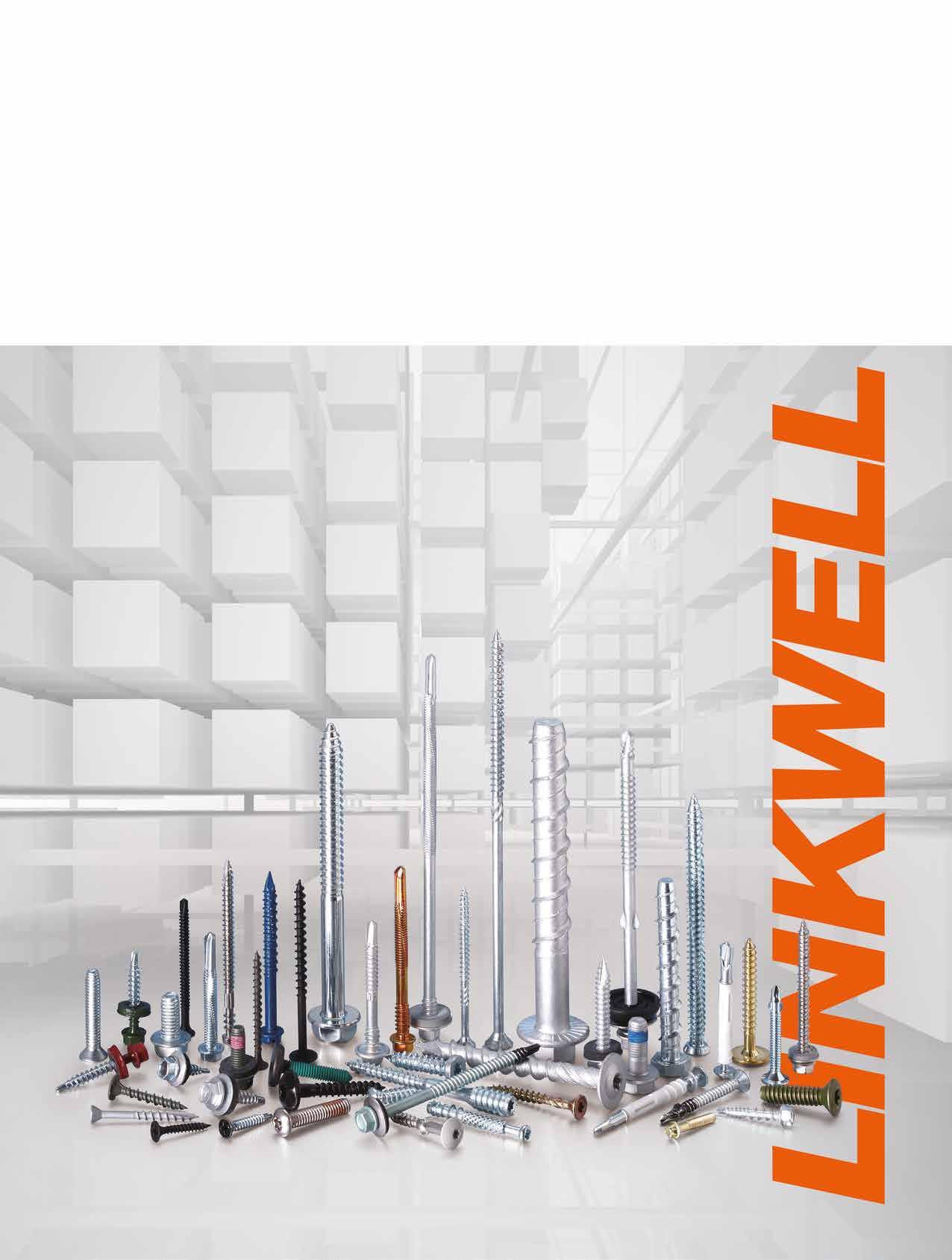

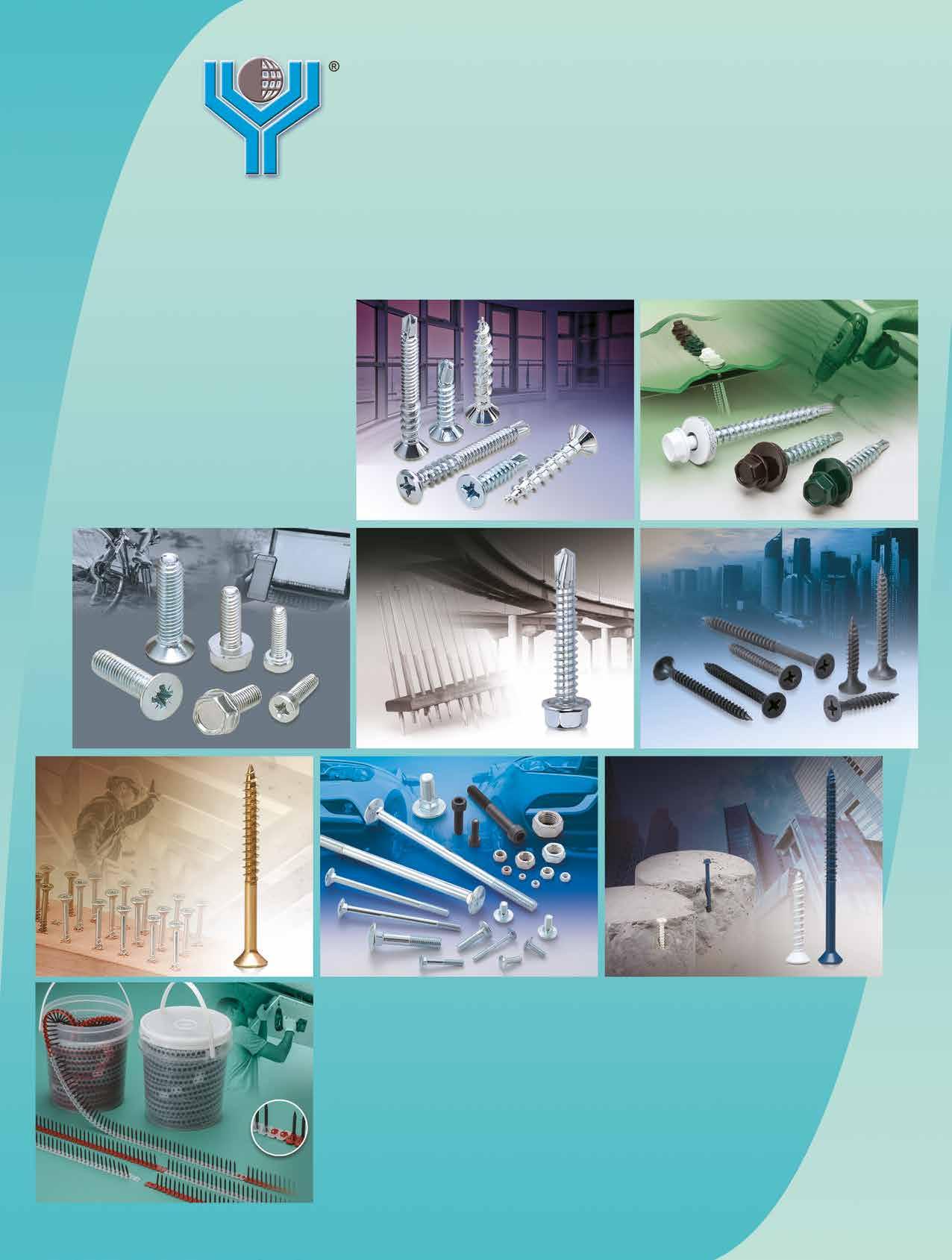

Founded in 1977, Linkwelll has walked through 45 years and now into the 46th year. It was one of the pioneers dedicated in fastener trade back when Taiwan fastener industry was taking form. Extending to fastener manufacture and utilizing both roles as a manufacturer and trader, it is known as a one-stop fastener hub. Its assorted range of fasteners guaranteed with Taiwanese credibility and quality are supplied to the machinery, automotive and construction industries. Linkwell has manufacturing plants in Vietnam, Malaysia, Indonesia, Thailand, China and Taiwan, and a majority of customers from the U.S., Europe, and Japan.

The reason that it can be a reliable supply source for clients is because it is rooted in Taiwan and extends to Southeast Asia and China. All of its overseas plants support one-stop and streamlined production with stable quality, starting from material handling to production, processing, electroplating, packaging, inspection and delivery.

Each of Linkwell’s plant is characterized as in Table 1. The Vietnam and China plants feature carbon steel screws (Vietnam: mostly small screws and self-drilling screws; China: mostly large bolts). The Indonesia and Malaysia plants mainly manufacture stainless steel screws (Indonesia: mostly standard screws; Malaysia: mostly special screws). The Vietnam plant began production 5 years ago and is now fullfledged with a full process from heading to threading, slotting, heat treating and electroplating completed under stringent quality control. This plant continues to gain additional orders. Each plant above comes with a feature and competitiveness that are recognized by buyers.

Regions Malaysia Indonesia

Plant Name Well Union Metal Sdn. Bhd PT. Batam Well Industry

heading machines

forming machines

tons

Capacity

Mainly stainless steel (A2、A4、410 SS) screws and small screws.

heading machines

forming machines

tons

Mainly stainless steel

Viet-Screw Company

Pinghu City (Zhejiang Province of China)

Fastwell Industry Co., Ltd.

heading machines

heading machines

tons

Mainly carbon steel and small screws.

forming machines

tons

Product

chipboard, drywall, self-tapping, machine screws, and bolts below (including) Ø M10.

Diameter M2.5-M12

、A4、410 SS) screws and small screws. Self-drilling, chipboard, drywall, self-tapping, machine screws.

M2.5-M8

screws, chipboard screws, drywall screws, collated screws, self-tapping screws, concrete screws.

M2.5-M10

Carriage bolts (DIN 603), hexagon head screws, flanged bolts, machine screws.

Length 4mm-150mm 4mm-150mm 12mm-320mm 6mm-300mm

Beginning in 2020, the market took a hit from the pandemic and was particularly at its lowest in April to June 2020. It started to pick up in July, and in October 2020, various industries were faced with clients’ revenge spending. Prices of all materials and particularly shipping heightened. Everyone seemed afraid of the shortage and this phenomenon lasted for astounding one and a half years.

And then the fourth month of 2022 became a turning point. Clients had been overstocking, the prices were too high and the pandemic came back. Plus, with Russia-Ukraine war, market demand took a plunge and drastically changed the world’s business. All material and shipping prices started to come down. (The inflation, however, is an existing fact and supposedly the price will not go down to the point it initially rose from.)

“Our only path in response is to change our structure to further automate production, lower operating costs, manufacture higher-value special products and enhance collaboration with clients so that we can work together to create a better future.”

PDT Rolls out Dual Y Axis Automated Screw Fastening Platform by PDT (Taiwan) that improves operation efficiency and cuts down the cost for labor. The platform comprises a work section on the left and another on the right side. Upon completing operation on the left section, the platform would automatically switch to the right section to continue operation, while the left section is already on standby for the operator to feed materials. When the operator finishes feeding and pushes the "production-ready" button, the left section will automatically start production as soon as the right section finishes production. This alternating operation flow keeps the platform running 24-7 and makes for a solution for factory upgrade and transformation towards automation and labor reduction.

(Image Source: Commercial Times, Taiwan)

National Nail’s CAMO® brand of tools and fasteners has introduced new CAMO Stainless Steel fasteners to help contractors, remodelers and DIYers build better in every environment. Now, the CAMO brand can add fastening efficiency and strength to exterior projects across the country, no matter the environment. Designed to protect connections against the elements, CAMO’s 316 Marine Grade Stainless Steel fasteners are ideal for use in highly corrosive coastal and agricultural environments and applications that face abrasive agents. CAMO 305 Stainless Steel fasteners provide excellent corrosion resistance and long-lasting aesthetics for a variety of inland exterior projects.

“CAMO is excited to offer a full line of Stainless Steel screws and nails for contractors to add value and performance to their upcoming projects,” said Doug Hutchings, Vice President of Product Development at National Nail. “The variety of Stainless Steel fasteners deliver superior corrosion resistance and holding power on any jobsite, even in the harshest coastal conditions.” Hutchings added that the unique Stainless Steel Fastener pails with metallic lids is the first in a series of visually bold, new CAMO packaging that will ultimately be rolling out to all CAMO products. Other brand colors like CAMO’s distinct orange is designed with the end-consumer in mind for easier selection.

Perfect for building wood or composite decks and other exterior projects, CAMO’s new line of Stainless Steel fasteners includes hand drive deck, composite and trim screws that come with a 2 in. (50.8 mm) power bit for jobsite convenience. They also offer 316 Stainless Steel Marine Grade Edge Screws for use with CAMO MARKSMAN Pro® tools and collated screws for use with the CAMO DRIVE™ stand-up tool. New to the CAMO brand are ring shank deck nails and joist hanger nails as well as collated ring shank framing nails and collated metal hanger nails that are compatible with a wide array of pneumatic nailers. Just like other CAMO tools and fasteners, CAMO backs up their line of Stainless Steel screws and nails with a warranty to resist rust and corrosion.

"Clean Tap" developed by Yamashina (Japan) can greatly reduce chips when it taps iron and other plates. Using tapping screws on circuit boards can generate chips that fall on electric wires and cause a short circuit; therefore, electronic parts have to limit the use of tapping screws despite the need to save costs.

To reduce chips, the self-tapping screws would have to be applied with adhesives, or the fastened object has to be attached with a device to capture chips. Doing so would increase costs. To tackle this, Yamashina analyzed the generation of chips as well as their constituents, and succeeded in developing a self-tapping screw with a brand-new shape that can be used on EVs, drones, robots and circuit boards.

Although stainless steel is less likely to rust than other metals do, it could actually rust from oil, iron, scales and other impurities attached to it in the manufacturing of fasteners. SS Coat's heat treatment pushes the inherent characteristics of stainless steel to the limit.

SS Coat (Japan) recently introduced a coating technology named SABINAI JYAN. This black-dyeing surface treatment is often said to have inferior corrosion resistance. However, SABINAI JYAN passed over 3,000 hours in an anti-corrosion test. It is suited for use with outdoor black materials and SUS410/SUSXM-7/SUS304/SUS305/ SUS430 materials, and it doesn't use Chromium-based chemical solutions.

To inspect a workpiece from 3 different angles, an inspection machine would have to be installed with multiple cameras. Japanese Oshima Setsubi's "Glass Rotor" inspection machine uses a transparent glass rotary plate that eliminates blind spots for cameras during inspection. Therefore, it only takes one camera to inspect screws, bolts and nuts from above, the side and below, all in one go. Additionally, "Glass Rotor" comes with a function to auto clean the glass plate.

Oshima Setsubi's product video)

The fixing specialist fischer offers the new TermoZ CS II screw fixing to anchor ETICS insulation panels made of any kind of material including fire bars into any conventional construction material. This enables simple, time-saving screw mounting with minimal thermal bridges.

Considerable efforts must be made in the building sector in order to attain climate goals by 2030. There is still tremendous potential for saving energy that lies dormant in existing buildings. Facade insulation is a highly effective measure to increase energy efficiency in this regard. But in order to be able to fulfil their function, external thermal insulation composite systems (ETICS) must be professionally installed. Securely anchoring the insulating layer in the anchor substrate with as few thermal bridges as possible is of key importance. The new fischer TermoZ CS II fixing is made for this task.

The latest addition to fischer’s range of ETICS fastenings is multitalented, as it is suitable for fastening insulating panels in any conventional material and thickness on all standard solid and hollow construction materials. The ETICS fixing therefore doesn't need to be replaced if the facade is equipped with various insulating materials such as a fire bar, which saves additional time. Its approval for every building material class (A, B, C, D, E) guarantees its secure application. fischer’s TermoZ CS II is therefore also suitable for subsequent insulation on renovated buildings if there is uncertainty about their anchor substrate. Further advantages include the fact that any improper use caused by unsuitable insulation fixings is prevented and users can make do with a single ETICS fixing even if the building has various substrates. The European Technical Assessment (ETA-14/0372) regulates the use of the TermoZ CS II in concrete, masonry (solid and perforated brick), lightweight aggregate concrete and aerated concrete. Thanks to its anchor sleeve with a symmetric expansion zone, the newcomer is the first insulation fixing with an approval for hammer-drilled holes in vertically perforated bricks. The special geometry below the plate (Fibonacci) reduces the required insertion torque for convenient and fast installation. Its upper side features a specialist surface structure for better adhesion to plaster. The closed plate does not allow any dirt to be ejected, providing a clean setting result.

With its new TermoZ CS II screw fixing, fischer offers system providers a universal insulation fixing that hardly, if at all, impairs the energy efficiency of ETICS and also enables efficient work and rapid construction progress.

The EU Construction Products Directive published in 2013 requires the use of stainless steel fasteners in exposed parts of buildings which are expected to last for over 25 years. Earlier, construction fasteners were mostly in carbon steel and they can finish drilling, threading fixating and fastening in one process. While this saves time, it jeopardizes building safety due to long exposure and corrosion.

MIRDC (Metal Industries Research & Development Centre, Taiwan) said lots of construction fasteners sold on the market are bi-metal self-drilling screws comprising carbon steel and stainless steel, possessing the hardness of carbon steel and corrosion resistance of stainless steel. However, they have a complicated processing procedure, and could potentially break apart on the welded spot or be corroded on the carbon steel section.

MIRDC developed a surface treating machine to handle anti-corrosion and surface hardening treatment for stainless steel parts, providing solutions to deficient stainless steel hardness, weakened corrosion resistance and inability of mass-production. The machine can make for a stainless steel surface hardness up to over HV1,200 (much higher than with carbon steel) without undermining corrosion resistance.

Furthermore, the machine can process a large number of stainless steel parts at a time. It can also handle complicated shapes and form an evenly hardened layer at the parts' surface. It uses AI for precise control of temperature, time and other parameters. Meanwhile, MIRDC provides IoT solutions tailored to production lines to facilitate smart manufacturing.

As the speed of technology and trends in consumer behaviour accelerates, companies around the world are evolving quickly and TR Fastenings is no exception. TR’s latest product launch of Compression Limiters has been developed to meet the growing global demand from multi-sector manufacturers developing products using plastics, particularly in the EV space.

Compression Limiters reduce the stress that’s generated by traditional threaded fasteners. Demand has mainly been driven by the automotive sector, and applications in the energy and general industrial sectors where high load bearing plastic components are used and have also contributed to the surge in worldwide demand.

Compression Limiters are used extensively in composites and plastic mouldings as through holes help reduce the stress generated by conventional fasteners. These non-threaded inserts are commonly used in applications where a compressive load is applied to a plastic assembly to prevent the integrity of the plastic from being compromised.

These products are used extensively in electric vehicles and the battery housings. As technological advances continue, so does the need to continually develop the primary components that make up an electric vehicle. Newly created giga factories and battery housings manufacturers in Europe, Asia and North America will be looking to include these products in many upcoming automotive research and development projects and with a global presence, TR Fastenings is ideally positioned to meet this demand, whilst also providing technical and design assistance.

TR’s experience over the last few years is that many of these are designed in specials and required in high volume. There are a number of different types and as a guide the TR’s Compression Limiter range consists of symmetrical, flanged, split seam and oval manufactured from steel, stainless, brass and aluminium.

The annually held Fastener Fair USA returned to Detroit with a physical event held on May 17-19 at Huntington Place. Being a professional tradeshow dedicated to the whole fastener supply chain (incl. manufacturers, distributors, equipment fabricators, mechanical & design engineers, processors, purchasers, distributors, OEM, packaging service providers, and end-users), the event this year attracted the attendance of professionals from automotive, aerospace, construction, furniture, electronic appliances, and many other industry sectors to look for the latest fasteners and learn about relevant industrial trends and market development intelligence.

123 exhibitors from various countries came to showcase their industrial fasteners and fixings, construction fixings, assembly and installation system, fastener manufacturing technology, storage, distribution, factory equipment services

by Gang Hao Chang, Vice Editor-in-Chief of Fastener World

(coating/packaging...), information and communication. In addition, several well-known specialists from within the industry were also invited to give thematic sessions on relevant fastener technology, logistics, electroplating, etc., and associations also gave their own activities for further interaction. This tradeshow provided the best opportunity and platform for all participants to meet each other, strengthen collaboration, and deepen multilateral interaction.

The worldly known marketing press dedicated to the fastener and hardware industries, Fastener World Inc., which booked a booth this year, also made the most of this opportunity to conduct deep communication with local buyers, simultaneously share with the world the latest industrial intelligence through our multiple publications (incl. Fastener World, China Fastener World, Hardware & Fastener Components, Emerging Fastener Markets, etc.), and introduce superior suppliers of products, equipment, and relevant service from the world to local potential purchasers. Other Taiwanese exhibitors this year also included BBI and Angelray.

According to the observation of our staff onsite, although the number of visitors to Fastener Fair USA this year was not as many as observed in the last few editions due to reasons like pandemic control measures and travel restrictions, most buyers and visitors coming to Fastener World’s booth were from relevant industries and fields. As a result, we could ensure that all printed copies brought to the show were handed out to buyers with significant demand. The high demand for Fastener World publications at the show also revealed our long-term leading position in the global fastener industry and the fact that we were doing whatever we could to create opportunities for our advertisers to gain more exposure at every important international tradeshow.

According to the organizer of Fastener Fair USA, the next edition will be relocated to Music City Center, Nashville, TN on May 16-17, 2023.

Like M-Tech Osaka and Nagoya, M-Tech Tokyo as a barometer of the Japanese fastener industry attracted twice the number of exhibitors at the time when the Japanese government had loosened up border control. People were flowing back to the venue and visitors as well as exhibitors were in their masks having business talks, following the show’s regulation. Our exhibitor found a potential trend and an opportunity in the talks with visitors.

Most of the visitors to the Fastener World booth were key directors and managers, most of whom from the purchasing department. This reveals that Japan’s purchasing demand has been increasing in recent years regardless of the macroenvironment. It involves a cause as well as a concern.

Our staff on site asked the visitors why they came for the latest publications. Many of them spoke of a bottleneck they had in common — cost pressure. “Price is hiking so much in Japan that I have to reach out to price-competitive sources of supply. I know Taiwan has quality fasteners so I’m curious about the industry structure of Taiwanese fasteners, and whether there are any Taiwanese fastener suppliers able to collaborate ASAP,” said one Japanese visitor. The words hint at a large room for Taiwan’s fastener industry to develop the Japanese market. Taiwanese business owners need a full-range international sales expansion and marketing to get the Japanese owners to know Taiwan’s fasteners.

Previously we reported on Fastener World's official website homepage that the Russia-Ukraine war took a toll on the Japanese fastener industry that directly affected cost. It spiked up cost of materials including steel and aluminum, as well as the invisible costs for what the Japanese referred to as “submaterials”, including surface treatment and packaging, which

they would rarely pass on to clients. According to the Japanese press, the last two years already saw some small and medium enterprises close up, and the Japanese government has introduced subsidies for them to rebuild business and pull through.

To the Japanese visitors, Fastener World presented 5 series of publications containing companies intelligence. Some of them told us they actually came straight for our magazines. We met Japanese vendors with different specialties including construction, ship component trading, special steel manufacturing, automotive fastener production, fastener distribution and manufacture, and they were all asking which companies in Taiwan could supply fasteners. We have updated this information with related suppliers.

The show held across June 20 to 21 this year had 1,057 exhibitors from 51 countries (Italy, Turkey, Spain, Belgium, France, Austria, the Netherlands, Switzerland, UK, Sweden, Poland, Czech Republic, Germany, the U.S., Canada, S. Korea, Taiwan, India, Japan) displaying machines for wire production and processing, wires, and fastening technology on a 53 thousand square meters venue.

The visitors to Fastener World booth were mostly from India and Turkey, 75% of whom with a management role working in manufacturing companies. Our staff on-site probed and found that machines were the product they needed most, followed by fastener products. The number of visitors wasn’t as high as what it used to be because of border control policies and global economic status, but it is worth noting that valid visitors and successful deals significantly increased, our exhibitor analyzed. Provisitors with industry specialties increased as well.

Our staff on-site further discovered an increase of first-time visitors, a clear sign that the show’s products reflected the international market demand and met industry expectation. Up to 70% of the visitors said they will come back to the show again in 2024.

Our exhibitor noted the sight of a wire exhibitor of fastener manufacturing background displaying fastener products for

Wire companies are both innovative and more inclined to energy and resource-saving production. For many years, the organizer has been actively supporting these energy-intensive industries to transition to sustainable industries. The organizer put up a series of seminars discussing the transition to green energy, recycling and reuse, sustainability, carbon emission, and steel trade in a time of crisis.

Wire Düsseldorf will open again from April 15 to 19 in 2024 at Convention Center Düsseldorf.

by Gang Hao Chang, Vice Editor-in-Chief of Fastener World

by Gang Hao Chang, Vice Editor-in-Chief of Fastener World

Corrosion-incurred screw anchor failure or poor fastening results due to insufficient drilling point hardness have been sometimes heard, and the potential risk of unexpected fall of not-securely fastened objects may also lead to property loss or severe casualties. In such an era when regulations and users worldwide become more concerned about fastening security, how to develop products featuring both security and durability has undoubtedly become the priority consideration in the R&D of new-generation screw anchors. Sheh Kai Precision Co., Ltd. knows what challenge users may face in fastening applications, as a result, with years of leading bimetal welding and heat treatment technology, it has developed several amazing products for users. Drill bits with tungsten carbide tips and ETA Option 1 certified bimetal screw anchors approved by German DIBt are its most recent representative products.

Sheh Kai bimetal screw anchors are made of 300 series austenitic steel (body) and carbon steel (tip) and processed with precision welding and heat treatment to ensure high corrosion resistance of the stainless steel body and more effective fastening than other general screw anchors. However, manufacturing such products requires the welding strength to exceed the installation torque, otherwise, they are prone to breakage at the welding point, resulting in a more complicated situation. In addition, carbon steel tips must be also processed with localized hardening treatment, which will require sufficient experience and strong R&D capabilities and shows quite high technical entry barriers. Technically, the entry barrier is very high.

“300 series austenitic steel features exceptional anti-corrosion. While used outdoors, they reveal greatly increased service life and avoid security issues related to corrosion-incurred screw anchor failure, especially in highly corrosive environments. Tips made of harden-able carbon steel are used as lead threads during fastening to avoid unsuccessful fastening of stainless steel bodies due to material properties,“ says Sheh Kai Manager Barry Tsai.

Available head types and sizes Sheh Kai currently offers are: hex washer head (M6 x 75 ~ 150 / M8 x 90 ~ 150 / M10 x 105 ~ 150 / M12 x 125 ~ 150 / M6 x 75 ~ 150 / M8 x 90 ~ 150 / M10 x 105 ~ 150 / M12 x 125 ~ 150), pan head ( M6 x 75 ~ 150 / M8 x 90 ~ 150 / M10 x 105 ~ 150) and countersunk head (M6 x 80 ~ 150 / M8 x 95 ~ 150 / M10 x 110 ~ 150). Besides ETA, the application for U.S. ICC-ES is already underway.

Strict regulations of screw anchors for construction have been adopted in many markets. Australia, for example, adopts strict restrictions against the entry of non-certified products. Sheh Kai with OEM ability and int’l approval can help clients develop markets and supply latest regulations-compliant products. In Taiwan, its screw anchors have been also installed on fire protection pipes in many high-rise buildings and Ubike facilities.

Tsai added, “Screw anchors share only a minimal part of the total construction cost, and the security, convenience, and durability resulted from the correct use of products are more significant than future maintenance & repair cost. That air-con outdoor units fell down onto somebodies has been common, we've all heard stories of outdoor installation failures, such as air-con units, that caused horrible injuries, if installers can use specialty stainless steel products, such things can be avoided. Contractors can also require the project builders to use parts that are suited for the project to avoid future disputes. For more info please link to https://www.facebook.com/shehkai/

Formerly known as Jbest Cooperation, Homeyu Fasteners based in Hsinchu City of Taiwan previously focused on supplying fasteners to academic institutes and high-end semiconductor industry. Clients have supported and led the company to progressively open up business opportunities in conventional mechanical processing, construction and automotive industries. It led to the birth of Homeyu Fasteners which leveled up from the strengths of Jbest Cooperation. In mechanical processing, the company recently added cold forging, open-die forging and multi-stroke process to the existing manufacturing process including seamless stainless steel pipe cutting, machining and welding, further increasing product diversity. It will focus on domestic and overseas sales in construction and automotive industries. Inheriting past years of experience in serving high-tech and academic institutes, it does the right job to meet the quality and client’s requirement.

Homeyu's fastener products are used in the semiconductor, food and material chemical markets, and mainly supplied to manufacturing equipment companies, connecting various components in manufacturing equipment. Additionally, the company has clients including Industrial Technology Research Institute (ITRI), and academic entities including National Taiwan University, National Tsing Hua University, and National Chiao Tung University. The fact that these high-end equipment companies and R&D-capable academic entities use Homeyu products means its product level meets very high quality requirements.

by Dean Tseng, Fastener World

by Dean Tseng, Fastener World

Furthermore, the company has QA personnel to inspect using 2D projectors and ensure the products are manufactured to client-specified tolerances before shipment. The manufacturing equipment onsite is scheduled as per manufacturing efficiency, and are routinely checked by an appropriate number of inspectors who can immediately monitor dies and cutting tools wear and quality. The company can also provide customized products with various quality levels, performance and durability as per clients’ request. The options are diverse and the company can provide advice on use of materials and manufacturing methods according to clients’ need for environment application.

Homeyu’s high-end fasteners derive from continuously adding novel manufacturing methods, through which the company can provide customized products that are infused with diverse technology. The company has set the target this year to integrate the manufacturing process by migrating from “all machining” to “ forging before machining” . This way it can save material cost for clients and control quality more effectively.

From Jbest to Homeyu, the company has full curiosity to understand clients’ demand in various fields and double hospitality to provide clients with best-suited quality and service. In the past, it mainly served the domestic academic entities and semiconductor industry. Now it has turned to the overseas to develop clients and hopes to build a bridge for trade and collaboration utilizing its high quality products and rich experience.

ITRI-certified

Lars Holm, Managing Director of Swedish specialist stainless steel fastener maker BUMAX gives us his insights into what he sees as the three most important industry trends in 2022.

Many industries are facing greater demands for sustainability and circularity – including product Life Cycle Assessments (LCAs) and Environmental Product Declarations (EPDs). Stainless steel is highly recyclable, which means that stainless steel fasteners can be a more sustainable material option than carbon steel in many applications. There will be increasing pressure from customers, partners, owners and society as a whole on companies, products and projects to be as sustainable as possible and that includes using fastener raw materials that are as ‘green’ and long-lasting as possible.

As industries better understand LCA costs, longterm value and sustainability, we anticipate new market opportunities and a growing demand for stainless steel materials. The fact is that premium stainless steel fasteners last longer, and require less maintenance and replacement, which also boost their sustainability profile. Therefore, I anticipate a shift from standard to premium fasteners and specifically from carbon to stainless steel fasteners.

A great deal has happened with premium stainless steel fasteners in recent years in terms of new properties and capabilities, and I expect this to continue in 2022 as new products are developed to meet even more demanding

fastener applications. We see new fasteners that are stronger and more corrosion resistant for a wide range of industry segments.

Unfortunately, economic instability, supply chain issues and uncertainty are likely to continue well into 2022, largely due to the ongoing effects of the Covid-19 pandemic. We will continue to see supply chain pricing pressures in the form of higher steel and logistics costs and the challenge for industry actors is to curb these effects. Some will handle it better than others. Winners will be fastener manufacturers with longstanding relationships with their suppliers, their own production facilities and with large stocks of products ready for shipping to customers. It is likely that market prices will continue to rise further during 2022.

Lars Holm is Managing Director for BUMAX, a Sweden-based worldleading specialist manufacturer of premium stainless steel fasteners. Holm has a decade-long background from the global logistics, manufacturing, adhesive and tooling industries.

Indian Tata Steel CEO T.V. Narendran said steel prices in the coming

rise much beyond the past few years. The CEO explained the steel market

going through several changes, including cost increase and China’s role change in this market. “The last 10 years have been dominated by exports out of China. Now, there’s far more stability in world steel trade.”

At its peak, China exported more steel than India produced, Narendran said. China’s steel exports have since halved to around 60 million tons a year, and could fall further as the country pursues its net-zero carbon emissions goals, and for “the first time in many years,” steel demand is not being driven by China, said Narendran. The World Steel Association expects growth in steel consumption this year comes from countries other than China. “With the Western world investing in infrastructure, that’s positive for steel demand as well.”

On the supply side, steel production costs are at “historic high levels” because of coal prices. Iron ore prices, however, have weakened and should trade within the $100 to $120 per ton range in the long term, he said. Steel prices may also be pushed up by the increasing carbon cost in Europe. “I expect to see steel prices at a much higher level than we’ve seen in the last 10 years, over the next 10 years.”

sales and EU’s full transition into EVs starting from 2035.

The purpose of this determination is to facilitate the climate target for Europe, which particularly is to reach carbon neutrality by 2050. At the request of countries including Germany and Italy, the 27 EU nations agreed to consider giving the green light to the use of alternative technologies such as plug-in hybrids if they can achieve the complete elimination of greenhouse gas emissions.

Environment ministers meeting in Luxembourg also approved a five-year extension of the exemption from CO2 obligations granted to so-called “niche” manufacturers, or those producing fewer than 10,000 vehicles per year, until the end of 2035. The clause, sometimes referred to as the “Ferrari amendment”, will benefit luxury brands in particular.

彭博新能源財經:2025年將有7700萬輛電 動車路上跑

Bloomberg New Energy Finance (BNEF) released the latest Electric Vehicle Outlook that states electric passenger cars sales will grow rapidly in the coming years, from 6.6 million vehicles in 2021 to 21 million in 2025. The fleet of EVs on the road hits 77 million by 2025 and 229 million by 2030, up from 16 million EVs on the road at the end of 2021.

According to BNEF, developed countries and multilateral institutions should include electric vehicle investments, incentives and charging infrastructure deployments in their international climate finance plans, making capital available to emerging economies that have credible plans to develop this sector.

The fleet of passenger electric vehicles is set to hit 469 million in 2035 in the Economic Transition Scenario but needs to jump to 612 million by the same date in the Net Zero Scenario. Much of the gap will have to be met in emerging economies, while wealthy countries should look at ways to support the transition in those markets and avoid a global slowdown of adoption.

歐盟批准 2035年起禁售燃油車

EU announced on June 29 that it has approved a full-range ban of new fossil fuel vehicle sales by 2035 on the European continent. This is aimed to pull carbon emission down to zero. The proposition was brought to the table in July 2021, and the final determination hints at a total cease of fossil fuel vehicle

“This is a big challenge for our automotive industry,” acknowledged French Minister of Ecological Transition Agnes Pannier-Runacher, who chaired the meeting. But she said it was a “necessity” in the face of competition from China and the United States, which have bet heavily on electric vehicles seen as the future of the industry.

Wall Street Journal reports, according to S&P Global, the Russian-Ukraine war worsens the disruption of global supply chain and could make the global sales of light vehicles drop 2%. S&P Global previously predicted the automotive sales of 2022 would grow 4% to 6%. It says the war may affect the European market because Europe relies on the supply of materials, natural gas and petroleum.

Global states the price rise will not affect the transition to electric vehicles, and points out the possible shortage of palladium as well as a possible price increase in steel, copper, aluminum and nickel, which bring critical risks to the automotive industry this year.

Thailand launched an investigation on January 9 of 2015 on low carbon wire rods originated in China, and then imposed an anti-dumping tax of 12.81%-31.15% starting March 10, 2016. On March 9, 2021, Thailand launched the first sunset review investigation on China’s low carbon wire rods with a diameter greater than or equal to 16 mm and less than 0.29% of carbon content. The involved product codes are: 7213.9120.000, 7213.9190.010, 7213.9190.011, 7213.9190.012, 7213.9190.013, 7213.9190.033, 7213.9190.034, 7213.9190.035, 7213.9190.090, 7213.9920.000, 7213.9990.000, 7227.9000.021, 7227.9000.022, 7227.9000.023, 7227.9000.024, 7227.9000.030, 7227.9000.031, 7227.9000.032, 7227.9000.033, 7227.9000.034, 7227.9000.035, 7227.9000.039, 7227.9000.090.

March 11, 2022, Thailand announced the termination of anti-dumping tax on low carbon wire rods originated in China.

The Indian government has decided to reject the recommendation to impose a definitive antidumping duty on imports of wire rod of alloy or non-alloy steel originating in or exported from China. The Directorate General of Trade Remedies (DGTR) previously recommended extending the anti-dumping measures for five further years, Kallanish notes.

“In exercise of the powers conferred by subsections (1) and (5) of section 9A of the Customs Tariff Act, read with rules 18 and 23 of the Customs Tariff (Identification, Assessment and Collection of Anti-dumping Duty on Dumped Articles and for Determination of Injury) Rules, 1995, the Central Government, after considering the aforesaid final findings of the designated authority, has decided not to accept the aforesaid recommendations,” says India’s Finance Ministry.

The products under consideration were bars and rods, hot-rolled, in irregularly wound coils of iron or non-alloy steel or alloy steel, commonly known as wire rod. The products are used in automotive components, welding electrodes, springs, wire mesh, fasteners, nails, railway sleepers, and binding wires.

DGTR had recommended an anti-dumping rate equal to the difference between the landed value of the imports and $546/tonne. If the landed value of imports was more than $546/t, then no duties would be applicable.

International Trade Administration Commission of South Africa (ITAC, representing SACU members including Namibia, South Africa, Lesotho, Eswatini and Botswana) has made the final determination to impose taxes on imported bolts with hexagon heads of iron or steel for a period of 3 years. The product code involved is 73181543. The respective tax rates for certain periods are: 31.8% from December 10, 2021 to December 9, 2022; 30.8% from December 10, 2022 to December 9, 2023; 29.8% from December 10, 2023 to December 9, 2024.

The Ministry of Commerce of China announced to continue anti-dumping duties for 5 years on partial carbon steel fasteners originated from EU and UK, starting June 29, 2022. The Ministry claimed that if it ceased this anti-dumping measure, the dumping of carbon steel fasteners from EU and UK to China as well as the injury made to the Chinese carbon steel fastener industry would continue or happen again.

June 28, 2010, the Ministry decided to impose anti-dumping duties (rates from 6.1% to 26.0%) on carbon steel fasteners originated from EU. June 28, 2016, the Ministry decided to continue the anti-dumping duties for 5 years starting June 29, 2016.

The carbon steel fasteners subject to the duties include wood screws, self-tapping screws, screws and bolts with or without nuts or washers (excluding rail screws as well as screws and bolts with a diameter under 6mm), and washers. The scope of the investigation did not include nuts and fasteners used for the maintenance and repair of civil aircraft.

The U.S. Department of Commerce revoked the AD orders on helical spring lock washers from China and Taiwan because no domestic interested party filed an application.

June 28, 1993, Commerce issued an AD order on helical spring lock washers from Taiwan. October 19, 1993, Commerce issued an AD order on helical spring lock washers from China. The U.S. initiated 4 sunset reviews respectively on February 23, 2001, July 3, 2006, December 5, 2011, and May 26, 2017, each prolonging the duty expiration date. April 1, 2022, Commerce initiated the 5th sunset review investigation on helical spring lock washers from China and Taiwan.

According to the recent report by the Ministry of Industry and Trade of Vietnam, overreliance on material imports, small production value and outdated technology were among the major weaknesses of Vietnam steel industry. The report was part of the Ministry’s proposed “Strategy for the Development of Vietnam Steel Industry by 2030, with a Vision to 2050”, which called for additional governmental policies to support the steel industry.

Referred by the Ministry, Vietnam’s production capacity for steel billets stood at 27 million tons in 2021, of which 7-8 million tons were hot-rolled coils. With the exceptions of only a handful of large steel mills such as the Hòa PhátDung Qut Iron and Steel Complex, the Hng Nghip Formosa Iron and Steel Complex, and Nghi Sn Steel, the rest of the country’s steel industry was made up of small mills, equipped with outdated machinery and technology.

In addition, the industry lacked the capacity to meet domestic demand, especially for alloy steel which it has not been able to produce. The only long-term solution is to ramp up investment for the construction of large-scale steel complexes to reduce reliance on imports. The Ministry’s conclusion is that the industry’s competitive capacity is limited as its production is marred with energy inefficiency and environmental issues. “For the most part, the industry is overly dependent on imports of raw materials including ore, scrap and coking coal, resulting in unstable prices,” said the report.

By the Ministry’s estimate, Vietnam needs to import around 18 million tons of ore, 6-6.5 tons of scrap and 6.5 million tons of coking coal this year. As prices for said materials remained high, the steel price is expected to climb, hurting both domestic consumption and exports. The Ministry said the development of Vietnamese steel industry remained a key component in the country’s industrialization effort as a large number of industries including shipbuilding, manufacturing, defense hardware, mining and energy are highly dependent on quality steel. By 2030, Vietnam’s total demand for steel is projected to reach over US$310 billion, of which US$120 billion, railways US$35 billion and subways US$10 billion, among others.

Despite its key role in the country’s socio-economic development effort, the industry has not received adequate support, especially from a policy standpoint, due to a lack of tailored and streamlined policies to support its growth, said Minister of Industry and Trade Nguyn Hng Diên. Diên called for stronger government support for the sustainable and stable development of the industry as well as the country’s metallurgy sector with a focus on increasing production of hot-rolled coil, high-quality steel and the establishment of steel megacomplexes.

Dali Town (Guangdong, China) launched the construction of the Global Hardware Parts Purchase Center on June 27. This Center will span an area of 55 thousand square meters with a total investment of RMB 1 billion. It is set to be a supply chain finance service and management center for commerce, trade and exhibition. The construction started in July 2022 and comprises 3 phases. The first phase will be completed within 3 years and all phases will be finished within 6 years. There will be a supply chain management center and logistics dispatch center attracting high-end logistics talents.

The fastener industry in Lengshuijiang City (Hunan, China) makes a production value of RMB 1.6 billion a year on screws and nuts. Through the Chinese government, Lengshuijiang Tianbao Industrial (a fastener developer and manufacturer) signed a contract of collaboration with a little over ten local companies including Zoomlion, SANY Heavy Industry, and Hunan Valin Steel.

With its strength in steel materials, Lengshuijiang City is fully supporting the fastener industry. The city has had a company manufacturing high strength fasteners of grade 8.8 and above, the highest grades within China. These highperformance fasteners are extensively applied in equipment manufacturing, infrastructure, automobile, ship building and other areas across 29 provinces. Lengshuijiang Tianbao Industrial tops the chart of fastener production and sales in China. Last year Lengshuijiang City sold over 210 thousand tons of fasteners and made a production value above RMB 1.6 billion.

The Fastener Technical Service Center in Yongnian District of China is being built on a total floor area of 55 thousand square meters

a total investment of RMB 380 million. It comprises a commercial reception center, an inspection center, and is expected to be completed in October 2023.

The fastener industry in Yongnian produces a value worth of RMB 34 billion a year with a market share over 55% across China. The products from this district are sold across China and exported to more than 100 countries. The district has an increasing proportion of high-end products and an improving fastener supply chain, but still requires improvement on inspection capabilities.

the center is completed, the annual profits and taxes will amount to RMB 18 million and the center will add 500 jobs, provide standard parts inspection, R&D, and attract funds and technologies as well as talents.

Hardware components and

chain

in Germany. It has 30 brick-and-mortar stores

market share. Its Hungarian subsidiary increased revenue by 10% to around 84 billion forints

258.66 million) in 2021. The net profit after tax grew 36% to 6.1 billion forints (USD 18.87 million). General manager

Zsolt Partos said the main challenge in 2022 is the Russia-Ukraine war that is worsening inflation. Sales in the first half of 2022 were good, but he is pessimistic about the second half.

Praktiker's products are used in construction, sanitary ware, DIY, gardening, furniture, white appliances, bikes, etc. It also has products under its brand including hand tools, electric hand tools, pipe valves, glue guns, cable ties, and fasteners.

Capri Stressed Assets Fund announced in June that it has recently made its first investment in Deepak Fasteners Limited headquartered in India, taking significant minority stake in the company.

By capitalizing on its strong brand, market positioning, and distribution network, Deepak Fasteners targets to emerge as a major player in the industrial fasteners segment worldwide over the next few years and intends to come out with a public offering of its equity shares in the next few years.

“It is our belief that the company is at the cusp of emerging as a preferred fastener partner for the Indian industry driven by its strong world-renowned ‘Unbrako’ brand, excellent manufacturing capabilities and the unfolding India growth story. This investment underlines our philosophy of working with companies having strong and resilient business models, help them turn around their business operations and evolve as a major player within their industry,” commented Rajesh Sharma, Founder of Capri Global Group.

Frugal innovation is the prevalent culture in India. The Indian press reported a local man revamping his car into a helicopter and renting it for weddings.

The Indian Tata Group follows suit. Turning away from pouring loads of money into EV development like the American and European carmakers do, Tata manufactures affordable Nexon EVs at the lowest cost and succeeds in becoming the king of Indian EVs.

At first Tata didn’t have the latest automated production line, and production had to rely mostly on human workforce, so Tata was only able to manufacture 8 EVs a day. But when Nexon swept the local market after its rollout, the spike in demand had Tata increase workforce at adjacent plants. Up to this May, Tata’s daily capacity has breached 100 vehicles.

Like turning a car into a helicopter in the most frugal ways possible, Tata did whatever it could to spend the least budget to morph its existing models into EVs and install them with cheaper battery units. That’s how it succeeded in releasing an affordable EV for the Indians. It gave up investing billions of US dollars in EV production lines— the way that American and European carmakers would do. The frugal and innovative Tata draws a clear line that differentiates itself from market counterparts. Tata is well aware that a cheaper EV is the clear path to take to make a USD 19 thousand EV that is affordable for the local middle class. Tata’s success is also attributed to the Indian government providing subsidies and imposing a high tax on imported EVs.

From India to Indonesia, Elon Musk is scouting out sites to make more Teslas. With the world mired in supply chain chaos, access to materials matters the most. He’s got it right. After lobbying against India’s tight manufacturing policies and prohibitive import duties, Musk is headed to meet Indonesia’s President Joko Widodo and visit parts of the country, which is also the top producer of nickel, a key metal for batteries. That’s an astute bet—for Tesla and Indonesia. And a missed opportunity for New Delhi. To meet ambitious electric vehicle (EV) targets, Indonesia has drawn in several battery and car makers in recent months with a variety of incentives.

With a friendly policy bolstering the country’s EV goals, companies have started committing billions of dollars. LG Energy Solution, along with others, is investing about US$9 billion in a full supply chain in the country. With Hyundai, the firm is developing a battery plant, too. Meanwhile, the world’s top powerpack maker Contemporary Amperex is investing almost US$6 billion in a battery project with state-backed Aneka Tambang and Industri Baterai Indonesia. Further up the value chain, China’s Zhejiang Huayou Cobalt and Vale Indonesia announced they would work together on a nickel project.

The move by companies across the EV supply chain into Southeast Asia’s largest economy shows how important it is to be close to a source of raw materials. Tesla knows this well. It has created large manufacturing hubs in China and Germany. Now the EV-maker is looking to secure materials and make its own batteries. Wherever Musk sees problems in production, he looks for a solution. Tesla is essentially creating discrete supply chains across the globe.

Just as China made Tesla a global company, Indonesia could do the same for its battery supply chain. All while making manufacturing more affordable and eventually, EVs, too. It’s a means to an end—and a smart one at that.

Q195冷鐓鋼六角螺絲

Q195冷鐓鋼六角螺絲

The Q195 cold-forged steel wire rods developed by Lianxin located in Zhejiang went through pickling, drawing and straightening and were successfully forged into 600 hexagon screws. The pass rate is 100% and no defect was found in a random check, meeting clients' requirement. The success in trial manufacturing hexagon screws heralds a step further in Lianxin's development of special high-end steel and helps upgrade its products.

As Ace Hardware continues to grow globally, Ace Hardware International Holdings, Ltd., a subsidiary of Ace Hardware Corporation, announces it opened its first store in Monterrey, Mexico on October 28, 2021, with a plan to open 13 additional stores by the end of 2022. The store is the first under Ace’s new turnkey franchise model announced in 2020. Ace now operates in approximately 70 countries and has opened more than 900 stores globally in the past five years.

The new Ace Hardware store, located at Urban Village, Avenida Eugenio Garza Sada 3431, local SA009, Colonia Arroyo Seco, brings Ace Hardware’s knowledgeable, helpful service, convenience, and quality brands to the growing Mexico market.

With 15 employees, the new Ace Hardware store occupies more than 14,000 square feet, with 2,000 square feet dedicated as a showroom featuring decorative tiles, plumbing fixtures and bath accessories. Quality, consumer sought brands, such as Stihl, Big Green Egg, Milwaukee, DeWalt, Sayer, Hilti, Clark & Kensington, Bosch, Philips, Hunter, Steel Grip, and Grill Mark will be available to customers.

In 2021 Thailand imported USD 6.49 billion worth of products from Taiwan, up 25.3% over the same period in 2020, making Taiwan the 5th largest import source for Thailand. In 2021 Thailand exported USD 5.96 billion worth of products to Taiwan, up 24.2%, making Taiwan the 18th largest export market for Thailand. The bilateral trading value between the two countries are around USD 12.45 billion, so Taiwan is the 10th largest trade partner for Thailand.

Thailand seeks to take the leadership among the ASEAN countries, and therefore, it is close with China. China has greatly increased its strength in economy and trade in recent years. Ever since the FTA between ASEAN and China took effect, the dependency between Thailand and China has been increasing and China has become the largest trade partner for Thailand. However, the U.S.-China trade war in the last few years has impacted the world’s economic and trade landscape, and some Chinese companies made an exit to Southeast Asia to seek production bases that are tariff-free. The global fastener market, as we knew it, has changed, and many overseas purchase orders are flowing into Southeast Asia. This article will analyze the essence of this economic and trade change, and propose some corresponding measures.

Table 1 shows respective values of fasteners imported by major ASEAN countries from the world. The top 3 fastener importers were Thailand (around NTD 33.99 billion), Vietnam (NTD 21.56 billion), and Indonesia (NTD 16.31 billion). Although import doesn’t represent demand and one has to take a country’s capacity into account, it more or less draws a rough picture of a country’s demand for fasteners. Among the main ASEAN countries, excluding Indonesia with a negative growth, Thailand and Vietnam had positive CAGR.

Table 1. Fastener Import from the World by Main ASEAN Countries from 2017 to 2021

Unit: USD 100 million; %

billion). Thailand as the top ASEAN fastener-exporting country had a CAGR of around 4.2%, lower than the CAGR of Vietnam (the second largest ASEAN fastener-exporting country), supposedly due to Section 301 of the Trade Act that Trump imposed on China in 2018 leading to more than 600 Chinese companies to purchase land in Southeast Asia to build factories and circumvent tariffs derived from the U.S.-China trade war. Malaysia as the third largest ASEAN fastenerexporting country came after Vietnam with a 6.2% CAGR. It is worth noting how this development pans out.

Table 2. Fastener Export to the World by Main ASEAN Countries from 2017 to 2021 Unit: USD 100 million; % 2017 2018 2019 2020 2021 CAGR

Thailand

Vietnam

2018 2019

Thailand 10.51 11.54

Vietnam 6.24 6.43

Indonesia 6.61 7.93

Malaysia 4.62 4.83

Singapore 4.42 4.74

Philippines 1.41

Total

Table 2 shows fastener export to the world by main ASEAN countries from 2017 to 2021. The top 3 fastener-exporting countries in ASEAN were Thailand (around NTD 19.56 billion), Vietnam (14.12 billion), and Malaysia (NTD

Malaysia

Singapore

Philippines

Indonesia

Total

6.98 4.2%

8.8%

6.2%

2.5%

31.2%

2.7%

Table 3 shows Thailand’s fastener trade with the world and Taiwan. In 2021, Thailand imported USD 1.23 billion (NTD

billion) worth of fasteners from the world with a 5-year CAGR of 3.65%, and exported USD 698 million worth of fasteners to the world with a 5-year CAGR of 4.22%. It was a decelerated growth for Thailand in both import and export in

the last 5 years.

Taiwan’s fastener

Table

Value of Thailand's Fastener

Fastener

from the World

Value of Thailand's Fastener Export to the World

Value of Thailand's Fastener

from Taiwan

Value of Thailand's Fastener Export to Taiwan

growth was stable.

World

value

Thailand from USD 88 million to USD 106 million

Taiwan

USD 100 million;

CAGR

4.72%

Table 4 shows the top trade partners for Thai fastener industry in 2021. The top 3 import origins for Thailand were Japan (USD 496 million, accounting for 40.9%), China (USD 253 million, 20.8%), and Taiwan (USD 106 million, 8.7%). Japan alone took up 40% of import; the top 10 import origins took up over 90% of the total import. This is a highly concentrated market. Thailand’s top 3 export destinations were the U.S. (USD 177 million, 25.3%), India (USD 56 million, 8.1%) and Japan (USD 56 million, 8.0%). The U.S. as the top export destination accounted for 25%. The top 10 export destinations altogether accounted for over 70% of the total export. This is also a concentrated market. The U.S. is the top export destination for both Thailand and Taiwan, so there is competition between the latter two countries. Taiwanese companies should keep an eye on this development and opt for product and market differentiation.

Import Source Import Value Import Proportion Export Destination Export Value Export Proportion

Japan 4.96 40.9%

China 2.53 20.8%

Taiwan 1.06 8.7%

Malaysia 0.82 6.8%

Germany 0.48 4.0%

U.S.A. 0.48 3.9%

Singapore 0.29 2.4%

South Korea 0.24 2.0%

U.K. 0.21 1.7%

Vietnam 0.19 1.6%

Sub-total 11.26 92.8%

Total 12.13 100.0%

U.S.A. 1.77 25.3%

India 0.56 8.1%

Japan 0.56 8.0%

Indonesia 0.56 8.0%

Germany 0.38 5.4%

South Africa 0.28 4.1%

Argentina 0.27 3.9%

U.K. 0.23 3.3%

Vietnam 0.21 2.9%

Malaysia 0.19 2.8%

Sub-total 5.01 71.8%

Total 6.98 100.0%

Source: ITC/Taiwan Institute of Economic Research/MIRDC

Table 5 shows Thailand’s fastener import from the world from 2017 to 2021. In 2021 the value and CAGR of the top 3 fastener products imported by Thailand from the world were: other screws and bolts (USD 492 million, 3.8%), iron and steel nuts (USD 180 million, 2.5%), iron and steel washers (USD 152 million, 4.5%). These products had a CAGR growth of 2% to 5% in the last 5 years, denoting a stable demand for fasteners in Thailand. The top 3 fastener products with the largest CAGR in the last 5 years were iron and steel screw hooks (36.6%), other copper threaded products (29.6%), copper threaded products, screws, bolts and nuts (18.3%). These products didn’t record a high import value, but could be in demand or have a growth potential in the future.

Table 5. Thailand's Fastener Import from the World from 2017 to 2021 Unit: USD 100 million; %

Product Category 2017 2018 2019 2020 2021 CAGR

Other screws and bolts

4.24 4.63 4.53 3.69 4.92 3.8%

Iron and steel nuts 1.63 1.79 1.69 1.36 1.80 2.5%

Iron and steel washers 1.28 1.43 1.40 1.24 1.52 4.5%

Other steel non-threaded products 0.84 0.90 0.89 0.79 0.91 2.1%

Iron or steel cotters and cotter pins

0.69 0.77 0.72 0.66 0.83 4.8%

Iron and steel threaded products 0.56 0.59 0.53 0.56 0.66 4.0%

Iron or steel rivets 0.27 0.25 0.24 0.18 0.28 0.7%

Aluminum bolts, nuts, nails, hooks, pins, washers, etc. 0.34 0.32 0.28 0.20 0.24 -8.6%

Iron and steel spring washers and other locking washers 0.18 0.27 0.19 0.14 0.18 -0.5%

Product Category

Iron and steel self-tapping screws

2017 2018 2019 2020 2021 CAGR

0.10 0.11 0.10 0.12 0.17 14.2%

Copper threaded products, screws, bolts and nuts 0.06 0.06 0.06 0.06 0.11 18.3%

Iron and steel nails, tacks, corrugated nails, staples, pushpins 0.07 0.11 0.10 0.09 0.11 10.6%

Other copper threaded products

0.03 0.05 0.05 0.05 0.08 29.6%

Copper nuts, nails, hooks, pins, washers and the like 0.04 0.05 0.05 0.04 0.07 14.0%

Iron and steel automotive screws 0.06 0.07 0.05 0.05 0.06 2.4%

Base metal tubular rivets or bifurcated rivets 0.05 0.06 0.06 0.05 0.05 0.2%

Other iron and steel wood screws

Iron and steel screw hooks and screw rings

Copper washers (including spring washers)

0.03 0.03 0.02 0.02 0.05 8.4%

0.01 0.02 0.03 0.04 0.04 36.6%

0.02 0.04 0.04 0.03 0.04 16.0%

Iron or steel nuts 0.01 0.01 0.01 0.01 0.01 13.0%

Copper nails, tacks, pushpins, staples and the like

Total

0.00 0.00 0.00 0.00 0.00 10.4%

10.51 11.54 11.04 9.40 12.13 3.7%

Source:

Table 6 shows Thailand’s fastener export to the world from 2017 to 2021. In 2021 the value and CAGR of the top 3 fastener products exported from Thailand to the world were: iron and steel screws and bolts (USD 344 million, 3.9%), iron and steel nails, tacks, corrugated nails, staples, pushpins (USD 88 million, 28.4%), iron and steel nuts (USD 66 million, 4.3%). Iron and steel screws and bolts were the top exported products with an export value much higher than the one with iron and steel nails which were the second largest exported products. The top 3 fastener products with the highest CAGR were iron and steel nails, tacks, corrugated nails, staples, pushpins (28.4%), copper threaded products, screws/bolts/nuts (22.1%), other copper bolts, nuts, nails, hooks, pins, washers (18.4%). These products didn’t record a high export value, but their high CAGR could mean Thailand has improved product quality and efficiency and a stable client demand. This is worth keeping an eye on.

Table 6. Thailand's Fastener Export to the World from 2017 to 2021 Unit: USD 100 million; % Product Category

2017 2018 2019 2020 2021 CAGR

Iron and steel screws and bolts 2.96 3.61 3.27 2.50 3.44 3.9%

Iron and steel nails, tacks, corrugated nails, staples, pushpins 0.32 0.52 0.58 0.64 0.88 28.4%

Iron and steel nuts 0.56 0.67 0.58 0.45 0.66 4.3%

Other iron and steel threaded products 0.51 0.41 0.31 0.37 0.52 0.5%

Other iron and steel washers 0.45 0.43 0.38 0.28 0.40 -3.0%

Other iron and steel non-threaded products 0.31 0.29 0.29 0.25 0.30 -0.9%

Iron and steel self-tapping screws 0.29 0.31 0.24 0.19 0.25 -3.8%

Iron and steel pins and cotter pins 0.21 0.23 0.21 0.15 0.19 -1.3%

Iron and steel spring washers and other fastening springs 0.07 0.09 0.10 0.10 0.11 12.7%

Aluminum bolts, nuts, nails, hooks, pins, washers 0.08 0.08 0.07 0.06 0.06 -4.8%

Iron and steel rivets 0.04 0.03 0.04 0.03 0.04 3.8%

Other iron and steel wood screws 0.05 0.04 0.03 0.02 0.02 -16.4%

Other copper threaded products, screws, bolts and nuts 0.01 0.01 0.02 0.01 0.02 22.1%

Other copper bolts, nuts, nails, hooks, pins, washers

Other copper threaded products

0.01 0.01 0.01 0.01 0.02 18.4%

0.01 0.01 0.01 0.01 0.01 15.9%

Iron and steel automotive screws 0.02 0.02 0.01 0.01 0.01 -15.6%

Copper washers (including spring washers) 0.01 0.01 0.01 0.00 0.01 -8.9%

Iron and steel screw hooks and screw rings 0.00 0.00 0.01 0.00 0.01 2.6%

Iron or steel nuts 0.01 0.01 0.01 0.00 0.00 -4.0%

Copper nails, tacks, pushpins, staples and the like 0.01 0.01 0.00 0.00 0.00 -18.9%

Base metal tubular rivets or bifurcated rivets 0.00 0.00 0.00 0.00 0.00 -16.8%

Total

6.98 4.2%

Foreign companies invest in the following fastener-related industries in Thailand: local infrastructure, automobile and components, metal processing, electronics, construction. Thailand’s primary sources of foreign investment and the targeted fastener-related industries are Japan (motors and machinery), China (motors), and the U.S. (automobile-related metal machinery and electronics). The main target countries and related fastener industries for foreign investors in Thailand are Japan (automobile-related metal machinery and electronics), Singapore, and China (motors). Additionally, the major targeted industries for Taiwanese business owners in Thailand are electronics, rubber and steel. Fastener-related non-metal materials industry, metal products industry and construction industry are mostly small and medium manufacturers.

Thailand’s “2015-2022 traffic infrastructure development plan” includes railway transport expansion, dual railway construction, elevated mass rapid transit and subway extension in Bangkok, phase two Bangkok International Airport expansion, freeway expansion, deepwater port and container port expansion. Plus, on the Eastern Economic Corridor, the Thai government is working on 50 infrastructure plans including airport and airport MRO construction, phase three Map Ta Phut port construction, and transport system upgrade.

In 2021 the Thai government started to promote the “Bio, Circular, Green, BCG” national development tactic and establish “digital economy” and “smart city”. The Eastern Economic Corridor will have a physics center, biotechnology center and aerospace center which will focus on developing 6 industries including agriculture, biotechnology, electric vehicles, smart transport, aerospace, medical equipment, smart systems, bioenergy and biofuel.

There remain differences between the manufacturing development of Thailand and Taiwan. Taiwanese fastener industry has long been focusing export on the U.S. and Europe. Looking at the development prospect and industries with a potential, the economy, trade and technical collaboration between Thailand and Taiwan can target on motor vehicles, infrastructure, BCG (Bio-Circular-Green Economy), and medical equipment. The following is my advice to help Taiwanese owners develop business in the Thai market.

▲ Create an Extension for the Domestic Market

Taiwanese owners could consider regarding Thailand as a production base to support OEM and export, utilizing bilateral industry investment, trade, collaboration and exchange to extend Taiwan’s domestic market to Thailand. Thailand has signed an FTA with ASEAN countries, Japan, Australia, New Zealand, South Korea, China, India, Chile, and Peru, which is good for expanding export.

▲ Enhance Taiwanese Owners’ Industrial Deployment in Thailand

Taiwan could establish an investment strategy partnership and an investment platform with Thailand, gather up Taiwanese owners and enhance supply routes, enhance the support system for Taiwanese owners in Thailand, set up Taiwanese contacts to reach local sources in Thailand, and enhance connections with Taiwanese industries.

▲ Integrate with Taiwanese Owners’ Industry Chain in Thailand

Taiwanese fastener owners both in Taiwan and Thailand could combine their industry chains. They could utilize technical collaboration or joint ventures to produce lower-tech and labor-intensive products in Thailand, and then ship back to Taiwan before assembling for export, thereby leveraging advantages in international industry collaboration.

▲ Improve the Brand Image of Taiwanese Fasteners in Thailand

Taiwanese owners could utilize diverse methods and creative marketing on their selected fastener products that represent themselves, thereby improving the brand image of Taiwanese fasteners in Thailand.

Thailand is in the bottleneck of labor shortage and needs to upgrade and automate equipment. Taiwanese machinery and smart manufacturing companies could market their full line of equipment or set up smart fastener production lines in Thailand as long as this doesn’t undermine competitiveness.

Taiwanese owners must assess and monitor the investment risks in Thailand. The industrial land, water and power costs in Thailand are still acceptable, but there is a shortage of high-end talents and a slightly higher logistics cost. Therefore, Taiwanese owners could utilize resources from both Taiwanese and Thai governments to decrease investment risks and increase efficacy.

They could seek help from the government to solve problems with delayed customs clearance, quarantine, and product certificates, and reduce regulations on reciprocating products, personnel and funds between Taiwan and Thailand, as well as market entry into the service industry.

995,017,053 425,438,072

305,938,317 419,416,883 172,549,750

196,669,836 92,223,962

66,886,005 90,114,592 39,527,072

68,000,590 29,195,826

40,434,303 20,954,490

40,084,139 16,710,563

18,428,107 6,107,274

17,443,421 6,152,867

Japan 41,610,596 37,929,043 34,128,489 42,781,259 19,063,717

Germany 40,035,470 35,896,513 26,624,449 32,708,515 15,359,992

South Africa 21,901,504 19,870,262 15,598,526 24,639,253 10,122,732

Argentina 21,480,934 18,973,832 14,800,694 23,582,856 10,943,110

UK 18,645,452 14,960,640 11,208,908 20,157,626 7,351,162

Vietnam 18,586,764 16,251,447 14,065,676 16,401,453 8,386,205

Malaysia 20,391,600 18,628,540 14,665,840 16,364,062 7,597,136

USD

Ranking Partners 2018 2019 2020 2021 Jan.-May 2022

0 World 378,136,214 367,332,768 360,647,339 485,993,875 230,254,854

1 China 112,859,299 110,978,899 124,924,503 182,118,854 72,578,492

2 Singapore 62,678,424 47,854,611 47,153,453 80,949,459 54,306,339

3 Japan 59,680,596 56,374,507 50,120,675 61,414,185 26,794,719

4 USA 31,663,014 32,721,745 29,722,597 35,996,169 18,227,538

5 Thailand 15,112,411 16,189,764 15,824,153 18,855,837 9,720,604

6 Germany 11,920,369 13,085,976 10,624,004 14,250,471 6,155,253

UK 10,402,621 13,419,088 8,942,733 7,702,591 3,955,551

Indonesia 5,942,083 8,010,991 6,937,167 7,200,955 4,147,024

France 5,017,674 6,723,470 4,782,612 4,578,092 1,894,742

Vietnam 3,733,656 2,908,092 3,070,122 3,511,768 2,039,002

Malaysian Fastener Export Value to the World

2019

Jan.-May 2022

World 293,514,873 277,180,598 254,239,812 338,262,801 155,129,670

Thailand 44,625,519 60,180,367 62,226,113 81,374,612 31,022,537

Singapore 51,898,888 48,445,611 37,694,493 69,054,581 24,493,362

Germany 38,751,759 34,087,636 28,707,791 36,755,027 19,806,376

15,205,188

6,000,443

13,024,803 4,742,441

10,975,316 5,848,770

4,901,586

8,846,328 5,064,379

4,137,338

Philippines has had its new President in office since this May. Taipei Economic and Cultural Office in the Philippines stated in a press release that the economy team working with Ferdinand Marcos Jr. remains optimistic about the economic growth momentum for this year in the midst of a potential inflation rate increase to a pressuring 4.5% - 5.5%. The Development Budget Coordination Committee of Philippines announced the projected domestic GDP for 2022 were adjusted down from 7%-8% to 6.5%7.5%. However, increased private investment, the industrial recovery, high employment, and the growing tourism enable Philippines to reopen its economy. The country began to see a positive growth of 8.3% in the first quarter this year. The second quarter will surpass the first one and this upward drive is expected to continue through the end of this year. The Philippine Secretary of Finance estimates the country’s annual growth rate could reach 6.5%-8% from 2023 to 2028.

With the new Philippine regime on the front stage, this article analyzes Philippines’ fastener trend and the status quo of local investment as a reference for fastener business owners to evaluate investment in this nation.

Philippines exported USD 138 million worth of fasteners to the world in 2019. The number dropped to USD 107 million in 2020 and then bounced back to USD 142 million, which slightly surpassed the pre-pandemic level and reached USD 44.64 million in the first quarter this year. If the first-quarter growth momentum could last, there is a chance for the 12-month export value this year to surpass last year’s. A clear phenomenon is that the value of Philippines fastener export to Japan exceeded 60% of the total in 2021 and reached 70% in 2020, way past the U.S. which ranked second and accounted for just 10%. Clearly, Philippines highly relies on fastener purchase by Japan. Philippines is one of the important sources of low price fasteners for Japan. Additionally, Philippines has a small portion of fasteners exported to some European countries (such as Germany, the Netherlands, Italy, Poland), as well as Taiwan and China.

WORLD 36,129,961 138,115,316 100 34,016,319 107,041,505 100 46,643,925 142,467,784 100 13,641,069 44,646,038 100

2 Japan 23,367,600 98,246,433 71.2 23,618,090 75,300,195 70.4 32,429,115 90,176,410 63.4 9,716,149 28,991,779 69.1

3 USA 4,795,340 13,200,346 9.6 4,372,729 9,322,081 8.7 5,726,535 14,326,120 10.1 1,271,953 3,744,200 8.9

4 Germany 2,633,194 8,952,672 6.5 2,198,532 7,757,829 7.2 2,730,312 10,332,144 7.3 576,685 2,708,877 100

5 South Korea 938,135 2,984,255 2.2 1,384,304 4,615,376 4.3 1,090,599 8,347,455 5.9 91,053 1,661,736 4.0

6 Taiwan 1,121,284 3,277,946 2.4 482,271 1,271,219 1.2 2,068,938 5,581,337 3.9 540,171 1,689,881 4.0

7 Netherlands 191,503 628,938 0.5 195,172 705,035 0.7 605,490 2,756,948 1.9 94,346 663,681 1.6

8 Italy 1,372,861 4,166,490 3.0 701,800 2,449,484 2.3 743,257 2,415,917 1.7 75,728 411,007 1.0

9 China 141,283 545,789 0.4 140,177 1,247,051 1.2 55,790 2,032,188 1.4 10,504 243,898 0.6

10 Poland 136,977 396,380 0.3 89,070 306,939 0.3 190,747 669,538 0.5 41,113 199,634 0.5

11 India 67,302 282,562 0.2 65,869 291,297 0.3 136,989 550,972 0.4 15,842 98,145 0.2

12 Switzerland 86,425 283,951 0.2 44,826 165,822 0.2 128,298 548,571 0.4 99,965 518,644 1.2

13 UK 202,229 1,114,071 0.8 117,473 628,988 0.6 43,115 536,845 0.4 3,652 85,018 0.2

14 Malaysia 73,630 308,750 0.2 41,991 193,233 0.2 13,034 495,259 0.3 1,004 174,718 0.4

15 Denmark 109,357 361,586 0.3 70,731 233,435 0.2 98,851 410,676 0.3 13,123 71,330 0.2

16 Finland 145,010 373,241 0.3 46,333 114,855 0.1 87,791 361,962 0.3 28,361 176,342 0.4

17 Hong Kong 102 30,873 0.0 275 252,496 0.2 354 346,746 0.2 25 137,771 0.3

18 Thailand 42,277 438,364 0.3 34,883 386,256 0.4 33,004 320,906 0.2 6,685 193,319 0.5

19 Austria 50,818 182,618 0.1 58,611 208,388 0.2 91,401 320,744 0.2 1,272 9,684 0.0

20 Mexico 8,022 118,516 0.1 27,160 281,397

Sweden 46,473 145,937

20,372 67,116

30,525 300,588 0.2 3,427 35,195

53,663 279,067 0.2 15,716 101,466 0.2

terms of import, Philippines imported USD 142 million worth of fasteners from the world in 2019. The number dropped to USD 126 million in 2020 and then bounced back to USD 169 million, which surpassed the pre-pandemic level and reached USD 43.36 million in the first quarter this year. The import value is expected to surpass the level last year as well. We can find that the two top sources of fastener import for Philippines are China (taking up 29.6%) and Japan (26.7%). In an opposite

China and Japan are the top rivals to Taiwan and other countries selling fasteners to Philippines. China’s fastener price competitiveness and Japan’s fastener quality are very attractive to Philippines, which is a warning sign for Taiwan in pursuit of price competitiveness and other advanced countries with high-end quality.

WORLD 49,760,359 142,452,085 100.0 40,508,093 126,521,902 100.0 52,679,672 169,471,285 100.0 12,146,338 43,362,303 100

2 China 35,118,703 42,531,255 29.9 29,440,414 34,611,995 27.4 40,259,565 50,181,602 29.6 8,911,578 11,944,660 27.6

3 Japan 3,657,426 36,134,117 25.4 2,864,478 33,731,577 26.7 3,726,370 45,237,468 26.7 999,038 12,702,490 29.3

4 Singapore 1,213,605 12,973,903 9.1 830,918 10,864,810 8.6 850,878 13,576,453 8.0 288,191 5,528,710 12.8

5 Taiwan 4,110,774 12,779,852 9.0 3,244,458 9,957,463 7.9 3,294,196 12,012,270 7.1 641,769 2,701,727 6.2

6 Malaysia 315,902 1,708,294 1.2 269,478 2,517,092 2.0 345,722 6,369,320 3.8 73,919 1,298,716 3.0

Thailand 665,113 5,308,554 3.7 845,592 4,717,497 3.7 706,184 6,031,059 3.6 155,883 1,429,286 3.3

USA 135,422 3,943,471 2.8 113,254 4,038,340 3.2 139,441 5,029,198 3.0 32,027 771,561 1.8

Germany 258,941 3,967,961 2.8 193,723 4,685,087 3.7 162,754 4,952,936 2.9 37,898 782,651 1.8

Vietnam 1,161,793 3,533,002 2.5 816,665 2,548,547 2.0 1,307,527 4,899,910 2.9 487,781 1,282,215 3.0

South Korea 1,077,976 3,773,438 2.6 736,068 3,443,050 2.7 684,965 4,234,884 2.5 236,395 1,181,975 2.7

Hong Kong 315,951 3,917,552 2.8 210,964 2,654,599 2.1 303,384 3,942,275 2.3 46,597 851,127 2.0

France 75,650 1,406,279 1.0 111,977 2,120,648 1.7 101,533 2,050,701 1.2 2,259 118,715 0.3

Finland 6,905 203,865 0.1 72,062 2,181,351 1.7 40,218 1,342,403 0.8 5,506 137,876 0.3

Indonesia 170,959 1,110,211 0.8 101,936 766,333 0.6 200,085 1,177,296 0.7 70,607 245,644 0.6

Italy 85,704 1,071,876 0.8 48,908 741,460 0.6 52,299 1,176,091 0.7 4,487 144,159 0.3

Belgium 13,916 389,960 0.3 17,049 230,433 0.2 15,496 1,033,075 0.6 6,127 328,268 0.8

Australia 407,736 1,380,250 1.0 56,299 1,407,196 1.1 49,281 892,297 0.5 14,020 191,660 0.4

UK 53,971 930,646 0.7 20,277 688,362 0.5 56,183 813,055 0.5 8,928 205,830 0.5

Netherlands 53,610 1,107,060 0.8 97,701 962,527 0.8 24,573 751,150 0.4 9,568 183,530 0.4

Sweden 34,733 1,080,743 0.8 71,890 977,973 0.8 21,656 741,296 0.4 14,181 520,841 1.2

The total value of Taiwan's global fastener export already jumped back to USD 5.3 billion in 2021, up from USD 4.3 billion in 2019 before the pandemic. That value has reached USD 3.1 billion in the first half of this year with a chance to surpass last year’s level. Out of the total value, Taiwan’s export to Philippines only represented 0.48% (USD 25.73 million) in 2021 and 0.34% (USD 10.9 million) in the first half of this year; therefore, Philippines is a large potential market for Taiwan fastener industry.

Even so, there are several Taiwanese fastener companies already dedicated to developing the Philippine market. Long Pao Fasteners is a well-known Taiwanese fastener company in Philippines and its major product is self-drilling screws, having publicity and a high market share in local wholesaling and retailing endpoints. Multi-Tek Fasteners & Parts Manufacturer Corp produces socket set screws in Philippines and it has expanded production before. Lu Chu Shin Yee Works founded a plant manufacturing stainless steel fasteners in Philippines in 1988.

Targets 2019 2020 2021 H1 2022

WORLD 4,316,380,032 3,969,114,428 5,319,669,018 3,185,158,250

Philippines 21,659,571 17,159,062 25,738,798 10,902,282

Targets 2019 2020 2021 H1 2022

WORLD 159,937,426 154,202,514 204,201,927 108,229,405

Philippines 3,505,319 1,511,922 5,401,383 2,570,308

(1) Philippines lowers bar on foreign companies’ investment

Targets 2019 2020 2021 H1 2022

WORLD 1,479,292,223 1,363,249,857 1,610,686,052 845,091,029

Philippines 6,507,057 5,035,279 5,872,163 2,372,783

Targets 2019 2020 2021 H1 2022