Newsletter

Stay Informed

Investment & Wealth

The long-run rate of return on investments ultimately determines how much wealth people accumulate over time. Always look at returns when considering mutual funds or exchange-traded funds (ETFs)

The investor mind!

Do your homework before making a decision

Once you ' ve made a decision, make sure to re-evaluate your portfolio on a timely basis. A wise holding today may not be a wise holding in the future.

TheInvestor Mind

StayInformed

WE ARE ON A MISSION TO GET YOUNGER GENERATION INVESTING.

PODCAST FOR YOUNG INVESTORS

Our main goal with this show is to introduce you to the people, ideas and information that will help you literally execute on your Investing dreams.

LISTEN NOW

A weekly Podcast featuring leading thinkers in Finance, Insurance, Retirement and Investing.

Editor's Letter

As we navigate the ever-changing world of finance and investing,

it's important to remember that building a strong financial foundation takes time, patience, and persistence

As a young person, you may feel overwhelmed by the complexities of financial planning, but don't let that discourage you.

Within this edition, we have amassed insights and counsel from authorities in the field, aimed at empowering you to seize command of your finances and execute judicious investment judgments.

From grasping the fundamental tenets of Financial Wellness to delving into novel investment prospects, our purpose is to accompany you through every stage of this journey.

Remember, investment constitutes a voyage, not a terminus. By remaining wellinformed and exercising astute decisionmaking, you can construct a promising financial prospect for yourself

Editor: Nagasha G. Indumwa

09.

The Quarterly News Round - Up

31.

14.

Striking the balance: Navigating the fine line between Concentrated & Diversified Stock portfolios for optimal returns & risk management

16.

Retire your way: Crafting your dream retirement - A guide to financial freedom, lifestyle choices, & fulfilling golden years

18.

Things shaping how the financial service industry is work for the consumers in today’s modern society.

20.

Ways to optimize your long-term cash deposits & emergency fund reserves to grow & multiply your money.

22.

Mastering the art of selection: unveiling strategies to choose the optimal investment options in today's dynamic market.

26.

How thinking like a venture capitalist can revolutionize your investment game.

28.

A first-timer's blueprint for conquering the real estate investment: essential tips and insights for young adults.

How to effectively voice your insurance concerns and get swift compensation

Round-Up

THIS QUARTER'S REPORT

As we enter a new year, big changes are happening in finance and business Things are changing fast, and the ways to succeed are different than before Join us as we explore the key trends that industry leaders, policymakers, and stakeholders must navigate to seize opportunities, mitigate risks, and drive sustainable growth in this dynamic environment.

REFORMS TO THE NATIONAL HEALTH INSURANCE FUND (NHIF).

To boost affordable and quality universal health coverage (UHC), Kenya's authorities propose radical reforms to the National Health Insurance Fund (NHIF)

The new structure affects both employed and self-employed individuals, with specified rates based on their gross income

According to the proposal, individuals employed in salaried positions will contribute 2 75% of their gross monthly income from the previous month to the fund.

The state plans to drop the current deduction system, where salaried workers have been paying between Ksh 150 and Ksh 1,700, depending on their monthly pay Those in the informal sector have been paying a flat rate of Ksh 500

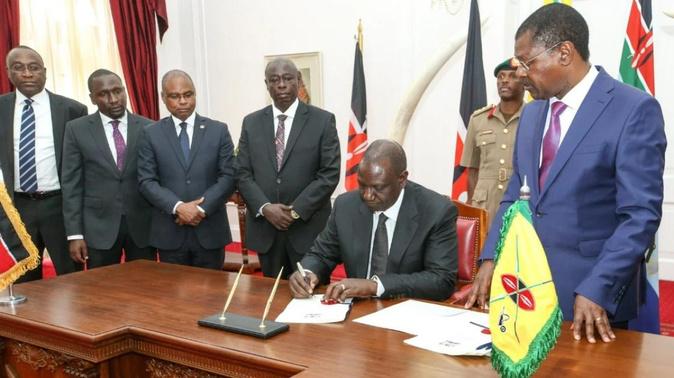

KENYA FINANCE ACT, 2023.

In a significant move to address the country's financial challenges, President Ruto signed the Finance Act, 2023 into law on 26 June 2023 This Act is expected to be a key support for the government's budget of KES 3.6 trillion, excluding KES 800 billion set for principal debt repayments The Act introduces several changes that affect taxation and social contributions

A notable change is the introduction of a Housing Levy This requires both employers and employees to contribute 1 5% to the National Housing Development Fund, and the contribution is nonrefundable

The Act also establishes new PAYE tax bands: 32 5% for incomes between KES 500,000 and KES 800,000, and 35% for incomes over KES 800,000 Many are watching closely to see how these new rates will affect middle-income earners.

VAT on petroleum products (excluding LPG gas) has increased from 8% to 16%, impacting the cost of living due to the significant role petroleum plays in the economy However, there's a positive change for businesses: the exportation of services is now tax-free at 0%, aligning Kenya's VAT rules with international norms and promoting global trade

Despite these efforts to increase revenue, some are concerned about the practicality of implementing the changes A controversial provision requires businesses to remit withholding tax to the Kenya Revenue Authority within just five days Critics argue that while boosting tax collection is a good goal, the potential burden on businesses wasn't fully considered, leading to widespread debate.

The Finance Act has capped the tax incentives currently available to taxpayers while on the other hand extending a tax amnesty program to enable taxpayers to be compliant and have a clean bill of tax ledger

Furthermore, the Finance Act 2023 has made several amendments in an effort to seal loopholes available in the taxation structure while widening the tax base for both individuals and entities

A contributor in self-employment shall pay a special contribution to the fund at a rate of 2 75 per cent of the declared or assessed gross monthly income, but subject to a minimum of Ksh 300

A contributor who is neither employed nor listed as an indigent or a vulnerable person shall pay a monthly contribution of Ksh 300, according to the proposal

This change aims to stabilize the fund, counteracting frequent liquidity issues due to high claims President William Ruto supports the move, emphasizing an equitable contribution system where everyone pays 2 75% of their earnings

The government will cover vulnerable Kenyans without income or benefactors

THE EXCHANGE RATE AND THE PERFORMANCE OF THE KENYA SHILLING.

There has been an increasing debate in the media regarding the exchange rate and the performance of the Kenya Shilling Discussions on this topic have centered on the recent weakening of the Kenya Shilling suggesting that this is a bad outcome for the economy

The depreciation of the Kenyan shilling has accelerated over the past year, losing almost 24% of its value against the dollar. This depreciation is making imports more expensive and increasing Kenya's debt, which stood at more than Ksh 10,100 billion (64 4 billion euros) at the end of June, according to Treasury figures, or around two-thirds of gross domestic product

A competitive exchange rate ensures that the interests of both exporters and importers are balanced In this regard, movements in the exchange rate serve to correct any imbalances in the market The movement of the exchange rate cannot therefore be classified as good or bad if it is adjusting to economic factors

There is a negative implication when the Kenya Shilling depreciates as this implies a higher cost in Shillings to finance imports However, there is also a positive side to a weak Shilling as it means lower foreign prices for our exports; this increases the country’s competitiveness in the world market, which improves our balance of trade position Further, a weak Shilling promotes domestic investments that create employment and also discourages final consumption of luxury imports

While many stakeholders approve of the UHC acceleration plan, concerns arise regarding NHIF's history of corruption and mismanagement. NHIF has grappled with financial and integrity challenges, including fund mismanagement and corruption.

Despite past setbacks, NHIF's new chairman, Michael Kamau, assures the public of ongoing reforms, including better benefits and wider ailment coverage

Stakeholders advocate for ensuring the revamped system's transparency and protection against graft

In essence, Kenya's strides towards achieving universal health coverage involve comprehensive reforms to NHIF and prioritizing primary healthcare, aiming to provide quality and affordable health services to all citizens.

All these are necessary to improve the current account balance and support economic growth For instance, in 2011 there was a large current account deficit of about 11 percent of GDP, the exchange rate had to depreciate significantly to correct this imbalance in the economy

However, for a small, open, developing economy like Kenya that has a huge oil import bill, a protracted weakening of the Shilling may eventually cause inflationary pressures by knock-on effects through energy prices via consumption and production processes This is not the case currently

On the other hand, a strong Kenya Shilling reduces the competitiveness of our exports which could dampen economic growth

Kenyan exports become expensive abroad and imports become cheaper thereby discouraging domestic competitive industries as the share of foreign goods in our domestic market increases

Furthermore, a high interest rate which discourages domestic investment, which in turn impacts negatively on economic growth and employment, is generally associated with short-term inflows of foreign exchange which strengthens the Shilling.

Strengthening the Shilling by short-term foreign exchange inflows increases the risk of exchange rate instability since these can be easily reversed An appreciating currency is like a tax hike It increases the burden on manufacturers of domestic goods

while making imports cheaper domestically This can lead to a recession as excess capacity can trigger layoffs As the economy goes into a recession there would be a weak effective demand and the National Treasury would collect less tax revenue which would undermine the activities of the Government.

On a broader perspective with respect to this subject, a depreciation or appreciation of a currency is an adjustment process in response to the underlying fundamentals

Economists generally agree that a desirable exchange rate should be at a level that makes a country’s export of goods and services competitive in the world market

A RUNDOWN OF COMPANIES THAT ISSUED PROFIT WARNINGS AT THE NAIROBI STOCK EXCHANGE IN 2023.

More than 10 firms listed on the Nairobi Securities Exchange, including Kakuzi Plc, Sanlam, Express Kenya, Kenya Power, Unga Plc, Sameer Africa, Crown Paints, WPP Scangroup, Longhorn Publishers, Sasini, Car & General, Nation Media Group, and Centum Investment Company, have issued profit warnings this year

This action aligns with the Capital Markets Authority (CMA) guidelines, mandating listed firms to provide advance profit warnings should they anticipate a minimum 25 percent decline in their annual net income.

Most of the notices, which could have an impact on dividends, are attributed to a tough operating environment, including higher costs of doing business, largely due to the declining shilling value and escalating inflation rates within the nation

A majority of listed companies, which have announced profit warnings have seen their share prices fall by a deeper margin compared to peers in their respective market segments, reflecting deepening appreciation for company fundamentals among local investors.

Many investors and analysts use profit data as a crucial factor in deciding whether to buy, retain, or sell shares of a specific company

A profit warning provides insights into a firm's performance in the current year relative to the previous year Additionally, it offers guidance on anticipated investor returns and provides a snapshot of the overall financial health of the company in question

Several companies listed on the Nairobi Securities Exchange, such as Kakuzi Plc, Sanlam, Express Kenya, Kenya Power, Unga Plc, Sameer Africa, Crown Paints, WPP Scangroup, Longhorn Publishers, Sasini, Car & General, Nation Media Group, and Centum Investment Company, have released profit warnings this year

This move is in line with the guidelines set by the Capital Markets Authority (CMA), which mandates these firms to issue advance profit alerts if they expect at least a 25 percent decrease in their yearly net earnings

The majority of these warnings, which might affect dividend payouts, arise from challenging business conditions

Factors contributing to these challenges include increased operational costs, largely influenced by a weakening shilling and rising inflation rates within the country

Interestingly, most companies issuing profit warnings have experienced a more significant decline in their stock prices compared to their market competitors This trend indicates a heightened sensitivity among local investors to the intrinsic value and performance metrics of these companies

For many stakeholders, including investors and analysts, profit warnings serve as pivotal information when determining whether to hold, buy, or sell shares in a particular company Such warnings offer valuable insights into a company's current fiscal year performance compared to previous periods Moreover, they give an indication of expected investor returns and shed light on the company's overall financial standing

NSSFACT,2013

COURT OF APPEAL AFFIRMS CONSTITUTIONALITY OF NSSF ACT, 2013; INTRODUCES REVISED CONTRIBUTION RATES FOR EMPLOYERS AND EMPLOYEES

The Court of Appeal has upheld the constitutionality of the NSSF Act, 2013, overturning a previous ruling by the Employment and Labor Relations Court (ELRC). This legal development is significant as it validates the revised law, which aims to boost employees' retirement savings by adjusting the monthly contributions made by both employers and employees to the National Social Security Fund (NSSF)

Before the implementation of the NSSF Act in 2013, both employers and employees contributed KES 200/= monthly, resulting in a total contribution cap of KES 400/= The new legislation now mandates a monthly contribution equivalent to 12% of an employee's monthly salary This contribution is divided, with 6% deducted from the employee's salary and the remaining 6% covered by the employer.

The updated NSSF rates are applied on a graduated scale Employees earning KES 18,000/= or more must remit contributions up to KES 2,160/= (Tier II), with employers responsible for half of this amount, i e , KES 1080/= For employees earning below KES 18,000/=, the contributions are fixed at KES 1,440/=, with employers contributing KES 720/= (Tier I)

NSSF issued a notice on February 7, 2023, expressing its intention to collaborate with stakeholders for the effective implementation of the NSSF Act. A subsequent notice on February 9, 2023, informed employers that the new NSSF rates would take immediate effect

Now that the NSSF Act is officially enforced, employers are obligated to ensure compliance with the updated law to avoid penalties All employers must make the necessary adjustments to their NSSF contributions in accordance with the new rates.

The new NSSF rates will remain in place until the next review in January 2025 The gradual increase in rates, which began last year, is structured over a five-year period This phased approach provides stakeholders with time to adapt to the changes introduced by the NSSF Act

GrowYour BusinessWithus

G S d

WehelpBusinessgrowbyfocusingon creating,publishing,anddistributing valuableandrelevantonlinecontentfora targetedaudiencetoattractandretaina clearlydefinedaudiencetodriveprofitable customeraction.

STRIKING THE BALANCE: NAVIGATING THE FINE LINE BETWEEN CONCENTRATED & DIVERSIFIED STOCK PORTFOLIOS FOR OPTIMAL RETURNS & RISK MANAGEMENT.

One of the perennial debates among investors centers around the composition of their stock portfolios The fundamental question they grapple with is whether to concentrate their investments in a select few assets or to diversify across a broader spectrum Striking the right balance between concentration and diversification is crucial for achieving optimal returns while effectively managing risks

In this article, we will delve into the nuances of concentrated and diversified stock portfolios, exploring the advantages and pitfalls of each approach and providing insights on how investors can navigate this fine line to enhance their investment strategies

The Case for Concentrated Portfolios: Chasing High Returns.

Concentrating a stock portfolio involves putting a significant portion of investments into a small number of carefully chosen assets. The rationale behind this approach is straightforward: by focusing on a select few stocks, investors aim to capitalize on the potential for outsized returns If these chosen companies perform well, the impact on the overall portfolio can be substantial

By Ivy Wandera

By Ivy Wandera

One of the primary advantages of a concentrated portfolio is the potential for high returns Successful stock-picking in a focused strategy can lead to significant wealth accumulation, as witnessed by renowned investors like Warren Buffett, who built his fortune through a concentrated approach If the selected stocks outperform the market, the impact on the overall portfolio can be substantial, leading to significant wealth creation

Another advantage of investing in a concentrated portfolio is focused expertise: Managing a concentrated portfolio requires a deep understanding of the chosen assets. Investors in concentrated portfolios often become experts in the industries and companies they invest in, enabling them to make more informed decisions

However, it's crucial to note that the potential rewards of concentration come with a commensurate level of risk If the selected stocks underperform or face unexpected challenges, the entire portfolio can suffer. The lack of diversification means that there is no safety net to cushion the impact of poor performance in a particular sector or industry

The Pitfalls of Concentrated Portfolios: Exposed to Unnecessary Risks

While a concentrated portfolio can offer the allure of exceptional returns, it also exposes investors to heightened risks

Increased Volatility: While concentrated portfolios offer the potential for higher returns, they also come with an inherent increase in volatility A negative development in one or a few holdings can have a more pronounced impact on the overall portfolio

Idiosyncratic Risk: Concentrated portfolios expose investors to idiosyncratic risks specific to the selected assets

Adverse events such as regulatory issues, management problems, or industry downturns can have a disproportionately negative effect on the portfolio

The success or failure of the portfolio becomes disproportionately tied to the performance of a small number of stocks

External factors, such as changes in market conditions, regulatory shifts, or unexpected events affecting specific industries, can lead to significant losses

Moreover, the lack of diversification in a concentrated portfolio means that there is limited protection against systemic risks Economic downturns or market corrections can have a more pronounced impact on a concentrated portfolio, amplifying the potential for losses This vulnerability is particularly evident in sectors that are susceptible to rapid and unpredictable changes, such as technology or biotech

Diversification: Spreading the Risk for Stability & Consistency

On the flip side, a diversified stock portfolio involves spreading investments across a broad array of assets, sectors, and industries reducing exposure to the risks associated with individual stocks or sectors. Diversification acts as a shield against market volatility, which is a constant presence in the world of investing

Different sectors respond differently to economic conditions, allowing a diversified portfolio to weather storms more effectively

For instance, during economic downturns, defensive sectors like healthcare and utilities may outperform, offsetting losses in more cyclical sectors like technology Moreover, diversification helps investors avoid the pitfalls of company-specific risks

Issues such as management problems, product recalls, or other company-specific challenges can significantly impact a concentrated portfolio. In a diversified approach, the impact of such setbacks is diluted, minimizing the overall effect on the portfolio's performance

The Power of Diversification: A Shield Against Market Volatility

The primary goal is to reduce risk by avoiding overreliance on the performance of a few stocks Diversification is often likened to the age-old saying, "Don't put all your eggs in one basket " The fundamental advantage of diversification is risk mitigation Diversification is a powerful tool for risk management.

By holding a variety of stocks, investors can offset poor-performing assets with those that may perform well under different market conditions, reducing the overall portfolio risk This strategy aims to create a more stable and consistent portfolio, protecting against the volatility inherent in the stock market

By holding a variety of assets, the impact of a poor-performing investment is mitigated by the positive performance of others Another advantage of a diversified portfolio is smooth returns Diversified portfolios often experience less volatility than their concentrated counterparts

This smoothing effect on returns can be appealing to investors who prioritize stability and are risk averse

Pitfalls of Diversification

Potential for Mediocre Returns: While diversification is effective in reducing risk, it can also limit the potential for outsized returns. The performance of the overall portfolio is diluted as each individual holding has a smaller impact.

Overwhelming Complexity: Managing a diversified portfolio requires staying abreast of a multitude of investments For some investors, this level of complexity can be overwhelming and may lead to suboptimal decision-making

Finding the Middle Ground: The Balanced Approach

While the merits of both concentrated and diversified portfolios are evident, finding the optimal balance between the two is key to successful long-term investing Striking the right equilibrium involves a nuanced understanding of one's risk tolerance, investment goals, and time horizon. A balanced approach might involve a core of well-diversified, low-cost index funds or exchange-traded funds (ETFs) to provide a stable foundation

This can be complemented by a carefully selected group of individual stocks for those seeking to capitalize on specific investment themes or opportunities This hybrid strategy allows investors to benefit from the stability of diversification while still having the potential for higher returns from concentrated positions.

Implementing the Balanced Strategy: Practical Considerations

Assess Risk Tolerance: Before embarking on any investment strategy, it's crucial to assess your risk tolerance Concentrated portfolios can be emotionally challenging, especially during periods of market turbulence Understanding your comfort level with risk is essential in determining the right mix for your portfolio

Define Investment Goals: Clearly defining your investment goals is paramount If your objective is long-term wealth accumulation, a more diversified approach may be suitable However, if you're comfortable with higher risk and seeking potentially higher returns, a more concentrated strategy might align with your goals

Regularly Reassess and Rebalance: The financial landscape is ever-changing, and what might be a sound strategy today may need adjustments in the future Regularly reassessing your portfolio and rebalancing as needed ensures that your investments align with your current financial situation, market conditions, and goals

Striking the Right Balance: Customizing Your Investment Approach

The key to successful portfolio management lies in finding the right balance between concentration and diversification Here are some strategies that investors can employ to navigate this fine line:

Thematic Concentration within Diversification: Instead of putting all their eggs in one stock, investors can focus on a specific theme or sector within a diversified portfolio This allows for targeted exposure to high-conviction ideas while maintaining overall diversification

Dynamic Portfolio Rebalancing: Regularly reassessing and rebalancing a portfolio is crucial This involves trimming positions that have become disproportionately large due to market movements and adding to underperforming assets It ensures that the portfolio remains aligned with the investor's risk tolerance and market conditions.

Risk Management through Position Sizing:

For those inclined towards concentrated portfolios, careful consideration of position sizes is paramount By limiting the exposure to individual assets, investors can manage the impact of adverse events while still benefiting from the potential for high returns

Utilizing Derivatives for Hedging: Investors can use derivatives such as options to hedge concentrated positions This strategy allows them to protect against downside risk while maintaining the core investment thesis

Global Diversification: Diversification doesn't only apply to individual stocks but extends to geographic regions and asset classes Global diversification can help mitigate risks associated with regional economic downturns or geopolitical events

In stock market investing, there is no onesize-fits-all solution The decision between a concentrated and diversified portfolio depends on individual preferences, risk appetite, and financial goals. Striking the right balance is an ongoing process that requires vigilance, adaptability, and a commitment to staying informed about market dynamics.

Investors can craft a customized strategy that aligns with their financial objectives, providing the best chance for optimal returns while effectively managing risk Whether you choose to concentrate, diversify, or find a middle ground, the key is to make informed decisions that reflect your investment philosophy and long-term vision

RETIRE YOUR WAY: CRAFTING YOUR DREAM RETIREMENT - A GUIDE TO FINANCIAL FREEDOM,

LIFESTYLE CHOICES, AND FULFILLING GOLDEN YEARS.

By Naya Moraa

Retirement marks a significant chapter in one's life When planning for retirement it is not just about numbers and financial calculations; you should also envision the life you want to live during your retirement years.

Retirement should offer you the promise of leisure, exploration, and the pursuit of lifelong dreams "Retire Your Way" is not just a catchy phrase; it encapsulates the essence of a fulfilling retirement tailored to your unique aspirations

Financial Freedom: Building a Solid Foundation

Before embarking on your retirement journey, it's crucial to lay a solid financial foundation Knowing where you want to be financially and how to get there forms the first layer of the foundation For many people there is a disconnect between the financial goals they are setting and the steps they are taking to realize them.

Creating a strong financial base goes beyond simply handling money wisely It involves thoughtful planning, discipline, and a comprehensive approach that covers different aspects of personal finance This includes budgeting, saving, investing, and preparing for retirement

Each of these steps plays a crucial role in building a sturdy financial structure that

can help you achieve your goals and dreams, start by assessing your current financial situation, including savings, investments, and potential income streams

If you feel stuck on this stage, it’s important to engage with a financial advisor to create a comprehensive retirement plan that considers your longterm goals, risk tolerance, and potential healthcare needs Diversify your investments to mitigate risk, and periodically reassess your strategy to adapt to changing circumstances.

Smart Saving and Investment Strategies

People often talk about whether it's better to save or invest in the world of finance However, saving and investing are like two parts of the same thing

A successful retirement plan involves strategic saving and investment If you save money wisely and invest in good places, you can lower the chance of losing money, boost your potential gains, and make more meaningful profits

The first step is to explore tax-efficient savings options Consider a mix of conservative and growth-oriented investments to balance risk and return. Investing helps you keep up with the rising cost of living caused by inflation. Typically, younger investors with many portfolios

years until retirement should opt for riskier

The extended time frame allows them to endure market fluctuations, especially as they continue adding to their investments during their working years

On the contrary, individuals approaching or at retirement face greater market vulnerability Using an investment account to cover living expenses may require withdrawing funds during a market downturn This not only reduces the portfolio size but also risks substantial investment losses

As a rule of thumb, remember that the best risk an investor can take is a calculated one Regularly review your portfolio and make adjustments based on market trends and your evolving financial goals Education and proactive decision-making are key to maximizing your financial resources during retirement

Smart Saving and Investment Strategies

Retirement means different things for different people Some folks use it to travel, while others might enjoy a hobby, learn something new, or spend more time with family

Retirement life is not just staying home and watching TV forever, retirement isn't the finish; it's the start of new chances ; it's an opportunity to design the life you've

always envisioned Planning for retirement lifestyle means figuring out and reaching the way you want to live during retirement This includes thinking about where you'll live, how much you might spend on healthcare, what activities you'll enjoy, and how socially involved you want to be

Retirement lifestyle planning helps you match your values, interests, and goals with the money you have, making you happier and improving your well-being overall. To do this well, you need to carefully think about what's most important to you and what resources you have to achieve your goals By creating a detailed plan that looks at both your lifestyle wishes and your finances, you can get the most out of your retirement years

Planning for all parts of retirement helps you take charge of your retirement future, so you can move forward with confidence

The earlier you start planning, the more room you'll have to adjust for life changes or unexpected problems that might otherwise make your goals hard to achieve.

Consider your passions, interests, and long-held dreams when shaping your retirement lifestyle Whether it's travel, hobbies, volunteering, or starting a second career, your golden years are a canvas waiting to be painted with experiences that bring you joy and fulfillment

Health and Wellness: The Cornerstone of a Happy Retirement

A fulfilling retirement goes beyond financial stability Physical health plays a crucial role in overall well-being during retirement; it involves prioritizing your health and well-being.

As the cost of healthcare keeps going up, staying healthy is a great way to keep your healthcare bills lower. Dealing with major health issues, especially as you get older, can be really expensive Taking care of your lifestyle now might mean less stress on your finances later on Lifestyle choices - like what you eat, how much you exercise, and how you take care of your mind, really impacts your health a lot

Invest time in staying physically active, maintaining a balanced diet, and addressing any healthcare concerns. Regular medical check-ups and a proactive approach to preventive care can significantly enhance your overall quality of life during retirement.

When you are healthier, strong, and more energetic, choosing to retire later could be a smart move for a successful retirement

This way, your money gets more time to grow in the market, and you have more time to add to and build up your retirement savings Overall, living a healthy life today gives you the best shot at making this strategy work

Social Connections: Cultivating Meaningful Relationships

Retirement offers the gift of time, and how you spend it matters As human beings, we naturally crave social connections. The desire to connect and belong is a fundamental part of who we are Having friends and relationships is really important for our happiness, well-being, and feeling fulfilled

When preparing for retirement is very important to foster and strengthen social connections with family, friends, and your community Engage in social activities, join clubs or groups aligned with your interests, and explore new friendships

When it comes to friends and connections, having good ones matters more than having a lot It's about forming strong relationships with people who care about the same things you do Real connections go deeper than just saying hello they're built on trust, respect, and being there for each other emotionally

A robust social network contributes to emotional well-being, providing a support system that adds richness to your retirement years. Studies show that strong social connections are linked to an increased chance of longevity, a better immune system, less inflammation, and faster recoveries from disease. When you feel more connected to others, you are less vulnerable to anxiety and depression and have higher self-esteem, empathy, and trust toward others

So, remember, it’s never too late to build new relationships or reconnect with old friends during your golden age Spending time to build connections and strengthen relationships is like an investment in happiness it's totally worth it.

Continued Learning: A Lifelong Pursuit

Retirement doesn't mean the end of personal and intellectual growth. Embrace continued learning through classes, workshops, or pursuing a degree in a field of interest Keeping your mind active by learning new things is important for brain health as you get older Engaging in intellectual pursuits not only keeps your mind sharp but also opens up new avenues for personal development and fulfillment

When you challenge your brain with new information and deep thinking, it helps

keep older adults mentally alert Research indicates that even as we age, our brains can still grow, forming new connections and pathways when we engage in learning activities Seniors can keep learning throughout their retirement years in different ways First, there's informal learning,

which happens naturally in everyday life like reading the newspaper, enjoying a good book, chatting with friends, or making discoveries about what's around us Second, there's formal learning, which is more intentional. It involves taking classes, attending lectures, joining programs, or participating in discussion groups Both informal and formal learning are good for seniors and offer different benefits

Key Takeaway

Many people only become aware of their insufficient retirement savings in their sixties, at this stage, it becomes challenging to accumulate the necessary funds for a comfortable retirement due to the limited time left for saving

To avoid this situation, it's crucial for individuals to start planning and saving for retirement earlier in life, ensuring a more secure financial future Implementing a consistent savings strategy and exploring investment options can significantly contribute to building a sufficient nest egg over time

Crafting your dream retirement involves a thoughtful blend of financial prudence, lifestyle choices, and a commitment to overall well-being "Retire Your Way" is a personal journey, unique to each individual

By proactively planning for financial freedom, embracing your passions, prioritizing health, nurturing social connections, and committing to lifelong learning, you can shape a retirement that is not only golden but also deeply satisfying Your retirement years are an opportunity to celebrate a life well-lived and to embrace the limitless possibilities that lie ahead

Seeking advice from financial professionals can provide valuable insights tailored to individual circumstances Understanding the importance of a diversified portfolio and periodically reviewing and rebalancing investments can further enhance the potential for long-term financial success

By recognizing the need for early planning, you can proactively work towards building a robust financial foundation for a comfortable retirement

THINGS SHAPING HOW THE FINANCIAL SERVICE INDUSTRY IS WORK FOR THE CONSUMERS IN TODAY’S MODERN SOCIETY

By Naya MoraaIn our today’s modern society, the financial services industry has experienced significant changes Customer expectations have been changing over the years, and the financial services industry is not immune to these new demands by the consumers Bowing to all this pressure, the financial service industry has gone through tremendous transformation over time

This has been fueled by changes in technology, customer intelligence and imposing of new guidelines and regulations by the industry regulators The financial service institutions are finding new ways of tackling traditional financial tasks in order to attract, and retain customers in this highly competitive market

Most of the financial institutions have become innovative in service delivery, new products design and reengineering In recent times, the financial service industry has witnessed a lot of disruption and positive innovation that brought about new opportunities and challenges for financial institutions

The following are the 3 key factors that we can expect to shape How the Financial Service Industry will work for the Consumers in today’s Modern Society

Technological innovation

In today’s financial services industry, Technological change is the most creative and destructive force that affects how financial institutions operate and serve their customers For decades, the financial service industry has implemented the same business models. But today they find themselves challenged on all sides by innovators seeking to disrupt their businesses

Technological innovations such us; Crowdfunding, peer-to-peer lending, mobile payments, bitcoin, robo-advisers have greatly changed business models of the financial service industry Nowadays, Financial services institutions compete to offer better products and services to their customers to avoid customer churn

The following are the technological advances that affect how financial institutions work for the consumers;

Fin-tech, 1 Block-chain,2. Sharing economy model, 3 Cloud computing, 4 Cyber-security 5 Artificial intelligence 6.

Regulators

Government regulation can affect the financial services industry in positive or negative ways In today's dynamic and fast-paced modern society, the financial service industry is undergoing a significant transformation, driven by a wave of regulatory changes that prioritize consumer protection and transparency As governments and financial authorities around the world implement new rules and regulations, the industry is adapting to ensure a more secure and consumerfriendly landscape

One of the key aspects of this transformation is the emphasis on transparency Regulations such as GDPR (General Data Protection Regulation) and PSD2 (Revised Payment Services Directive) are reshaping how financial institutions handle consumer data These measures empower consumers by giving them more control over their personal information and financial data

As a result, financial service providers are now required to be more transparent about how they collect, process, and utilize customer data, fostering a relationship built on trust This has a direct impact on how the financial services provide products and services to the end consumers The regulations influence the administration and operations of financial institutions

The most important part that the regulation plays in the industry is to call for increased vigilance and safeguards to protect the government, financial institutions and, most importantly, the consumers

For example, the global financial crisis of 2008 changed the face of banking in the United States by bringing in a new dawn to the new regulations Some of the regulations that changed the way the financial service institutions delivered the service and products to the consumers are: The Helping Families Save Their Homes Act 2009 – Key HFSHA provisions include the creation of a “safe harbor” against investor liability when servicers undertake loan modifications

The Dodd-Frank Wall Street Reform and Consumer Protection Act – restricted banks’ investing and trading and established the Consumer Financial Protection Bureau

Consumer rights are also at the forefront of regulatory changes Financial authorities are implementing measures to ensure fair treatment, disclosure, and resolution mechanisms for consumers

However, it's also good not to solely rely on external expertise; conduct your due diligence by meticulously inspecting properties andRegulations are not only shaping the financial service industry but also influencing the development of new products and services. Fintech startups and established financial institutions alike are adapting their offerings to comply with evolving regulatory standards This alignment ensures that consumers have access to innovative and competitive financial services without compromising on safety and security performing background checks Never skip these essential steps before finalizing a purchase, as they safeguard your investment and ensure transparency in the transaction.

Customer intelligence

Financial services institutions are using technology advancement to gather and analyse; customers ‘ details, activities and information to build deeper and more effective customer relationships and improve decision making In the past, the only ways customers could help companies better understand them was through traditional methods of market research

The traditional market research process used to be that slow and costly Technology advancement has given financial services institutions access to exponentially more data about what users do and want.

More financial institutions are using technological innovations to improve their processes or differentiate their products and services in relation to their competitors’’

By using tools like big data and analytics, financial services institutions can unlock the information inside the data to give customers what they really want It’s now every financial services institution’s job to understand the customers as the financial service industry strives to be customercentric organizations

The changing nature of money is only one facet of the financial services revolution.

WAYS YOU CAN OPTIMIZE YOUR LONG-TERM CASH DEPOSITS & EMERGENCY FUND RESERVES TO GROW & MULTIPLY YOUR MONEY.By Naya Moraa

Have you ever asked yourself why so many people who are making a lot of money are still struggling financially; they are in excessive debt According to financial advisors, the number one factor that people are struggling with their money is that most people don’t understand how to manage their money. Financial Experts suggest that Money that is sitting in checking accounts, savings account and or even emergency fund reserves is being wasted.

As you may know, taking a portion of your monthly income and simply depositing it into your checking or saving account means that the money is doing very little work for you Banks can lend up to 10 times what you deposited into your checking account and or savings account It means that for every shilling you put into those accounts is working for the bank and not for you.

To fully get value for your hard-earned money deposited in those checking and saving accounts, you have to look for better ways of putting that money to work for you This wisdom is not taught in schools, it’s not taught by our parents as well Instead, our parents are in the same financial mess that most people may end up in It is a system that trickles down the family The burden is being transferred from one generation to another This can keep you thinking of the behaviors of typical savings including emergency fund reserves as well.

Reason why people don’t invest their long-term Cash Deposits

It has been said that you can’t save your way to wealth Those who park their money in checking accounts or saving accounts may find that these accounts have far less purchasing power This Low consumer buying power is being caused by a growth killing combination of low return and moderate inflation To beat all these obstacles you need to put your money to work for you A lot of people don’t invest their money into their future.

Here are three reasons why individuals refrain from making investments:

Fear 1

Lack of money 2

Don’t believe in investing 3

Fear – Just fear of the unknown, fear of taking their money outside their bank and putting it into an investment that they are fearful

Lack of money – They just don’t believe they make a lot of money or they have a lot of money left over at the end of the month to be invested

They don’t believe in investing – Their parents did not do it, their friends don’t do it. They just don’t believe in investing. The best way to grow and multiply your money is to invest.

But you just don’t get your money invested if you don’t have goals for it It will tend to get away from you Have an assignment or a mission for every shilling you own

Some of the places you can put your money to grow and multiply.

It does not matter if you are a working class or very wealthy individual, everyone needs an emergency fund or money saved for future use. You might have some thousand shillings lying around either in your checking account or just some cash saved up at home which is earning you nothing There is no better place to park your money that you are trying to save than making it work for you and double it in figure

Here are several locations where you can consider investing your money to potentially double it:

1 Good growth stocks mutual funds

A mutual fund is a collective investment that pulls together money of a large number of investors to purchase a variety of securities like stocks Mutual funds were created as a way of a bunch of people to pool their money and make investments together.

The thing to consider is that investing in mutual funds, you don’t own the underlying shares of the mutual fund; you own an interest There is a pooled interest in the mutual fund

By investing in mutual funds, you get access to a number of different appropriate securities So, you can be liable for capital gains that other people might have experienced

Mutual funds offer three key benefits, making them an attractive option for investors looking to potentially double their money. These benefits include:

Convenience

1 Diversification

3

2. Active management

Mutual funds can benefit investors in several ways;

Convenience – by investing in mutual funds you get to own a bunch of different stocks all in one easy package The fund could have a hundred different stocks in it By investing via mutual funds you get instant ownership in all the stocks the mutual funds already own

Diversification – it’s a strategy that reduces your investing risk by spreading out your eggs. By investing in mutual funds, you spread out your money across many different stocks. In this case, if one of the stocks in the mutual fund totally crashes you will still be fine because each stock is only a small portion of your overall portfolio

They are managed by investment professional – rather than trying to find stocks on your own you have some super smart guy who supposedly knows what he is doing pick the stocks for you

2. Dividend paying stocks.

Dividend paying stocks is another good place to put your money to grow and multiply You can put your money in stock even if the stock does not make any money by appreciating in price If you buy stock for Ksh 45 a share and stay at Ksh 45 for the entire year you did not make any money on the appreciation part but you did get paid in the form of dividend

Another strategy to make money with dividend paying stocks is to look at stocks that have a history of not just paying dividend but also increasing their dividend over time. Disclaimer – This past performance does not guarantee future results. It does not mean that just because they have always increased their dividend, they are always going to. But still, this gives you some piece of mind knowing that they have a solid history of doing so

3 High yield savings accounts

Many people like you have some big financial goals to achieve

The best place to start is by having your money kept in the right bank accounts that offer the highest interest rate It’s not a good idea for your money just sitting in your bedroom or under your pillow or mattress This is because your money will be losing purchasing power every single year due to inflation

If you have a few thousand shillings that you are saving away for an emergency fund, a high yield saving account is a perfect way for you to save that money and earn really good interest. Especially if it’s not something that you are planning to withdraw anytime soon. Mostly these accounts are very much convenient whereby it’s easy to withdraw and easy to transfer to other banks If you think of saving your cash and maybe you may need it to be super liquid somewhere or sometime in the future, a high yield savings account is the best place to park your money

4. Short Term Bonds

Bonds are generally seen as a safer investment than stock When you purchase a bond, you are giving your money as a debt to a Corporation or Government They will then owe you your money and pay you back the principle plus interest at the end of the maturity period

Short term bond is considered a bond with a maturity date of 2 years or less Maturity date above two years up all the way to ten years is considered intermediate, and a maturity date longer than ten years is considered a long term bond This kind of investment should be able to provide a more attractive income but with lower price volatility Buying only one bond can be more risky than buying a large basket of bonds Large bonds would provide a diversification which is essential for reducing investment risk If you have a limited amount to invest or you only have enough money to buy one or two bonds; buy units of bond funds

The bond fund should have a diverse portfolio of shorter maturity bonds To make sure that your money is kept safe, you need to keep the maturity of the bond short and you should invest in a diversified range of bonds. Short term bond is going to mature quicker, it’s going to be less volatile or it’s going to be less sensitive to the interest rate moves when compared to a long term bond. Remember that you typically hold bonds in your portfolio for stability

MASTERING THE ART OF SELECTION: UNVEILING STRATEGIES TO CHOOSE THE OPTIMAL INVESTMENT OPTIONS IN TODAY'S DYNAMIC MARKET.

By Naya MoraaThe ability to identify and select optimal investment options is an invaluable skill that any investor wishes to have Navigating the complexities of today's dynamic market requires a better understanding of various strategies and a keen eye for emerging trends

Whether you are a seasoned investor or a novice, mastering the art of selection is crucial for building a resilient and profitable investment portfolio In this comprehensive guide, we will explore key strategies and insights to empower you on your journey to making informed and strategic investment choices

Before delving into specific strategies, it is essential to understand the fundamental dynamics that shape today's market The global economy is interconnected, and market conditions can change rapidly due to geopolitical events, economic indicators, and technological advancements

These changes can impact every type of business, economy, and government decisions. These changes, known as market dynamics, play a big role in how things work. They affect industries, the way businesses operate, and even the rules set by the government.

Keeping abreast of macroeconomic trends and understanding how they impact different asset classes is the first step towards making informed investment decisions In the investing world, some finance experts really know how things work, but not all of them The ones who do make smart choices that benefit their clients by using all the information they have. These smart professionals decide things by looking at everything carefully, using their experience, and proven methods

They also take the time to understand what their clients need, what goals they have, how long they want to invest, and how much risk they can handle One of the cornerstones of successful investing is a thorough understanding of risk Different investors have different comfort levels when it comes to risk, and aligning your investment strategy with your risk profile is fundamental Before diving into the market, it's imperative to assess your risk tolerance and establish clear investment goals.

Various investment opportunities carry different degrees of risk, and every investor possesses a distinct risk tolerance. It is essential to evaluate your personal risk appetite and harmonize it with the risk characteristics of potential investments Setting practical and measurable goals serves as a guide for your investment venture, enabling you to maintain focus on your priorities

The age-old adage "don't put all your eggs in one basket" holds true in the world of investing. Diversification is a powerful strategy that involves spreading investments across different asset classes to reduce risk It is both an art and a science that lies at the heart of sound investment strategy At its core, diversification involves spreading investments across different asset classes, industries, and geographic regions to mitigate risk and enhance potential returns To spread your investments wisely, it's important to understand how the market is changing

That means you need to know about different trends, individual asset performance, and investor goals. Crafting a well-balanced portfolio involves selecting a mix of investments that can collectively weather market volatility

The science of diversification relies on quantitative analysis and risk management principles Modern portfolio theory, developed by Nobel laureate Harry Markowitz, underscores the importance of combining assets with low or negative correlations to achieve optimal diversification benefits A well-diversified portfolio should encompass a range of asset classes such as stocks, bonds, real estate, and possibly alternative investments Additionally, within each asset class, careful consideration must be given to factors like company size, industry, and geographic exposure Utilizing tools like correlation matrices and risk models can aid in constructing portfolios that balance risk and reward

Successfully navigating the art and science of diversification requires ongoing monitoring and periodic adjustments. Markets evolve, economic conditions change, and individual investment performance varies Regularly reviewing the portfolio's composition and rebalancing to maintain the desired asset allocation is crucial Furthermore, investors should stay informed about global economic trends and geopolitical developments, as these factors can impact the performance of different assets By delving into the intricacies of diversification, investors can create portfolios that not only endure market fluctuations but also provide the potential for consistent returns over the long term.

Effective investment selection involves a comprehensive analysis of both fundamental and technical factors. Fundamental analysis focuses on the financial health and performance of a company, while technical analysis involves studying price charts and market trends By combining these two approaches, investors can gain a holistic view of

potential investment options

Successful investors often distinguish themselves by their ability to conduct thorough analyses and leverage information to make strategic decisions One exemplary investor who exemplified this skill is Warren Buffett, widely regarded as one of the most successful investors of all time Buffett's investment approach is grounded in a deep understanding of the companies he invests in

He famously said, "I never attempt to make money on the stock market I buy on the assumption that they could close the market the next day and not reopen it for five years." This statement highlights his focus on long-term value and the importance of conducting in-depth analyses of a company's fundamentals

To conduct thorough analyses, investors should delve into a company's financial statements, understand its business model, assess its competitive advantages, and evaluate the competence of its management team Buffett's investment in Coca-Cola provides a compelling example of this approach Before investing, he studied the company's financials, recognized the enduring appeal of its brand, and appreciated the economic moat created by its strong market position By leveraging this information,

Buffett made a strategic decision to invest heavily in Coca-Cola, a move that has proven immensely profitable over the years In addition to financial analyses, successful investors also pay attention to broader economic and industry trends For instance, during times of economic downturns, astute investors like Buffett often see opportunities where others perceive risks.

By understanding the cyclical nature of the economy and having a long-term perspective, they can make strategic decisions that capitalize on market inefficiencies Successful investors also leverage macroeconomic insights to position themselves strategically in the market For instance, during economic downturns, some investors adopt a defensive stance by allocating more resources to stable and dividend-paying stocks

Others might identify growth opportunities in sectors poised for expansion. This proactive approach, exemplified by investors like Ray Dalio, demonstrates the importance of adapting investment strategies based on a comprehensive understanding of both micro and macroeconomic factors This ability to synthesize information and make informed decisions based on comprehensive analyses is a hallmark of successful investors and serves as a

valuable lesson for those looking to navigate the complexities of financial markets As technology continues to reshape industries, investors must pay attention to innovation and emerging markets Identifying disruptive technologies and understanding their potential impact on various sectors can uncover lucrative investment opportunities

Pioneering investors recognize that staying ahead of the curve and embracing innovation is crucial in the art of selection An exemplary figure in this regard is Peter Thiel, the co-founder of PayPal and an early investor in numerous successful tech companies Thiel's investment strategy involves identifying and supporting businesses that are not just following current trends but are actively shaping the future

For instance, his early investment in Facebook reflected a visionary approach, recognizing the potential of social networking to revolutionize communication and connectivity. Thiel's success underscores the importance of foresight and a willingness to embrace innovative technologies and business models In the dynamic landscape of modern investments, embracing innovation extends beyond technology to include disruptive ideas and unconventional strategies

Cathie Wood, the founder and CEO of ARK Investment Management is a notable example Wood's investment approach focuses on disruptive innovation, and her firm actively seeks out companies that are at the forefront of technological advancements, such as those in genomics, robotics, and artificial intelligence.

By consistently staying ahead of the curve and understanding the transformative power of innovation, Wood has achieved notable success, demonstrating that being forward-thinking is a key element in the art of selection for investors navigating rapidly evolving markets

Investors often face the dilemma of choosing between long-term and shortterm strategies Each approach has its merits and risks. Successful investors carefully consider the factors that influence their investment horizon, whether opting for long-term or short-term strategies One notable example is Jack Bogle, the founder of Vanguard Group and a proponent of long-term, passive investing

Bogle's investment philosophy encourages investors to focus on the fundamentals of a diversified portfolio and to resist the temptation of frequent trading By emphasizing low-cost index funds and a buy-and-hold strategy, Bogle advocated

for aligning one's investment horizon with the long-term growth potential of the market His approach, often referred to as "Boglehead" investing, underscores the importance of patience and discipline in achieving financial goals over an extended period On the other hand, some investors, such as day traders, pursue short-term strategies to capitalize on market fluctuations These individuals, like Paul Tudor Jones, a prominent hedge fund manager, leverage technical analysis and market trends to make short-term trades for quick profits

While short-term strategies can be lucrative, they come with higher risks and require a deep understanding of market dynamics. Regardless of the chosen strategy, investors should align their investment horizon with their financial goals This involves assessing risk tolerance, time horizons, and specific objectives, ensuring that the chosen approach aligns with the investor's unique circumstances

Whether adopting a patient, long-term strategy or an active, short-term approach, the key is to align the investment horizon with individual financial goals and risk preferences In today's digital age, information is abundant, but navigating through the noise can be challenging. Investors who stay informed and leverage technology and data analytics can make more timely and well-informed investment decisions, as exemplified by the approach of quantitative hedge fund manager Jim Simons

Simons, the founder of Renaissance Technologies, is known for using advanced mathematical models and algorithms to analyze vast amounts of financial data His firm's success in achieving consistent returns over the years highlights the power of leveraging technology for data analysis Simons' approach underscores the importance of embracing cutting-edge tools and technologies to gain a competitive edge in the rapidly evolving financial landscape.

To effectively stay informed and make data-driven decisions, investors can utilize a variety of tools and resources For example, financial news aggregators, realtime market data platforms, and algorithmic trading strategies are readily accessible in today's digital age Additionally, advancements in machine learning and artificial intelligence enable investors to analyze complex datasets more efficiently

By incorporating these technological resources into their decision-making processes, investors can sift through information more effectively,

identify trends, and respond to market changes in a timely manner The key is to combine technological tools with a deep understanding of the underlying data, allowing investors to make informed decisions that align with their investment objectives

Mastering the art of selection in today's dynamic market is an ongoing journey that requires continuous learning and adaptation

By understanding market dynamics, managing risk effectively, diversifying strategically, and staying informed, investors can enhance their ability to make optimal choices The art of selection is not a static skill but a dynamic process that evolves with the market.

As you embark on this journey, remember that knowledge, discipline, and a long-term perspective are your greatest

allies in the quest for financial success in today's ever-changing investment landscape

By Naya Moraa

By Naya Moraa

HOW THINKING LIKE A VENTURE CAPITALIST CAN REVOLUTIONIZE YOUR INVESTMENT GAME.

Thinking like VC can help young investor make better investment decisions with their money. Venture capital commonly known as VCs, offers funding to businesses and startups that are growing quickly in exchange for an equity stake in the company With so many investment opportunities and start-up pitches, VCs often have a set of criteria that they look for and evaluate before making an investment

VCs investing knowledge and operating experience are as valuable as their capital. This is because venture capital investments tend to be high-risk. With around 65% of VC invested businesses failing to provide a return on investment, VCs tend to be very careful about where they invest their capital Most VCs expect a return of between 25% and 35% per year over the lifetime of the investment

Their investment strategy is basically to invest in a company’s balance sheet and infrastructure until it reaches a sufficient size where they can get their money back Fundamentally, VCs buy a stake in a business idea, rears it for a period, and then exit. Of course, after receiving a sufficient return on capital

If venture capitalists can exit the company and industry before it tops out, they can reap extraordinary returns at relatively low risk As a young investor, thinking like a VC can help you make good investments decisions

Below are some of the ways you can apply the VC mindset when investing your money

Thinking big

In the world of investing, one of the factors that separate the most successful investors from the rest is the capacity to think big Many investors have been chasing investment returns for years But to the surprise, not too many investors have achieved what they thought they would with their investments

The naked truth is that they have been focusing on the wrong target. For VCs, Investment profile and how each deal is structured is the only single ingredient of how they usually meet their investors’ expectations at acceptable risk levels They believe that the best opportunities don’t always walk into their office They go beyond to identify and research industry trends and bold enough reach out to those entrepreneurs who share a

vision of where the world is going As a young investor, thinking big requires that you see your investments from a wider and far-reaching perspective For instance, if you have a lot of money to invest, you have a lot more opportunities, options, and choices to make. Many VCs don’t necessarily concentrate too much on financial terms during their investment tenure with the start-ups Instead, they give equal emphasis to how the company aligns with their portfolios and gain As well as how their experience and expertise can help the owners and management of the business to grow

To make right investment decisions as a young investor, it is necessarily important to have a clear point of view beyond just making money. You should have a clear picture of what you-as an investor trying to do, and does it align with the company, industry, or investment landscape you want to get in?

‘‘Thinking big can help you ‘‘Thinking big can help you get better results with your get better results with your investments, even if you investments, even if you don’t achieve the desired don’t achieve the desired result.’’ result.’’

Taking risks and managing them accordingly

Many young investors find it hard to define and measure risk Our perception of risk is greatly influenced by what we experienced in the past as well as what is currently or likely to happen to us. The only way you can learn about risk is by taking risks By their very nature, venture capitalists take on extensive risk when investing in a startup or an entrepreneur The risky aspect of it entails a high level of uncertainty as well as a high chance of failure by the startup

However, it can be very rewarding when the investments do pay off For example, Alphabet Inc., commonly known as Google Was launched as a startup in 1997 with $1 million in seed money from FF&F.

In 1999, the company was growing rapidly and attracted $25 million in venture capital funding, with two VC firms acquiring around 10% each of the company In August 2004, Google’s IPO raised over $1 2 billion for the company and almost half a billion dollars for those original investors, a return of almost 1,700% This big return potential is the result of the incredible amount of risk inherent in new companies

As a young investor, when you invest you make a possible course of action about what to do with your financial assets You might not need that saved money for 30 or more years, so you can benefit from it by getting invested in the stock market Data shows that stocks have historically done well over long periods So, it’s worth taking the risk and diving into stocks.

The tools you can use to assess, eliminate, and mitigate investment risks may vary by different financial asset classes All investments: stocks, bonds, mutual funds, or exchange-traded funds carry some degree of risk The investment can lose value Good knowledge of capital allocation, risk management, and effective investment is mandatory for a thorough understanding of the risks involved in each financial asset invested in To mitigate the risk factor, there are a whole host of unique risk factors that you must address when considering a new investment Being patient with your investment is one way of controlling risk

Taking risks and managing them accordingly

Investing is an extensive practice; different people invest with a specific objective in mind. Also, each investment has its own distinctive set of rewards and risks Investment is made because it serves some objective for an investor In the past, many people have made their luck in the process Venture capitalists exist to serve founders much like businesses exist to serve customers The objective of most corporations is to benefit from venture capital investing, such as product marketing rights, acquisitions, technology licenses, and or international opportunities

However, this objective is often mixed with a financial gain objective and can lead to a confused strategy

The starting point for young investors in this process is to determine the characteristics of the various investments and then match them with individual objectives

Depending on the age and risk appetite of the investor; there are 3 main objectives of investment:

Safety, Growth, Income

The first assignment of any successful young investor is to find the correct balance among these three objectives While safety, growth and income objectives are the most common among investors, some other objectives include Liquidity, Tax, Lifestyle, Financial Security, and Peace of mind

Investment objectives are usually associated with risk and return, which are interdependent, as the risk that you are willing to take, will determine your returns Higher risk investments may have greater long-term rewards, but in the meantime, you will probably experience turbulence along the way You will see some ups and downs It is important to be prepared and be aware of this in advance before putting your money on a certain financial asset

‘‘

‘To achieve anything in ‘To achieve anything in life you need to take life you need to take risks.’’ risks.’’

A

By Naya Moraa

By Naya Moraa

FIRST-TIMER'S BLUEPRINT FOR CONQUERING THE REAL ESTATE INVESTMENT: ESSENTIAL TIPS AND INSIGHTS FOR YOUNG ADULTS.

Real estate investment, although complicated and tricky, especially if you are new to the game, remains vital to our economy and lifestyle Whether you are someone interested in buying your first house, land or you are curious about real estate as a career, it’s important to understand the real estate market process Real estate is an industry that plays by its own rules As technology, incomes, buying habits, and lifestyles change, real estate will only become more complex and exciting It’s your job to stay on top of it

Estate Investment

Real estate investment stands as one of the most lucrative and enduring wealthbuilding avenues It offers a tangible asset, potential rental income, and long-term appreciation

Real estate investors have many types of real estate investments to consider, allowing opportunities for those looking for investments with potentially high returns or conservative options to find what they need

As a physical entity, real estate includes four different categories of property: residential, commercial, industrial, and land

Residential properties: You can purchase single-family homes, condos, or townhomes to live in or to use as rental property. This creates passive income and allows you to earn capital appreciation as the home's value increases

Commercial properties: Investing in commercial property allows for more diversification and the potential for rental income Like residential properties, you are the landlord, handling property management and collecting passive income from tenants Land: Buying undervalued land, developing it, and then selling it for a profit is another option for a real estate investment. Alternatively, you could purchase the land to build your dream family home, thereby saving on the rent you used to pay

Real estate investment trusts (REITs): Investors who want to passively own real estate can invest in REITs or real estate investment companies that own and manage real estate Investors earn rental income and capital gains according to their investment but have no responsibility for the properties themselves

Dispelling Common Myths & Misconceptions

The world of real estate is filled with myths and misconceptions that can often lead to confusion, misinformation, and missed opportunities Understanding the realities of real estate is crucial for making informed decisions

Many misconceptions surround the real estate market, such as the need for vast wealth to start, or that it's a guaranteed path to riches overnight

Embarking on real estate journeys becomes straightforward when equipped with the right knowledge

Setting Realistic Goals

Setting goals is a critical aspect of success in any field, and real estate is no exception If you want to succeed, you need to have a clear plan in place to help you achieve your dreams For young adults, real estate can seem daunting However, with strategic planning, research, and dedication, it's entirely achievable

Start with your why’ The first step to creating a winning real estate goals plan is to understand why you want to invest in real estate in the first place. This could be anything from financial freedom to a desire to have your own roof over your head Understanding your why will help you stay motivated and focused as you work towards your goals

Understanding the Importance of RealAssessing Your Financial Situation

Embarking on a real estate investment journey begins with creating a budget and diligently saving for a down payment A well-structured budget not only helps you manage your finances but also accelerates your path toward accumulating sufficient funds for a down payment

If you're considering applying for a mortgage or seeking bank financing, it's important to manage existing debts effectively and aim to improve your credit score Focus on prioritizing the repayment of high-interest debts and consistently work on improving your credit score

Additionally, strengthening your financial foundation involves exploring financial assistance programs tailored for first-time buyers Many programs are specifically designed to support first-time buyers, offering enticing benefits such as lower interest rates or down payment assistance options

Finding Your Perfect Property

Before finalizing the decision on that property or land, it's essential to clarify your needs and priorities to make a wellinformed choice Begin by identifying location and neighborhood preferences, considering factors such as proximity to amenities, schools, or work

At the same time, determine the essential features and amenities you desire in a property by listing them out, such as the number of bedrooms, type of flooring, or outdoor space As you evaluate options, maintain a balance between wants and needs within your budget, prioritizing necessities to ensure financial stability.

Additionally, consider future growth opportunities or potential resale value to make a holistic decision that aligns with both your immediate needs and long-term goals

Researching the Local Real Estate Market

Engaging in the real estate process requires a holistic approach that combines research, expert guidance, and thorough evaluations. Begin by researching the local real estate market, staying up to date with housing trends, prices, and market stability to ensure you make informed decisions

This insight empowers you with knowledge about fluctuations, growth patterns, and potential investment opportunities Collaborating with real estate agents and professionals further enhances your journey; they provide invaluable insights, negotiation skills, and access to exclusive listings, enriching your perspective and widening your options