2024 Private Equity Opportunity Report

Rethinking the thesis

Committed capital for funds that were launched in the first half of 2024 versus 2023 may look great. However, the picture could look very different for an emerging manager versus an established manager, to say nothing of an independent sponsor. In this report, we examine the private equity and venture capital industry from several perspectives, including that of newer entrants. Players throughout the PE and VC market are feeling pressure to act — deal value is down to 2018 levels despite 1.5 times more dry powder — but as we will explore, those challenges are distributed unevenly.

Broadly, this market is giving managers reason to rethink their fund thesis. They’re meeting more frequently with more limited partners to understand what they’re looking for, be it technology,

Alexander Reyes Partner, Financial Services Industry Practice Leader

Citrin Cooperman

environmental, social and governance priorities (ESG), or the service provider teams around them. Meanwhile, many of those limited partners feel trapped in funds in a low-exit market.

They want greater liquidity, which is leading to some novel fund structures. Welcome to our first-ever private equity opportunity report, where we unpack the data from three of our recent surveys with over 400 responses from financial services leaders as well as U.S. economic data to highlight opportunities for you to take advantage of. It is enriched by our experience working with some of the largest private equity companies, ranging from emerging managers up to those with $100 billion in assets under management. The primary data sources include:

• 2024 Private Company Performance Report

• 2024 Emerging Managers Survey

• 2024 Independent Sponsor Report

• PitchBook more dry powder today than in 2018. There is 1.5x

The state of private equity

Fund managers and investors are under no illusions that the issues of the last few years will correct soon. Raising capital continues to be a challenge.

EBITDA multiples have fallen. The depressed IPO and exit environment has driven firms to seek creative ways to extract more liquidity. And two-thirds of emerging managers worry about macro trends and their future place in the market. General partners are adapting more than ever to the priorities of limited partners, and technology such as AI continues to change the dynamics for operators. One ray of hope is that the talent market has loosened and it is now easier to hire.

Despite that, 90% of emerging managers say they will be raising more capital soon. A sense of pessimism does not preclude the fact that opportunities still abound.

Let us explore the four major trends we are observing right now.

1 Raising capital continues to be difficult. Compliance, cybersecurity, legal, and other costs are rising.

Workforce conditions have improved. 2 3 4

PE funds and PE-owned companies are using more technology.

Raising capital continues to be difficult

Between inflation and interest rates, the funding environment remains difficult. The median time to close a round has nearly doubled over the past decade, from 7.4 months to 13 months according to PitchBook. Sixty-two percent of emerging managers had to meet with more than 100 limited partners to close their recent fund according to our survey.

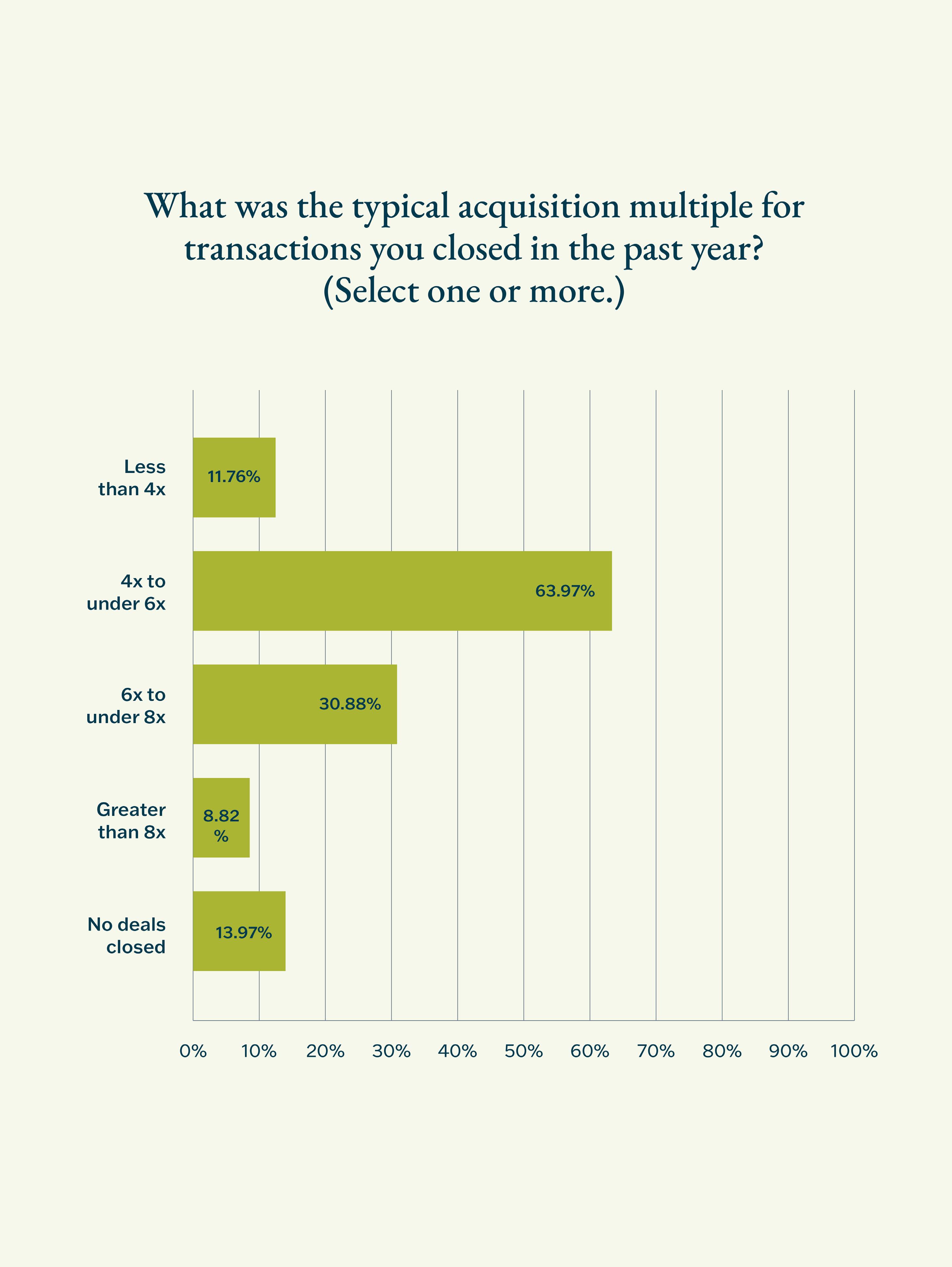

Meanwhile, interest rates are finally impacting deals and EBITDA multiples dropped from 9.9x to 9.6x last year reports Capstone. If we exclude a small number of large outlier deals, the multiple is just 8x. Seventysix percent of independent sponsors told us they’d closed a deal for 6x or less in the past year.

of emerging managers had to meet with 100+ LPs to close their recent round. months to close a round, which is 76% longer than 10 years ago. 62% 13

Source: Emerging Managers Survey

of independent sponsors said it was harder to close a transaction in 2023 compared to the year before.

In this depressed M&A/IPO/exit environment, investors are trapped in funds while companies cling to what may now appear to be elevated valuations. This “pricing gap” has all but halted M&A activity. Investor allocations are far from their targets. Forty-four percent of independent sponsors said it was harder to close a transaction in 2023 compared to the year before, according to our survey.

PE and VC funds are reacting in a variety of ways. Some are getting more involved in managing portfolio company performance. Some are working harder to help those companies tell a better story, and some are structuring funds and deals in new ways:

• “Continuation funds” to create more liquidity without exiting those investments

• General partner-led secondaries

• Funds buying the investments in another fund

• Funds set up around private credit to take advantage of high interest rates

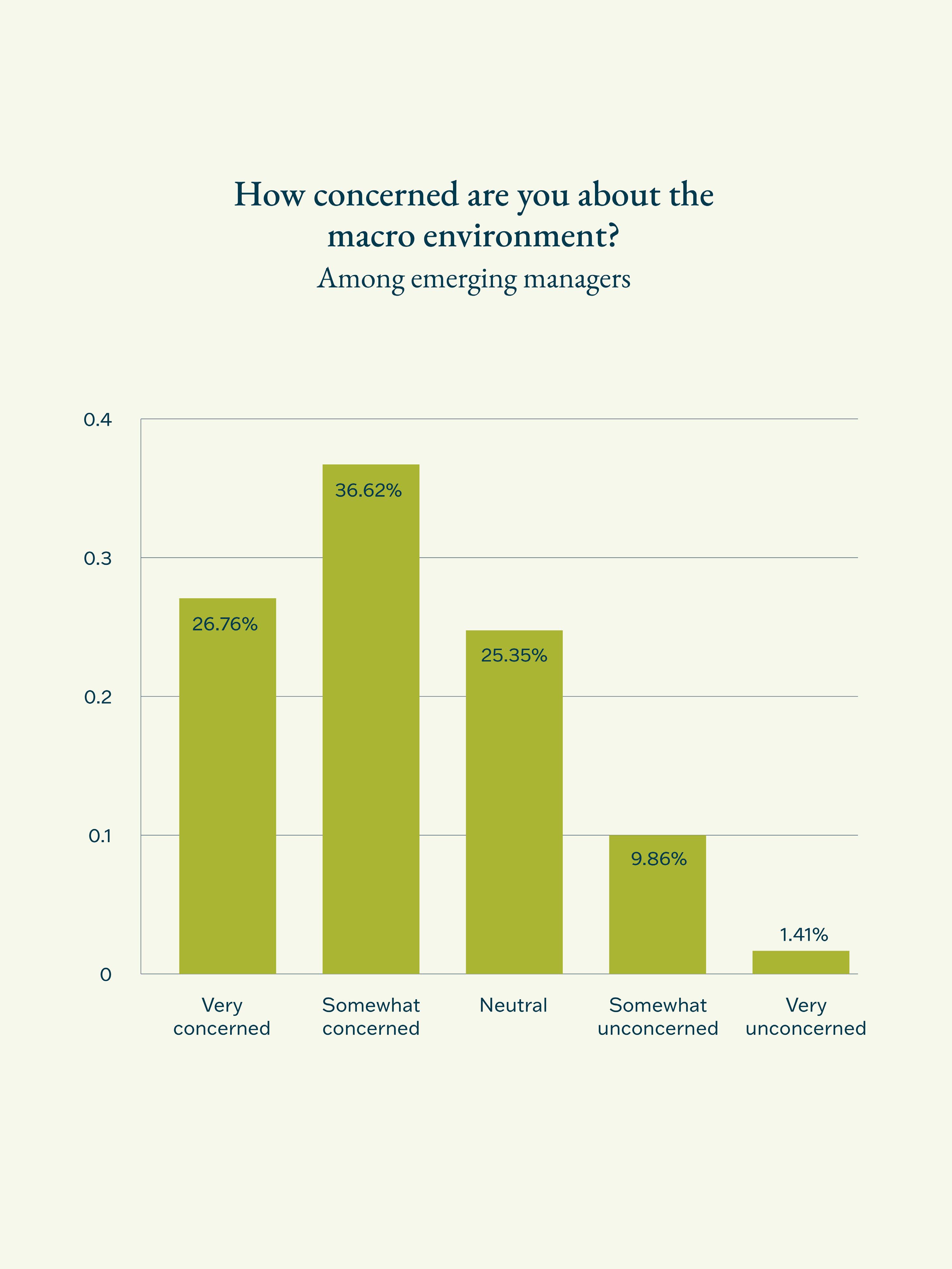

The future is unknown, but investors and fund managers tell us they are somewhat more pessimistic than the general market. Sixty-seven percent of emerging managers are concerned or very concerned about the macro environment. Independent sponsors’ answers vary and range from recession fears to predictions that falling interest rates and valuations will restore the market. Whereas 47% of CEOs hold a very or somewhat positive outlook on the U.S. economy and expect good things from next year. Board members are 19% more optimistic about the next 12 months than they were one year ago.

Source: Emerging Managers Survey

That said, fund managers’ pessimism isn’t dampening their plans to raise capital — 90% of emerging managers say they plan to increase investment capital by 25% or more in the next 18 months. They’re persisting regardless of the increased challenges of raising capital and the prospect of having to provide more discounts.

of emerging managers are concerned or very concerned about the macro environment. of emerging managers plan to increase capital by 25% or more. 67% 90%

Emerging manager and independent sponsor spotlight

Emerging managers and independent sponsors continue to influence the PE industry. According to our survey, 54% of emerging managers have been in business two years or less, and offer investors a variety of advantages:

1. Diversification: New geographies and specialized deal strategies unavailable at larger funds

2. Innovation: New ideas and trends that established funds lack

3. Returns: The option to take on more risk for superior returns

4. Access: Founders and senior team members with an attractive pedigree

Meanwhile, independent sponsors are responsible for a significant amount of the present activity because they aren’t focused on the public markets. Our survey finds they are most likely to target business services and manufacturing companies with EBITDA of $2-10 million. They draw their deals from business brokers and independent banks and capital from family offices, which for larger firms, represents just a small slice. Independent sponsors’ biggest challenge in doing deals right now is due diligence and concerns about fundamentals.

Compliance, cybersecurity, legal, and other costs are rising

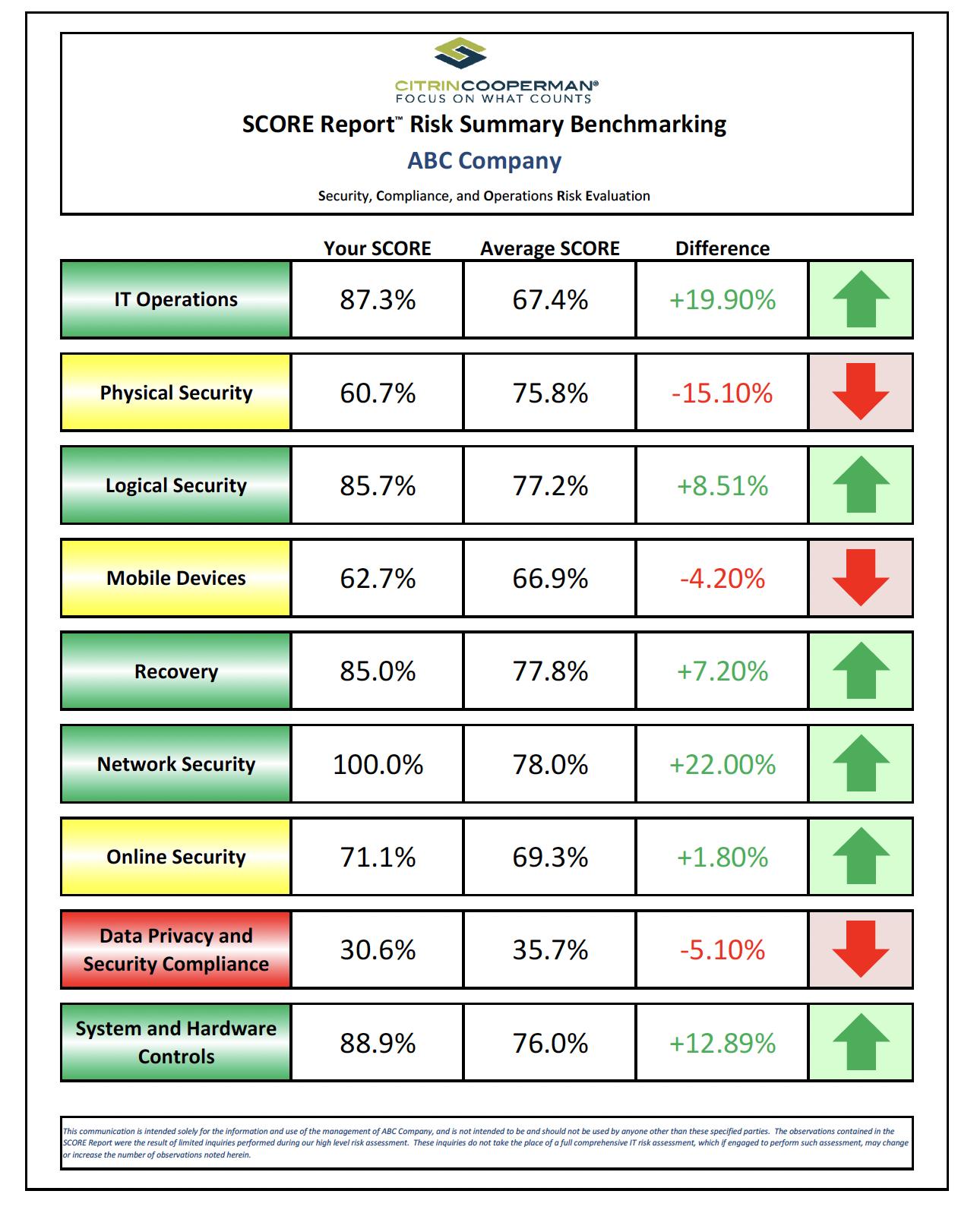

In this market, costs are increasing across the board, and it is no different for funds. “Costs associated with operating a fund have surged due to heightened demands in compliance, information technology (IT), cybersecurity, legal matters, and fund administration,” says Christopher Brown, Partner at Citrin Cooperman.

Increased costs of compliance

In August of 2023, the SEC adopted new rules and amendments to the 1940 act governing private equity which requires fund operators to provide more detailed information regarding fund performance, advisor compensation, and more. It was then overturned by a U.S. appeals court, but may still result in increased SEC scrutiny. Part of the court’s objection was that the SEC had not sufficiently defined “fraudulent acts” and “as a result, the SEC may redouble its efforts to identify private fund cases,” says the law firm Proskauer.

Increased legal costs

The furor over the SEC’s new rules is driving up legal costs. Before the rule was challenged, fifty-one percent of law firms polled said private equity was the number one area for which they expected to receive more legal work, reports Bloomberg. Now things are in limbo. Lawyers expect that work will come from increased inflows of investment funds, followed by enforcement and litigation, increased activity for broker-dealers, and IPO preparation. It is worth noting that lawyers are also expecting larger firms to challenge future disclosure rules in court.

“Costs associated with operating a fund have surged.”

Christopher Brown

Citrin Cooperman

“Cyberattacks against financial firms and funds have doubled since 2020.”

Source: IMF

Increased IT and cybersecurity costs

As private equity has become digitized, there is more to manage; more systems, licenses, and upkeep. This “digital sprawl” creates new costs and overhead, and opens new cybersecurity vulnerabilities. Cyberattacks against financial firms and funds have doubled since 2020.

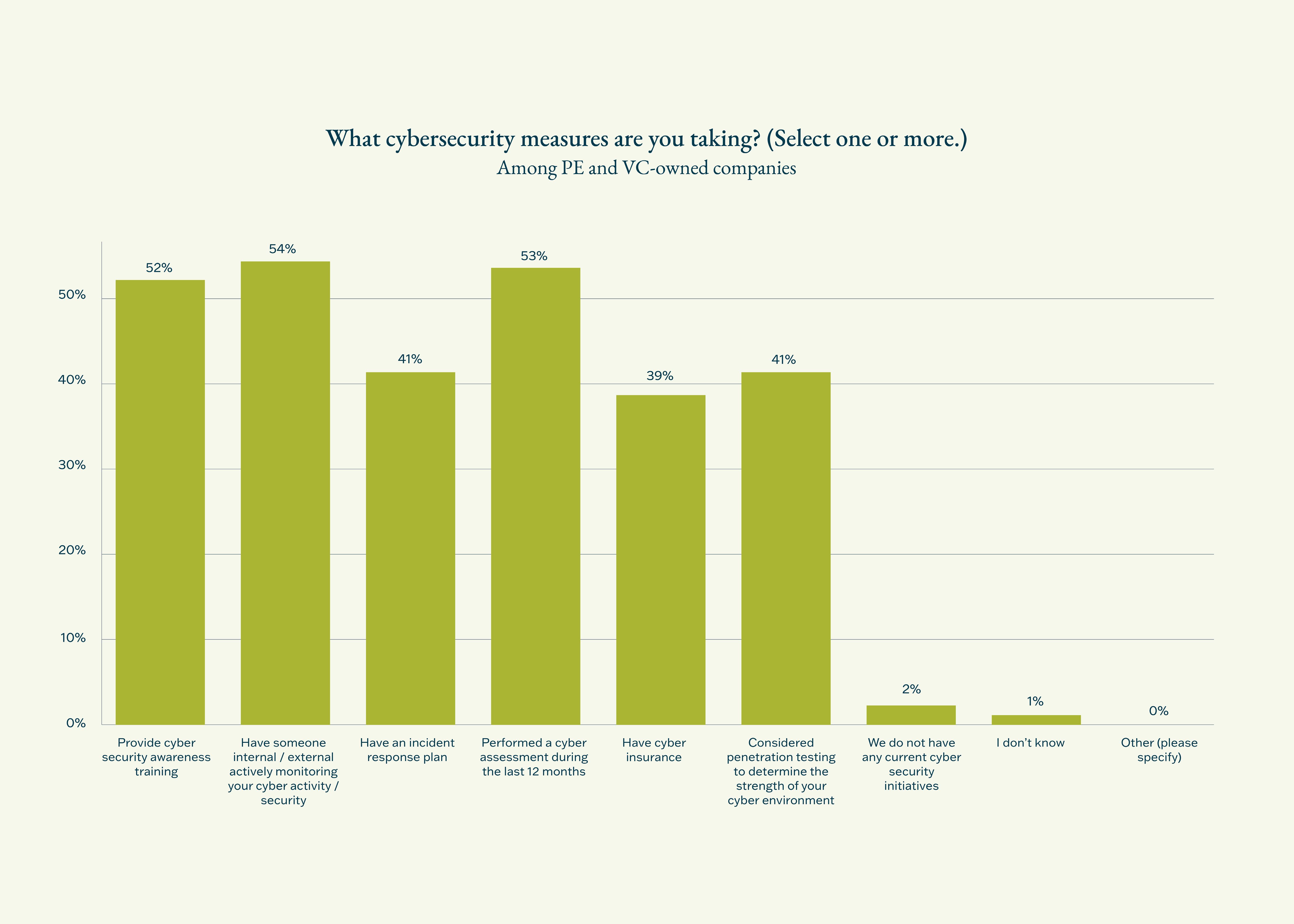

Only two-thirds of our PE and VC fund respondents provide their employees with cybersecurity awareness training, spear phishing simulations, and access to security policies according to our survey. “These are the most cost-effective ways to reduce the risk of the most common type of cyberattack and therefore should really be non-negotiables for funds,” says Kevin Ricci, Partner, Risk Advisory and Compliance Practice at Citrin Cooperman.

In addition, only 24% of fund respondents conduct cybersecurity assessments in advance of making an

investment. “Going forward, I expect that percentage will increase and more firms will conduct cybersecurity assessments of potential portfolio companies,” says Mr. Ricci.

Increased governance costs

Managers must also wrestle with environmental, social, and governance (ESG) issues. As a topic, ESG rose swiftly over the past decade, though stopped short of becoming a formal requirement for funds. Today, investors tell us that they want to know what operators and fund managers are thinking about it. Some consider it a potential advantage for an allocation, but a lack of ESG commitment doesn’t appear to be stopping deals. It is more of an additive — especially as attitudes turn and the SECs cracks down on funds that use the appearance of an ESG program as a marketing tool.

3

PE funds and PE-owned companies are using more technology

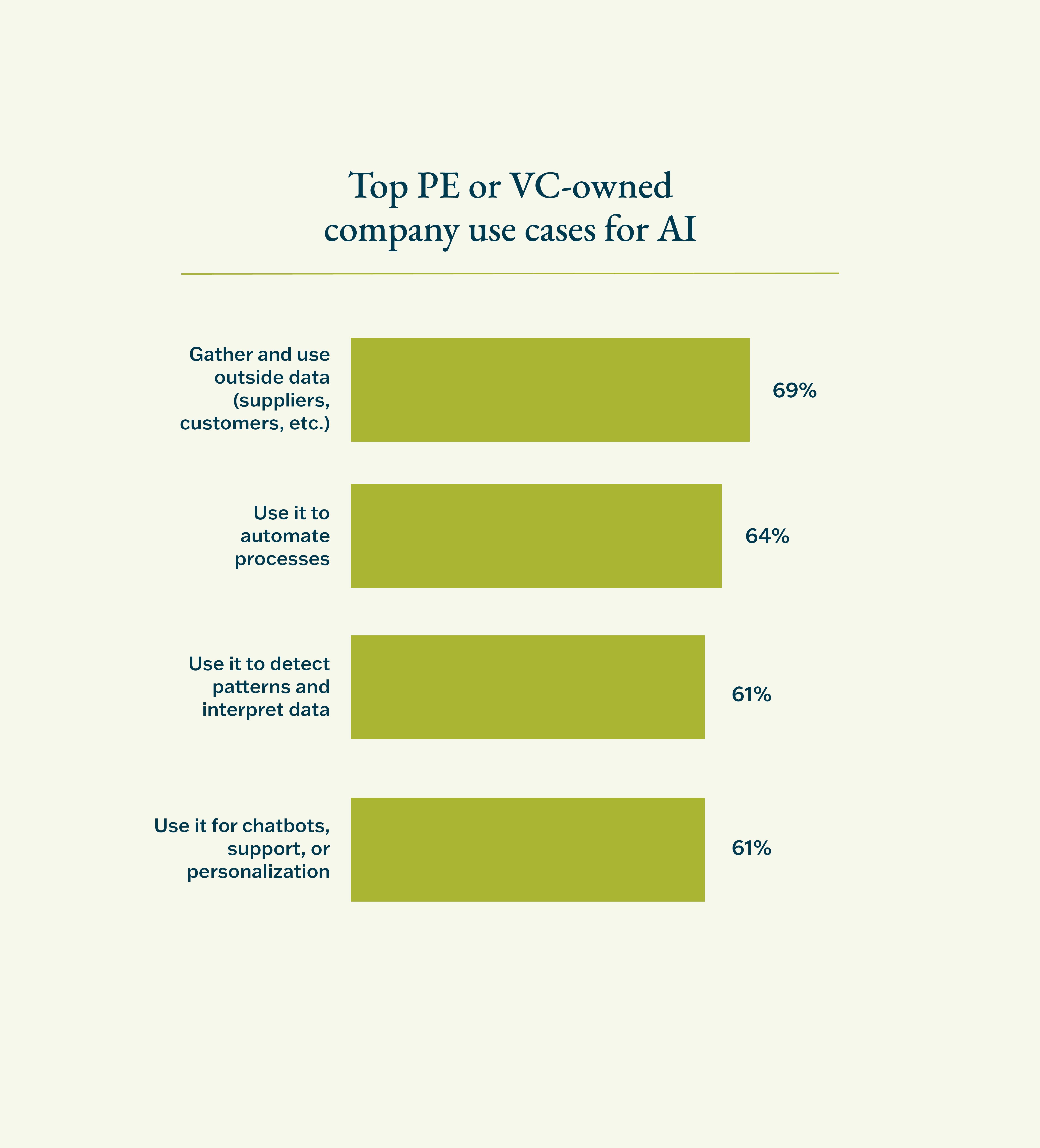

Funds have long relied on technology and we believe that reliance will only grow. We are observing private equity firms adopt more technology at a faster pace, and so too their portfolio companies. PE and VC-owned companies are adopting AI at a slightly higher rate than non-PE-owned companies, and report that the number one benefit is being able to gather and use data from outside their organization.

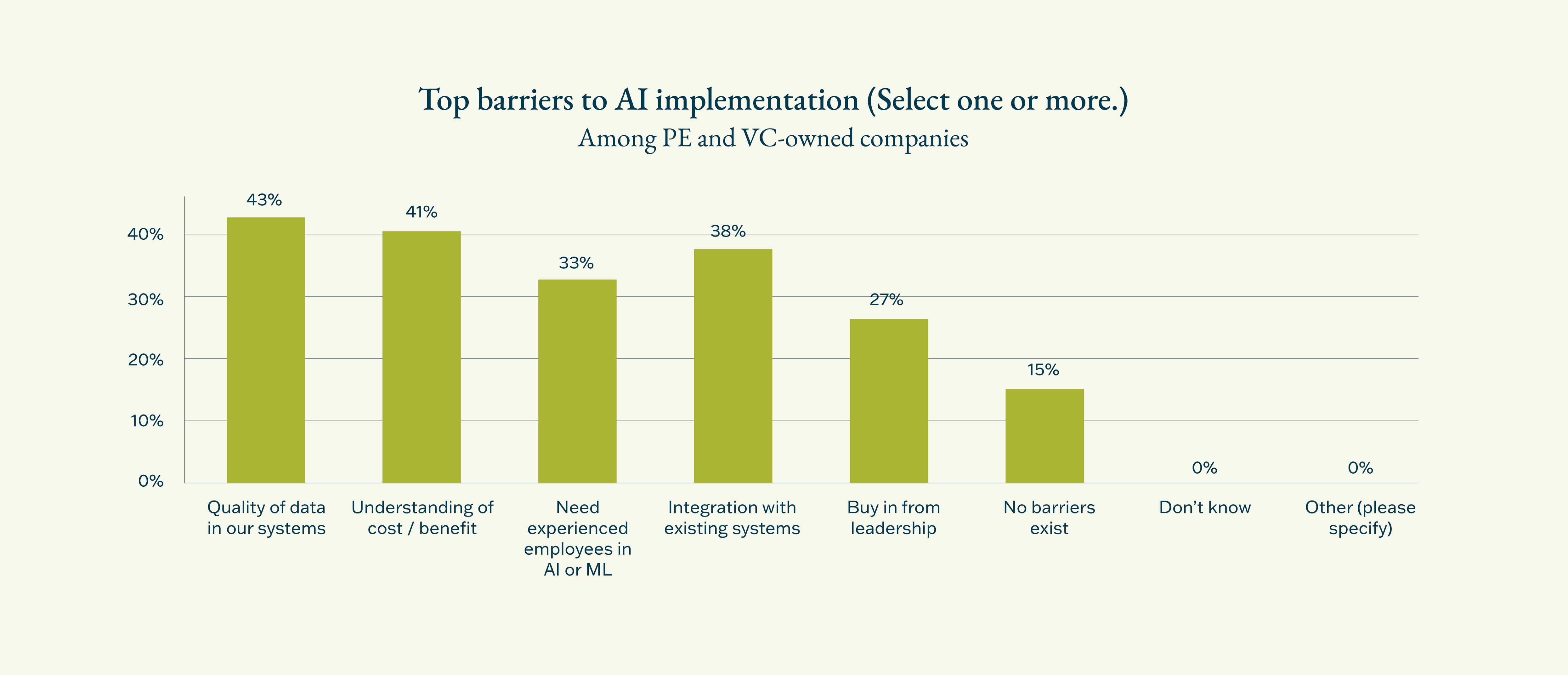

The biggest barrier to portfolio companies adopting AI is their data quality, followed by leadership not fully understanding the costs or benefits, the company not having trained employees, and ineffective integrations with their existing systems. This is unsurprising because a separate Citrin Cooperman survey found that 47% of PE and VCowned companies have not updated their ERP systems in over five years — a lower rate than among non-PE or VC-owned companies.

That lower rate of system maintenance is no doubt related to their higher incidence of cyberattacks. Forty-one percent of PE and VC-owned companies had a cyber incident or breach in the past 24 months. This is 28% higher than the average company and serious cause for concern because they do not have robust cybersecurity protections. Forty-five percent of PE or VC-owned companies admitted they have nearly no protections.

We cannot overstate the risk here: In an economy where everything is becoming software and intellectual property is stored as code, this is a glaring hole that demands immediate action. of PE or VC-owned companies have not updated their ERP system in 5+ years. of PE or VC-owned companies faced a cyberattack or breach in the past 24 months. more likely to face a cyberattack. PE or VC-owned companies are 47% 41% 28%

Emerging managers may lack cybersecurity rigor

Fifteen percent of emerging managers told us they do not know who handles their cybersecurity. Sixty-three percent rely on an external resource and those partners do not appear to be doing an effective job.

Of emerging manager funds:

• Only 54% have a cyber incident response plan or periodical testing.

• Only 24% conduct periodic testing with portfolio companies.

Source: 2024 Private Company Performance Report

4

Workforce conditions have improved

Across the PE and VC market, more talent was available last year than the year prior, and this year is even more promising. The opportunity is particularly pronounced among emerging managers, who in the past may have struggled to compete with larger and better-known employer brands — 65% say they have more access to talented operators than they did a year ago.

The source of this talent surplus is economic. Uncertainty and lower-value deals have caused companies to pause their executive searches. With reduced M&A activity came slower post-acquisition hiring. The slowdown has been uneven — we are seeing

an increased number of companies looking to replace top executives who aren’t performing. But broadly, it is an employer’s market.

This is good news for the PE industry. Recent senior talent hiring shortages have made it difficult to achieve superior returns and manage risk. Now that it is easier to find, attract, and retain talent, funds and their portfolio companies should have an easier time, which is critical to the long-term success of any fund. The same is true for those funds’ service providers — more access to talent means more talented and resilient partners.

Fifty-six percent of PE and VC-owned companies say they have made significant progress establishing upskilling programs to develop their team’s technical and digital skills, which far surpasses the general market — 38% of non-PE-owned companies say they have achieved this.

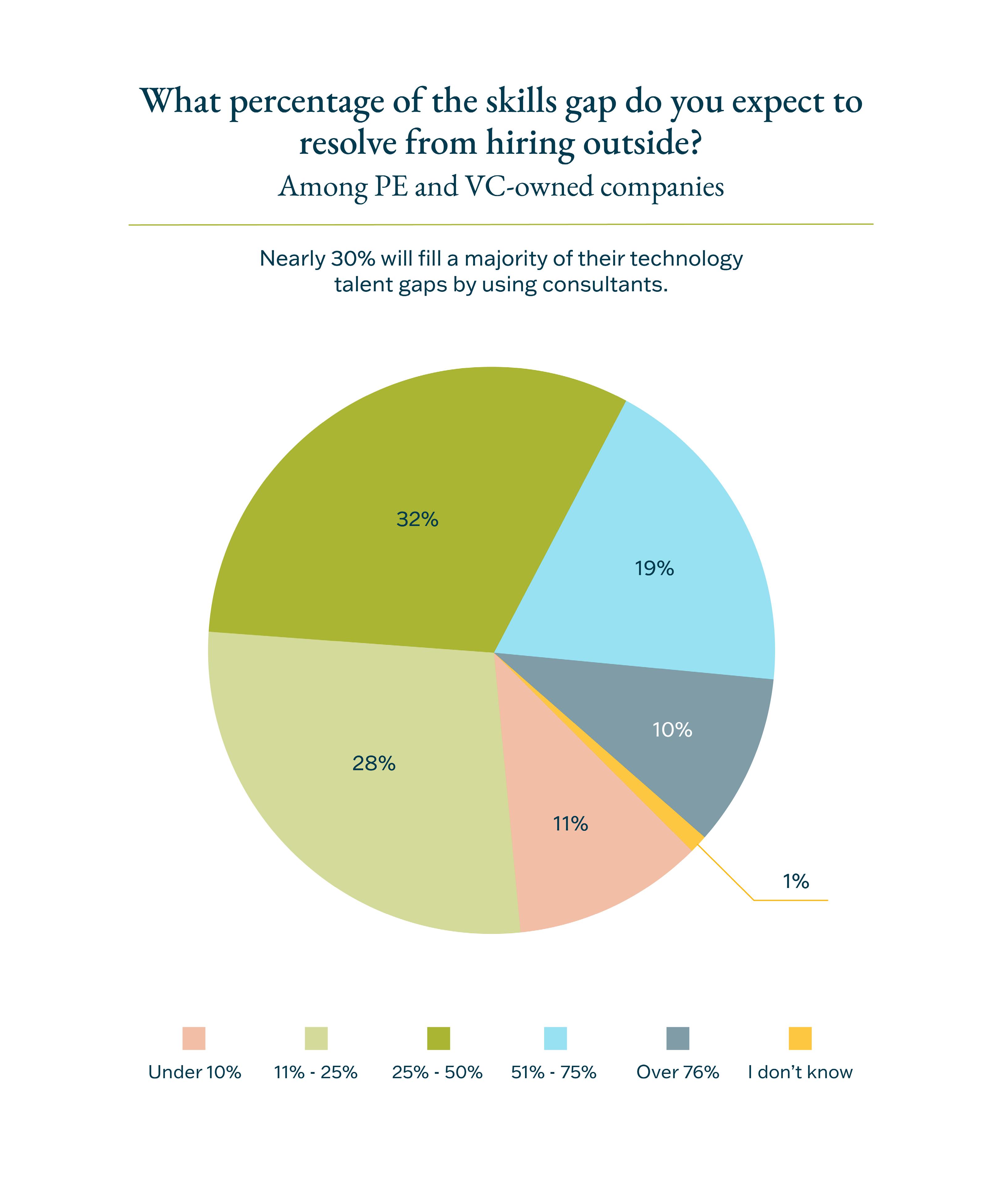

That said, there remains a pronounced skilled-talent shortage, especially in advanced technologies such as machine learning and AI. This is why 30% of PE or VC-owned companies say they will fill a majority of their talent gaps using consultants and 90% of companies generally say they must look outside their walls for at least 25% of advanced technical talent.

What can firms make of all this?

In a difficult market, there are nevertheless plentiful opportunities. The surplus of talent is promising, and as we will explore next, firms have an opportunity to rethink their thesis and tell a more competitive story.

Tell a better story to raise capital and reorganize your fund

In

this market, limited partner desires matter more.

Many emerging managers tell us they are now feeling a strong pressure to discount. They are considering accepting lower fees to accelerate fundraising. We believe they must be very careful about giving away future returns, especially if they give preference in a way that is not transparent and affects the returns for other limited partners. The market is unlikely to change, and we feel managers must structure deals for the reality of today and focus more on differentiating with a thesis they know gets investors excited. OPPORTUNITY

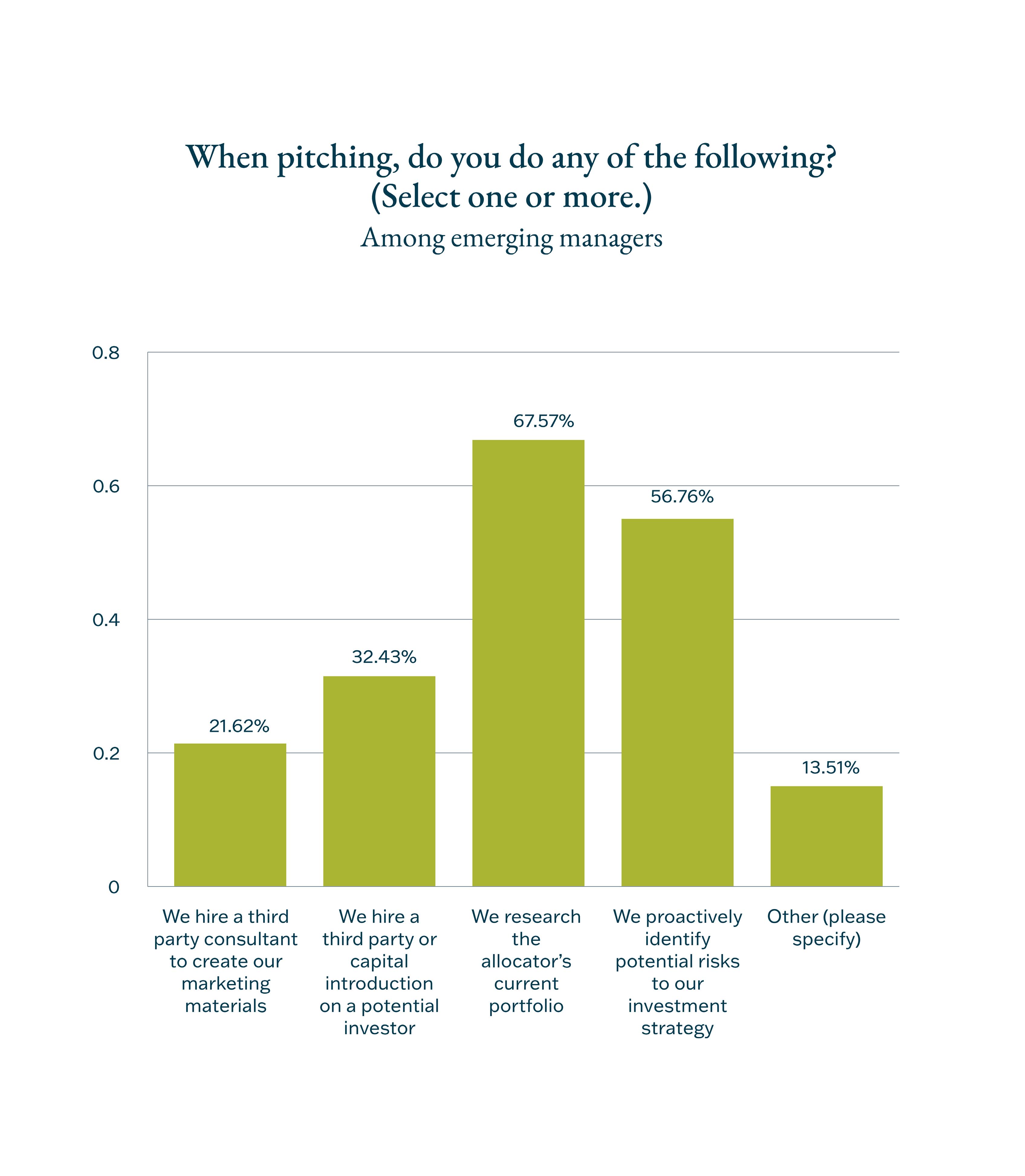

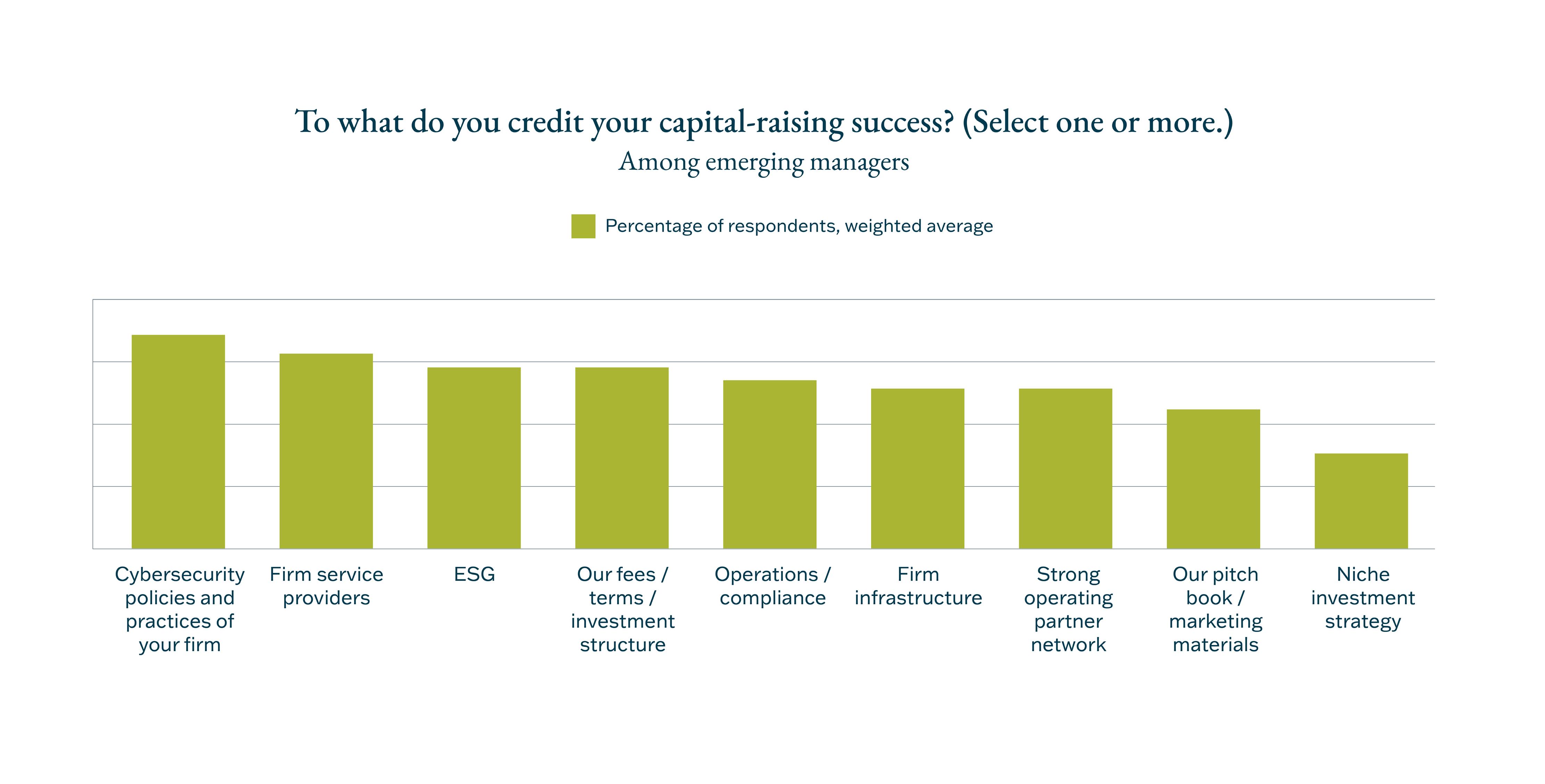

Funds may need to change their sales strategy or cast a wider net to hit their goals. Now, where one size used to fit all, specialized strategies are more likely to win. Fund managers are competing for largely the same sources of capital and there may be a “shakeout” from this period among those who did not adapt to tell a more compelling story, nor cement a track record worthy of supporting that story. “Now more than usual, emerging managers must highlight what distinguishes their fund from others by using a more bespoke approach to better engage investors,” says Christopher Brown, Partner at Citrin Cooperman.

of emerging managers with an anchor investor gave them more favorable fees.

Furthermore, it is vital that fund managers reevaluate their service providers. Limited partners want to know they have a tight circle capable of realizing value in this market. “I expect fundraising to continue to be challenging going into 2025 so it is very important for emerging managers to have the right team around them with the right compliance, fund administrator, and so on,” says Alexander Reyes, Partner, Financial Services Industry Practice Leader at Citrin Cooperman. “I believe they have no choice but to be out there being passionate about that strategy in public.”

Established managers naturally have more options. They may have access to institutional allocations unavailable to emerging managers

and can tap their network for new fund launches. Their largest opportunity right now is to reevaluate their fund investment strategy. Reevaluating the types of businesses your fund will target may require outside expertise to build models and explore scenarios for, say, moving from established companies and consistent returns to higher-risk startups which are seeing more movement right now. We have seen established fund managers who historically invested in real estate raising private credit funds because they see that strategy appealing to potential limited partners in the current interest rate environment.

What limited partners expect right now

Limited partners expect financial and due diligence rigor. They want to see your strategy broken down into actionable plans:

• Short-term plans: Immediate fundraising targets, initial investments, and operational setup tasks. Clearly defined milestones for the first one to two years.

• Long-term plans: A clear definition of success for five years and beyond. Outline how you aim to scale the fund, possible exit strategies, and how you will adapt to market changes across the fund’s lifecycle.

The benefits of a reinvigorated advisory board and team of talent

All funds right now can benefit from building a stronger advisory board with rich industry experience and access to new networks that enhance the fund’s credibility. The right new advisors can also help you aggregate insights and seize new opportunities you might not have otherwise known about. Also, do not underestimate the value of new external consultants or in-house professionals. An experienced attorney can help navigate the legal landscape, a regulatory expert can ensure compliance, and an independent accountant can bring transparency to the fund’s financials.

“Do not underestimate the value of new external consultants or in-house professionals to help you seize opportunities right now.”

Alexander Reyes Partner, Financial Services Industry Practice Leader

Citrin Cooperman

Source: Emerging Manager Survey

“Thirty percent of independent sponsors returned more than 5x to investors. This underscores what a valuable asset class they represent.”

Sylvie Gadant Managing Partner, Transaction Advisory Services Citrin Cooperman

Spotlight on emerging managers raising capital

#1 #2

differentiator is a niche investment strategy.

differentiator is their operator network.

hire a third party to help produce their marketing materials.

have an anchor investor.

of those with an anchor investor gave them more favorable fees.

2/3 1/3 1 in 5 1 in 5

said ESG helped in their investment strategy.

say emerging manager allocations are worth the added work.

say their emerging manager allocation application was successful.

Action:

Seek help on defining your investment strategy

An outside advisor can help you benchmark, pressure-test, and craft a more appealing story. They can help you build a wellcrafted pitch deck and hone your fundraising strategy based on experience helping dozens of other funds. To ensure the success of your launch, request:

• Help establishing well-defined fee structure: Including a breakdown of management fees, finder’s fees, profitparticipation fees, and performance fees.

• Help building the right team: From legal counsel to fund administrators, is vital to the success of the launch.

• Help producing marketing materials: Including forecasts, pitch decks, and brochures.

These are particularly important for emerging managers. A reputable team and a solid back-office foundation will reinforce the impression that things are well-managed.

Learn how we help with fund strategy

Action: Niche down on your investment strategy

Focusing on a specialized sector or investment theme can help managers differentiate.

A niche strategy can attract investors looking for exposure to specific areas they believe have high-growth potential or are underrepresented in their existing portfolios.

Action: Improve your operational infrastructure

Demonstrating a robust and efficient operational infrastructure can instill confidence in investors. This includes:

• Strong governance practices

• Advanced technology systems

• Comprehensive risk management protocols

• A capable team

We recommend emerging managers seek advice from fund formation attorneys, accountants, placement agents, and fund administrators. These advisors should have a wide breadth of knowledge in servicing peers in similar sectors and investment strategies. They can provide important guidance on complex regulatory compliance matters at critical junctures.

Action: Reinforce your compliance program

ESG is not a defining criterion for most investors, but it is important according to 70% of emerging managers in our survey. Some 37% of established funds say they incorporated sustainable investment strategies last year, up from 30% the year prior, according to PitchBook. Though among those who have not, fewer now say they plan to explore it.

Your compliance program should include written policies and procedures that address:

• Anti-money laundering

• Record keeping

• Investment suitability

• Trade monitoring

• Confidentiality

OPPORTUNITY 2 / DEAL FLOW

Improving your pipeline with deal flow

The PE market is loaded with trillions of dollars in dry powder that demand allocation.

Yet many have committed that capital and it is locked away in funds that are not finding reasonable exits. We’d encourage you to become more creative about doing deals and find ways to circumvent the competition. For example, reexamine your pipeline and look at adjacent industries, sectors, and subsectors. If you previously invested in franchised medical groups, you might now explore health technology or medical supply companies.

At the same time, sellers can reduce deal failures with strong sell-side planning. The number one

problem with failed deals right now, according to our independent sponsor report and corroborated by PitchBook, is due diligence issues. Ensure deal success by bringing in outside advisors to do the sell-side quality of earnings (QofE) analysis on a portfolio company to truly understand the financial performance of your investment and maximize potential profits. The QofE report can give your fund a leg up on the negotiations and allow you to identify any issues prior to the buy-side’s due diligence.

The number one problem with failed deals right now is due diligence issues.

“We always advise more standardization among portfolio companies.”

Alexander Reyes Partner, Financial Services

Industry Practice Leader

Citrin Cooperman

Many PE and VC firms haven’t been rigorous enough over the past two decades in requiring that their portfolio companies use true professional service providers. A portfolio company that has gotten by with a small, generalist accounting firm lacking specialized financial services expertise may be exposed. When it comes time for due diligence, the buyer may discover out-of-state tax and worker compliance issues and back taxes that can affect prices or the entire deal.

We always advise more standardization among portfolio companies. Done well, reports should be

comparable across all assets so managers have much richer insights into, for example, the go-tomarket strategy of one company versus another.

If one is achieving uncommonly high returns on its marketing, that is an opportunity for all. Though this advice may sound obvious, it isn’t easy and is rarely enforced.

Addressing these matters from back-office to front can create opportunities for deals and clear the path to closing them.

Learn about our transaction advisory services

Action: Outsource accounting and finance

Amidst the ongoing accounting talent shortage, it may be much more economical to outsource your finance team than to staff up. Outsourcing may give you access to many niche advisors who unlock previously unavailable expertise, such as insight into state and local taxes (SALT), international tax treaties, and more.

model get their work done just as well as those that use traditional staffing models — but four to five times faster and eight to 10 times more cheaply,” found researchers writing in the Harvard Business Review.

Benefits to outsourcing finance include:

• Immediate access to key financial skills

An outsourced team can also support faster decisions, keep up to speed on matters your in-house team can’t manage, and provide tactical support to portfolio companies. Some are calling this the “open” talent model — renting rather than buying, so to speak. “Companies that embrace the open talent

Learn more about outsourcing finance

• Immediate access to key tax insights

• The team size flexes to meet your need

• No employment overhead (+20%)

• No added management overhead

• Strategic advice from rotating experts

It is 8-10x

more efficient to use an open talent model.

Source:

Harvard Business Review

Action: Explore co-investment opportunities

By offering co-investment opportunities, managers can attract investors who are looking for more control and direct involvement in their investments. This approach can also help build stronger relationships with investors by aligning interests.

Action:

Explore alternative financing

Bridge funds can offer short-term financing, while warehousing strategies allow managers to accumulate assets before transferring them to a permanent investment vehicle. These strategies provide flexibility and liquidity, making it easier for managers to seize investment opportunities without waiting for traditional fundraising cycles.

OPPORTUNITY 3 / PORTFOLIO

Encourage portfolio companies to use technology

We advise fund managers to become more involved in their portfolio companies’ technology decisions.

Beyond being able to show limited partners that you have a strong grasp of the fundamentals and intimate operations of each of those businesses, those companies likely have significant opportunities to improve EBITDA with technology. The further that business is from the technology industry, the greater this opportunity.

For example, while it is all but expected that manufacturers and distributors are investing in supply chain software, it is less obvious that smaller professional services businesses would be investing

in AI to create new service offerings. Your strategic insights may be tactically valuable to those operators, and those are gains you may be able to scale across your portfolio.

Top opportunities we’re seeing among companies:

• AI for customer service, such as chatbots and help articles

• AI-assisted coding to ship new features faster

• A greater investment in ecommerce

• Automated insights from advanced analytics

“New technology increased the overall value of one portfolio company in particular and contributed to a very successful exit.”

Alexander Reyes

Partner, Financial Services Industry Practice Leader

Citrin Cooperman

According to our survey of 1,000 private companies, 53% sold more than half their products online over this past year. Twenty-four percent have seen ecommerce sales double over the past month. Ecommerce is, as one commentator has called it, the “new vehicle.” How can you find non-obvious opportunities to leverage this growth, say, for business-to-business companies?

One foundation of leveraging more technology is upto-date back-office systems. A significant number of companies have not set up their ERP system to provide the data analysis they need to launch new product offerings, continuously pass costs along to their buyer, forecast, or use advanced analytics. This remains a major opportunity.

“We have seen portfolio companies expand their services by helping customers directly through remote delivery and indirectly with virtual chatbots,” says Alexander Reyes, Partner, Financial Services Industry Practice Leader at Citrin Cooperman. “This allowed them to scale and expand service capacity, significantly reduce overhead and labor costs, improve customer satisfaction, and accelerate the sales conversion process. Additionally, data collected on these platforms provided greater customer insights. This increased the overall value of one portfolio company in particular and contributed to a very successful exit.”

“Companies

should consider developing security policies and an incident response plan, revisiting compliance requirements, committing to regular hardware and software patches, and using multi-factor authentication and stronger passwords.”

Additional technology does introduce an additional problem: Connected systems are vulnerable. Cyberattacks have increased: 32% of all companies in our survey experienced an incident in the past 24 months, as did 41% of PE and VC-owned companies. Not only does this risk their intellectual property and customer information, it also risks their reputation and enterprise contracts.

Kevin Ricci Partner, Risk Advisory and Compliance Practice

Citrin Cooperman

Action:

Encourage portfolio companies to revisit their data strategy

Encourage companies to revisit their ERP, CRM, product lifecycle management (PLM), and other major software implementations to ensure they’re generating the data necessary to provide insights into how to improve the business. Consider standardizing this across portfolio companies, if applicable.

Learn how we help with technology audits

Action:

Encourage portfolio companies to get a cybersecurity audit

Cyberattacks are not a matter of “if” but when. Outside experts can apply the knowledge of hundreds of incidents and recommend better policies, programs, and software. For example, how do portfolio companies evaluate all new tools, including AI? Do they require SOC compliance? Uniform SLAs? Given the poor state of cybersecurity hygiene among portfolio companies, this may be a competitive advantage.

Learn how we help with cybersecurity

OPPORTUNITY 4 / ANALYTICS

Use technology for your fund

Technology may offer funds a way to find better deals.

Today, just 16% of private equity firms say they are using AI, but 80% expect to use it within three years according to Bain & Company. The same way cryptocurrencies and blockchain recently created all new asset classes, AI may create all new ways of understanding and predicting performance. Deputize someone in your fund to explore ways technology can improve infrastructure, controls, and processes, or assist with analysis and due diligence.

Established funds we work with tell us they are already using AI to do better deals. They’re using algorithms to accelerate due diligence and compliance, and to

produce internal data analytics that allow managers greater insight and oversight. Many of these technologies are impractically expensive for emerging managers, but may grow more accessible.

Your fund should explore how technology can:

• Better risk-rate a portfolio company

• Compare one potential allocation against another

• Mine existing data for unconventional insights

• Normalize an allocation’s data and compare it to peers

• Analyze an allocation’s technological maturity

“In this era, it is essential that the technology strategy be closely aligned with the investment thesis, at the fund level and the portfolio company level.”

Alexander Reyes Partner, Financial Services Industry Practice Leader

Citrin Cooperman

“In this era, it is essential that the technology strategy be closely aligned with the investment thesis, at the fund level and the portfolio company level,” says Alexander Reyes, Partner, Financial Services Industry Practice Leader at Citrin Cooperman. “The clients we work with focus on leveraging technology to drive top-line growth, create cost improvements, and establish a comprehensive approach to optimal capital utilization.”

Just as with portfolio companies, managers who embrace technology must also embrace cybersecurity. Anything online is hackable and funds are holding sensitive data on their partners, down to social security numbers and financial information. They cannot allow their small team to become a threat vector. If they do not have robust help with security, which is a very different skill set from IT, they should consider outsourcing that work to professionals.

Action: Commission a cybersecurity audit

Consider engaging an outside partner that specializes in cybersecurity for private equity funds to conduct an audit and risk assessment. This professionalized cyber stance can help funds de-risk investments, tell a better story, and help clear the way for an exit.

Action: Develop an AI use policy

Consider developing a strong AI use policy for your fund that aligns with your investment thesis. Just as software has consumed the world, AI is now posed to do similar — through many of those existing software platforms. Nearly every company is, to some degree, a technology company, with an opportunity for vast efficiencies.

Acting on opportunities in the present market

The present market seems unlikely to improve quickly, but that doesn’t mean it is devoid of opportunities. There is a reason 90% of emerging managers plan to raise more capital in the coming year despite broad pessimism: There is an opportunity for you to turn every disadvantage into an advantage. In a market where raising is difficult, you can use clever accounting and technology to craft a differentiated thesis and tell a better story around companies that may eke out an exit where before none was possible. You can use technology and technological security to enhance your fund, attract new advisors and service partners, and assemble a team that meets the present moment and limited partners’ needs.

As you look to the future:

Tell a better story to raise capital and improve how you organize your fund

Listen to limited partners, meet with more of them, and adjust your thesis to the present reality. Clarify your unique strategy and consider using a partner to pressure-test it and generate the marketing materials.

Improve your pipeline with deal flow

Become more creative about expanding the aperture to consider related subsectors. Get ahead of deal failures with quality of earnings research and risk assessment by a trusted third party.

Encourage portfolio companies to better use technology

Use technology to find hidden efficiencies, especially in subsectors that are not traditionally tech-savvy.

Use technology to optimize fund performance

Look for better ways to analyze company maturity, risk-rate them, and structure deals.

Subsectors we serve:

Inside Citrin Cooperman’s Private Equity Industry Practice

Citrin Cooperman’s Private Equity Industry Practice is on the pulse of the industry, actively monitoring the events that will affect you while providing strategic guidance and a multidisciplinary approach to today’s evolving business landscape.

• Broker-Dealers

• Digital Asset

• Financial Services

• Hedge Funds

• Independent Sponsors

• Private Equity

• Venture Capital

• Registered Investment Advisors

• Family Offices

About Citrin Cooperman