5 minute read

OPERANNG OPPORTUNITIES

WALLY LYNCH Paid Associates PO. Box 741623 Dallas. Tx.75243

eltvenY completes every sale, I butit's amazing how few consider this heinous cost when making and submitting bids. lf this strikes a discordant note with you, it certainly is a readily remedied malady.

You need to know three specific bits of information in order to properly anticipate the impact of delivery costs on the gross margin dollars.

(1) The Cost Per Drive Mile. This will be somewhere between $1.75 and $2.25 for most dealers.

(2) Number and Types of Deliveries Expected. In at least one area ofthe country it takes a minimum of nine deliveries to handle a complete house. Your list may be different, but here's what it looks like: Framing, Mortar Mix, Windows & Ext. Doors, Boxing, Roofing, Sheetrock, Interior Trim & Doors, Fireplace Materials, Miscellaneous.

(3) Driving Distance To andFrom the Job Site.

For illustration purposes, let's use $2 per driven mile as the cost to deliver, the minimum of nine stops listed and a driving distance of 40 miles, 20 out and 20 back, to make each delivery. Also assume a total bid of $10,000 at 2001t margin,or $2,000.

Now look at these numbers in the context of the bid. At $2 per mile, each trip costs $80. All nine deliveries cost $720. This is 7.20/o of the bid total and 360/o of the anticipated gross margin dollars.

Now you have decision making information. First consider that nine stops is absolutely the best you can expect. Experience has shown that you'll be more accurate if you plan on 12 visits. This might include a hot shot or two and at least one pick-up.

Now the numbers change to $960, which is 9.6% of the sale and 4806 of the gross margin. lt is possible that these figures could be reduced by combining stops to other sites on the same trip, but just the opposite can happen as well. During the course of completing the sale you could make 20 trips at $80 each and $1600 in total. The gross margin dollars are massively depleted andthe $10,000 transaction quickly becomes a losing proposition.

There are other things you can do to preserve the initial gross margins envisioned in your bid.

Set up a delivery schedule with routins that takes a truckinto the customer's area on aroutine pre-determined basis.

Consider an incentive program since drivers on incentive programs don't like to drive half full/empty trucks andwill bring pressure to bear for larger loads.

Since sales people paid on a percentage of the gross margin on delivered cost tend not to give away the store in terms of service, particularly at $80per shot, this is another way to go.

Finally this same methodologY,or lack of it, will allow you to analyze completed transactions to determine why they weren't profitable. You also can identify what procedures might have helped.

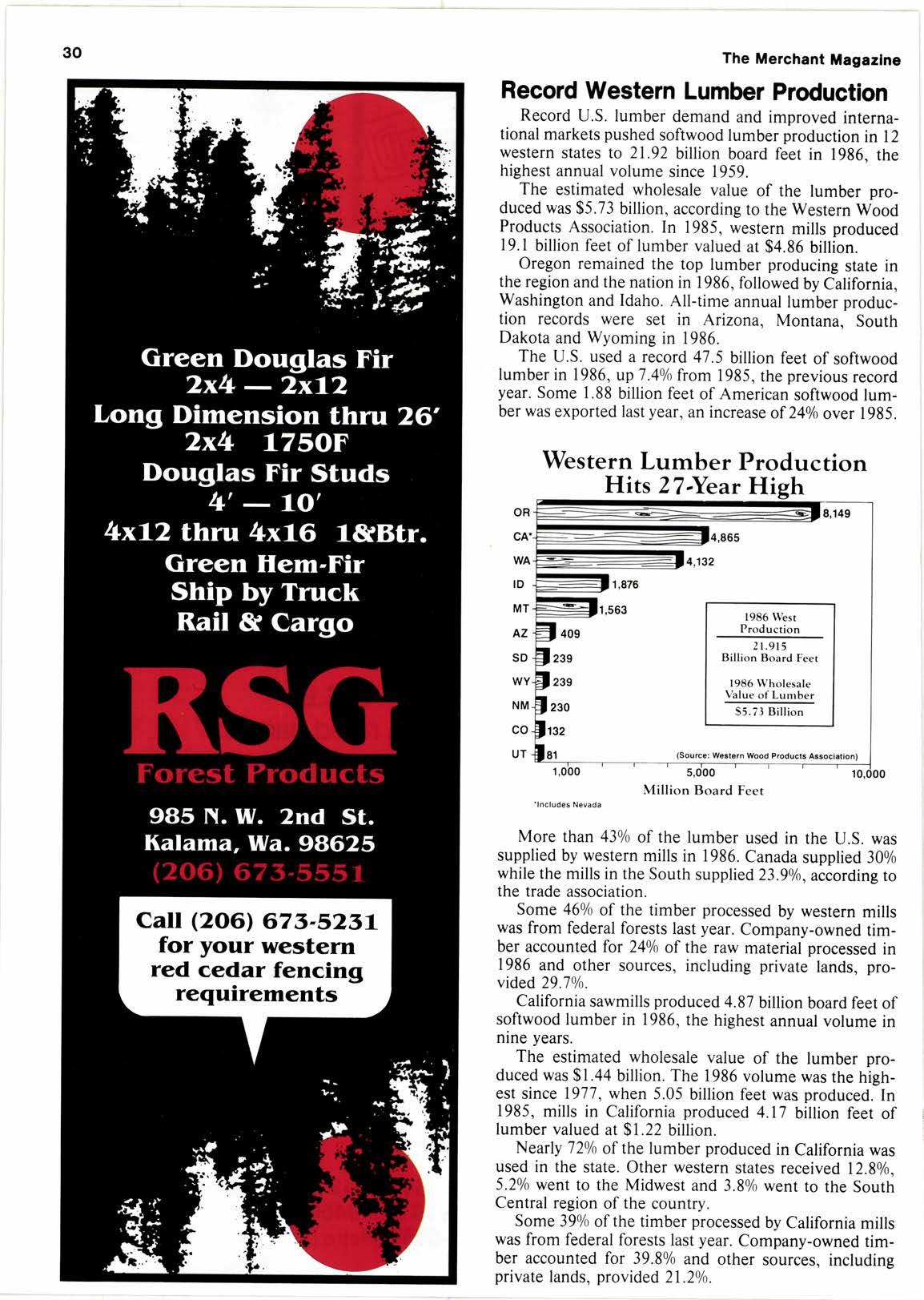

Record Western Lumber Production

Record U.S. lumber demand and improved international markets pushed softwood lumber production in l2 western states to 21.92 billion board feet in 1986, the highest annual volume since 1959.

The estimated wholesale value of the lumber produced was $5.73 billion, according to the Western Wood Products Association. In 1985, western mills produced 19.1 billion feet of lumber valued at $4.86 billion.

Oregon remained the top lumber producing state in the region andthe nation in 1986, followed by California, Washington and Idaho. All-time annual lumber production records were set in Arizona, Montana, South Dakota and Wyoming in 1986.

The U.S. used a record 47.5 billion feet of softwood lumber in 1986, up7.40/o from 1985, the previous record year. Some 1.88 billion feet of American softwood lumber was exported last year, an increase of240/o over 1985.

Western Lumber Production Hits 27.Year Hieh

More than 430/o of the lumber used in the U.S. was supplied by western mills in 1986. Canada supplied 30% while the mills in the South supplied 23.90/o, according to the trade association.

Some 460lo of the timber processed by western mills was from federal forests last year. Company-owned timber accounted for 240/o of the raw material processed in 1986 and other sources, including private lands, provided 29.70/0.

California sawmills produced 4,87 billion board feet of softwood lumber in 1986, the highest annual volume in nine years.

The estimated wholesale value of the lumber produced was $1.44 billion. The 1986 volume was the highest since 1977, when 5.05 billion feet was produced. In 1985, mills in California produced 4.17 billion feet of lumber valued at $1.22 billion.

Nearly 720/o of the lumber produced in California was used in the state. Other western states received 12.80/0, 5.20/o went to the Midwest and 3.8% went to the South Central region of the country.

Some 39% of the timber processed by California mills was from federal forests last year. Company-owned timber accounted for 39.80/o and other sources, including private lands, provided 21.20/0.

Hazardous Substance Rules

A regulation requirihg people working with hazardous substances be made aware of the potential dangers and be trained to eflectively protect themselves is being enforced by OSHA.

OSHA has already imposed fines of $209,665 for violations such as employers having no written hazard communication program, no employee information or training program, no material safety sheets, no label indentification or incorrect labeling on in-plant containers, no exposure limit information on sheets for chemical mixtures, no written hazard determination, no inventory of chemicals in program, not making sheets accessible to employees and having hazardous chemicals not contained in the sheet.

Remodeling Growth Doubles

Residential remodeling markets which keep growing at double-digit rates are changing the way suppliers do business.

Instead of selling by the truckload, more are selling smaller lots of better quality merchandise. "The

The Merchant Magazlne distribution system is much like the aftermarket auto-parts industry of 20 years ago," explains James Tolliver, National Association of the Remodeling Industry.

Home center sales are growing 10% to 720/o ayear, twice the rate of other retailers, reports economist Kermit Baker. For example, an estimated $12.0 billion will be spent on remodeling bathrooms this year, up from $8.1 last year.

"We've gone from a construction-based economy to a renovationbased economy like Europe," said David Sauer, publisher of Qualified Remodeler.

U.S. Models For The British

The American Plywood Association is leading a major marketing program to promote the benefits of timber frame housing in the United Kingdom with "Street of Dreams," a project of six model homes to be built near London.

"This is an excellent opportunity to unite U.S. wood systems with British architectural stvles." said William T. Robison. APA president.

September 1987

New Crawlspace Energy Rules

California Energy Commission approved regulations should result in California homes built on traditional crawlspace costing $1,200 to $1,700 less as of July 1, 1988, giving crawlspace and concrete slab foundations equal energy conservation considerations.

The wood products industry in an effort to regain its share of the flooring market lost by 1983 commission energy regulations is promoting the Perimeter-lnsulated Raised Wood Floor, an advanced yet less expensive crawlspace.

Tax Deductible Donations

Donations of excess inventory to the National Association for the Exchange of Industrial Resources (NAEIR), are still eligible for an above cost federal tax deduction since the section of the tax code which affects such donations was not changed in the 1986 tax reform.

Manufacturers, distributors and wholesalers donated approximately $63 million worth of new merchandise to this non-profit, tax-exempt organization last year. Those donors were eligible for a federal tax deduction of up to twice the cost of the material donated. Deductions are allowed under Section 170 (e)(3) of the Tax Reform Act of 1976, which has not been changed.

NAEIR distributes the materials to 7,000 members: non-profit, taxexempt schools, hospitals, nursing homes, camps, YMCAs, and other non-profit organizations in the U.S.

Donors may deduct the cost of the material donated, as carried on their books, plus half the difference between the cost (basis) and fair market selling price. However, the deduction cannot exceed twice the cost.

"Donating excess, slow-moving inventory to NAEIR is a smart move," said Cruz A. Ramos, NAEIR's director of donor relations. "Our donation process is simple, fast, and there is no charge to the donor."

The association accepts almost any type of new, finished product. A free information kit is available from Ramos, Director of Donor Relations, NAEIR, Dept. BT-1, P.O.Box 8076, Galesburg, Il. 61402 or (309) 343-0704.

WE SPECIALIZE IN PRE.STAINING "YOUR MATERIAL" IN ALL OLYMPIC COLORS, COATING ALL 4 SIDES OF EXIERIOR SIDING AND DIMENSIONALTRIM, PLUS ,I COAT APPLICATION ON ALL SIZES OF PLWOOD. ENCLOSED WAREHOUSE FAOLW