CONTENTS Our vision, mission, values and heritage 11 The year in numbers 03 Foreword from the Chair 05 Vice-Chancellor’s review 06 Delivering our strategy 13 Education and student experience 18 The view from the deans 26 Research and innovation 30 Valuing our people 46 Sustainability and environmental impact 50 Managing risk 54 International engagement 58 Corporate Governance Statement 62 Financial statements 83 Building strong relationships 39 Welcoming our new Provost 10 Financial review 73

in the UK, National Student Survey overall rankings1 alumni in 187 countries overseas students research income philanthropic support raised from donors in the world, Times Higher Education Impact Rankings 1 All higher education institutions, excluding specialist providers 2 As measured by grade point average (GPA) for employability in high-skilled jobs, south-east of England, HESA Graduate Outcomes survey undergraduate students postgraduate students employees2 for quality of research outputs in the Research Excellence Framework 20212 9TH 55TH 2ND 136,000 5,006 £41.3m £7.74m 11,418 4,230 3,064 TOP 20 THE YEAR IN NUMBERS 03

1891

OUR STORY SO FAR

Battersea Polytechnic Institute, the forerunner to the University, is founded.

1966 Royal Charter establishes the University of Surrey; construction begins on the new campus in Guildford, Surrey.

1968 Students arrive on the new university campus.

1985 Surrey Research Park’s first tenants take up residence.

1995 The European Institute of Health and Medical Sciences is established.

1998 HM Queen Elizabeth officially opens the Surrey Space Centre.

2010

Surrey Sports Park opens; Guildford School of Acting (GSA) merges with the University.

2015

HM Queen Elizabeth opens the School of Veterinary Medicine’s new buildings; the 5G Innovation Centre (5GIC) officially opened.

2016

Surrey is named University of the Year and University of the Year for Student Experience in The Times and Sunday Times Good University Guide.

2017

Innovation for Health laboratory opens, advancing learning in medical engineering and physical sciences.

2020

Kate Granger Building, home to the School of Health Sciences opens; the new 6G Innovation Centre (6GIC) is launched.

2021

Surrey named University of the Year for Graduate Employment in The Times and Sunday Times Good University Guide for 2022.

2022

New Surrey School of Medicine announced, to begin training doctors from 2024; the Institute for People-Centred AI and the Institute for Sustainability open.

04 CONTENTS

THE FINANCIALS

FOREWORD FROM THE CHAIR

In 2021-22 we began to deliver on our Forward Thinking. And doing strategy.

Having laid the groundwork for success in the previous academic year, I was delighted to see the University already achieving some of the goals we set.

We improved our ranking in the Research Excellence Framework 2021, a testament to the investment we’ve made in cross-disciplinary research and innovation. And we significantly increased our student satisfaction scores in the National Student Survey (NSS).

These are two critical benchmarks that reflect our core mission – to deliver a great student experience and to create new knowledge and impact through the research we do. It’s especially gratifying to see that our students appreciate the efforts we made to improve during a difficult time when the pandemic continued to affect our services.

Our greatest impact lies in what our students go on to do when they leave the University. I’m proud that our graduates continue to be attractive to employers, which was reflected in another strong performance in the Graduate Outcomes survey.

I also welcomed the announcement that we will open a new School of Medicine, training new doctors for the first time from 2024. The last couple of years has taught us the importance of our health services and the need for well-trained nurses and doctors.

I can’t think of a greater contribution we can make as a University than adding to the talents we already produce through our nursing and paramedic graduates. Our medical degrees will integrate the latest medical technology and artificial intelligence (AI), creating doctors who can meet the needs of patients in the 21st century.

During 2021-22, we created a new pan-University research institute, The Institute for People-Centred AI, and announced the Surrey Institute for Sustainability, to open in late 2022. These are examples of how our academic mission can reach out across all disciplines, sharing knowledge, innovation and ideas in key areas of development for the future of our economy and society.

All of these achievements are a testament to the leadership provided by the Vice-Chancellor Max Lu

and the Executive Board. I was glad to see the executive team strengthened with the appointment of a Provost and new faculty deans bringing a wealth of academic, research and commercial experience to the University. I’m confident that they will continue to deliver excellent programmes for our students, while also helping to spur future economic growth.

During the coming year I will step down as Chair of the Council after four years in the role and a total of nine years serving on the Council. I’m glad to say that as I leave, the University is very well placed to take an international leadership role in both excellence of its teaching and the high quality of its research across a broad range of disciplines.

Following the refinancing we arranged last year, the University is in good financial shape, while the governance changes we put in place in 2020-21, including the new structure of the Council and committees, have been highly effective. I am delighted that the University has found such an able candidate to replace me in Charlie Geffen, who has extensive governance experience in the private and charity sectors.

I also step down this year as head of the national Committee of University Chairs, a role that has given me a wider perspective on the sector. As I do so, I’m more convinced than ever that universities are an immense national asset. They are critical to driving the UK forward, solving societal, economic and productivity challenges through investment in research and encouragement of innovation and entrepreneurship. Surrey exemplifies this approach with our hub for innovative companies, which is helping to create the high-value jobs of the future.

Finally, as I go, I would like to thank all of the staff, students and Council members I have worked with over the last nine years. It has been a privilege to serve in your company.

Michael Queen Chair of the Council

05

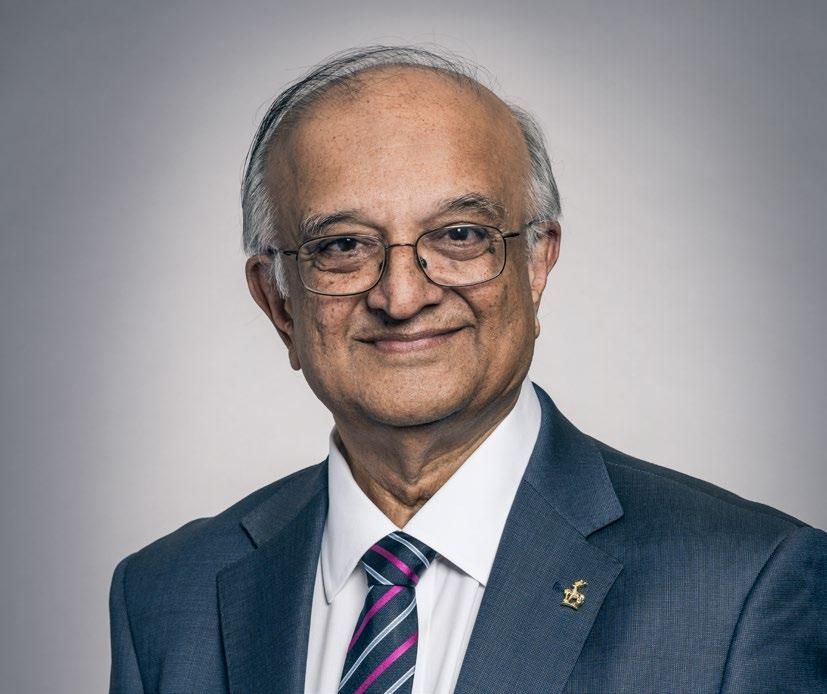

VICE-CHANCELLOR’S REVIEW

It gives me great pleasure to introduce this year’s Annual Report, which shows how the University’s contribution to society and its reputation continues to rise

of our staff and colleagues

and research.

In the last academic year, we’ve seen the fantastic achievements of our staff and students show through in our Research Excellence Framework (REF) and National Student Survey (NSS) results, as well as a number of improved league table positions.

These successes come despite the economic and societal challenges caused by the war in Ukraine, the cost-of-living crisis and the ongoing impact of the global pandemic at a time of political flux.

The Surrey Community has shown great resilience as it continues to improve lives through practical education and research. I am confident we will build on our successes in the year to come.

Our priorities for the year ahead include streamlining and strengthening research and innovation support for all academics to help them reach the next level, and optimising our academic achievement framework to enable everyone to achieve their full potential.

We will also be supporting early career academics via a future fellowship scheme to further boost our research capacity and performance. And we’ll invest in student services and facilities as part of our ongoing commitment to providing an excellent student experience.

STRATEGY OVERVIEW

Over the past year our refreshed strategy, Forward thinking. And doing, has guided us to make great strides in creating the conditions for our success, enhancing the student experience and focusing research intensity.

To realise our vision of being a leading global university and to deliver on our core mission of best-in-class research and education, we cannot stand still.

This report provides a record of our key achievements in the last year and offers insights into how we can achieve greater things by investing in our students and research capabilities. In turn, this will enable our students and staff to shape the future for a fairer, healthier and more sustainable world.

To help towards these goals, in February we launched an ambitious global campaign, The Future Says Surrey, which aims to supplement our existing investment by raising £60 million. It promises to inject new funds into key areas of research including health, sustainability and artificial intelligence (AI), as well as providing much-needed support for students experiencing hardship.

06

ANNUAL REPORT AND FINANCIAL STATEMENTS 2021-22 CONTENTS THE FINANCIALS

thanks to the hard work, dedication and commitment

in supporting our core mission in education

INSTITUTES

In November 2021 we opened our pan-University Institute for PeopleCentred AI with the aim of delivering an inclusive and responsible future for the technology.

I am pleased to say that the Institute is already working with industry and academic stakeholders to unlock the potential of AI in health, robotics, cyber security and the creative industries – all the while putting people and their needs at the heart of AI development.

Similarly, the new Surrey Institute for Sustainability due to be launched late in 2022 is tasked with maximising the positive impact of our sustainabilityfocused research and innovation.

This includes our multidisciplinary research on sustainable living, net-zero energy, clean air and sustainable prosperity.

In the field of health and medicine, we are launching the new Surrey School of Medicine to train a new generation of doctors. They will be equipped with cutting-edge skills from the world of AI and digital health, as well as innovative solutions in healthcare, to shape the medical landscape of tomorrow.

Our researchers are developing new diagnostics as well as treatment for diseases, helping to improve the quality of life in an ever-ageing society. We are also leading innovative studies into the healthcare of humans and animals.

TEACHING, ASSESSMENT AND THE STUDENT EXPERIENCE

The wellbeing and success of our students remain a key part of our strategy, so I am proud that we improved our satisfaction score in the National Student Survey significantly to 84.25%, which ranks us 9th in the UK.3

We also placed 9th in the Postgraduate Taught Experience Survey (PTES), rising 12 places and improving our satisfaction scores in every category.

In line with our refreshed strategy, we are improving more than 90 teaching spaces across campus, including the Teaching Block, where new technology and furniture will create the flexibility to accommodate different learning and teaching pedagogies.

The University is also investing in new learning technologies such as MySurrey Engagement and MySurrey Attendance to support the seamless student journey, helping them to fulfil their potential.

I firmly believe that anyone, regardless of their personal circumstances, should have the chance to benefit from an excellent education to launch their career.

Funds generated by our fantastic supporters and The Future Says Surrey campaign will help us offer more scholarships than ever before to students, regardless of their background.

COMPARATIVE PERFORMANCE

Our NSS and PTES results are not standalone successes.

In April, we achieved our highest position ever in The Times Higher Education Impact Rankings, rising from global 61st place in 2021 to 55th in April 2022 because

of our contributions to the United Nations’ Sustainable Development Goals.

In REF 2021, Surrey submitted research from over 660 staff in 14 of the 36 units of assessment, representing the breadth and depth of research across our faculties. We were rated in the top 20 for the quality of our research outputs when measured by Grade Point Average (GPA).

This exceptional outcome makes Surrey one of only three institutions in the UK to be in the top 20 of REF output rankings and the top 10 of the NSS overall satisfaction ranking3

The REF outcomes also saw Surrey move up 12 places (from 45th to 33rd) in the overall ranking of our research quality (by GPA), with 89% of our submitted research outputs rated as world-leading or internationally excellent.

More success in league tables came in June as Surrey rose an impressive 17 places in the Complete University Guide’s best university league table to 18th out of 130 institutions. Our courses in information technology and systems and tourism, transport, travel and heritage studies ranked as the best in the United Kingdom.

07 RESEARCH

3 Excluding specialist institutions and colleges

MANAGING OUR FINANCES

Our financial performance in 2021-22 showed continued recovery from the impact of the pandemic. Our consolidated income for 2021-22 was £305.3m, up by £5.5m (2%) on the previous year. Student numbers held up better than expected, partly due to continuing to offer the mid-year intake of postgraduate students, first introduced in 2020-21.

We managed to keep our operational spend within internal budgets through careful management of costs by department leaders throughout the University. Our investment in the ongoing University strategy meant that we reported an underlying operating deficit of £6.6 million as seen on page 77, compared to a deficit of £1.5 million in 2020-21. We also invested more than £30 million in our estate and IT infrastructure to advance the University and improve the student experience.

The UK economy is being buffeted by severe inflationary headwinds. We will need to manage our resources ever more efficiently during this period, prioritising activities that have the greatest positive impact on achieving our strategic goals. We will focus on managing our costs carefully to ensure we achieve value for money in a challenging external environment, as well as exploring and identifying further opportunities to grow our income.

EMPLOYABILITY – SURREY

AS THE PLACE TO START AND BUILD A CAREER

These successes align with our mission to produce graduates that continue into further study or progress into highly skilled graduate jobs. We are very proud of our staff who support and cultivate the employability of our students.

Our reputation and legacy depends on our graduates having a real-world impact and changing lives for the better. So, I was delighted that Surrey is ranked in the top 10 of this year’s Graduate Outcomes survey, as published by the Higher Education Standards Agency (HESA). Over 85% of our graduates have gone on to secure graduate-level employment.

We are currently University of the Year for Graduate Employment in the Sunday Times/Times Good University Guide and in March we won Best University Careers and Employability Service at the National Undergraduate Employability (NUE) awards.

We continue to invest in our students’ employability and help them transition into the workplace. This includes building on the success of our Professional Training Year programme and finding more opportunities for work experience through summer and graduate internships for students of all backgrounds.

The new Surrey Graduate Futures programme provides successful student applicants with a year’s placement at the University working in professional services. This will give them an employability head start and is the next step in empowering our students.

08

ANNUAL REPORT AND FINANCIAL STATEMENTS 2021-22 CONTENTS THE FINANCIALS

WE ARE CURRENTLY UNIVERSITY OF THE YEAR FOR GRADUATE EMPLOYMENT IN THE SUNDAY TIMES/TIMES GOOD UNIVERSITY GUIDE.

THE SURREY COMMUNITY

We have a strong sense of community at Surrey which we value greatly. Our strategic workstream, Build the Surrey Community, has a range of initiatives and events designed to instil a sense of pride and belonging at the University. We’re also encouraging our students and staff to enjoy our wonderful campus, facilities, and the benefits of being together in person. This is especially important as we emerge from the Covid-19 pandemic.

Nothing has given me greater joy this year than seeing colleagues and friends returning to campus, strengthening a community identity and collegiate spirit that even several lockdowns could not break.

Particularly memorable was the Free Fest event which took place on campus to mark the Queen’s Platinum Jubilee, bringing staff and families together to celebrate an incredible milestone.

At the end of the year, Surrey Showcase brought together some of our leading academics and gave them a platform to talk about how their research and innovations are transforming lives and the human condition. Our Alumni Awards also allowed us to see and celebrate some of the incredible contributions Surrey graduates are making to the world.

The first in-person open day in two years created a real buzz on campus, topped only by the remarkable and memorable postgraduate and undergraduate graduation ceremonies in April and July, respectively.

The easing of Covid-19 restrictions meant we could once again celebrate the achievements of our students in person at Guildford Cathedral, together with their families and friends, with a spectacular reception each day in the marquee on PATS field. We also celebrated the contribution of our colleagues in a new Values Award Scheme. This recognises and rewards colleagues for their passion and dedication in living our values of inclusion, inspiration, innovation and integrity. I’m pleased to say that well over a thousand staff have received an award since the scheme’s launch in March.

CONCLUSION

Our values define our culture and create a more inclusive community.

In this community, we all have a role to play to firmly establish Surrey among the UK’s top higher education institutions and enhancing our reputation for world-leading research, innovation and graduates who shape a better future for the world.

The University of Surrey community has emerged from the pandemic with a fresh determination to thrive in a quickly evolving higher education landscape, driving positive change for our students so they can go on to contribute to the wider society.

We can look forward to an exciting year ahead, working together to advance the University, our community, the UK and the world.

09

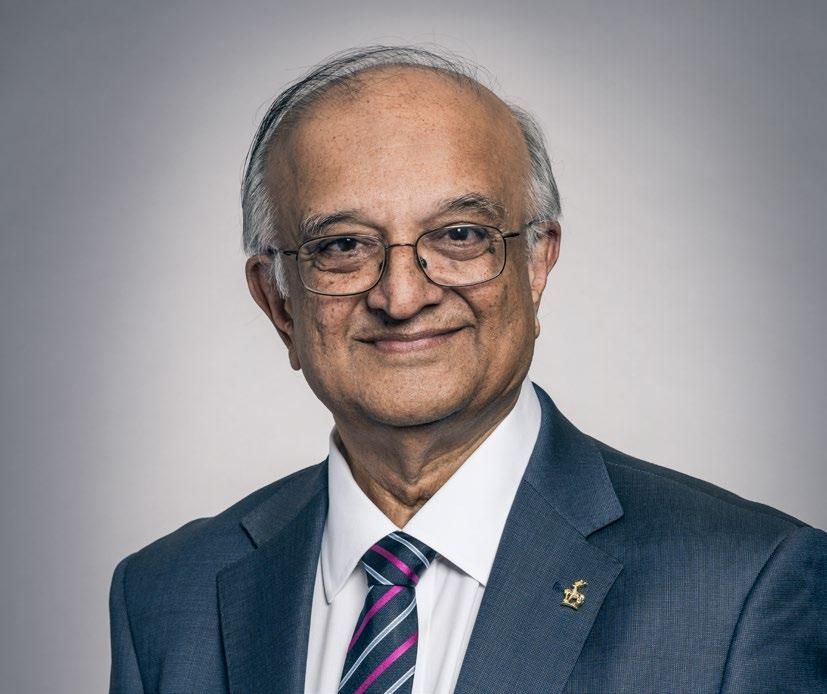

Professor G Q Max Lu AO DL President and Vice-Chancellor

WE CAN LOOK FORWARD TO AN EXCITING YEAR AHEAD, WORKING TOGETHER TO ADVANCE THE UNIVERSITY, OUR COMMUNITY, THE UK AND THE WORLD.

WELCOMING OUR NEW PROVOST

Previously Deputy Provost at The University of Queensland in Australia, Tim is responsible for delivering the academic mission set out in our Forward thinking. And doing strategy, working closely with the faculty deans.

He brings more than 30 years’ experience as an academic leader, having been Executive Dean of large faculties at both Queensland and Exeter universities. A world-renowned expert in the field of international relations, he is recognised for his research on human rights protection and foreign policy making, on which he has written and edited 14 books.

Tim is an elected Fellow of the Academic of Social Sciences, Australia and an Emeritus Professor at The University of Queensland, and has continued to be an active teacher and researcher throughout his career.

He said: “It is a privilege to serve the University of Surrey as the next Provost. The University is well placed to move forward confidently despite the disrupted world in which we live.

“All the elements for future success are in place. Clear strategic vision from the leadership team, internationalist in outlook, values-led, and above all, committed to providing the best educational experience for Surrey’s students. I am relishing the opportunity to play a constructive part in building a community where our people can reach their full potential.”

10

Surrey appointed Professor Tim Dunne as its new Provost and Senior Vice-President in April 2022.

IT WILL BE A PRIVILEGE TO SERVE THE UNIVERSITY OF SURREY AS THE NEXT PROVOST. THE UNIVERSITY IS WELL PLACED TO MOVE FORWARD CONFIDENTLY DESPITE THE DISRUPTED WORLD IN WHICH WE LIVE.

ANNUAL REPORT AND FINANCIAL STATEMENTS 2021-22 CONTENTS THE FINANCIALS

WE TRANSFORM LIVES AND SHAPE THE WORLD FOR A BETTER FUTURE.

OUR VISION, MISSION, VALUES AND HERITAGE

The University of Surrey is a research-intensive university committed to teaching and research excellence, with a focus on practice-based education. We strive to deliver a world-class experience to our students, who go on to make positive contributions to society.

OUR MISSION

To be a leading global university by providing excellent education and advancing and disseminating knowledge. We transform lives and shape the world for a better future by partnering with students, governments, businesses, alumni and local communities. We deliver social and economic impacts through research and innovation, together providing solutions to global challenges.

OUR VALUES

OUR VISION

We will be renowned for the outstanding quality and impact of our graduates and research, as well as our collective contributions to society. We will build on our distinctive heritage of practice-based learning and excellent student experience and embrace our future by focusing on digital transformation.

Everything we do is informed and shaped by our core values:

• Inclusion: to value everyone in our community.

• Inspiration: to find it in ourselves and each other.

• Innovation: to work together to make tomorrow better than yesterday.

• Integrity: to do the right thing, individually and collectively.

11

BUILDING ON OUR UNIQUE HISTORY

The University of Surrey’s rich heritage goes back to the founding of the Battersea Polytechnic Institute in 1891. In 1956, the Institute was among the first to receive the designation ‘College of Advanced Technology’ and in 1966 the University of Surrey received its Royal Charter.

Since then, we’ve continued to make an impact through our research, teaching, innovation and enterprise. We’re committed to working in partnership with students, businesses, governments and communities to push the boundaries of knowledge and apply it in the real world.

We’ve developed innovative research in areas as diverse as satellite technology, mobile telecommunication, chronobiology, food and nutrition science, and hospitality and tourism.

Our academic reach has broadened to incorporate the humanities, arts and social sciences, and health and medical

sciences, while continuing to build on our traditional strengths in science and engineering.

Additions to our campus have included the School of Veterinary Medicine, opened in 2015, and the multidisciplinary Innovation for Health building, opened in 2017. Our 5G Innovation Centre, originally opened in 2015, was relaunched in November 2020 as the 6G Innovation Centre, pioneering the next generation of wireless telecommunication technologies.

During 2021-22, we announced the new Surrey Medical School, which will begin training doctors from 2024. And we created a new interdisciplinary research institute – the Institute for People-Centred Artificial Intelligence – which will help to shape the future of AI for public good, and announced the upcoming launch of an Institute for Sustainability.

CREATING THE SURREY ADVANTAGE

We aim to equip our students with a set of skills and attributes that will lead them to personal and professional success, creating exceptional graduates who can think critically and make a real impact on society.

This is the Surrey Advantage, the premium that each and every student or partner gains by choosing us as the place to study, qualify or collaborate. It’s based on:

• excellence in academic programmes, teaching practice and facilities

• practice-centred Professional Training programmes

• enhanced soft skills including global and cultural intelligence, digital capabilities, employability and resilience and resourcefulness

• extra-curricular activities and campus life that give students the confidence to adapt to change, as well as an outstanding network of friends and alumni.

12

ANNUAL REPORT AND FINANCIAL STATEMENTS 2021-22

CONTENTS THE FINANCIALS

DELIVERING OUR STRATEGY

Last year the University of Surrey embarked on a new strategy – Forward Thinking. And Doing – to meet the needs of a changing world and make the most of new opportunities, while also contributing solutions to some of the great societal challenges such as climate change.

In 2021-22 we made significant progress towards achieving the goals and ambitions we set in our three priority areas – providing a world-class student experience, intensifying the excellence of our research, and creating the right conditions for success.

This section outlines these priorities, how we are working to achieve them and how we are doing so far against our target metrics.

OUR AMBITION

13

TO BE A LEADING GLOBAL UNIVERSITY RENOWNED FOR THE OUTSTANDING QUALITY AND IMPACT OF ITS GRADUATES, RESEARCH AND INNOVATION, TOGETHER MAKING GREAT CONTRIBUTIONS TO SOCIETY.

DRIVING THE STUDENT EXPERIENCE

OUR PRIORITY

We will deliver an excellent experience for all students regardless of background.

HOW WE ARE WORKING TO ACHIEVE THIS

TEACHING AND LEARNING

• Embedding our learner-centric curriculum design across all programmes to ensure that students get a rounded research-led education, including opportunities to contribute to a networked digital society and develop as future leaders in sustainable thinking.

• Using learning analytics to ensure all students are supported across the student journey, targeting early intervention where it is needed.

• Providing flexible, digitally-enabled learning opportunities and spaces, delivered by engaged academic staff using the latest technology, while building on the hybrid education model developed during the pandemic.

STUDENT EXPERIENCE

• Giving our students an employability head start by enabling them to become rounded and resilient graduates with the skills to succeed.

• Ensuring a seamless experience for students of all backgrounds from pre-arrival to post-graduation, listening to what they say, identifying and improving support services and infrastructure for a truly joined-up experience.

HOW WE WILL MEASURE SUCCESS

• Student satisfaction:

TOP 25%

for assessment and feedback, teaching on my course and academic support in the National Student Survey4

• Awarding gap:

4 All higher education institutions, excluding specialist providers

LESS THAN 6%

• Student retention (continuation):

a good degree (2:1 or above) attainment gap between white and black students of with parity between POLAR quintile 5 and quintile 1

TOP 25%

PROGRESS SO FAR

We have achieved some of our student experience targets already, placing in the top 15% for teaching and top 12% for academic support in the National Student Survey 2022. We also improved in assessment and feedback although we still have work to do to reach our objectives in this area. The awarding gap between white and black students rose to 20%. We are working hard to investigate the causes and reverse this trend. The number of students progressing to their second year of study fell slightly, partly a result of the disruption to study caused by the pandemic over the last two years.

14

(ACHIEVEDBY2025)

ANNUAL REPORT AND FINANCIAL STATEMENTS 2021-22 CONTENTS THE FINANCIALS

STUDENT EXPERIENCE

• Highly skilled graduate employability:

TOP 10%

1% GAP

• Student voice:

TOP 25%

• Learning community:

with less than between white and black students in the National Student Survey in the National Student Survey

TOP 25%

PROGRESS SO FAR

We have achieved our targets for student experience, placing us in the top 10% of universities for highly skilled graduate employability in the Graduate Outcomes survey, with a 1% gap in outcomes between black and white undergraduates. In the National Student Survey 2022, we ranked in the top 15% for both student voice and learning community. Our goal is now to maintain and build on these achievements in future years ensuring all students regardless of background are able to achieve their potential.

15

OUR GOAL IS NOW TO MAINTAIN AND BUILD ON THESE ACHIEVEMENTS IN FUTURE YEARS ENSURING ALL STUDENTS REGARDLESS OF BACKGROUND ARE ABLE TO ACHIEVE THEIR POTENTIAL.

FOCUSING RESEARCH INTENSITY

OUR PRIORITY

We will focus our resources and support around our existing and emerging critical masses of excellence.

HOW WE ARE WORKING TO ACHIEVE THIS

• Creating pan-University research institutes to serve as flagships of cross-disciplinary research, from which to elevate our global impact and visibility.

• Scaling our innovation to grow societal impact, involving greater numbers of staff, students and postgraduate researchers in impact and innovation.

• Increasing the synergies between our research and teaching, bringing the research and education missions of the University ever closer together, building on the synergies already achieved by individual teachers and researchers.

• Strengthening our support and infrastructure for researchers, making sure it is researcher-centric, can-do, digital and integrated.

•

CAPITA

PROGRESS SO FAR

We moved up 12 places in the Research Excellence Framework rankings for the overall quality of our research, from 45th to 33rd, putting us on track to achieve our goal of a top 30 position by 2027. While income from research grants and contracts was slightly lower than in 2020-21, we’ve put measures in place to drive this forward. We’ve grown our pipeline of bids year-on-year and need to maintain this momentum to achieve our income target by 2024.

16

HOW WE WILL MEASURE SUCCESS

Research income:

Research Excellence Framework:

Knowledge Excellence Framework: £50M A YEAR BY 2024 be on track to exceed TOP 30 OUTCOME IN 2027 be on track for a in working with business and in IP and commercialisation TOP 10%

•

•

PER

ANNUAL REPORT AND FINANCIAL STATEMENTS 2021-22 CONTENTS THE FINANCIALS

CREATING THE CONDITIONS FOR SUCCESS

OUR PRIORITY

We will foster talent and create an environment where all our staff, students and postgraduate researchers are empowered and supported to flourish, valuing each and every contribution.

HOW WE ARE WORKING TO ACHIEVE THIS

• Make Surrey the place to start and grow a career by creating a fulfilling environment where diversity and wellbeing are championed and where everyone can achieve their potential.

• Redesigning our resource allocation model and our support processes to reward excellence, enable growth, and to create more resources for teaching and research.

• Building a stronger Surrey community, an inclusive culture in which our staff, students and postgraduate researchers feel a sense of belonging and everyone can flourish and fulfil their potential.

• Using technology to enhance our systems and simplify processes, removing unnecessary bureaucracy while seizing the significant opportunity to improve processes and remove duplication.

HOW WE WILL MEASURE SUCCESS

•

•

These top-level

will enable us to see that we are creating the conditions in which our staff are able to excel within a financially sustainable model.

17

measures

Staff engagement:

Underlying operating surplus: 70% ENGAGEMENT SCORE 3.5% PER ANNUM BY 2025 (based on a basket of metrics in our People Survey) At least

SO

We exceeded our staff engagement target with a 75% engagement score in our latest

Survey. We made an underlying operating deficit as we

to invest to improve the quality of our

research

return

surplus

our

PROGRESS

FAR

People

continue

teaching,

and the student experience. We expect to

to

as we move on from the investment phase of

strategy in the coming years.

EDUCATION AND STUDENT EXPERIENCE

PRIORITY: DRIVING THE STUDENT EXPERIENCE

SUMMARY

The University returned to in-person teaching while building on the experience of the hybrid model we developed during the pandemic. This allowed students to learn in a way that suited their learning preferences and personal needs, but maintaining the campus-based experience that is at the heart of the Surrey advantage.

Throughout the year, we continued to invest in teaching services, study resources and student welfare. We continued our upward trajectory in the 2022 National Student Survey with an improved score for overall satisfaction and a ranking inside the top 10.

The proportion of students graduating with good degrees and the number progressing to their second year

of study both fell slightly, partly a result of the disruption to study caused by the pandemic over the last two years. The awarding gap between white and black students rose. We are working hard to investigate the causes and reverse this trend.

The total student population fell as intakes continued to be impacted by the pandemic. However, the number of postgraduates increased slightly.

At the start of the year, we were named University of the Year for Graduate Employment in The Times/Sunday Times Good University Guide for 2022 and Graduate Outcomes data placed Surrey in the top 10 nationally for progression into highly skilled employment.

9th in the UK in the National Student Survey overall rankings, up 16 places on the 2021 survey and into the top 10.

9th in the UK in the Postgraduate Taught Experience Survey.

Top 10 nationally for employability in high-skilled jobs, shown in analysis of the Graduate Outcomes survey and second in the south-east of England.

Best University Careers/Employability Service in the National Undergraduate Employability Awards 2022.

Up to 100 new paid summer internships created for under-represented groups.

2021-22 HIGHLIGHTS

18

OUR RELENTLESS FOCUS ON MAINTAINING A HIGH-QUALITY TEACHING AND STUDENT EXPERIENCE CONTRIBUTED TO A GOOD PERFORMANCE IN LEAGUE TABLES.

9TH 100 9TH 10 TOP ANNUAL REPORT AND FINANCIAL STATEMENTS 2021-22 CONTENTS THE FINANCIALS

PROVIDING A HIGH-QUALITY EDUCATION

2021-22 marked the return to face-to-face teaching as we began to emerge from the shadow of the pandemic. Although we still faced considerable Covid-related uncertainty, we managed to bring all of our students back onto our Surrey campus by the end of week six at the beginning of the academic year.

We resumed in-person lectures, tutorials, seminars, and lab and studio sessions and delivered more than 90% of our teaching in-person face-to-face.

However we did this while integrating the best aspects of the hybrid education we developed during the pandemic. We continued to develop our interactive virtual learning environment SurreyLearn improving the quality and variety of modules available. We also enabled students to submit assessments online and offered new digitally-enhanced study spaces.

We maintained online options alongside face-to-face for all of our careers and other support services so that students could access them seamlessly on or off campus.

Surrey continued to invest in teaching staff and facilities. In 2021-22, we began to implement a plan that will increase the number of our academic staff by over 10%. This will help us to reduce class sizes and increase the quality of interactions between teaching staff and students.

We announced the creation of our new Medical School, which will offer a four-year, graduate-entry bachelor’s degree medical programme, and expects to welcome the first cohort of 40 students in 2024. This will be the first time we have trained new doctors, who will join our excellent nursing, veterinary and paramedic graduates in contributing to the nation’s health services.

Our relentless focus on maintaining a high-quality teaching and student experience contributed to a good performance in league tables, including the Complete University Guide, where we rose 17 places among best universities to 18th out of 130 institutions.

19

STUDENT NUMBERS

Overall, we welcomed 11,418 undergraduates to Surrey, either for the first time or as returning students, a slight decrease compared to the previous year as we continue to see the impact of reduced intakes during the pandemic.

The number of postgraduate students held up well, increasing from 3,863 to 4,230. Of these, 3,068 were postgraduate teaching students and 1,162 were postgraduate research students.

Overseas recruitment continued to be impacted by the global pandemic and the consequences of Brexit with smaller intakes than prior years, but nevertheless in line with plan. However, our international student intake was better than expected in 2022-23. We are exploring new and growing overseas markets as well as continuing our efforts to recruit from countries that have sent students to Surrey in the past.

We expect renewed interest in Surrey as a place to study, driven by both improving league table performance and growing demand for UK higher education from students in the UK and abroad.

STUDENT OUTCOMES

We saw a small decrease in good degrees (first or 2.1 for all students) from 83% last year to 79%.

This was partly due to the impact of the pandemic. It caused severe disruption for the students who graduated in 2021-22, affecting their engagement with study.

The removal of the pandemic safety net arrangements during the year may also have contributed, along with an increase in students repeating part of their final year, Level 6.

The attainment gap increased between white students and all ethnic groups except mixed. The gap between white and black students increased by more than 5% to over 20%. The attainment gap also increased between higher and lower socio-economic groups.

We are implementing long-term measures to investigate the causes and turn this around. During 2021-22, we carried out a comprehensive quantitative analysis of the awarding gap, which will inform our inclusive education agenda in the coming year. We also set up a new Students Success Group which is focusing specifically on learning and teaching approaches to improve inclusivity and reduce the gaps.

STUDENT RETENTION

As part of our commitment to increasing participation, we work to retain students and help them progress through to complete their degrees. We have a goal of 90% continuation from first to second-year study, Level 4, across the student population.

Continuation to Level 4 dipped from 85% last year to 82%. Pandemic disruption was a major factor in this result. We saw that first-year students struggled to engage with study, particularly in the second term. The lack of examinations at A-level and reduced content in many subject areas, such as maths, may have also affected students’ preparation for study at university and ability to undertake the expected requirements of their courses.

We have taken action to support first-year students and make sure that more of them progress to second year. We introduced a new Progression Enhancement Support service in 2021-22. Early in 2022-23, we launched My Surrey Engagement, which will help students and their personal tutors to track engagement. We also developed a seven-point attendance plan, and we will shortly launch further interventions to support retention across the University.

Our Student Success team, which launched in 2021, provides guidance, pastoral care and personal mentoring for any student who needs it, including disadvantaged, at-risk and disengaged students who are thinking of leaving their studies.

20 ANNUAL REPORT AND FINANCIAL STATEMENTS 2021-22 CONTENTS THE FINANCIALS

STUDENTS 4,230

IMPROVING STUDENT SATISFACTION

Our overall satisfaction rating in the National Student Survey (NSS) 2022 was 84.25%, up 3.8% from last year, improving our position6 relative to our peers from 25th to 9th. This is the highest it has been since 2014-15. We also rose in the Postgraduate Taught Experience Survey (PTES) rankings, moving to 9th in the UK with an improved overall satisfaction rating of 87.2%. We achieved our target scores in both overall satisfaction and assessment and feedback, while also scoring highly on pandemic response.

Some of the actions we took to improve the student experience during 2021-22 include:

• improving assessment and feedback content and turnaround times, providing enhanced support, guidance and clarity around assessments and improving the consistency of developmental feedback across our programmes

• supporting academics to improve their teaching effectiveness by paying attention to student feedback through module evaluation and MySurrey Voice

• launching additional shared study space, MySurrey Spark, to complement the Library, MySurrey Hive and MySurrey Nest

• investing in academic posts to bring down student-to-staff ratios across all academic departments

• communicating throughout the year to help students make the most of the education and support activities available to them.

POSTGRADUATE

21 6

NUMBER OF

Excludes specialist institutions and colleges

FOCUSING ON EMPLOYABILITY

Surrey graduates are among the most employable in the UK according to the latest Graduate Outcomes survey. The results ranked Surrey 10th in the UK for the number of graduates in high-skilled jobs – up two places from last year – and second only to Oxford University in the south-east.

A total of 95% of those who graduated in 2020 were employed or in further study, a 2% improvement on the previous year, while 87% were in graduate-level employment or study, also a 2% improvement.

These results come from a consistent focus on employability in our curriculum, our placement schemes and the support provided by our award-winning Employability and Careers team.

There was a 2.3% gap between black, Asian and minority ethnic students and their white peers in securing highly skilled employment. This was a slight increase on the previous year. We are committed to reducing this gap and will work to address the causes during the coming year.

Surrey won the National Undergraduate Employability Award for the Best University Careers and Employability Service 2022. This reflects the quality of our experiential learning opportunities, which range from laboratory and group work to short placements, through to full one-year Professional Training programmes.

We continued to run our Professional Training placements for students, increasing participation from 723 students in 2020-21 to 900 this year. This was a welcome increase but is still below pre-pandemic levels. Although we are seeing the number of opportunities rise as businesses recover from the disruption of the pandemic, we need to be aware of the impact a potential recession could have on our work placement partners.

We offered 100 new University-funded internships, focused on under-represented groups to help boost their employment prospects, including internships for final-year undergraduates following graduation.

We also launched our new Surrey Graduate Futures programme, which offers full-time, year-long internships for newly graduated students. The successful candidates will work in our professional services functions, getting a head start in the world of work.

22

CONTENTS THE FINANCIALS

A TOTAL OF 95% OF THOSE WHO GRADUATED IN 2020 WERE EMPLOYED OR IN FURTHER STUDY, A 2% IMPROVEMENT ON THE PREVIOUS YEAR, WHILE 87% WERE IN GRADUATE-LEVEL EMPLOYMENT OR STUDY, ALSO A 2% IMPROVEMENT.

23

ON: EMPLOYABILITY GRADUATE OUTCOMES SURVEY 2021 Graduates who

were

history

1. Nursing professional 2. Sales and marketing professional 3. Engineering professional 4. Finance professional 5. IT professional 6. Business professional 7. Teaching professional 8. Therapy professional 9. Natural and social sciences professional 10. Health professional SURREY GRADUATES IN HIGH-SKILLED JOBS KEY FINDINGS 95% of Surrey’s graduates surveyed were in work or study 97% of those who took industry placements were in work or study 87% of graduates were in graduate-level roles 89% of graduates strongly agree that their current activity is meaningful 82% said their current activity fits with their future plans 2nd in the south-east 3rd 10th in the south (combining south-east and south-west) overall in the UK TOP 10 SURREY GRADUATE OCCUPATIONS The survey

GRADUATES

FOCUS

completed a higher education course in 2019-20

asked about their employment

15 months after they graduated in the annual survey by the Higher Education Standards Agency (HESA).

was completed by more than 400,000

from over 400 universities and colleges in the UK.

LOOKING AFTER STUDENT WELLBEING

As we emerged from the pandemic, Surrey continued to offer wellbeing MOTs for staff and students at the Centre for Wellbeing to help them build resilience and coping strategies.

Our new Residential Life team helps students living in University accommodation to navigate challenges, such as getting used to living independently, communal living and conflict resolution. They will also help students build a community and enjoy their time in halls.

We supported more students than ever with our Disability Assessor Quick Queries, which reduce waiting times for those wanting information on services for disabled and neurodiverse students.

FOCUS ON: STUDENT WELFARE AND WELLBEING

MORE WAYS TO ACCESS COUNSELLING

Our Centre for Wellbeing offers confidential one-to-one counselling for students via Teams, on the phone, or face-to-face. This gives students the option to choose the method they feel they can best express themselves.

STRONGER PEER SUPPORT NETWORKS

We launched a service offering our students the chance to discuss any aspect of student life with others. The service offers non-judgmental peer support and help with accessing useful activities and services, seven days a week. As part of the service, peer support ambassadors visit new students in their accommodation shortly after they’ve arrived on campus to welcome them and answer any questions they have.

Post-pandemic, the wellbeing of students is a key priority for all institutions. We are committed to continuing to develop and improve our services in line with sector recommendations, frameworks and best practice in order to support our diverse community. We will address the challenges faced in recruiting staff to deliver the provision in this challenging landscape by working in partnership with local NHS providers.

24

ANNUAL REPORT AND FINANCIAL STATEMENTS 2021-22

CONTENTS THE FINANCIALS

FOCUS ON: STUDENT EXPERIENCE

TALKING ABOUT THE STUDENT EXPERIENCE

What makes the Surrey student experience special? We spoke to some Surrey undergraduate and postgraduate students about their experience of the University, from teaching to student support services, and life on campus after hours.

THE STUDENTS

LUANA: I appreciate the amount of support that students can get from their teachers. They’re mostly very willing to listen to student feedback and make changes to ensure learning is a good experience for everyone. There are also a lot of different study spaces. Between the Library, Sparks and academic buildings which can be booked there is always a free spot for a study session.

GEMMA: I agree. There are several study spaces that offer different levels of silence which give you different options in case you want to do a group project, study on your own or just chill out. Being a PhD student I also get assigned a PC in an office with other students, which is convenient for discussing any issue you may be having and also for socialising.

LUANA: I feel there’s been a good balance between in-person seminars and online lectures. Having lessons recorded is helpful for students who are neurodiverse, commuters or in case of illness. I also enjoyed being able to access all materials online when I was outside the UK during the pandemic.

GEMMA: The University and Student Union have been making big efforts to address wellbeing. There have been a lot of new initiatives that have helped improve student satisfaction.

Canet Tarres, PhD student in Computer Vision

LUANA: Between societies and events, there is never a boring moment. In fact, the campus facilities, like its own pub and nightclub, mean that I don’t feel the need to go to town either.

STEPHAN: I like the support services, from the on-campus GP and the Wellbeing Centre to the student life mentors, who look out for freshers in their first year at University. We also have 24/7 security around the University, which is good to know.

GEMMA: When I needed some documentation for opening my bank account, I went to MySurrey Hive and they made it possible to solve my problem very quickly.

LUANA: MySurreyNest is a good place to wind down after lectures. I appreciate having an alternative place to go other than the Hive or Library.

STEPHAN: I’ve used the new MySurrey app many times to view my semester timetable, check the status of my loaned library books, and look at the Surrey campus map. It makes life a little bit easier.

25

Gemma

Luana Vasconcelos, BA in English Literature with Creative Writing

Stephan Rapley, BSc in Civil Engineering

THE VIEW FROM THE DEANS

Surrey’s three faculties have all welcomed new deans over the last 18 months, each bringing a wealth of academic, research and commercial experience. In this section, they speak about their transition to the role and their vision for the future of their faculties.

26

ANNUAL REPORT AND FINANCIAL STATEMENTS 2021-22 CONTENTS THE FINANCIALS

PAUL TOWNSEND

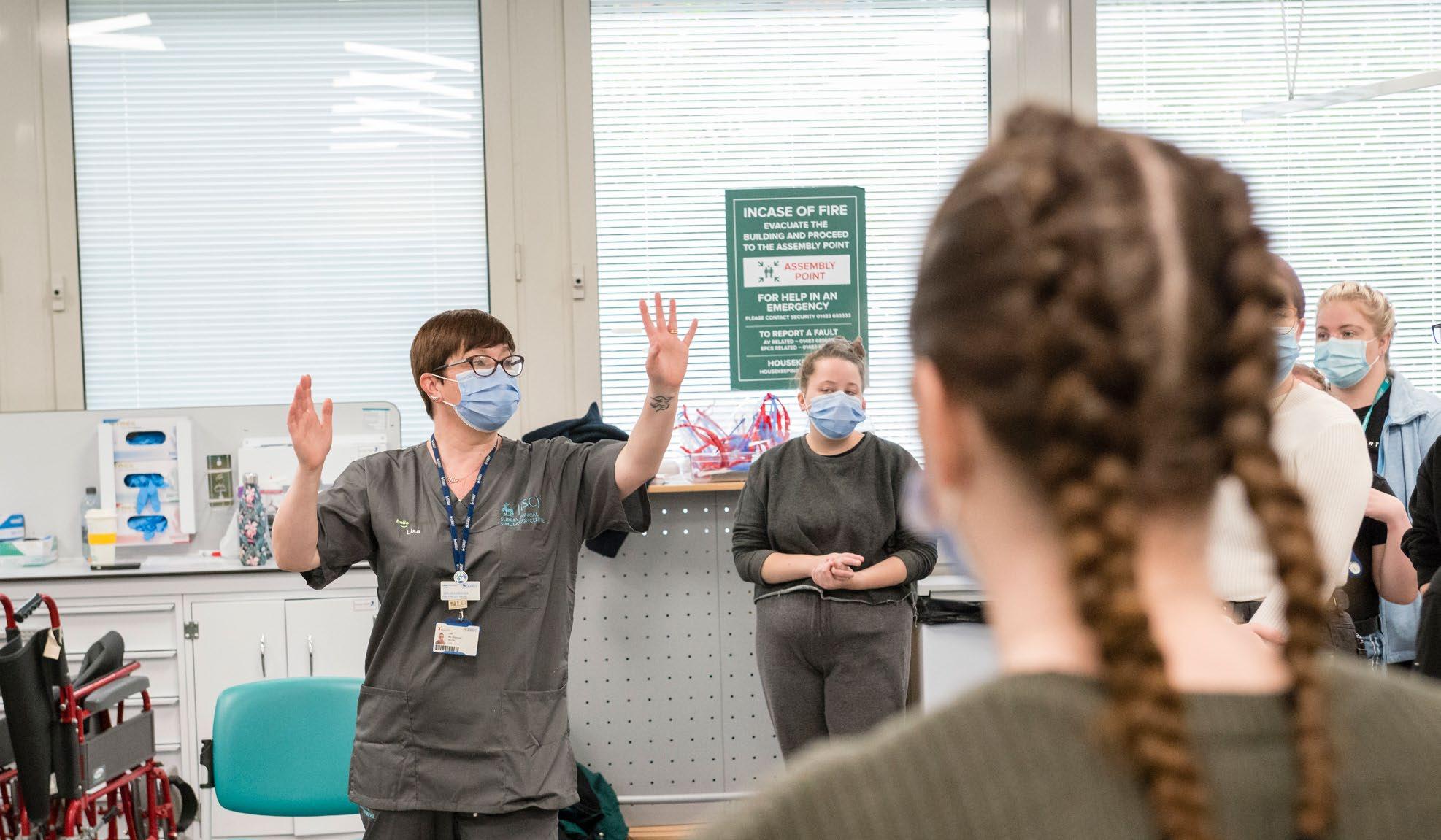

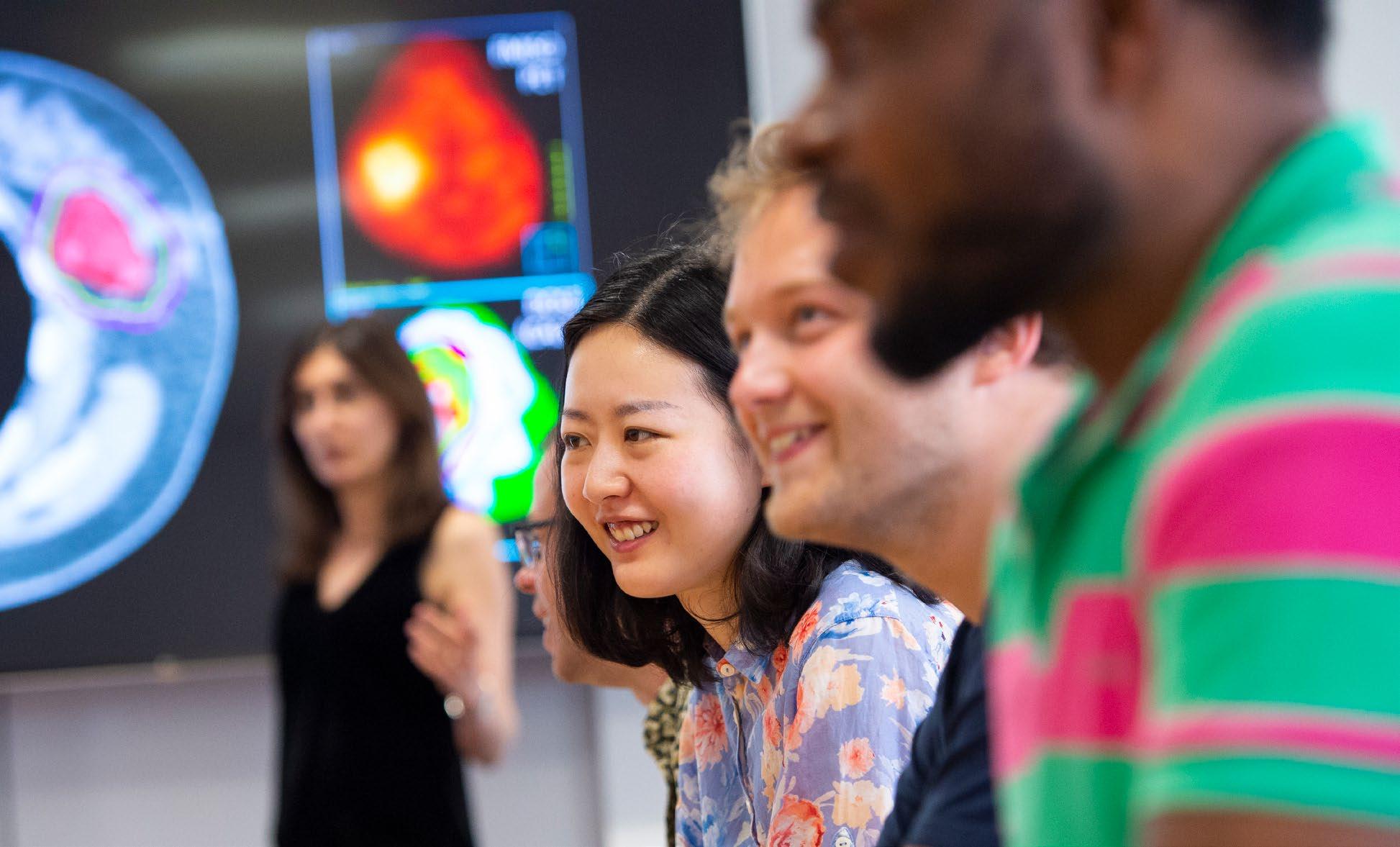

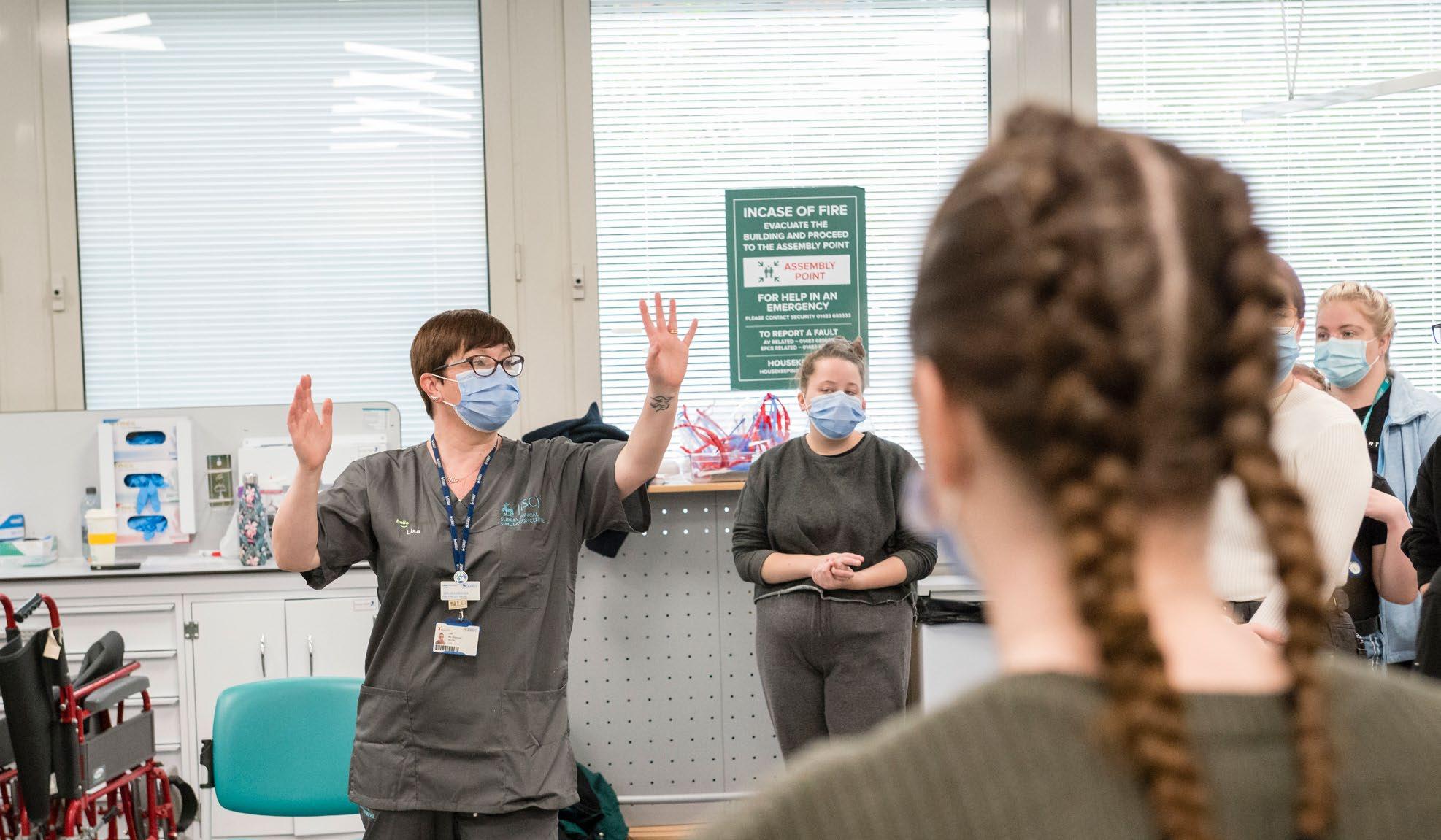

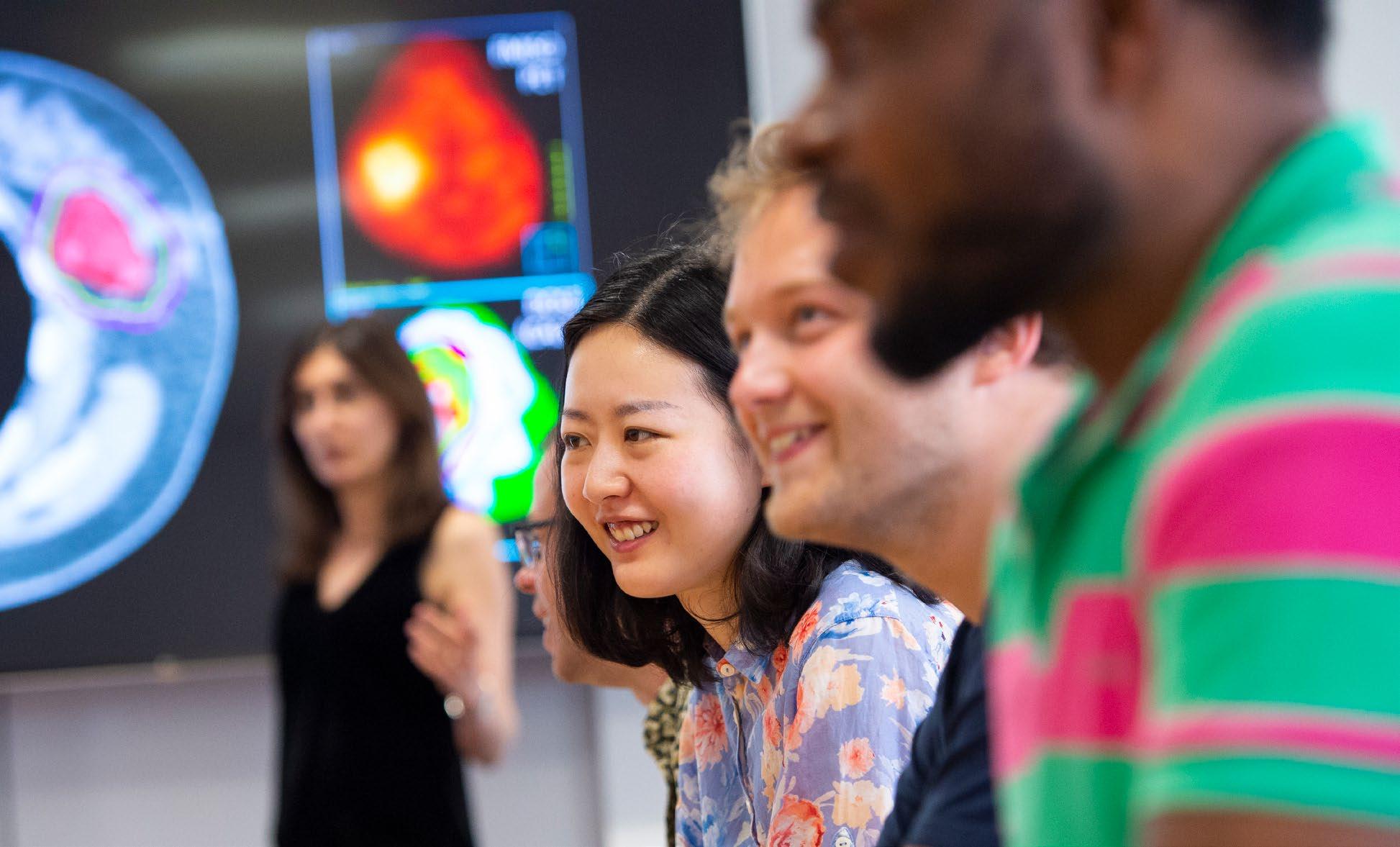

Faculty of Health and Medical Sciences (FHMS)

Paul joined Surrey as Pro-Vice-Chancellor, Executive Dean of FHMS in February 2021 from the University of Manchester where he was Associate Dean in the Faculty of Biology, Medicine and Health. He is an internationally renowned scientist and innovator in the field of cell stress and survival mechanisms.

I came to Surrey attracted by the University’s aspirations and its people. There is a ‘can-do’ ethos and desire to move the bar higher and achieve more, not just for our students, but also for the public good. That fits with my aspirations and experience as an academic who is focused on real-world innovation, invention and entrepreneurialism.

In the time I’ve been Dean, we have already achieved some big ambitions. Our new Medical School is about to open its doors and start training the next generation of doctors. We are seeing exciting collaborations with the NHS and attracting more funding from the National Institute for Health and Care Research (NIHR) for cutting-edge projects.

There’s great research coming out of areas such as nutrition, exercise, animal health, infection and immunity, chronobiology and sleep, digital health and intervention, and brain and behaviours. Working synergistically with our pan-university institutes, along with our wonderful partners including the Pirbright Institute, the Animal and Plant Health Agency (APHA) and the Defence Science and Technology Laboratory (DSTL), these research areas will become beacons, increasingly attractive to a wider community of research funders and policy leaders in the UK and globally.

These successes are a testament to the quality of our teaching and research. We’re investing in our academic staff, not only increasing their numbers but also providing more funding for pedagogic research, and offering more practical early career support through our new Faculty Academy.

Students are at the centre of everything we do. We are privileged to be educating the next leaders in health care and science. I want to ensure that they gain from our interdisciplinary approach, learning lessons from subject areas such as engineering or social sciences that can enhance their practice in health and medicine. Surrey’s digital innovation programmes, such as our Digital Transformation project, will also ensure students benefit from the latest technologies.

Looking ahead, our vision is for a ‘Surrey to Stanford’ transformation. By that I mean increasing not only the quality of our teaching and research but also our real-world impact, driving change for the greater good.

I want to reinvigorate our health and biomedical innovation capacity – turning research into useable, everyday innovations and delivering them at scale. This could be through a biomedical research centre of excellence that we constantly strive towards which would attract more partners, donors, investors, and most importantly, improve the student experience.

I would really like to see FHMS grow, develop new schools, new innovative teaching programmes and to drive more real-life, impactful medical, scientific and veterinary expertise. I know we can do this and the FHMS community and culture is there to deliver.

27

LOOKING AHEAD, OUR VISION IS FOR A ‘SURREY TO STANFORD’ TRANSFORMATION. BY THAT I MEAN INCREASING NOT ONLY THE QUALITY OF OUR TEACHING AND RESEARCH BUT ALSO OUR REAL-WORLD IMPACT, DRIVING CHANGE FOR THE GREATER GOOD.

Everyone I’ve met since I came to Surrey is passionate about what they do and eager to work at a very high level. Being surrounded by so many dedicated colleagues has given me a head start since I became Dean earlier this year.

Shortly after I joined, I did a roadshow of the schools and departments, asking them to present their strategies, plans and aspirations for the future. What really came across from those presentations was the desire to work in a collegiate, collaborative way. Establishing and fostering those connections is now a major theme of my leadership and the forthcoming faculty strategy.

I also want to build stronger relationships with other institutions, government bodies and industry to supercharge our reputation for innovation – translating our excellent research into inventions, innovations and public knowledge must make a difference for the wider economy and society.

One example would be continuing to raise Surrey’s profile as a leader in space technology. Our Space Centre does excellent research and teaching in space engineering. But we could do more given the current strong UK government support.

There’s also a lot of potential in the sustainability arena as demonstrated by the forthcoming launch of our pan-University Surrey Institute for Sustainability. This will build on a range of sustainability research and education across the campus from policy interventions

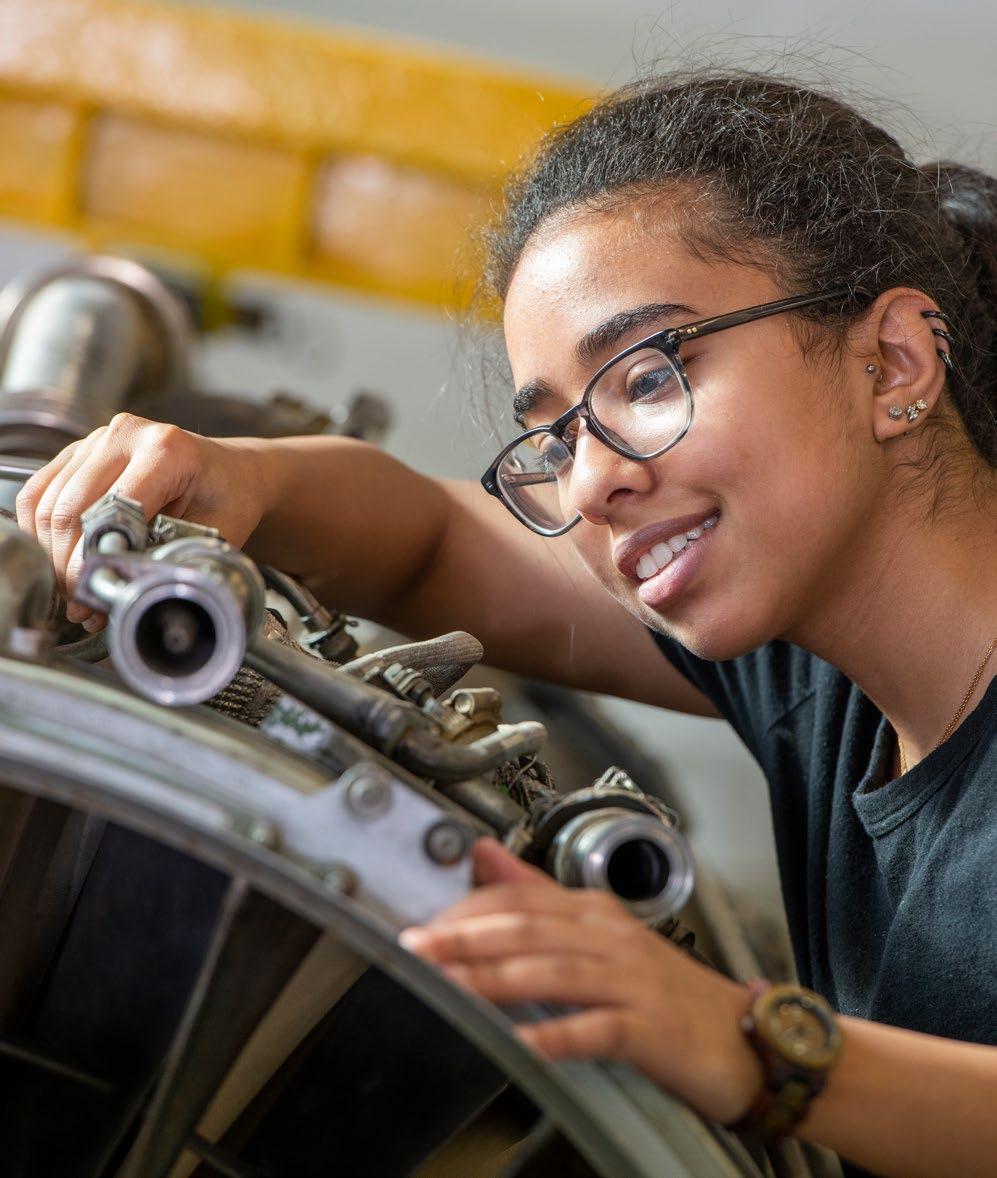

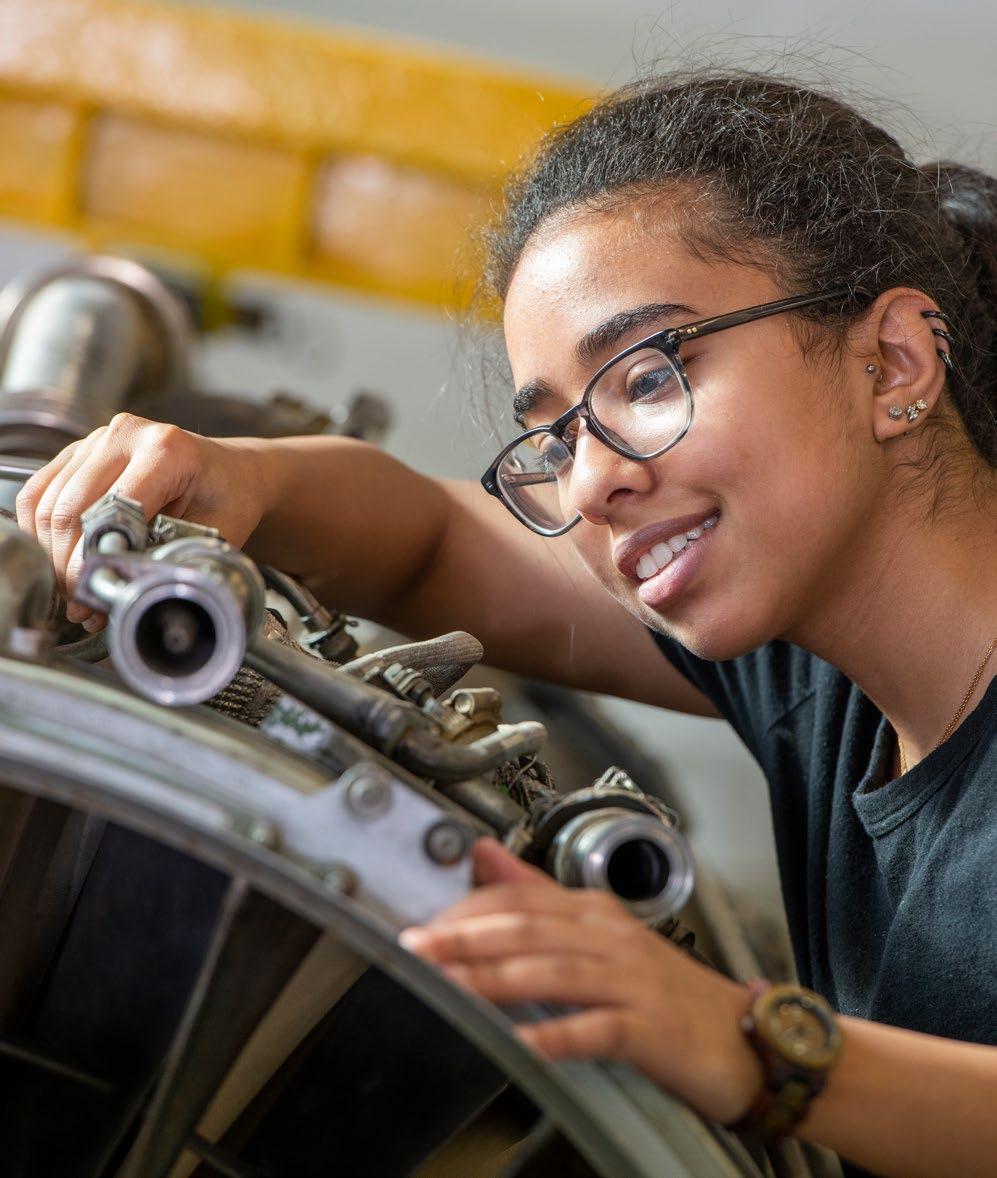

BOB NICHOL

Bob is one of the UK’s leading astrophysicists. Before joining Surrey, he was Pro-Vice Chancellor for Research and Innovation and Director of the Institute for Cosmology and Gravitation at the University of Portsmouth. He took up his role as Pro-Vice-Chancellor and Executive Dean of FEPS in early 2022.

around plastic pollution to renewable energy sources. We need to do more, and on a larger scale, to deliver on a net-zero campus and world. This autumn, we’ll consult on the new faculty strategy, which will help us to be more connected with colleagues, students and partners, working together to create critical mass in a host of new and existing fields of endeavour. We also need to optimise our work and space, embracing new ways of working after the pandemic and providing the right incentives to deliver a host of activities across teaching, learning, innovation and research. I’m excited to be revisiting the schools during the next few months to talk more about this strategy and get colleagues involved.

Faculty of Engineering and Physical Sciences (FEPS)

Faculty of Engineering and Physical Sciences (FEPS)

28 ANNUAL REPORT AND FINANCIAL STATEMENTS 2021-22 CONTENTS THE FINANCIALS

I ALSO WANT TO BUILD STRONGER RELATIONSHIPS WITH OTHER INSTITUTIONS, GOVERNMENT BODIES AND INDUSTRY TO SUPERCHARGE OUR REPUTATION FOR INNOVATION – TRANSLATING OUR EXCELLENT RESEARCH INTO INVENTIONS, INNOVATIONS AND PUBLIC KNOWLEDGE MUST MAKE A DIFFERENCE FOR THE WIDER ECONOMY AND SOCIETY.

BRAN NICOL

Faculty of Arts and Social Sciences (FASS)

Bran is Professor of English Literature at Surrey. He was appointed Interim Pro-Vice-Chancellor and Executive Dean of FASS in April 2022, having previously been Head of the School of Literature and Languages and serving on the Faculty’s Executive Board for several years.

FASS prepares students for work that makes a real difference in many walks of life. It includes some of the key disciplines that shape the modern world, from law and politics to business and economics, from sociology and hospitality to literature and the performing arts.

Our role as a faculty is to equip our students with the practical skills they need to succeed and thrive in these diverse fields – while also helping them think about the contemporary world and how they can have a positive impact on society through their chosen professions.

Since becoming Interim Dean, I’ve been awestruck by the sheer energy and range of activities across the disciplines, the talent among our academics and professional staff, and the quality of work being produced. Not only academic work and research projects – but the end of year shows in music, film production, creative writing and acting, which showcase amazing creativity among our students.

I’m proud that we achieve high rates of employability across our arts and humanities subjects, as well as in business and social sciences. That success comes partly from Surrey’s Professional Training Year placement programme (PTY), which is consistently rated among the best in the UK. But it’s also from the cutting-edge, contemporary ethos we have in both our teaching and research, and the supportive, collegiate, can-do culture within FASS.

It’s also a product of the support we offer students. That means good pastoral care but also supporting them to be professional in their outlook, and giving them a sense of ethics and what it means to be a responsible, respectful member of society and any work environment.

Looking ahead, I want to increase our reputation for producing research that has meaningful impact in both academic and non-academic spheres.

I’d like to increase our success in attracting external funding, while also engaging industry partners, and further enhancing our ability to equip our students to go out and make a difference to the world. I’d also like to see more research and taught programmes that tap into cross-cutting themes affecting young people’s lives – from the digital society to energy and the environment, sustainability, the nature of future society and culture, and the value of arts and literature –adding relevance and giving students a sense of improving their future.

Overall, I’d like to consolidate our position as a top 10 institution for student satisfaction and ensure that staff at all levels find working in FASS fulfilling, inspiring, collegiate and supportive.

29

LOOKING AHEAD, I WANT TO INCREASE OUR REPUTATION FOR PRODUCING RESEARCH THAT HAS MEANINGFUL IMPACT IN BOTH ACADEMIC AND NON-ACADEMIC SPHERES.

RESEARCH AND INNOVATION

PRIORITY: FOCUS RESEARCH INTENSITY

SUMMARY

We achieved some excellent results in 2021-22, not least rising 12 places in the Research Excellence Framework, the independent system for assessing the quality of higher education research when measured by overall grade point average (GPA).

Two new pan-University research institutes were formed, one of which –the Institute for People-Centred Artificial Intelligence – launched during the year.

We significantly increased our research activity in bidding and outputs, and increased the impact of our research with an all-time high citation index score.

We used funding from government and UK Research and Innovation (UKRI) to invest in research projects and infrastructure, as well as enhancing our research culture. And we continued to drive innovation, creating wider societal and economic benefits from our research outputs.

Research awards increased significantly, although income from research grants and contracts was slightly lower year-on-year. This was mainly due to lower levels of bidding during the pandemic, which translated into fewer research grants in 2021-22. We expect income to recover as the high level of bids and submissions made throughout 2021-22 starts to feed through.

2021-22 HIGHLIGHTS

Up 12 places in REF 2021 to 33rd in the UK (based on overall GPA).

£44.4m in research awards, an increase of £11.2m from 2020-21.

We helped secure £53m growth funding for our spin-outs, graduate start-ups and other companies in our innovation ecosystem.

1.86 field-weighted citation index, a key measure of research impact.

30

WE SIGNIFICANTLY INCREASED OUR RESEARCH ACTIVITY IN BIDDING AND OUTPUTS, AND INCREASED THE IMPACT OF OUR RESEARCH WITH AN ALL-TIME HIGH CITATION INDEX SCORE.

12 £11.2m £53m 1.86 ANNUAL REPORT AND FINANCIAL STATEMENTS 2021-22 CONTENTS THE FINANCIALS

PROVING OUR RESEARCH EXCELLENCE

Surrey moved up to 33rd in the UK rankings for overall research quality in the Research Excellence Framework 2021 (REF) when measured by Grade Point Average (GPA), which was published in 2022 after a pandemic delay.

More than 40% of Surrey’s research was rated as world-leading, the highest possible rating, up from 22% when REF last took place in 2014. The University is now also ranked in the top 20 in the UK for the overall quality of research outputs – research papers and other published works as measured by GPA.

REF is the UK’s system for independently assessing the quality of research in higher education institutions and has a direct impact on the allocation of future government research funding.

Highlights from Surrey’s REF 2021 results include:

TOP 20

FOR RESEARCH POWER 6TH

the quality and scale of the University’s health research7

TH

TH FOR RESEARCH POWER 15TH the quality and scale of the University’s engineering research8

Rated in the for the quality of our RESEARCH OUTPUTS for the quality and for the real-world impact of our ECONOMICS RESEARCH9

While these achievements are considerable, REF also showed that Surrey has the opportunity to enhance its position further with greater emphasis on the impact of its research. This is an area of focus in the current strategy and we expect to see significant improvements in the next REF exercise.

Our field-weighted citation index for the full year 2021 was at an all-time high of 1.86. This measures how many citations our research receives compared to other similar published work, and is another strong indicator of the quality and impact of our research.

7 When measured using GPA for Unit of Assessment 3; Allied Health Professions, Dentistry, Nursing and Pharmacy

8 When measured using GPA for Unit of Assessment 12; Engineering

9 When measured using GPA for Unit of Assessment 16; Economics and Econometrics

31

10

6

INVESTING FOR THE FUTURE

Surrey launched the Institute for People-Centred Artificial Intelligence (AI) in November 2021, which will pioneer crossdisciplinary research on how to use AI for public good.

By December 2021 more than a hundred AI fellows were appointed to the Institute illustrating the existing strengths in this area across the University. These fellows were joined in early 2022 by 12 new academic appointments to bring additional capacity in key domains. A cohort of postgraduate students have started work in autumn 2022.

We also announced the formation of the Surrey Institute for Sustainability, which is due to launch in late 2022. It has already recruited a new world-class Director as well as a Head of Operations and Partnerships.

As part of our Forward thinking. And doing strategy, we continued to recruit researchers into areas of research concentration across the faculties. We expect to see long-term returns from these investments in terms of research quality and grant funding.

32

ANNUAL REPORT AND FINANCIAL STATEMENTS 2021-22 CONTENTS THE FINANCIALS

FOCUS ON: ARTIFICIAL INTELLIGENCE

NEW INSTITUTE PUTS PEOPLE AT THE HEART OF AI

Surrey opened the new Institute for People-Centred AI in November 2021 to help shape the future of AI for public good and address the grand challenges the technology poses for people and society.

The Institute will build on the University’s 30 years of excellence in AI research and link this expertise with a range of disciplines where AI is beginning to have a transformative impact, including engineering and physical sciences, health, law, business, finance and the social sciences.

Through this cross-disciplinary fusion of ideas and research, the Institute will look for answers to the five grand challenges identified by UKRI, the AI Council, Society 5.0 and the United Nations Sustainable Development Goals.

How can we ensure that AI is of benefit to all?

How can AI improve learning and access to trusted information?

How can AI improve health and wellbeing?

How can AI systems understand, interact and communicate naturally with people?

How can AI transform business and the workplace for the benefit of society?

The new Institute will also work in partnership with industry, the public sector, government and national AI organisations to deliver a step-change in AI research, training and innovation.

33

FOCUS ON: INNOVATION

SCALING INNOVATION FOR SOCIETAL IMPACT

We began a scaling innovation workstream as part of our Forward Thinking. And doing strategy. It focuses on giving researchers the skills, motivation and capacity to innovate, and growing innovation outputs through a range of ongoing projects.

INNOVATION SABBATICALS: funding sabbaticals for academics so they can focus on creating impact from their research outputs in society, and create knowledge exchange pathways.

INDUSTRY INNOVATION FELLOWS: enabling employees of our industry partners to visit the campus for extended periods to develop links with researchers and enhance our innovation ecosystem.

INDUSTRY-INFLUENCED UNDERGRADUATE CURRICULUM: making sure the skills we are teaching are what employers need, and that they will help industry thrive and support our innovation ecosystem to grow CROSS-SELL: training non-research staff who work with industry to develop opportunities for research and innovation collaborations and knowledge exchange partnerships.

INNOVATION VISIBILITY: installing knowledge exchange exhibits and displays in highly visible locations on campus to inspire students and staff to take part in innovation projects.

We have continued to raise awareness of our support for innovation, creating easy-to-read guides for the website and engage the external community through news, case studies and events.

34

MOTIVATION CAPACITY SKILLS INNOVATION ANNUAL REPORT AND FINANCIAL STATEMENTS 2021-22 CONTENTS THE FINANCIALS

MAINTAINING OUR RESEARCH INCOME

Overall, research and innovation income from all sources held up well in the financial year 2021-22.

Research grants and contract income fell slightly to £41.3m, compared to £43.4m in 2020-21. However, this result was £1m higher than budgeted expectations.

Awards and bidding both showed marked increases on the previous year, returning to pre-pandemic levels. Awards, at £44.4m, are significantly up from £33.1m in 2020-21, including grants transferred in. Bidding was on a par with the previous best-ever year. We need a continued focus on growing the pipeline of bids so that we can increase research activity and meet our future plans.

Our improved awards performance was partly thanks to measures taken in response to the disruptive impact of the pandemic. These included:

funding for postgraduate researchers and post-doctoral research assistants to support academic leads on bid development of large strategic bids

providing additional resource to provide short-term specialised EU bidding support strong messaging around the need for high-quality bidding to be prioritised reviewing and prioritising existing bids in the pipeline redoubling efforts to raise awareness of funding opportunities developing forecasting methodologies and dashboard to better track progress against targets.

35

AWARDS AND BIDDING BOTH SHOWED MARKED INCREASES ON THE PREVIOUS YEAR, RETURNING TO PRE-PANDEMIC LEVELS.

THE FUTURE SAYS SURREY FUNDRAISING CAMPAIGN

The University launched an ambitious new global fundraising campaign, The Future Says Surrey, during 2021-22. It aims to raise £60 million to support our students and help Surrey continue making positive impacts on society, confirming us as one of the UK’s leading research and educational institutions.

A first for the University in terms of scale and ambition, the campaign will direct significant new funds into key areas of research. Building on the University’s strong track record in developing ground-breaking innovations, from barcode technology to affordable miniature satellites, the money raised will support a wide range of emerging research, including:

upskilling the labour force in the AI era, finding ways for AI to automate tedious tasks that free up time for humans to think more creatively tackling the diagnosis and treatment of those suffering from long-term conditions such as cancer and dementia creating the next generation of solar energy capture and storage technology supporting the work of the Global Centre for Clean Air Research and the Centre for the Understanding of Sustainable Prosperity.

ANNUAL REPORT AND FINANCIAL STATEMENTS 2021-22 CONTENTS THE FINANCIALS

SUPPORTING POSTGRADUATE RESEARCH

The University ranked 13th overall in the AdvanceHE Postgraduate Research Experience Survey (PRES) in 2022, the same ranking we achieved in 2021. Surrey was ranked 6th for facilities, resources and online provision out of 58 other institutions, an improvement from 20th in 2021.

Our ranking for postgraduate research support improved from 12th to 10th, showing that investing in our postgraduates is having a direct impact on their experience. PRES is the only higher education sector-wide survey to gain insight from postgraduate researchers directly.

Surrey’s Doctoral College commissions an in-depth statistical analysis of the responses to PRES each year to identify the issues that matter most to our postgraduates. We develop action plans from this analysis and publish them so postgraduates can see what is being done in response to their feedback.

The success of our researcher development can be seen in our consistently high pass rate at the first attempt in viva. In 2021-22 this was 94%, resulting in 216 postgraduate research awards.

THE SUCCESS OF OUR RESEARCHER DEVELOPMENT

CAN BE SEEN IN OUR CONSISTENTLY HIGH PASS RATE AT THE FIRST ATTEMPT IN VIVA.

IN 2021-22 THIS WAS 94%, RESULTING IN 216 POSTGRADUATE RESEARCH AWARDS.

37

PROMOTING DIVERSITY AND INCLUSION

offering Studentship Awards specifically aimed at under-represented groups, including black British UK postgraduates and women within disciplines traditionally dominated by men

launching the Surrey Black Scholars Studentship Award programme, aimed at reducing structural inequalities in postgraduate research and improving participation for black British students decolonise research development training creating an EDI resource bank developed by our Doctoral College to build competency and knowledge within our community granting student enterprise ‘founderships’ aimed at LGBTQ+ student and graduate entrepreneurs.

We are also developing an EDI monitoring process for research funding applications, looking at physical and digital accessibility of research and innovation services.

FOSTERING OPENNESS

AND INTEGRITY IN RESEARCH

We increased our efforts to make our research and innovation activities more equal, diverse and inclusive (EDI). Steps we’re taking to address under-representation of particular groups include: Surrey is one of a consortium of 18 universities helping to drive the uptake of open research practices across the sector, aligned with the government’s R&D Roadmap.

The project, which began in September 2021, is backed by £4.5 million from Research England Development (RED) Fund. Surrey is contributing to several workstreams and working groups, as well as the development of examples of good practice and resources across disciplines.

Open research initiatives during 2021-22 included: taking part in the international Open Access Week

launching an open research in practice module, an open research website and an open research action plan holding the inaugural Surrey annual open research lecture.

We also focused on enhancing our research culture during 2021-22. Funding was used to: invest in online training courses in ethical research, research integrity and supervising doctoral studies provide undergraduate internships accelerate and evaluate the effectiveness of current and future research culture initiatives.

38

ANNUAL REPORT AND FINANCIAL STATEMENTS 2021-22 CONTENTS THE FINANCIALS

BUILDING STRONG RELATIONSHIPS

PRIORITY: CREATING THE

FOR SUCCESS

SUMMARY

CONDITIONS

During 2021-22 the University continued to build relationships with business, industry, alumni, the local community and government and create positive impacts for local communities and the wider economy. We fostered more than 70 innovative new businesses on our Surrey Research Park and received funding to develop our research into a range of real-world applications through the Surrey Living Lab.

Within Guildford, we strengthened our relationships with the local community, supporting businesses and residents to understand how to improve their sustainability and reduce their impact on the local environment.

With the return to face-to-face events, we were able to expand our links with alumni, supporters and potential donors in support of our ambitious The Future Says Surrey fundraising campaign. As a result of this renewed activity, we secured £7.74 million in pledges of philanthropic support.

2021-22 HIGHLIGHTS

£13.2 million secured for tech start-up companies through our SETsquared Surrey incubator programme.

£7.74 million income pledged in philanthropic support from alumni and donors.

42% of Surrey Research Park businesses surveyed interact with University academics with 30% interacting with the Surrey Business School.

£13.2m £7.74m 42%

39

RESEARCH AND INNOVATION PARTNERSHIPS

Surrey works with a wide range of external partners to develop our research into real-world applications that deliver economic benefits for our communities. In 2021-22 the University was awarded funding to enable joint research and innovation activities with external organisations and the general public. Some of the projects we supported through Surrey’s Living Lab include:

CARBON REDUCTION INCENTIVES: our environmental psychology team and Sociology department worked with Surrey County Council and service provider ThamesWey to better understand why some residents don’t follow through with council-run carbon-reduction programmes, such as subsidised insulation and solar panel schemes. Through data analysis and interviews with residents in existing schemes, the research will look for answers that help to target these incentives more effectively.

SMART BUILDING OCCUPANCY: our estates space planning team and the Centre for Environment and Sustainability partnered with a local business using smart occupancy monitoring technology to assess how staff use existing office space. The research will help organisations make better use of space for post-Covid hybrid working and could help to shape future office redesign and reconfiguration.

ACTIVE TRAVEL: we’re working with Surrey Climate Commission, Surrey County Council and several local transport organisations to better understand the barriers to active travel modes such as cycling, walking and wheeling. The results will support local policy development and plans for infrastructure improvement.

SUSTAINABLE BUSINESS: a collaboration between our Innovation Strategy department and Zero Carbon Guildford, a community interest organisation, will pilot a sustainable business network for Guildford. The aim is to lower the environmental impact of businesses and social enterprises in the area, while helping to build resilience to medium and long-term threats posed by climate change.

40

COLLABORATION BETWEEN

INNOVATION STRATEGY

ANNUAL REPORT AND FINANCIAL STATEMENTS 2021-22 CONTENTS THE FINANCIALS

A

OUR

DEPARTMENT AND ZERO CARBON GUILDFORD, A COMMUNITY INTEREST ORGANISATION, WILL PILOT A SUSTAINABLE BUSINESS NETWORK FOR GUILDFORD.

SUPPORTING ENTERPRISE GROWTH

Surrey supports innovative start-up businesses by offering them office space in the Surrey Research Park. This gives them the opportunity to collaborate with researchers to develop their products and grow their businesses, within a supportive innovation ecosystem of collaborating companies.

Innovation ecosystem highlights include:

• 21 collaborative innovation grants completed with space sector SMEs, accelerating their technology commercialisation through knowledge exchange