As

In

Alexis Wolfson Executive Partner Chief Human Resources Officer

As

In

Alexis Wolfson Executive Partner Chief Human Resources Officer

An eligible employee with respect to the programs described in this Guide is any individual who is designated as eligible to participate in and receive benefits under one or more of the component benefit programs described herein. The eligibility and participation requirements may vary depending on the particular component program.

You must satisfy the eligibility requirements under a particular component benefit program in order to receive benefits under that program.

Certain individuals related to you, such as a spouse or your dependents, may be eligible for coverage under certain component benefit programs.

To determine whether you or your family members are eligible to participate in a component benefit program, please read the eligibility information contained in the Conner Strong & Buckelew Summary Plan Description and Plan Document which can be found on BenePortal

To enroll online, login to ADP Workforce Now (using Google Chrome) at workforcenow.adp.com

Step-by-step online enrollment instructions can be found on BenePortal

Make sure you update your dependents and beneficiaries in ADP Workforce Now: Login at workforcenow.adp.com

Select the “Myself” tab, then under “Benefits,” choose Enrollments

Click Manage Info under the section titled “Manage Dependents and Beneficiaries”

Select Add to add a new dependent or beneficiary

To Edit or Remove an existing dependent or beneficiary, click on the appropriate function located at the bottom of each square When you finish, click Save

Benefit elections cannot be changed during the plan year unless you or one of your eligible dependents experiences a qualified change in status. Changes requested must be consistent with the event that occurred.

Qualified status changes include:

Marriage

Divorce

Birth or adoption of a child

Change in child’s dependent status

Death of spouse, child or other qualified dependent

Commencement or termination of adoption proceedings

Change in spouse’s or dependent child’s benefits or employment status

Certain loss of other group health coverage

The request to make a mid-year election change must be made within 31 days of experiencing a qualified change in status.

Eligible employees can choose from three medical plan options: the HSA-Qualified High Deductible Health Plan (HDHP), the PPO Core plan, and PPO Buy-up plan. Explore the key differences between these plans to select the option that best meets your needs and those of your eligible family members.

Premiums: HDHP premiums are lower than those of the PPO options but come with higher out-of-pocket costs.

Deductible:

If you are enrolled in employee-only coverage, you are required to meet the individual deductible ($1,700) before the plan begins paying for covered services.

If you cover dependents, the full family deductible ($3,400) must be met before the plan pays for covered services.

Out-of-pocket maximum:

Once an individual reaches their out-of-pocket maximum ($6,750), they will no longer incur costs for in-network services for the year.

Other family members will continue contributing until the overall family out-of-pocket maximum is met.

Network accumulation: Deductibles and out-of-pocket maximums apply across all networks.

Invest in your health with a Health

The HDHP allows eligible participants to save money through a Health Savings Account (HSA) – which can be used to set aside pre-tax dollars via payroll deductions to pay for qualified healthcare, dental, and vision expenses. For more details and to confirm your eligibility, see page 10 of this guide.

About the PPO Core and PPO Buy-Up Plans:

These plans have higher premiums compared to the HDHP but offer lower out-of-pocket costs.

In-network savings: You’ll pay less when using in-network providers.

No referrals required: You can see a specialist without needing a referral.

Preventive care: Routine physicals and immunizations are covered 100% in-network— no copays, deductibles, or coinsurance.

Specialty drugs: Certain specialty medications are covered under the “Most Cost Effective Setting” (MCES) program.

Lab access: Members outside the Philadelphia 5-county and NJ areas can use labs within the BlueCard PPO network.

Vision benefit: Includes one routine exam per calendar year with Davis Vision providers (hardware not included).

Out-of-network coverage: Services are covered up to 110% of Medicare rates. Any provider fees exceeding this amount are the member’s responsibility (“balance billing”).

The table below provides a high-level overview of the plan offerings. For more details, please refer to the plan information available on BenePortal

Preventive Care services for adults and children are covered 100% in-network under all three plans—no copays, deductibles or coinsurance.

Access convenient virtual healthcare through Teladoc for general medical issues, mental health counseling, and dermatology consultations. Available 24/7 via phone, video, or mobile app. For more information, visit BenePortal

Members are required to use mail order for maintenance medications.

Once the initial prescription and two refills are filled at the retail pharmacy (a total of three fills), the mail order program is mandatory for ongoing prescriptions. If the member does not transition to the mail order program after three refills, they will be responsible for 100% of the prescription cost

Mail order often provides a greater discount compared to the retail pharmacy. In addition to the savings, your prescriptions will be delivered right to your home.

Complete a mail order form and send it to Express Scripts along with your prescription(s) written for a 90-day supply. For more information, call 800.698.3757 or visit express-scripts.com

Specialty drugs are medications that require special handling, administration, or monitoring. These are generally administered by injection.

Your provider will indicate if the medication you are being prescribed is considered a specialty medication. Specialty medications must be filled by the Express Scripts specialty pharmacy, Accredo

While we understand that health care costs increase at a higher rate than general inflation, we also recognize that in order to create a more equitable cost share arrangement, our employees who earn less pay less when enrolled in our medical/prescription drug plans.

Conner Strong & Buckelew pays the majority of the premium costs and absorbs the entire cost of wellness, tobacco cessation and disease management programs.

* When a spouse is enrolled, BOTH the employee and the spouse MUST complete the BenePoints activities in order to earn the credit.

If you participate in the HSA-Qualified HDHP, you may be eligible to participate in a Health Savings Account (HSA). HSAs are a great way to save money, allowing you to set aside pre-tax dollars, via payroll deductions, to pay for qualified healthcare, dental, and vision expenses. See page 10 of this guide for additional details.

By participating in BenePoints, employees earn incentive credits that are applied toward the medical/prescription drug plan employee contributions. Participation is voluntary – however, earning BenePoints reduces your payroll deductions.

To receive BenePoints credits in the first pay of 2027, your BenePoints action items must be completed by December 1, 2026*. If you miss the deadline, you are not eligible for a credit of $60 per pay or $120 if you have a spouse enrolled.

Remember: Preventive care is covered at 100%, including one physical per calendar year with an in-network doctor if coded as preventive. Inform your doctor and request the visit be coded accordingly.

* If an employee is hired before 9/1, their BenePoints items must be completed by 12/1 of the current year. If an employee is hired after 9/1, their BenePoints items must be completed by 12/1 of the following year.

All employees and their covered spouses enrolled in a Conner Strong & Buckelew medical/prescription drug plan are eligible to earn non-tobacco premium incentives.

If you and your enrolled spouse certify that you are both non-tobacco users**, you will pay less for your medical and prescription drug coverage.

You must certify tobacco status for yourself and your spouse (if applicable) via ADP Workforce Now.

We offer a $50 premium incentive per pay period for employees who are non-tobacco users and enrolled in coverage under one of the Conner Strong & Buckelew medical/prescription drug plans.

An additional $50 non-tobacco premium incentive applies to spouses who are enrolled in the medical/prescription drug plan and are non-tobacco users.

Note: If you

Any BenePoints earned in the 2026 calendar year (no later than 12/1) will count towards 2027 wellness credits. There will be no extensions.

For more details, including step-by-step instructions to complete the required action items, visit csbbeneportal.com/benepoints

The HSA is only available to employees who elect the HSA-Qualified High Deductible Health Plan (HDHP) option and are otherwise eligible according to HSA eligibility rules. HSAs are known for their triple tax advantage — contributions are made pre-tax, growth is tax-free, and withdrawals used for qualified health-care expenses are also untaxed. For more information about your Health Savings Account, visit BenePortal.

The HSA is portable, meaning that if you leave the organization, you can take your HSA funds with you.

There is no “use it or lose it” provision with an HSA. If you don’t use the money in your account by the end of the year, it stays there and collects interest on a tax-deferred basis.

The HSA includes a banking partner that offers you several investment options.

The HSA does not require third party substantiation for transactions; however, you should keep records of these transactions in the event of an IRS audit.

You can use your HSA funds to pay for qualified expenses with tax-free dollars and plan for future and retiree healthrelated costs.

For 2026, the contribution limits are:

$4,400 for individual coverage

$8,750 for family coverage

$1,000 annual catch-up contribution age 55 and older

The maximum amount that can be contributed to the HSA in a tax year is established by the IRS and is dependent on whether you have single or family coverage in the HDHP. For more information regarding eligible expenses, please visit irs.gov

If you elect the HDHP for 2026 and want to enroll in the HSA, you must enroll through ADP Workforce Now. Should you have other HSA funds to move to HSA Bank, please call HSA Bank at 800.357.6246

To be eligible for an HSA, you:

Must have coverage under an HSA-qualified HDHP

Cannot have other first-dollar medical coverage (i.e. policy with no deductible)

Cannot be enrolled in Medicare

Cannot be claimed as a dependent on someone else’s tax return

Contributions to the HSA must stop once you are enrolled in Medicare. However, you can keep the money in your account to pay for medical expenses tax-free.

If you are enrolling in the High Deductible Health Plan (HDHP) and elect the HSA, you may not participate in the Healthcare FSA. However, you may elect up to $3,400 in a Limited Purpose FSA (LPFSA), which can only be used for eligible dental and vision expenses.

Eligible employees may contribute up to $3,400 to a Healthcare FSA in calendar year 2026 to pay for qualified healthcare expenses such as deductibles, copays and coinsurance which are not paid by your medical, dental, prescription drug or vision programs.

When you enroll for the first time, BAI will mail a letter to your home address. The letter will include a unique participant username and password that will allow you to view account information online. You must use the assigned username and password the first time you visit benefitanalysis.com

If you are enrolling in the HDHP and elect the HSA, the IRS prohibits you from participating in the Healthcare FSA. However, you may elect up to $3,400 in a Limited Purpose FSA, which can be used for dental and vision expenses only.

A Dependent Care FSA reimburses you for expenses that allow you and your spouse, if married, to work while your eligible dependents are being cared for. Eligible employees may contribute up to $7,500 in calendar year 2026 ($3,750 if married filing separately) to a Dependent Care FSA to pay qualified dependent daycare expenses.

Money left in your Healthcare or Limited Purpose, and/or Dependent Care FSA at the end of the plan year is forfeited according to the IRS use-it-or-lose-it rule. You can avoid forfeitures by carefully reviewing your prior year’s expenses and planning only for predictable costs.

Please be sure to retain required receipts for documentation purposes. All eligible claims for FSA expenses incurred between January 1, 2026 and December 31, 2026 must be submitted to BAI by March 31, 2027.

BAI provides new participants with two Visa Debit Cards which will be mailed to your home once your enrollment is processed.

For 2026 you may contribute:

Transit: up to $340 per month for transportation (mass transit, train, subway, bus fares, ferry rides). Transit requires payment with the BAI Visa Debit Card only.

Parking: up to $340 per month for parking expenses incurred at or near your work location or near a location from which you commute using mass transit.

Unlike an FSA, at the end of the plan year, any balances in either account will remain in your account and be available for your use in the next plan year, unless your employment is terminated.

Note: The table below provides a high-level overview of the plan. Service limitations and frequencies may apply. For more details, please refer to the plan information available on BenePortal

Preventive and Diagnostic Services

Exams, Cleanings, X-rays, Fluoride Treatment, Space Maintainers, Sealants

Basic Services

Fillings, Extractions, Oral Surgery, Root Canals, Repair of Dentures or Bridges, Periodontics

Major Services

Prosthodontics & Crowns, Crowns, Onlays and Inlays, Full & Partial Dentures, Implants

Year Maximum

Maximum annual benefit per enrolled member

Orthodontia Benefits

In addition to coverage for dependent children up to 19, coverage is now available for adults.

* Non-participating dentists may balance bill above the maximum allowable charge. Members are responsible for balance bill.

** $1,500 lifetime maximum for orthodontia benefits applies to new cases beginning January 1, 2017. If treatment began prior to January 1, 2017 the lifetime maximum is $1,000.

Roll over part of your unused annual maximum to increase your benefit amount in future years.

Get extra cleanings, exams, and treatment modifications if you have a qualifying special healthcare need.

Receive additional cleanings and periodontal care if you have been treated for gum disease.

Learn more about each of these programs and view additional plan details on BenePortal.

Note: The table below provides a high-level overview of the plan. Service limitations and frequencies may apply. For more details, please refer to the plan information available on BenePortal.

The plan covers a variety of lens enhancements, including progressives, polarized lenses, and more.

Available to members at a low copay, this technology aids in the early detection of conditions like Macular Degeneration.

Members can enjoy exclusive discounts on LASIK procedures through the plan.

Shop in-store or browse online at LensCrafters, Target Optical, RayBan, Glasses.com, and other network partners with instant benefit application, free shipping, and returns.

Members receive exclusive savings to retailers such as Sunglass Hut to protect against UV eye damage.

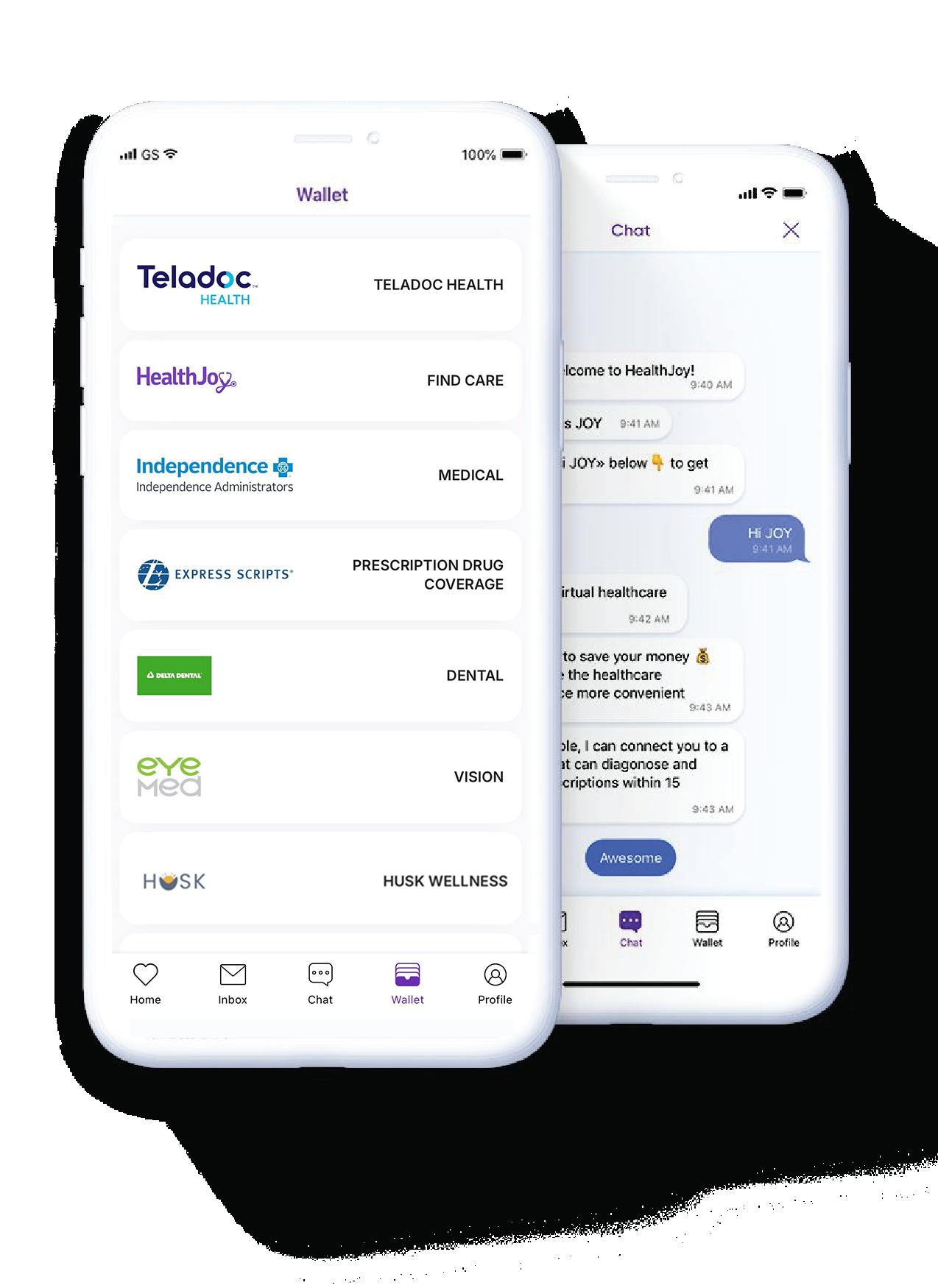

Using benefits can be complicated. Through personalized guidance and AI technology, HealthJoy makes it simple and is here to help your family anytime, anywhere.

HealthJoy is available to all benefit eligible employees* and is the first stop for all of your healthcare and employee benefits needs.

This service is provided for free and personalized for you. Employees have access to HealthJoy’s concierge team which consists of highly trained specialists with a wide variety of backgrounds, ranging from registered nurses to benefits and claims specialists, who work together to deliver exceptional service.

You can send benefits questions to HealthJoy’s healthcare LIVE concierge team.

Use HealthJoy’s provider search to choose in-network providers and find the best value and quality care based on your benefits.

An expert can review or negotiate your medical bills.

HealthJoy Includes:

Digital wallet with all your benefit ID cards

Employee Assistance Program (EAP) — including 8 in-person or virtual sessions!

Healthcare Concierge

Prescription Drug Savings Review

Medical Bill Review

Appointment Booking

Provider Recommendations

HSA/FSA Support

Download the HealthJoy app from the App Store or Google Play, scan the QR code, or call 877.500.3212. For more information, visit csbbeneportal.com/ healthjoy

(Concierge is available Monday through Friday from 8:30 AM to 1:00 AM EST and Saturday through Sunday from 11:00 AM - 7:00 PM EST. EAP consultations are available 24/7/365).

To access the EAP benefit, you must register with HealthJoy. Spouses and dependents over 18 years old must create their own account.

All benefit eligible employees and their dependents, regardless of medical enrolled status, have access to the HealthJoy EAP.

The EAP gives you confidential access to Licensed Professional Counselors and Work/Life Specialists to help you with personal, family and work/life issues. You have access to:

Up to eight (8) free in-person or virtual counseling sessions per calendar year, per topic

In-the-moment support: reach a licensed clinician 24/7/365 by phone, app, text, or email

Legal consultations and financial expertise: Free, no-pressure guidance and advice from legal and financial professionals

Use the HealthJoy mobile app (for best service) Call 888.731.3EAP (3327) Visit eap.healthjoy.com

Scan the QR code and activate HealthJoy today!

You can also learn more at csbbeneportal.com/healthjoy

Teladoc

Learn more about Teladoc by visiting BenePortal.

Benefit eligible employees/dependents enrolled in a CSB medical plan have access to Teladoc telemedicine services. Services are available for general medical, behavioral health, and dermatological needs.

With Teladoc General Medical, you get 24/7 access to low-cost, high-quality virtual health care for common health concerns like cough, sore throat, fever, rashes, allergies, asthma, pink eye, nausea, and more. Using Teladoc General Medical is quick and convenient.

Telebehavioral Health allows plan members to access a counselor or psychiatrist by phone, secure video, or app from the comfort of their own home.

While in-person behavioral health appointments can take weeks to set up, virtual behavioral health appointments with our partner can be made 3 to 5 days in advance with occasional availability the next day

Below are the member costs per Teladoc consult that will apply (costs vary based on medical plan enrollment):

HSA/HDHP Plan Costs

General Telemedicine: Plan pays 100%; member pays $0.

Telebehavioral Health: Plan pays 100%; member pays $0.

Teledermatology: Member pays 100%* up until plan deductible is met, then member pays $85 per consult

* Cost per consult prior to meeting deductible will be based on Fair Market Value, and cost is subject to change.

General Telemedicine: Plan pays 100%; member pays $0.

Telebehavioral Health: Plan pays 100%; member pays $0.

Teledermatology: Member pays $85 per consult

If you have concerns about your skin, Teladoc Health (Teladoc) Dermatology can connect you to doctors who can diagnose your condition, recommend a treatment plan, and provide follow-up. Teladoc Dermatology gives you access to board-certified dermatologists anywhere you are.

Whether you have a question about a recent skin change or need help managing a chronic skin condition like acne, rosacea, or psoriasis, Teladoc Dermatology can help. Using Teladoc Dermatology is quick and convenient.

You get access to:

A network of board-certified dermatologists

An online message center where you can connect with your dermatologist

A personalized treatment plan with follow-up care

You can schedule an appointment with Teladoc for general medical, dermatological needs by:

Calling: 1-800-835-2362

Visiting: teladochealth.com

Downloading the Teladoc mobile app

Make sure you are taking advantage of these benefits and resources, available to you via Independence Administrators. Independence Administrators offers a variety of resources to help members get behavioral health care and support quickly. These resources are available to employees and dependents enrolled in a Conner Strong & Buckelew medical plan. Additional IA resources are outlined on the following page.

Do you need help finding behavioral health care?

Call 800.778.2119, which is the Mental Health number located on the back of your member ID card, to reach our Behavioral Health team. The Behavioral Health team can guide you to the information or care you need.

Our Behavioral Health Care Advocates can directly schedule or connect you to an in-network behavioral health provider so you can get care quickly — usually within a week.

Independence Administrators works with several innetwork behavioral health providers that offer fast access, are culturally responsive, and provide high-quality care for:

General mental health issues, such as anxiety, depression, and stress

Specialty behavioral health conditions, including care for children, substance use disorders, eating disorders, obsessive-compulsive disorder, and bipolar disorder

Our Behavioral Health team also includes Behavioral Health Clinical Triage Case Managers who can quickly guide you to the right behavioral health care. These licensed clinical staff specialize in:

Clinical assessment to understand your needs and provide information about treatment options

Finding in-network care, including identifying and directly connecting you with a provider that meets your specific needs to help you get care quickly

Providing in-the-moment support during tough times, including crisis management

Connecting you to resources for ongoing support, including case management

Support for finding addiction treatment facilities

Finding addiction treatment can feel overwhelming because one size does not fit all when it comes to finding the best care for your needs. Shatterproof’s Treatment Atlas can help you find and compare treatment facilities.

Complete a brief and anonymous set of questions that offers initial guidance on the most appropriate level of care and recommendations for additional treatment services.

The Atlas tool contains a comprehensive list of addiction treatment providers, including hospital-based inpatient facilities, residential facilities, and intensive outpatient services. When searching for care on Atlas, you can filter results by location, specific treatment services offered, languages spoken, and more.

To get started, visit treatmentatlas.org. You can also call the Mental Health number on the back of your member ID card to connect with a Behavioral Health Care Advocate, who can help you search for in-network facilities. They can also send you the link to the tool by email.

Here are resources that can help if you are in a crisis:

Suicide and Crisis Lifeline: Call or text 988, available 24/7.

Veterans Crisis Line: Call 1-800-2738255, then press 1, or chat online at veteranscrisisline.net

These resources are available to employees and dependents enrolled in a CSB medical plan.

Benefit eligible employees and dependents enrolled in a Conner Strong & Buckelew medical plan can access Teladoc’s telebehavioral and mental health services.

Telebehavioral and Mental Health: Connect with a counselor or psychiatrist via phone, video, or app from home. Appointments are available within 3 to 5 days, with occasional next-day options.

Support is available for conditions such as anxiety, depression, trauma, chronic pain, and substance use. Get the care you need, when you need it.

Telebehavioral and mental health consults through Teladoc are covered 100% under all three medical plans—no member cost share.

How to get started:

Visit teladochealth.com. Once registered, download the Teladoc mobile app, visit the website, or call 800.835.2362 to get care today.

The Connect to Care Network includes providers with a national reach offering high-quality care and resources for a range of behavioral health conditions. Call 800-778-2119 (located on the back of your ID card) to speak with a Behavioral Health Care Advocate.

You may also visit ibxtpa.com/providerfinder to review all network Connect to Care behavioral health providers and resources.

Expanded support tailored to your needs

In addition to general mental health resources, specialized support is available for children and adolescents, substance use disorders, and other areas of specialty care.

Scan the QR code to explore the Connect to Care Directory and find providers categorized by specialty, ages treated, and convenient locations.

Eligible employees and dependents enrolled in a Conner Strong & Buckelew medical plan can access Spring Health, an in-network mental health provider. Spring Health offers services such as therapy, medication management, care navigation, and crisis support for anxiety, depression, stress, and trauma.

Medication Management: Meet with a psychiatrist or nurse practitioner.

Care Navigation: Get personalized guidance from a licensed Care Navigator.

Crisis Support: Receive help determining the best next steps.

Members can book appointments directly through Spring Health, entering your insurance details (first and last name, DOB, gender, state, insurance carrier, and ID number), or through the Independence Blue Cross provider directory. Most appointments are available within 24 to 48 hours, with virtual and in-person options available.

Member cost share per visit:

HSA-Qualified HDHP: Plan pays 80% after deductible

Core Plan: $40 copay

Buy-Up Plan: $30 copay

Members can also access Spring Health Moments—a library of 1,000+ on-demand videos, audio exercises, and articles—at no cost. Based on proven techniques like cognitive behavioral therapy, Moments offers quick relief and lasting skills for better mental health. Available anytime through the Spring Health app or website, topics include anxiety, depression, burnout, parenting, insomnia, neurodiversity, and more.

How to get started:

Visit benefits.springhealth.com/ insurance/ibx to sign up. Once registered, download the Spring Health mobile app, visit the website, or call 855-448-5790

If you or a family member is struggling with a health issue, Guardian Nurses can help.

Guardian Nurses is a team of registered nurses who have one goal: To ensure that patients understand their options, receive the support they need, and get the most appropriate care for their condition.

Conner Strong & Buckelew partners with Guardian Nurses to support our covered employees and dependents in managing healthcare costs. If you have a chronic condition, serious illness, or are hospitalized, Guardian Nurses may reach out to you directly.

This program is available at no cost to employees and is completely voluntary and strictly confidential everything stays between you and your nurse advocate. We hope you will engage with them if a Guardian Nurse is needed.

Guidance and advocacy during hospitalizations

Research for treatment options

Assistance in the decision-making process

Making appointments and participating if needed

Coaches to manage chronic health conditions

Expediting specialists’ appointments

Assisting with discharge planning

Your nurse becomes your personal guide and champion, advocating for you with doctors, hospitals, and insurance companies.

Conner Strong & Buckelew is committed to providing you and your family with the support you need. In the event you or your family member has a serious medical concern, please contact Human Resources.

Getting access to the best cancer care can make a substantial difference with regard to recovery and survival. Thankfully, we have access to one of the premier cancer providers in the nation here in South Jersey; MD Anderson Cancer Center at Cooper with locations in Camden, Egg Harbor Township, Voorhees, and Willingboro.

There are a series of special amenities uniquely available for our employees, including:

Direct phone number for Conner Strong & Buckelew employees: 856.536.1816

Access to a dedicated Nurse Navigator that will help manage and coordinate cancer care needs within the MD Anderson Cancer Center at Cooper system, including scheduling appointments and working with family members

After-hours access to clinical team members to assist with urgent situations

Access to transportation to the various MD Anderson Cancer Center at Cooper locations

If you are enrolled in one of the Conner Strong & Buckelew medical/prescription drug plans, you can take your healthcare benefits with you when you are traveling or living abroad.

Through Global Core, you have access to doctors and hospitals around the world.

Conner Strong & Buckelew has partnered with Goldfinch Health to provide employees and dependents enrolled in the medical plan with a path to experience the most advanced surgical techniques — AT NO COST TO YOU

When you are considering surgery, Goldfinch Health’s team of surgery experts provides you a clinically validated health navigation approach to surgery that delivers the best possible experience from pre to post-op.

Your personal Goldfinch Nurse Navigator can help:

Match you with providers who drive better clinical outcomes and high patient satisfaction

Reduce your recovery time after surgery by 2X or more

Minimize opioid painkiller use

Reduce pain and complications

Non-surgical treatment options

Regenexx is available to members enrolled in a Conner Strong & Buckelew medical/prescription drug plan.

Regenexx provides patients with an alternative to orthopedic surgery by harnessing their body’s own healing processes to treat orthopedic injuries including osteoarthritis, joint injuries, spine pain, overuse conditions, and common sports injuries.

Regenexx’s proprietary, research based methods and patented protocol allow their doctors to concentrate your cells and apply them precisely to your injured area. Regenerative medicine provides many advantages over traditional surgeries—including faster recovery time, reduced risk, and lower cost.

Regenexx is covered as an in-network benefit within the Conner Strong & Buckelew medical/prescription drug plans. Charges depend on your specific plan details and your deductible and out-of-pocket status at time of service.

To learn more about Regenexx, call 866.671.3099 to speak with Conner Strong & Buckelew’s dedicated patient liaison. Learn about these programs and more by visiting

Frame helps those interested in growing their family by providing 1:1 support from journey start to journey finish. Frame will help you to understand what is within your control and what you can do about it today as a first step to building a family.

Frame seeks to displace reactive, one-size-fits-all models, offering a new way forward with tailored resources and expert support from empathetic people who get where you’re coming from and lead you where you want to go.

Just curious about your fertility

Planning for pregnancy soon

Trying to conceive

Seeking treatment/egg freezing

LGBTQ and exploring options

Personalized action plan

Dedicated care team and coordination help

Best-in-class products, including partner testing, vitamins and more

On-call support via text, email, or phone

Simply sign up and fill out a fertility evaluation. Your information is completely private. You will then be connected with the Frame Care Team who will work with you to craft a personalized plan that aligns with your overall fertility goals.

To get started with Frame, text 415.917.1886 or scan the QR code.

Conner Strong & Buckelew provides benefit eligible employees with a benefit equal to one and a half times your annual base salary up to a maximum amount of $1,000,000 for group life and accidental death and dismemberment (AD&D) insurance.

Benefit eligible employees who want to supplement their Basic Life and AD&D insurance may purchase additional coverage. When you enroll yourself and/or your dependents in this benefit, you pay the full cost through bi-monthly payroll deductions.

You may purchase Supplemental Life and AD&D insurance for yourself as outlined below. During your initial eligibility period, you may elect up to the guaranteed issue amount* shown below without answering medical questions.

Evidence of Insurability (EOI) may be required for any amount elected after your initial eligibility period.

If you purchase Supplemental Life insurance for yourself, you may purchase it for your spouse as outlined below. During your initial eligibility period, you may elect up to the guaranteed issue amount* shown below without answering medical questions. EOI may be required for any amount elected after your initial eligibility period.

Increments of $25,000 to a max of $100,000 or up to 1/2 Employee election

Spouse Life Insurance Guaranteed Issue Amount

$50,000* *Typically only available during initial eligibility period.

Example: An employee’s annual salary is $50,000 and the employee elects Supplemental Life insurance for themselves at 3 times their salary, which is $150,000. The employee can elect to cover their spouse for half of that amount, which is $75,000. EOI may be required and must be approved before coverage becomes effective.

If you purchase Supplemental Life insurance for yourself, you may purchase it for your children in the amounts of either $5,000 or $10,000. This benefit covers all of your children up to age 26, regardless of full-time student status, at one rate.

Note: The information herein provides a high-level overview of the life and accidental death and dismemberment (AD&D) options. For plan details, please refer to the plan information available on BenePortal

Benefit eligible employees who work in New Jersey have NJ Temporary Disability Insurance Protection. Benefit

eligible employees who work outside of New Jersey have company paid short-term disability protection through New York Life.

Company-paid long term disability provides you with income continuation in the event your illness or injury lasts beyond the elimination period. This helps ensure you have a continued income if you are unable to work due to a covered sickness or injury. These benefits are paid through New York Life.

Administered by Unum

Individual Long-Term Disability Insurance can provide an additional monthly benefit if you experience a covered disability, so you focus on your recovery — not your finances.

The premium is paid with post-tax dollars but, under current tax laws, benefits are tax free. IDI coverage belongs to you, even if you change employers.

Please note: This benefit is only available to new hires in their initial eligibility period. You may not elect this benefit during annual open enrollment.

Administered by Transamerica

Benefit eligible employees have the option to purchase Hospital Indemnity Insurance, which provides financial support for hospital stays and other medical care.

This benefit pays a predetermined amount for each day a covered individual is hospitalized and can be expanded to cover additional medical situations through optional riders. This coverage is fully portable.

Administered by Unum

Benefit eligible employees may purchase Accident Insurance, which helps with out-of-pocket expenses incurred as a result of an accident. Under our medical plans, members must meet an in-network deductible before the plan begins covering most services, including emergency room visits and hospital stays.

This insurance provides scheduled benefit payments for accidents occurring both on and off the job. Coverage is also available for eligible spouses and children.

Administered by Boston Mutual

Benefit eligible employees may purchase Critical Illness Insurance. This coverage pays a lump sum benefit upon confirmed diagnosis of a heart attack, stroke, end-stage kidney failure, cancer and more.

An annual wellness benefit of $50 is available to enrollees who receive a covered wellness screening. Coverage also extends to eligible spouses and children.

Eligible employees may elect up to the policy guaranteed issue amounts with no medical questions asked:

Employee: $20,000

Spouse: $10,000

Please note: Applications are required for each of these voluntary benefit options.

For additional plan details and rate information, visit BenePortal or contact the carriers listed above (using the contact information found on page 30.)

This plan provides benefit eligible employees and their families with affordable access to a number of valuable legal services from network attorneys.

Whether you are closing on a house, filing for divorce, facing a traffic violation, need a will, or filing a consumer complaint, receiving legal advice is important. Participating members will receive a 40% discount on attorney hourly rates and a 10% discount on contingency fee matters.

The cost to participate is $12.92/per month.

This plan provides identity theft insurance as well as credit monitoring, credit scores and credit reports. In addition to coverage for yourself, you can choose to cover your spouse, dependents, parents, and in-laws*

This plan includes:

Quarterly bureau credit reports/scores from 3 bureaus

ID Theft insurance up to $1,000,000

Opt Out Option (Junk Mail/Do Not Call List)

Checking Account Report (to show history of consumers checking account transactions)

Credit Score Tracker

Information & Resource Center

And more!

The monthly cost to participate is $11.96 per person.

* Coverage for parents and parents-in-law require a “direct bill” relationship with the carrier.

Eligible full-time employees are insured under our Business Travel Accident (BTA) Policy underwritten by The Hartford.

“Business travel” includes any travel on behalf of Conner Strong & Buckelew, regardless of location, period of time (part of day or full day) or form of travel (air, train, etc.). This coverage excludes travel to and from work.

A benefit of $250,000 will be provided to your beneficiary in the event of the employee’s accidental death during business travel which occurs anywhere in the world. Reductions apply beginning at age 70.

The policy also covers injury resulting from an accident during business travel, including an injury which occurs while the employee is a passenger on, boarding, or exiting from an aircraft.

An additional benefit of the Business Travel Accident Policy is Identity Protection. This service is available 24 hours a day. You’ll be assigned a personal caseworker who will help you through the entire resolution, step by step, to ensure a quick and easy recovery.

If you suspect you’re a victim of identity theft, call 800.243.6108

For more information about this benefit, visit BenePortal.

Conner Strong and Buckelew is committed to helping you achieve your best health and best self.

CSB partners with Health Advocate for the administration of the CSB Cares wellness program, including wellness rewards and coaching, BenePoints tracking and the tobacco cessation program.

Track healthy behaviors and meet recommended goals to earn points. Earn up to 100 wellness points by December 31, 2026. Each point represents $1 (100 points = $100). Points can be redeemed for gift cards or other rewards of your choice.

Unlimited access to a Wellness Coach by phone, email or secure online messaging anytime, 24/7. Work with your coach to set clear, attainable goals and get support along the way.

Get the latest health information and monitor your progress with handy planners, trackers and more.

Go to HealthAdvocate.com/members

Type “Conner Strong & Buckelew” when prompted for the organization name and select it from the drop-down box.

Click Register Now and follow the prompts until your registration is complete.

You will receive a message congratulating you and advising you to sign in by clicking Continue

You will be required to verify your account through email before logging in for the first time.

Download the Health Advocate mobile app to instantly upload relevant documents and forms, and view the status of your cases in real time.

Exercise Class Reimbursement

All employees who complete 60 exercise classes may submit up to $200 in studio receipts to Human Resources for reimbursement. Virtual fitness classes are eligible for reimbursement too. The maximum 2026 exercise class reimbursement is $200.

Free In-Network Nutritionist Visits Per Year

Employees and their covered dependents on our medical plan are entitled to 3 free in-network visits with a nutritionist. A registered dietician takes a personalized approach to diet and nutrition that is geared specifically to your needs. To locate an in-network nutritionist, go to ibx.com

The HealthyLearn On-Demand Library features all the health information you need to be well and stay well. Learn more at healthylearn.com/connerstrong

Access a broad array of services, discounts and special deals on consumer services, travel services, recreational services and much more. Simply visit the site and register at connerstrong.corestream.com

HUSK members can access exclusive savings and flexible membership options to a variety of gyms and fitness center facilities. HUSK members also have access to:

Virtual nutrition counseling with a Registered Dietician

Virtual mental health assistance from a licensed therapist

Discounts on home equipment and wearable technology

To learn more, visit marketplace.huskwellness.com/ connerstrong

(Available to Delta Dental and/or EyeMed members)

Through Amplifon Hearing, members have access to a comprehensive hearing savings program featuring hearing aids from top industry brands. The program includes virtual and in-person screening options, risk-free trial, follow-up care support, battery supply or charging stations, warranty coverage, and financing options for qualified individuals.

Delta Dental Members: For more information, visit BenePortal

EyeMed Members: For more information, visit BenePortal

Learn more about these benefits on BenePortal.

important notice

This Guide is intended to provide you with the information you need to choose your 2026 benefits, including details about your benefit options and the actions you need to take during this Enrollment period. It also outlines additional sources of information to help you make your enrollment choices. If you have questions about your 2026 benefits or the enrollment process, please visit csbbeneportal.com. The information presented in this Guide is not intended to be construed to create a contract between Conner Strong and any one of Conner Strong’s employees or former employees. In the event that the content of this Guide or any oral representations made by any person regarding the plan conflict with or are inconsistent with the provisions of the plan document, the provisions of the plan document are controlling. Conner Strong reserves the right to amend, modify, suspend, replace or terminate any of its plans, policies or programs, in whole or in part, including any level or form of coverage by appropriate company action, without your consent or concurrence.