in travel retail – the new boutique is dressed in accordance with the new brand visual identity; the iconic red representing Aberlour’s distillery oak doors, the beige of Scottish barley fields and the warm gold of Aberlour’s fine amber liquid –a celebration of its craft, heritage and commitment to the natural environment.

Heinemann Americas has unveiled a bold new cruise retail concept aboard Royal Caribbean’s Star of the Seas, further strengthening a partnership that has grown steadily since 2019.

With ten distinct retail venues on board, the vessel delivers a next-level shopping experience, featuring everything from exclusive Royal Caribbean logo merchandise, fine watches, and fashion jewelry, perfumes and cosmetics, as well as vintage luxury leather goods and timepieces. A standout highlight: the highly curated collection of prestige and rare spirits, crafted to surprise and captivate connoisseurs with selections found nowhere else at sea.

The new retail offer builds on the success of Icon of the Seas, with a focus on curated exclusivity, elevated design, and category innovation across four distinct store formats.

Operating as Rio de la Plata Duty Free, Bernabel Trading manages travel retail onboard several Buquebus ferries sailing between Argentina and Uruguay. The company is preparing to introduce a new vessel to its fleet, which will replace those selected to be discontinued and further its commitment to the in-store and onboard experience.

When it comes to leveraging digital investment to provide an enhanced customer experience, Bernabel Trading is concentrated on in-store design and promotion via the implementation of screens to increase engagement. Speaking about consumer mix and spending patterns, Martin Laffitte, Director at Bernabel Trading, notes, the only difference across retail categories has to do with the economic stability of the two countries and whether Argentina

or Uruguay is in better shape. According to Laffitte, 70% of passengers are from the region; 30% are from outside of the region.

Speaking about the greatest opportunities for growth in the travel and tourism sector in the next decade in Latin America, he says the region is advancing, which is good for business and the company is always trying to improve: the vessel, the structure, the experience. Fortunately, Laffitte isn’t too concerned about the imposing of tariffs on business; its pricing has not changed and he doesn’t foresee that being the case in the future. “In our case, we mainly import from the region where products are manufactured,” he adds.

Muscat Duty Free has reinforced its reputation as a regional innovator with the launch of Malayali Beer, becoming the first duty free operator in the Middle East to introduce this distinctive brand.

The launch event, held at the JW Marriott, was attended by prominent leaders from Muscat’s F&B industry, reflecting the brand’s significance and Muscat Duty Free’s commitment to delivering unique experiences to travelers.

The evening was a celebration of culture and innovation, featuring live music, a lively Polka dance performance, and the traditional Panjavadhyam music, creating an engaging and vibrant atmosphere. Guests mingled, explored the brand’s story, and experienced firsthand the unique story behind Malayali Beer.

Renat Rozpravka, CEO of Muscat Duty Free, said, “We are proud to be the first in the Middle East to introduce Malayali Beer. This launch reflects our vision to continually enrich our offerings and create memorable experiences for passengers.”

Malayali Beer, celebrated for blending international brewing standards with cultural authenticity, offers a refreshing taste and an engaging story that resonates with global travelers. Its introduction in Muscat is said to provide passengers with an exclusive opportunity to experience a brand that combines heritage and modern appeal.

The International Association of Airport and Duty Free Stores (IAADFS) Chairman Rene Riedi has announced that Michael Payne will be stepping back from his role as President and CEO of IAADFS.

“Michael will continue to serve as a chief advisor to the Board on matters relating to advocacy, governance and program content, but will continue to move away from the day-to-day operational activities dealing with membership services, budget items and related areas,” says Riedi. “As we go through some of our scheduled strategic changes and redefining our scope as an organization, we want to

be able to take advantage of his knowledge and relationships and are pleased to have his continued involvement and support. We plan to have Michael actively participating in Cannes to focus on his areas of responsibility and helping to promote the next Summit.”

Steven Antolick, who was promoted in 2023 to the Executive Director position, will continue to manage the operational requirements for the association, including membership development, budgets and Summit meeting requirements.

In a bold move to elevate the duty free shopping experience, Ospree Duty Free has rolled out its first year-long campaign, titled “Duty Free Now Free.”

The campaign launched in June 2025 across all participating airports in India. With Mumbai Airport at the forefront – boasting the largest portfolio of brand partners – this initiative aims to transform every duty free purchase into a gateway for exclusive travel and lifestyle privileges.

According to Ospree Duty Free, “Duty Free Now Free” “isn’t just a retail campaign; it’s a digitally powered, travelinspired reward ecosystem that offers consumers perks equivalent to the value of their shopping.”

Each transaction at Ospree Duty Free unlocks benefits across Adani’s diverse infrastructure and service businesses, including:

• Access to Pranaam premium airport services

• Parking privileges

• Value-added travel bookings through Yatra and Ixigo

• Additional perks from hospitality and infrastructure partnerships within the Adani ecosystem like Cococafe, Adani Lounge, Common House Brewery, Skybites-Inflight Meals

• Shoppers can redeem the rewards by scanning a QR code at checkout. A personalized voucher is sent directly via WhatsApp upon entering basic details like name and contact number, ensuring a hassle-free, touchless experience

The Swedavia Group – which owns, operates and is developing ten airports throughout Sweden – has released traffic statistics for August 2025, indicating positive development in both international and domestic travel.

In the course of the month, approximately three million airline passengers flew via one of Swedavia's ten airports. This is a total increase in passengers of 5% compared to August 2024.

Jonas Abrahamsson, President and CEO of Swedavia, says, “August was a strong month, with both international and domestic travel up 5% year-on-year at our ten airports. Stockholm Arlanda had the strongest development, with

an 8% increase. It’s gratifying that the airlines continue to invest in Sweden, and that during the summer season, Swedavia enhanced our offerings by opening another 22 new routes.”

Sweden's largest airport, Stockholm Arlanda Airport, had the largest overall increase in passengers, followed by Göteborg Landvetter Airport, Luleå Airport and Umeå Airport. Arlanda, Landvetter and Malmö Airport had the greatest increase in internationally bound passengers. After Arlanda, Luleå Airport and Umeå Airport saw the biggest increases in domestic travelers, followed by Åre Östersund Airport.

As Qatar Duty Free (QDF) marks a record-breaking 25th anniversary with over 25 new openings and 18% sales growth, Chief Retail and Hospitality Officer Thabet Musleh reveals how data-driven personalization, strategic talent acquisition and cultural authenticity are positioning QDF for its next phase of global expansion

by HIBAH NOOR

Qatar Duty Free’s (QDF’s)

25th anniversary year has delivered both record performance and operational transformation. The retailer posted 18% year-on-year sales growth in 2024 while delivering on its promise to open more than 25 new concepts across Hamad International Airport this year, from Daily Chef Noof's modern Qatari cuisine to Last Call’s hybrid retail-F&B format.

“Passenger response to our recent openings has been exceptionally strong across categories,” says Thabet Musleh, Chief Retail and Hospitality Officer, Qatar Airways Group. “Daily Chef Noof has quickly become a standout for travelers wanting to experience Qatari flavors in a modern way, while Day2Day

Eats proves that convenience can go hand-in-hand with quality.”

The expansion extends beyond F&B innovations. QDF opened Concourse D & E operations and secured luxury brands enjoying strong regional momentum but limited travel retail exposure, such as Brunello Cucinelli. These developments reflect a deliberate strategy blending authentic, locally rooted concepts with timely global brands.

Real-time retail intelligence

QDF’s 36Q data platform represents the most significant shift in how the retailer approaches merchandising and brand partnerships. Now several months since launch, the system has been successfully tracking passenger behavior, shopping

patterns and interactions across the airport in real time.

“36Q has allowed us to shift from assumptions to action,” Musleh explains.

“We’re now able to see how different passenger groups behave, shop and interact across the airport in real time and that changes everything.”

The platform enables brands to adjust campaigns without relying on seasonal forecasts or static data. QDF has leveraged the insights gleaned from 36Q to refine campaigns, rethink merchandising and introduce targeted pop-ups responding directly to traveler preferences.

“We’re also seeing stronger, more collaborative conversations with our brand partners because we’re speaking the same language, one that’s grounded in

shared data and focused on enhancing the passenger journey,” Musleh adds.

Earlier this year, QDF strategically added senior executives Caroline Hannah Sartory to lead customer journey and digital experience, Ewan Lawson to strengthen brand voice and communications, and Hanno Hellwig to drive category strategy.

“Bringing in new leadership marks an important step in how we’re evolving as a business,” Musleh asserts. “It’s about strengthening the team with people who bring different perspectives, deep expertise and a fresh lens on the challenges and opportunities ahead.”

The retailer’s workforce has tripled over three years to more than 4,000

employees representing 78 nationalities. The appointment of six women executives this year reflect QDF’s commitment to diverse leadership development.

The new spaces in Concourses D and E apply the customer-centric principles of data-led planning, diverse product mix and clear experience focus. The retail curation strikes balance between global luxury positioning and everyday accessibility.

QDF has incorporated lessons from existing spaces to improve layout and visibility. The integrated ecosystem with Hamad International Airport and Qatar Airways provides flexibility to adapt spaces based on passenger profiles.

“For example, if a concourse con-

sistently serves U.S. departures, we can shape the retail and F&B offer to suit those travelers’ preferences, creating a more relevant and engaging experience for each market we serve,” Musleh explains. One such offer is the new “Last Call” concept, a combined retail and dining space created for US-bound passengers, who often lose shopping time because of additional security checks.

QDF’s digital initiatives center on purposeful implementation. The retailer’s upcoming e-commerce platform is set to add an expansive and convenient shopping channel for passengers, while Privilege Club continues to add genuine value through hyper-personalized offers. Using passenger data, QDF can deliver

curated recommendations for families and exclusive perks for frequent flyers.

AI technology will soon power transit area digital displays with automatic content switching based on passenger profiles. “But no matter how advanced the technology, we never lose sight of the human element,” Musleh emphasizes. “Great retail is still about timing, tone and connection. That’s why we continue to train our teams to read situations, anticipate needs and create meaningful, in-person experiences on the ground.”

Local relevance has emerged as a key differentiator through concepts like Daily Chef Noof and partnerships with Qatari brands including Slicy and Flat White. These collaborations reinforce QDF’s commitment to providing what travelers overwhelmingly desire.

“These partnerships have reinforced our belief in the power of cultural storytelling,” Musleh says. “Travelers today are looking for a sense of place, even in transit, and we’re responding by weaving Qatari culture more meaningfully into our retail and F&B offer.”

The approach creates layered experiences where passengers can discover local craftsmanship alongside international brands. This defines QDF’s “transit tourism” strategy, extending beyond the terminal through sporting partnerships supporting Qatar’s global profile.

“It’s about creating a journey that feels layered and inclusive, where a passenger can discover local flavors and craftsmanship one moment, then engage with iconic international brands the next,” Musleh states. “That layered and inclusive approach defines our ‘transit tourism’ strategy by curating experi-

ences that feel authentic and accessible, with something for every traveler, every time.”

Sporting partnerships align with QDF and Qatar Airways Group’s pursuit of excellence. Qatar’s position as host to world-class events creates opportunities for immersive retail experiences extending beyond traditional sponsorship.

“We see sporting partnerships as a natural fit for QDF and the wider Qatar Airways Group, as we all strive for excellence, innovation and continual refinement of our respective crafts,” Musleh says. “Sport captivates a global audience in much the same way an airport connects the world, making it a powerful extension of the passenger experience.”

The “Live the F1 Life” campaign transformed HIA into a Formula 1

environment featuring interactive zones, exclusive merchandise and curated F&B offerings that drove measurable engagement and sales.

“With campaigns like ‘Live the F1 Life,’ we moved past traditional sponsorship into curated moments that brought the thrill of live sport into the terminal through interactive zones, exclusive merchandise, and curated F&B offerings,” Musleh points out.

Future activations emphasize deeper integration, using data to personal-

ize offers around major events while designing spaces that invite participation. “The focus now is on integration – making these experiences feel less like activations and more like extensions of the journey,” Musleh says. “The goal is to connect the energy of global events with commercial opportunities in a way that feels like a natural extension of the airport experience.”

Future positioning QDF reportedly sits 28% ahead of

targets for doubling the business within three years. The retailer’s focus remains on staying ahead of traveler expectations as new passenger generations reshape airport experience desires.

As Musleh asserts, “Whether it’s through new geographies, new digital channels, harnessing new technology, or new experience formats, we’re building towards a more agile and connected QDF, one that’s ready to meet tomorrow’s travelers wherever they are.”

With the support of more relevant product ranges, more easily navigable stores and locally inspired environments, it is time to get creative and reinvent the duty free offer to effectively respond to the needs of the modern traveler

by LAURA SHIRK

During a keynote address earlier this year, Dag Inge Rasmussen, Chairman & CEO at Lagardère Travel Retail, noted the greatest concern the industry faces is the risk of decline in spend per passenger across the core duty free categories. He cited the restructuring of the retailer’s travel essentials brand RELAY as an example of how Lagardère Travel Retail is focused on delivering what the consuming traveler really wants: more options and greater convenience, and drew a comparison between the restructuring and duty free.

“We have to question whether we are always offering the right product, in the right place, at the right price. Just as we did with RELAY, we need to review our product mix and ensure it is still relevant to travelers,” Rasmussen tells GTR Magazine in a follow up interview.

“In our view, locally sourced goods across all product categories will play an especially vital role in the future of the duty free sector.”

The recent transformation of RELAY demonstrates how heritage brands can evolve to remain relevant in a fastchanging travel environment. While the brand had been historically reliant on the core categories of books, press and tobacco, by diversifying and reinforcing its product mix to include convenience, snacking and portable tech, RELAY turned a shining light on local items and souvenirs. In doing so, Lagardère Travel Retail helped to give fresh dynamism to RELAY’s main offer and responded more effectively to the needs of the modern traveler. The RELAY concept is now fit for growth, and it is believed the duty free channel needs to transform similarly with the help of more relevant

product ranges, more easily navigable stores and welcoming, locally inspired environments.

On ways to avoid structural decline and reinvent the duty free offer, Rasmussen says, adaptability, agility and local relevance are key. “In all our stores, we should aim to create differentiated, culturally rich experiences that enhance core categories with freshness and diversity. Success lies in offering immersive, dynamic and flexible store formats, and will require close collaboration with airports to trial innovative concepts,” he explains. Rasmussen goes on to say, in some areas, hybrid locations may be

suitable. For instance, where duty free and snacking or dining combine in a seamless, easily navigable space.

The retailer defines locally sourced products as a powerful lever of differentiation, traveler engagement and commercial performance. Its target of having 30% local products in its duty free shops responds directly to the traveler’s growing appetite for authenticity and uniqueness. “It also reflects our belief that embracing local culture makes commercial sense,” he states. “In Lima, this strategy is brought to life in our extensive local offer in duty free, and also through our food hall, Nación Sazón, which celebrates Peruvian cuisine and identity. By empowering our local teams to design bespoke offers, we drive growth while responding to travelers’ demand for something different.” It is apparent whatever concepts Lagardère Travel Retail deploys, the

retailer relies heavily on “a genuine spirit of partnership” between operator and landlord. Rasmussen refers to Lima as an excellent example of what can be achieved when such a partnership exists.

The move toward a profit-sharing model

The opening of the new terminal at Lima Jorge Chavez Airport is a milestone for Lagardère Travel Retail in Latin America. With 4,000 square meters of retail and 3,300 square meters of dining, the initiative reflects the retailer’s ambition in the region. “We are conscious that we remain a challenger in Latin America, but that mentality helps drive our determination to set new standards in travel retail and dining, and to create value for current and future partners,” says Rasmussen. “Lima showcases our ability to deliver flagship operations in partnership with local stakeholders, while reinforcing our commitment to

adaptability, local empowerment and trust. It also demonstrates our capacity to meet the high expectations of airports and travelers, and gives us confidence in our ability to succeed elsewhere in the region.”

In the case of Lima Airport, Lagardère Travel Retail moved away from the traditional concession model toward a profit-sharing model, which allows both landlord and operator to invest in and optimize the business together. “If we want to be creative in the way we get travelers to enter our shops, then we have to be creative in the way we structure our business model,” explains Rasmussen. Built on trust, a successful profit-sharing model requires transparency and a close alignment of objectives. According to Rasmussen, this structure supports innovation, enables responsiveness to market volatility and fosters a stronger partnership. The one in play at Lima Airport

has already yielded tangible results. “While not universally applicable, it is a valuable option, especially at a time of uncertainty and unpredictability,” he says.

Rasmussen maintains that Lagardère Travel Retail remains a challenger in Latin America; the retailer continues to study the region to see where it can bring value. Preserving confidence in this industry is a key factor of success. When it comes to how the retailer is contributing to the regaining of traveler confidence, Lagardère Travel Retail is committed to ensuring the duty free price promise. “We need travelers that are confident in the future, in the economy,” he shares. On this front, the retailer also takes active steps to support local communities through inclusive hiring and by investing in teams that reflect the regions it serves.

newly refurbished Arrivals

experiential zones

Dubai

Duty Free

Managing Director Ramesh Cidambi reveals how experiential arrivals retail, strategic luxury expansion and digital innovation are driving the company toward a projected annual revenue of US$2.2 billion

by HIBAH NOOR

Dubai Duty Free’s positive performance trajectory has intensified through 2025, with record half-year sales of US$1.128 billion and August revenues reaching US$177 million, marking 15% year-on-year growth. Managing Director Ramesh Cidambi’s transformation of arrivals retail through experiential zones and strategic digital integration is reshaping passenger engagement patterns while driving the retailer toward estimated annual revenues of US$2.2 billion.

Year-to-date sales through August reached US$1.48 billion, representing 6.93% growth over 2024. August’s performance surpassed the operator’s previous peak of US$161 million reached in August 2018, with sales averaging US$5.70 million per day during the month.

Arrivals transformation delivers Dubai Duty Free’s refurbished Terminal 3 Arrivals store spans 1,300 square meters with a wide entrance topped by a 57-meter LED screen. Les Caves de Champagne, developed through partnership with Moët Hennessy, anchors the front of the space.

“We are very happy with the passenger response to the newly refurbished Arrivals shop in Terminal 3 and we have received very positive feedback from our staff and customers,” says Cidambi. “The first thing you notice about the new shop is the wide and inviting entrance; the shop runs to around 1,300 square meters.”

Four experiential zones within the space demonstrate measurable commercial impact. From January to June 2025, the location generated US$9.3 million

Managing Director of Dubai Duty Free

in sales, marking 7.83% growth over the same period in 2024. July delivered a dramatic 68.36% year-on-year surge with US$1.44 million in sales, driven by longer dwell times and increased spending.

Tasting areas have become powerful conversion engines. “The sampling of wine, whisky and other spirits are proving crucial to conversion,” notes Cidambi. “The tasting sections, which include Salon Prive, Wine O’Clock and the Mixology section, really encourage the passengers to sample and the conversion rate from a tasting to purchase is nearly 60%, which is very high.”

Category performance surge

Spirits performance within experiential zones reveals the power of curated retail environments. Whisky sales increased 91.78% with volume rising 74.50%, while tequila posted 130.27% sales growth alongside 123.26% volume increases. Wine sales rose 46.29% and Champagne climbed 55.06%, reflecting strong performance in upscale zones.

The Beer Garden delivered 29.13% sales growth and 28.13% volume increases, proving casual spaces drive meaningful engagement. Other categories also benefited from improved presentation and navigation. “Another thing that resonates with our customers is the improved representation of the non-alcohol category,” says Cidambi. “The product range includes beauty, confectionery, tobacco and consumer technology.”

Shifting passenger behavior

Traveler engagement patterns are transforming Dubai Duty Free’s strategic approach to arrivals versus departures retail. Historically dominant departure sales face competition from increasingly engaged arrivals customers seeking immediate indulgence and destination connection.

“We are seeing a significant shift in travelers’ behavior, particularly in our arrival shops, which now features four innovative experiential zones following its recent renovation,” observes Cidambi. “Arrivals are no longer a passive phase of the journey.”

Customers across demographics are using the new Terminal 3 arrivals experiential zones not just for shopping but for photography and social media content creation. The spaces are evolving beyond convenience into curated environments that showcase destination appeal and deliver seamless welcome experiences. “We see arrivals retail as a vital touchpoint for early engagement, brand building and incremental revenue,” says Cidambi. “It’s no longer a secondary channel but a strategic frontline opportunity.”

Technology implementation focuses on enhancing rather than replacing human interaction. Dubai Duty Free introduced Scan, Pay & Go in October 2024, allowing customers to shop and pay entirely through mobile devices, though adoption reveals continued preference for human interaction. “We introduced the Scan, Pay & Go solution in October

2024,” says Cidambi. “However, in reality many customers still gravitate toward staffed counters.”

That said, mobile POS systems generated over US$356,000 in sales across more than 6,300 transactions in July alone. “Customers like the fact that a member of staff completes transactions on handheld devices, offering the speed of tech with a personal touch,” notes Cidambi.

Payment ecosystem expansion includes Alipay+, which comprised 36% of wallet-based transactions during the first half of 2025 while contributing 47% of sales value. Current options span UPI and Terrapay, with cryptocurrency integration planned for the near future.

August 2025 performance reinforced broad-based strength across Dubai Duty Free’s product range. Confectionery led in sales growth at 68.90%, followed by gold at 28.55%, perfumes at 13.13%, and cigarettes and tobacco recording 11.05% increases. “It is a great sales achievement and August’s record adds to the impressive streak of records set earlier this year in January, February, April, May and July,” says Cidambi. Fashion boutiques in Terminal

3’s Concourse A and Concourse B increased 10.86% compared to August 2024. Cartier posted the strongest performance among boutiques with 29.33% growth. Average daily boutique transactions rose to 254 from 237 in August 2024, while average transaction value increased to AED8,004 (US$2,180) from AED7,748 (US$2,109).

Confectionery’s standout performance from January to June reflected 62% growth, with Dubai chocolates contributing significantly. Boutiques delivered strong results with 11.38% increases across the network.

“Both the Eid holidays were good for us this year and this summer. Though it’s a bit complicated, the spend per passenger is better than last year,” notes Cidambi. “Terminal-wise, spending is stronger in Concourse B of Terminal 3 mainly because our fashion offers are strongest in Concourse B.”

Geographic performance patterns

Regional market analysis reveals varying growth trajectories across Dubai Duty Free’s passenger base. US-bound travelers generated the highest growth at 27.94%, followed by Middle East passengers at 19.78% and Indian sub-

continent travelers surging 17%.

All major terminal areas posted exceptional growth compared to August 2024. Concourses A and B each rose 17%, Concourse C grew 16.45%, and Concourse D increased 7.91%. Terminal 2 Departures recorded 13.60% growth, while Al Maktoum International Airport experienced remarkable 56.91% increases.

Arrivals shops posted 11.72% growth despite increased Terminal 3 competition. Spend per passenger improvements reflected nearly US$4 increases per departing passenger and penetration rates at least half a percentage point higher than previous August periods.

The second-half strategy centers on strengthening Concourse A’s fashion offering through new boutique openings. Louis Vuitton and Cartier boutiques are scheduled to open in September, with a temporary Chanel shop launching in December.

“In Concourse A we are strengthening the fashion offer with the opening of Louis Vuitton and Cartier boutiques in September and a Chanel (temporary shop) in December. That should bring

Concourse A up to the same level of Concourse B,” says Cidambi.

Concurrent renovation work will introduce a new “Gifts from Dubai” concept store by December, alongside refurbishment of Concourse A perfumes and cosmetics shops. These initiatives build on momentum already visible in luxury performance, where boutiques account for almost 10% of total sales.

Dubai Duty Free’s approach to maintaining record performance emphasizes continued renovation, refurbishment and strategic boutique openings alongside meaningful customer engagement and service excellence from welltrained staff.

“Our priority for the remainder of this year is to sustain the strong revenue growth achieved over the past seven months, with five of seven months setting new monthly records,” says Cidambi. “We will also continue to engage meaningfully with our customers and to offer a high level of customer service from a well-trained and motivated workforce.”

Avolta CEO Xavier Rossinyol speaks with GTR Magazine about the company’s multi-channel evolution, from experiential retail concepts to cruise expansion, as the travel retail giant targets sustainable growth through innovation and collaboration

by HIBAH NOOR

Avolta’s momentum has been building throughout 2025, with the company reporting strong H1 results that included 5.7% organic growth and a 30% increase in Club Avolta loyalty membership to over 13 million members. Against this performance backdrop, CEO Xavier Rossinyol’s strategic vision centers on what he calls “Predictably Surprising,” a framework built around five growth-engine pillars that span duty free, duty paid, F&B, spaces and digital channels.

The company’s financial strength has been reinforced by successful debt refinancing, including a €500 million (US$585 million) seven-year senior notes issuance in May at 4.5% interest to refinance existing debt. This financial flexibility supports Avolta’s ambitious expansion plans across multiple channels and geographies.

The company’s significant expansion into cruise reflects a strategic pivot toward premium, immersive environments where retail and dining integrate seamlessly into the travel experience. This expansion has gained momentum with Avolta’s partnership across Norwegian Cruise Line’s fleet, including the launch of Norwegian Aqua, featuring first-at-sea standalone Breitling and Tag Heuer stores.

“We see cruise as an increasingly premium channel, and one that offers a unique opportunity to connect with travelers in a more immersive, longerstay environment, in which both retail and dining are an integral part of the journey,” Rossinyol states. “Growth will then be driven by tailoring the offer to fit each cruise profile, using our own data and insights to really personalize the experience, and underpinning it all

with world class customer service from our knowledgeable store teams.”

Within the five-pillar strategy, retail and F&B have emerged as the most advanced in terms of transformation. This is seen in recent milestone openings such as the company’s first F&B outlet in Brazil at São PauloCongonhas Airport, which features the Vista Corona concept combining a full-service restaurant and grab-and-go sections across 334 square meters.

*Source: Nielsen Total US Universe 52 weeks ending 11/2/24

Hudson Café at Sharjah International Airport showcases Avolta’s hybrid “Refuel, Recharge, Restock” concept, integrating retail, bookstore and F&B operations with exclusive Toblerone experiences through partnership with Mondelez World Travel Retail

“Retail and F&B are perhaps furthest along in transformation. Introducing hybrid formats, we’ve been bold in reimagining the customer experience, embracing local sourcing, and leading on inclusion,” Rossinyol notes.

The company has also expanded its border retail presence, opening a 1,000-square-meter store in Foz do Iguaçu, Brazil, marking its third nonairport Latin America location.

While retail and F&B transformation has advanced significantly, other pillars of the strategy remain works in progress. “Spaces and digital remain the most experimental as we continue to explore and push the boundaries of what travel environments can be,” says Rossinyol. “They offer great potential in terms of reshaping the future of our business.”

Technology and service

Avolta’s approach to integrating tech-

nology with luxury service focuses on removing operational friction while enhancing human interaction. The company has implemented various technological solutions, from data-driven mini-apps in China to frictionless checkout systems, alongside high-touch offerings like the lounge-style VIP area for Club Avolta members inside the Toronto Duty Free store.

“Our approach is to use technology to remove friction and free up our teams to focus on what matters most, which is delivering expert, in-person customer service,” Rossinyol explains. “In some cases that means frictionless checkout options or AI-driven personalization. In others, it’s about offering curated, exclusive experiences for our most loyal members.”

The strategy ensures each touchpoint feels “effortless, premium, and tailored to the traveler’s journey,” creating a cohesive experience across different

service levels and technological implementations.

Looking ahead, Avolta aims to expand experiential concepts like Presentedby in Abu Dhabi across multiple locations and formats over the next three to five years. The 210-square-meter concept, which won a Platinum Award at the 2025 London Design Awards, combines sneakers and streetwear with sustainable 3D-printed materials.

“Our goal is to move beyond traditional retail and create spaces that surprise, engage and stay with the traveler long after they’ve left the airport,” Rossinyol says. “Concepts like Presentedby are a great example of this, designed to bring emerging experiential digital elements together with entertainment, community and storytelling into the heart of the travel experience.”

For these immersive concepts, Avolta

has redefined how it measures impact. “For us success isn’t just measured in terms of sales, but also how long people stay in the space, how they interact with it, how often they come back, and how these experiences strengthen their overall connection to the Avolta brand,” says Rossinyol.

Despite ongoing airport pressures and shifting travel patterns, Rossinyol remains confident in the company’s 5-7% organic growth targets, citing diversification as a key advantage. “Our diversified business strategy is designed to flex with shifting travel patterns, allowing us to generate sustainable growth across a variety of different areas,” he says.

Primary growth drivers include increasing spend per passenger through innovative product assortments and premium experiences, says Rossinyol. “A key driver is increasing spend per passenger, with innovative and new product assortments, for example, as well as through more premium experiences that travelers want to engage with, and invest in.”

Avolta’s category management strategy has evolved beyond traditional vertical structures. “We’re moving more into what we call contextual, or experiential retail. It’s about understanding the traveler’s intent in the moment — are they celebrating, relaxing, gifting, grabbing something quick? By designing around these moods and moments we can deliver more relevant and engaging experiences,” Rossinyol explains.

While category expertise remains important, it now operates within a broader framework of behavioral understanding, he says. “Category expertise remains important of course, and now it’s linked to a broader understanding of traveler behaviors and emotional drivers.”

The depth and timing of brand partnerships has intensified, with collaboration beginning earlier in the development process. “What’s evolving now is the depth and timing of that collaboration. We’re increasingly co-creating from the very beginning, whether that means developing exclusive formats, designing omnichannel experiences, or launching limited editions and pop-ups tailored to specific locations,” Rossinyol notes.

Sustainability initiatives extend across multiple dimensions of Avolta’s operations, from workforce development to community engagement and environmental responsibility. “Sustainability remains a central part of our business strategy, embedded in our culture and integrated into our ways of working,” says Rossinyol.

The company’s approach prioritizes human development. “Our focus is on empowering our people, engaging our communities and creating sustainable travel experiences, making a difference where we are. We’re committed to developing our people to grow and learn, amplified by our continuous improvement culture as well as the opportunities offered by the scale and breadth of our business.”

Community engagement initiatives include water-related projects, beach cleanups and education programs in Brazil’s favelas, while environmental efforts encompass the award-winning WAS products that repurpose waste materials into eco-design furnishings, and sourcing 93% of electricity from renewable energy sources.

Heinemann’s expansion into cruise retail demonstrates the practical application of its centralized knowledge strategy across diverse channels

Gebr. Heinemann CCO Inken Callsen is reshaping travel retail through strategic curation, datadriven decision-making and a renewed focus on luxury and accessibility that’s driving commercial impact across diverse global markets

by HIBAH NOOR

Travel retail operator and distributor Gebr. Heinemann is transforming how it approaches product curation and market expansion. The company’s strategic pivot away from broad, democratic assortments toward curated, impact-driven selections represents a shift in industry thinking, delivering measurable results across several categories.

“We have fundamentally evolved our approach by introducing global negotiations, thereby consolidating our purchasing power across all regions and channels,” says Gebr. Heinemann Chief Commercial Officer Inken Callsen.

“This shift allows us to act globally, leverage our collective know-how and then apply it strategically to local market needs.”

Heinemann’s expansion into new markets including Jeddah, Noida and Keflavik plus Royal Caribbean and AROYA Cruises applies this centralized knowledge strategy while maintaining cultural fit through local partnerships.

Data-driven curation

Central to Heinemann’s strategy is a comprehensive initiative focused on data-driven SKU rationalization. This approach has restructured decisionmaking processes and generated

commercial impact by embedding data analysis across all areas of the business.

“Our global assortment initiative is centered on clarity, efficiency and customer focus,” explains Callsen. “By embracing a data-driven approach, we are able to define and manage our assortment with greater precision and commercial impact. We actively encourage our partners to work closely together with us to develop a shared vision for effective impact based on data and collaboration.”

Our Spectra 3.0. Durable and stylish Carry-on. Front-opening compartment for priorty access to essentials. The ideal choice.

Heinemann’s strategic evolution marks a pivotal shift in product selection philosophy. “We are moving away from broad, democratic assortments toward a more curated and impactdriven strategy,” states Callsen. “Our focus is on luxury products, niche selections, travel retail exclusives and entrylevel options that offer accessibility without compromising on experience.”

The strategy includes innovative formats such as smaller pack sizes and travel retail-exclusive editions that make luxury more attainable for wider audiences. “By simplifying the offer and creating space for innovation, we are seeing stronger consumer engagement and an increase in basket sizes across markets,” notes Callsen.

Category performance data from 2024 reveals the effectiveness of the company’s strategic approach. Beauty achieved 24% growth, Fashion & Accessories increased 28%, and Liquor, Tobacco and Confectionery rose 17%. However, the first half of 2025 has shown that the environment for travel retail remains challenging.

“This has a noticeable impact on overall growth,” says Callsen. “Nevertheless, we continue to actively develop our categories with a strong focus on innovation, relevance and customer experience.”

Callsen notes that Beauty has expanded with the introduction of new concepts, including the expansion of

beauty services and the launch of wellness and health. Niche luxury fragrances are driving category growth while Test & Learn zones showcase trending brands favored by Gen Z consumers, allowing Heinemann to evaluate potential for broader rollouts. Callsen mentions that the company maintains three-year development partnerships with established suppliers including L’Occitane, Puig and Coty.

The Fashion & Accessories category is benefitting from new luxury marketplace implementations. According to Callsen, “We are seeing strong momentum through the implementation of new luxury marketplaces, for example in Antalya with our joint venture partner ATU Duty Free, and in Jeddah,” she says. “Istanbul, with its exceptional luxury marketplace, continues to be a major growth driver. Within FA, subcategories such as Sunglasses and Toys are performing particularly well. We are currently developing a new kids’ concept that includes Toys and other relevant subcategories, and we are continuously enhancing our retail concept for Sunglasses.”

Heinemann is seeing mixed performance indicators in Liquor, Tobacco and Confectionery, though premium tequila is outpacing the broader spirits market. “A highlight is our global exclusive Reserva de la Tequila, developed in partnership with Proximo,” says Callsen. “This demonstrates the impact of exclusivity and the power of collaboration.”

Tobacco is particularly flourishing in Middle East and African markets while next-generation product investments are generating positive returns through specialized airport implementations.

Confectionery faces pressure from elevated cocoa costs, driving focus toward exclusive products and targeted promotional activities. “We are closely monitoring consumer reactions, working to mitigate any potential impact through travel retail exclusives and innovative promotions,” says Callsen.

Heinemann’s enhanced retail concept for Sunglasses reflects strong performance in the Fashion & Accessories subcategory

Changing preferences

Showing 29% growth in several locations in 2024, the success of specialty fragrances reflects changing traveler preferences. “Niche beauty is striking a powerful chord with today’s travelers, who are increasingly seeking individuality, authenticity and exclusivity,” observes Callsen. “Niche fragrances are often only selectively available in domestic and online markets, which makes them especially desirable in the travel retail environment.”

The company has identified this category segment as particularly suited to travel retail’s unique positioning, and is investing accordingly. “We are expanding this segment through dedicated spaces in key locations creating experiences that highlight the uniqueness of these brands,” says Callsen. “Niche fragrances have proven to be a strong growth driver, maintaining both price integrity and sales performance without the need for discounts. In contrast, broader assortments often rely on price

discounts to perform, which is one of the reasons we initiated our global assortment project.”

Sustainability and social responsibility form core elements of Heinemann’s corporate strategy. “In 2024, we made significant progress toward our 2030 goals within all four dimensions of our global sustainability strategy, which are Environment, Social, Governance and Responsible Value Chain,” says Callsen.

By the end of 2024, 70% of Heinemann’s purchasing volume was covered by independent third-party assessments such as EcoVadis and B Corporation certifications. The company has expanded its network of green partnerships to include joint green business plans with Diageo, Tony’s Chocolonely and EssilorLuxottica.

“One tangible example is our exclusive chocolate pack with Tony’s Chocolonely,” Callsen expands. “For every pack sold, we donate €1 to the

Tony’s Chocolonely Foundation, supporting education, healthcare, climate protection and gender equality in cocoa-growing regions.”

Heinemann takes a proactive role in driving supply chain change. Two years ago, the company’s first Sustainability Summit brought together freight forwarders, truck manufacturers and start-ups to develop action plans.

“We have seen a measurable reduction in CO₂ emissions by 28%,” says Callsen. “In September 2025, we hosted a second summit. This time, we invited our key suppliers to align on joint goals in order to secure sustainability along the entire value chain.”

The environment for travel retail remains challenging in 2025. “Geopolitical conflicts, economic uncertainty and evolving regulatory frameworks continue to shape both our operations and consumer behavior,” says Callsen. “In this context, we have to accept that instability is no longer an exception –it is a constant.”

Callsen emphasizes the need for industry cooperation that transcends traditional competitive boundaries. She advocates rethinking contractual frameworks and concession agreements to allow for greater operational flexibility and shared risk management across the industry. “This requires the entire industry to work more closely together, really living collaboration beyond company borders, thereby fostering agility and space for innovation,” she explains.

“But it goes beyond commercial terms; it is also about how we lead and how we work,” she continues. “We are operating in a fundamentally different world, and that calls for new leadership styles and management capabilities. Navigating uncertainty successfully means being adaptable, transparent and forward-looking, qualities that we have taken to heart and that will guide us on our way forward.”

Discover our range, from to a variety of flavors

X-Low

For Trade Only. Not for Distribution to Consumers.

*PMI reported global shipment volumes and in-market sales estimates of nicotine pouch units, from July 2023 to December 2024.

MULTIPLE PODS. RE-USABLE DEVICE.

For Trade Only. Not for Distribution to Consum ers. ONE VAPE HAS IT.

These products are not risk free and provide nicotine, which is addictive Only for use by adults.

Newly appointed MEADFA President Abdeslam Agzoul shares his vision for collaboration, sustainability and growth across the Middle East and Africa

by ATOOSA RYANNE ARFA

Since its founding in 2001, the Middle East and Africa Duty Free Association (MEADFA) has served as an important voice for duty free and travel retail across the Middle East and Africa, bringing together regional players to promote growth and collaboration.

Now, newly appointed MEADFA President Abdeslam Agzoul leads the charge through a time of shifting market dynamics and evolving traveler expectations. With more than 20 years of experience in travel retail and hospitality, including senior roles across Europe, the

Middle East and Africa, Agzoul plans to expand MEADFA’s membership, raise the region’s profile internationally and make ESG an industry priority. Speaking with Global Travel Retail Magazine (GTR Magazine) ahead of the TFWA World Conference and Exhibition in Cannes, Agzoul outlines his vision to strengthen collaboration, bridge global and local priorities and drive sustainable growth across the region.

GTR Magazine: Congratulations on your appointment as President of MEADFA! Can you share a bit about your profes-

Abdeslam Agzoul brings over 20 years of experience in travel retail and hospitality

sional journey in travel retail and what drew you to this industry?

Agzoul: Thank you very much. I feel truly honored to serve MEADFA in the position of Chairman. I began working in travel retail and hospitality over 20 years ago in Barcelona, starting in a

business controlling role with the Areas Group. Since then, I’ve had the opportunity to take on various roles across different companies and countries. I first joined Avolta in 2006 and remained until 2016, before returning in 2023 as CEO for the Middle East and Africa.

What has always drawn me to this industry is the spirit of travel itself –particularly the discovery of cultures and the rich histories of different regions. Travel retail is a unique window to the world, constantly evolving and offering new perspectives through the diversity of our customers.

GTR Magazine: As you begin your new term, what are your main goals for MEADFA and how do you envision working to achieve them?

Agzoul: Over the next two years, I plan to focus on a few priorities. One is strengthening our organization by

attracting more members (especially larger players) and providing meaningful support to all members, with a particular focus on small and independent operators. Another is establishing a strong and unified position at the upcoming MOP4 gathering to ensure our industry is recognized as clean, transparent and collaborative. I also plan to elevate ESG as a central pillar of our industry by implementing the ESG charter and ensuring that Africa is given the visibility and recognition it deserves within the global travel retail landscape.

To achieve these goals, reinforcing the role of the MEADFA Board and empowering our technical committees – the backbone of MEADFA – will be essential. Increasing engagement with key stakeholders and partners, including industry associations, landlords and regulatory bodies such as ACI and Customs authorities will also be a priority. We will also need to improve

communication with our members to ensure alignment, transparency and shared progress.

GTR Magazine: You’re taking on this role at a time of rapid change. What are the most pressing priorities you believe MEADFA must address first and how do you plan to ensure member markets across the Middle East and Africa feel heard and supported?

Agzoul: One of our top priorities is to understand the latest trends in travel retail and the evolving expectations of new generations. In our region, this is especially relevant. Gen Z and Millennials are projected to represent over 70% of global travelers by 2040, and their behaviors and values are reshaping the industry.

We must also embrace technology and data as key drivers of business transformation. Leveraging insights and

japan’s nature

digital tools will be essential to staying competitive and relevant. We also want to bridge the gap between global and local. This means helping local operators become more globally connected, while encouraging international players to adapt more locally. This dual approach will strengthen the ecosystem across our diverse markets.

To ensure our members feel heard and supported, we plan to reinforce our communications through multiple channels, including our newsletter, regular town halls and of course, our annual conference. We will also facilitate access to insights and studies that help members make informed decisions and stay ahead of trends. Last but not least, we plan to encourage deeper interaction within the community – between vendors and operators, and among peers – so that MEADFA becomes a true platform for collaboration and shared growth.

GTR Magazine: Given the diverse market dynamics across the Middle East and Africa, what do you see as the key similarities and differences within the region?

Agzoul: Despite their diversity, the Middle East and Africa share several important similarities. They both are massively investing in connectivity, particularly in air transport. Both regions are developing airport infrastructure, strengthening national carriers and building ecosystems around airports. They are also working to improve mobility through supportive laws and regulations. Both regions also have young, mobile populations with strong aspirations for connectivity and travel and have held resilience in the face of geopolitical challenges. Over the past decade, both regions have demonstrated remarkable adaptability and strength. These shared traits create a strong foundation for growth.

GTR Magazine: How do these shared traits shape the main opportunities and challenges for businesses operating in the region?

Agzoul: I see three major opportunity areas in particular.

One is geography. Africa’s vast landscape demands improved mobility and infrastructure, and air travel is often the only viable solution. Similarly, in the Middle East, air travel remains the safest

and most efficient mode of transport. The region’s strategic location as a bridge between East and West further reinforces its role as a global travel hub.

Another is demographics. Personal and family ties drive travel across both regions. With a predominantly young population, the potential for growth in air traffic is enormous. In Africa alone, over 95% of the population has never flown – representing a future market of 1.3 billion potential travelers.

Then there is growth potential. We are already witnessing the rise of a strong middle class in the Middle East. This trend is expected to continue, bringing increased demand for travel and retail experiences.

These dynamics present both opportunities and challenges. Businesses must adapt to local realities while leveraging regional strengths. The key will be to remain agile, inclusive and forwardlooking.

GTR Magazine: In what ways can MEADFA evolve its strategies to better foster collaboration, advance sustainability and drive meaningful outcomes across the region?

Agzoul: To move forward meaningfully, MEADFA must continue to strengthen collaboration with key stakeholders, particularly airports and landlords. We also need to work more closely with regulators to promote greater transparency and facilitate travel through improved visa policies, exchange controls and passenger allowances.

At the same time, we must never lose sight of the customer. Customercentricity should remain at the heart of every initiative, both within the industry and within MEADFA’s role as a catalyst and facilitator.

MEADFA’s various forums, and especially our annual conference, provide a vital platform for dialogue and alignment among stakeholders across the region.

I also want to pay special tribute to the efforts of the ESG Committee, under the leadership of Dr. Munif Mohammed. MEADFA has been a pioneer in sustainability, launching this journey years ago and achieving significant milestones. Importantly, we’ve succeeded in tailoring our ESG initiatives to reflect the unique needs and realities of our region, ensuring that sustainability is not just a global trend, but a locally relevant commitment.

by ATOOSA RYANNE ARFA

Nuno Amaral has returned to Bahrain to lead ARI Middle East (ARIME) as the company celebrates its 35th anniversary, a milestone in the region’s travel retail landscape. With decades of experience overseeing ARI’s global operations, Amaral is focused on driving passengercentric strategies, operational excellence and technology-led innovation across ARIME’s portfolio. Speaking with Global Travel Retail Magazine (GTR Magazine), he shares insights on catering to diverse passenger demographics, expanding the business footprint and delivering on ESG commitments.

Returning to ARI Middle East as CEO during its 35th anniversary, Nuno Amaral outlines his vision for operational excellence, passengercentric strategies and strategic expansion across the region, while continuing his global role as ARI’s Chief Operations Officer