INFRASTRUCTURE A tale of two banks

The high street giant and the speedboat – how Cloud journeys compare

CRYPTO

The cr ypto wild child has grown up: but can it behave?

INFRASTRUCTURE A tale of two banks

The high street giant and the speedboat – how Cloud journeys compare

CRYPTO

The cr ypto wild child has grown up: but can it behave?

Jethro MacDonald explains how SmartStream has come up with a tool the investment industry might find hard to put down

18 Daring to dream

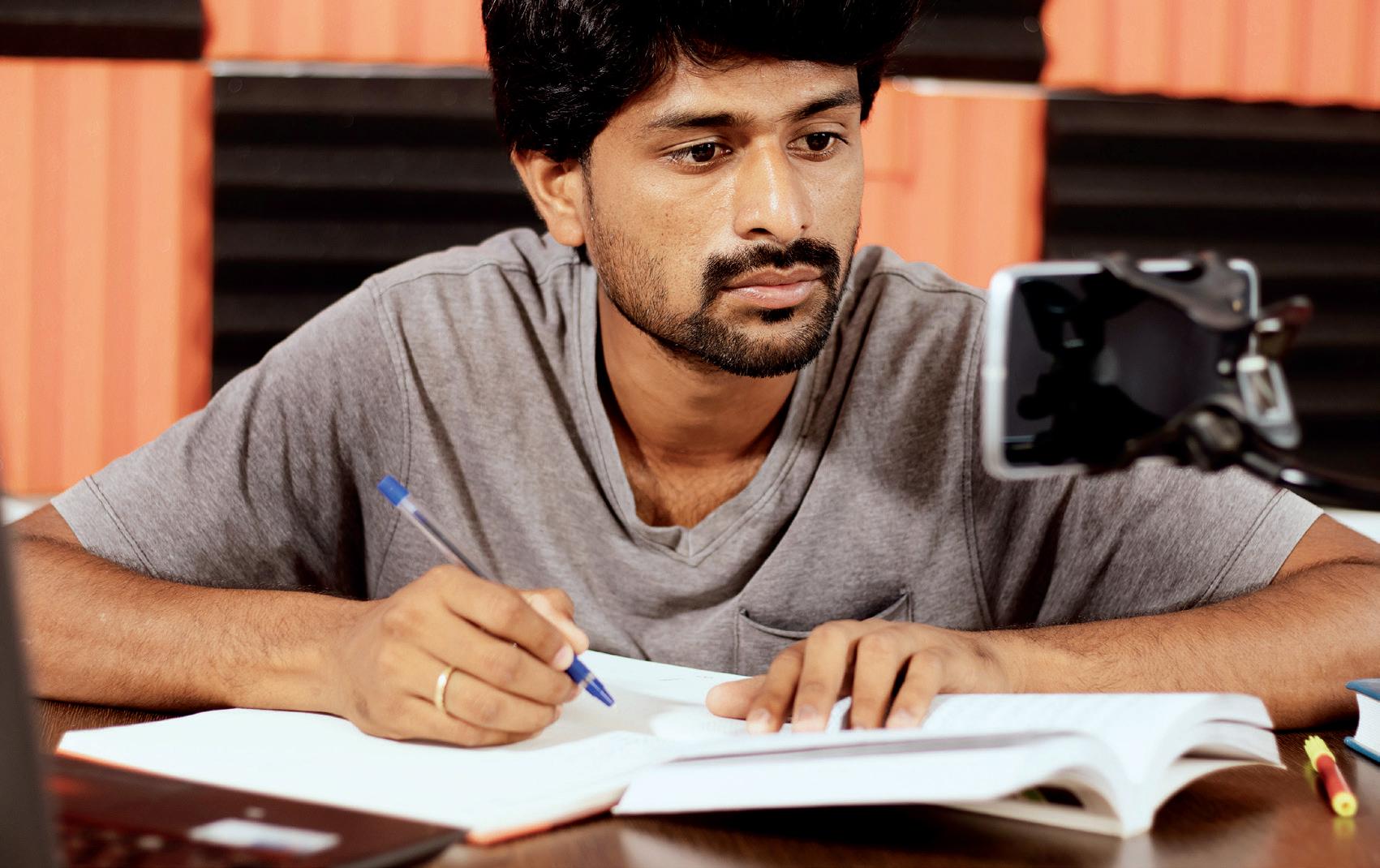

A new breed of fintech is transforming lives in India by turning the traditional education lending market on its head and releasing millions of dollars to students who’d never otherwise have been able to study. Swati Sanyal Tarafdar talks to the entrepreneurs driving change – and one of the students to benefit from it

35 Riding the IPO rollercoaster

Going for growth? Then make sure the figures stack up, says Mark Aubin, Senior VP of Solutions Consulting at Aptitude Software, which is helping CFOs to meet the revenue management challenge

48 Time to share?

ATM pooling is taking off in many markets, both cashless and cash-heavy, says Karolina Rachwol at RBR REPORTING & REGTECH

6 Rules of conduct

SmartStream has combined its deep knowledge of regulatory reference data and super-fast, Cloud-based, AI-driven reconciliation to solve the investment industry’s reporting challenges. And – perhaps surprisingly – digital assets traders are clamouring for it, too, says Jethro MacDonald

11 Risk and reward

In an increasingly unpredictable compliance environment, Trulioo is giving companies confidence and control around their IDV. It’s creating new business opportunities in an uncertain world, says Hal Lonas

15 Cracking the KYC nut

Does a big bank like NatWest have lessons for challengers when it comes to regulatory oversight? We asked its Head of Digital Jonathan Hall CLOUD

24 Journeys through the Clouds UK banks of all shapes and sizes are turning to Cloud environments as they search for scalability, operational efficiency and resilience. We asked Gary Delooze, CIO at high street building society Nationwide, and Wayne Freeman, CTO of NatWest’s neobank for SMEs, Mettle, to tell us more about their organisations’ experiences

29 Sweet harmony

TSB’s Kavin Mistry on keeping customers happy in a complex multi-Cloud, physical and digital environment

38 When the ‘enfant terrible’ of finance becomes the adult in the room

The wild child of finance is finally being taken seriously by the adults... the institutions and regulators which dismissed and ignored it, have come to realise that crypto was a prodigy they mis-took for a delinquent. Three leading members of the altfi economy came together recently to discuss what maturity looks like

42 The CBDC conundrum

Are central bank digital currencies a solution in search of a problem, or a race to the future of money?

ProgressSoft’s Hussein Jundi and payment consultant Jeff Stewart explore the pros and cons

45 Grabbing Wall Street by the horns

Aussie trading app Stake set out to liberate retail investors by giving them direct access to the biggest stock market in the world. Crypto asset trading represents the next financial reedom, says its CEO BANKING-AS-A-SERVICE

51 Service with a smile

Tom Bentley from platform player Vodeno and Martin Häring of banking technology provider

Temenos on how the next megatrend in banking is likely to shape up

54 Gold BaaS

During the first wave of fintech disruption, banks feared they would be condemned to irrelevance. Now, that’s very far from the case, says Finastra’s Angus Ross LENDING

58 Moving on… and up

With rampant property price inflation, many first-time buyers in the UK despair of ever owning a home of their own. Startup Keyzy believes it’s found a solution

61 Chain reaction

Lack of trade finance for SMEs threatened to bring supply chains to a halt in 2020. Martin McCann from Trade Ledger and Barclays Bank’s James Binns consider how a more collaborative approach could keep them moving in future

65 Take your partner

The first BaaS Market Maturity Index from Finastra has identified a wide open goal to improve lending and other services to SMEs. Dee Burke and Josh Cogan walk us through the results

So, banking-as-a-service is emerging as a strong theme in this issue – not by design.

But I guess that’s just evidence that what it represents – the maturing and mass adoption of technologies including Cloud, AI and APIs, combined with a new perspective on the role of finance, and who orchestrates it (i.e. it’s no longer the exclusive territory of old-world institutions) – has moved from an aspiration to reality.

Now, we’re not talking about what it might do, but if there’s anything it can’t. It’s now beginning to impact every aspect our lives – and not just in purely monetary terms, but in addressing real-world issues and real people’s problems that couldn’t be adequately solved under the old, top-down, hierarchical financial system.

Will we be saying the same thing about crypto in 10 years’ time? Notwithstanding Bitcoin’s latest cyclical correction and the Terra ecosystem’s collapse, driven by some bizarre strategic decisions, mainstream investors, corporates and

banks are now finding jobs for crypto to do. There is still a lot of nervousness – among regulators who still don’t have a firm grasp of this new phenomenon, just as much as mainstream institutions concerned that they might miss the boat. But one thing is for certain: crypto is a pebble in the financial system’s shoe that it won’t now shift. And if it makes it walk in a slightly different way, maybe that’s no bad thing.

Sue Scott, EditorDid you recognise Issue 23’s spine tingler? “Always give 100 per cent. Unless you are giving blood” – American actor and comedian

SALES TEAM

Tom Dickinson

Shaun Routledge

Nicole Efthymiou

VIDEO TEAM

IMAGES BY www.istock.com

PRINTED

"PROUDLY NOT

Lewis Averillo-Singh

Lea Jakobiak Oliver Chapman

ABC AUDITED"

SmartStream has combined its deep knowledge of regulatory reference data and super-fast, Cloud-based, AI-driven reconciliation, to solve the investment industry’s reporting challenges. And – perhaps surprisingly –digital assets traders are clamouring for it, too, says

The second Markets in Financial Instruments Directive (MiFID II) isn’t something you want to bring up in a dinner party conversation with investment managers. Why spoil a perfectly good evening? It’s likely to have them reaching for the Hors d’Age brandy and dabbing beads of sweat from their brows.

Four years ago, they might have been more sanguine, bullish even, about the impact of what was seen as one of the most important regulatory initiatives of the EU since the global financial crisis.

But then came two years of getting compliance systems, which were largely manually based, up to speed as the subsequent Markets in Financial Instruments Regulation (MiFIR) was embedded into European member states’ legislation.

In 2021, the first report from the European Securities and Markets Authority (ESMA) revealed how the industry was doing: badly. Figures showed that the number of penalties imposed across Europe for breaching the rules had quadrupled from €1.8million in 2019 to €8.4million in 2020.

And these transgressions weren’t committed by small family offices, but large organisations, with teams dedicated to compliance, handling thousands of transactions. Big trading venues were falling foul of the rules, too.

While the huge increase in regulatory action could perhaps be partly explained by the way national authorities identified and reported breaches to ESMA during that difficult honeymoon period, research the same summer from financial services advisory firm ACA Group found that almost all firms it surveyed were still incorrectly reporting transactions. And the majority didn’t even know it.

Complying with the demands of MiFID II transaction reporting is undeniably complex; and proving the integrity of that data to regulators can place a real strain on organisations, according to transaction lifecycle management (TLM) solutions provider SmartStream. It was only too well aware of the immense pressure the directive was likely to put on firms

Jethro MacDonaldmanually bringing together data, as most were, from multiple data sources in non-aligned formats, at immense scale.

It had been operating in the field for years, developing sophisticated, automated reconciliation software to give businesses better insight into their data and improve accuracy and processing speeds. But its decision to move its services to the Cloud, where it could infinitely scale resources and to make research and development of artificial intelligence (AI) and machine learning (ML) a strategic priority, put it on the front foot when the reality of MiFID II began to sink in.

SmartStream’s AI-driven, Cloud-native solution, AIR (Artificial Intelligence Reconciliations), is capable of reconciling ‘volumes of data that are unheard of in our industry; not just millions of rows, but billions of rows’, says Jethro MacDonald, product manager of AI and machine learning at the SmartStream Innovation Lab.

“SmartStream AIR is a solution to the painful manual onboarding process of building new reconciliations. We speed up the whole process,” he continues. “Throw AIR two files and it will tell you how they come together – in seconds. Then you can make informed decisions as to whether you want to change those match rules or not.

“On top of that, we use ML: if a user is manually matching data, we learn from their behaviour, then propose matches to that client based on what the ML has observed. That means it’s not just helping with onboarding, but with day-to-day tasks, too.”

For many, meeting MiFID II compliance requirements is onerous. “Under RTS 22, Article 15 of MiFID II, firms have to reconcile from their front-office systems to the regulator, ensuring there are no gaps or reporting errors,” says MacDonald.

That can involve up to 65 fields of information which must be completed as part of daily trading activity – information that will be used by regulators to monitor, for example, who is involved in a trade, and, in combination with other reports, perhaps flag market abuse. Too little or missed information risks censure; but neither do firms want to spend time on going to unnecessary effort.

“We not only give clients the means to reconcile the data and demonstrate the accuracy of their transaction reporting processes to the regulator, but we can also tell them whether their reporting decision is correct,” explains MacDonald. And that’s the game changer.

SmartStream achieves it by using an API to link two of its existing solutions: near-real-time reconciliations provided by AIR; and SmartStream Reference Data Utility (RDU), which tracks data from regulatory and industry bodies. It sensechecks what data the regulator actually requires, including validating whether a financial instrument is traded via a trading venue and is therefore reportable – or not.

SmartStream claims the resulting tool – Transaction Reporting Reconciliation and Reporting Decision Control – is an industry first. “It’s certainly a really exciting use of the technology,” says MacDonald.

So, that’s the firms, but what about the trading venues? They have to meet an even higher bar.

We not only give clients the means to reconcile the data and demonstrate the accuracy of their transaction reporting processes to the regulator, we can also tell them whether their reporting decision was correct or not

Post-Brexit, ESMA increased the data continuity checks that trading venues must perform when reporting instrument reference and quantitative data. Any irregularities must be accounted for and mistakes re-reported, so that ESMA can meet its publishing timelines. That includes for instrument liquidity, size-specific-to-instrument and large-in-scale calculations.

At present, trading venues typically check their records retrospectively, on a three-month basis, against massive ESMA data files. This highly complex exercise is costly and accompanied with a huge operational burden.

“The obligation on trading venues, from a MiFID perspective, is so much more than for any other firm,” says MacDonald. “Importantly, the regulator reconciles their reference data and the quantitative data. The problem here is that there are nuances between these two reports, which means some instruments are reportable on one, and not on the other. You need really specialist reference data to help you with that.

“So, again, we’ve combined internally with the RDU, to feed in the reference data needed to make really important decisions, and, instead of asking the client for their reference data report, we’re taking that directly from ESMA, because it’s publicly available information. All the trading venue has to do, then, is submit their quantitative report to us, and we’ll tell them whether they have an issue or not. And that’s carried out proactively, daily.”

The new regulatory solution, Trading Venue Quantitative Reporting Outlier Reconciliation, was launched in March of this year.

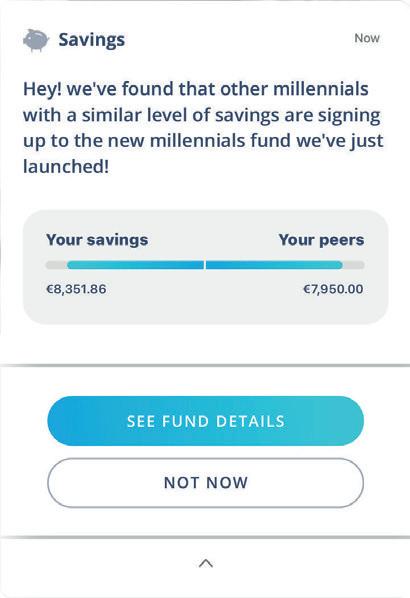

By virtue of the fact that SmartStream works with 70 of the world’s top 100 banks, capital markets, buy-side firms and corporations, it has eyes across the industry and that gives its clients another major advantage when it comes to whether they are on the right side of regulations that are often hard to accurately interpret, andin a state of constant flux.

“The more data you have, the more

powerful the AI,” says MacDonald. “So, we’re looking at how we can use AI to tell us how the data comes together across multiple entities, to see if there are any reporting differences between a firm and its peers. That’s huge for them because, while there are validation rules in place, at the moment, in regulation, that doesn’t tell you if what you’re reporting is in line with that of the rest of the market.”

It could give an early signal of whether a firm is over or under-reporting, both of which it’s wise to avoid. “In fact, recent fines have all been around over-reporting,” says MacDonald. “And some of these issues may not be flagged to users until weeks, months, even years later.”

Waiting, oblivious of some indiscretion, until a surprise knock on the door from prosecutors, isn’t good for business, and neither is the lack of contemporaneous reporting and monitoring for policing the world’s financial markets.

Like the weather, those markets are constantly changing. ESMA has already proposed amendments to MiFIR transactions and reference data reporting regimes, and, since the UK has taken a different regulatory path, following Brexit, they may well not align in future. But there are other winds blowing.

“Right now, digital assets aren’t regulated, but, at some point, ESMA will review them. We saw that between MiFID I and MiFID II; we started reporting a lot more derivatives under MiFID II,” says MacDonald. “From a foreign exchange (FX) perspective, I wonder

The obligation on trading venues, from a MiFID perspective, is so much more than for any other firm

if cryptocurrencies will be regulated, because FX isn’t directly; however, I imagine cryptocurrency derivatives will be, in the next couple of years. We’ll certainly adapt our systems to meet those regulations.”

Perhaps encouragingly for SmartStream, given the potential disruption that decentralised finance could cause incumbents, digital asset companies have been seeking it out, reveals MacDonald.

“One of the things we’d hear people say is ‘what’s the use of reconciliation tools anymore? They’re not going to be needed?’. But, actually, we’ve found the opposite. These firms themselves have a number of controls they need to meet.

“Trading venues, crypto firms, these companies are using the latest technology, too. So it’s not hard trying to sell AIR to them! They understand the technology, they know the power of it, so we work quite well together in delivering a combined control framework.

“We’re more than willing to help them with any reconciliation needs they have. We’re always looking at how we can improve our tools and create new products that will help the industry.”

Banking Circle’s proprietary technology enables Payments businesses and Banks of any scale to seize opportunities, compete and grow.

From multi-currency accounts to real-time FX, international payments to local clearing, we’re quick, low-cost, and secure.

Bypass old, bureaucratic and expensive systems and enable global banking services for your clients.

bankingcircle.com

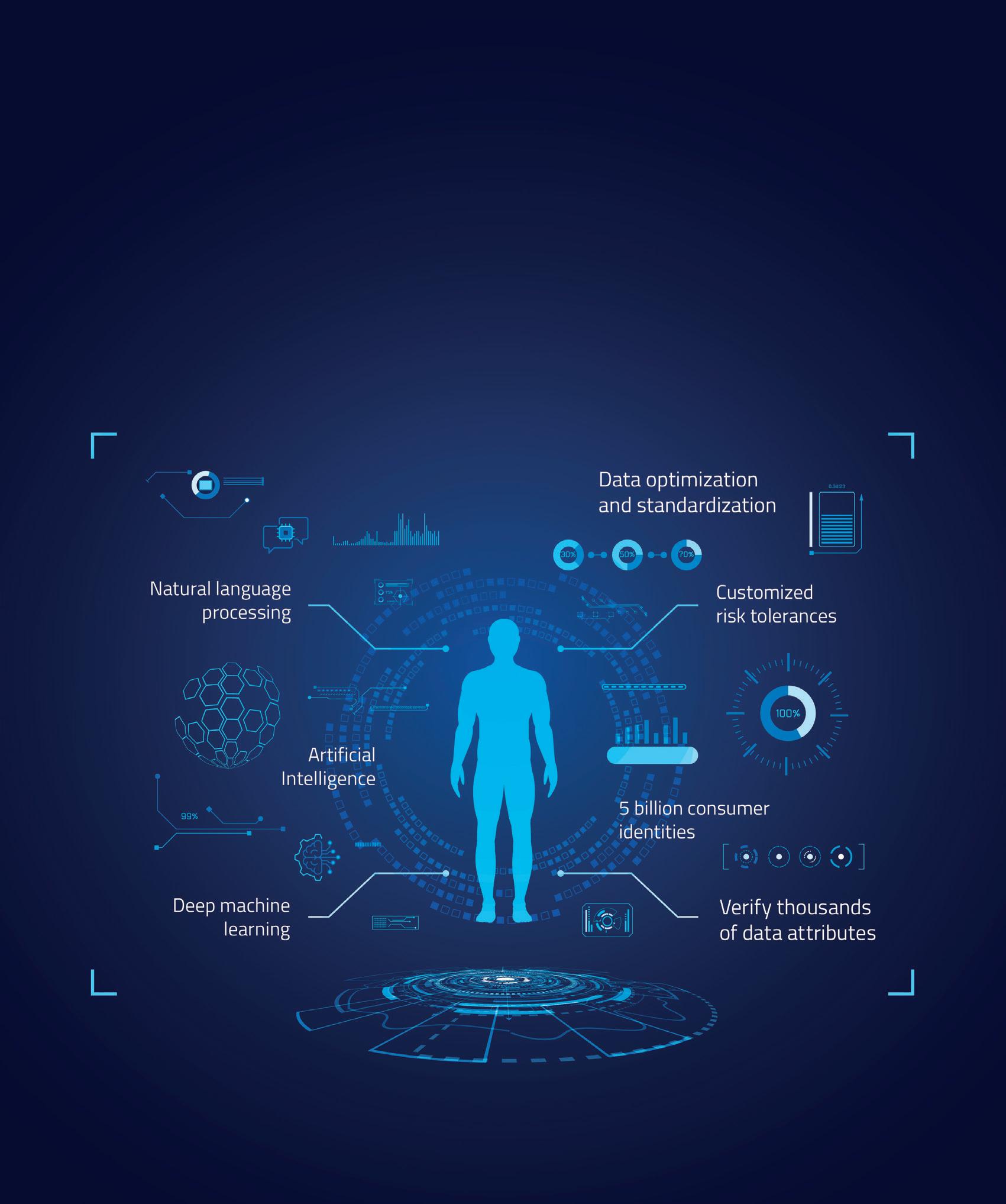

In an increasing unpredictable compliance environment, Trulioo is giving companies confidence and control of their IDV. It’s creating new business opportunities in an uncertain world, says Hal Lonas

Whether you’re a financial institution, big corporate or SME, staying on the right side of compliance when it comes to screening new and existing clients and suppliers is becoming increasingly hazardous, especially if you operate in multiple jurisdictions.

It’s not helped that since the sanctions curtain came down on Russia, governments opposed to its invasion of Ukraine have been moving the regulatory pieces at different speeds across the geopolitical board. What looks like a legitimate business relationship one minute could prove a toxic mistake the next.

At last count (May), there were, for instance, 148 Russian-linked entities and 1,255 individuals whom the UK government alone had made subject of asset freezes. That included manufacturing companies, research institutes, banks and insurers, among others.

Breaching financial sanctions in relation to any one of those carries a maximum prison sentence of seven years or a fine (or both) – not to mention the reputational damage of being publicly excoriated for indirectly supporting ‘Putin’s war’. With the economic thumbscrews

being applied to major international companies and smaller entities alike, banks could perhaps be forgiven for taking a low/no-risk approach to onboarding SMEs, especially as they have historically been more expensive to service, anyway.

Hal Lonas, chief technology officer for global identity verification (IDV) platform Trulioo says that needn’t be the case if they let a third-party specialist pipe in the technology that ensures real-time and comprehensive know your customer and know your business verification – in its case, drawing from both structured and unstructured data way beyond the reach of most internal compliance teams.

Trulioo’s data comes from 450-plus data sources in around 195 countries, and, thanks to the company’s recent acquisition of HelloFlow, it can now be offered to customers with a no-code tool so they can bespoke how that information is used in-house, further reducing the cost of customer acquisition.

HelloFlow’s no-code, drag-and-drop solution for customer onboarding, will dovetail with Trulioo’s existing proprietary tools – GlobalGateway, eIDV, KYB and DocV – to assist in both individual and business ID verification to provide a single, holistic IDV platform aimed at saving financial institutions time, money and, potentially, penalties. So, far from retreating from sections of the business community that might have been seen as too difficult to serve because of KYB limitations, the technology can unlock opportunities, says Lonas.

“More and more, the smallest company looks the same as the biggest company; you need to know where they’re doing business, the problems that they’re solving,” he says.

If financial institutions can overcome the onboarding hurdle, then digital enablement will drive the conversion of that business to them.

“A lot of financial institutions looked at SMEs before and said ‘do I want to do business with a smaller company? Is it worth the investment to get them on board?’,” says Lonas.

“Now, with that particular friction point going away, they can look at SMEs as the new greenspace opportunity. With onboarding costs lower, they can afford to really serve SMEs with a much wider range of solutions.”

A tricky balance: If they can reduce the cost of compliance, banks might look more favourably on SMEs

The Russia-Ukraine conflict has added to the pressure that Trulioo had already seen building on banks following revelations contained in the Panama Papers and, later, the Pandora Papers, which exposed the criminal and tax-evading practices of some of the world’s richest, most famous and powerful individuals.

Originally released in 2021, further investigation of the Pandora Papers by the International Consortium of Investigative Journalists, recently revealed that eight executives at five of Russia’s biggest financial institutions – Sberbank, Alfa Bank, VTB, Gazprombank and VEB – had already taken advantage of the opaque nature of the offshore financial system to store their wealth.

“Many businesses underestimate the task of ensuring that those they are onboarding aren’t fraudsters, money launderers,

jurisdictions. And, given the current scrutiny around who the ultimate beneficial owners of businesses are, they must also combine knowing whether a business is legitimate with identifying the people behind it, whether they are legitimate operators and where they are located.”

Outlining how HelloFlow can help in this scenario, Lonas says: “Previously, we brought powerful intelligence to our customers, but had to leave them to piece components together and build specific workflows and actions around them. HelloFlow allows us to build very simple to very complex workflows, to automate those checks on businesses and individuals.

“We’ve given some early demos because, as an agile development shop, we want to get feedback from customers and prospects so that, by the time of the

No place to hide:

terrorist financiers – or, now, linked to Russia,” observes Lonas. “They think they can do it themselves, then find out it’s much more sophisticated than they thought, in large part due to the shifting nature of the regulations.

“Even if they understand it this year, next year it’s a whole new game, as it’s a very rapidly evolving space. With the political landscape these days, and the additional scrutiny on who you’re doing business with, there’s just that much more.

“The identity and verification (ID&V) problem gets exponentially more difficult, the broader the geographic area a firm wants to do business in. If they’re confined to one region or country, it’s bad enough. But as soon as they tackle two, three countries, or several regions, it becomes much more complicated because regulations and sources of information change, country-by-country.

“They have to become expert at pulling this information from these different

writing new code. That’s pretty revolutionary,” says Lonas.

The strong pre-release interest that Trulioo has seen in the product would indicate that companies are both increasingly aware of how worldwide developments will impact ID&V, and of the need to ensure that, by outsourcing the data piece, compliance doesn’t distract them from delivering new products and services for customers.

“We’ve discovered there are a tonne of use cases, even among the biggest customers for tweaking and fine-tuning their onboarding steps,” says Lonas.

“Customers are interested in an automated workflow for things like A/B testing to refine their solutions in terms of forms, order of events, etc. Instead of having to assign a whole development team to take four months to develop that, it might take them an afternoon to get it live.

“It’s a question of companies asking ‘where do we want to spend our time as a business?’. When businesses look at how competitive the environment is, do they want to spend developer time and resources to get to market with a product in a couple of months because they’re building something compliance-related? Or would they rather get there sooner by outsourcing it? I think the decision is pretty clear.”

A lot of financial institutions looked at SMEs before and said ‘do I want to do business with a smaller company? Is it worth the investment to get them onboard?‘ Now, they can look on SMEs as the new greenspace opportunity

general release, we’ll know we’ve built the right thing and that customers will love it.”

The new workflow tool will let companies build bespoke solutions with very little or no code, via a drag-and-drop interface that allows them to choose from data sources using specific criteria.

“Once they’ve discovered the individuals behind a business, they can also then conduct an identity verification – again, simply by dragging and dropping that component – and then overlay the whole thing with their risk tolerance, setting up flags or parameters to alert them in certain situations. It will also enable clients to flow that data into other tasks they want to complete downstream, like linking into a CRM system, but without

For Trulioo, too, the added heft of HelloFlow could be a game-changer.

“We’ve been very mature in the identity verification (IDV) market for several years now,” says Lonas. “Our GlobalGateway KYB product is in very high demand and improving by leaps and bounds. [But] HelloFlow brings higher-level orchestration to the platform for the first time.”

And it comes at just the right moment as regulators react to recent events. However, as Lonas points out, the rules will never be static; the quest for control and visibility never complete.

“Banks either have to deal with all this themselves or find trusted partners like us to work with,” says Lonas. “It’s a case of building that bridge to the future.”

This is where the industry moves forward. From global leaders to new challengers and from tech giants to scrappy startups. No matter who you want to meet across Fintech, transform your business with every connection, conversation and collaboration. Business deals happen here. Buy your ticket to the only Fintech show that matters and get €200 off with this exclusive discount code FTF200.

europe.money2020.com

Does a big bank like NatWest have lessons for challengers when it comes to regulatory oversight? We asked its Head of Digital Jonathan Hall

In March, the Economic Crime (Transparency and Enforcement) Act 2022 came into effect in the UK to make it easier to identify and trace illicit wealth in money laundering and economic crimes. The law was expedited through parliament in light of Russia’s invasion of Ukraine, which prompted the imposition of sanctions on those linked to Vladimir Putin’s regime.

Then, just a month later, the Financial Conduct Authority (FCA) found that some challenger banks need to do more to prevent their platforms being used to commit financial crimes.

The UK finance regulator said they were failing to check customer details properly

and/or had no financial crime risk assessments, although it added that there were signs of good practice among the challengers, with technology being used to identify and verify customers quickly.

The FCA also pointed out that challenger banks are now in a different growth phase – many are no longer the toddlers of the financial system and their internal controls need to reflect the responsibility that comes with size and maturity.

Incidentally, the regulator’s report happened to come out around the same time that Italy’s central bank banned German digital challenger bank N26 from taking on new customers, or offering new services to existing ones, due to ‘significant shortcomings’ in its anti-money laundering controls.

So, where does that leave banks, new and old, big and small?

Jonathan Hall, head of digital at NatWest Group, observes that the incumbent high street banks have been navigating and dealing with regulation

for many years, unlike their younger rivals. Does that put them at an advantage? Maybe.

“I think it’s a strength of those organisations, that we’re able to take the regulation and apply it, efficiently and effectively. Largely, we have that on our side, so we’re not creating something from new,” he says. But he stresses there’s no room for complacency, as NatWest itself found when it was fined £265million last December for failing to prevent nearly £400million of money laundering by a Bradford jeweller who used branches to deposit cash between 2012 and 2016.

Technology and processes have moved on significantly since then, but what it illustrates is that knowing your customer isn’t a one-and-you’re-done exercise at onboarding.

NatWest had adequately risk-assessed the jewellery business when it opened an account. The company managed to fly under the radar because its transaction behaviour and, therefore, its risk status, weren’t monitored closely enough to raise an early red flag.

NatWest Group is the UK’s largest business and commercial bank and counts one in four businesses – from start-ups to multinationals – in the UK and Ireland as its clients. The lion’s share of NatWest’s new customers – 98 per cent – start their application digitally, but Hall stresses it is very much a full-service bank, and NatWest has clear evidence that customers like a hybrid, physical and digital model.

“We recognise that there are segments within a business customer base that are relatively straightforward, and they may feel very comfortable just to service their needs digitally, and we provide propositions for that,” Hall explains.

“But as businesses become more complex, they often find points where they need some extra support. So, actually, having that hybrid model – where they want to dip out of the digital channels and talk to someone, be it a service centre or a relationship manager – we feel that’s the best proposition.”

And it goes to the heart of knowing your customer (KYC).

One of the biggest ongoing challenges facing banks and other financial service providers, believes Hall, is balancing the necessarily strict compliance around KYC and KYB (know your business) with seamless CX. A degree of positive friction can give confidence to the vast majority of legitimate customers who want to see evidence that a bank is taking security seriously; too much can drive them into the arms of competitors.

“Our customers tell us frequently that they find the KYB processes frustrating, they don’t understand why we’re asking for some of the information – they say ‘you should have that already’.

“[But] as third parties develop their capabilities, and with the use of third-party data, we can shorten the onboarding processes, over time. For the more simple and straightforward [business] customers that we onboard, it’s pretty much a straight-through process now. Where there’s a bigger number of key parties, or the shareholder structure is more complicated, that’s where it becomes more difficult. There is still some work to do on that, but

We have zero tolerance for noncompliance.

So that’s our starting point

“How you balance the need to deliver a really good, enduring experience for customers, with the complex requirements of the regulatory environment, and bring those two things together to make sure that you get that right for customers,” says Hall is something his team strives to reconcile daily.

“Banks have to meet those regulatory needs and, at the moment, that drives friction into the process. NatWest and others are still facing into that challenge.

“We have zero tolerance for noncompliance. So that’s our starting point and what we look to do is break down the processes to make sure we understand where the friction is [then] put in place optimisation techniques to smooth the experience for our customers.

the process is still based around the customer, and trying to make it as easy for them as possible.

“We’ve been able to integrate third-party services, through the use of APIs,” says Hall. “It’s now more to do with how we develop and optimise those journeys than it is about anything new.”

And this may well be where incumbents, challengers and technology providers would benefit from pooling knowledge and resources to everyone’s benefit. There is no shortage of third-party specialists in the area of individual and business identity verification services for banks to partner with. Well-known names in the space include Trulioo, TruNarrative, IDnow, Jumio, ComplyAdvantage, Onfido, Shufti Pro, PassFort, and Detected.

NatWest has been working with the regtech HooYu since 2019, when the bank

became the first on the UK high street to offer account opening with a selfie. HooYu verifies new business customers’ identity using digital footprints, ID document authentication and facial biometrics and the smoother onboarding experience across NatWest’s personal and business account opening channels has led to a 33 per cent rise in customer conversions.

“I believe that, through the use of data and partnership with third parties, we can nail frictionless KYB and protect customers from fraud and financial crime,” says Hall.

It’s a bold thought. Successfully balancing compliance and usability is one of – if not the – toughest of digital nuts to crack. It’s resource-intensive, too, and could be seen to divert resources away from other, revenue-generating projects at a bank. But gathering and monitoring the data on which good compliance is predicated and building the fintech and regtech ecosystem that’s necessary to deliver it, is the basis for other, more profitable and customer-pleasing outcomes, argues Hall.

“I’ve a data strategy to take my channels, and build them into ecosystems, initially integrating all of our group products and services into the single channel where our customers go to conduct their finances every day – shifting from perhaps a transactional relationship with the bank today, into one in which we can use data to really generate insights that are relevant and meaningful for customers,” he says.

“For example, we’re looking at more innovative ways in which our customers can make and receive payments. In the business space, of course, it’s about not just making the and receiving the payment, it’s about how you then help businesses reconcile that in the back end. We can make their lives easier there, too. Another example would be around sustainability.”

The NatWest Carbon Tracker app, currently being trialled among SMEs in the manufacturing and transport sectors, has been developed in partnership with Cogo to estimate their carbon footprint, help manage it, and then offset it, if they choose.

“So, using data to help them manage their business and thrive. That, for me, is where we’re heading,” says Hall.

Perhaps that’s the pay-off from taking such a close interest in data to meet compliance needs – and it’s the lesson for challengers that have failed to give it the attention it deserves.

Integrate everything. Automate anything.

A new breed of fintech is transforming lives in India by turning the traditional education lending market on its head and releasing millions of dollars to students who’d never otherwise have been able to study. Swati Sanyal Tarafdar talks to the entrepreneurs driving change – and one of the students to benefit from it

To jumpstart her career in management accountancy, 35-year-old Aanchal Mahapatra finally enrolled for a specialised international course in 2020.

She had been wanting to do so for several years but her financial responsibilities and the meagre salary in her job at a textile firm, were hindering her dreams. As the pandemic hit India in March 2020, and work from home became the norm, Mahapatra found time to reflect on what she was doing with her life. The current job was also hanging by a thread, forcing her to make some tough decisions.

As she explored options for financial help – because the two-year course cost half her annual salary – she came across a digital lendtech that offered short-term and unsecured educational or upskilling loans.

“I was in two minds. I have seen how tough it was for my cousin, a meritorious student from one of the premier engineering institutes in India, to secure a loan from an Indian PSU [a public sector undertaking, wholly or partially owned by government] around 10 years ago,” Mahapatra says, recalling how stressful it was to queue up in the banks and various government offices for days to obtain necessary documents and to understand the various terms and conditions set out.

“I always accompanied my cousin and uncle on these trips. They didn’t feel good. Somewhere inside, we felt a loss of dignity,” she adds. “Fortunately, my cousin’s father had their own house to offer as a moratorium. I still don’t have that.”

That experience had led Mahapatra to sacrifice her hopes for a higher education, and saw her enter the job market instead.

“Big dreams were not for people like us,” she tells me.

But now she began to think again.

“Loans are a scary subject in Indian middle-class households. We often need them, and we often fall victims to them,” she says, referring to hidden and exploitative terms and high and informal rates of interests. But these new lendtechs seemed upfront and friendly. Moreover, they often came through the institutes offering the courses, and that gave her confidence and made the application process easier.

Big dreams were not for people like us… Loans are a scary subject in Indian middle-class households

Aanchal Mahapatra

“They didn’t ask for any out-of-the-way or difficult documentations – in fact, once I had managed to get the papers scanned and digitised, my loan application was done within 10 minutes,” Mahapatra adds.

The repayment amounts are variable, and are based on a current income and potential future income formula.

“Repayment started after four months. Initial sums were smaller, and they would go up once I finish the course, on the assumption that, by then, I’ll manage to secure a higher-paying job,” Mahapatra explains. “It still gives me chills, but I am able to manage my finances a lot better now.”

She has little to worry about, because, with her newly acquired skills and armed

with a potential higher education accreditation, Mahapatra is already appearing for virtual interviews with multinational companies that promise better pay packages.

According to the All India Survey on Higher Education (AISHE) 2019-20 report, published in June 2021, the gross enrolment ratio (GER) in higher education in India is 27.1 per cent. The GER is the ratio of enrolment of people in higher education in relation to the population at large in the eligible age group, which is 18-23, in India. Corresponding global rates range from around eight per cent in sub-Saharan Africa to 75 per cent in Europe and North America.

The education finance scenario in India is primarily driven by the socio-economic profile of students and their cost of education. Private education, and technical, professional and vocational courses are usually expensive and require external financing. Traditionally, Indians recoursed to public sector banks (PSBs) for financing higher education – PSBs had been responsible for almost 95 per cent of the education loans.

The other common financing options were direct student loans from nonbanking financial institutions or informal sources, such as borrowing from friends and relatives, credit card borrowings, and secured loans against properties.

Over the years, however, PSBs started to shrink away from small-sized education loans, as these unsecured loans with no moratorium attached to them were the ones people mostly defaulted on. Borrowers used these smaller loan packages to cover basic education, such as graduation courses (10+2+2 or 3 years in college), which had lower employment opportunities. No doubt these were pushing banks into an unending spiral of non-performing assets.

After 2010, as the fintech waves started settling down in India and

the start-up scene began to show promise, tech-leaders identified this hugely untapped segment of lower loan packages for education and upskilling, and started working towards filling it through creative ways that might suit the domestic education market.

“We were surprised by the huge gap in the domestic education finance market in India,” says Victor Senapaty, co-founder of Propelld, an Indian ed-fintech focussed on supplying the entire domestic education market with highly customisable products.

“Finance penetration in the domestic education segment was hardly at the two to three per cent level, whereas, in developed countries like the US or UK, it was at 60-70 per cent or even higher. We believe that financing is a tool that can enable any ecosystem, so we focussed on the domestic education market.”

Many more creative solutions started cropping up – some worked as marketplaces and some as aggregators. What followed soon was a paradigm shift in the way lending for education was viewed. A new breed of ed-fintech companies with an empathetic approach to lending started to emerge.

“When we launched in 2015, our objective was really to help students find the right source of funding. Initially, we just listed different scholarships on our website, and we continue to do so, hoping some students might obtain

We were surprised by the huge gap in the domestic education finance market in India

Victor Senapaty, Propelld

meaningful amounts,” explains

Ankit Mehra, co-founder and CEO of GyanDhan, which calls itself India’s first-ever education financing marketplace for both the domestic education segment as well as those opting to study abroad.

The domestic offer specifically caters to finance upskilling and vocational programmes, or specialised coaching programmes for competitive exams. These are relatively shorter programmes with a clear outcome. The loan sizes vary from INR 20,000 (around £200) to four lakhs (£4,000). Typically, repayment time for these loans are one to one and a half years.

For these loan parcels, GyanDhan, a nonbanking financial company, works as a lender itself, and earns from the processing fee, and sometimes interest on the loans.

borrowers’ income-earning potential and when will they be in a position to repay this debt?” says Mehra.

What has continuously been overlooked is the income-earning potential of the candidate themselves

Ankit Mehra, GyanDhan

What these new-age ed-fintech have broken here is the link to any moratorium.

“If you go to the right school with the right credentials, then you can get loans without collateral as well at this point in time,” say Mehra. “What has continuously been overlooked is the income-earning potential of the candidate themselves. That is the key factor we’re looking at, alongside what their current salary levels are, what their current obligations are, what their repayment history has been like.

“But the one big difference for us is actively trying to understand whether this course will materially change the

This change of outlook has resulted in both a market expansion as well as a changing demographic in terms of the economic profiles of the candidates choosing to get skilled or educated. Often these loans are divided into phases or spread across semesters, and the assurance of a future loan depends on the borrowers’ performance at class plus repayment behaviour –ensures a higher rate of success for all concerned.

When it comes to funding study abroad, GyanDhan funds students going into higher education. The average loan size is INR 30 lakhs (£30,000) and repayment is over a period of seven to 15 years. For these high-end products, GyanDhan acts as the bridge between individual clients with established banks who provide secured loans against a moratorium.

“Customers come to us for these because of the convenience we offer. Even if they are not eligible for a loan, at least they’ll get the answer immediately,” says Mehra.

Then there’s the clarity on the product itself. “Your experience could vary

significantly, over years, across banks. For us, our customers are the whole focus. We understand the product, the need of the customers, and match them accurately.”

Historically, in India there have been challenges to do with communication around financial products. By tying up with PSBs, Mehra says GyanDhan smooths out all the friction points. “We look at the analytics and say, what can be improved from an operations standpoint?”

While digital-first, it collects necessary documentation from the end-clients’ doorsteps, and that makes a huge difference.

“The traditional way in which a banking system looks at a client is as a bank statement – or their parents’ bank statements – in order to assess their ability to pay back a loan,” agrees Senapaty.

“They’ll look at particular collaterals. But we are looking at our clients from a different lens – as someone building their capacities and skills to increase their worth. And, if financing them involves risk, can we distribute the risk if we work along with the institute with which our clients are working?”

If an educational institute promises potential clients a job after the completion of a certain course, these new ed-fintech companies make them put their money where their mouths are.

“The individual may not have the current balance sheet to support a loan today, but, if the Institute is promising a secure job after the candidate attends its courses, the clients will have a higher return in future,” reasons Senapaty. “This also means that the risk is divided. The placement risk is with the Institute, contractually. If the Institute fails to secure my client a job, the institute should repay me the loan.”

Similarly, Mehra adds: “In the domestic space, we operate a B2B model. We don't accept applications from individual customers. We first onboard specific training institutes. Students admitted to these training institutes apply either directly to our website or through that partner.”

One of the main challenges ed-fintechs faced initially was convincing educational institutes to partner with them.

“It took a lot,” says Senapaty. “The entire education ecosystem had been overlooked in terms of adequate financing and the education institutes have faced a lot of challenges. The traditional financial system has not been helpful for them. So, when a young start-up says that I'm going to solve your problem, they’re going to be sceptical.”

But, he argues, the result is an improved conversion rate of applicant to student for the institutes, while the cost of conversion also decreases. Their go-to-market strategy becomes better, and they can now think of investing in the quality of their courses

rather than focus on receivables, cash flow management, etc.

“Overall, it becomes a structure where every stakeholder has some skin in the game, and it’s a win-win for everyone” says Senapaty. “That was the intent and that's how we started building the product. But it takes a lot of tech capability.”

Unlike GyanDhan, Propelld focusses purely on the domestic education market. Every segment has a different level of risk and requires bespoke products accordingly. But, having delivered results for their partners, Senapaty says Propelld is now seeing more educational institutes approaching it, asking to collaborate.

The use of technology has accelerated a mindset change, post-COVID, but what’s really driving these new partnerships is improved cashflow management and the ease of doing business for the educational organisations, he says.

“The effort of enrolling a student is far less onerous now because they can offer reliable finance solutions for the students at the same time as they offer admission – that’s made it easier for the educational institutes to trust the new system.”

Essentially, this new generation of edu-fintech offers finance solutions that were mostly absent for Indian students and mid-career professionals looking to upskill.

What was earlier ‘financial support for the meritorious’ became ‘finance for anyone with a promising future’, defined as a new job or better role, while tangible assets and parents’ payslips stopped becoming the criteria for loans.

And, the really big difference, Mehra explains, is that they are zero interest loans.

“If you buy a mobile on Amazon now, you can pay INR 30,000 by cash upfront, or you can convert it into installments of INR 5,000 payments for each of six months. That’s exactly how it works in the domestic sales space for most of our loans,” he says. The companies get their revenue from the institutes. So, the end consumer is better off than if they had applied for a personal loan to take the course.

Demand for education loans in India rose exponentially in 2020 as the population focussed on skills development and increasing capabilities during an uncertain year. Education loan companies, including banks and non-bank lenders, had disbursed INR 11,000 crore (GBP £10,91,345) in loans by September 2020 and more than 3,00,000 new borrowers had signed up, according to data from CRIF High Mark, a credit bureau.

Helping to drive that demand were new-age edu-fintech companies, acting as the bridge between willing students and educational institutions. So, now it is possible for people like Aanchal Mahapatra to dream of a secure, better future.

The US Federal Reserve estimated that in quarter three of 2020, student loans exceeded US$1.7trillion, showing an increase of nearly four per cent, compared to quarter three of 2019.

In 2020, 55 per cent of bachelor degree recipients took student loans, graduating with an average of $28,400 in federal and private debt. About 14 per cent of parents with students in the class of 2019 took an average of $37,200 in federal loans.

COVID certainly was responsible for a part of this, but data shows student debt have been on the rise in the US for decades. It increased by approximately 102 per cent between 2010 and 2020.

Noticing this trend, lendtechs like SoFi, were quick to innovate, creating new ways to service the education loan

segment in the US with no-fee, fixed and variable rate deals for first and second degrees and professional upskilling. A US government-imposed pause on all federal student loan repayments since COVID has unsettled the market, but SoFi’s success so far means there is now a multitude of companies financing education loans in the US in creative ways.

In Asia, it’s recognised that education can empower and transform lives, especially those in the lowest income households, who are also least able to pay. Schools struggle with cash management issues there, too, and lendtechs are bridging these gaps.

In Indonesia, for example,

the cost of higher education reaches up to US $5,000 a year, while the average Indonesian family earns just US 2,700 a year, which goes a long way to explain why enrolment rate falls from 97.2 per cent at elementary school to 31 per cent at university level.

In the UK, the first regulated peer-to-peer lendtech to focus exclusively on funding postgraduate study and professional qualifications, launched in 2019. Like India’s GyanDhan, the Lendwise model is built on the premise that its borrowers, who were being under-served by high street banks, are likely to be in a better position to repay over time.

UK banks of all shapes and sizes are turning to Cloud environments as they search for scalability, operational efficiency and resilience. We asked Gary Delooze, CIO at high street building society Nationwide, and Wayne Freeman, CTO of NatWest’s neobank for SMEs Mettle to tell us more about their organisations’ experiences

The narrative around digital banking usually focusses on the idea of incumbents with creaking legacy systems and entrenched cultures, versus challengers with a flexible mind-set and even more agile tech. But that polarity is fast becoming old news.

Because, while it’s clear that established financial institutions must indeed change in order to compete, the use of Cloud services – once a critical point of difference – is increasingly common to both , even if how they choose to deploy them often differs.

Some established institutions have weighed the cost of migration in terms of both cost and risk and chosen to launch Cloud-based brands, at arm’s length of ‘the mothership’. To name a few, JP Morgan launched its digital banking brand Chase in the UK (following an unhappy experience with its US digital bank Finn), Goldman Sachs similarly sent Marcus speeding into UK waters, while Standard Chartered floated Mox in Hong Kong, and NatWest entered the digital SME banking space with Mettle. Others, like the UK’s sixth biggest bank Nationwide, have chosen instead to focus

internally on transforming both culture and technology. Whether you’re a startup, a digital-only neobank, a long-established institution or one of their speedboats, you can tap into the Cloud to drive growth.

Nationwide made a conscious decision to switch to the Cloud around five years ago and its journey is ongoing; NatWest’s digital offshoot Mettle, meanwhile, was born into an on-demand IT world – it knows nothing else.

We were keen to find out from both how their differing experiences shaped their strategic approach to using Cloud services in relation to regulation, data privacy, and the ability to offset build and running costs by integrating third-party services through APIs.

As we discovered, while they share some similarities, they’ve each have their own challenges and perspectives.

Nationwide is the largest building society in the world; a mutual owned by its 16 million members.

Historically, a very high-touch, branch-heavy business, its digital transformation into a full-service bank began more than a decade ago. But its experience of the Cloud is relatively recent.

“We’ve been progressively adopting Cloud for the last five years or so,” says Gary Delooze, chief information officer, Nationwide. “Today, we probably run about 20 per cent of our IT estate on public Cloud services, and that will increase over time.”

In March 2019, Nationwide took a £15million stake in 10x Future Technologies, the fintech start-up founded by former Barclays boss Antony Jenkins, with the intention of using the 10x Cloud-native platform as a springboard into the business banking market. The idea was to offer an array of modern mobile and online services aligned to Nationwide’s branch-based network. But then COVID-19 hit and the business plan no longer stacked up.

The bank subsequently also invested in Cloud-native payments technology firm Form3, sending a clear signal that it,

believes Cloud is the future. And it certainly proved its worth for Nationwide during the pandemic, helping its members to cope with financial distress.

“Our initial response was to use the contact centres, and the branches that were open to help. But, of course, they were inundated very quickly with demand for payment holidays,” recalls Delooze. “So, we instead built a number of digital journeys on our Cloud platform to allow members to access products and services.”

It also quickly scaled up its Cloud-hosted Microsoft Office 365 and Microsoft Teams pilot to enable all 15,000

employees to access it, facilitating a smooth technology shift to homeworking. “The transition was seamless,” says Delooze. “If we’d tried to do that on-premise, we’d have been building infrastructure for months.”

Then, in December 2021, Nationwide announced it had moved its member website to Microsoft’s Azure Cloud to cope with the organisation’s increased size and complexity. As it ventures deeper into the Cloud, the bank has teamed up with Cloud-based service providers like regtech Jumio. It enhance Nationwide’s online onboarding process, using AI and machine learning to check that documents used by customers to open accounts are genuine, integrating with existing workflows via an API.

Gary Delooze, Chief Information Officer, Nationwide

Gary Delooze, Chief Information Officer, Nationwide

QWhat have you learned from Cloud migration in relation to compliance?

The challenge in a public Cloud environment is that you’re taking on much more risk. You’re hosting your technology in someone else’s data centre, you’re running it on their services, so that risk requires a set of solid controls to be built around it.

The focus of our journey has therefore been on differentiating the risks from our on-premise capabilities. This includes making sure we don’t lose data, and we don’t get hacked. The kind of controls that we look at are everything from encryption, typically, of data in transit and data at rest, to make sure that, if there is a breach, and someone accesses that information, it can’t

be read, to tokenising, to make sure that we don’t connect personally identifiable information to transactional information.

When you’re building more complex controls – around things like encryption and key management – on-premise, it becomes hard to wrap legacy technology up in some of the newer technologies to protect it. What Cloud gives us, in many respects, is the ability to access some of those technologies as a service.

QHow can Cloud technology improve operational efficiency, whilst also boosting your ability to fight off threats going forward?

The big focus in banking technology, for the last five or six years, has been around operational resilience, and making sure that institutions can provide services to customers 24/7. It’s, of course, been a big shift for us from a 9-to-5 banking model to a 24/7 banking model, but our members assume we’ll be there whenever they need us. They expect their payments to be made and to see balances updated instantly.

So, as we’ve rolled out more banking apps, and more capabilities, operational resilience is, therefore, crucial. It’s the ability to make sure we’re providing those services, and, where we see issues and challenges in our technology, overcome them to continue processing.

What Cloud gives us, in this context, is the ability to engineer solutions for fault tolerance, so if one part fails the rest can deliver, but if more faults occur then we can degrade gracefully. Technology breaks can happen over time. We therefore need to build in a way that makes sure we have stand-in processing

capabilities available, or that there’s sufficient resilience in the design so that when one part fails, the rest can deliver.

When we start to deploy containers of code into the Cloud, we can build clusters to allow for the loss of any one of them to be tolerated. Cloud providers have put a lot of investment into creating really resilient environments, with multiple zones and multiple regions.

Deploying containers into multiple availability zones means that, if the Cloud provider loses a single zone, then that service can be delivered from the second. Beyond that, we can build a multi-region solution. So, we now have the ability to tolerate failures from the lowest component level, all the way up to the loss of multiple data centres, across multiple zones – and globally, if we go multi-Cloud.

The key thing is that just lifting and shifting existing capabilities into a Cloud doesn’t solve anything. To get to that level of capability, you really have to re-engineer and re-architect what you have, and build it Cloud native, to get access to those benefits.

QHow has Cloud-based infrastructure enabled Nationwide to accelerate innovation?

It gives us tremendous agility. The speed at which we can mobilise Cloud environments and build new services on top of them, is far greater [than on-premise].

The simple fact is that a lot of the latest innovation is occurring in the Cloud. This is providing us with access to new data services, everything from cutting-edge AI algorithms through to alternative ways to manage our code. It provides a wealth of opportunities.

Mettle is a standalone app-only business bank, focussed on freelancers, sole traders and small businesses – what it refers to as ‘the passion economy‘ – that was soft-launched by NatWest in 2018.

Through its link to the bigger bank, Mettle is able to offer customers access to Free Agents accounting software free of charge, and this ability to leverage such assets while remaining independent helps set the brand apart.

“Mettle is in a unique space, as part of NatWest,” says Mettle’s chief technology officer Wayne Freeman. “This gives us the best of both worlds: not only can we draw on the vast experience of the bank, but we have the agility to innovate rapidly, building compelling products for our customers. We’re passionate about protecting our customers’ data and their privacy, which is, of course, fundamental to the fintech industry’s credibility and survival.”

Cloud-native Mettle hasn’t had the smoothest start to life, having to more or less immediately deal with the pandemic’s impact on business customers and the wind-down of NatWest’s challenge-tothe-challengers, Bó, whose accounts were merged with Mettle. That said, it appears to now be flying, having announced a 500 per cent growth in its customer base since the start of 2021.

Part of its success has been due to the ability to seamlessly integrate value-adding third-party services. This includes using Slack to ensure its internal

and external communications are on point. Initially, Mettle used Slack for collaboration across its teams, but as the business has grown, it’s efficiently integrated the majority of its businesscritical tools into Slack and created hundreds of custom apps of its own.

Without leaving Slack, Mettle’s employees can now monitor customer satisfaction in real time, quickly resolve incidents and manage the software production cycle. Mettle highlights Slack as a ‘springboard to productivity’, and claims that resolution times are now ‘a matter of minutes, rather than hours’.

Wayne Freeman, Chief Technology Officer, Mettle

Q

How has Cloud helped you deliver customer value through partnership? We use a wide range of partners to serve different needs for our customers, and for the organisation. One of the real benefits of agility is that if we’re not happy with a particular partner, we can swap them quickly. We leverage multiple Cloud providers to host our platforms, but we also partner with a number of software-as-a-service (SaaS) providers, who are all Cloud-based. Without the Cloud, such interactions simply aren’t possible.

Q Would you describe Mettle as being a technology-first organisation and how does that affect the structure? Technology has long since stopped being just a cost. It is central to building digital

products and, because of that, the CTO role, I think is now a pivotal one in enabling organisations to delight their customers. So, the technology strategy must be aligned with the product strategy, and the commercial strategy, as well.

For customers to get a really great experience, the CTO needs to work very closely with the other execs. Product and engineering, in most of these organisations, are very much intertwined, and we must jointly own the customer experience, as well as looking after the privacy, the security, and other non-functional requirements.

QGiven the strict regulations around upholding data privacy and minimising data breaches, is it getting tougher for newer fintechs to get on the scene and are we going to start seeing a reduction in fintech ingenuity?

New entrants obviously have to take into account all the appropriate regulations, which means it might get tougher, over time. But they also have the advantage of starting from scratch, and building their products and their organisations with agility in mind.

They should consider building security and privacy by design. Many fintech organisations, and Mettle is one, are built for constant change. Our agile customer-centric product development processes, our modular componentised architectures, and our continuous integration and deployment of code all come together to enable rapid change.

Interestingly, as part of the NatWest Group, we’ve had to find new ways of meeting regulatory and the Group’s own policy requirements, in a different way to possibly how it has, in the past. This has involved highly collaborative, multidisciplinary teams, new processes, new technology, and new partners – just because we’re organised differently and operate in a different way.

For customers to get a really great experience, the CTO needs to work very closely with the other execs. Product and engineering, in most of these organisations, are very much intertwined

Regarding ingenuity, in financial services, there are a growing host of partnerships available. You no longer need to build everything in-house. New tools are being brought online every day to solve specific regulatory challenges, and I think being able to integrate quickly with the right partners is actually the advantage.

Given our link with NatWest, we’re able to rely on that organisation’s

historic experience in customer onboarding, risk and cybersecurity. We also have a very rigorous process we go through during the engagement of any potential new suppliers, and their cybersecurity capabilities, and the way that they look after their customers’, or our customers’ data, is absolutely at the top of this.

Q As customers become more aware of the value of their data, is a strong data security offering actually a customer demand, almost like a customer experience?

Certainly customers are now rightly questioning big tech and data collection. We should expect this trend to grow, as mass awareness of the power of data will only increase.

I therefore think that strong data security should be a top priority for any business working with customers’ data. That’s why we’re seeing growing regulation, when it comes to data and security, to prevent fraud and criminal activity, particularly. With the increased reliance on mobile applications, fintech users are potentially at a higher risk of cyberattacks, which we’ve seen during the COVID-19 lockdowns.

As a result, we’re seeing more and more regtech companies, which are

S panish headquartered financial services giant Banco Santander – one of the world’s top 20 banks – revealed in May that 80 per cent of its core infrastructure is now operating in the Cloud. One of the first major banks to digitise its core banking platform, it’s using proprietary software, called Gravity, and a team of 16,500 in-house and third-party

essential in the digitally-led financial space. Regtech organisations improve other organisations’ ability to comply with the most important rules, such as KYC and suspicious activity reporting. I read recently that regtech companies raised US$8.3billion in 2020, up from US$7.2billion the previous year. So there is obviously a growing market to serve others seeking to protect their customers.

Does automation actually allow organisations to action their customers’ data? Can we get to a point where an organisation can have access to all this data, but not actually need to see it? That surely has to be the goal. No one inside any organisation should have access to sensitive customer data, unless there’s a very good reason to do so.

Automation through technology can enable us to collect, process and eventually dispose of data, without unnecessary human access. But, practically, there are times when staff may need to see customer details and transaction details, for example when a customer is requesting to change their personal details. Or potentially during an investigation into some suspicious activity and financial transactions.

But I think, as an industry, we’ll continue to strive to reduce the need to have access to sensitive data.

developers and engineers to further its ambition to become ‘the best open financial services platform’. Gravity is key to a €20billion digitisation programme that will see the bank adopt a common tech stack ‘utilised across the group's footprint for the benefit of both customers and shareholders’, the bank said. Santander has a hybrid private and public Cloud strategy, currently using AWS and Microsoft Azure.

Digital engagement in banking has significantly increased over the past year, with the bulk of this new usage happening on mobile apps. Even among baby boomers, 37% said they are using mobile banking apps more in the past 12 months than they did previously. Find out what this means for customer loyalty www.mobiquity.com/ banking-infographic

Mobiquity’s digital offerings cover the full range of digital banking requirements including: digital omnichannel setup for customers and employees, greenfield digital bank setup, and incumbent bank digital transformation.

Digital banking strategy

API strategy & development / Open Banking implementation

Cloud foundation setup & cloud migration

Confirmation of payee service

User experience design

Next gen core banking implementation

Digital onboarding & e-KYC

Digital Innovation Labs

Good for the bank, good for customers: TSB has chosen a multi-Cloud environment

TSB has managed to deliver a workable hybrid of digital banking and a modernised branch system by successfully balancing on-premise, managed services, and Cloud technology. Head of Digital Sales and Growth Kavin Mistry outlines its approach

Digital transformation isn’t easy, in fact it’s blooming hard, especially if you are a traditional bank with more than 5.2 million customers, and a UK-wide network of 290 branches. That’s been the challenge for TSB.

A completely uninterrupted ride to the Cloud has been demonstrably hard to achieve for many incumbents, which is why TSB was keen that its current march towards becoming a fully digital bank goes smoothly for staff and its customers.

TSB’s banking platform is based on a multi-Cloud strategy: AWS, IBM Cloud and BT Cloud. And it wanted to be sure that, if a problem arose across any of its IT environments, the system surfaced it immediately – preferably, before customers were impacted.

So, in early 2022, TSB brought in DynaTrace, which was described by one executive as the ‘killer app’ to assist in this ongoing Cloud journey. DynaTrace is its spy in the Cloud, observing each step of

the customer’s digital journey, and delivering real-time insight into performance, availability, and potential issues in the user interface. That way, the bank’s IT teams can prioritise their focus on service enhancements that will have the biggest impact on customer experience.

We spoke to TSB’s head of digital sales and growth Kavin Mistry who told us how the need for digitisation went hand in hand with customer satisfaction and confidence in the bank – across all of its channels.

THE FINTECH MAGAZINE: With the increasing competition from fintech challengers – and a change in customer habits – how important has it been for a legacy bank like TSB to embrace digital transformation?

KEVIN MISTRY: There is, of course, the competition element, which we are aware of, and actually welcome, but overarching all of that is a recognition that there has been, in recent years, a real shift in

customers’ and general population trends, in terms of how people choose to live their daily lives. The pandemic has altered everything and banking is not immune from that impact.

We are seeing now that 90 per cent of our servicing transactions are done digitally. More than 75 per cent of our new product sales are coming digitally, and, of that, 80 per cent of those come through the mobile channel. We also don’t want to forget the overall digital ecosystem with customers using different digital channels in different ways. So we have more than 60 million visits to our website, which is clearly a key source of information for new customers to understand more about TSB and what we can offer, but also for existing customers to service their accounts.

It’s important to note that customers are using multiple channels, depending on what their need is. Increasingly, they are willing to embrace the digital channels to do their everyday banking; but also having that human touch, where they may have more complex needs, is important. For example, big one-off purchases, like buying a home, may require more face-to-face interaction as will more sensitive needs, such as a bereavement in the family, that can lead to many complex financial situations, so it probably warrants more face-to-face and human contact.

FF: That’s an interesting point you make about customers still needing face-to-face contact, especially as the number of high street branches across the whole sector declines. How do you square that paradox when discussing the digitisation of TSB’s offering?

KM: I think it’s important to look at the role of the branch in this context, with the role of physical presence versus digital presence evolving in recent times. Previously, you would have customers who maybe stuck more to their channel of choice, say doing all of their banking through branches and branch colleagues. They naturally would’ve been more reticent to deal with banking themselves. Whereas, what the pandemic appears to have done is to put the onus on customers to do some of their everyday banking digitally and more remotely, using things like the TSB mobile app. But for more complex needs, they can visit a branch, or speak to somebody on our telephony lines.

In this new environment, the branch provides more of a support structure for customers who are interested in digital adoption, but are afraid to take those first tentative steps. The onboarding journey that we have launched is actually being used in our branches, so that customers can self-learn, and self-apply, to get themselves well-versed in how to use not only the onboarding journey, but the mobile app, too, more holistically.

We’re offering a hybrid approach of digital complementing a face-to-face modern branch network, providing customers the best in both digital and traditional banking.

TFM: You mentioned TSB’s digital onboarding, what are some of the friction points for an organisation of your size?

KM: We think about this in two different ways – protecting the customer and helping customers navigate what can be quite a complex landscape. From a friction point of view, we try to allow the customer to have all the information at their disposal, in order to make an informed decision on which product they would like to go for. We like to make it very clear, and very intuitive. We want the customer to make that choice, in terms of what is the right product that suits them.

A blended approach:

TSB’s Cloud architecture helps support both physical and digital channels

The second thing is recognising that navigating an onboarding journey, historically, can be quite cumbersome, so we have used a lot of research to inform our design, to make that as slick and as easy as possible and very intuitive. At the same time, we wanted to address some of the other things that customers find quite challenging, like issues around the know-your-customer and identity and verification process.

And finally, I think we remember that it’s not just important to focus on the onboarding journey; we also look at what comes after that for the customer. For example, we give very clear information in the journey about when to expect their various bits and pieces through the post. We’ve also followed that up with a review of our welcome experience for customers, so that the customers can not only make the most of their banking experience with TSB, but they can also make the most out of the product they have secured from us.

TFM: One would suspect that one barrier to some customers digitally onboarding is concern around security. Tell us more about your partnership with Onfido, which seeks to alleviate those fears while ensuring a quick and satisfactory onboarding experience.

Remember that it’s not just important to focus on the onboarding journey, we also look at what comes after that for the customer

We provide very, very clear instructions, and allow for feedback loops, so that the customer doesn’t make a mistake – and they can get the decision pretty much instantaneously with zero friction.

There is also the daunting nature of credit decisioning, so we’ve strived to provide very clear instructions about what we are actually doing at our end, and how that can affect the customer, before we make a decision for them.

KM: As you say, we’ve partnered with Onfido to provide our verification process and this allows customers to access mobile banking in just 10 minutes – that involves just 22 questions to open an account, but with security front and centre. We check that the customer’s ID is genuine, matching it to the user’s face using biometric technology and there is also email and device verification for increased protection. Behind the scenes, we also have anti-money laundering checks, industry-wide fraud checks. But all of this is performed quickly and efficiently, meaning we’re one of the first high street banks to have instant mobile registration through the signup journey. That also means that customers don’t have to wait to receive an activation code in the post; after 10 minutes, they have instant access to the TSB mobile banking app and their account details.

Underpinning everything is Cloud technology, which actually allows a lot of those complex processes that happen behind the scenes to occur much more quickly and at scale. And so, when we are fully ramped up, and delivering thousands of customers’ onboarding experiences simultaneously, we don’t have those annoying, nagging glitches that some customers experience.

ARE LEGACY SYSTEMS HOLDING YOU BACK?

IF YOU’RE READY TO EVOLVE, WE’LL GET YOU TO THE FINISH LINE. FAST. Our cloud payments as a service allows you to accelerate innovation and serve your customers like never before. So, what’s holding you back? Visit volantetech.com.

IF YOU’RE READY TO EVOLVE, WE’LL GET YOU TO THE FINISH LINE. FAST. Our cloud payments as a service allows you to accelerate innovation and serve your customers like never before. So, what’s holding you back? Visit volantetech.com

BaaS Provider

PaaS Provider

BaaS Provider

PaaS Provider