E-Mail: dailyshipping@gmail.com

E-Mail: dailyshipping@gmail.com

Cont’d. Pg. 6-7

“Ease of Doing Business” looking at newer opportunities and Challenges faced by the CFS/ICD/AFS sectorascustodiansofCustomscargo.

By the end of 2024, Indian Roads will Match the American Standard

NEW DELHI: Addressing the annual convention and 95th AGM of FICCI, Union Minister Shri Nitin Gadkari promised that logistics cost, which is 16 per cent of GDP presently, will fall to single digits, up to 9 per cent of GDPbytheendof2024.

Cont’d. Pg. 15

Cont’d. from Pg. 3

Being one of the key stakeholder in the Export-Import Conatiner Logistics Chain, CFS/ICDs have contributed immensely towards the growth of the Indian Export-Import Containerized trade which inter-alia propelstheIndianeconomy.

The event saw an overwhelming record participation of around 75 Delegates from the member CFSs panIndia. A special feature & highlight of this conferencecum-interactive Meet was the gracious presence of the President, National Secreatry and office bearers of National Association of Container Freight Stations (NACFS) as “SpecialInvitees”. Both CFSAI & NACFS, the apex associations with their members operating state-of-the-artCFSs/ICDspanIndia,havebeenworking closely together in tandem for last few years and have been complimenting and supplementing each others efforts towards adopting best global practices to reduce the dwell time and the Logistics costs and also extensive useofdigitization.

Mr. George Joseph, President CFSAI extended a warmwelcometoallthedelegatesfromCFSAI&NACFS and thereafter requested Mr. Umesh Grover Secretary Generaltocommencethesession.

Mr Umesh Grover on behalf of CFSAI President & MC,whilstwelcomingdelegatesthankedeachandevery member CFS for operating their facilities round-theclock during the most difficult and unprecedented

“Covid” era despite inheriting huge risks to their own staff. CFS leadership collectively ensured that the essential logistics supply chain was maintained uninterrupted to a large extent during the peak of pandemic and on humanitarian grounds they provided accommodation, food and other basics amenities under best hygienic condition to each and every stakeholders, be it CBA staff, equipment handlers, truck drivers or the Labour.

Capt. Nishit Joshi, SVP CFSAI moderated the conference and made a crisp presentation to all the delegates sensitizing the futuristic growth of ExportImport trade, opportunities and the challenges in CFSs/ ICDs industry. He also sensitized the delegates about various issues in hand which adversely impacted on dwell time and Logistics costs and are being jointly represented by CFSAI & NACFS in CBIC & other concerned Ministries’ . With redressal of these issues in due course, our Member CFSs as the custodians as well as the Export-Import trade would benefit with reduction in cost and dwell time under “Ease of doing Business”. During the interactive session, delegates from across India namely Mundra, JNPA, Chennai, Pipavav, Vizag & Kolkatasharedtheirvaluedviewsanduniquechallenges in their region and also made suggestions towards innovativesolutions.

CFSAI & NACFS, both the apex associations for the last few years have been working in close coordination and harmony and share best practices adopted by their members. Both associations after internal deliberationshavebeenmakingjointrepresnetaionson policy related issues as well as various operational issues and also on the proposed way forward for CFS/ICD industry by optimising the space with help of digitization of all the processes. Honouring and formalizing the true spirit of cooperation and mutual understanding, a “Joint Cooperation Agreement” was signed by Mr. George Joseph, President CFSAI & Mr. Pramod Kumar Srivastava PresidentNACFS.

Cont’d. from Pg. 6

All the delegates welcomed this move and congratulated the ManagementofboththeAssociation.

Anothernoteworthyfeatureoftheconferencewasthe formal Launch of CFSAI “Referencer of CBIC NotificationHandbook”, asystematiccompilationofall the relevant CBIC Notifications / Circulars done internally by CFSAI member Mr. Jeetendra Kadu from HTPL under the guidance of Capt. Nishit Joshi for the benefitofallthemembers.

Mr.PramodKumarSrivastava,PresidentNACFS inhisaddresstothedelegatesapplaudedthejointefforts of both the Associations. He mentioned that this conference with participation of expert delegates from pan-India was unique in the sense that varied views/ challenges faced by delegates from different commissionarate’s got highlighted and this gave immense exposure to all, particularly on some specific issues thus educating all on diversified issues in our CFS/ICD industry. He was of the view that NACFS & CFSAI teams will continue to work in the spirit of cooperation and the teams would jointly organize such interactiveconferencesatleast2-3timeseveryyear.

Mr. George Joseph, President CFSAI, in his address mentioned that with unprecedented economic reforms India’s Export-Import trade is growing exponentially and CFSs/ ICDs being the Infra providers in the Export-Import containerized supply

chain will continue to play a key role in the Logistics supply chain. In order to optimally utilize the existing infrastructure in our facilities, under NLP launched by Hon’blePMon17thSeptember2022,neweropportunities are emerging for our industry. With the aid of technology and extensive digitization, CFSs would need to re-engineer their existing business plans and in addition to being CCSPs would need to focus on value added services which are permitted in MMLPs & Logistics Parks. He too applauded the efforts of CFSAI & NACFS especially Mr. S Padmanabhan & Capt. Nishit Joshi who have played a key role in strengthening the bonds betweenboththeNationalAssociations.

Mr.PercyVapiwala,VPCFSAI on conclusion of the Conference took the opportunity to profusely thank each andeverydelegatebothfromCFSAI&NACFSfortaking their time off from their busy schedule to be a part of this important conference. He especially thanked the delegates who travelled for various parts of the country. Healsothanked MrAdarshHegde,ourpastPresident, Mr Suresh Kumar R, CEO Allcargo, Capt. Ashsih Chandna & Allcargo team for making available their facility avialble year after year for CFSAI offsite meet. Finally he thanked each and every member of the event organizing team and Capt Nishit Joshi & Mr. Umesh Grover for planning and organizing the entire event and leadingtheirpassionateteam.

After the conference, all the delegates gathered for a GalaMusicaleveningcocktails&dinner.

Southampton, Helsingborg, Gothenburg & Red Sea,

Mediterranean, Gioia Tauro (D).

ANL CMA CGM Ag. Southampton, Rotterdam, Antwerp, Dunkirk, Felixstowe, Le Havre, Dron-3 & Mul Riga, Klaipede, Tallim, St.Petersburg, Genoa, Valencia, Fos. SCI/Hapag CMT/ISS Shpg. Southampton, Rotterdam,Antwerp,Dunkirk, Felixstowe, Le Havre —/ULA CFS COSCO COSCO Shpg. U.K., North Cont., Scandinavian, Red Sea & Med. Ports. Indial Indial Shpg. U.K., North Cont., Scandinavian, Red Sea & Med. Ports. Seahorse Ship U.K., North Continent, Scandinavian Ports & Riga, Klaipede, Tallim, St.Petersburg, Genoa, Valencia, Fos Globelink Globelink WW U.K., North Continent, Scandinavian Ports & Ashdod, Piraeus, Thessaloniki, Athens, Unifeeder Group Unifeeder Ag. U.K., North Continent & Scandinavian Ports. Dron.2 & TLP TSS L'Global Ag. U.K., North Continent & Scandinavian Ports. Dronagiri-2 AMI Intl. AMI Global U.K., North Cont., Scandinavian, Red Sea & Med. Ports. Dronagiri-3 Kalko Faredeal U.K., North Continent & Scandinavian Ports. Dronagiri-3

Team Leader Team Leader Felixstowe, Rotterdam, Antwerp, Hamburg, Barcelona, JWR CFS Le Havre, Istanbul, Genova.

Safewater Safewater Lines U.K., North Continent, Red Sea & Med. Ports.

Team Global Team Global Log. U.K., North Continent & Scandinavian Ports. Pun.Conware

IS252A N1782 261064-15/12 SCI CMT Barcelona,Felixstowe,Hamburg,Rotterdam,Gioia Tauro, 06/0107/01 TBA TBA MSC Lauren IS301A U. K. North Continent & Other Mediterranean Ports.

NBCL Axis Shpg. Felixstowe, Rotterdam, Hamburg, Antwerp & All Inland Desti. Dronagiri-1 Service Allcargo Allcargo Log. U.K., North Cont., Scandinavian & Med. Ports. Dron. 2 & Mul. ICC Line Neptune Felixstowe, Hamburg,Rotterdam & other Inland Dest. GDL-3 & Dron-3 GLS Global Log. U.K., North Continent & Scandinavian Ports. JWR Team Leader Team Leader Felixstowe, Rotterdam, Antwerp, Hamburg, Barcelona, JWR CFS Le Havre, Istanbul, Genoa.

Team Global TeamGlobalLog. U.K., North Continent & Scandinavian Ports. Pun.Conware 24/1225/12 TBA TBA Nagoya Express 2350W N1705 260477-08/12 CMA CGM CMA CGM Ag.(I) Hamburg, Antwerp, London Gateway, Cagliari, Jeddah, Tangier. Dron-3 & Mul 30/1231/12 TBA TBA One Henry Hudson 085W Hapag ISS Shpg. U.K., North Cont., Scandinavian, Red Sea, & Med.Ports. ULA CFS 06/0107/01 TBA TBA Tsingtao Express 3301W COSCO COSCO (I) U.K., North Cont., Scandinavian, Red Sea & Med.Ports. 13/0114/01 TBA TBA Sofia Express 3302W ONE Line ONE (India) Hamburg, Tilbury, Antwerp, Red Sea & Med. Ports. (IOS) Gold Star Star Ship Hamburg, Antwerp, Tilbury. (IOS) Oceangate CFS

25/1226/12

2000 Maersk Chicago 250W N1738 260195-04/12 Maersk Line Maersk India Charleston, Norfolk, New York (Direct) Maersk CFS 01/0102/01 31/12 2000 Maersk Atlanta 251W N1748 260201-04/12 Safmarine Maersk India Charleston, Norfolk, New York, Savannah & Other Maersk CFS 08/0109/01 07/01 2000 Maersk Pittsburgh 252W

US East Coast Ports. Middle East Container Lines(MECL) 15/0116/01 14/01 2000 Maersk Denver 301W Pegasus Maritime Noble Shipping US East Coast & West Coast Dronagiri-1 02/0103/01 TBATBA Wide Alpha 233E N1715 260494-08/12 TS Lines TS Lines (I) Vancouver Dronagiri-2 09/0110/01 TBATBA Ever Ulysses 148E (CISC Service)

India America

ICC Line Neptune New York,Norfolk,Charleston,Miami,Baltimore,Houston & Other Ports. GDL/Dron.-3 Express (INDAMEX) Team Lines Team Global Log. Norfolk, Charleston. JWR Logistics Pegasus Maritime Noble Shipping US East Coast & West Coast Dronagiri-1 Kotak Global Kotak Global US East, West & Gulf Coast 19/12 20/12 19/12 1200 MSC Teresa IV250A N1707 260470-08/12 MSC MSC Agency New York, Savannah, Norfolk (INDUSA) Hind Terminal 26/12 27/12 TBATBA MSC Ivanna IV251A N1777 261029-15/12 02/01 03/01 TBA TBA MSC Francesca IV252A 22/1223/12 21/12 0900 MSC Rida IU250A N1761 260895-13/12 MSC MSC Agency New York, Charleston, Huston, Freeport. Hind Terminals 29/1230/12 TBA 0900 MSC Rikku IU251A N1781 261032-15/12 Kotak Global Kotak Global US East, West & Gulf Coast (INDUS) 05/0106/01 TBA 0900 MSC Tianing IU252A 23/1224/12 22/12 1200 MSC Benedetta IS251A N1746 260896-13/12 MSC MSC Agency Baltimore,Boston,Philadelphia,Miami,Arica,Buenaventura, Hind Terminals 30/1231/12 29/12 1200 MSC Topaz IS252A N1782 261064-15/12 Callao, La Guaira, Paita, Puerto Cabello, Puerto Angamos, Iquique, 06/0107/01 TBA TBA MSC Lauren IS301A Valparaiso,Cartagena,Coronel,San Antonio,Santiago De Cuba,Mariel (Himalaya Express) Globelink Globelink WW USA, East & West Coast. (Himalaya Express)

In Port 19/12 X-Press Bardsey 22020E N1718 260231-05/12 ONE Line ONE (India) USA, East & West Coast, USA, South & Central America 25/1226/12 TBA TBA Bangkok Bridge 0139E N1729 260650-09/12 & Caribbean Ports, Canada South & Central America. 01/0102/01 TBATBA Clemens Schulte 018E Globelink Globelink WW USA, Canada, Atlantic & Pacific, South American & 08/01 09/01 TBA TBA Seaspan Chiba 013E West Indies Ports. (TIP Service) In Port 20/12 OOCLLuxembourg 099E N1696 260425-07/12 OOCL OOCL(I) USA East Coast & Other Inland Destinations. GDL 26/1227/12 TBA TBA Seamax Stratford 119E N1774 261014-15/12 RCL RCL Ag USA East Coast & Other Inland Destinations. 05/0106/01 TBA TBA Zim Charleston 10E COSCO COSCO Shpg. US West Coast. 12/0113/01 TBA TBA OOCL Genoa 061E Yang Ming Yang Ming(I) US West Coast. China India Express III - (CIX-3) Contl.War.Corpn. (CIX-3) ICC Line Neptune US East, West Coast, Canada, South & Central American Ports. GDL-3 & Dron-3 20/1221/12 TBA TBA CMA CGM Titus 0MXDNW N1681 260105-02/12 CMA CGM CMA CGM Ag. New York, Norfolk,

Shpg. Jebel Ali, Bandar Abbas.

Emirates Emirates Shpg. Jebel Ali, Sohar. LMR Logistic Ser. Jebel Ali, Bandar Abbas. X-Press Feeders Sea Consortium Jebel Ali, Bandar Abbas. Dronagiri Hapag ISS Shpg. ULA CFS

QNL/Milaha PoseidonShpg. Jebel Ali, Bandar Abbas. Speedy CFS Cordelia Cordelia Cont. Jebel Ali, Sharjah, Abu Dhabi, Ajman, Dammam,Jubail, Hamad, Baharin, Shuaiba, Shuwaikh, Sohar, Umm Qasr Alligator Shpg. Aiyer Shpg. Jebel Ali. BSS Bhavani Shpg. Jebel Ali, Doha, Kuwait, Bahrain, Bandar Abbas. Ashte CFS Seahorse Ship Gulf Ports.

LMT Orchid Gulf Ports.

Dronagiri-3 Bay Line Freight Conn. Port Sudan & Al Sokhna CWC, GDL & DRT ICC Line Neptune UAE & Upper Gulf Ports. GDL-5 Ceekay Parekh Gulf Ports. GDL-2 Team Leader Team Leader Dubai, Jebel Ali JWR CFS Team Lines Team Global Log. Gulf Ports. JWR Logistics 24/1225/12

260776-12/12 X-Press Feeders Sea Consortium Khalifa, Jebel Ali. 31/1201/01

Global Feeder Sima Marine Dronagiri

Unifeeder Group Transworld Shpg. Basra. Emirates Emirates Shpg. Jebel Ali. Alligator Shpg. Aiyer Shpg. Jebel Ali. Cordelia Cordelia Cont. West Asia Gulf Ports. Bay Line Freight Conn. Port Sudan & Al Sokhna CWC, GDL & DRT

TBA Celsius Naples 893E ONE Line ONE (India) Colombo. (CISC Service) 23/0124/01 TBATBA Shimin 22008E CSC Seahorse Colombo.

19/12 20/12 19/12 1200 MSC Teresa IV250A N1707 260470-08/12 MSC MSC Agency Colombo. (INDUSA) Hind Terminal 22/1223/12 21/12 0900 MSC Rida IU250A N1761 260895-13/12 MSC MSC Agency Karachi. (INDUS)

Hind Terminals

In Port 20/12 OOCLLuxembourg 099E N1696 260425-07/12 OOCL OOCL (I) Colombo. GDL 26/1227/12 TBA TBA Seamax Stratford 119E N1774 261014-15/12 Star Line Asia Seahorse Yangoon. (CIX-3) Dronagiri-3 In Port 19/12 X-Press Bardsey 22020E N1718 260231-05/12 ONE Line ONE (India) Colombo. 25/1226/12 TBA TBA Bangkok Bridge 0139E N1729 260650-09/12 X-Press Feeders Sea Consortium Colombo. (TIP) Dronagiri 01/0102/01 TBA TBA Clemens Schulte 018E CSC Seahorse Colombo. 24/1225/12 TBA TBA Conti Contessa 112E N1682 260112-02/12 ONE Line ONE (India) Colombo. 05/0106/01 TBA TBA One Competence 089E Yang Ming Yang Ming(I) Contl.War.Corpn. 12/0113/01 TBA TBA MOL Courage 051E Hapag/CSC ISS Shpg/Seahorse (PS3 Service) ULA CFS/ 29/1230/12 TBA TBA Kota Megah 0141E N1755 260833-13/12 ONE/KMTC ONE(I)/KMTC(I) Karachi, Colombo —/Dron-3 04/0105/01 TBA TBA Pontresina 238E X-Press Feeders SeaConsortium (CWX) 12/0113/01 TBATBA Dalian 2209E TS Lines/PIL TS Lines(I)/PIL Mumbai Dronagiri-2/—

19/1220/12 19/12 0900 MSC Tracy V IW250A N1712 260471-08/12 MSC MSC Agency Colombo (IAS SERVICE)

Hind Terminal 20/1221/12 Kota Lagu 8W N1640 259804-28/11 ZIM ZIM Integrated Colombo. (ZMI) Oceangate CFS 20/1221/12 TBA TBA Xin Shanghai 140E N1700 260338-06/12 COSCO COSCO Shpg. Karachi, Colombo. (CI 1) 20/1221/12 19/12 0800 BLPL Faith 3220E N1728 260436-07/12 BLPL Transworld GLS Chittagon, Yangoon 07/0108/01 TBA TBA BLPL Trust 1211E 21/1222/12 TBA TBA Kumasi E006 N1698 260404-07/12 Wan Hai Wan Hai Lines Colombo. (CI2) Dron-1 & Mul CFS 23/1225/12 22/12 1600 KMTC Dubai(GTI) 2207E N1680 260084-02/12 Evergreen Evergreen Shpg. Colombo Balmer Law. CFS Dron. 02/0103/01 TBA TBA Zim Norfolk 7E N1703 260284-06/12 KMTC/Gold Star KMTC(I)/Star Ship Dronagiri-3/— 08/0109/01 TBA TBA Ever Uberty 180E X-Press Feeders SeaConsortium (CIX3 Service) 13/0114/01 TBATBA Seaspan Emerald 13E EmiratesEmirates Dronagiri-2

20/12 21/12 TBA TBA Gulf Barakah 2233E N1704 260298-06/12 Asyad Line Seabridge Singapore, Port Kelang. (IEX) 30/12 31/12 TBA TBA Stephanie C 2217E N1742 260821-12/12 21/1222/12 21/12 1100 Shanghai Voyager 2210E N1660 259963-30/11 Global Feeder Sima Marine Port Kelang, Shekou, Shanghai, Ningbo (CSC) Dronagiri 05/0106/01 TBA TBA GFS Pride 2215E N1691 260294-06/12 Heung A Line Sinokor India 11/0112/01 TBA TBA GFS Priestige 2216E Sinokor Sinokor India Seabird CFS (CSC) Sealead Giga Shpg. Cordelia Cordelia Cont. Port Kelang, Far East & China Ports Blue Water Poseidon Shpg. Shanghai, Ningbo, Qingdao. Speedy CFS 22/1223/12

PIL Mumbai/ONE(I) —/— 23/0124/01 TBA TBA Shimin 22008E

Hapag ISS Shpg. P.Kelang, Singapore, Xiangang, Qingdao, Shanghai, Ningbo, Da Chan Bay. ULA CFS 30/0131/01 TBA TBA Celsius Nairobi 892E

KMTC KMTC (I) P.Kelang,Singapore,Tanjung Pelepas,Xiangang,Qingdao,Laem Chabang. Dronagiri-3 06/0207/02 TBA TBA Ever Ursula 184E

TS Lines TS Lines (I) P.Kelang,Singapore,Tanjung Pelepas,Xiangang,Qingdao,Laem Chabang. Dronagiri-2 CISC Service

CU Lines Seahorse Ship Port Kelang, Singapore, Haiphong, Qingdao, Shanghai, Ningbo. BSS Bhavani Shpg. Port Kelang, Singapore, Jakarta, Yangoon, Surabaya, Belawan, Ashte CFS

ONE Line ONE (India) Port Kelang, Singapore, Hong Kong, Shanghai, Ningbo. 12/0113/01 TBA TBA OOCL Genoa 061E

COSCO COSCO Shpg. Port Kelang, Singapore, Hong Kong, Shanghai, Ningbo. (CIX-3) Gold Star Star Ship Singapore, Hong Kong, Shanghai.

ANL CMA CGM Ag. Port Kelang, Singapore Dron.-3 & Mul. TS Lines TS Lines (I) South East Asia, Far East, China. Dronagiri-2

In Port 19/12 X-Press Bardsey 22020E N1718 260231-05/12 ONE Line ONE (India) Port Kelang, Singapore, Laem Chabang, 25/1226/12 TBA TBA Bangkok Bridge 0139E N1729 260650-09/12 X-Press Feeders Sea Consortium Port Kelang, Singapore, Laem Chabang. (TIP Service) 01/0102/01 TBA TBA Clemens Schulte 018E

Samudera Samudera Shpg. Port Kelang, Singapore, Laem Chabang. Dronagiri 08/01 09/01 TBA TBA Seaspan Chiba 013E RCL RCL Ag. Port Kelang, Singapore, Laem Chabang. 23/1224/12 TBA TBA Northern Diamond 251E N1714 260193-04/12 Maersk Line Maersk India Port Kelang, Tanjung Pelepas, Singapore, Hongkong, Maersk CFS 30/1231/12 TBATBA ALS Apollo 252E N1749 260199-04/12 CMA CGM CMA CGM Ag. Kwangyang, Pusan, Hakata, Shanghai. Dron.-3 & Mul. 06/0107/01 TBA TBA Shijing 301E (FM-3) 25/1226/12 TBA TBA Kota Gabung 098E N1720 260580-09/12 RCL/PIL RCL Ag./PIL Port Kelang, Haophong, Nansha, Shekou. 04/0105/01 TBA TBA Calais Trader 022E CU Lines Seahorse Ship (RWA) 15/0116/01 TBA TBA CULManila 2301E InterasiaInterasia 22/0123/01 TBA TBA Interasia Engage E003 Emirates Emirates Shpg. 24/1225/12 TBA TBA Conti Contessa 112E N1682 260112-02/12 ONE Line ONE (India) Port Kelang, Singapore, Leme Chabang, Kaimep, 05/0106/01 TBA TBA One Competence 089E Yang Ming Yang Ming(I) Shanghai, Ningbo, Shekou. Contl.War.Corpn. 12/0113/01 TBA TBA MOL Courage 051E Hyundai HMM Shpg. Seabird CFS (PS3 Service) Samudera Samudera Shpg. (PS3 Service) Dronagiri Gold Star Star Ship Port Kelang, Singapore, Hong Kong, Ningbo, Shanghai Ocean Gate 26/1228/12 TBA TBA Wan Hai 502 E108 N1695 260395-07/12 Wan Hai Wan Hai Lines Port Kelang, Singapore, Kaohsiung, Hongkong, Shekou. Dron-1 & Mul.CFS 03/0105/01 TBA TBA Wan Hai 507 E208

Evergreen Evergreen Shpg. BalmerLaw.CFSDron. 10/0111/01 TBA TBA Ital Unica E156 Hapag/RCL ISS Shpg./RCL Ag. (CIX) ULA-CFS/ 17/0118/01 TBA TBA Argolikos E147

TS Lines TS Lines (I) South East Asia, Far East, China. Dronagiri-2 29/1230/12 TBA TBA Kota Megah 0141E N1755 260833-13/12 ONE Line ONE (India) Port Kelang, Hongkong, Shanghai, Ningbo, Shekou 04/0105/01 TBA TBA Pontresina 238E

X-Press Feeders SeaConsortium (CWX) 12/0113/01 TBA TBA Dalian 2209E KMTC KMTC (India) Dronagiri-3 20/0121/01 TBA TBA X-Press Anglesey 22008E

TS Lines TS Lines (I) Dronagiri-2 24/0125/01 TBA TBA TS Ningbo 23001E

RCL/PIL RCL Ag./PIL Mumbai (CWX) Blue Water Poseidon Shpg. Shanghai, Ningbo, Qingdao. Speedy CFS

In Port 19/12 Gabriela A E007 N1663 259984-01/12 Sinokor Sinokor India Port Kelang, Shekou, Dalian, Shanghai, Ningbo, Seabird CFS 21/1222/12 21/12 0600 Jakarta Voyager E2210 N1667 260031-01/12 Heung A Line Sinokor India Hongkong 28/1229/12 TBA TBA Interasia Cattalyst E020 N1772 260867-13/12 Wan Hai Wan Hai Lines (CI6) Dron-1 & Mul CFS 04/0105/01 TBA TBA GH Curie E012 InterasiaInterasia Unifeeder Feedertech/TSA Dronagiri In Port 19/12 Cypress 0FF7ME1 N1675 260069-02/12 CMA CGM CMA CGM Ag. Singapore, Qingdao, Shanghai, Ningbo, Shekou Dron-3 & Mul 26/1227/12 TBA TBA CMA CGM Melisande 0FF7KE1 N1731 260657-10/12 RCL RCL Ag. (AS1) 20/1221/12 TBA TBA Xin Shanghai 140E N1700 260338-06/12 COSCO COSCO Shpg. Shanghai, Laem Chabang. 29/1230/12 TBA TBA COSCO Thailand 090E N1773 260999-14/12 APL CMA CGM Ag. (CI 1) Dron.-3 & Mul 04/0105/01 TBA TBA Xin Hongkong 059E OOCL/RCL OOCL(I)/RCL Ag. GDL/— (CI 1) CU Lines Seahorse Ship Singapore,Shanghai,Ningbo,Shekou,Nansha,Port Kelang 20/1221/12 20/12 0900 Hyundai Colombo 0129E N1674 260044-01/12 Hyundai HMM Shpg. Port Kelang, Singapore, Laem Chabang, Caimep, Kaohsiung, Seabird CFS 03/0104/01 TBA TBA Hyundai Oakland 0120E N1763 260860-13/12 Maersk Line Maersk India Pusan, Indonesia, Thailand, Vietnam & Other Indland Destination. Maersk CFS 09/0110/01

Frementle, Brisbane, Auckland, Adelaide(LCL/FCL). Dron.2&Mul(W) 08/01 09/01 TBA TBA Seaspan Chiba 013E

GLS Global Log. Australia & New Zealand Ports. (TIP Service) JWR

In Port 20/12 OOCLLuxembourg 099E N1696 260425-07/12 ANL CMA CGM Ag. Australia & New Zealand Ports. Dron.-3 & Mul. 26/1227/12 TBA TBA Seamax Stratford 119E N1774 261014-15/12 RCL RCL Ag. Brisbane, Sydney, Melbourne. Dronagiri-1 05/0106/01 TBA TBA Zim Charleston 10E OOCL OOCL (I) Sydney, Melbourne. GDL 12/0113/01 TBA TBA OOCL Genoa 061E

TS Lines TS Lines (I) Australian Ports. (CIX-3) Dronagiri-2 (CIX-3) Austral Asia MCS (I) Port Lae, Port Moresbay, Madang, Kavieng, Rabaul, Honiara Dronagiri-3 Team Lines Team Global Log. Australia & New Zealand Ports. JWR Logistics 26/1228/12

27/1228/12 Morning Peace 053

Eukor Car Carr Parekh Marine Europe and Mediterranen Ports.

In Port 20/12 Hoegh Kobe 74/75 1059888-28/11 Hoegh Autoliners Merchant Shpg. Kingston, Veracruz, Freeport, Jacksonville. 25/0126/01 Alliance St Louis 45 27/1228/12 Morning Peace 053

Eukor Car Carr Parekh Marine USA South America & Caribbean Ports. 20/0124/01 Pederewski 26

Chipolbrok Samsara Houston.

In Port 20/12 Hoegh Kobe 74/75 1059888-28/11 Hoegh Autoliners Merchant Shpg. Durban, Tema, Dakar 25/0126/01 Alliance St Louis 45 27/1228/12 Morning Peace 053

Eukor Car Carr Parekh Marine Singapore, Laem Chabang, Pyungtaek (Direct) & other Far East, African Ports 17/0118/01 Hoegh Tracer 40

Hoegh Autoliners Merchant Shpg. Singapore. 20/0124/01 Pederewski 26 Chipolbrok Samsara Singapore, Kaohsiung, Shanghai.

VESSEL VOYAGE ARR/ETA

HANSA ROTENBURG 919E NSICT 17/12/2022 HYUNDAI COLOMBO 139 BMCT 19/12/2022 GABREILA A 007E BMCT 18/12/2022

VESSEL VOYAGE ARR/ETA JAKARTA VOYAGER 2210 BMCT 21/12/2022 NORTHERN DEDICATION 2205W BMCT 19/12/2022

The above vessels are expected has arrived to arrive APMT/JNPT/NSICT/BMCT on above mentioned dates with Import Cargoes in containers.

Consignees are requested to obtain the Delivery Order by surrendering ORIGINAL BILLS OF LADING duly discharged on payments of relative charges as applicable within 5 days or else detention charges will be applicable.

Consignees will please note that the carriers of their agents are not bound to send individual notification regarding arrival of the vessel or the goods. For detailed information on cargo availability, please contact our office.

*Note: The importers having AEO status and those who are availing DPD facility for containerized cargo are allowed to pay Terminal Handling Charges (THC) directly to Ports/Terminal through their P.D Accounts. Upon making THC payment importers are requested to submit proof of payment duly stamped and acknowledged by Port/Terminal to Avana Global FZCO for issuance of Delivery Order (DO) without Avana Global FZCO’s THC Invoice and Receipt. Visit our Website : www.avanalogistek.com for Import Vessel arrival & IGM details

The above vessel has arrived at NHAVA SHEVA (APMT) on 18/12/2022 with Import Cargo in containers.

Consignees are requested to obtain DELIVERY ORDERS on presentation of ORIGINAL BILLS of LADING and

MUMBAICont’d. from Pg. 3

"It is going to help us get more exports", the Minister said, adding now is the time to increase our business and presence in the internationalmarket.

The Minister further stated that before the end of 2024, India's road infrastructure would be equal to the Americanstandard.

MinisterGadkariaddedIndiaison the path to building an inclusive Bharat by following the vision of the Hon'ble Prime Minister Shri Narendra Modi by boosting investment, economic growth, and employment creation to achieve sustainable development. However, "we need to have cooperation, coordination and communication betweenallstakeholders",hesaid.

Inaddition,ShriGadkarinotedthe research in battery chemistry and said, "we should be the leaders in the sector". He added that the government aims to double the

automobile sector to Rs.15lakh crores. "This will create new jobs and make India one of the biggest automobile manufacturers in the world", he said. Moreover, underscoring the importance of sustainability in the construction sector, he noted, "we are trying to minimise the use of cement and steel in construction work by adopting substitutes like fly ash, oil slag, waste plastics,demolitionwaste.

Minister Gadkari invited FICCI to prepare a comprehensive growth plan forthenextfiftyyearsforallsectors.

On occasion, Mr Sanjiv Mehta, President, FICCI, noted that the "all-inclusive, all-pervasive, and all-round development initiatives" of the government are transforming India, with each step bringing the nation closer to Aatmanirbhar Bharat. He added that the National Logistics Policy would be instrumental in creating an integrated pathway towards economic development.

Moreover, he said, "the increased spending on infrastructure development is leading to a multiplier effect in rejuvenating the aggregate demandintheeconomy."

"Infrastructure construction alone has the potential to contribute 25 per cent of incremental growth non-farm jobs by 2030", he added. He also drew attention to India's Century - achieving sustainable, inclusive growth, a unique FICCI initiative supported by the McKinsey & Co. to establish a roadmap for India forthenext25years.

Mr Subhrakant Panda, President-elect, FICCI, underlined several policies that will catalyse the national economy by driving growth in allied sectors, like housing, steel, and cement. These include PM GatiShakti for integrated infrastructure development worth Rs 7.5 lakh crore in FY23, construction of 65000 kilometres of national highways, and National Infrastructure pipeline.

NEW DELHI: Merchandise exports barely inched up in November from a year before to $32 billion but they reversed a steep contraction witnessed in the previous month in the wake of a demand slowdowninkeymarkets.

The Commerce Ministry said imports grew 5.4% on year in November to $55.9 billion, leading to a tradedeficitof$23.9billion,lowerthan the October level of $26.9 billion. Exports in November last year stood at$31.8billion.

Withthis,goodsexportsinthefirst eight months of FY23 touched $295.3 billion, up 11.1% from a year earlier, while imports grew 29.5% to

$493.6 billion, mainly due to robust growthearlierthisfiscal.

Exports had shrunk 16.7% in October, the first drop in 20 months andtheworstsinceMay2020.

Exports dropped in 15 of the 30 key segments, against 24 in the previous month. However, some segments have performed relatively well. These include electronics (growth of 54.5%), rice (19.2%), garments (11.7%), drugs and pharmaceuticals (8.7%) and gems andjewellery(4.6%).

The easing growth in imports suggests domestic consumption of goods may be slowing after the revengepurchasesearlierthisfiscal.

Commerce Secretary Sunil Barthwal had last month said that strong external headwinds were impacting consumption worldwide, which would have an impact on India’s exports as well. The aggressive interest rate hikes by the US and Europe to tame runaway inflation there is also weighing down demand for merchandise globally, he suggested.

Therestrictionsonexportsofnonbasmati rice and the ban on those of wheat to ease domestic inflation have alsocontributedtotheexportdecline. Even export curbs on select steel productsandironorewerelistedonly latelastmonth.

NEW DELHI: The Government is closely monitoring imports of non-essential products with a view to enhancing domestic production of those items, a senior official of the Commerce Ministry said recently. Containing these imports would also help reduce the trade deficit, which has reached USD 198.35 billion during April-November 2022 as against USD 115.39 billion in April-November 2021.

While talking to reporters, Additional Secretary in the

Commerce Ministry L Satya Srinivas saidIndiantradeneedstobeseeninthe globalcontext.

"Indian exports are showing great resilience despite challenges", he said. "Indiaisstillabrightspot."

Another official said the Ministry sends information of import surge on monthly basis to all Line Ministries and Departments.

TheLineMinistrieswouldnominate nodal officers to coordinate with the DepartmentofCommerceontheissue.

The strategy, he said, is to address

domestic supply rigidities by enhancing local capacities and production opportunitiesforthoseitems.

"Global growth and trade prospects continue to be gloomy with headwinds resulting in weak global demand, therefore slowdown in exports growth while India's domestic demand continues to be robust with continuing growthofimports.

"There will be a pressure on the tradedeficit.TheGovernmentisclosely monitoring imports -- especially non-essentialimports,"theofficialsaid.

NEW DELHI: The Union Minister for Ports, Shipping and Waterways, Shri Sarbananda Sonowal informed the Lok Sabha that as a part of Sagarmala Programme, more than800projectsatanestimatedcostofaroundRs.5.4lakh crore have been identified. Sagarmala projects includes projects from various categories such as modernisation of existingportsandterminals,newports,terminals,RoRo& tourism jetties, enhancement of port connectivity, inland waterways, lighthouse tourism, industrialization around port, skill development, technology centres, etc. These projects are broadly classified into five pillars of Sagarmala

Undertheportmodernizationpillar,241projectsatcost of around Rs. 2.5 Lakh Cr. have been undertaken for implementation. Ministry is partially funding 20 port modernizationprojectsatanestimatedcostofRs.1,191Cr. Out of total 20 projects, 4 projects worth Rs. 157 Cr. have beencompletedand11projectsworthRs.868Cr.areunder implementation. The State-wise details of port modernizationprojectsisprovidedinAnnexureI.

In Paradip Port, 4 major capacity addition infrastructure projects worth Rs. 3264 Cr. have been implemented in last 7 years. These projects have increased the capacity of port by 55 MTPA. The details of Port Modernization projects at Paradip Port is provided in AnnexureII.

Additionally, Deepening and optimization of inner harbour facilities including development of Western Dock on BOT basis to Handle Cape Size Vessels at an estimated costofRs.3004.63Cr.hasbeenawarded.

Gopalpur is a notified Non- Major Ports in the State of Odisha. Non- Major Ports are under the administrative

control of the respective State Governments. Government of Odisha has informed that Gopalpur Port is developed & operational by Gopalpur Ports Limited (GPL) through PPP mode on BOOST basis. Hence, it is the responsibility of GPL to modernize and to augment the capacity of GopalpurPort.

NEW DELHI: The Minister of State in the Ministry of Commerce and Industry, Smt. Anupriya Patel recently highlighted various initiatives by the Government to boost exportsandreducetradedeficit:

i. ForeignTradePolicy(2015-20)extendedupto31-03-2023.

ii. Interest Equalization Scheme on pre and post shipment rupee export credit has also been extended upto 31-032024.

iii. Assistance provided through several schemes to promote exports, namely, Trade Infrastructure for Export Scheme (TIES) and Market Access Initiatives (MAI)Scheme.

iv. Rebate of State and Central Levies and Taxes (RoSCTL) Scheme to promote labour oriented textile export has beenimplementedsince07.03.2019.

v. Remission of Duties and Taxes on Exported Products (RoDTEP) scheme has been implemented since 01.01.2021.

vi. Common Digital Platform for Certificate of Origin has beenlaunchedtofacilitatetradeandincreaseFreeTrade Agreement(FTA)utilizationbyexporters.

vii. 12 Champion Services Sectors have been identified for promoting and diversifying services exports by pursuing specificactionplans.

viii. Districts as Export Hubs has been launched by identifyingproductswithexportpotentialineachdistrict, addressing bottlenecks for exporting these products and supporting local exporters / manufacturers to generate employmentinthedistrict.

ix. Active role of Indian missions abroad towards promoting India’s trade, tourism, technology and investment goals hasbeenenhanced.

x. Package announced in light of the COVID pandemic to support domestic industry through various banking and financial sector relief measures, especially for MSMEs, whichconstituteamajorshareinexports.

NEW DELHI: India is the fastest growing major economy in the world and is all set to achieve USD 5 trillion GDP by 2024-25, Union Minister Nitin Gadkari said recently. Addressing an event organised by industry body FICCI, Gadkari said the Government is aiming to boost growth and

employmenttoachievesustainabledevelopment.

TheRoadTransportandHighwaysMinistersaidIndiawill play a key role in achieving global Sustainable Development Goals(SDGs)2030.GadkarinotedthatIndianeedstoincrease itsexportsandreduceimports.

MUMBAI: The Reserve Bank of India’s (RBI's) foreign exchange reserves rose by $2.9 billion to $564.07 billion in the week ended December 9. This is the fifth consecutive week of anincreaseinthecentralbank’scoffers.

The rise in the previous week was mainly on account of an increase in the RBI’s foreign currency assets, which rose by $3.1 billion to $500.13 billion, according to latest data. In the week ended December 9, the RBI’s gold reserves declined by

$296millionto$40.73billion,thedatashowed.

Over the past five weeks, the RBI’s reserves have increased significantly amid a steep decline in the US dollar index.

In the week ended December 2, the reserves rose $11.02 billion to $561.16 billion, marking their highest levels since August 26. As of October 28, the reserves were at $531.08billion.

NEW DELHI:Responding to November, 2022 Trade Data, FIEO President, Dr A Sakthivel said that exports coming back in the positive territory is on expected line thoughthechallengescontinuedueto slowdown in demand and rising inflationinmosteconomies.Marginal increase in merchandise exports is a reflection of the toughening global trade conditions on account of high inventories, economies entering recession, high volatility in currencies and geopolitical tensions. The drop in commodity prices and restriction on some exports, with a view to stem the price increase in the domestic market, have also affected the growth numbers. Further going forward, we should also look at the upcoming Fed rate hike as that also may add pressure on the flight of capital with the Bank of England also goingforarecentratehike.Growthin only15outof30majorproductgroups isofconcernandthereforePresident, FIEO is of the view that the coming months would be quite challenging unless both global economic growth

and geopolitical situation improves drastically.

However, the minor increase in importsisduetothejumpinimportof petroleum, crude & products, fertiliser and coking coal etc. We hope thattheenergypriceswillcomedown further to provide more relief to us on thetradedeficit,opinedFIEOChief.

Dr Sakthivel added that in the current situation, the focus should be on providing liquidity at competitive cost to the export sector and therefore, RBI may consider opening export credit refinance facility to banks so as to encourage themtolendtotheexportsectorwith refinancing from RBI at the Repo Rate. Government may also extend the ECLGS for one more year till 31.3.2023 suitably enhancing the moratorium period. Since the interest rates have moved upward and are now more than the pre-covid level,thereisastrongcasetorestore the Interest Equalization support to 5% and 3% respectively as existed prior to the covid period. Moreover, the Government should look into the

request of the export sector for continuing with IGST exemption on freight on exports, which lapsed on 30th September, 2022, particularly as the freight rates are still at much elevated level and GST on such freight will affect the liquidity of the exporters, though refundable later. Besides these, the tenure of PCFC may be enhanced from 180 days to 365 days looking into the supply side and logistics challenges. While welcomingtheextensionofRoDTEP rates for Chemicals, Pharma and Articles of Iron & Steel, Dr Sakthivel requested that the rates may be notified for the holders of Advance Authorization, DFIA and EOU units aswell.

Further, the Federation is also of theviewthatthenewTMAschemefor agri exporters may be announced as the cost of freight, particularly the reefer, is very high. The upcoming Budget should allocate funds for exports development with a corpus of Rs5000Croreforaggressiveoverseas marketing by MSME to showcase Indianproductsglobally.

NEW DELHI : The next Budget may announce measures to reduce India’s import dependence from China, through various tariff and nontariff measures, pursuing its strategy of Atmanirbhar Bharat (self-reliant India) in a “calibrated” manner, two officialsawareofthemattersaid.

The Budget may announce measures to reduce India’s import dependence from China, through varioustariffandnon-tariffmeasures, pursuing its strategy of Atmanirbhar Bharat (self-reliant India) in a “calibrated” manner, two officials awareofthemattersaid.

WhileIndiawillcontinuetoimport raw materials and intermediates from its neighbour, it may disincentivise through strict enforcement the entry of finished Chinese goods imported directly into India or shipped in via a third country violating the ‘rules of origin’ norm, theyadded,requestinganonymity.

The move comes amid India’s effortstogetChinatorespectexisting agreements regarding the Line of Actual Control in the context of the 20-month long standoff between the twocountriesalongtheLineofActual Control (LAC) in Ladakh. It also

comes in the immediate context of a clash between the two sides along the LAC in Arunachal Pradesh following an attempted incursion by Chinese soldiersthatwasrepealed.

OnewaytocheckinfluxofChinese finished products is to recalibrate customs duties. The other is by levying anti-dumping duties, non-tariff measures such as strict enforcement of rules of origin, and encouraging cost-effective local manufacturing through incentives, the officials said. “Recalibration of customsdutiesisexpectedonseveral items,”oneofthetwoadded.

NEW DELHI: Apparel exports in November rose by 11.7 per cent to about USD 1.2 billion after declining for the last few months amid global challenges, export promotion body AEPCsaid.

Apparel Export Promotion Council (AEPC) Chairman Naren Goenka said that exports of ready-made garments (RMG) from India witnessed a rough patch in the past few months since most of the traditional markets such as the UK, the EU and the US have been witnessing recession and global headwinds, leading to falling

demandinthesecountries.

Inflation and rising costs of raw material and freight, aggravated by the Russia-Ukraine war, added to the burdenofexporters,hesaid.

"However, after a few months of slip, RMG exports have again turned positive signalling the resilience of theindustrytoadjusttotheprevailing challenges,"Goenkaadded.

He also said that the target for apparel exports for 2022-23 is USD 17.6 billion against which "We have been able to achieve more than USD 10 billion during AprilNovember2022".

The council has flagged certain issues with the government, the resolution of which will help in increasingexports.

The major issues include early announcement of the productionlinked incentive scheme for apparel, extension of ATUFS (Amended Technology Upgradation Fund Scheme), RoSCTL (Rebate of State and Central Levies and Taxes) disbursements through bank transfer, and one time relaxation on account of bankruptcy / insolvency / discounting / cancellation of export orders,itsaid.

Cargo

CJ-I MV Obe Heart Interocean 20/12

CJ-II MV Lady Moon DBC 22/12

CJ-III MV Pegasus 01 DBC 21/12

CJ-IV MV Armonia ACT Infra 20/12

CJ-V MV Loyalty Hong Arnav Shpg. 21/12

CJ-VI MV Carina B S Shipping 24/12

CJ-VII MV Ocean Future J M Baxi 22/12

CJ-VIII MV Wolverine J M Baxi 24/12

CJ-IX VACANT

CJ-X MV Sunny Royal

CJ-XI VACANT

CJ-XII VACANT

CJ-XIII MV Pac Adil Tristar Shpg 24/12

CJ-XIV MV Jabal Samhan Chowgule Bros. 26/12

CJ-XV MV Flag Gangos Seacoast 20/12

CJ-XVA MV Chakravati Chowgule Bros. 20/12

CJ-XVI MV Common Galaxy Cross Trade 25/12

TunaTekra Steamer's Name Agent's Name ETD

MV Olympus Tauras 20/12

MV Incredible Bulk Tauras 22/12

Oil Jetty Steamer's Name Agent's Name ETD

OJ-I LPG Berlian Ekuator Nationwide 20/12

OJ-II MT Solar Roma GAC Shpg. 20/12

OJ-III MT Chemroad Orchid J M Baxi 20/12

OJ-IV MT NCC Yanbu Interocean 20/12

OJ-V MT C Seashine

OJ-VI MT High Leader J M Baxi 20/12

Stream

Stream

Ocean Harmony 9.000 T. Rice

Stream MT Carp Samudra 12,000 T. Caustic Soda

CJ-XVA MV Chakravati Chowgule Bros. Cotonou 50,000 T. Rice Bags 2022111169

CJ-XVI MV Common Galaxy Cross Trade 59,000 T. Salt

Stream MV Elisar Ocean Harmony Durban 31,750 T. Sugar Bags 2022111243

CJ-XV MV Flag Gangos Seacoast Douala 32,000 T. Bagged Rice 2022121026

Tuna MV Incredible Bulk Tauras 40,200 T. RSM In Bulk

CJ-XIV MV Jabal Samhan Chowgule Bros. China 61,600 T. Salt

Stream MV Jaohar UK Interocean 26,500 T. Sugar In Bags

Stream MV Jupiter DBC Port Sudan 23,000 T. Sugar Bags 2022121036

CJ-II MV Lady Moon DBC Somalia 24,900 T. Sugar Bags 2022111377

Stream MV Lady Demet DBC 29,000 T. Sugar Bags (50 Kgs) 2022121157

Stream MV Mont Blanc Hawk Interocean Sudan 71,000 T. Sugar In Bulk 2022121042

CJ-I MV Obe Heart Interocean Sudan 25,000 T. Sugar Bags 2022111247

Stream MV Obe Queen Ocean Harmony Sudan 40,100 T. Sugar In Bags 2022121014

Stream MV Osprey Cross Trade 59,000 T. Salt 25/12 MT Owl 2 GAC Shpg. 4,500 T. C. Oil

CJ-XIII MV Pac Adhil Tristar Shpg 2,500/1,500 T.M. Chloride/Sul. & 18 Wind Mill 2022111285

CJ-III MV Pegasus 01 DBC Somalia 8,000 T. Sugar Bags 2022111256

Stream MV Propel Progress DBC Sudan 25,000 T. Sugar Bags 2022121003

20/12 MT Stolt Sypress J M Baxi 2,300 T. PDCB 20/12 MV Thor Fortune Aditya Marine 10,200 T.S Pipes 2022121150

Stream MV Wolverine J M Baxi 60,500 T. Mill Scale

Stream MV Zagori Interocean 49,500 T. Sugar Bulk 2022121042

M Baxi 48,100 T. MOP Tuna MV Olympus Tauras 49,474 T. Urea In Bulk Stream MV Serena Tauras 49,910 T. Urea In Bulk

22/12 LPG/C AL Jabirah GAC Shpg. 13,500 T. Ammonia

OJ-I LPG Berlian Ekuator Nationwide 20,000 T. Propane/Butane 25/12 MT Bow Cedar GAC Shpg. Al Jubail 5,000 T. Chem. 25/12 MT Bow Tribute GAC Shpg. 11,000 T. Chem. OJ-III MT Chemroad Orchid J M Baxi 23,665 T. Chem. 20/12 MT Dalmacija Interocean 21,000 T. CDSBO 21/12 MT Daw Won Wilhelmsen South Korea 4,000 T. Chem. 20/12 MT Dawn Mansarovar MK Shpg. 3,990 T. LSHS In Bulk

Stream LPG/C IGLC Dicle Seaworld 18,850 T. Propane/Butane

Stream MT Global Pioneer J M Baxi 13,000 T. Palm

Stream MT Fairchem Intergrity Samudra 6,000 T. Chem. Stream MT Furano Galaxy GAC Shpg. Taiwan 5,276 T. Chem. OJ-VI MT High Leader J M Baxi Sohar Oman 30,670 T. MS

Stream MT Lavender Ray Samudra 5,500 T. Chem. Stream MT Lucky Chem Samudra Sohar Oman 10,000 T. Chem. OJ-IV MT NCC Yanbu Interocean Brazil 21,000 T. CDSBO 26/12 MT Nord Victorius Interocean 30,500 T. CDSBO/CSFO 20/12 MT Pacific Citrine Interocean 19,000 T. CDSBO 26/12 MT Rustaq Silver Interocean 32,000 T. CPO Stream MT Sanman Sitar MK Shpg. 31,500 T. HSD 2022121168 Stream LPG/C Sakura Spirit ISS Shpg.

23/12 23/12-AM

30/12 30/12-AM

Atlanta 251W 22409 (MECL) 30/12

LOAD FOR FAR EAST, CHINA, JAPAN,

NEW

AND PACIFIC

Feeders Merchant Shpg. Port Kelang, Singapore, Laem Chabang. 19/12 26/12 26/12-AM Clemens Schulte 018WE 22408 ONE ONE (India) (TIP) 26/12 21/12 21/12-AM OOCL Luxembourg 099E 22401

19/12 19/12-AM Bangkok Bridge 139E 22406

DBC & Sons/OOCL(I) Port Kelang, Singapore, Hong Kong, Xingang, Dalian, Qingdao, 21/12 28/12 2812-AM Seamax Stratford 119E 22413

Star Star Shipping Busan (Ex. Pusan), San Pedro, Kwangyang, Chiwan. (CIXA) 28/12 22/12 22/12-AM Xin Shanghai 140E 22410 COSCO COSCO Shpg. Singapor,Cai Mep,Hongkong,Shanghai,Ningbo,Schekou,Nansha (CI1) 22/12 25/12 25/12-AM Northern Diamond 251E 22404 Maersk Line Maersk India Singapore, Dalian, Xingang, Qingdao, Busan, Kwangyang, 25/12 Ningbo, Tanjung Pelepas. (FM3) 25/12 25/12-AM Conti Contessa 112E 22407 ONE ONE (India) West Port Kelang, Singapore, Leam Chabang, Busan, Sanshan, 25/12 07/01 07/01-AM One Competence 083E 22415 Ningbo, Sekou, Cai Mep. (PS3) 07/01

19/12 19/12-AM SSL Krishna 050 22411 SLS SLS Hazira, Cohin, Mangalore, Tuticorin, Mundra. (PIC 1) 19/12 22/12 22/12-AM SCI Chennai 541 22414 SCI J. M Baxi Jebel Ali. (SMILE) 22/12 23/12 23/12-AM Maersk Chicago 250W 22400 Maersk Line Maersk India Salalah, Jebel Ali, Port Qasim. 23/12 30/12 30/12-AM Maersk Atlanta 251W 22409 (MECL) 30/12 23/12 23/12-AM BIG DOG 251W 22412 Maersk/GFS Maersk India/GFS Jabel Ali, Dammam, Mundra (Shaheen) 23/12

TBA X-Press Feeders Merchant Shpg. Jebel Ali, Sohar (NMG)

TBA SLS SLS Mangalore, Kandla, Cochin.(WCC)

19/12 19/12-AM Bangkok Bridge 139E 22406 X-Press Feeders Merchant Shpg. Karachi, Muhammad Bin Qasim. 19/12 26/12 26/12-AM Clemens Schulte 018WE 22408 ONE ONE (India) (TIP) 26/12 21/12 21/12-AM OOCL Luxembourg 099E 22401 OOCL/APL OOCL(I)/DBC Sons Colombo. (CIXA) 21/12 22/12 22/12-AM Xin Shanghai 140E 22410 COSCO COSCO Shpg. Karachi, Colombo (CI1) 22/12 25/12 25/12-AM Irenes Bay 251S 22403 Maersk Line Maersk India Colombo, Bin Qasim, Karachi (JADE) 25/12 25/12 25/12-AM Northern Diamond 251E 22404 SCI J. M Baxi Colombo. (FM3) 25/12

19/12 19/12-AM Bangkok Bridge 139WE 22406 X-Press Feeders Merchant Shpg Seattle, Vancouver, Long Beach, Los Angeles, New York, 19/12 26/12 26/12-AM Clemens Schulte 018WE 22408 ONE ONE (India) Norforlk, Charleston, Halifax. (TIP) 26/12 23/12 23/12-AM Maersk Chicago 250W 22400 Maersk Line Maersk Line India Newark, North Charleston, Savannah, Huston, Norfolk. 23/12 30/12 30/12-AM Maersk Atlanta 251W 22409 Safmarine Maersk Line India (MECL) 30/12 25/12 25/12-AM Conti Contessa 112E 22407 ONE ONE (India) Los Angeles, Oakland. (PS3) 25/12

COPENHAGEN: As part of its strategy to decarbonize customers’ supply chains, A.P. Moller - Maersk (Maersk) has entered a green methanol Letter of Intent with U.S. based SunGas Renewables, Inc., a spin-out of GTI Energy, and a leader in providing technology and equipment systemsforlarge-scaleproductionofrenewablefuels. This is Maersk’s 9th such partnership to drive the acceleration of global production capacity for green methanol.

TheLetterofIntentcoverstheproductionofgreen methanol from multiple facilities to be developed by SunGas in the United States from which Maersk intends to offtake full volumes of green methanol. Thefirstfacilityisexpectedtobeginoperationsin2026 and have an annual production capacity of approximately390,000tonnes.

Securing green marine fuels at a global scale within this decade will require rapid scale up of green methanol production capacity using a variety of technology and feedstock pathways. “We are very pleased to welcome SunGas Renewables as a strategic partner in our efforts to achieve our goal of net zero greenhouse gas emissions in 2040 across our entire business, and to ensure meaningful progress is made within this decade in line with the Paris Agreement,” said Emma Mazhari,Head of Green Sourcing and Portfolio Management, A.P. Moller –Maersk.

The SunGas facilities will utilize its flagship System 1000 platform to convert sustainably sourced residues from the forestry and wood products industriesintogreenmethanol.

“OurpartnershipwithMaerskmarksanimportant milestone for SunGas as we continue our mission to make a global impact in the energy transition. We applaud Maersk’s leadership in catalyzing decarbonization of the entire marine shipping industry and look forward to working together to accelerate growth of production capacity for green methanol marine fuels,”said Robert Rigdon, CEO of SunGas.

SunGas joins eight other strategic partners working to supply the green fuel needed for the 19 methanol enabled container vessels Maersk currentlyhasonorder.TheotherpartnersareCarbon Sink, CIMC ENRIC, Debo, European Energy, Green TechnologyBank,Orsted,Proman,andWastefuel.

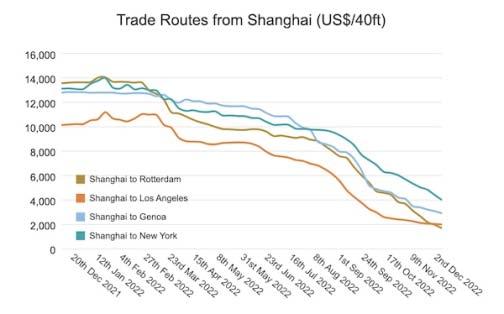

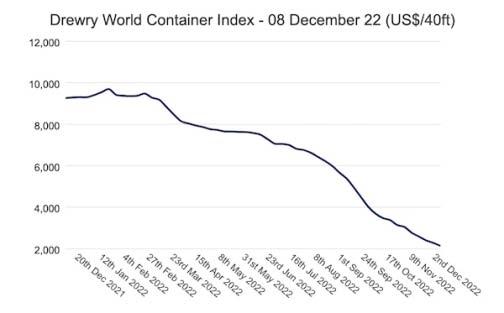

LONDON: The composite index decreased by 1% last week, the 42nd consecutive weekly decrease, and has dropped by 77% when comparedwiththesameweeklastyear.

The latest Drewry WCI composite index of $2,127 per 40-foot container is now 79% below the peak of $10,377 reached in September 2021. It is 21% lower than the 10-year average of $2,692, indicating a return to more normal prices, but remains 51% higher than average2019(pre-pandemic)ratesof$1,420.

The average composite index for the year-to-date is $6,547 per 40ft container, which is $3,855 higher than

the10-yearaverage($2,692mentionedabove).

The composite index decreased by 1% to $2,127.33 per 40ft container, and is 77% lower than the same week in 2021. Freight rates on New York – Rotterdam dropped 4% or $53 to $1,269 per feu. Spot rates on Shanghai – New York and Shanghai – Rotterdam fell 1% each to $3,952 and $1,674 per 40ft box, respectively. Similarly, rates on Los Angeles – Shanghai and Rotterdam – New York slipped 1% each to $1,175 and $7,050 per 40ft container, individually. Rates on Rotterdam – Shanghai, Shanghai – Genoa and Shanghai – Los Angeles hovered around the previous week’s level. Drewry expects smaller week-on-week reductionsinratesinthenextfewweeks.